Financial Budget Worksheet

Creating a financial budget is essential for anyone looking to manage their money effectively. Whether you're a student learning to budget for the first time or an adult seeking to improve your financial situation, having a reliable and organized tool like a financial budget worksheet can make a world of difference. With a clear layout and straightforward categories, this worksheet allows individuals to track their income and expenses, helping them gain a better understanding of their overall financial health.

Table of Images 👆

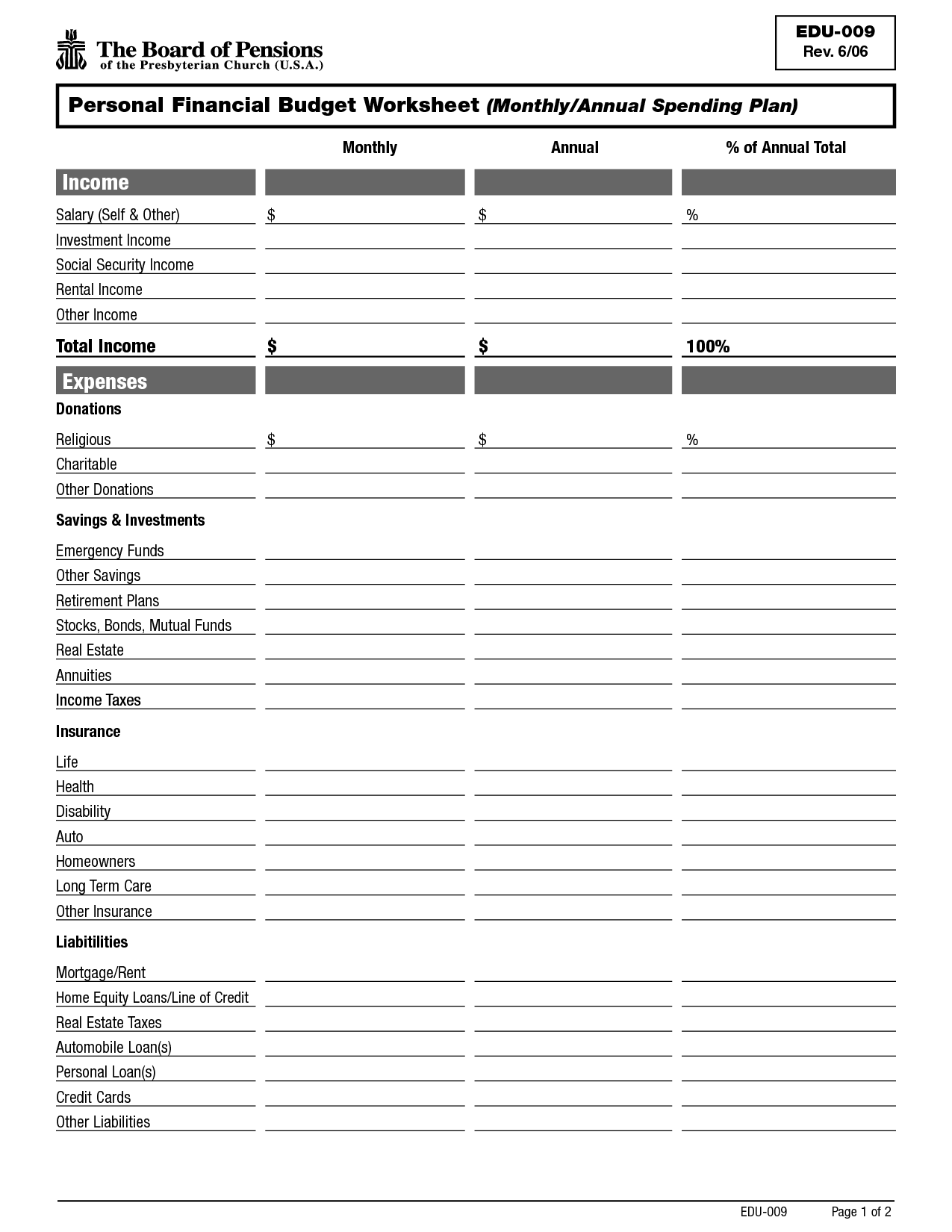

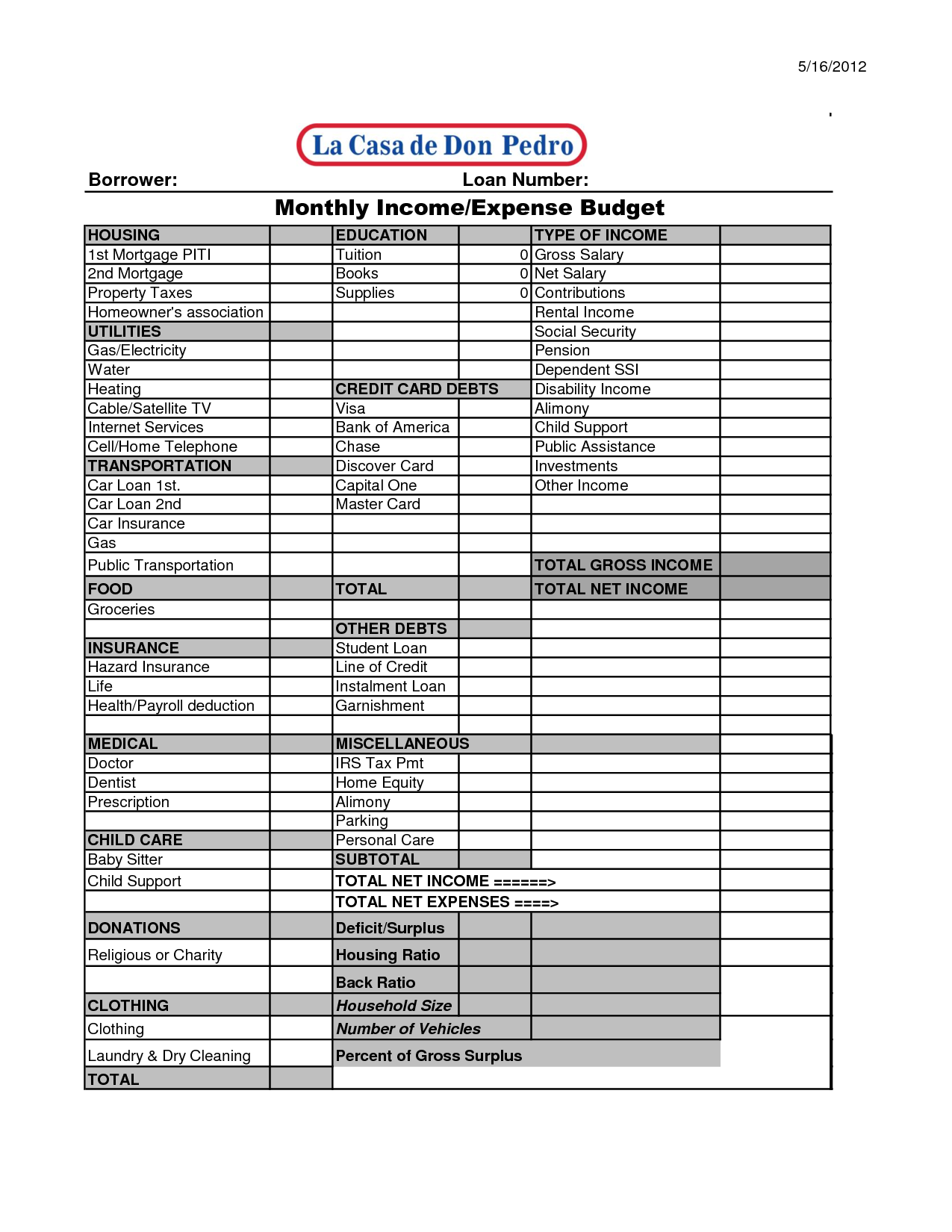

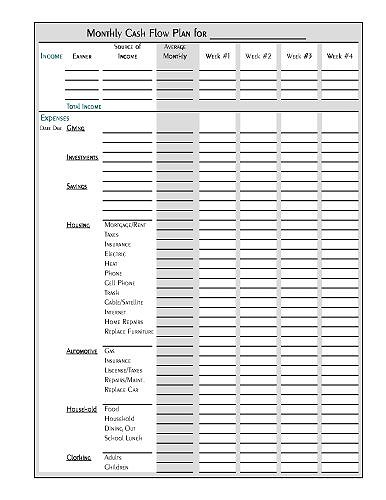

- Monthly Financial Budget Worksheet

- Financial Budget Worksheet Printable

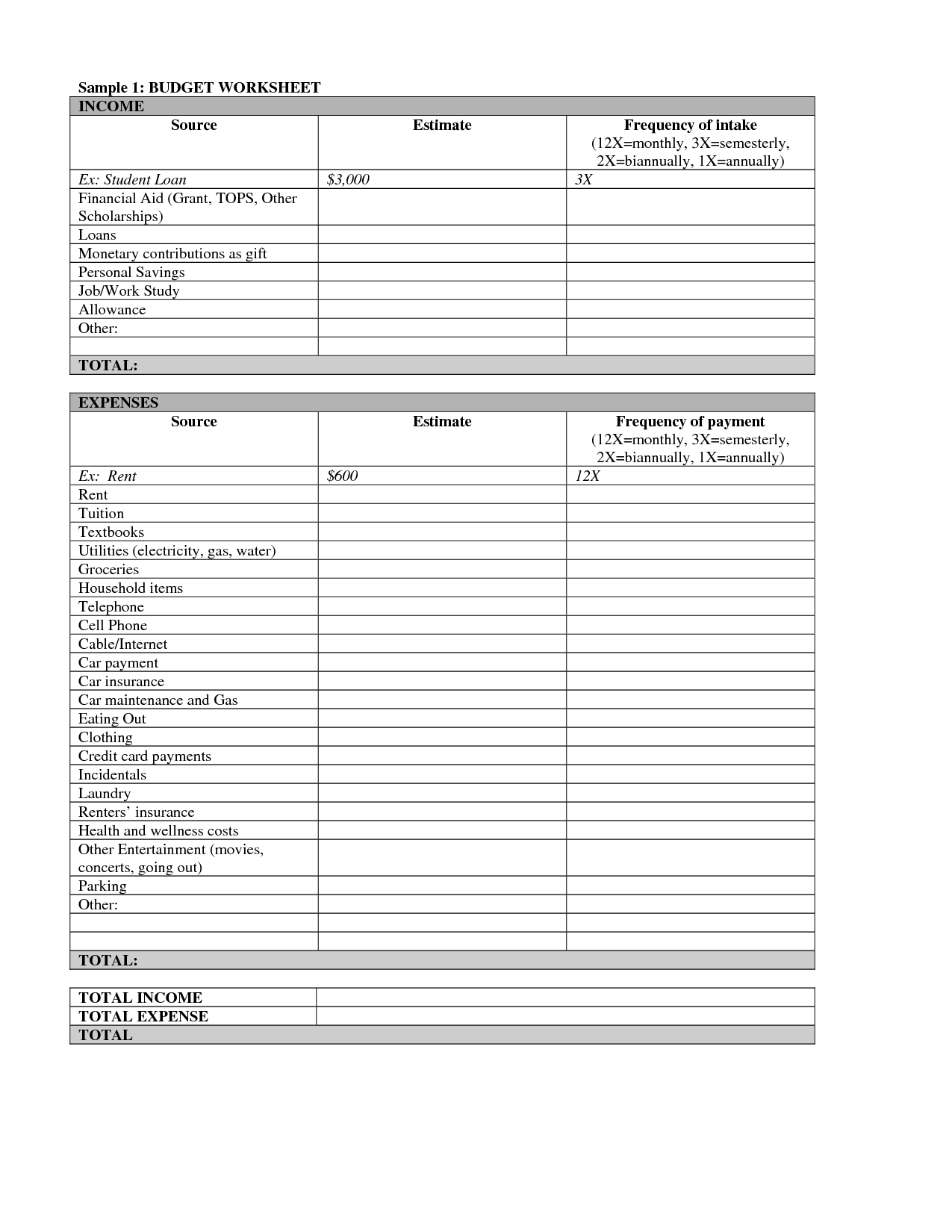

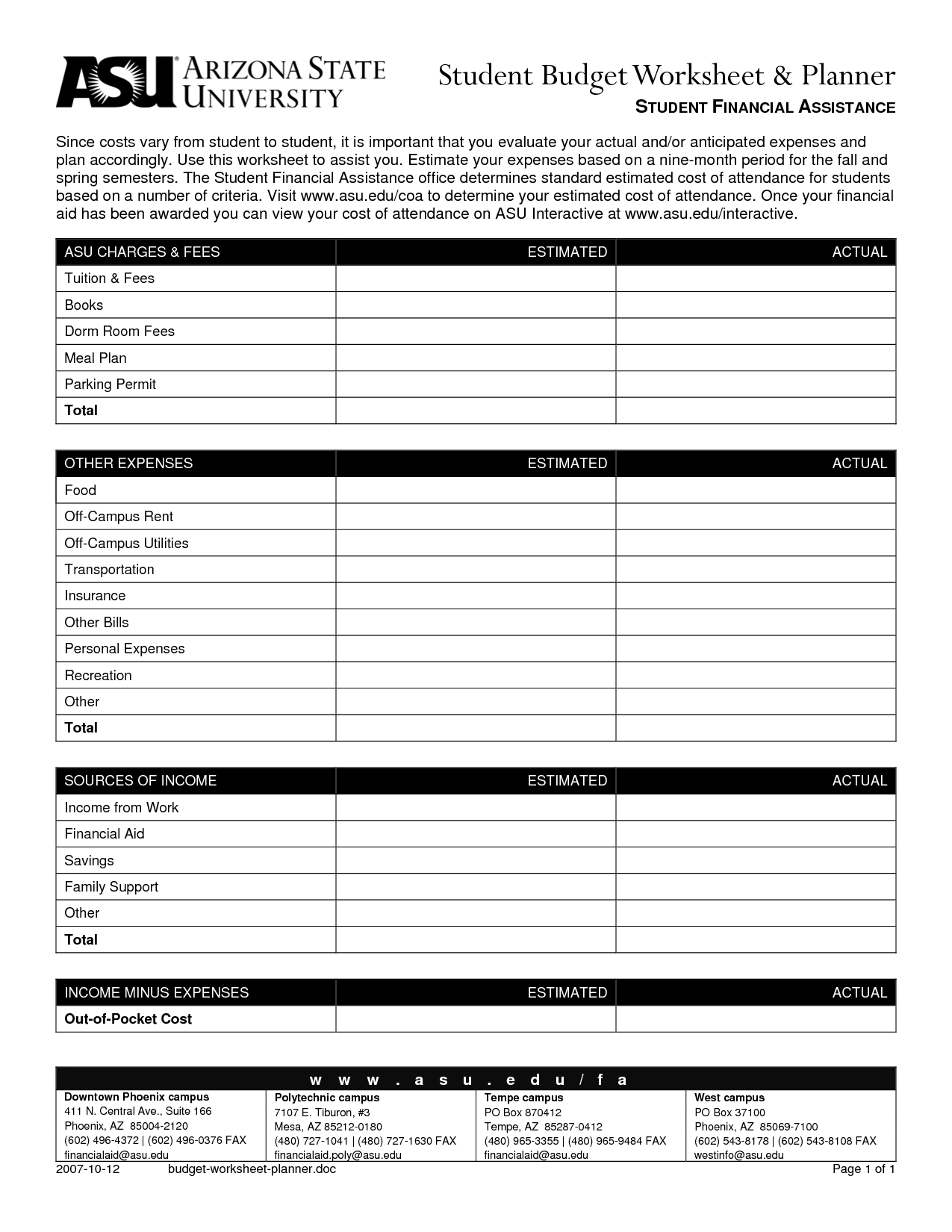

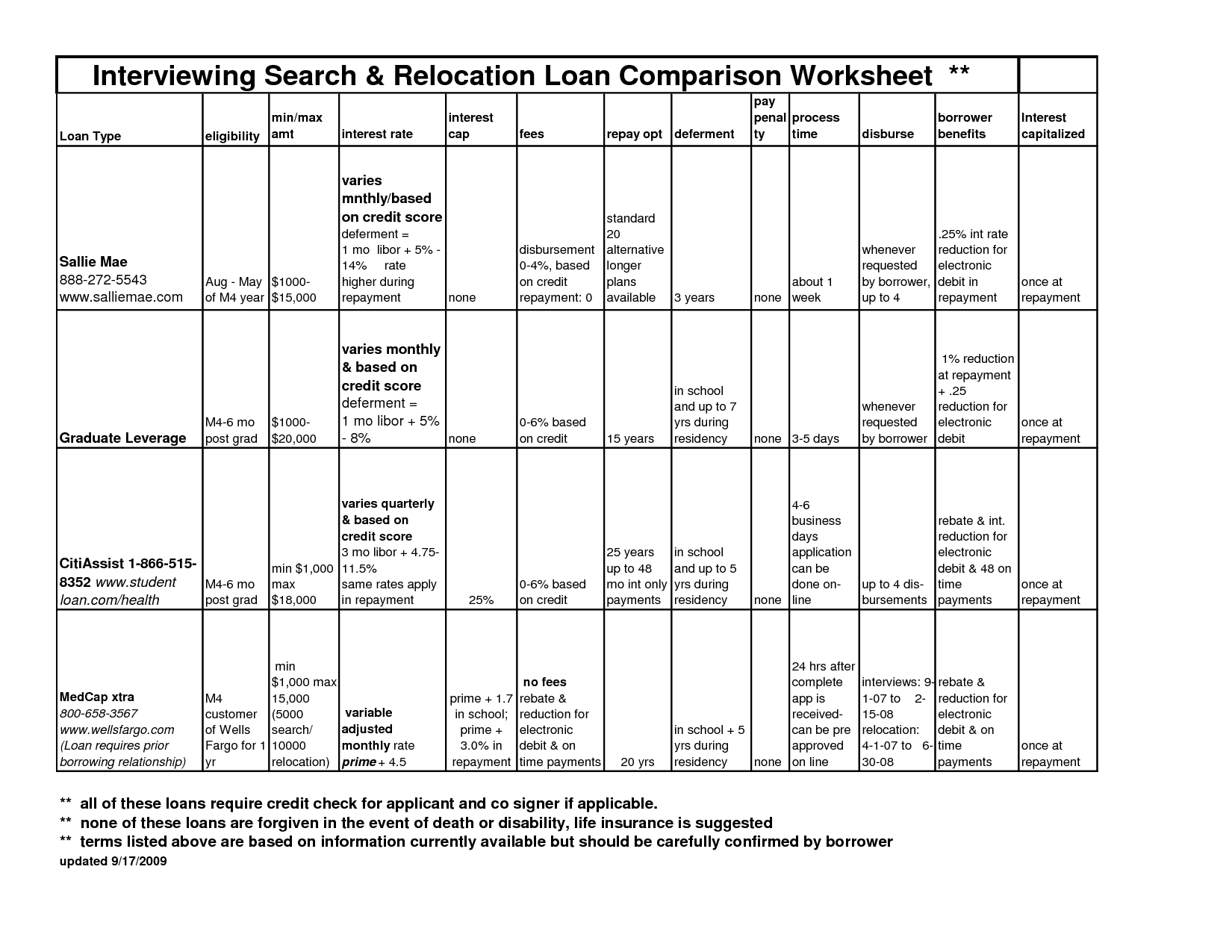

- Budget Worksheet Financial Aid

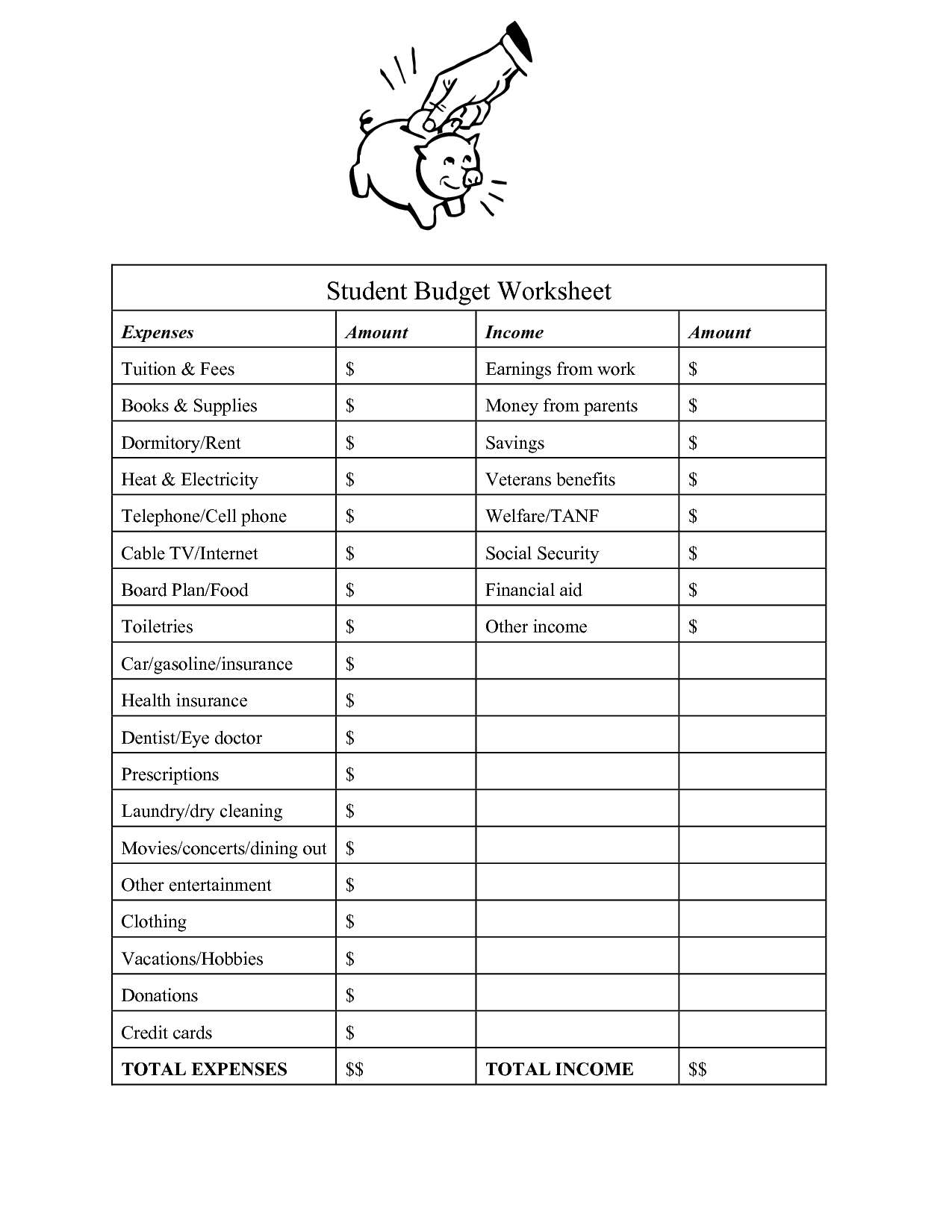

- College Student Budget Worksheet

- Financial Budget Worksheet Blank

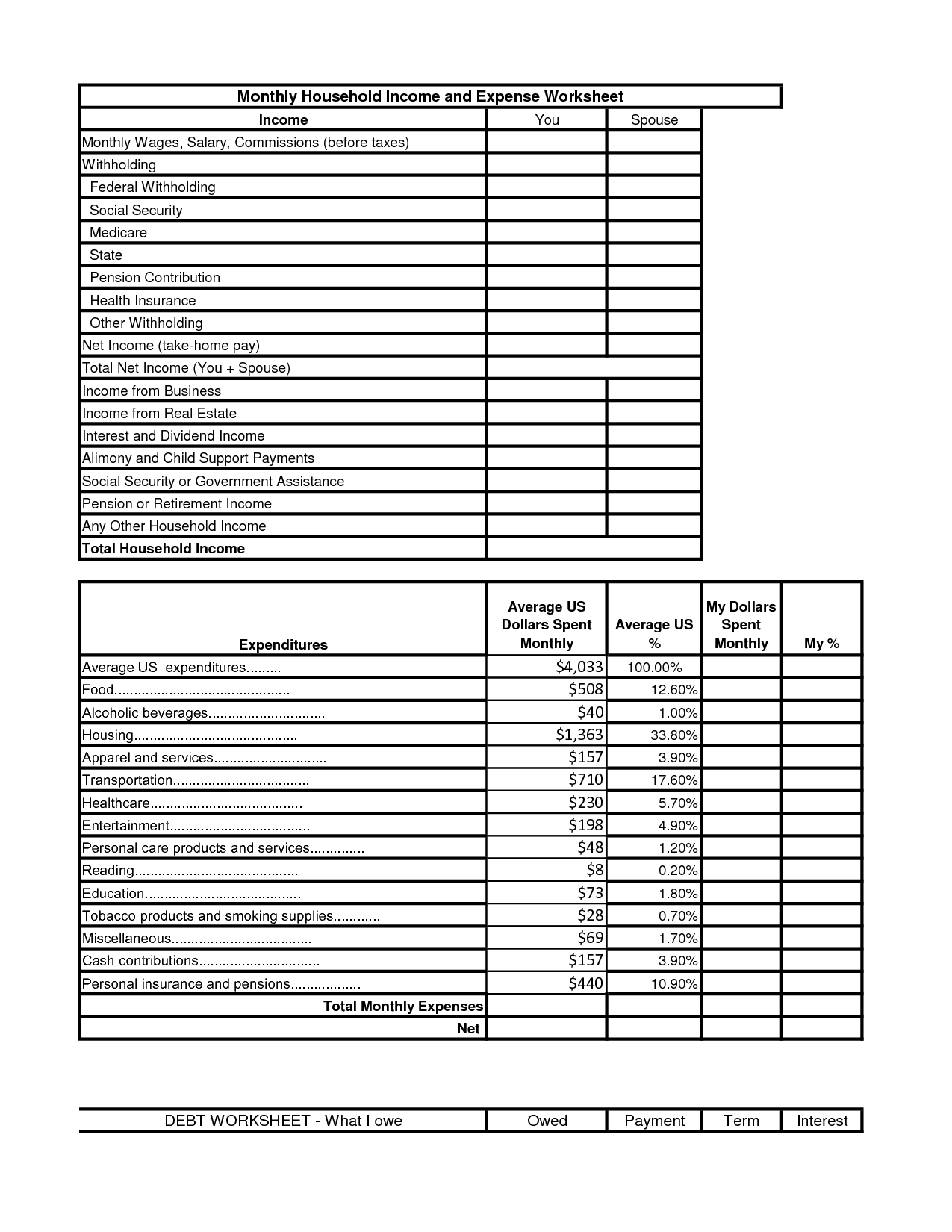

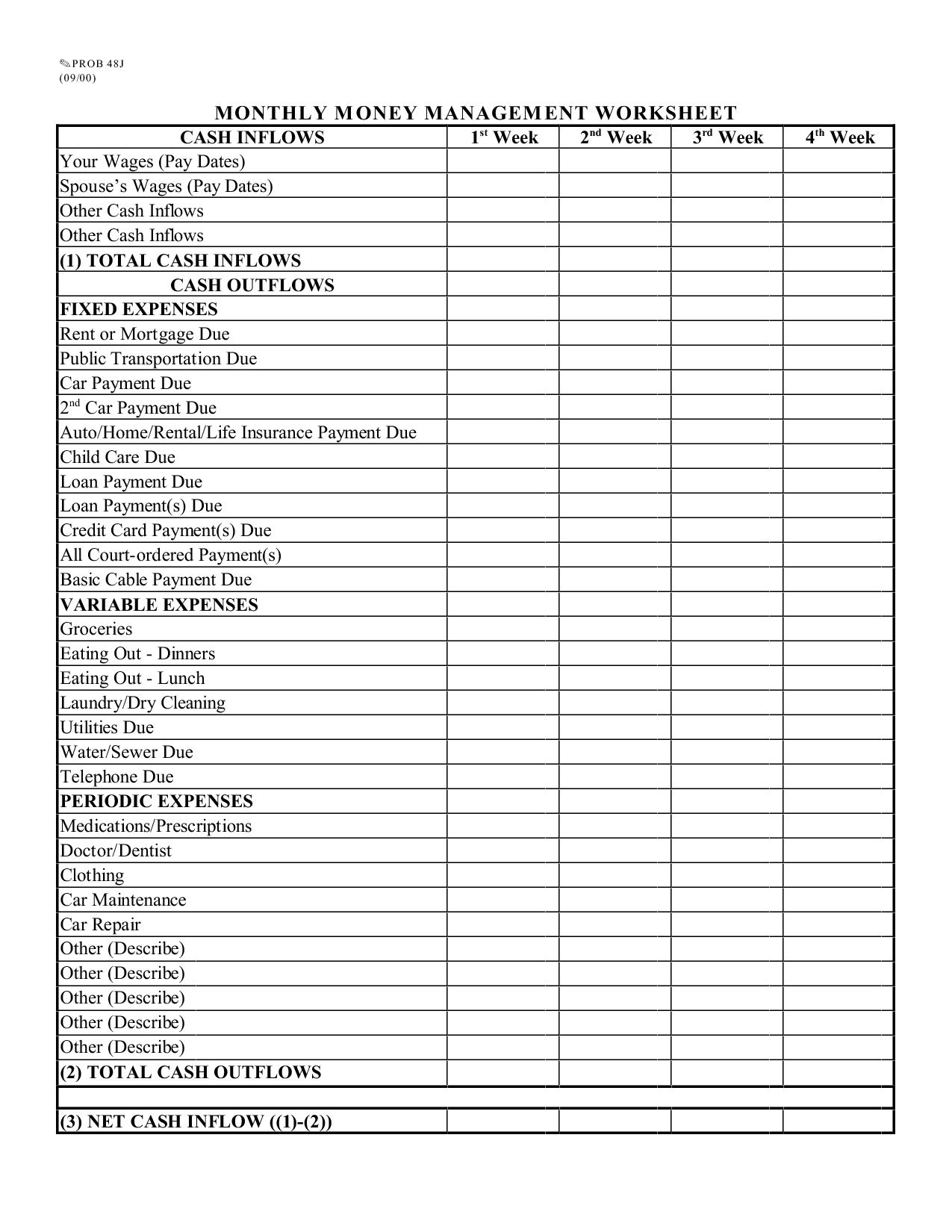

- Monthly Money Management Worksheet

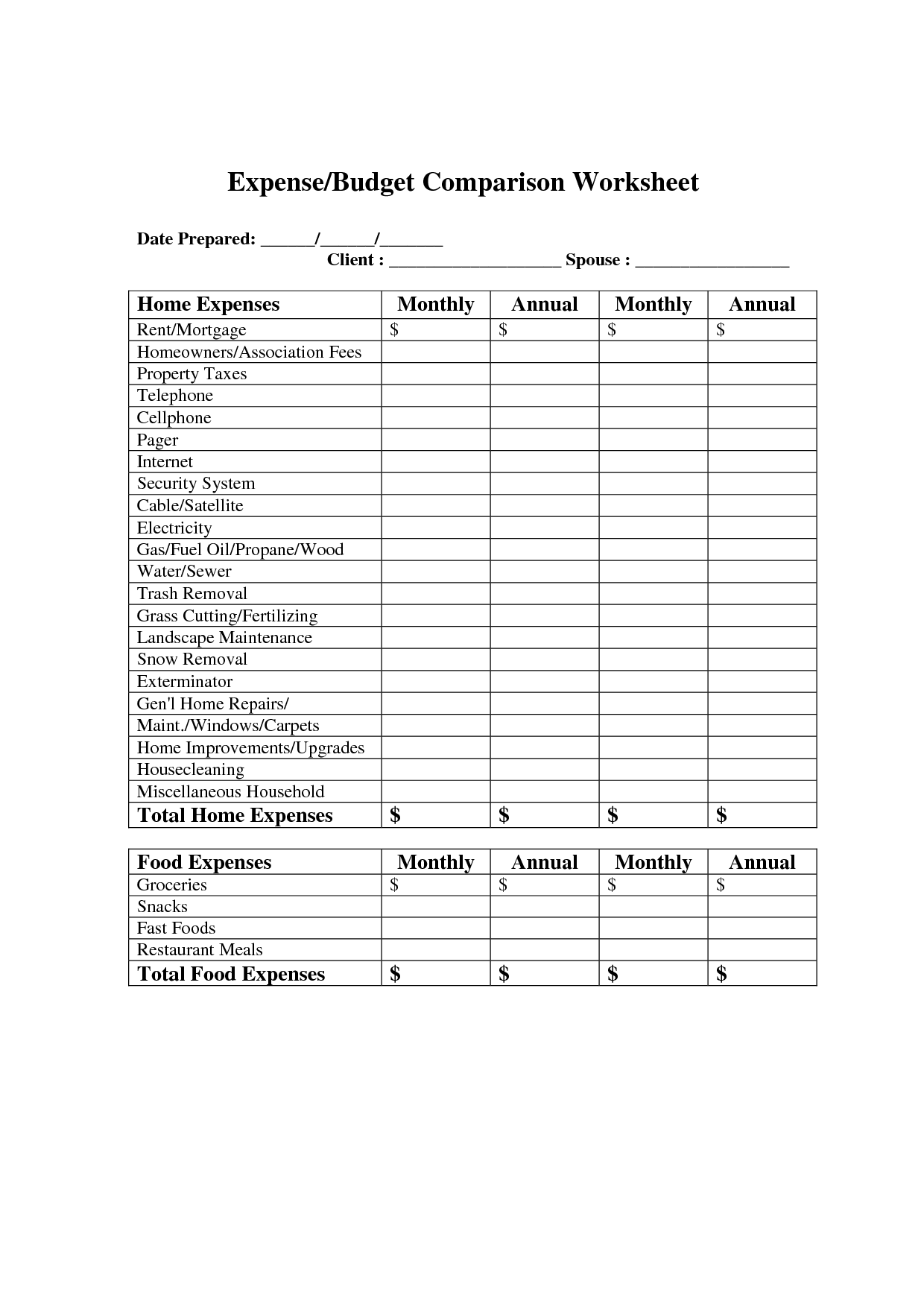

- Sample Household Budget Worksheet

- Monthly Financial Worksheet Wells Fargo

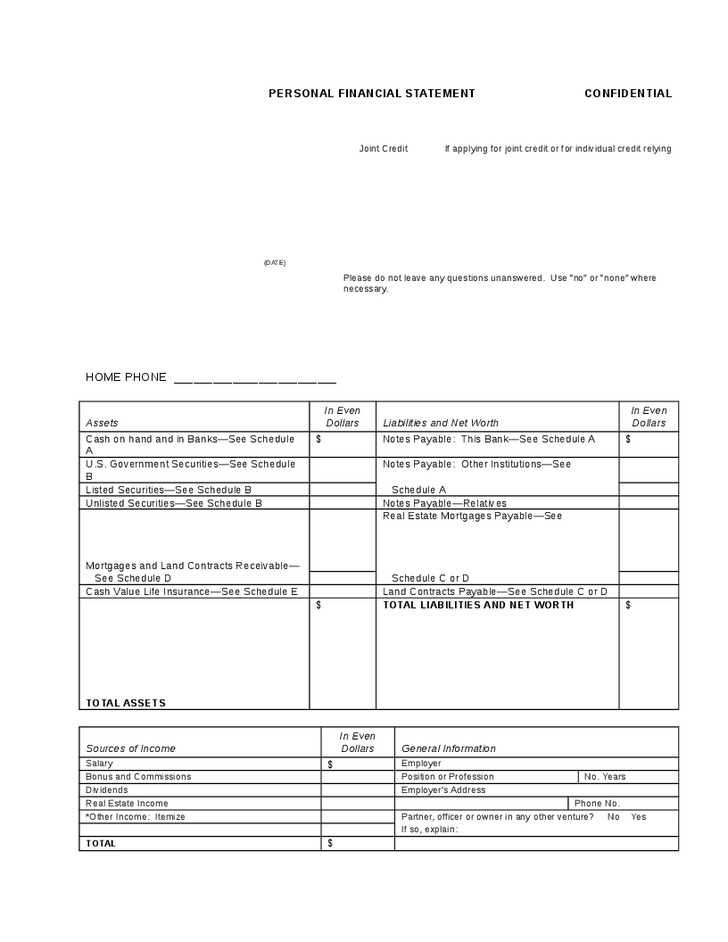

- Personal Financial Statement Template

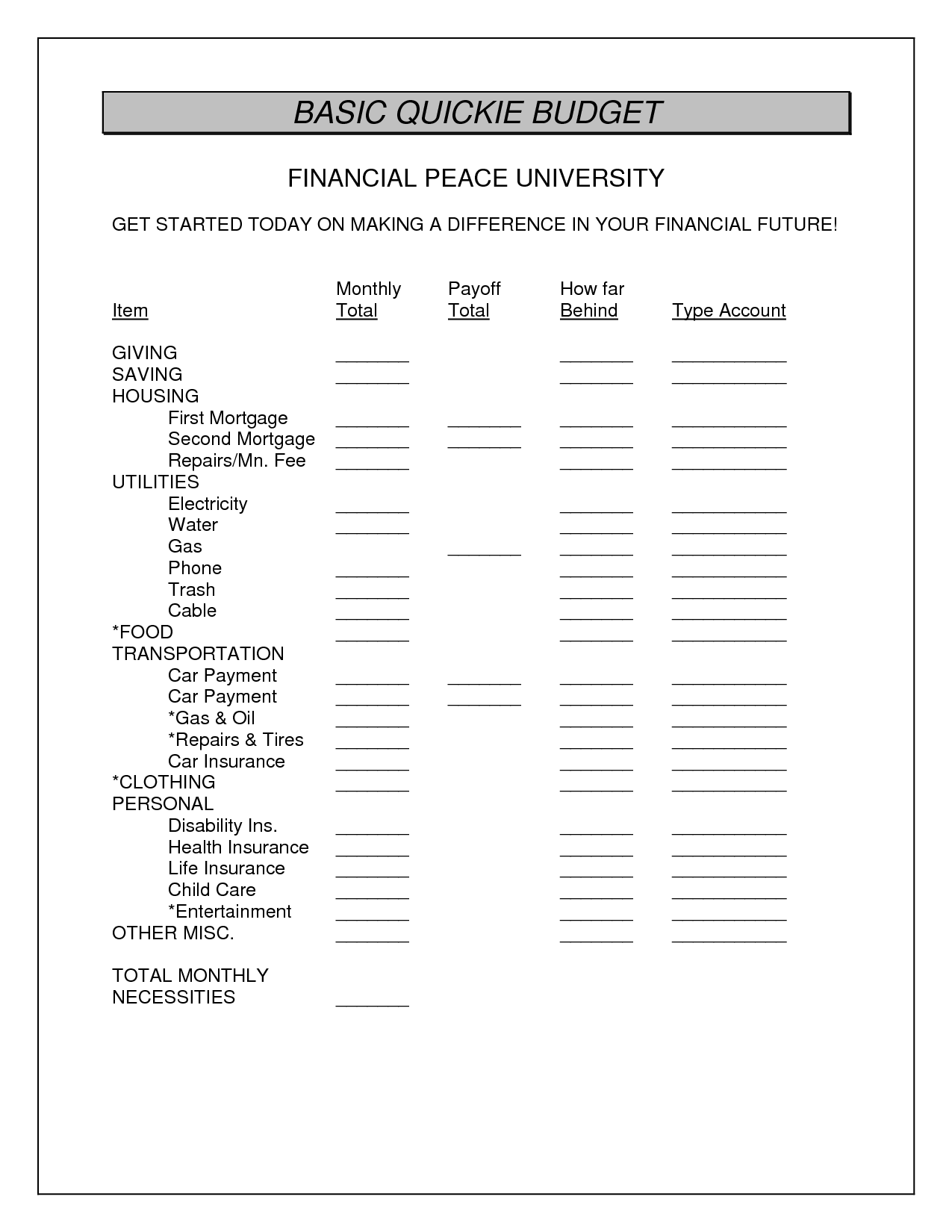

- Financial Peace Budget Worksheet

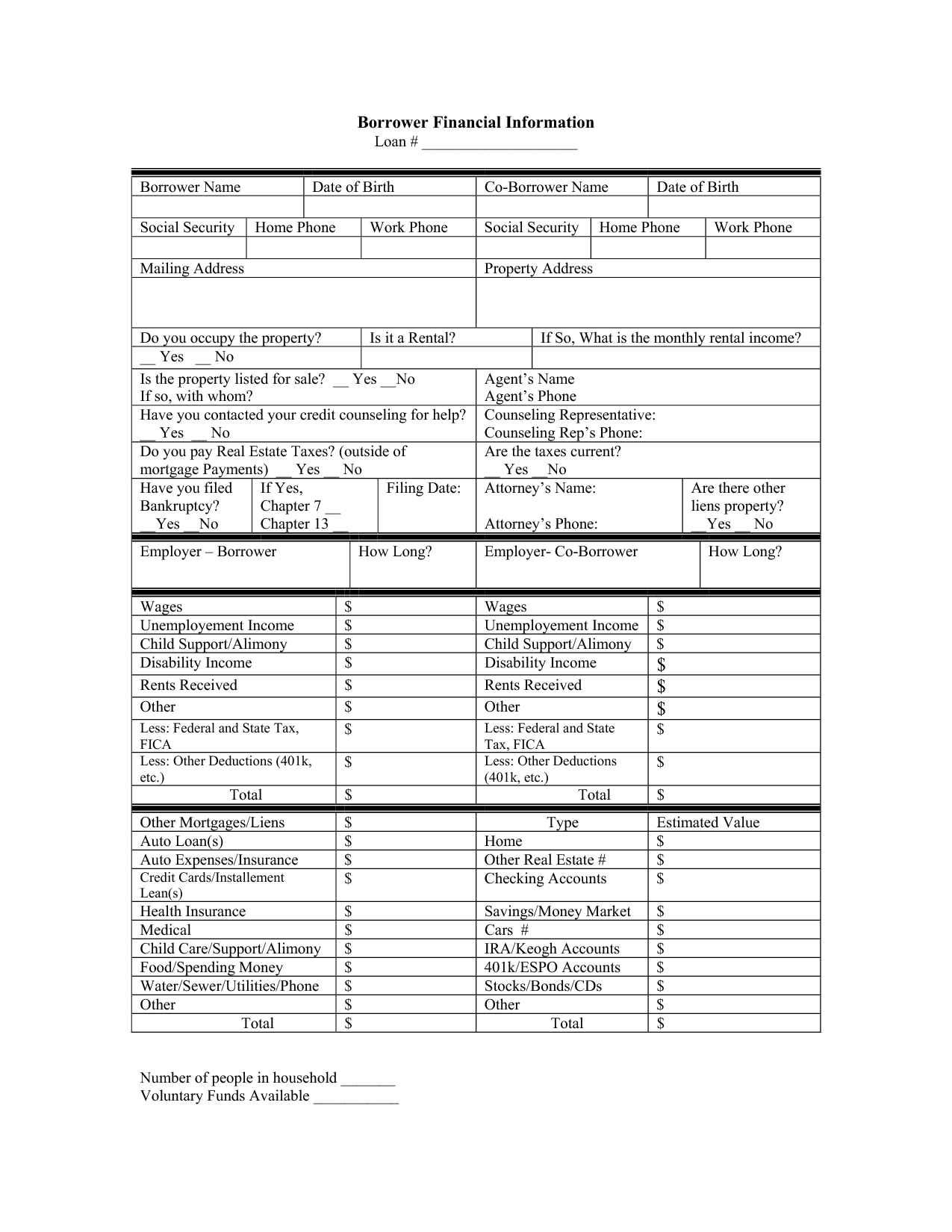

- Wells Fargo Financial Worksheet Form

- Free Printable Household Budget Worksheets

- Retail Store Budget Template

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a financial budget worksheet?

A financial budget worksheet is a tool used to track and manage one's finances by listing income sources and expenses. It typically includes categories for different types of expenses such as housing, transportation, groceries, and entertainment, allowing individuals to compare their actual spending against their budgeted amounts. This helps in identifying areas where adjustments may be needed to meet financial goals and stay within budget constraints.

Why do individuals or families use financial budget worksheets?

Individuals or families use financial budget worksheets to track their income and expenses, help them plan and manage their finances effectively, identify any areas where they may be overspending, set financial goals, and ultimately work towards achieving financial stability and security. It provides a clear overview of their financial situation and allows for better decision-making when it comes to managing money and saving for the future.

What are the key components of a financial budget worksheet?

The key components of a financial budget worksheet include income sources, expenses (fixed and variable), savings goals, debt repayment amounts, and a section for tracking actual spending against budgeted amounts. It is important to have categories for both regular monthly expenses and irregular expenses, as well as sections for emergency funds and long-term financial goals. Additionally, a budget worksheet should be regularly reviewed and adjusted to ensure that financial goals are being met.

How can a financial budget worksheet help in tracking income and expenses?

A financial budget worksheet can help in tracking income and expenses by providing a detailed breakdown of sources of income and different categories of expenses. By organizing this information in one place, the worksheet allows individuals to see where their money is coming from and where it is going, making it easier to identify areas where adjustments can be made to meet financial goals. Regularly updating the worksheet with accurate information also helps in monitoring spending patterns and making informed decisions on budgeting and saving.

How does a financial budget worksheet assist in setting financial goals?

A financial budget worksheet helps in setting financial goals by providing a clear overview of income and expenses, allowing individuals to identify their spending patterns and areas where they can save or cut back. By tracking their finances through a budget worksheet, individuals can better understand their financial situation, prioritize their spending, and allocate resources towards achieving specific goals such as saving for a house, an emergency fund, or retirement. The worksheet acts as a roadmap that guides individuals in making informed decisions about their money and helps them stay accountable to their financial objectives.

What role does a financial budget worksheet play in managing debt?

A financial budget worksheet plays a crucial role in managing debt by providing a clear overview of income, expenses, and debt obligations. It helps individuals track their spending, identify areas where they can cut expenses, and allocate funds towards debt repayment. By creating and following a budget, individuals can prioritize debt payments, avoid accumulating more debt, and work towards achieving financial stability. The budget worksheet serves as a tool to monitor progress, make informed financial decisions, and ultimately reduce and eliminate debt over time.

How can a financial budget worksheet help in identifying potential savings or areas for cost-cutting?

A financial budget worksheet can help in identifying potential savings or areas for cost-cutting by providing a detailed overview of all income and expenses. By organizing and tracking expenses, individuals can easily identify unnecessary or excessive spending in specific categories. This visibility allows for better decision-making regarding where expenses can be trimmed or eliminated to increase savings. Additionally, by comparing actual spending to budgeted amounts, individuals can pinpoint areas where adjustments can be made to achieve financial goals more effectively.

How does a financial budget worksheet aid in maintaining financial discipline and accountability?

A financial budget worksheet assists in maintaining financial discipline and accountability by providing a clear overview of income and expenses, helping individuals track and plan their spending. By setting specific budget goals and categories for expenses, individuals can easily identify areas where they may be overspending and adjust their habits accordingly. This tool also holds individuals accountable as they can regularly review their budget worksheet and assess their progress towards their financial goals, fostering a greater sense of responsibility and control over their finances.

What types of expenses and income sources should be included in a financial budget worksheet?

In a financial budget worksheet, you should include all sources of income such as salaries, bonuses, rental income, and dividends. Expenses to include are rent or mortgage payments, utilities, groceries, transportation costs, insurance premiums, debt repayments, savings contributions, entertainment expenses, and any other regular or occasional expenditures. It's also important to factor in unexpected expenses and a contingency fund to cover emergencies.

How often should a financial budget worksheet be reviewed and updated?

A financial budget worksheet should ideally be reviewed and updated regularly, at least once a month, to ensure that it accurately reflects your current financial situation and goals. This frequent review allows you to track your expenses, monitor your progress, and make any necessary adjustments to stay on track with your financial plans.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments