Self -Employment Expense Worksheet

Are you a self-employed individual searching for a simple and organized way to keep track of your business expenses? Look no further! Our Self-Employment Expense Worksheet is designed specifically for individuals like you, providing a user-friendly tool to help you efficiently track and categorize your expenses, all in one place.

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a Self-Employment Expense Worksheet?

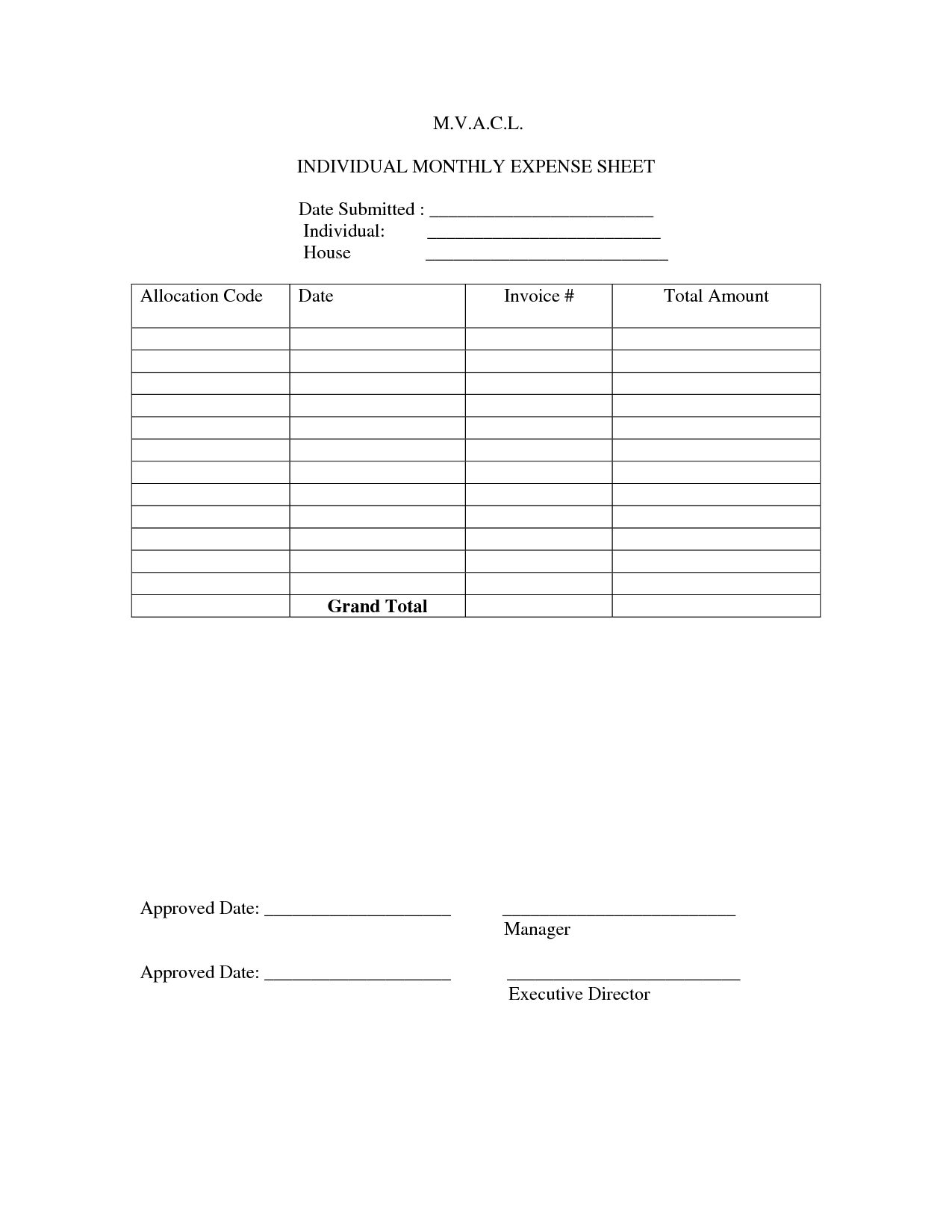

A Self-Employment Expense Worksheet is a tool used to track and document all the expenses associated with running a self-employed business. It typically includes categories such as office supplies, equipment, marketing, travel, utilities, and other business-related costs. This worksheet helps self-employed individuals organize their expenses to accurately report them on their tax returns and monitor their financial performance.

How does a Self-Employment Expense Worksheet help with tracking expenses?

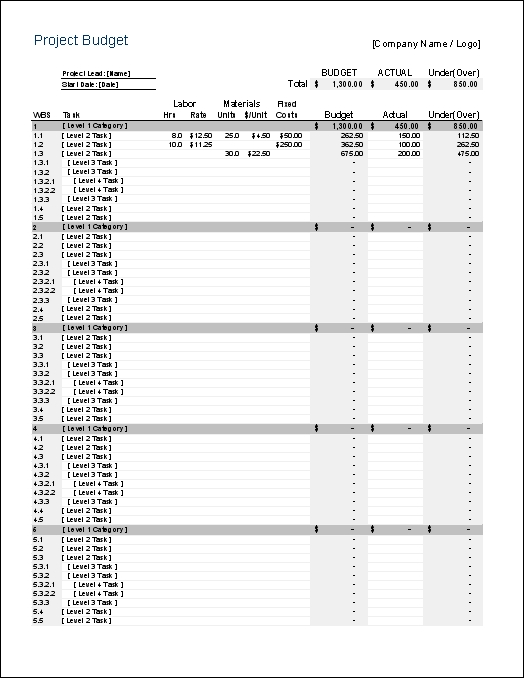

A Self-Employment Expense Worksheet helps with tracking expenses by providing a structured format to organize and categorize all business-related expenses. By listing and detailing each expense, the worksheet enables self-employed individuals to easily see where their money is being spent, which helps in creating a budget, identifying tax-deductible expenses, and monitoring the financial health of their business. This tool simplifies the process of tracking expenses and ensures that all costs are accurately recorded.

What types of expenses can be included on a Self-Employment Expense Worksheet?

On a Self-Employment Expense Worksheet, you can include various types of business-related expenses such as office supplies, advertising costs, utilities, equipment purchases, travel expenses, insurance premiums, professional development courses, and any other expenses directly related to running your self-employed business. These expenses can be deducted from your business income to calculate your net profit and ultimately your taxable income.

How often should a Self-Employment Expense Worksheet be updated?

A Self-Employment Expense Worksheet should be updated regularly, ideally on a monthly basis, to accurately track and manage your business expenses and keep financial records up to date. This frequency ensures that you have a clear understanding of your income and expenses, helps with budgeting, tax planning, and decision-making for your self-employment activities.

What information should be recorded for each expense on the worksheet?

For each expense recorded on the worksheet, the following information should be documented: date of the expense, description of the item or service purchased, amount spent, category of expense (e.g., utilities, office supplies), method of payment, and any relevant notes or explanations. This comprehensive record-keeping will help track and analyze expenses effectively, ensuring accurate budgeting and financial management.

How can a Self-Employment Expense Worksheet help with tax deductions?

A Self-Employment Expense Worksheet can help with tax deductions by organizing and categorizing all business expenses in one place, making it easier to identify eligible deductions. By tracking and documenting business expenses such as office supplies, travel costs, and utilities, self-employed individuals can ensure they are claiming all allowable deductions when filing their taxes, ultimately reducing their taxable income and potentially lowering their overall tax liability.

Is it necessary to keep physical receipts for expenses recorded on the worksheet?

No, it is not necessary to keep physical receipts for expenses recorded on the worksheet as long as the information is accurately documented and stored electronically or in another secure format. However, it is important to maintain proper records and ensure that all expense information is complete and easily accessible for verification purposes.

Are there any specific categories or sections on a Self-Employment Expense Worksheet?

A Self-Employment Expense Worksheet typically includes categories such as business expenses (e.g., utilities, rent, supplies), travel expenses, insurance, advertising, and professional fees. It may also have sections for home office expenses, vehicle expenses, meals and entertainment, and other miscellaneous expenses related to self-employment.

Can the worksheet be used for multiple self-employed individuals or only one?

The worksheet can be used for multiple self-employed individuals as it allows you to input information for each individual separately, making it suitable for calculating taxes or expenses for multiple self-employed individuals.

How can a Self-Employment Expense Worksheet assist in evaluating the profitability of a self-employed business?

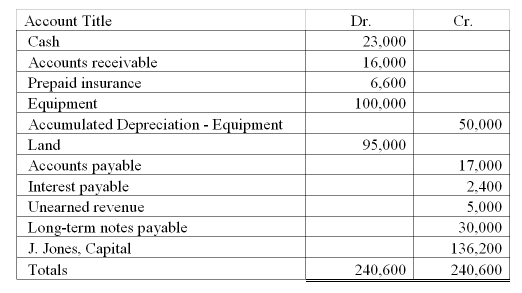

A Self-Employment Expense Worksheet can help in evaluating the profitability of a self-employed business by allowing the self-employed individual to track and analyze all business-related expenses. By detailing and organizing expenses such as materials, supplies, utilities, and other overhead costs, the worksheet provides a clear view of the total expenses incurred in running the business. By comparing these expenses to the business revenue, the individual can assess the profitability of the business and make informed decisions on cost-cutting measures or pricing adjustments to improve the bottom line.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments