Monthly Cash Flow Budget Worksheet

A Monthly Cash Flow Budget Worksheet is an essential tool for individuals or families who are seeking a clear and organized way to track their income and expenses. By using this worksheet, you can effectively manage your finances and gain a comprehensive understanding of where your money is going each month.

Table of Images 👆

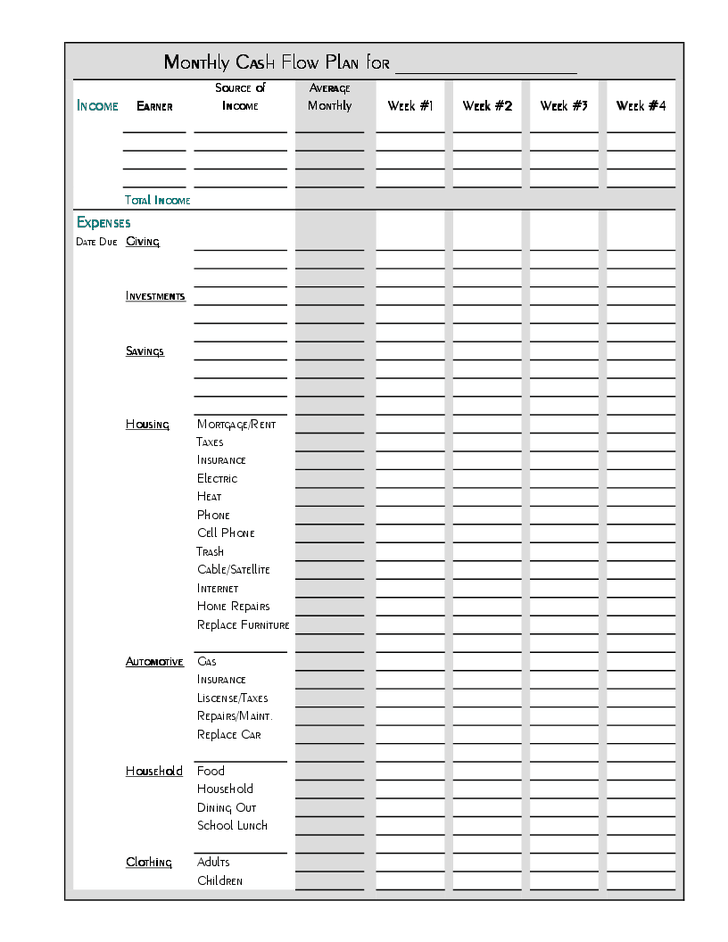

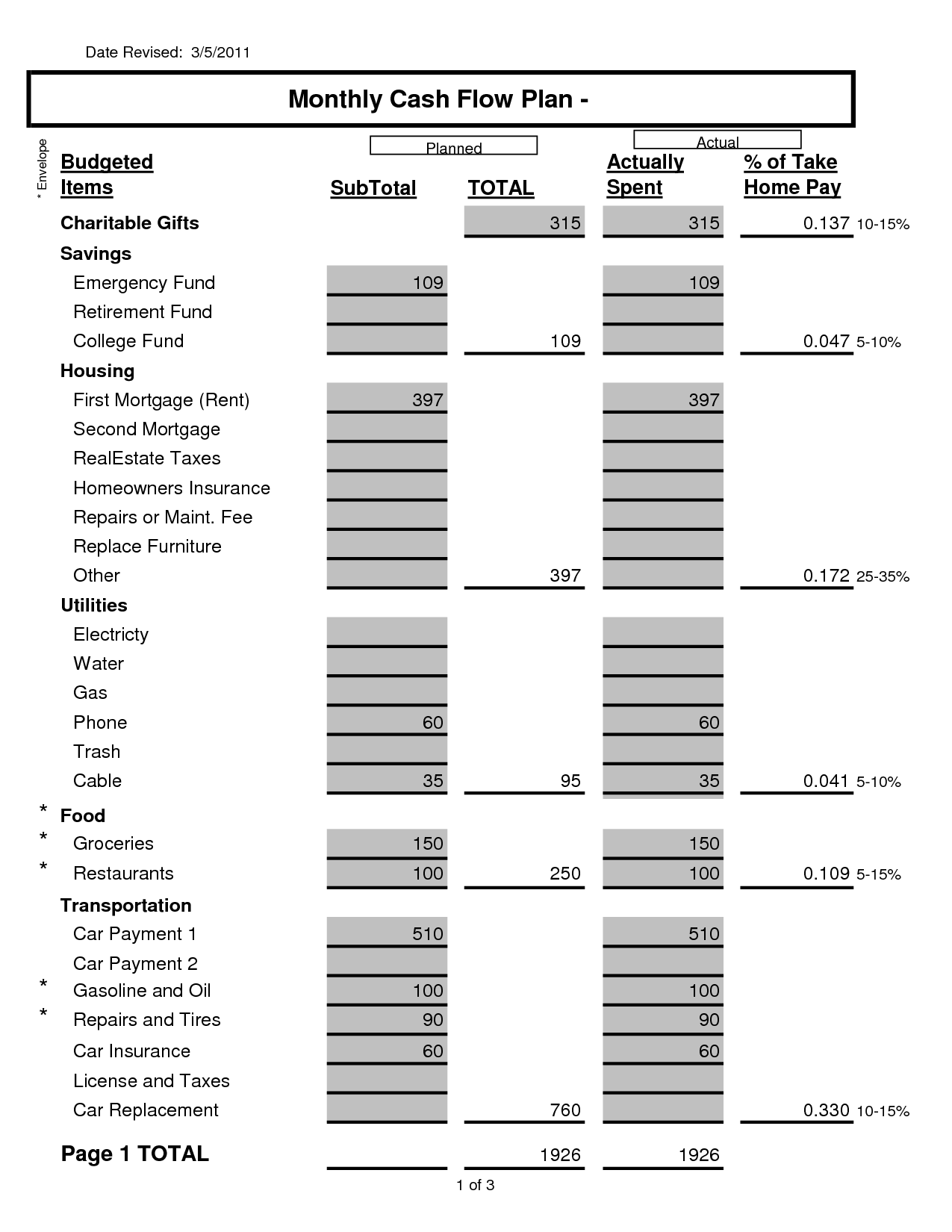

- Dave Ramsey Monthly Cash Flow Plan

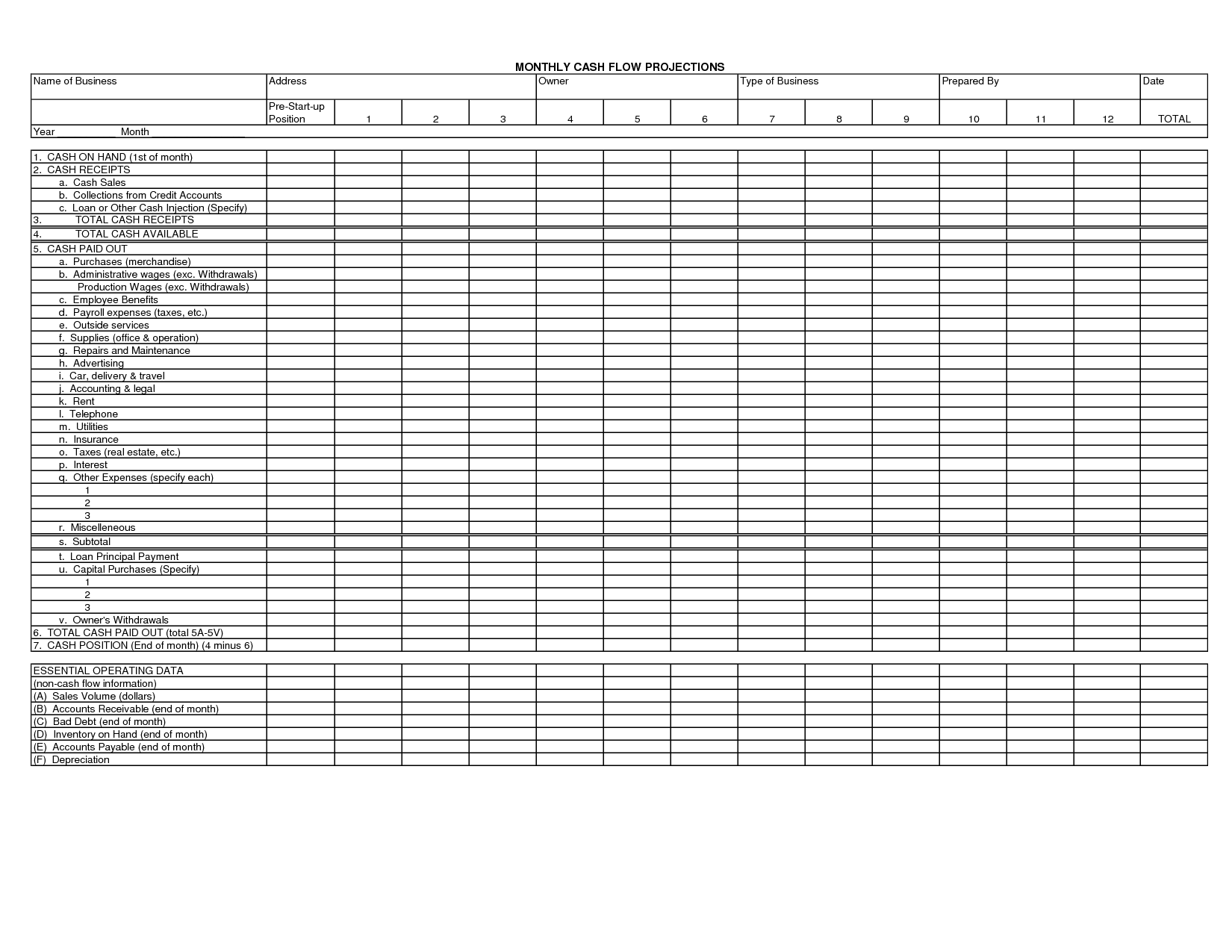

- Monthly Cash Flow Worksheet

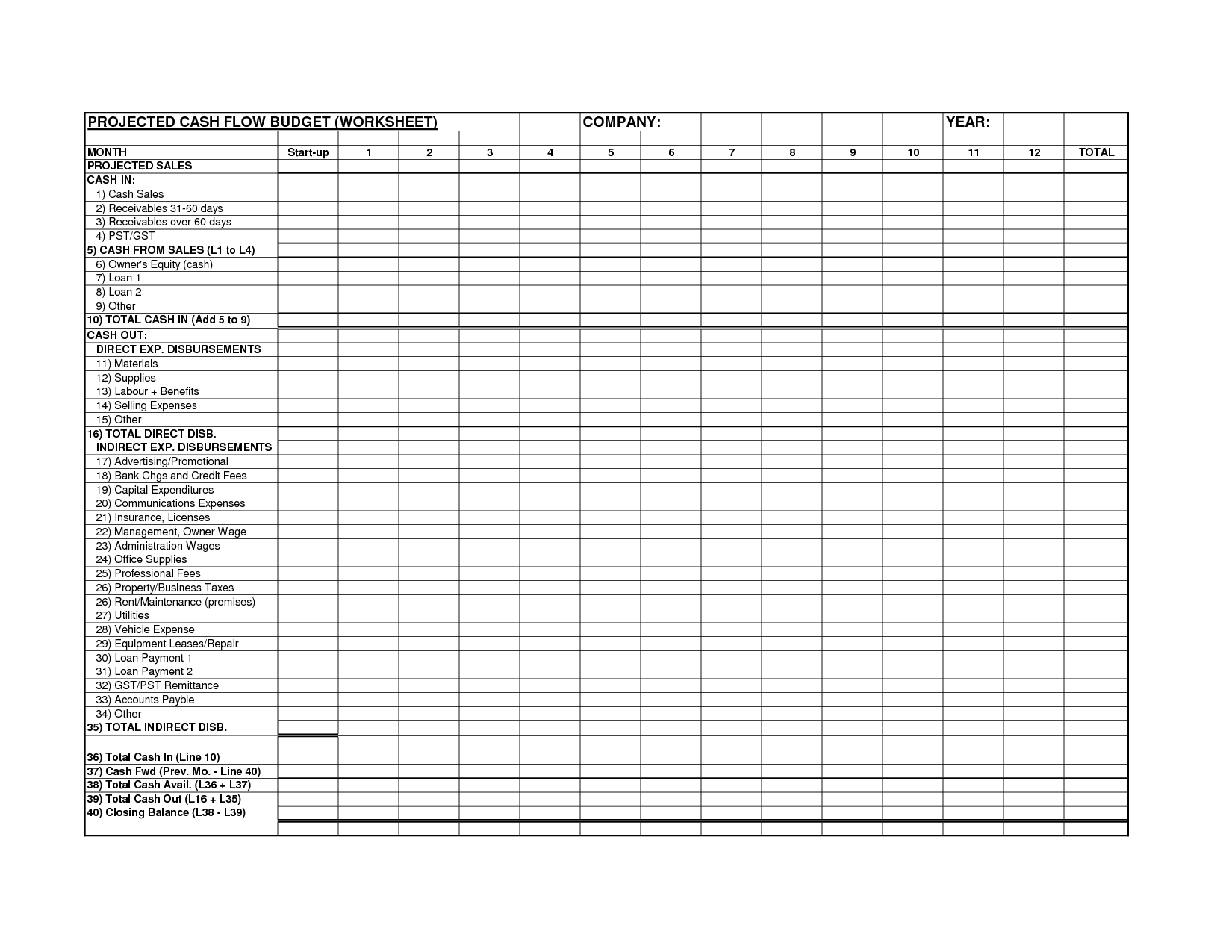

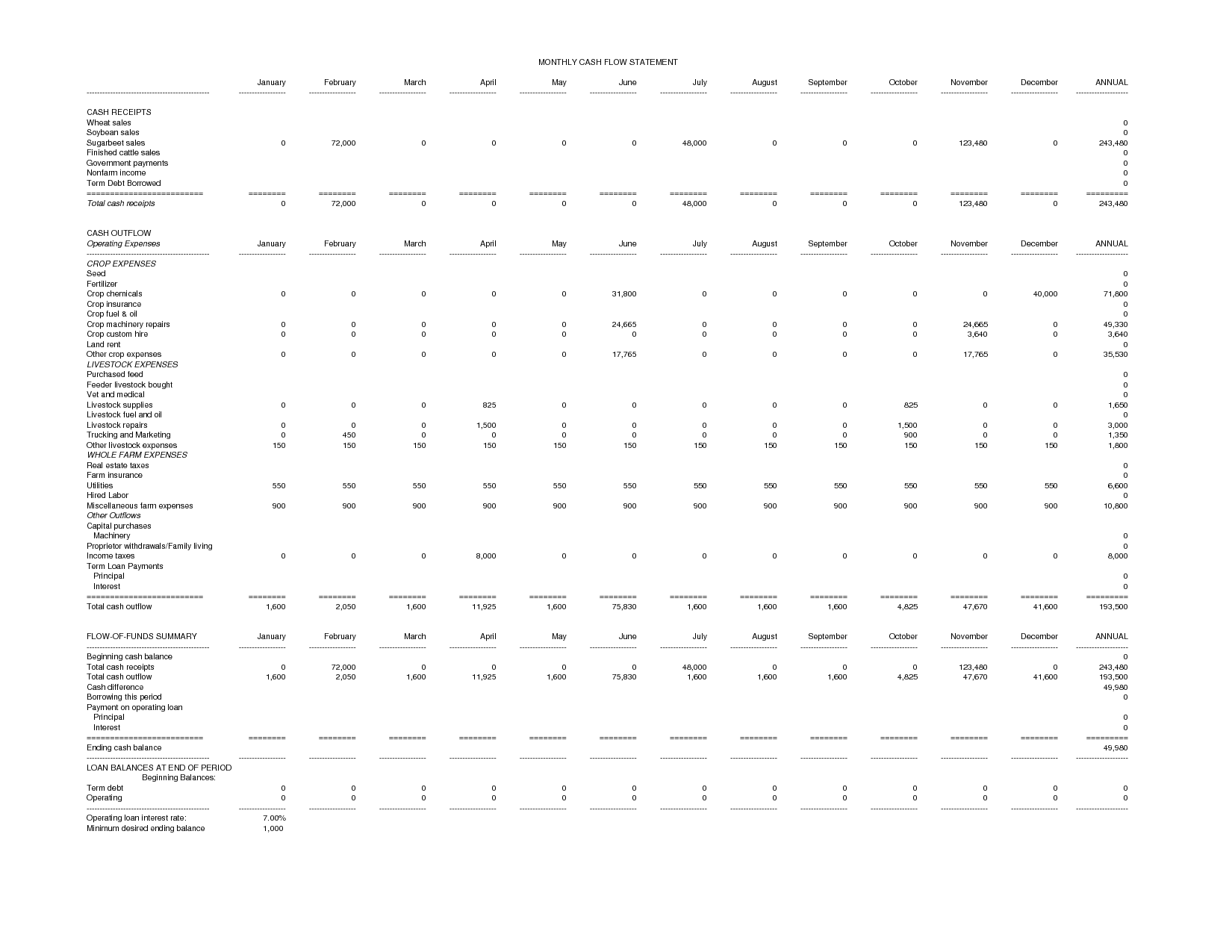

- Monthly Cash Flow Budget Template

- Monthly Cash Flow Projection Template

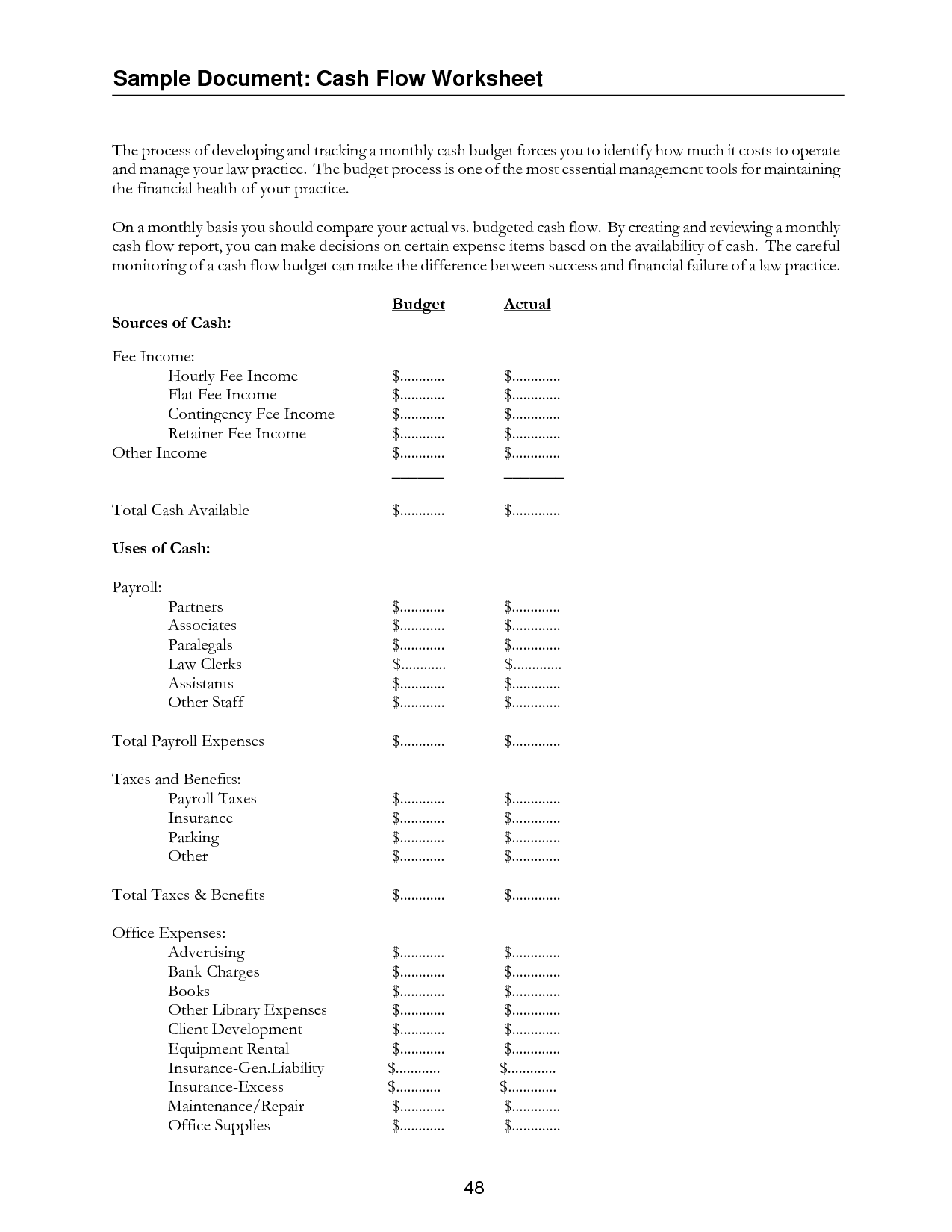

- Cash Flow Budget Worksheet Template

- Free Budget Worksheets Spreadsheets

- Monthly Cash Flow Projection Worksheet

- Sample Cash Flow Projection Worksheet

- Monthly Cash Flow Spreadsheet

- Free Cash Flow Worksheet Template

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a Monthly Cash Flow Budget Worksheet?

A Monthly Cash Flow Budget Worksheet is a tool used to track and manage your income and expenses on a monthly basis. It helps you see how much money you are bringing in versus how much you are spending, allowing you to set financial goals, prioritize spending, and identify areas where you can cut back or save money. This worksheet typically includes sections for income sources, fixed expenses (such as rent or utilities), variable expenses (like groceries or dining out), and savings. By using a Monthly Cash Flow Budget Worksheet, you can gain a clear understanding of your financial situation and make informed decisions to achieve your financial objectives.

Why is it important to have a Monthly Cash Flow Budget Worksheet?

A Monthly Cash Flow Budget Worksheet is important because it helps individuals and businesses track their income and expenses, enabling them to effectively manage their finances and make informed decisions. By keeping track of cash flow on a monthly basis, one can identify trends, anticipate upcoming expenses, allocate resources wisely, and ensure that there is enough money to cover essential costs. This tool also helps in setting financial goals, monitoring progress, and adjusting spending habits as needed to achieve financial stability and success.

How can a Monthly Cash Flow Budget Worksheet help with financial planning?

A Monthly Cash Flow Budget Worksheet helps with financial planning by providing a clear overview of income and expenses for each month. It allows individuals to track where their money is coming from and where it is going, making it easier to identify areas where adjustments can be made to increase savings or reduce unnecessary spending. By analyzing the data on the worksheet, individuals can make informed decisions about their finances, set realistic goals, and create a plan to achieve financial stability and security.

What are the key components of a Monthly Cash Flow Budget Worksheet?

The key components of a Monthly Cash Flow Budget Worksheet typically include income sources, such as salaries or investments, expenses like housing, transportation, and utilities, savings contributions, debt payments, and a section for tracking actual versus budgeted amounts for each category. It is crucial to include both fixed expenses that remain constant each month and variable expenses that may fluctuate, as well as setting aside funds for emergency savings or unexpected costs. Lastly, a section for notes or comments can help track patterns or changes in spending habits over time.

How do you track and categorize income and expenses on a Monthly Cash Flow Budget Worksheet?

To track and categorize income and expenses on a Monthly Cash Flow Budget Worksheet, you can start by listing all sources of income for the month in one section and then categorizing expenses into fixed (e.g., rent, utilities) and variable (e.g., groceries, dining out) expenses in separate sections. Divide each category further into subcategories if needed. Record the actual amounts next to each item as they occur throughout the month and then calculate the total income and total expenses to determine your cash flow. Regularly update and review your budget to make informed financial decisions.

What are some common categories to include on a Monthly Cash Flow Budget Worksheet?

Common categories to include on a Monthly Cash Flow Budget Worksheet are income sources (such as salary, rental income), fixed expenses (like rent, utilities), variable expenses (such as groceries, entertainment), debt payments (credit cards, loans), savings contributions, and miscellaneous expenses (like gifts, travel). It's important to also have a section for tracking actual expenses to compare against the planned budget and make adjustments as needed.

How do you calculate your net cash flow on a Monthly Cash Flow Budget Worksheet?

To calculate the net cash flow on a Monthly Cash Flow Budget Worksheet, subtract your total expenses from your total income. Total income includes all sources of money coming in for the month, such as wages, investments, and rental income. Total expenses are the sum of all outgoing cash flows, including bills, rent, groceries, and other spending. The resulting number will show whether you have a surplus (positive net cash flow) or a deficit (negative net cash flow) for the month.

What are some tips for creating an accurate Monthly Cash Flow Budget Worksheet?

When creating an accurate Monthly Cash Flow Budget Worksheet, start by listing all sources of income and fixed expenses, such as rent, utilities, and loan payments. Next, estimate variable expenses like groceries, transportation, and entertainment. Be thorough and realistic with your estimates. Track your actual spending each month and adjust your budget accordingly. Consider using budgeting tools or apps to help streamline the process and stay organized. Lastly, be flexible and willing to make adjustments as needed to stay on track with your financial goals.

How often should you update and review your Monthly Cash Flow Budget Worksheet?

You should update and review your Monthly Cash Flow Budget Worksheet at least once a month. This will help you stay on top of your financial situation, track your spending, identify any potential issues, and make any necessary adjustments to stay within your budget and financial goals.

Can a Monthly Cash Flow Budget Worksheet help in identifying areas for savings and reducing expenses?

Yes, a Monthly Cash Flow Budget Worksheet can be an excellent tool for identifying areas for savings and reducing expenses. By tracking income and expenses regularly, you can see where your money is going and identify areas where you can cut back or make adjustments. This can help you prioritize your spending, set savings goals, and ultimately improve your financial health. Additionally, the visibility and awareness provided by a budget worksheet can help you make more informed decisions about your finances.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments