Worksheet About Saving Money

Are you interested in mastering the art of saving money? Look no further than our comprehensive worksheet on the subject. Designed specifically for individuals who want to take control of their finances, this worksheet is a valuable tool for understanding your spending habits, tracking your expenses, and creating a budget that works for you.

Table of Images 👆

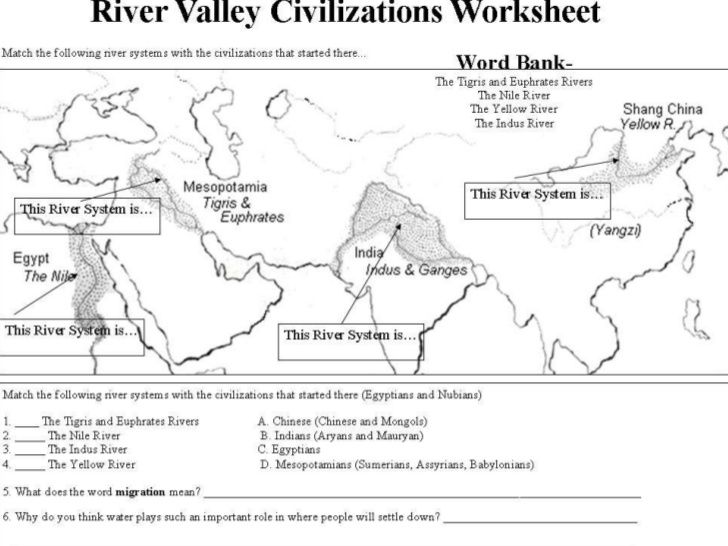

- River Valley Civilization Worksheet

- Goods and Services Worksheet First Grade

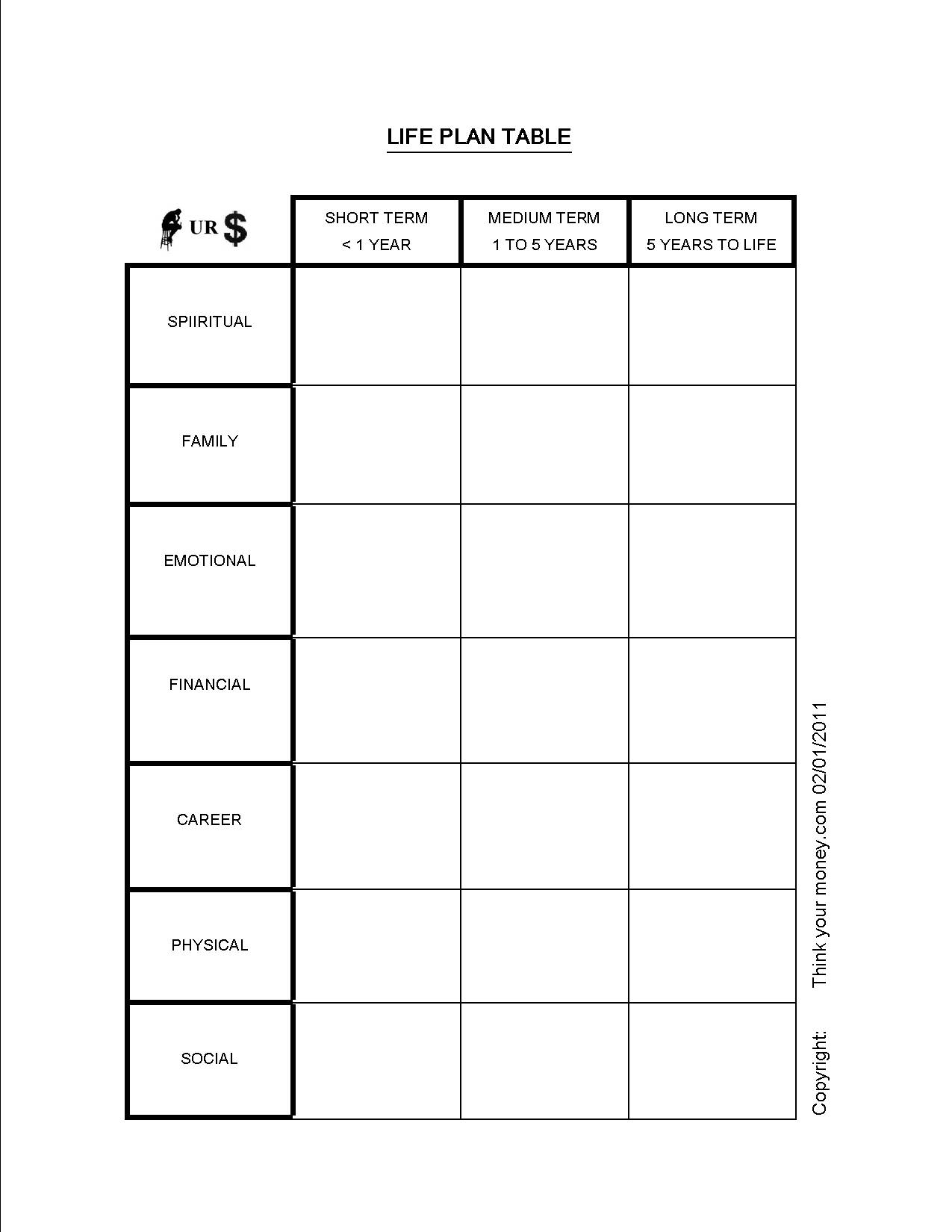

- Templates for Goal Setting Worksheets

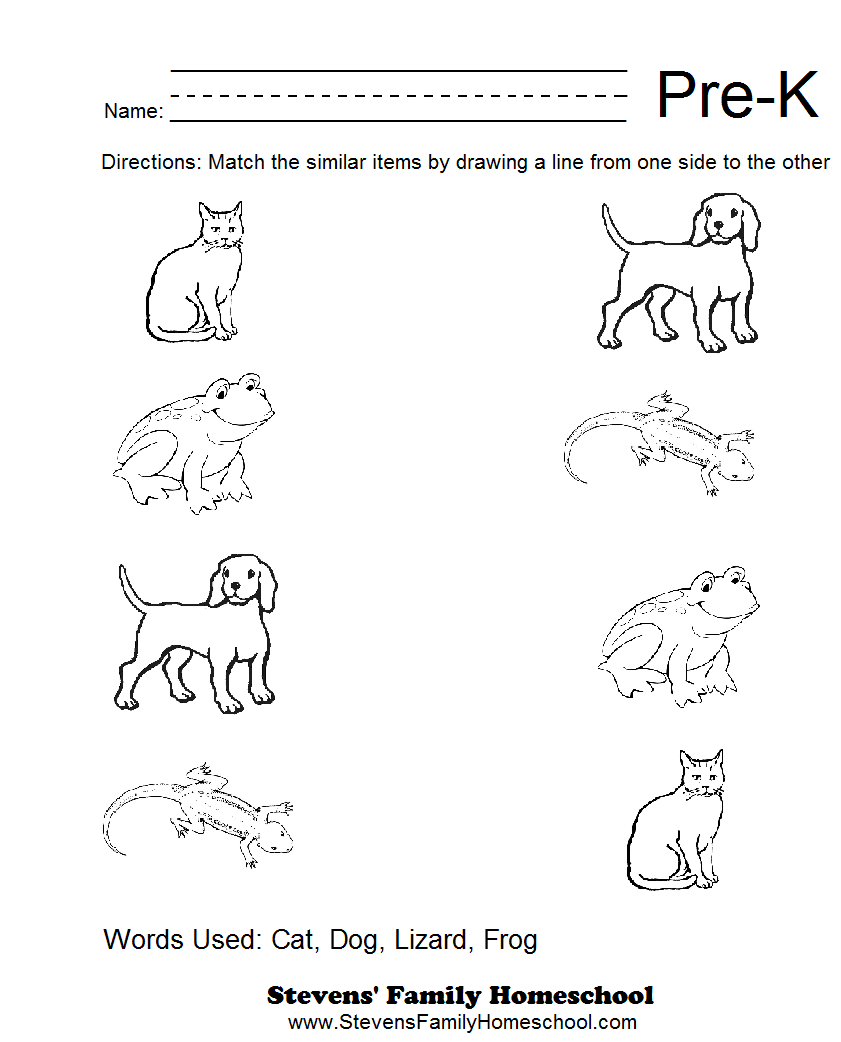

- Pre-K Math Worksheets Printable

- Fun Addition Worksheets No Regrouping

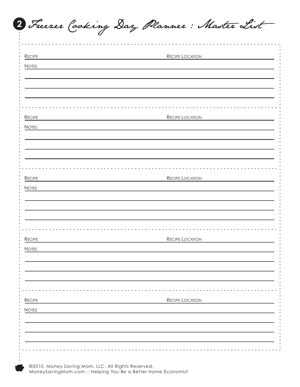

- Free Printable Cooking Worksheets

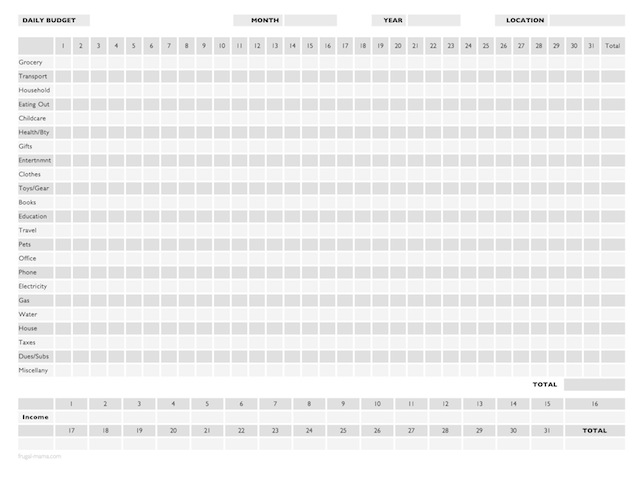

- Daily Budget Worksheet Printable

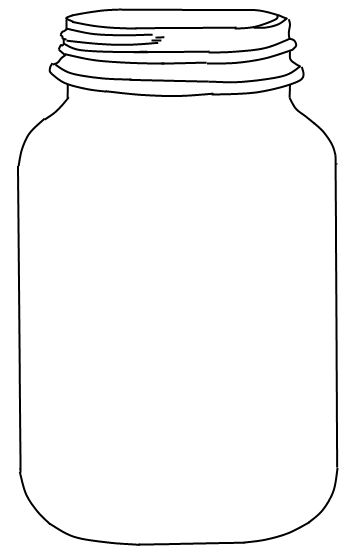

- Mason Jar Template Printable Free

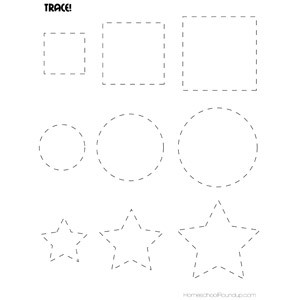

- Preschool Shapes Tracing Lines Worksheets

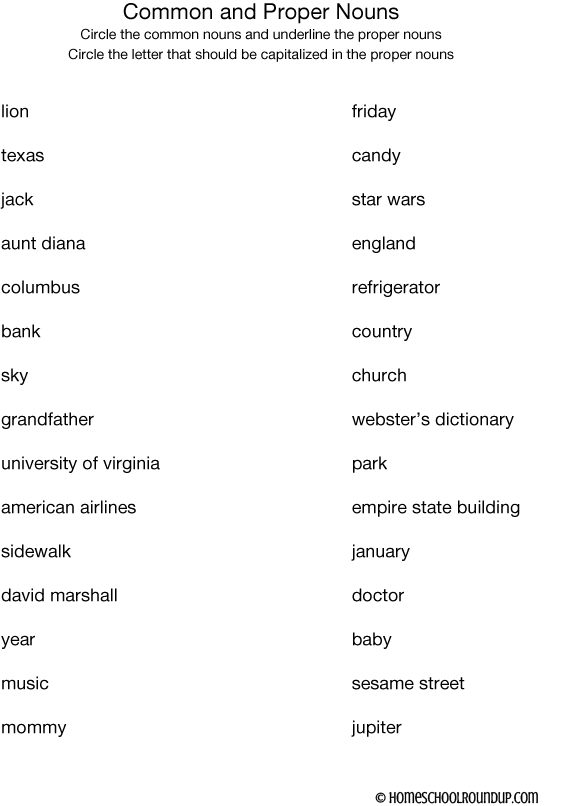

- Common vs Proper Noun Worksheet

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a budget?

A budget is a financial plan that outlines an organization's or individual's expected income and expenses over a specific period, typically a month or a year. It serves as a valuable tool for managing and tracking finances, helping to ensure that spending aligns with income and financial goals. Budgets can vary in complexity and detail but are essential for effective financial management.

What are some common expenses that should be included in a budget?

Some common expenses that should be included in a budget are rent or mortgage payments, utilities, groceries, transportation costs (such as gas or public transportation), insurance premiums, healthcare expenses, debt repayments, savings contributions, and discretionary expenses like entertainment and dining out. It's important to account for both fixed and variable expenses in your budget to ensure you have a comprehensive financial plan.

How can you track your spending habits?

You can track your spending habits by keeping a detailed record of all your expenses, whether through a spreadsheet, budgeting app, or personal finance software. Make sure to categorize your expenses, set budget goals, review your spending regularly, and adjust your budget as needed. Additionally, consider using tools like bank statements, credit card statements, and receipts to reconcile your spending with your budget. By consistently monitoring and analyzing your spending, you can gain a better understanding of your financial habits and make informed decisions to manage your money effectively.

What is the importance of setting financial goals?

Setting financial goals is important because it gives you a clear roadmap towards achieving your desired financial objectives. It helps you prioritize your spending, save more effectively, and make informed decisions about investments and debt management. Financial goals provide motivation and focus, guiding your financial habits and decisions to ensure long-term financial stability and success.

What are some ways to reduce unnecessary expenses?

Some ways to reduce unnecessary expenses are to create a budget and track your spending, identify areas where you can cut back such as dining out or subscription services, compare prices and shop around for better deals, avoid impulse buying, and consider the value of each purchase before making it. Additionally, you can try to renegotiate bills or subscriptions for better rates, reduce energy usage to lower utility costs, and prioritize needs over wants when making spending decisions.

How can you save money on groceries?

To save money on groceries, consider making a shopping list before going to the store to avoid impulse purchases, look for deals and discounts, buy store brands instead of name brands, buy in bulk when items are on sale, plan meals around what's on sale, use coupons, shop at discount grocery stores, and consider shopping online for lower prices and to avoid impulse buys.

What is the difference between needs and wants when it comes to spending money?

Needs are essential items or services that are necessary for survival, such as food, shelter, and clothing. Wants, on the other hand, are desires or preferences for goods or services that are not essential for survival but are chosen based on personal tastes or preferences. Needs are typically viewed as priority expenses that must be met before allocating resources to wants, which are considered discretionary expenses that can be adjusted based on individual circumstances. Ultimately, distinguishing between needs and wants can help individuals prioritize their spending and make informed decisions about how to allocate their resources.

What are some strategies for saving money on transportation costs?

There are several strategies for saving money on transportation costs, such as using public transportation or carpooling to split expenses, walking or biking for short distances, maintaining a fuel-efficient vehicle, comparing gas prices at different stations, utilizing apps for finding cheaper parking options, and staying on top of vehicle maintenance to improve fuel efficiency. Additionally, considering alternatives like telecommuting or working flexible hours to avoid peak commuting times can also help cut down on transportation expenses.

How can you save money on utility bills?

You can save money on utility bills by being mindful of your energy consumption, such as turning off lights and electronics when not in use, adjusting your thermostat to save on heating and cooling costs, using energy-efficient appliances and light bulbs, sealing any drafts or leaks in your home, and considering alternative energy sources like solar panels. Additionally, you can also explore switching to a more cost-effective utility provider or plan, and consider implementing smart technology to monitor and control your usage more efficiently.

What are some long-term benefits of saving money?

Some long-term benefits of saving money include building financial security, having funds for emergencies or unexpected expenses, being able to invest in opportunities for growth and wealth-building, and having the freedom to make choices based on personal values and goals rather than financial constraints. Additionally, saving money can lead to less stress and anxiety about finances and can help individuals achieve their long-term financial goals such as buying a home, starting a business, or retiring comfortably.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments