Budget Expense Worksheet

Are you in search of a practical solution to help you stay organized and track your expenses? Look no further than the Budget Expense Worksheet. This simple and efficient tool enables individuals or families to take control of their finances by carefully monitoring their income and expenditures. With its user-friendly interface and comprehensive categories, this worksheet serves as the perfect entity for anyone seeking to manage their budget effectively.

Table of Images 👆

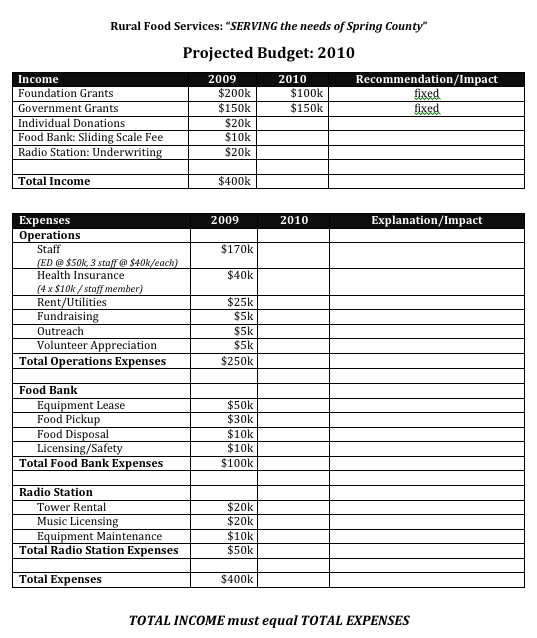

- Non-Profit Budget Worksheet

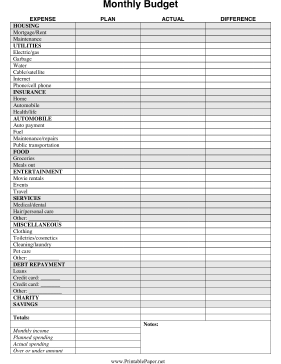

- Free Monthly Family Budget Template

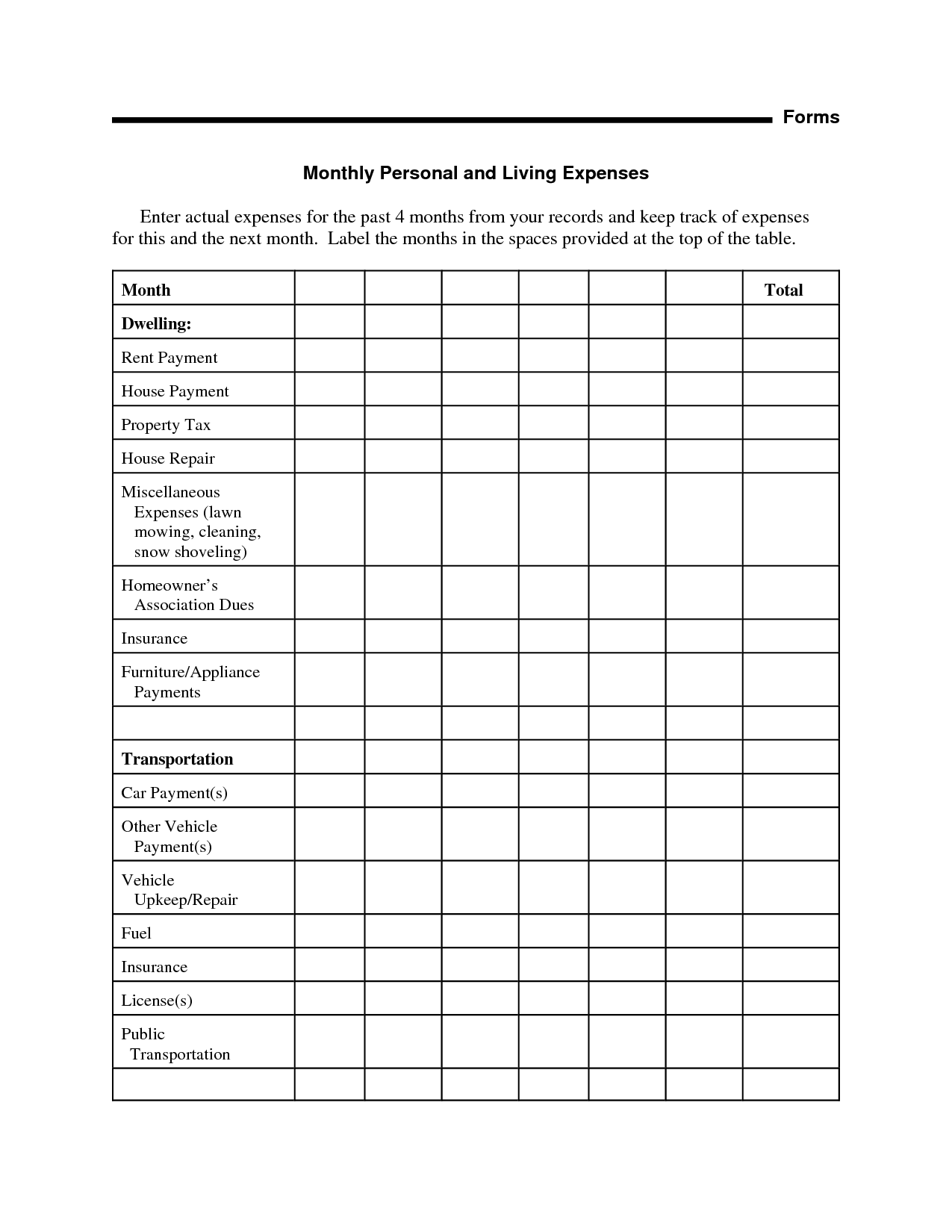

- Basic Budget Worksheet Template

- Marketing Budget Spreadsheet Template

- Printable Monthly Budget Paper

- Personal Monthly Expense Report Template

- Sample Monthly Budget Form

- Free Printable Weekly Budget Template

- Wedding Flower Worksheet

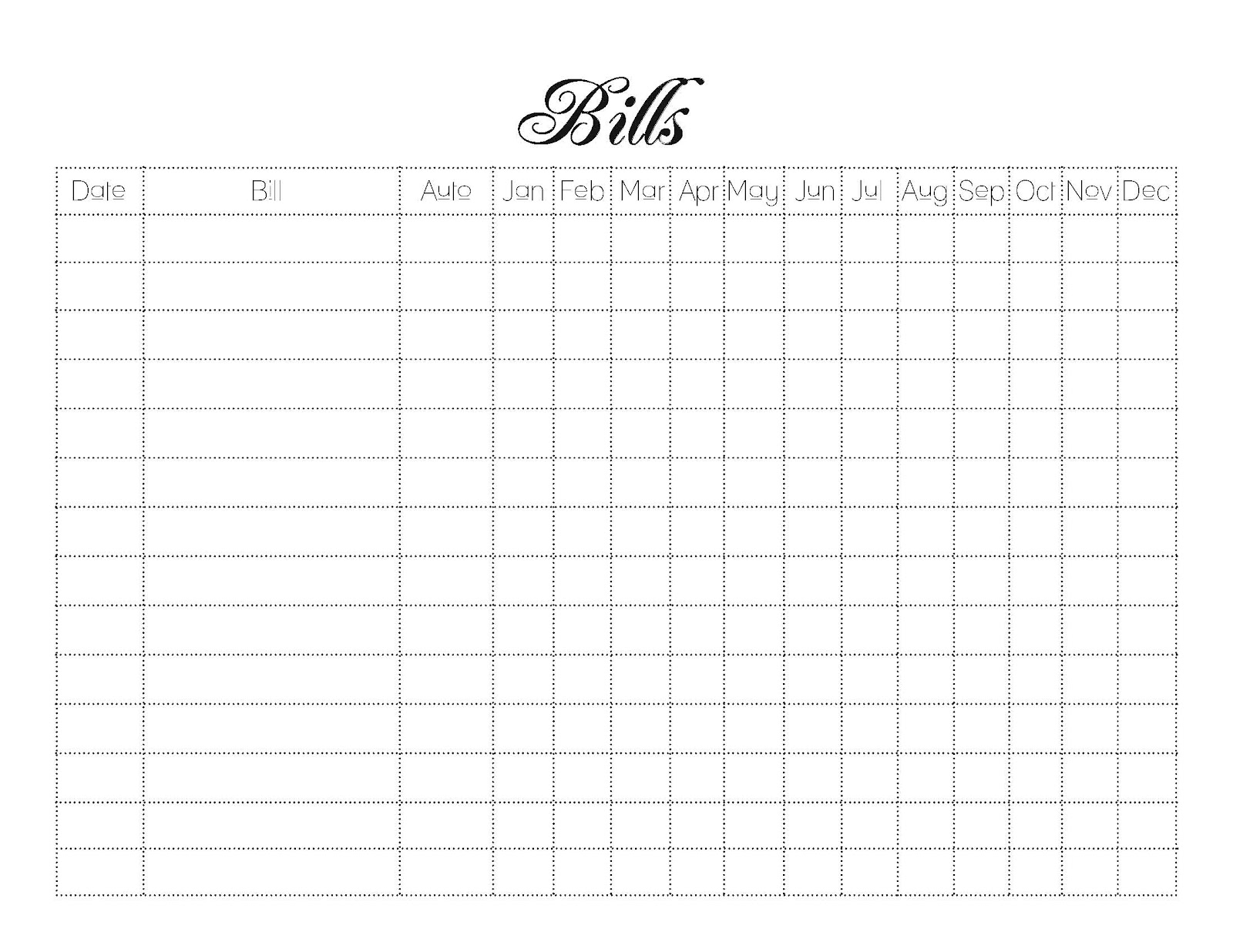

- Free Printable Monthly Bill Templates

- Real Estate Business Plan Template

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a budget expense worksheet?

A budget expense worksheet is a tool used to track and record all expenses in a budget. It typically includes categories for different types of expenses, such as housing, transportation, groceries, and entertainment, and allows for the input of actual expenses incurred within each category. By using a budget expense worksheet, individuals can analyze their spending habits, identify areas where they may be overspending, and make adjustments to align their expenses with their financial goals.

How can a budget expense worksheet help in managing finances?

A budget expense worksheet can help in managing finances by providing a clear overview of income and expenses, allowing individuals to track where their money is going and identify areas where they can cut back or save. By listing all expenses in one place, individuals can prioritize spending, set financial goals, and make informed decisions on how to allocate their resources effectively. Additionally, it can help in identifying any unnecessary expenses or potential areas where costs can be reduced, leading to better financial planning and overall improved financial well-being.

What are the key elements of a budget expense worksheet?

A budget expense worksheet typically includes key elements such as categories for income and expenses, a breakdown of all expenses including fixed and variable costs, space to track actual expenses against budgeted amounts, columns for recording dates and descriptions of expenses, and a section for notes or comments to provide context or additional information about specific expenses. Additionally, there may be features like color-coding, formulas for automatic calculations, and charts or graphs to visualize spending patterns and trends.

How can you calculate your monthly income on a budget expense worksheet?

To calculate your monthly income on a budget expense worksheet, simply list all sources of income you receive each month, including wages, bonuses, rental income, etc. Add these amounts together to calculate your total monthly income. Make sure to account for any taxes or deductions to arrive at your net monthly income. This figure can then be used to allocate funds for various expenses on your budget expense worksheet to ensure you are staying within your financial means.

What categories can be included in a budget expense worksheet?

Categories that can be included in a budget expense worksheet include housing (rent/mortgage, utilities), transportation (car payment, gas, insurance), food (groceries, dining out), health (medical expenses, insurance premiums), personal care (toiletries, clothing), entertainment (movies, outings), savings (emergency fund, retirement), debt payments (credit cards, loans), and miscellaneous expenses. These categories help track and manage spending in different areas to ensure financial health and stability.

Why is it important to track expenses on a budget expense worksheet?

Tracking expenses on a budget expense worksheet is important because it helps individuals or businesses to have a clear understanding of where their money is being spent. It allows them to identify any unnecessary or excessive expenses, make informed decisions on how to allocate funds more efficiently, and ultimately stick to their budget. By keeping track of expenses, individuals can also monitor their financial health, set realistic financial goals, and make adjustments as needed to ensure long-term financial stability.

How can a budget expense worksheet help identify areas for potential cost savings?

A budget expense worksheet can help identify areas for potential cost savings by providing a detailed breakdown of all expenses, allowing for a comprehensive analysis of spending patterns. By reviewing the expenses on the worksheet, one can pinpoint areas where costs are high or unnecessary, enabling them to make informed decisions on where to cut back or find more cost-effective alternatives. This analysis helps prioritize expenditures, allocate resources more efficiently, and potentially uncover opportunities for reducing overall expenses.

What are some common mistakes to avoid when filling out a budget expense worksheet?

Some common mistakes to avoid when filling out a budget expense worksheet include underestimating expenses, not tracking small or irregular expenses, forgetting to budget for savings or emergencies, not reviewing and updating the budget regularly, and not accounting for all sources of income. It's important to be thorough, realistic, and disciplined when filling out a budget expense worksheet to ensure accurate financial planning and management.

How often should you update your budget expense worksheet?

It is recommended to update your budget expense worksheet on a regular basis, ideally at least once a month. This allows you to track your spending, identify any changes in your financial situation, and make adjustments as needed to stay on track with your budget goals. Regular updates will help you stay organized and in control of your finances.

Are there any tools or software available to help create and manage a budget expense worksheet?

Yes, there are several tools and software available to help create and manage a budget expense worksheet. Popular options include Microsoft Excel, Google Sheets, Mint, YNAB (You Need A Budget), and EveryDollar. These tools offer features such as templates, customizable categories, automated tracking, and visual representations of your expenses to help you effectively manage your budget.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments