Household Spending Plan Worksheet

Are you looking for a helpful tool to help you manage and track your household expenses? Look no further than the Household Spending Plan Worksheet. Designed to cater to individuals and families who want to gain better control of their finances, this worksheet provides a comprehensive way to organize your expenses, track your income, and create a realistic budget that fits your needs. With its user-friendly format and easy-to-understand sections, this worksheet is the perfect solution for anyone who wants to take charge of their financial situation.

Table of Images 👆

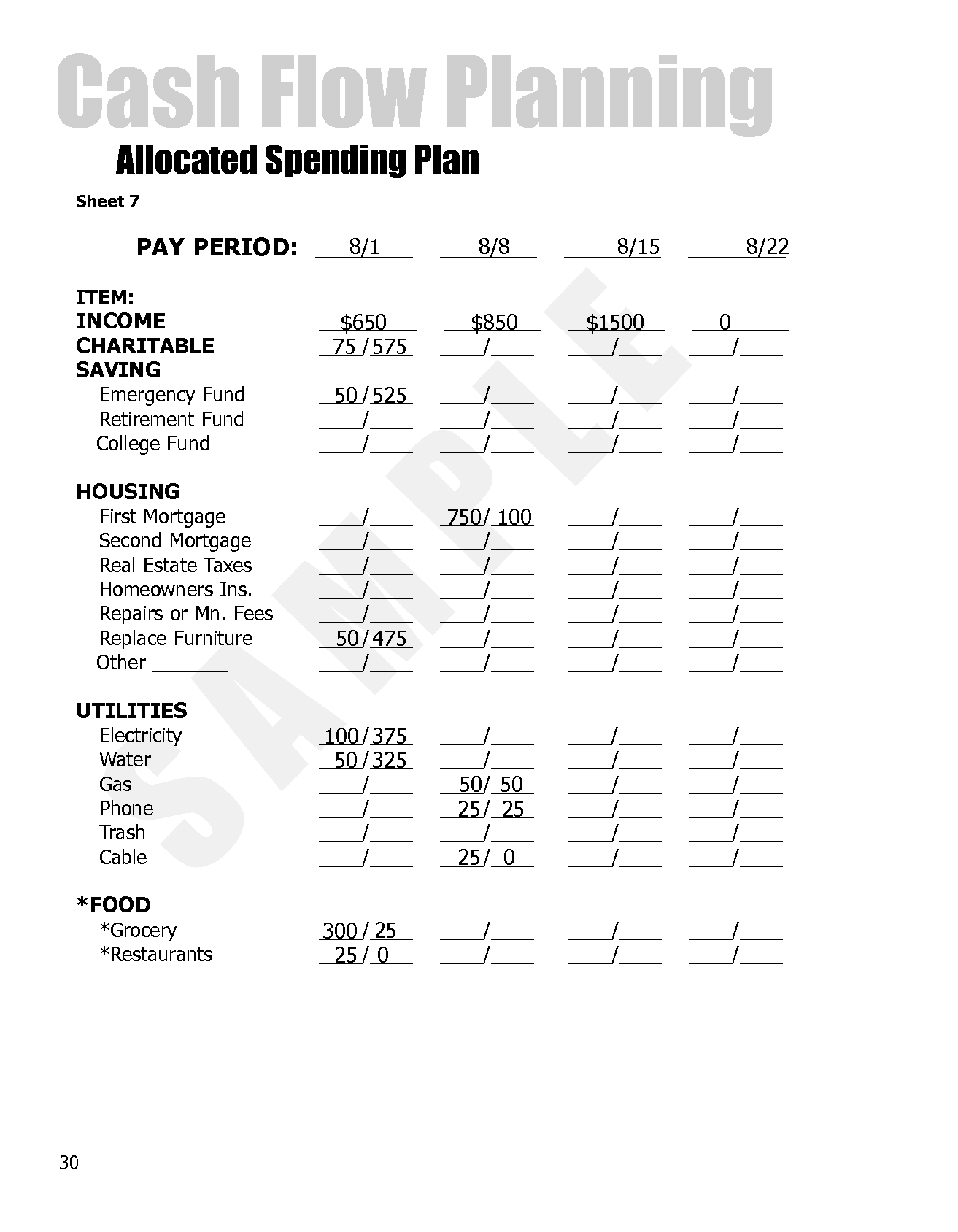

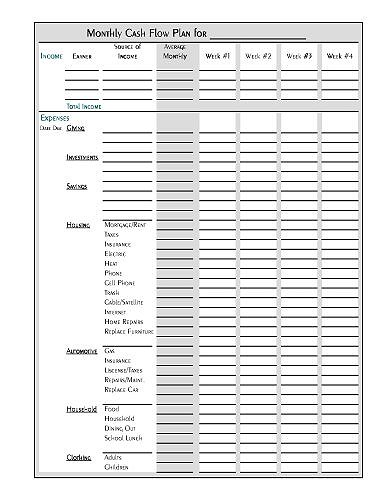

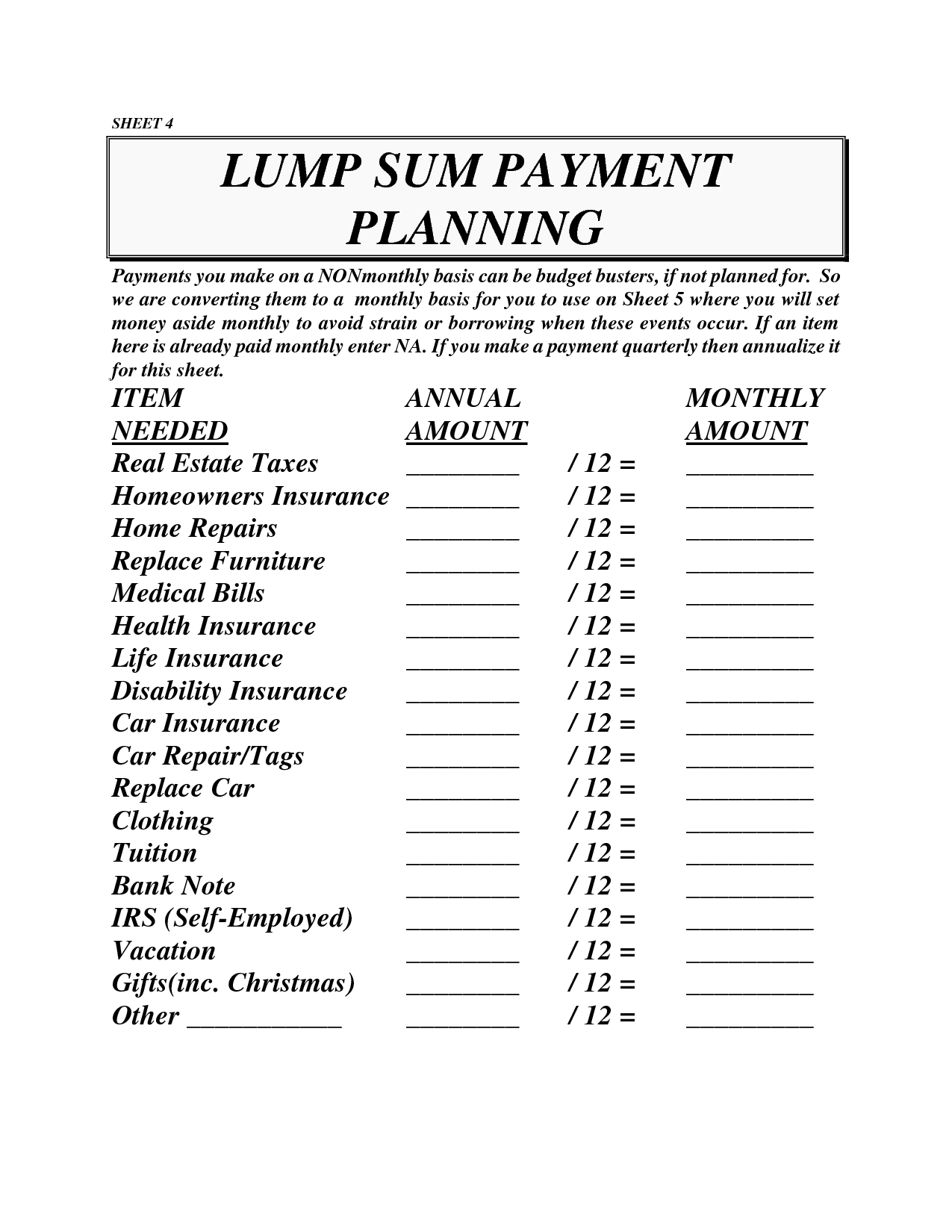

- Dave Ramsey Allocated Spending Plan Budget

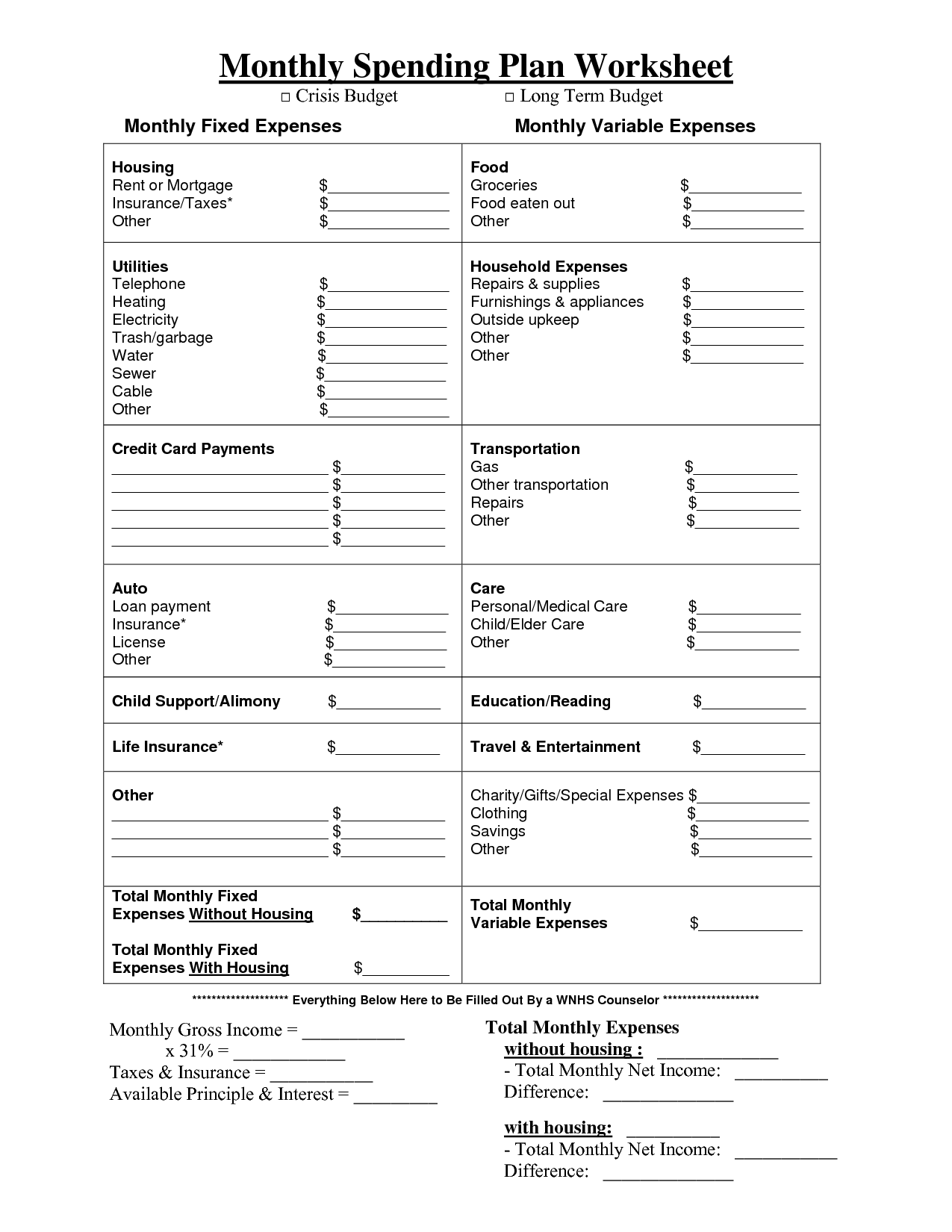

- Spending Plan Worksheet PDF

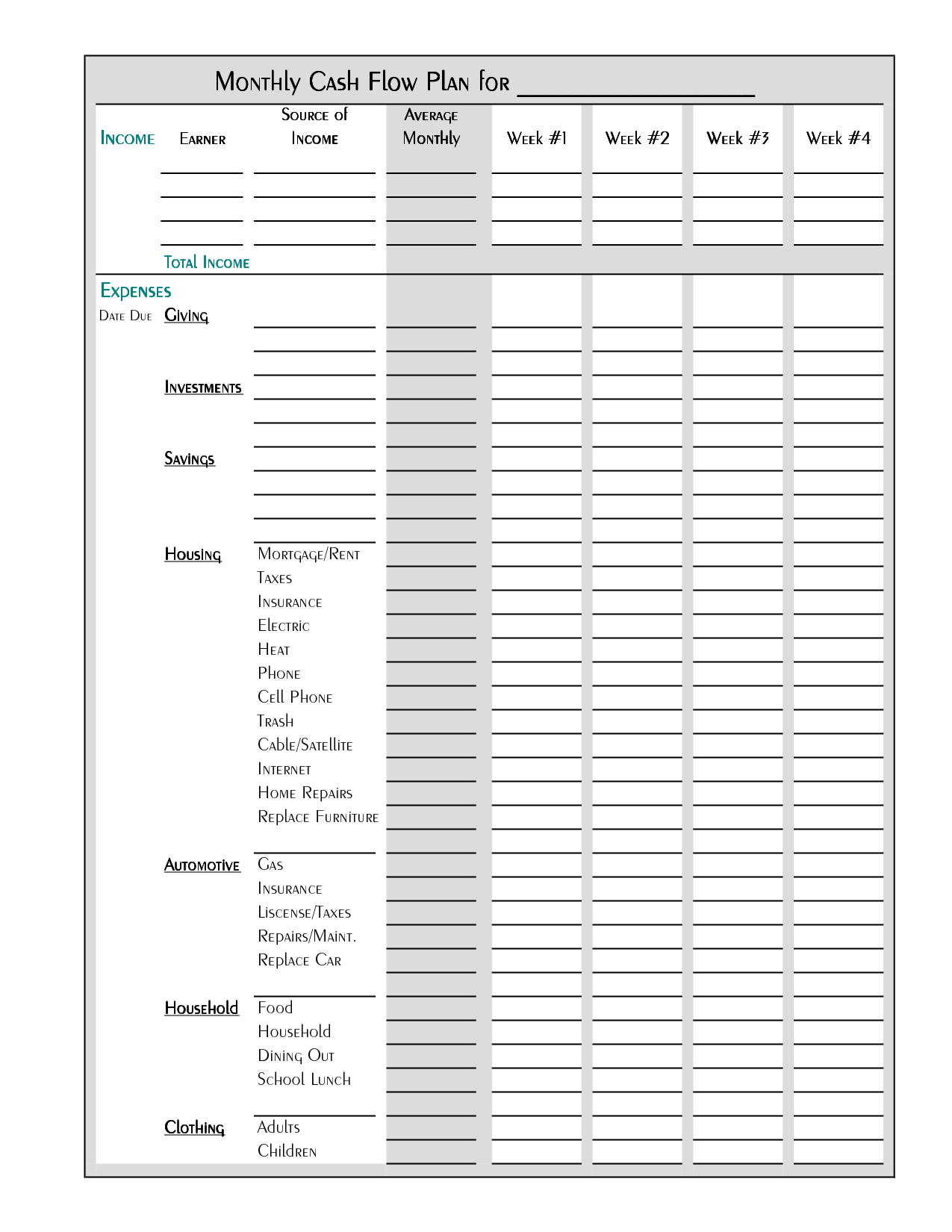

- Free Printable Budget Worksheet Template

- Monthly Cash Flow Budget Template

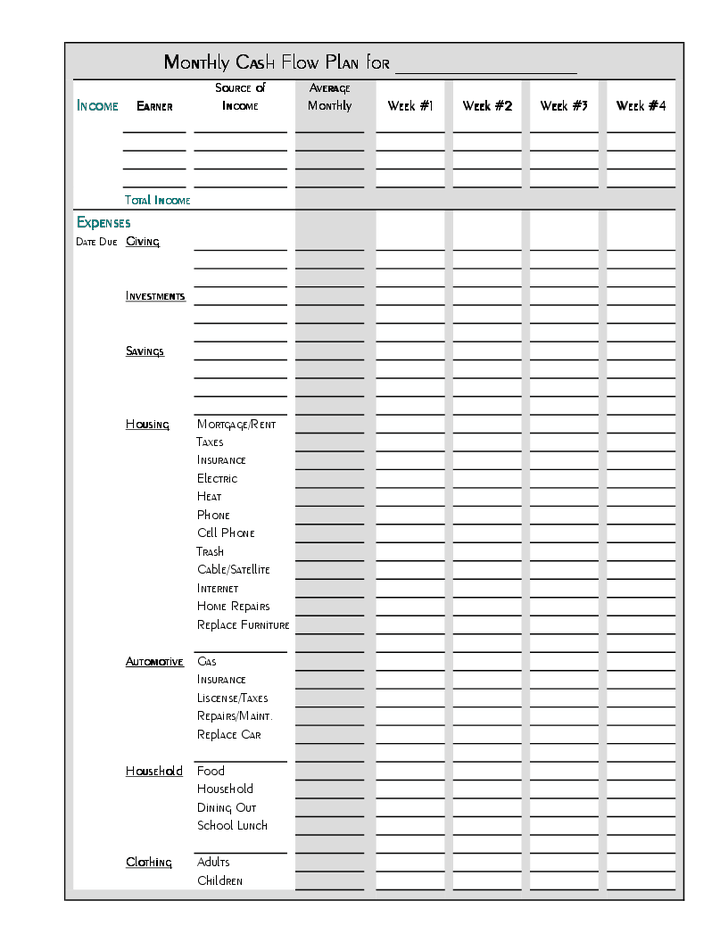

- Free Printable Household Budget Worksheets

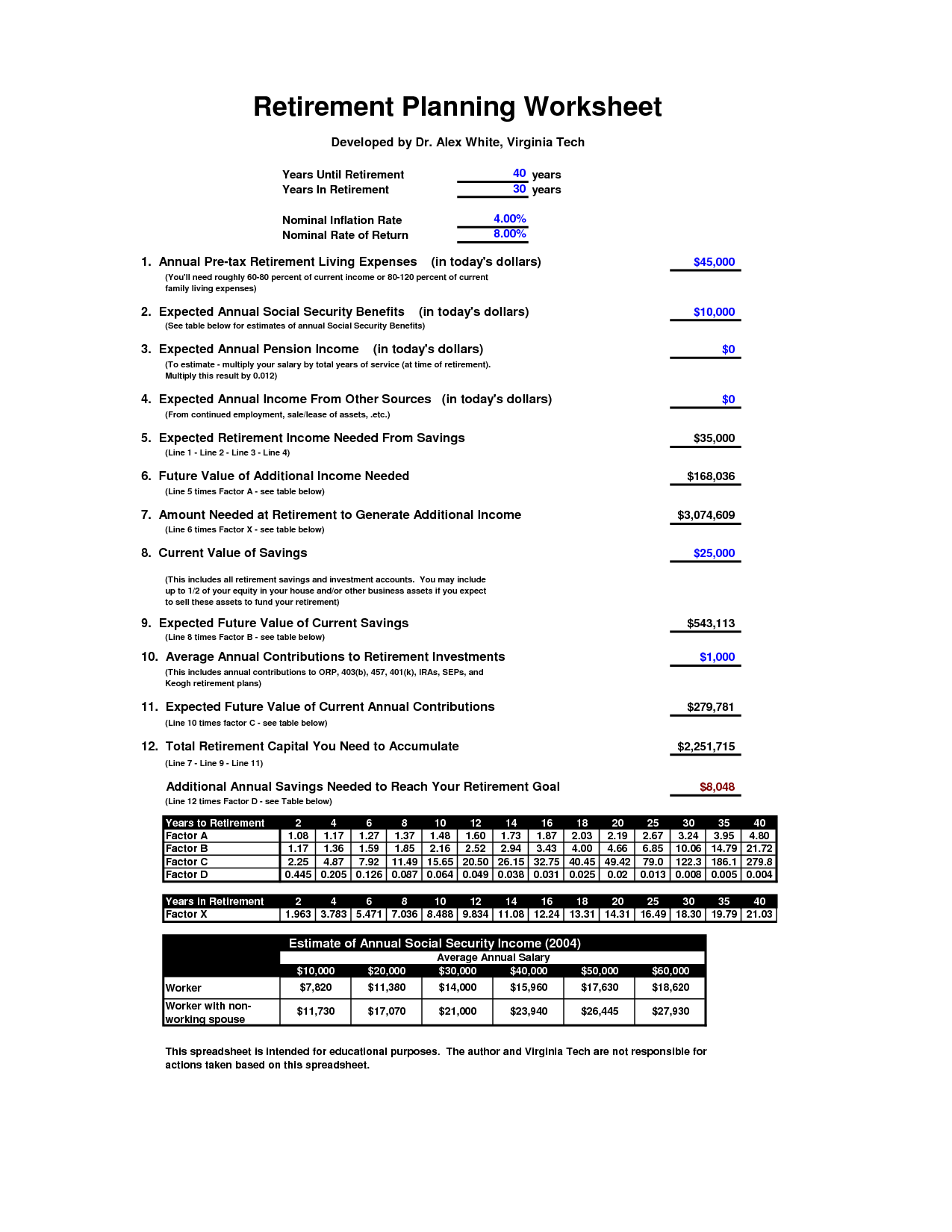

- Retirement Planning Worksheet Printable

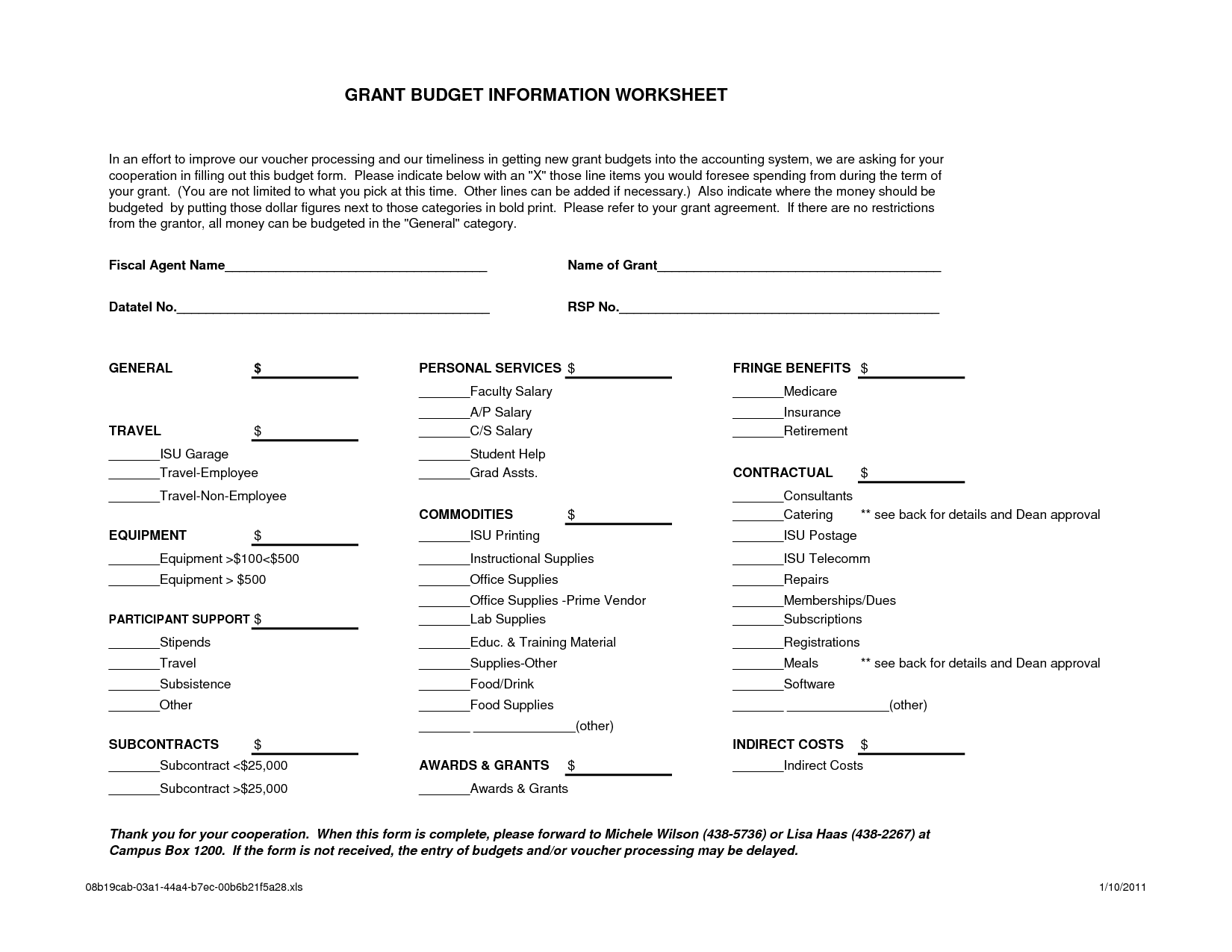

- Grant Budget Worksheet Template

- Dave Ramsey Budget Worksheet Printable

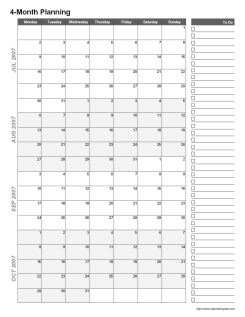

- Printable 4 Month Calendar Template

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a household spending plan worksheet?

A household spending plan worksheet is a tool used to organize and track a household's income and expenses. It typically includes categories such as monthly income sources, fixed expenses (e.g. rent, utilities), variable expenses (e.g. groceries, entertainment), savings goals, and debt payments. By filling out this worksheet, individuals or families can gain a clearer understanding of their financial situation, identify areas for potential savings or adjustments, and make informed decisions to achieve their financial goals.

What is the purpose of using a household spending plan worksheet?

The purpose of using a household spending plan worksheet is to help individuals track and organize their expenses, income, and savings in order to create a clear overview of their financial situation. By budgeting and analyzing their spending habits, individuals can better manage their money, identify areas where they can save or cut back on expenses, and work towards achieving their financial goals.

What categories or sections does a typical household spending plan worksheet include?

A typical household spending plan worksheet includes categories such as income sources, fixed expenses (e.g. rent, utilities), variable expenses (e.g. groceries, entertainment), savings goals, debt repayments, and miscellaneous expenses. It may also have sections for tracking spending, setting financial goals, and calculating net income.

How often should a household spending plan worksheet be updated or reviewed?

A household spending plan worksheet should be updated or reviewed at least once a month to track income and expenses accurately, identify any changes in financial goals, and make necessary adjustments to ensure financial stability and success in managing finances. Regular review and updates help in staying on track with financial goals and avoiding any surprises or setbacks.

What information should be recorded in the income section of a household spending plan worksheet?

In the income section of a household spending plan worksheet, you should record all sources of income for the household, including salaries, wages, bonuses, freelancing income, rental or investment income, alimony, child support, and any other sources of money coming into the household regularly. It is important to have a comprehensive and accurate list of all income sources to effectively plan and manage your household finances.

How can expenses be categorized in a household spending plan worksheet?

Expenses in a household spending plan worksheet can be categorized based on different expenditure categories such as housing, utilities, groceries, transportation, entertainment, healthcare, and savings. Each expense should be allocated to its respective category to track and analyze spending patterns effectively. Additionally, subcategories can be used for more detailed breakdowns within each main category, providing a clear overview of where money is being allocated and aiding in budgeting efforts.

Why is it important to track and analyze expenses in a household spending plan worksheet?

Tracking and analyzing expenses in a household spending plan worksheet is crucial for financial stability and success because it provides a clear picture of where money is being spent, helps identify areas where costs can be reduced, allows for better budgeting and planning for future expenses, and ultimately helps in achieving financial goals and staying within one's means. By understanding and managing expenses effectively, individuals and families can make informed financial decisions, save money, and avoid debt.

How can a household spending plan worksheet help in identifying areas for saving or cutting down expenses?

A household spending plan worksheet can help in identifying areas for saving or cutting down expenses by providing a clear overview of all income and expenses. By listing and categorizing all expenses, individuals can easily see where their money is going and identify areas where they can potentially cut back. This worksheet allows for a more deliberate and intentional approach towards managing finances, as it encourages individuals to review their spending habits and prioritize areas where they can make adjustments to save money. By tracking expenses over time and comparing them to budgeted amounts, individuals can determine which areas may be excessive and in need of trimming, ultimately leading to more efficient money management.

What are some common mistakes or challenges in maintaining a household spending plan worksheet?

Common mistakes or challenges in maintaining a household spending plan worksheet include failing to regularly update the worksheet with accurate expenses, underestimating or forgetting certain expenses, not adjusting the plan when financial circumstances change, and not involving all household members in the budgeting process. Additionally, some people may struggle to stick to the budget due to unexpected expenses, lack of discipline, or difficulty prioritizing spending. It's important to be proactive, realistic, and flexible when managing a household spending plan to ensure it remains effective and sustainable.

How can a household spending plan worksheet contribute to financial stability and better financial decision-making?

A household spending plan worksheet can contribute to financial stability and better financial decision-making by helping individuals track their income and expenses, set financial goals, prioritize spending, identify areas where costs can be reduced, and plan for unexpected expenses or emergencies. By having a clear overview of their financial situation, individuals can make more informed decisions about their money, avoid overspending, and work towards building savings and financial security for the future.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments