Blank Profit and Loss Worksheet

Are you in need of a simple and organized way to track your business's income and expenses? Look no further than the Blank Profit and Loss Worksheet. Designed to cater to small business owners and individuals managing their finances, this worksheet provides a comprehensive layout for recording all essential financial data. With designated sections for income, expenses, and net profit calculations, this worksheet offers a convenient and efficient solution for tracking and analyzing your financial health.

Table of Images 👆

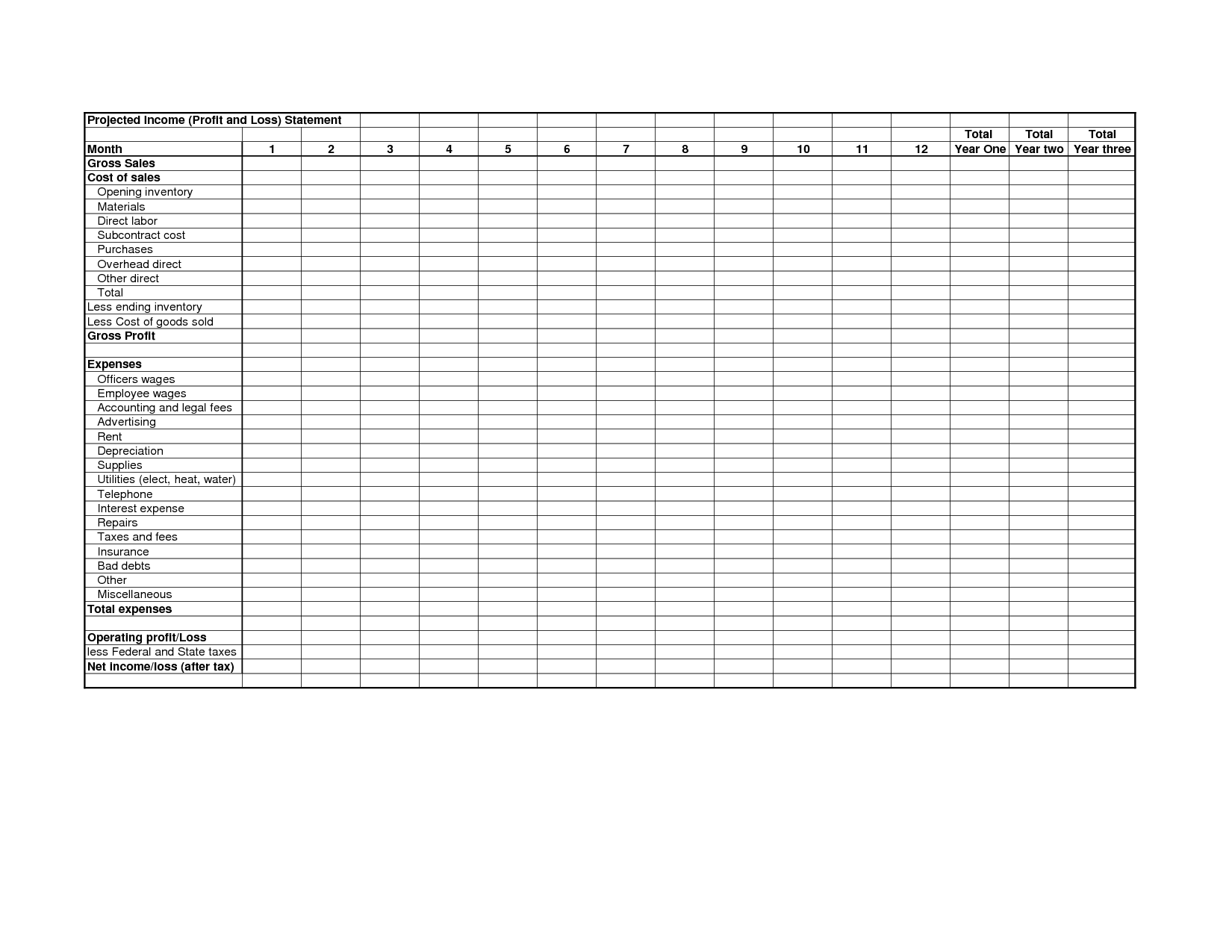

- Printable Profit and Loss Statement Form

- Monthly Profit and Loss Worksheet

- Personal Asset and Liability Worksheet

- Great American Smoke Out

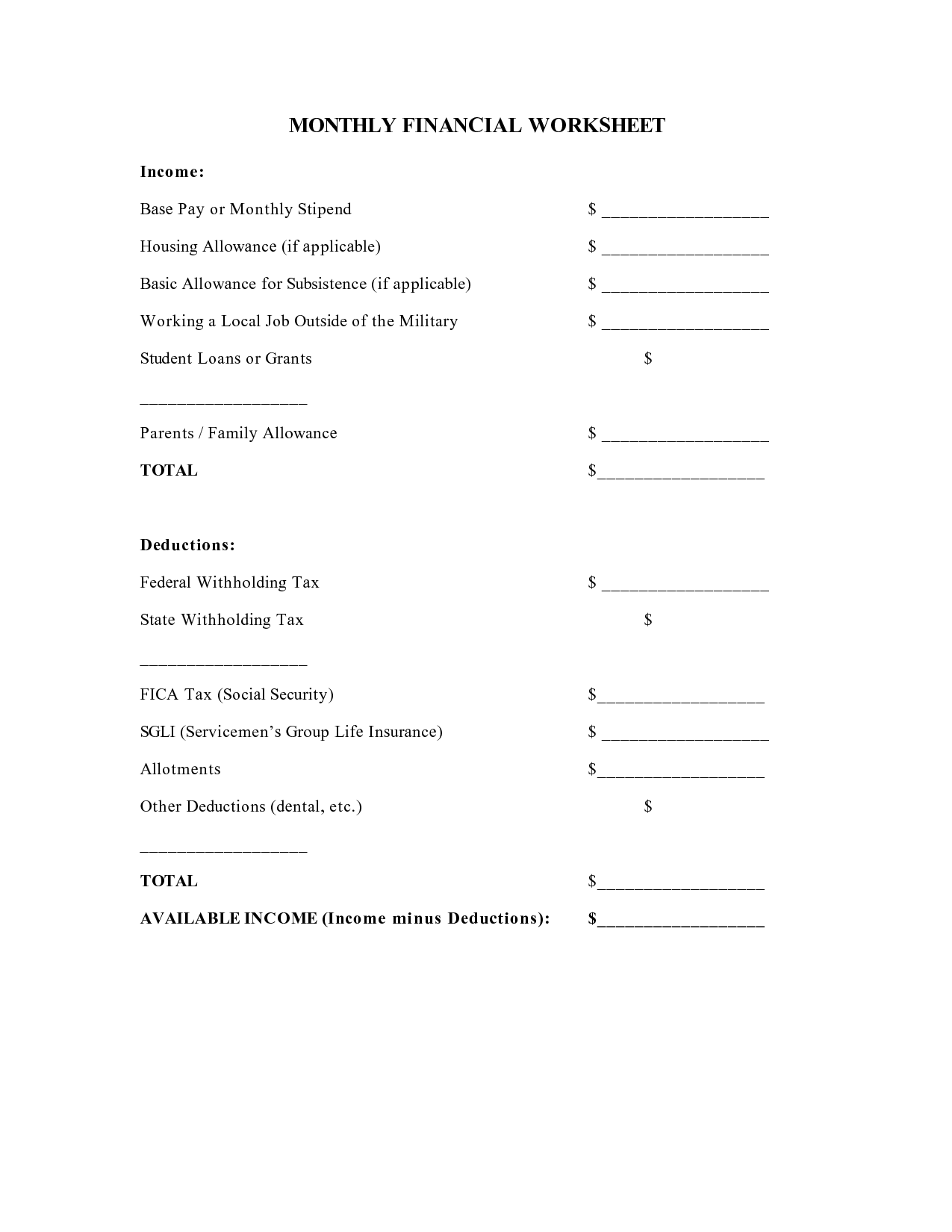

- Blank Monthly Income and Expense Sheet

- Rental Property Income and Expense Worksheet

- Wells Fargo Profit and Loss Statement Form

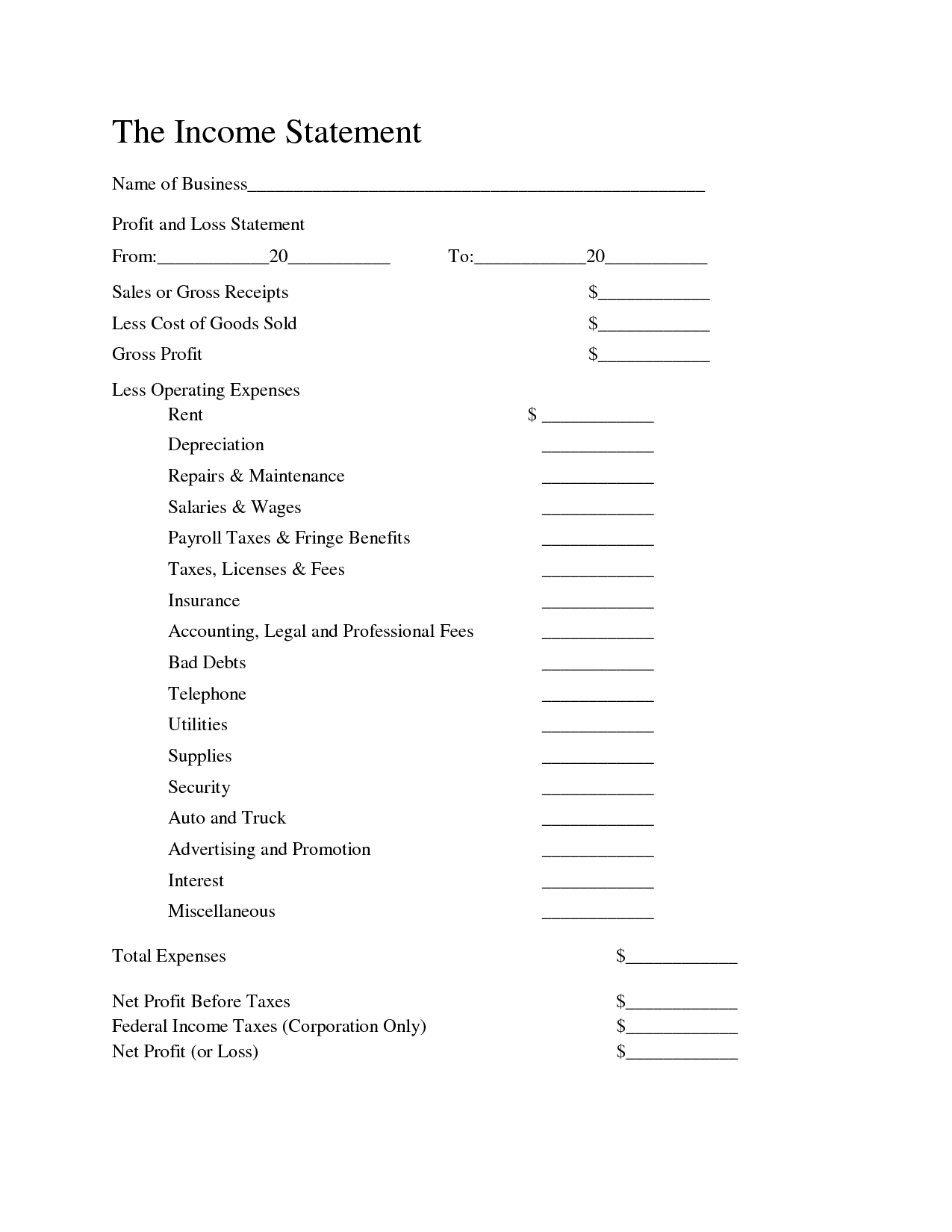

- Free Printable Profit and Loss Statement

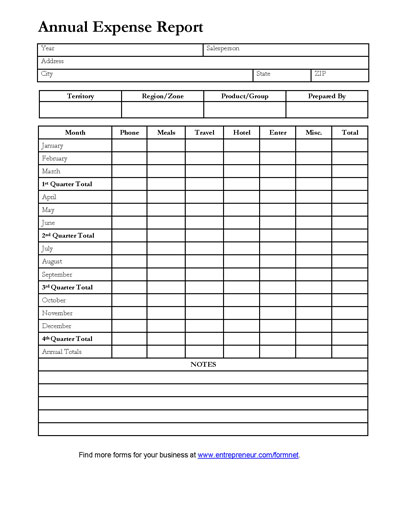

- Free Printable Expense Report Template

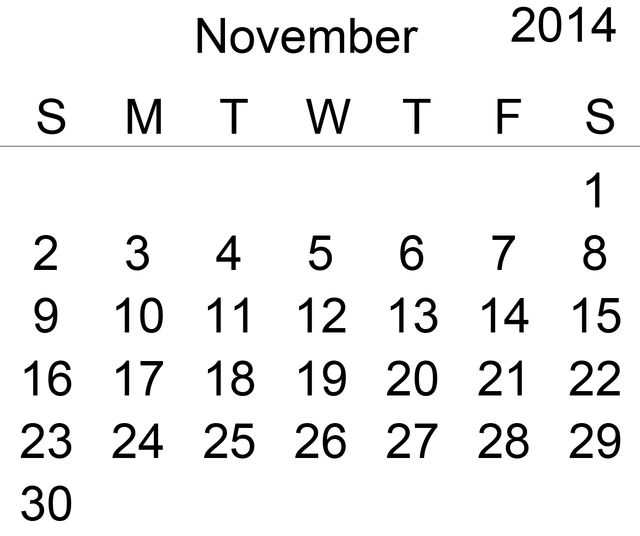

- November 2014 Calendar

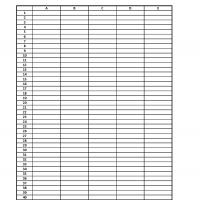

- Blank Spreadsheet Printable

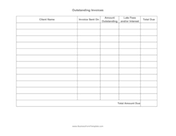

- Free Printable Gifts Received List

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a Profit and Loss Worksheet?

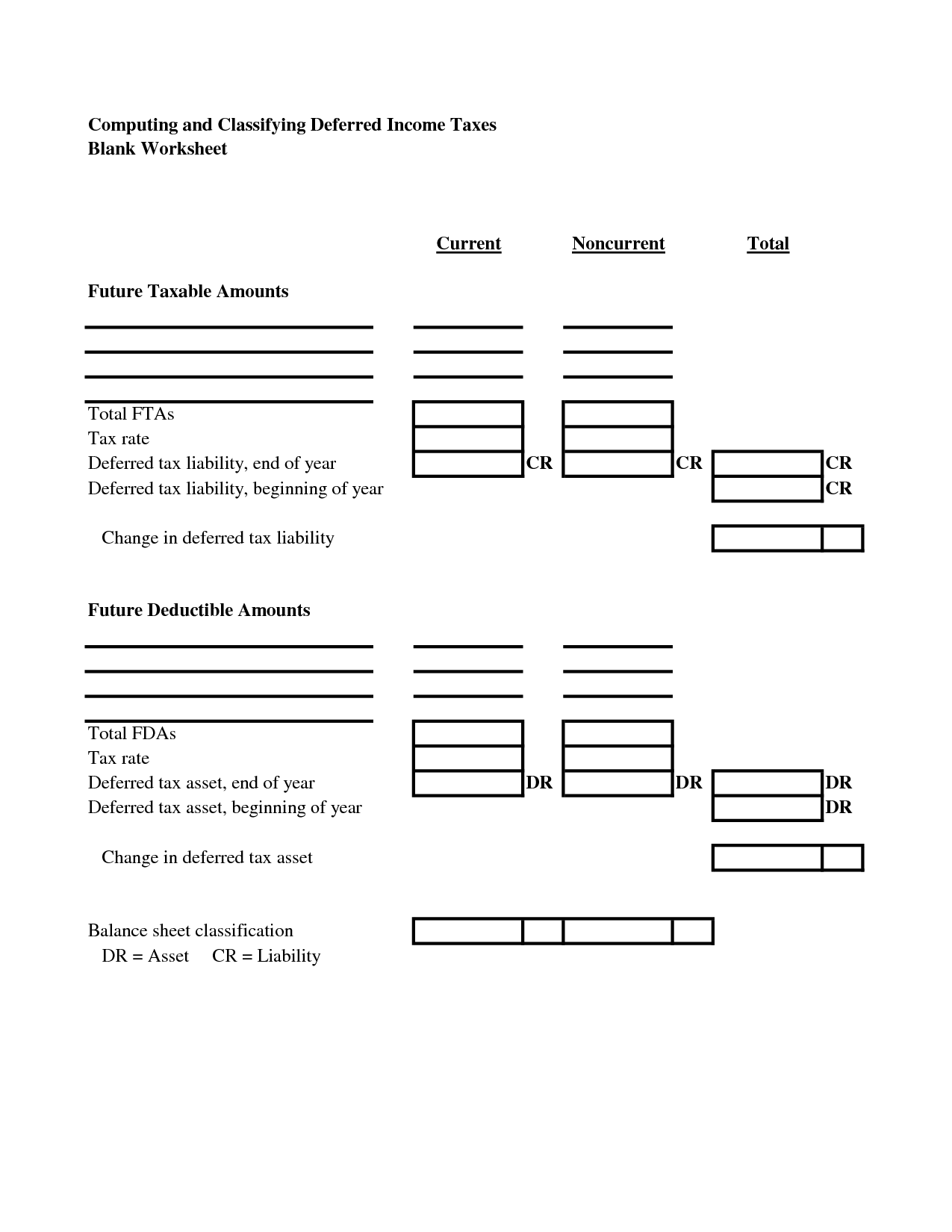

A Profit and Loss Worksheet is a financial document that outlines a company's revenues, expenses, and profits over a specific period of time. It helps to track and analyze the financial performance of a business by comparing income to expenses, ultimately determining the company's net profit or loss. This document is crucial for businesses to monitor their financial health and make informed decisions to improve profitability.

How is the Profit and Loss Worksheet used in financial analysis?

The Profit and Loss Worksheet, also known as the income statement, is used in financial analysis to evaluate a company's profitability by comparing its revenues and expenses over a specific period. It helps analysts to assess the company's financial performance, identify trends, and make informed decisions. By analyzing the data in the Profit and Loss Worksheet, stakeholders can understand the company's ability to generate profits, control expenses, and ultimately make strategic business decisions based on the financial results presented.

What are the main components included in a Profit and Loss Worksheet?

A Profit and Loss Worksheet typically includes the following main components: Revenue or Sales, Cost of Goods Sold (COGS) or Cost of Sales, Gross Profit, Operating Expenses, Net Income before Taxes, Taxes, and Net Income after Taxes. These components help businesses analyze their revenues, expenses, and overall profitability over a specific period of time.

How does a Profit and Loss Worksheet help in measuring a company's profitability?

A Profit and Loss Worksheet helps in measuring a company's profitability by providing a clear breakdown of all revenues and expenses over a specific period. By subtracting all expenses from total revenues, the worksheet calculates the net income or loss of the company. This helps in identifying areas of strength and weakness in the business operations, allowing management to make informed decisions to improve profitability. Additionally, having a detailed profit and loss statement can also help in setting financial goals, monitoring performance, and assessing the overall financial health of the company.

Why is it important to regularly update and review a Profit and Loss Worksheet?

It is important to regularly update and review a Profit and Loss Worksheet because it provides a clear picture of a business's financial health and performance. By tracking income and expenses accurately and consistently, businesses can identify trends, make informed decisions, and take corrective actions if needed. Regular updates help in monitoring progress towards financial goals, identifying areas for improvement, and ensuring financial stability and success in the long run.

How can a Profit and Loss Worksheet help identify trends and insights in a company's financial performance?

A Profit and Loss Worksheet can help identify trends and insights in a company's financial performance by providing a detailed breakdown of revenues, expenses, and ultimately the net profit or loss over a specified period. By analyzing these figures over time, businesses can track patterns in their financial results, identify areas of strength or weakness, and make informed decisions to optimize performance. Comparing multiple periods allows for trend analysis, pinpointing fluctuations and helping managers understand what factors are driving financial performance. This analysis can reveal valuable insights such as patterns in revenue generation, cost trends, operational efficiencies, and potential areas for improvement, enabling companies to make strategic adjustments to enhance their financial outcomes.

What are some of the key metrics and ratios that can be calculated using a Profit and Loss Worksheet?

Key metrics and ratios that can be calculated using a Profit and Loss Worksheet include gross profit margin, net profit margin, operating income, earnings before interest and taxes (EBIT), return on investment (ROI), and earnings per share (EPS). These metrics help analyze the financial performance of a business, its profitability, efficiency, and overall health by comparing revenues to expenses and identifying areas for improvement or growth.

How can a Profit and Loss Worksheet help in budgeting and financial planning?

A Profit and Loss worksheet can help in budgeting and financial planning by providing a clear overview of a company's revenues and expenses over a specific period. By analyzing this information, businesses can identify areas of strength and weakness, make informed decisions on cost-cutting measures, forecast future financial performance, and set realistic goals for growth and profitability. This tool enables businesses to track their financial health, make strategic adjustments, and ultimately improve their overall financial management.

What are some common challenges or errors to watch out for when working with a Profit and Loss Worksheet?

Some common challenges or errors to watch out for when working with a Profit and Loss Worksheet include incorrectly categorizing expenses or revenues, failing to account for all sources of income or expenses, omitting non-operating income or expenses, using outdated or incorrect data, miscalculating formulas or not properly linking cells, and not reviewing and reconciling the worksheet regularly to ensure accuracy. It is important to pay attention to these potential pitfalls to ensure the accuracy and reliability of the financial information provided by the Profit and Loss Worksheet.

What are some strategies or tips for effectively utilizing a Profit and Loss Worksheet for financial analysis and decision making?

To effectively utilize a Profit and Loss Worksheet for financial analysis and decision making, start by regularly updating and reviewing the data to ensure accuracy. Focus on analyzing key metrics such as gross profit margin, net profit margin, and operating expenses to gain insights into the financial health of your business. Compare the current period's results to previous periods or industry benchmarks to identify trends and areas for improvement. Use the data to make informed decisions on pricing strategies, cost-cutting measures, and revenue-generating opportunities. Additionally, consider creating different scenarios or conducting sensitivity analyses to assess the potential impact of various factors on your business's profitability.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments