Personal Income and Expense Worksheet

Are you struggling to keep track of your personal finances? Look no further than the Personal Income and Expense Worksheet! This user-friendly tool is designed to help individuals effectively manage their money by keeping a detailed record of their income and expenses. By providing a clear structure and easy-to-use format, this worksheet allows you to stay organized and gain control over your financial situation. Whether you’re a budgeting beginner or a seasoned pro, the Personal Income and Expense Worksheet is the perfect solution to help you take charge of your money.

Table of Images 👆

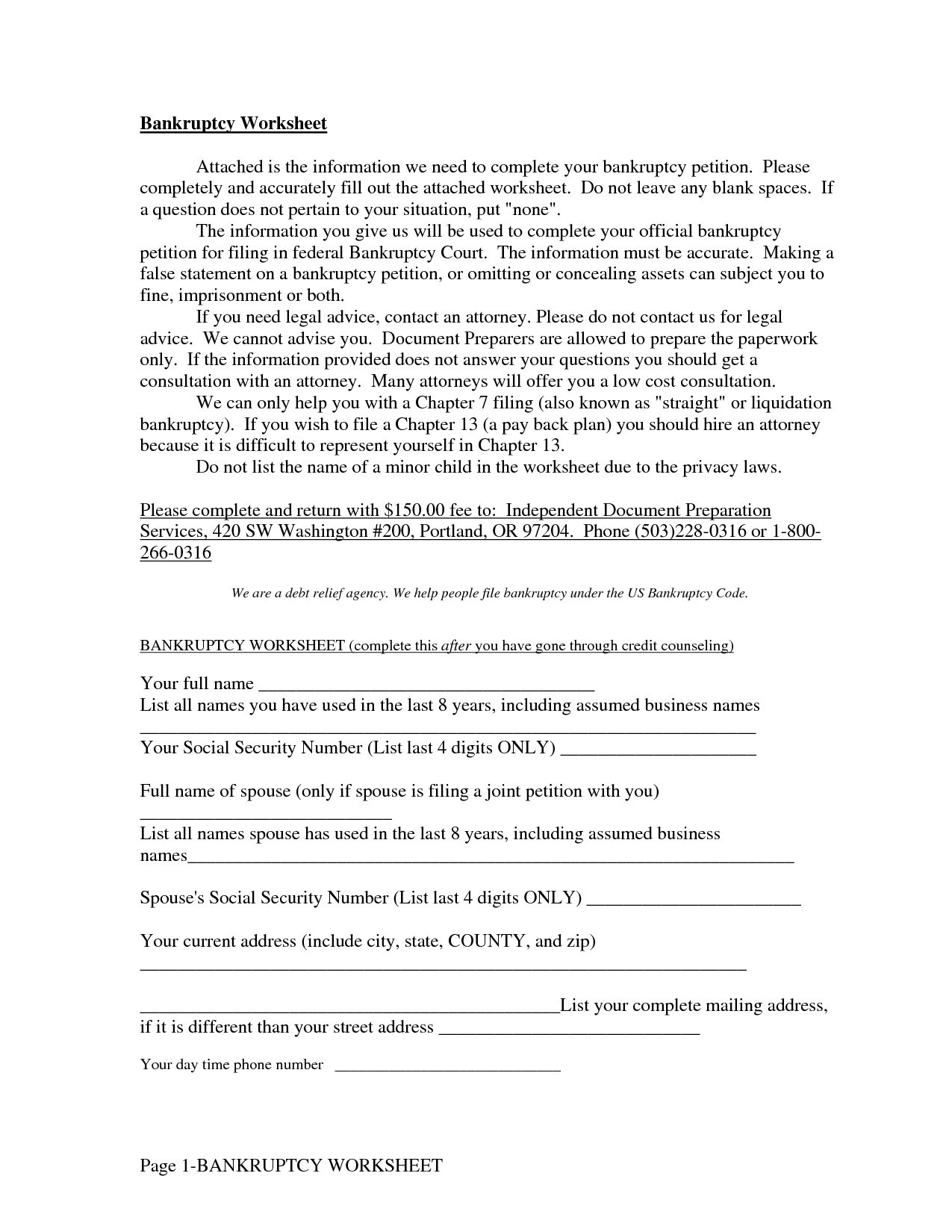

- Income and Expense Worksheet

- Income and Expense Worksheet Template

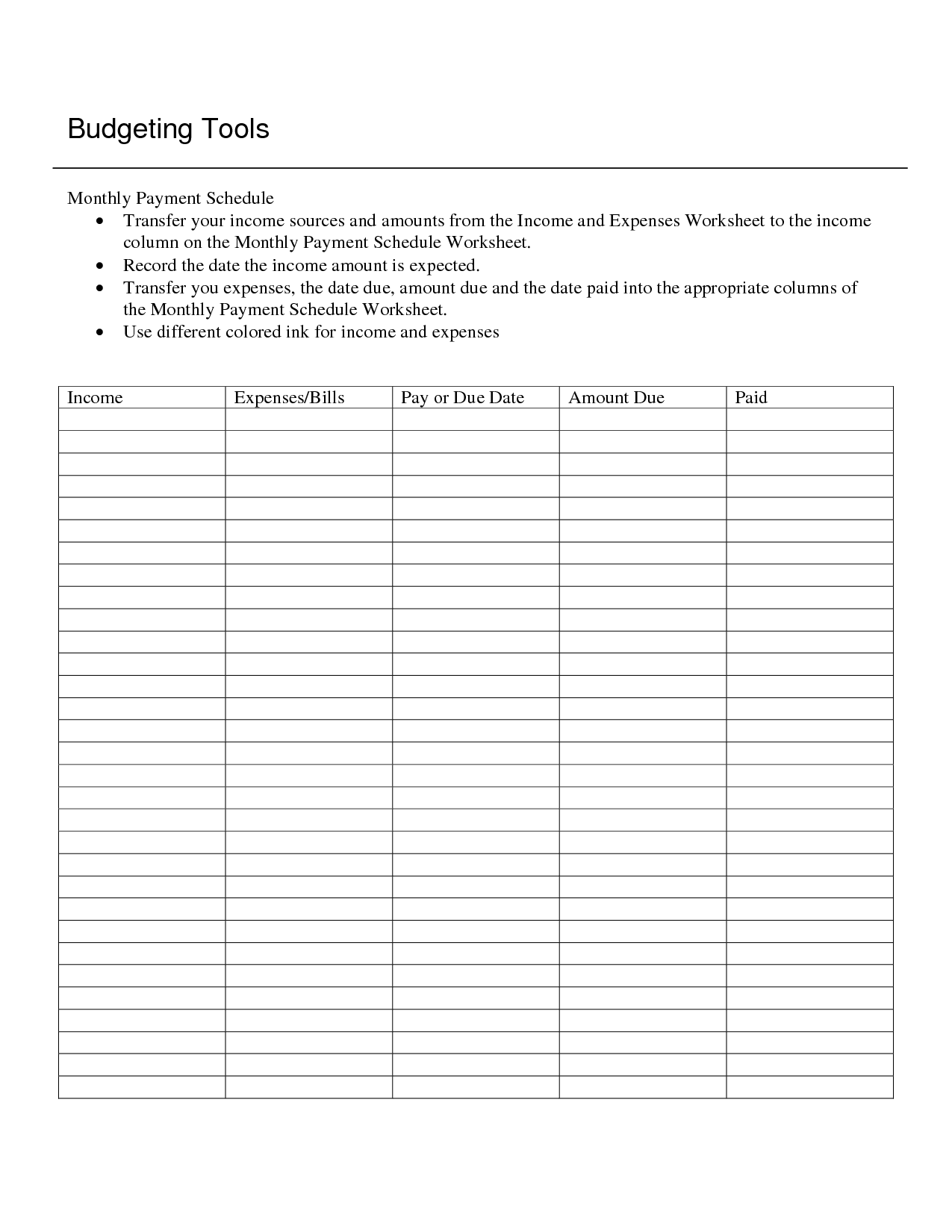

- Monthly Bill Payment Worksheet

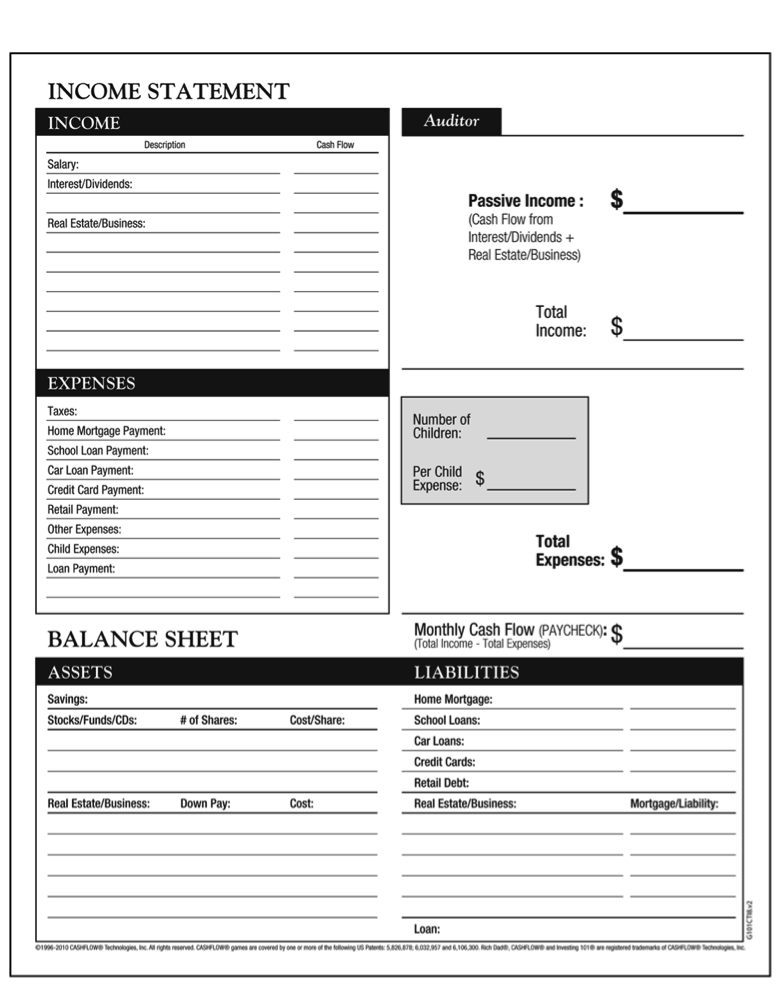

- Rich Dad Financial Statement

- Free Blank Spreadsheets

- Marketing Budget Spreadsheet Template

- Daily Budget Worksheet Printable

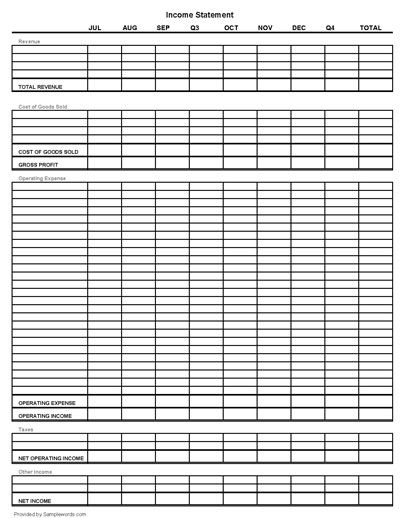

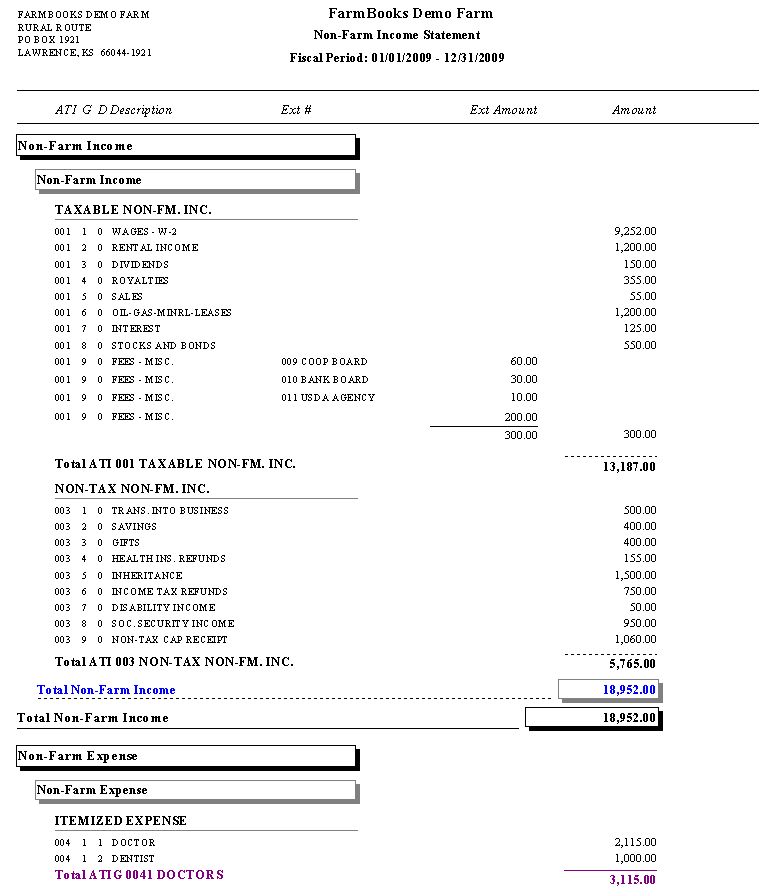

- Non-Profit Income Statement

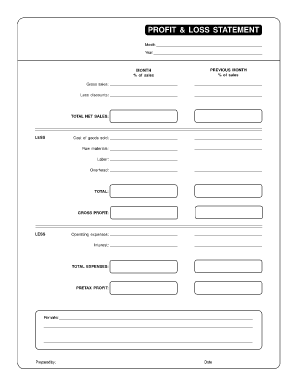

- Blank Profit and Loss Statement Form

- Adjusted Trial Balance Worksheet Template

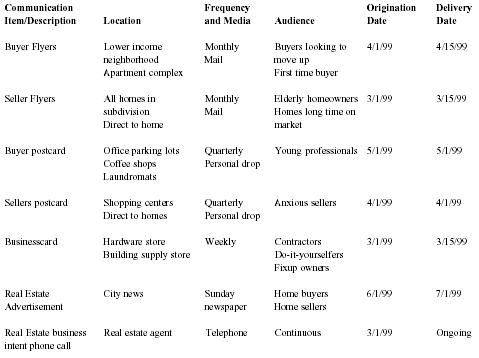

- Real Estate Business Plan Template

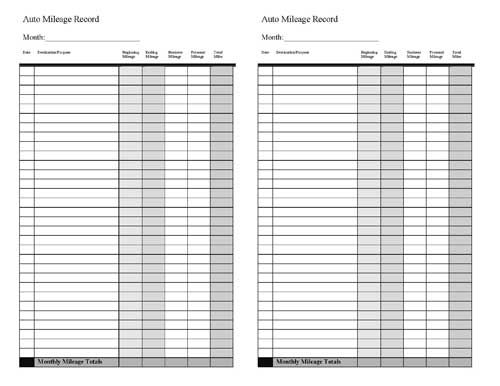

- Free Printable Mileage Log Template

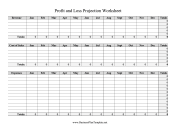

- Monthly Profit and Loss Worksheet

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a Personal Income and Expense Worksheet?

A Personal Income and Expense Worksheet is a tool used to track and manage one's finances by recording all sources of income and expenses. It helps individuals organize their financial information, set budget goals, and monitor their spending habits to better understand their financial health and make informed decisions about saving and spending.

Why is it important to track personal income and expenses?

Tracking personal income and expenses is important because it allows individuals to have a clear understanding of their financial situation. By monitoring these details, one can identify areas where they can save money, prioritize spending, set financial goals, and make informed decisions about budgeting and saving for the future. This practice helps in maintaining financial stability, avoiding debt, and ensuring that one is on track to meet their financial objectives.

What are the different sections included in a personal income and expense worksheet?

A personal income and expense worksheet typically includes sections for listing sources of income such as salary, investments, or rental income, as well as sections for detailing expenses such as housing costs, utilities, groceries, transportation, and other regular expenditures. Additional sections may cover savings goals, debt repayment, and discretionary spending categories like entertainment or travel. The worksheet allows individuals to track their financial inflows and outflows, helping them to budget effectively and make informed decisions about their money management.

How do you calculate your net income on a personal income and expense worksheet?

To calculate your net income on a personal income and expense worksheet, subtract your total expenses from your total income. Start by listing all sources of income, such as salary, rental income, or side hustle earnings. Then, list all expenses including rent/mortgage, utilities, groceries, transportation, and any other regular expenses. Once you have these totals, subtract your total expenses from your total income to determine your net income. This calculation will give you a clear picture of how much money you have left after covering your expenses.

Why should you include both fixed and variable expenses in the worksheet?

It is important to include both fixed and variable expenses in the worksheet because fixed expenses represent consistent, regular costs that do not change regardless of the level of business activity, providing a stable baseline for budgeting and planning. On the other hand, variable expenses fluctuate based on business operations and can impact overall profitability, making it essential to understand and monitor these costs for effective financial management and decision-making. By tracking both fixed and variable expenses, businesses can develop a comprehensive view of their financial obligations and better control their budgeting processes.

How can a personal income and expense worksheet help with budgeting?

A personal income and expense worksheet can help with budgeting by providing a clear overview of all sources of income and expenses in one place. By tracking and categorizing expenses, individuals can identify where their money is going and make informed decisions on where to cut back or save. This worksheet serves as a tool for setting financial goals, monitoring progress, and ultimately creating a realistic budget that aligns with individual financial priorities and objectives.

What are some common sources of income that should be included in the worksheet?

Some common sources of income that should be included in a worksheet are wages/salaries, self-employment income, rental income, investment income (such as interest, dividends, and capital gains), retirement income (such as pensions and Social Security), alimony, child support, bonuses, and any other forms of income received regularly.

How often should you update your personal income and expense worksheet?

It is recommended to update your personal income and expense worksheet at least once a month. This frequency allows you to keep track of your finances accurately, identify any patterns or trends, and make adjustments as needed to stay on budget and achieve your financial goals.

What are some common categories for expenses that should be included in the worksheet?

Common categories for expenses that should be included in a worksheet are housing (rent or mortgage), utilities (electricity, water, gas), transportation (car payments, gas, public transport), food (groceries, dining out), insurance (health, car, home), debt payments (credit cards, loans), entertainment (movies, hobbies), savings (retirement, emergency fund), and miscellaneous expenses. Keeping track of these categories can help individuals better understand and manage their finances.

What are some benefits of using a personal income and expense worksheet?

A personal income and expense worksheet helps individuals track their finances, identify spending habits, create a budget, and plan for financial goals. It provides a clear overview of income sources, expenses, and savings, helping to prioritize spending and make informed financial decisions. By using a worksheet, individuals can better manage their money, reduce unnecessary expenses, and improve their overall financial well-being.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments