Build a Budget Worksheet

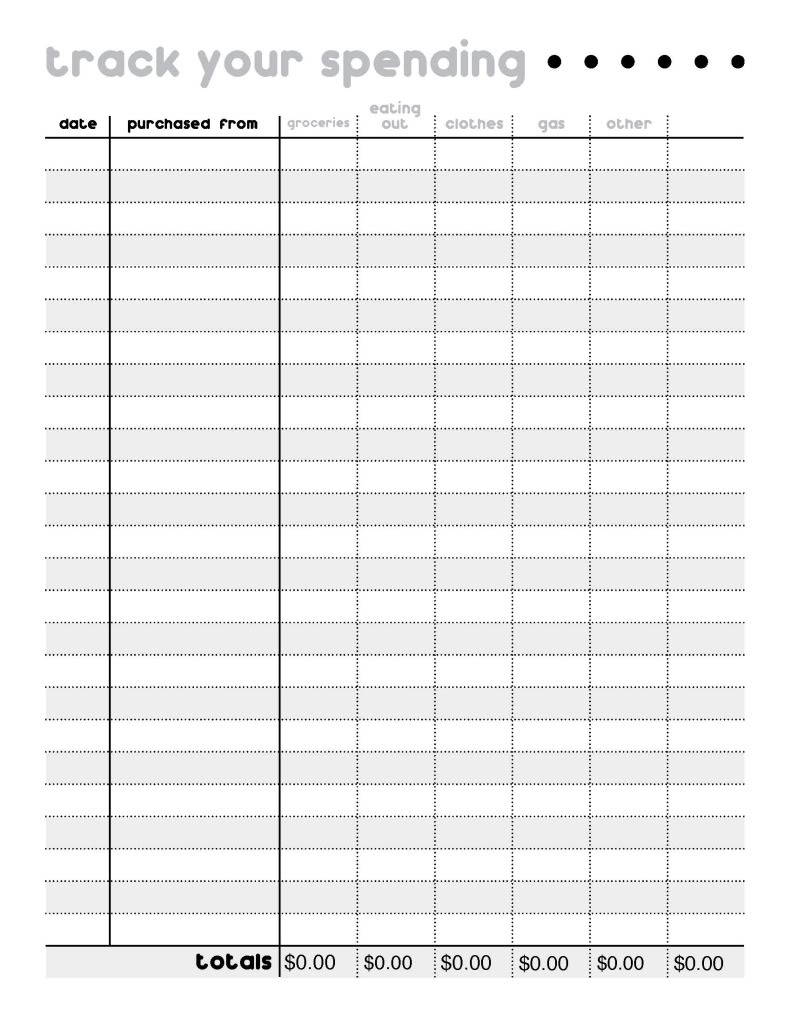

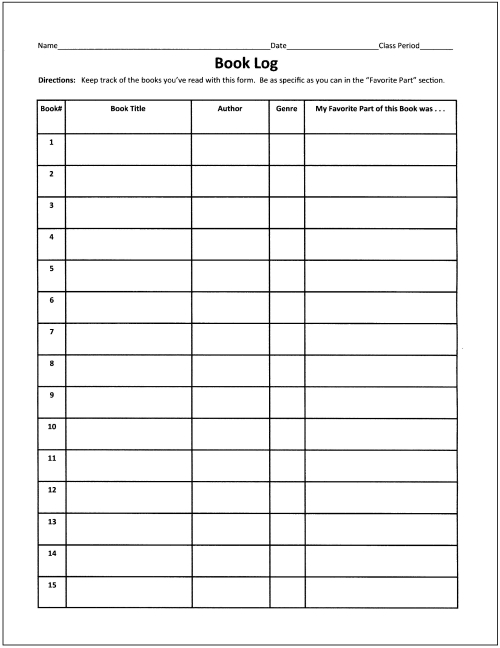

Are you an individual or a small business owner looking to take control of your finances? If so, you may find that a budget worksheet is just what you need. A budget worksheet is a tool that helps you track your income and expenses, allowing you to better manage your money and make informed financial decisions.

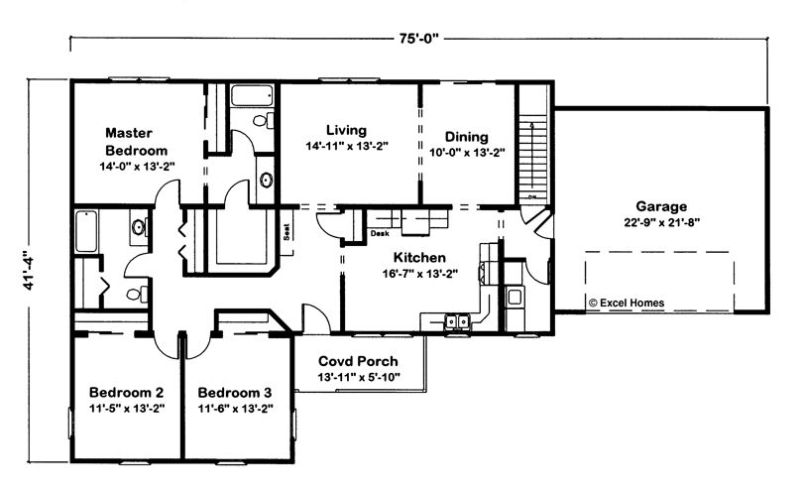

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a Build a Budget Worksheet?

A Build a Budget Worksheet is a tool used to help individuals or households plan and track their finances by outlining their income and expenses. It typically includes categories to list sources of income, fixed and variable expenses, as well as space for discretionary spending. By filling out this worksheet, individuals can create a clear picture of their financial situation, identify areas for savings or cutbacks, and work towards achieving their financial goals.

How can a Build a Budget Worksheet help with financial planning?

A budget worksheet can help with financial planning by providing a structured way to track income and expenses, identify areas of overspending or opportunities to save money, set financial goals, and monitor progress towards those goals. By creating and regularly updating a budget worksheet, individuals can gain a clearer understanding of their financial situation, make informed decisions about where to allocate their money, and ultimately work towards achieving their long-term financial objectives.

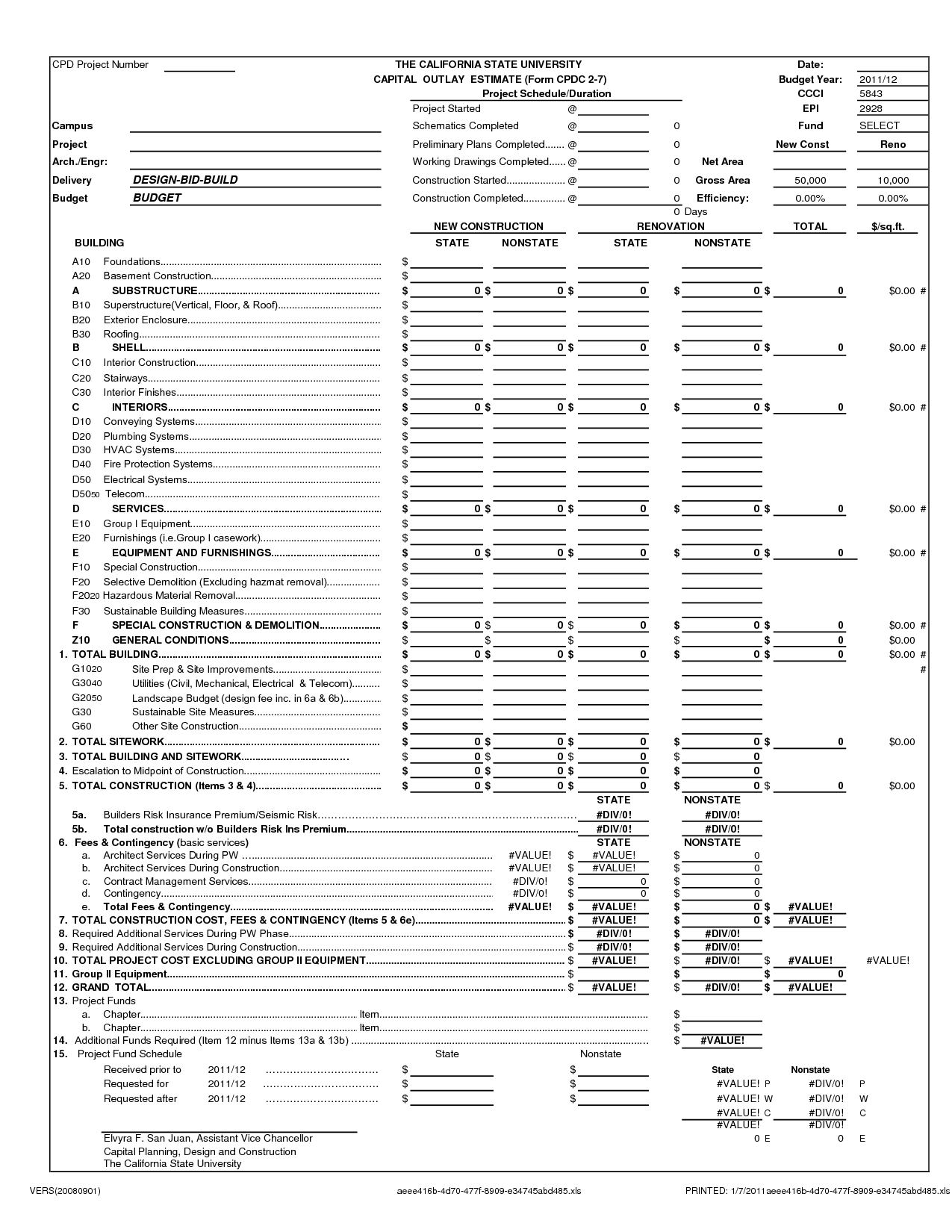

What are the key elements typically included in a Build a Budget Worksheet?

A Build a Budget Worksheet typically includes key elements such as income sources, expenses, savings goals, debt payments, and a breakdown of discretionary spending categories. It helps individuals track and manage their finances by detailing their financial inflows and outflows, identifying areas for improvement, and setting specific financial goals. Additionally, the worksheet may also include sections for emergency savings, investment contributions, and tracking progress towards achieving financial milestones.

How does a Build a Budget Worksheet help track income and expenses?

A Budget Worksheet helps track income and expenses by providing a structured template where you can list all sources of income and various expenses categories. By organizing and categorizing financial information in one place, you can easily compare your income against your expenses to see where your money is going and identify areas where you may need to cut costs or increase income. This tracking helps you stay within your budget, make informed financial decisions, and work towards your financial goals.

What are some common categories to consider when creating a Build a Budget Worksheet?

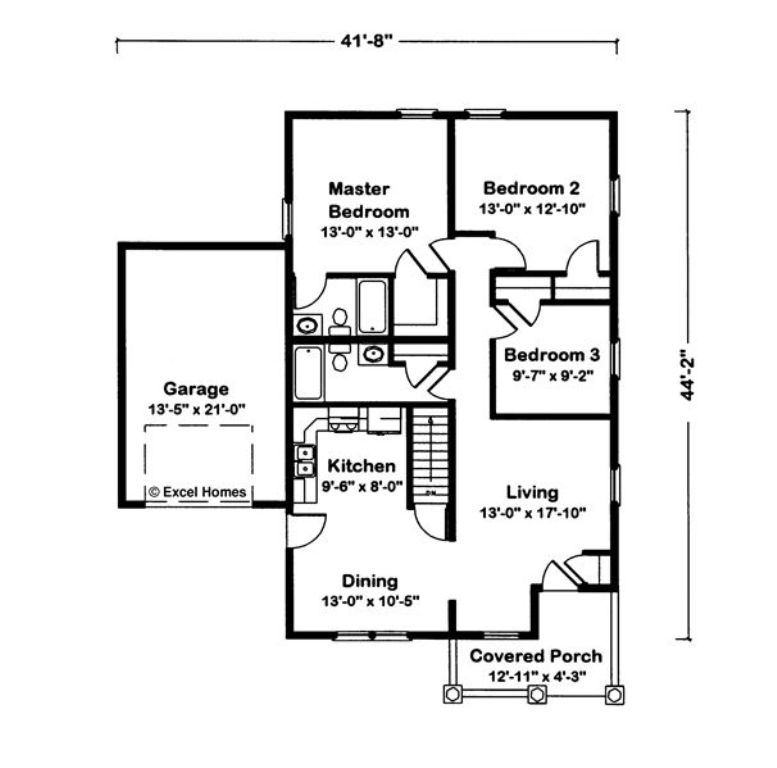

When creating a Build a Budget Worksheet, some common categories to consider include income (such as salary, investments, and other sources), expenses (such as housing, transportation, groceries, and utilities), savings and investments, debt repayment (such as credit cards and loans), and discretionary spending (such as entertainment and dining out). Additionally, it is important to include categories for emergency funds, irregular expenses (like gifts or vacations), and any other specific financial goals or obligations you may have.

Why is it important to review and update a Build a Budget Worksheet regularly?

It is important to review and update a Build a Budget Worksheet regularly because financial circumstances can change over time. By regularly reviewing and updating the budget, individuals can ensure that it accurately reflects their current income, expenses, and financial goals. This practice also helps in identifying any areas where adjustments may be needed to achieve financial stability and long-term success.

How can a Build a Budget Worksheet help with savings goals?

A Budget Worksheet can help with savings goals by providing a clear overview of income, expenses, and potential areas for cutting costs or increasing savings. By tracking spending habits and creating a budget, individuals can identify where their money is going and better allocate funds towards their savings goals. This tool helps to set realistic savings targets, monitor progress, and make adjustments as needed to stay on track towards achieving financial objectives.

What are some common pitfalls to avoid when using a Build a Budget Worksheet?

Some common pitfalls to avoid when using a Build a Budget Worksheet include underestimating expenses, not tracking spending accurately, failing to account for irregular expenses, neglecting to adjust the budget as needed, and not sticking to the budget consistently. It is important to be diligent in updating the budget regularly, being realistic about expenses, and actively managing your financial goals to ensure the worksheet is an effective tool in achieving financial stability.

How can a Build a Budget Worksheet be adapted for different financial situations or goals?

A Budget Worksheet can be adapted for different financial situations or goals by customizing income and expenses categories, adjusting the frequency of tracking (daily, weekly, monthly), setting specific financial goals, and allocating resources accordingly. It can also be modified by incorporating saving strategies, debt repayment plans, emergency funds, or investment targets based on individual needs and priorities. Additionally, the worksheet can be updated regularly to reflect changes in income, expenses, or financial goals to ensure it remains relevant and effective in achieving desired outcomes.

Are there any online tools or templates available for creating a Build a Budget Worksheet?

Yes, there are several online tools and templates available for creating a Build a Budget Worksheet. You can find ready-made budget templates on websites like Microsoft Office Templates, Google Sheets, and Canva. These templates can be customized to fit your specific needs and financial goals. Additionally, there are budgeting apps like Mint, YNAB (You Need a Budget), and EveryDollar that offer built-in budgeting tools to help you track your expenses and income effectively.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments