Tax Deduction Worksheet

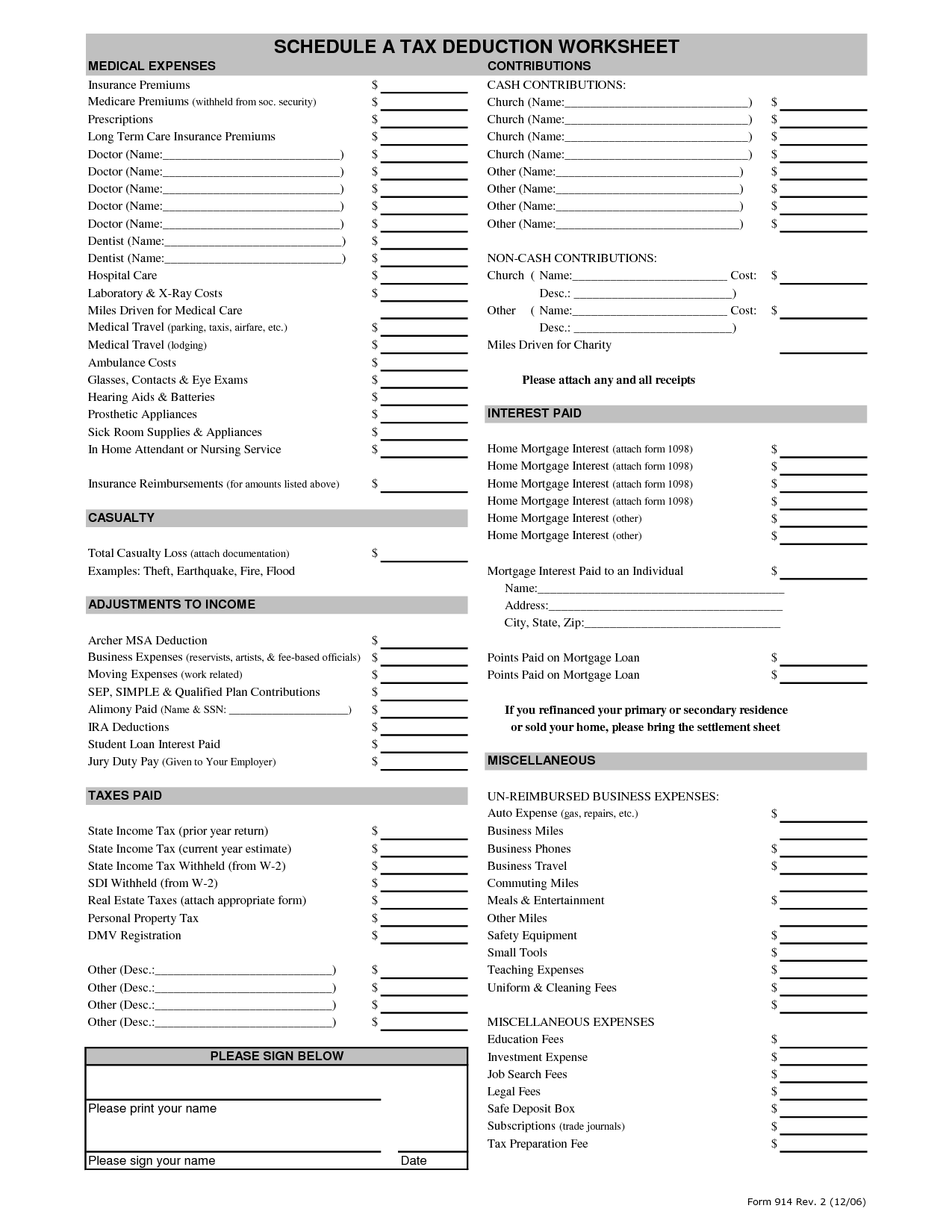

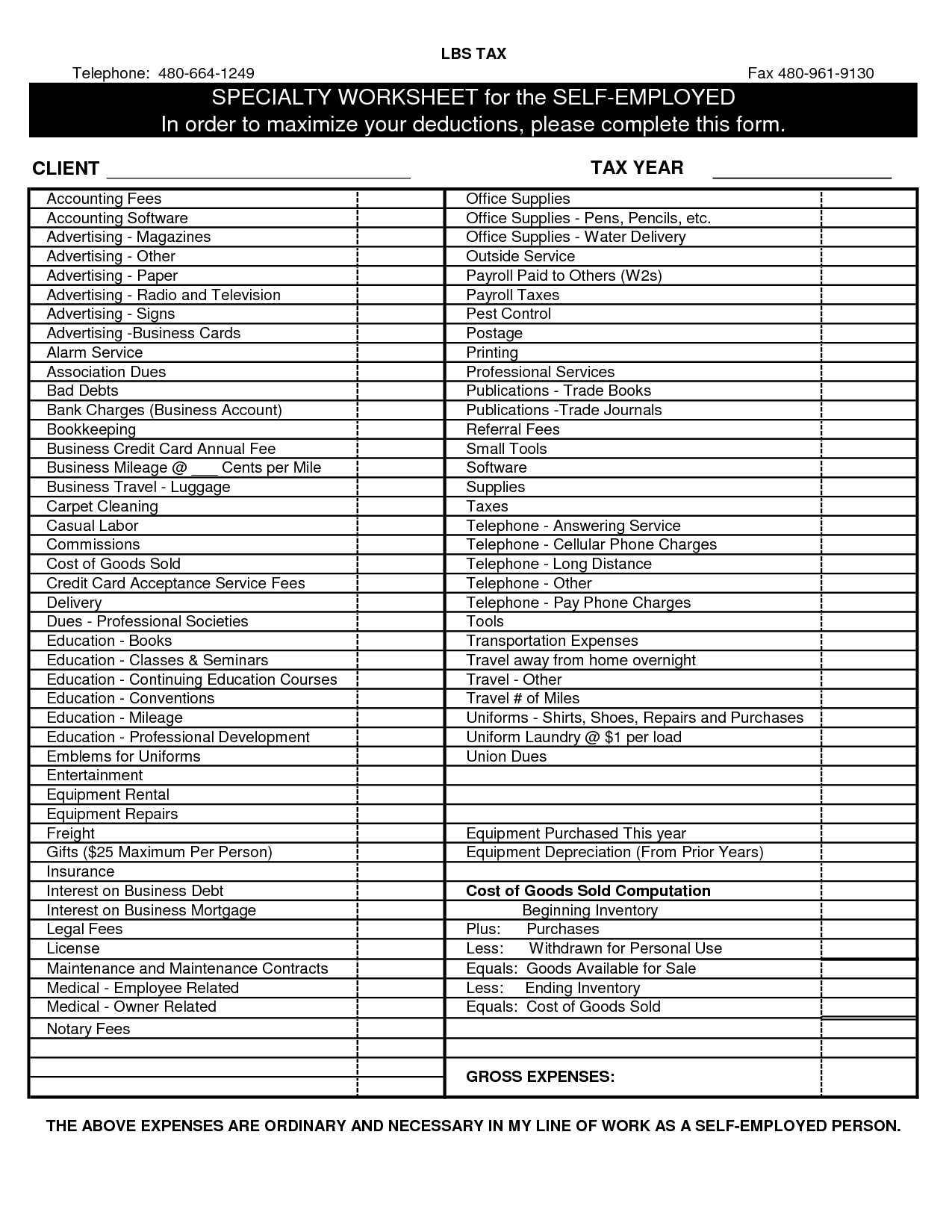

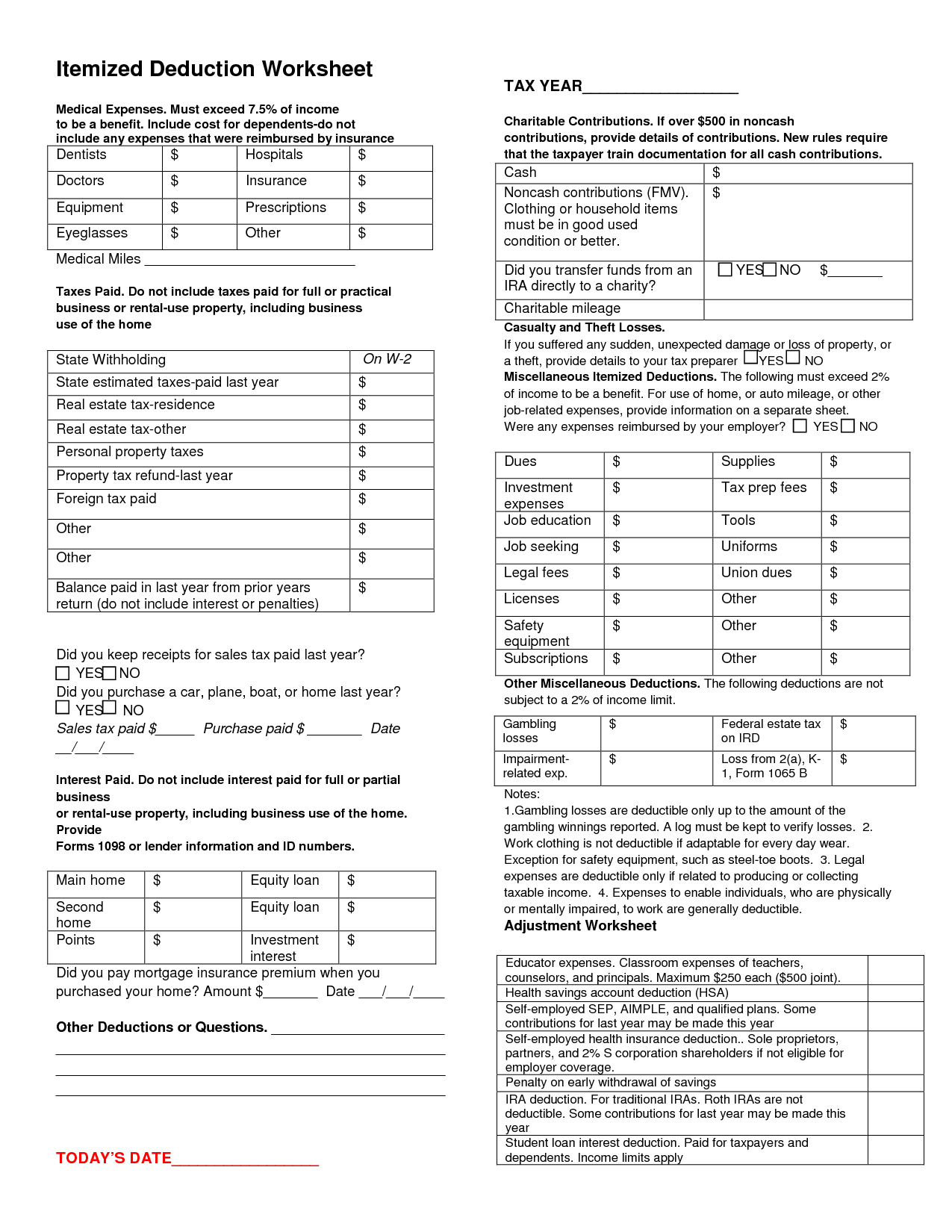

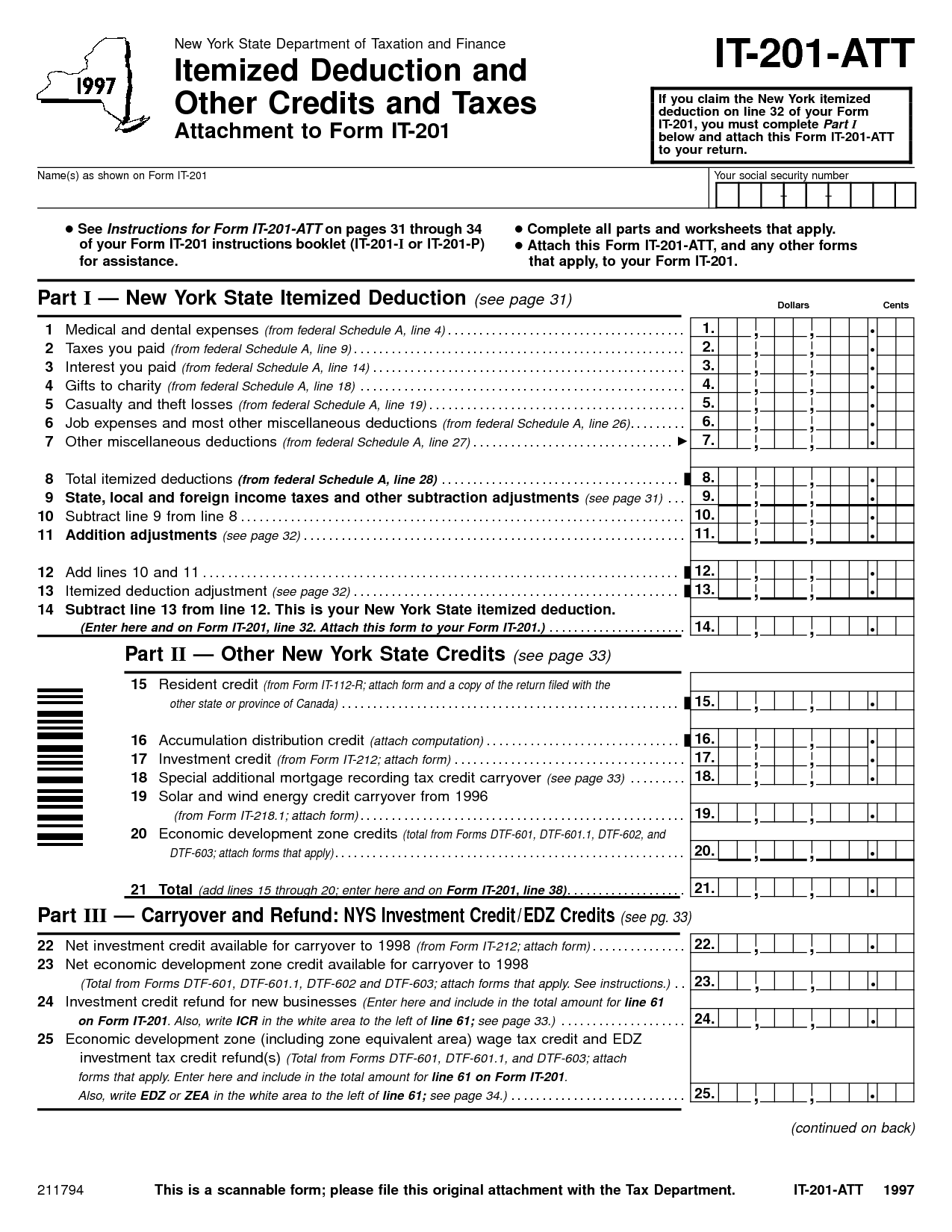

If you are a diligent taxpayer who wants to maximize your savings, a tax deduction worksheet can be a valuable tool. Designed to help you identify and track potential deductions, this worksheet serves as a handy organizational aid for individuals or small business owners seeking to optimize their deductions come tax season. By providing a systematic approach to recording and categorizing expenses, this worksheet can simplify the process of determining which expenses may qualify as deductions, ensuring that you don't overlook any eligible expenses.

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a tax deduction worksheet used for?

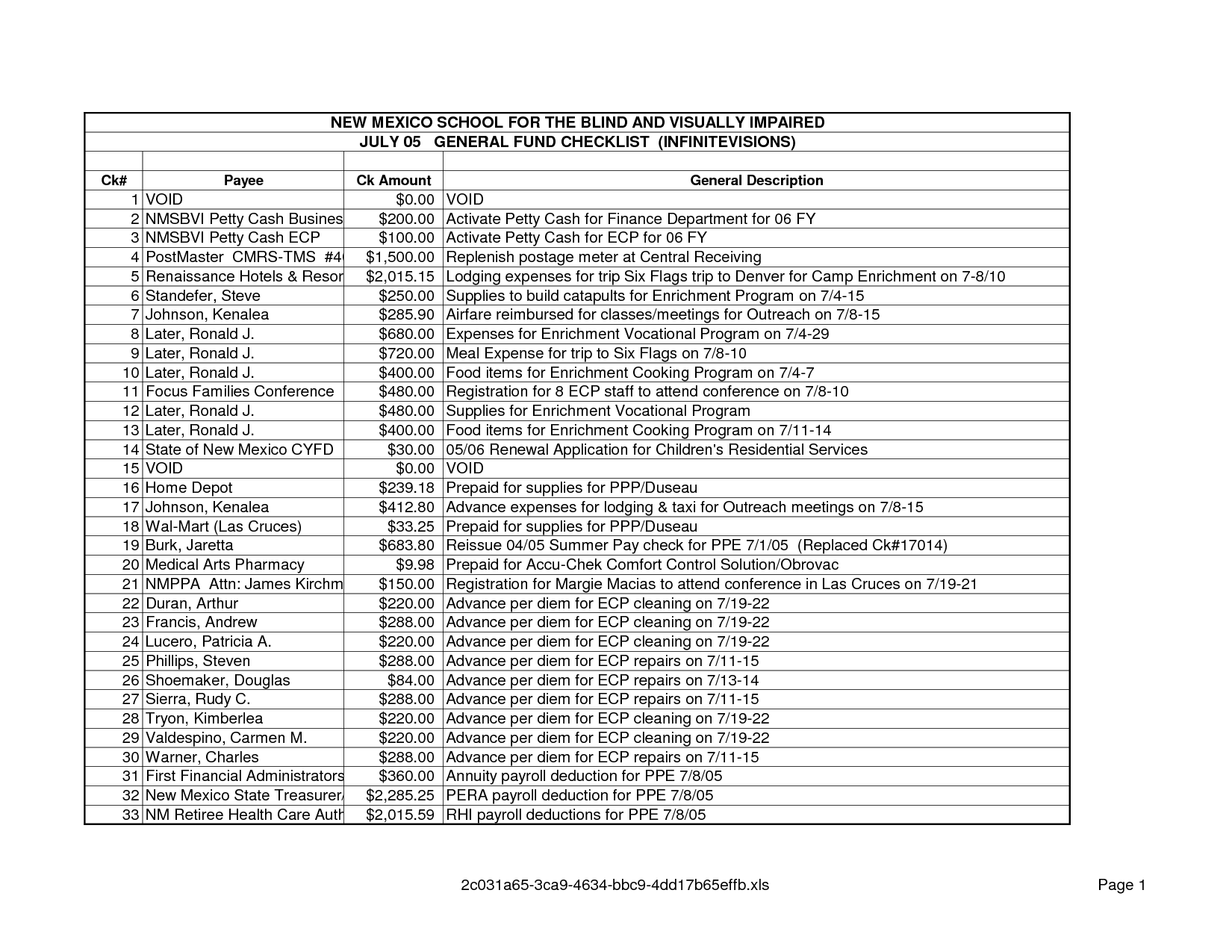

A tax deduction worksheet is used to help individuals or businesses keep track of their potential tax-deductible expenses throughout the year. This can include expenses such as charitable contributions, unreimbursed work expenses, medical expenses, and more. By keeping a detailed record on a tax deduction worksheet, taxpayers can accurately report their deductions on their tax returns, potentially lowering their taxable income and reducing their overall tax liability.

How does a tax deduction worksheet help you maximize your tax deductions?

A tax deduction worksheet helps maximize tax deductions by providing a structured way to organize and categorize potential deductions, ensuring that you don't overlook any eligible expenses. By systematically listing and totaling your deductions, you can identify opportunities to optimize your tax return by itemizing deductions or claiming additional credits. This proactive approach can result in a lower taxable income and ultimately reduce the amount of taxes you owe or increase your refund.

What information should be included on a tax deduction worksheet?

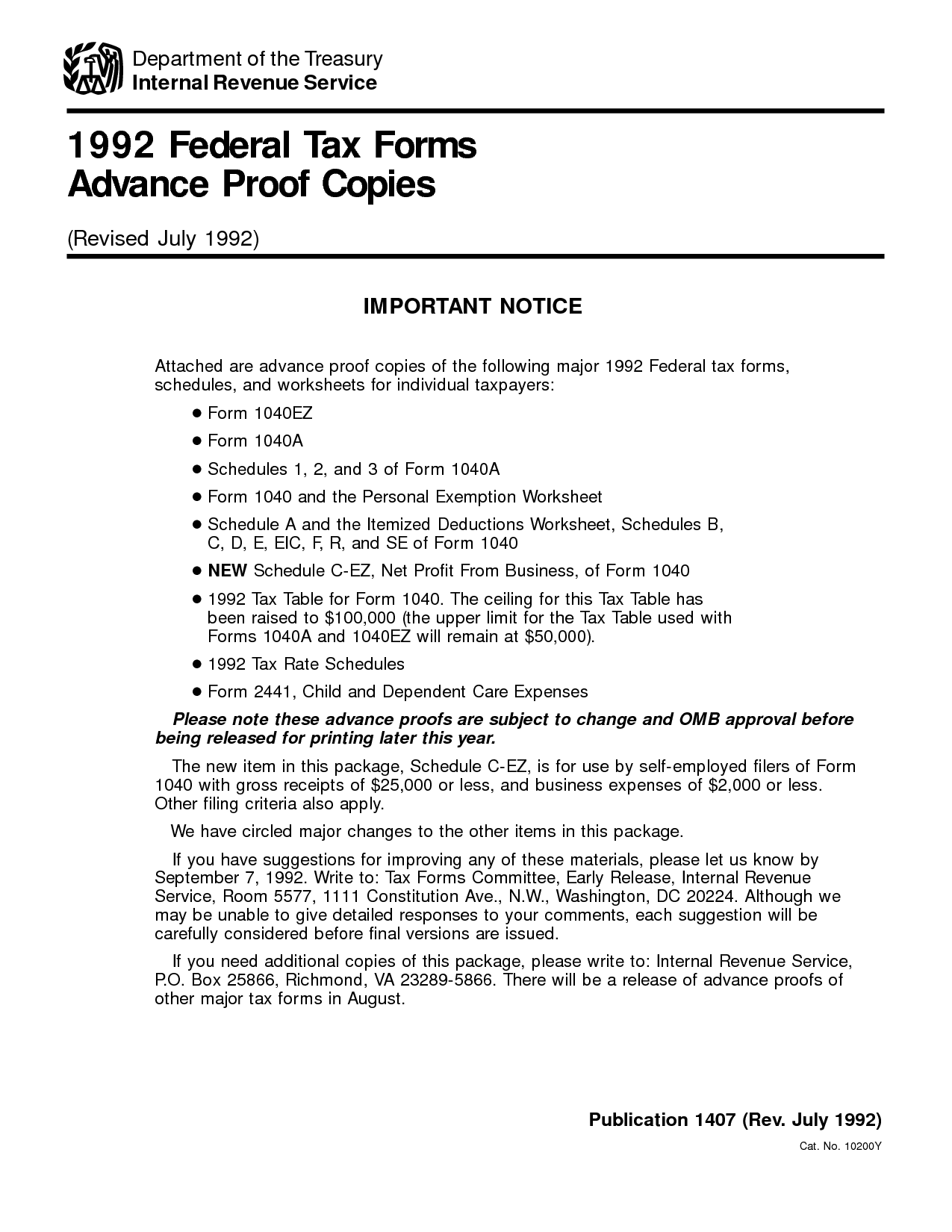

A tax deduction worksheet should include key information such as the taxpayer's name, social security number, filing status, detailed list of expenses or items being claimed as deductions, amount paid for each expense, relevant receipts or supporting documentation, and a calculation of the total deduction amount. Additionally, the worksheet should outline any specific requirements or rules for claiming each deduction to ensure accuracy and compliance with tax laws.

How does the tax deduction worksheet help you track your eligible expenses?

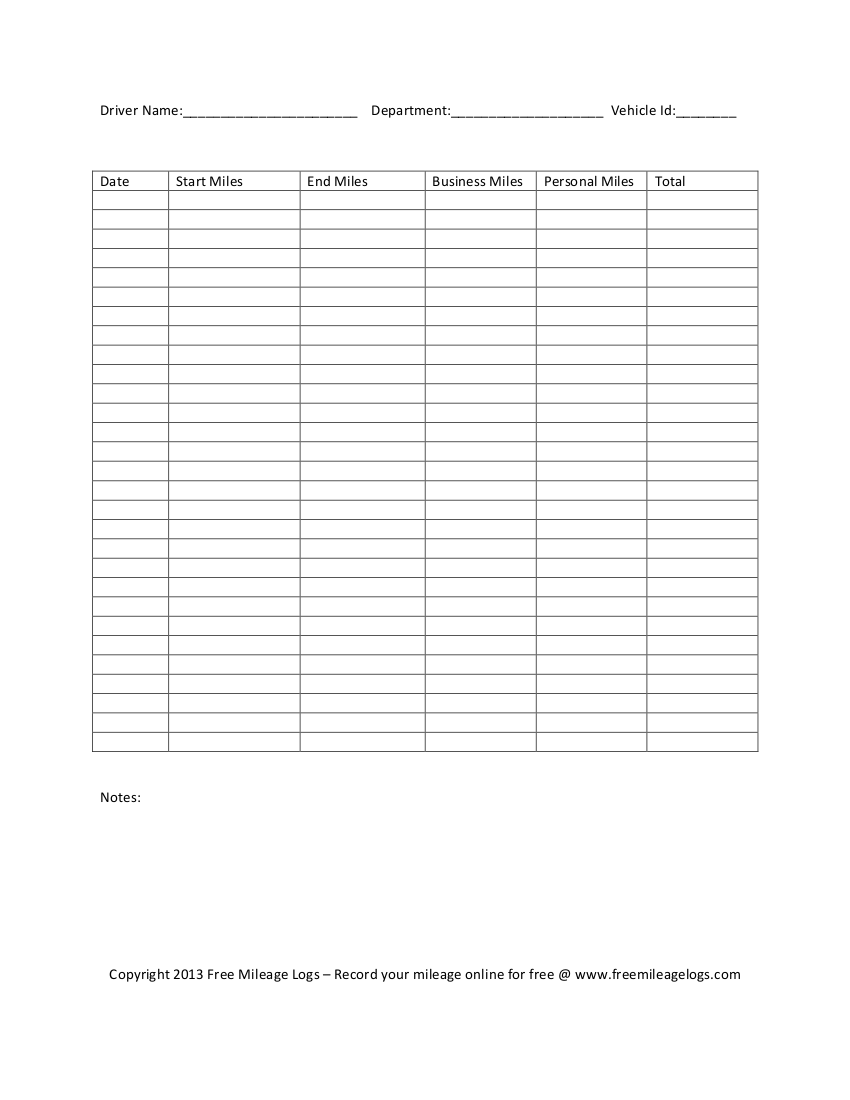

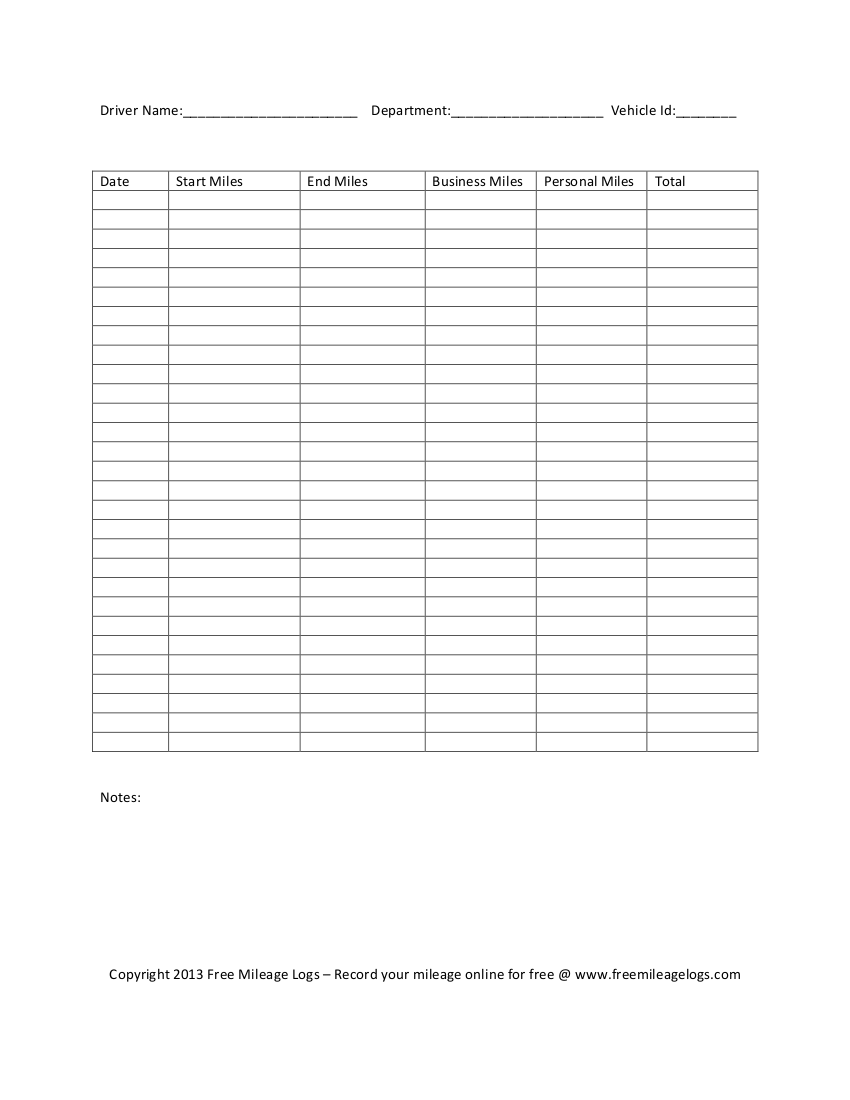

The tax deduction worksheet helps track eligible expenses by providing a structured format for documenting and categorizing expenses that may be tax-deductible, such as business expenses, medical expenses, and charitable contributions. By systematically itemizing expenses on the worksheet, individuals can ensure they capture all relevant expenses that may qualify for tax deductions, helping them maximize their potential tax savings and ensuring compliance with tax regulations.

How can a tax deduction worksheet help you organize your financial documents?

A tax deduction worksheet can help you organize your financial documents by providing a structured format to list all potential deductions you may be eligible for, such as charitable contributions or mortgage interest. By filling out this worksheet, you can ensure that you have all necessary documents in one place, making it easier to prepare your taxes and potentially maximize your deductions. This organized approach can save you time and stress during tax season, as well as help you keep track of important financial information throughout the year.

What are the different categories of deductions that should be listed on a tax deduction worksheet?

Some of the common categories of deductions that should be listed on a tax deduction worksheet include medical expenses, charitable contributions, mortgage interest, property taxes, state and local income taxes, business expenses, education expenses, and investment-related expenses. It is important to keep detailed records of all deductible expenses to accurately report them on your tax return.

Why is it important to keep accurate records when filling out a tax deduction worksheet?

Keeping accurate records when filling out a tax deduction worksheet is important because the information provided on the worksheet will be used to calculate your tax deductions, which ultimately affects the amount of tax you owe or the refund you receive. Inaccurate or incomplete records could lead to errors in claiming deductions, potential audits by tax authorities, or even penalties for underreporting income or overstating deductions. By maintaining detailed and precise records, you can ensure that you are taking full advantage of all eligible deductions and avoid potential issues with tax compliance.

How does a tax deduction worksheet help you calculate your total deductions?

A tax deduction worksheet helps you calculate your total deductions by guiding you through the process of identifying and calculating all eligible expenses that you can deduct from your taxable income. The worksheet typically lists common deductible expenses such as medical expenses, mortgage interest, charitable contributions, and business expenses, allowing you to input the respective amounts. By calculating and totaling these deductions, the worksheet gives you a clear picture of how much you can reduce your taxable income, ultimately lowering the amount of tax you owe.

Are there any specific rules or guidelines to follow when completing a tax deduction worksheet?

When completing a tax deduction worksheet, it is important to follow some basic rules and guidelines. Be sure to accurately list all applicable deductions and provide supporting documentation for each one. Follow the instructions provided on the worksheet carefully to ensure that you are including the right information and calculations. Keep track of any changes in tax laws and regulations that may affect your deductions, and consult with a tax professional if needed to ensure accuracy and compliance with tax laws.

How can using a tax deduction worksheet simplify the tax preparation process?

Using a tax deduction worksheet can simplify the tax preparation process by allowing individuals to systematically organize and list their potential deductions. This helps in identifying all eligible expenses that can be deducted, ensuring that taxpayers do not miss out on any possible tax breaks. By tracking and categorizing deductions on a worksheet, individuals can easily transfer this information to their tax return forms, making the filing process more efficient and accurate.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments