2014 1040EZ Worksheet

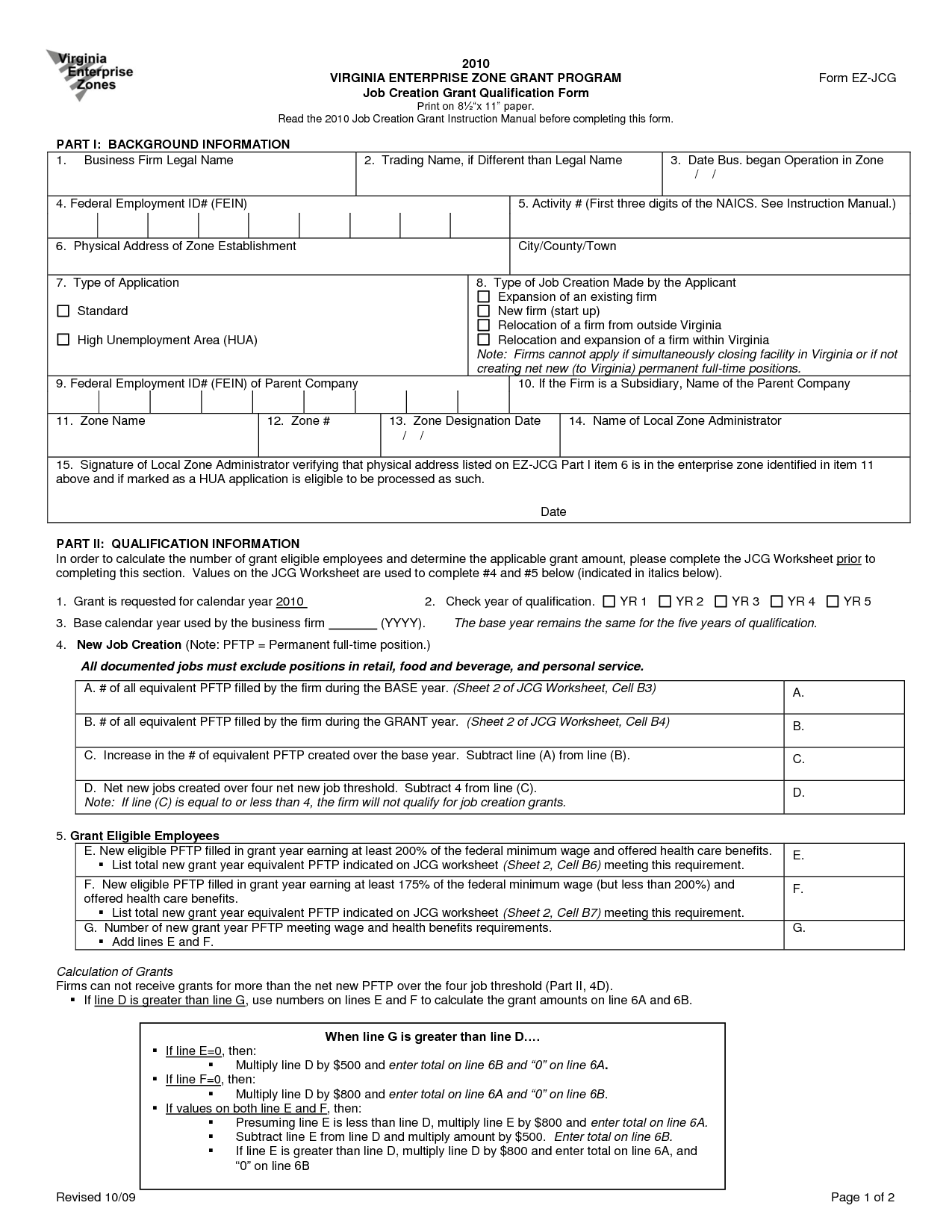

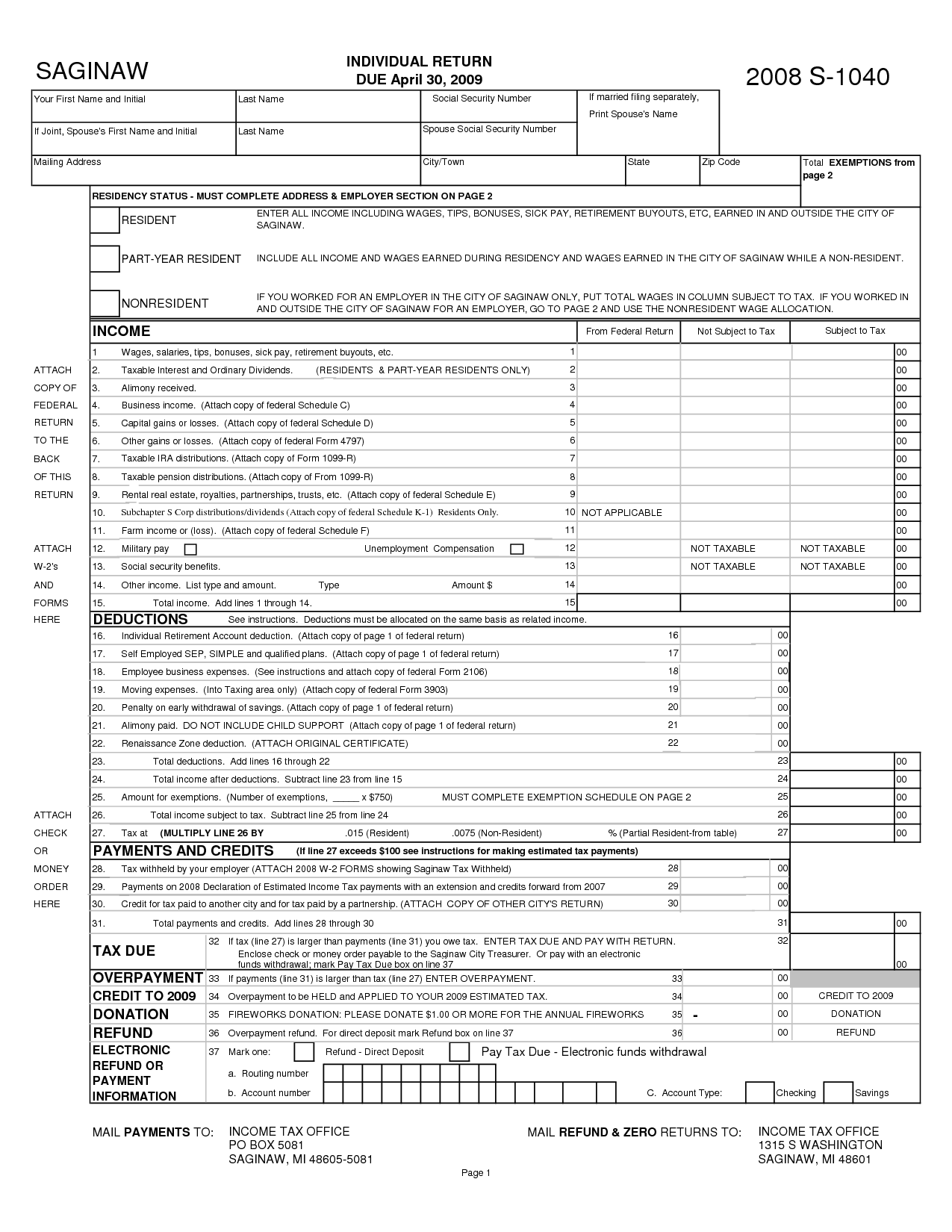

The 2014 1040EZ Worksheet is a convenient tool that assists individuals in calculating their taxes accurately and efficiently. This worksheet is designed specifically for individuals who have a simple tax situation and do not need to itemize deductions or report additional income sources. By utilizing this worksheet, individuals can easily determine their taxable income and ensure they are filling out their tax forms correctly.

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is the purpose of the 2014 1040EZ Worksheet?

The purpose of the 2014 1040EZ Worksheet was to help taxpayers determine if they were eligible to use the simplified 1040EZ form for their tax return. This worksheet assisted taxpayers in calculating their taxable income, deductions, and determining whether they met the requirements for using the 1040EZ form based on their income, filing status, and sources of income.

How many sections are there in the 2014 1040EZ Worksheet?

There are six sections in the 2014 1040EZ Worksheet.

In Section 1 of the worksheet, what information should be entered for the taxpayer and spouse?

In Section 1 of the worksheet, you should enter the taxpayer's and spouse's personal information, including their full names, Social Security numbers, addresses, and any other relevant contact details. This section is crucial for identifying the individuals and ensuring the accuracy of the tax return.

What is the significance of line 5 on the worksheet?

Line 5 on the worksheet is significant because it typically represents a key calculation or total that is crucial for understanding the overall data or solving a specific problem. It may contribute to a final answer, provide important information for decision-making, or serve as a reference point for further analysis. Understanding the significance of line 5 is essential for interpreting the data accurately and drawing valid conclusions from the worksheet.

What information is required in Section 2 of the worksheet?

Section 2 of the worksheet typically requires demographic information such as the employee's full name, address, contact details, date of birth, Social Security number, and other personal identification details. It may also include information about the employee's marital status, number of dependents, and any other relevant personal data needed for payroll, benefits, and tax purposes.

What is the purpose of line 6 on the worksheet?

The purpose of line 6 on the worksheet is to provide a space for the individual to input relevant information or data that corresponds to the specific instructions or requirements outlined within that line.

What items are included in Section 3 of the 2014 1040EZ Worksheet?

Section 3 of the 2014 1040EZ Worksheet includes the calculations for taxable income, deduction for exemptions, adjusted gross income, and earned income credit.

What is the purpose of line 10 on the worksheet?

The purpose of line 10 on the worksheet is to calculate a specific value or perform a particular mathematical operation that is relevant to the overall objective of the worksheet. This line typically contributes to the final result or analysis of the data being collected or analyzed on the worksheet.

How is the taxable income calculated in Section 4 of the worksheet?

The taxable income in Section 4 of the worksheet is calculated by subtracting deductions from the adjusted gross income. This results in the final figure that the taxpayer will be taxed on. Deductions can include items such as eligible expenses, credits, and any other allowable deductions as per tax regulations.

What is the final step in completing the 2014 1040EZ Worksheet?

The final step in completing the 2014 1040EZ Worksheet is to transfer the total taxable income from line 6 to line 1 of the 2014 Form 1040EZ, along with any other required information from the worksheet to the corresponding lines on the tax return form. Make sure to double-check all calculations and entries before filing to ensure accuracy.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments