Personal Financial Worksheet

A personal financial worksheet is a useful tool for individuals who want to gain clarity and take control of their finances. With this worksheet, you can track your income, expenses, and savings, allowing you to understand and manage your financial situation more easily. By accurately organizing your financial data, you can create a solid foundation for making informed decisions about your money.

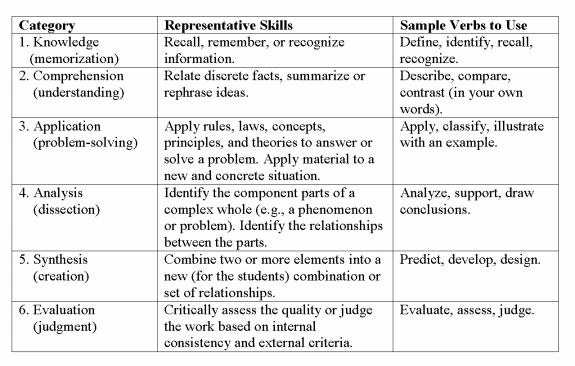

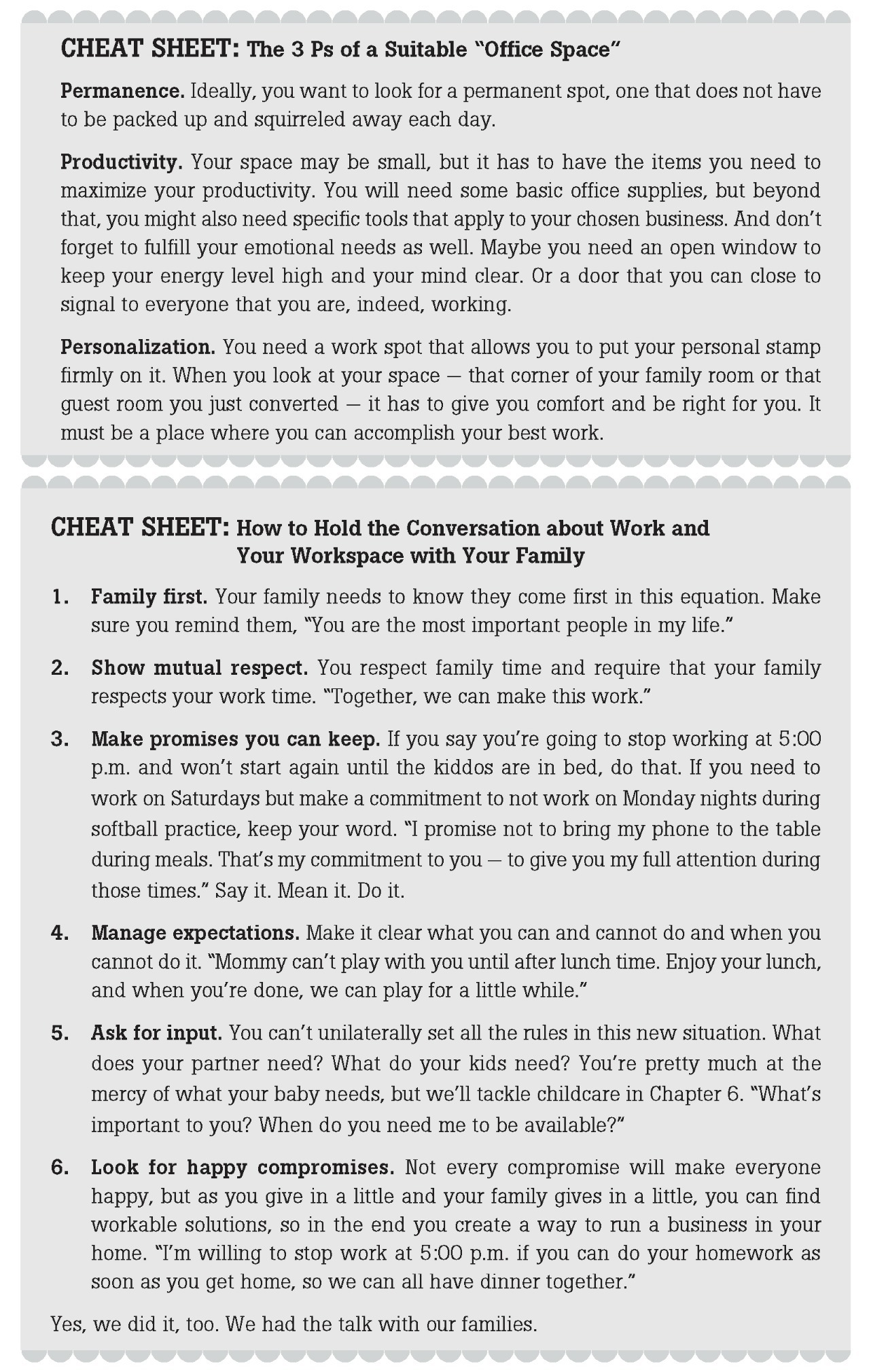

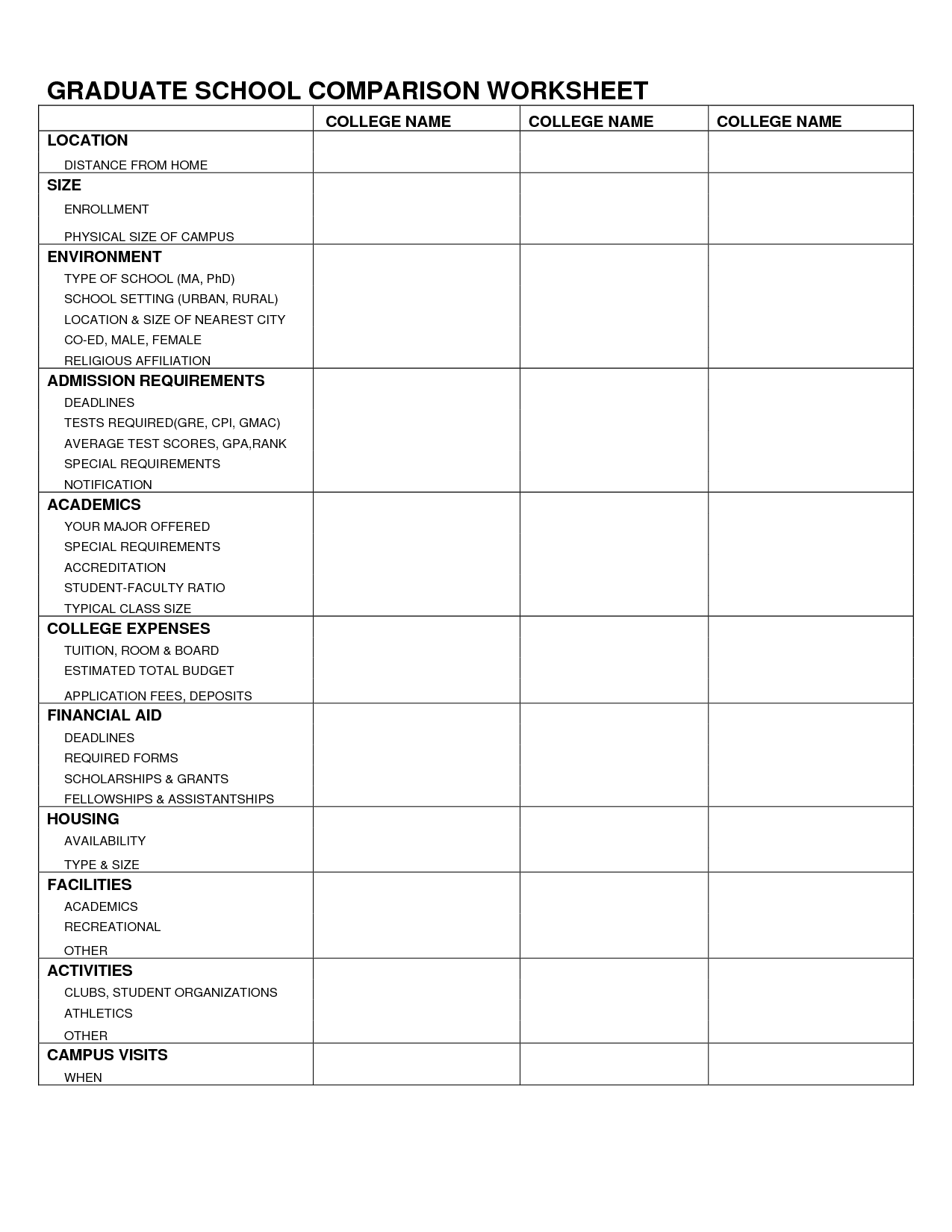

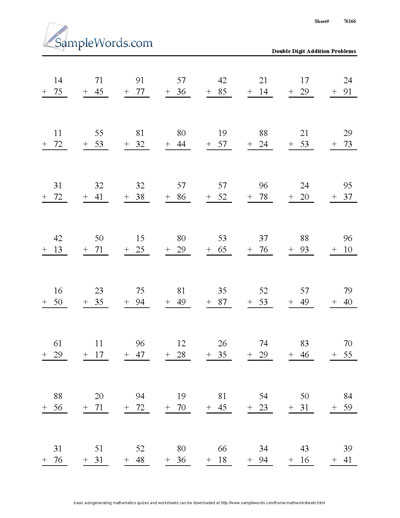

Table of Images 👆

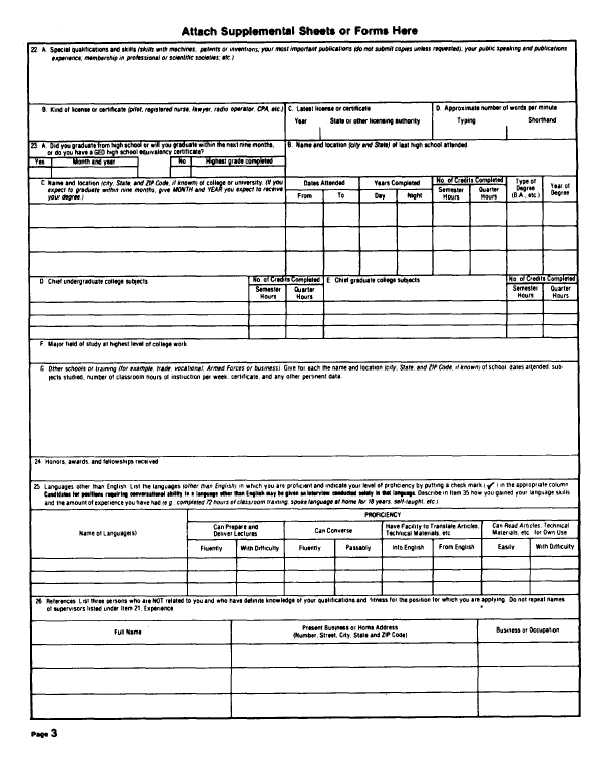

- Collaboration Worksheets

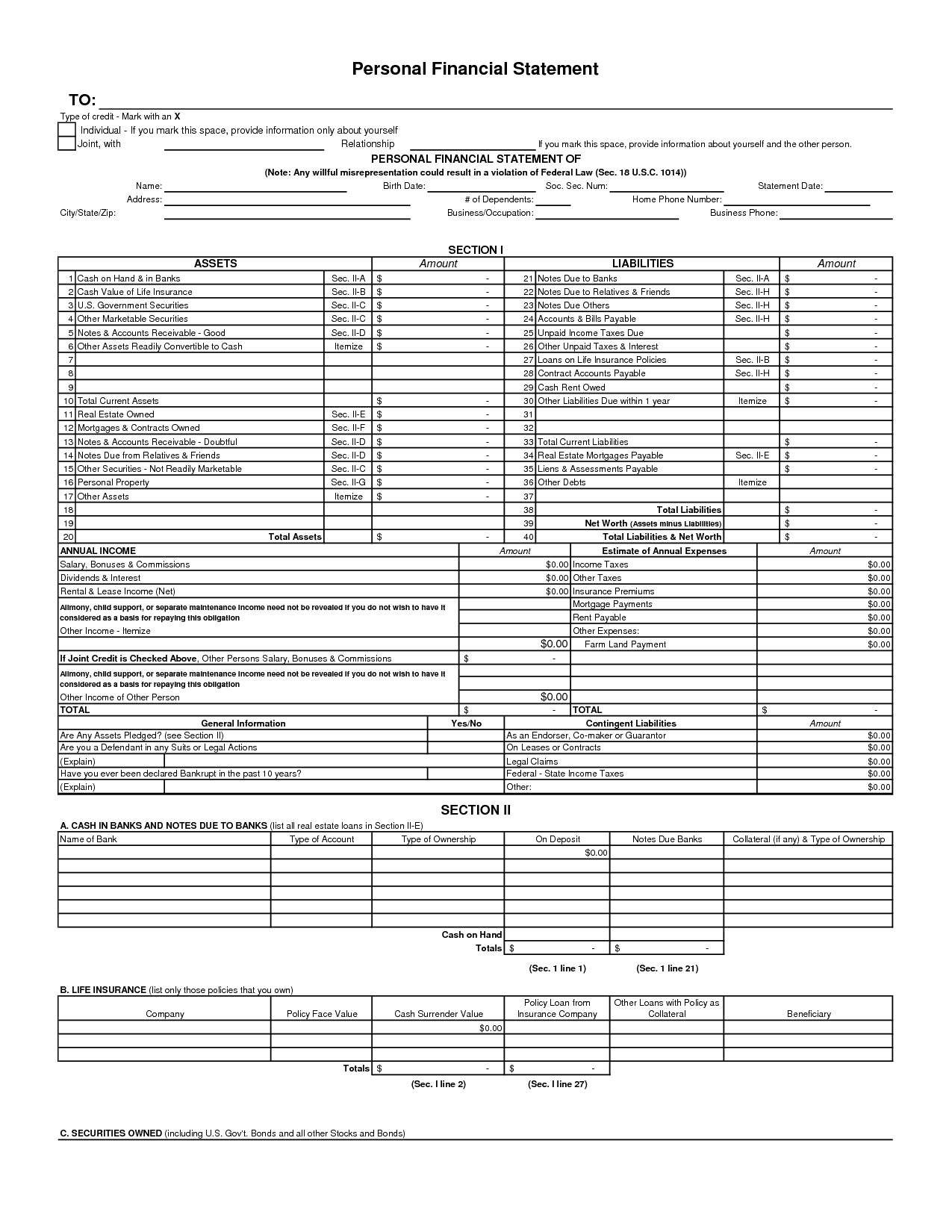

- Printable Personal Financial Statement Form

- Personal Financial Statement Template for Excel Worksheet

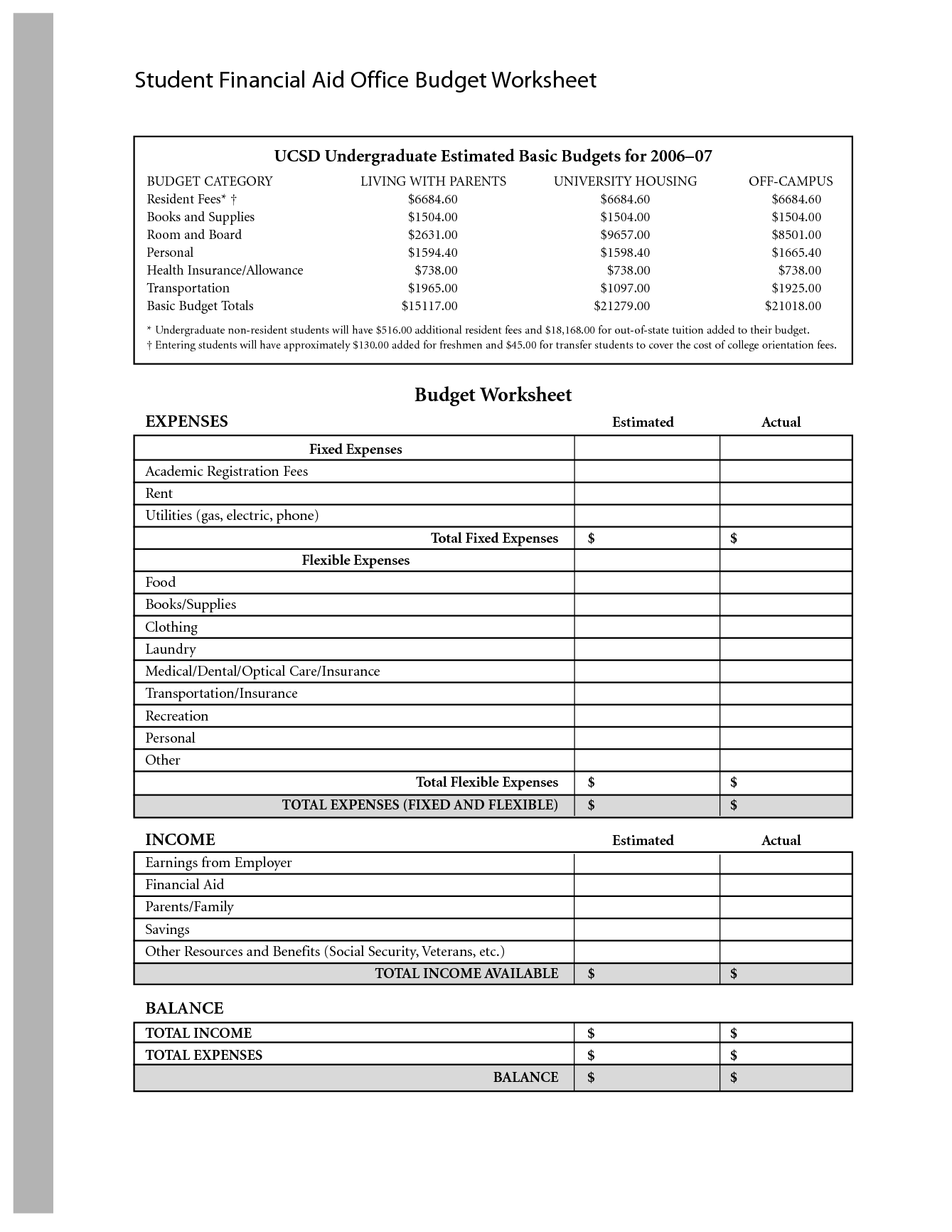

- Budget Worksheet Financial Aid

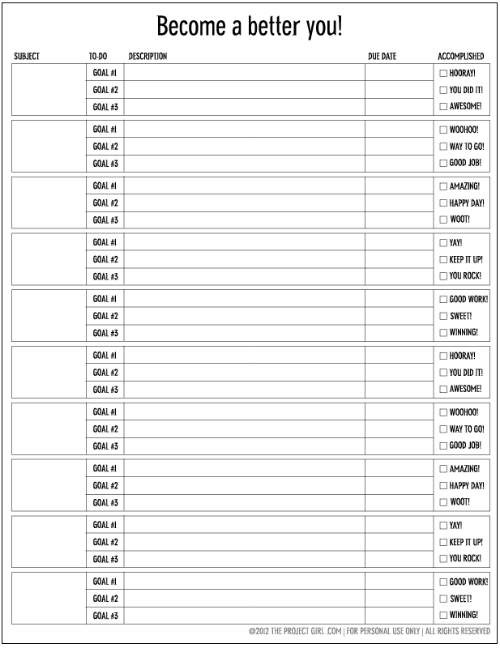

- Blank Goal Sheets

- Free Personal Financial Statement Template

- Free Printable Financial Worksheets

- Blank Monthly Budget Spreadsheet

- Free Financial Analysis Report Template

- Personal Development Plan Example

- Restaurant Food Inventory Template

- Family Financial Planning Worksheet

- Percent Tax Tip Discount Word Problems Worksheet Answers

- Graduate School Comparison Worksheet

- Free Math Double-Digit Addition Worksheet

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a personal financial worksheet?

A personal financial worksheet is a document that helps individuals organize their financial information and track their expenses, income, assets, and debts. It typically includes sections for listing monthly expenses such as rent, utilities, groceries, and transportation, as well as sections for recording sources of income, savings goals, and investments. This tool can provide a comprehensive overview of an individual's financial situation, helping them make informed decisions and budget effectively.

What information can be found on a personal financial worksheet?

A personal financial worksheet typically includes details such as income sources, expenses, assets (such as savings, investments, and property), liabilities (such as debts and loans), budgeting information, and financial goals. It provides a comprehensive overview of an individual's financial situation and helps in tracking, managing, and planning personal finances effectively.

How can a personal financial worksheet help individuals manage their finances?

A personal financial worksheet can help individuals manage their finances by providing a clear overview of their income, expenses, assets, and liabilities. It allows individuals to track their financial activities, identify areas where they can save money or cut expenses, and set realistic financial goals. By using a financial worksheet, individuals can better understand their financial situation, make informed decisions, and create a budget that aligns with their financial objectives.

What are the key components of a personal financial worksheet?

A personal financial worksheet typically includes key components such as income sources, expenses (both fixed and variable), debt obligations, assets, savings goals, and emergency funds. It may also incorporate budget allocation for different categories, such as housing, transportation, food, and entertainment. Additionally, tracking of financial goals, investments, retirement planning, insurance policies, and a net worth statement are crucial elements of a comprehensive personal financial worksheet.

How often should a personal financial worksheet be updated?

A personal financial worksheet should be updated regularly, ideally at least once a month. This will help you stay on top of your expenses, track your income, savings, and investments, and make adjustments as needed to meet your financial goals. Regular updates can also help you identify any financial issues early on and take necessary actions to address them.

Can a personal financial worksheet be used for budgeting purposes?

Yes, a personal financial worksheet can be used effectively for budgeting purposes. It can help individuals track their income, expenses, savings goals, and debt payments in a structured format, providing a clear overview of their financial situation. By using a personal financial worksheet, individuals can better manage their finances, identify areas where they can save money, and make informed decisions to achieve their financial goals.

How does a personal financial worksheet help individuals track their expenses?

A personal financial worksheet helps individuals track their expenses by providing a structured framework to record their income and expenditures in an organized manner. By listing all sources of income and categorizing expenses such as housing, transportation, food, and entertainment, individuals can easily identify where their money is going and analyze their spending patterns. This visibility allows for better budgeting decisions, highlighting areas where adjustments can be made to improve financial stability and reach financial goals. Additionally, the worksheet serves as a reference point for monitoring progress and making informed financial decisions based on actual spending habits.

What are the benefits of regularly reviewing a personal financial worksheet?

Regularly reviewing a personal financial worksheet can help individuals track their expenses, identify patterns in spending, create a budget, set financial goals, monitor progress towards those goals, and make informed decisions about saving, investing, and debt management. It can also help in identifying areas where adjustments may be needed to improve financial health and stability, and ultimately lead to better money management and increased financial security.

Can a personal financial worksheet help individuals identify areas of overspending or potential savings?

Yes, a personal financial worksheet can certainly help individuals identify areas of overspending and potential savings. By tracking expenses and income in detail, individuals can clearly see where their money is going and identify areas where they may be overspending. This can help them make more informed decisions about their finances and identify opportunities to cut costs and increase savings.

How can a personal financial worksheet serve as a useful tool for financial goal setting?

A personal financial worksheet can serve as a useful tool for financial goal setting by providing a comprehensive overview of an individual's financial situation. By listing income, expenses, assets, and liabilities in one place, it allows individuals to assess their current financial position and track their progress towards their goals. This information can help in setting specific, measurable, achievable, relevant, and time-bound (SMART) financial goals that are tailored to one's unique circumstances, ultimately shaping a more strategic and effective financial plan.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments