High School Personal Finance Worksheets

Personal finance is an important subject for high school students as it equips them with essential skills for managing their money effectively. Worksheets provide a practical and interactive way to teach these concepts by allowing students to engage with the material hands-on. Whether you are a teacher or a student looking for extra practice, these high school personal finance worksheets can be a valuable resource to enhance your understanding of this crucial subject.

Table of Images 👆

- Personal Finance Activity Worksheets

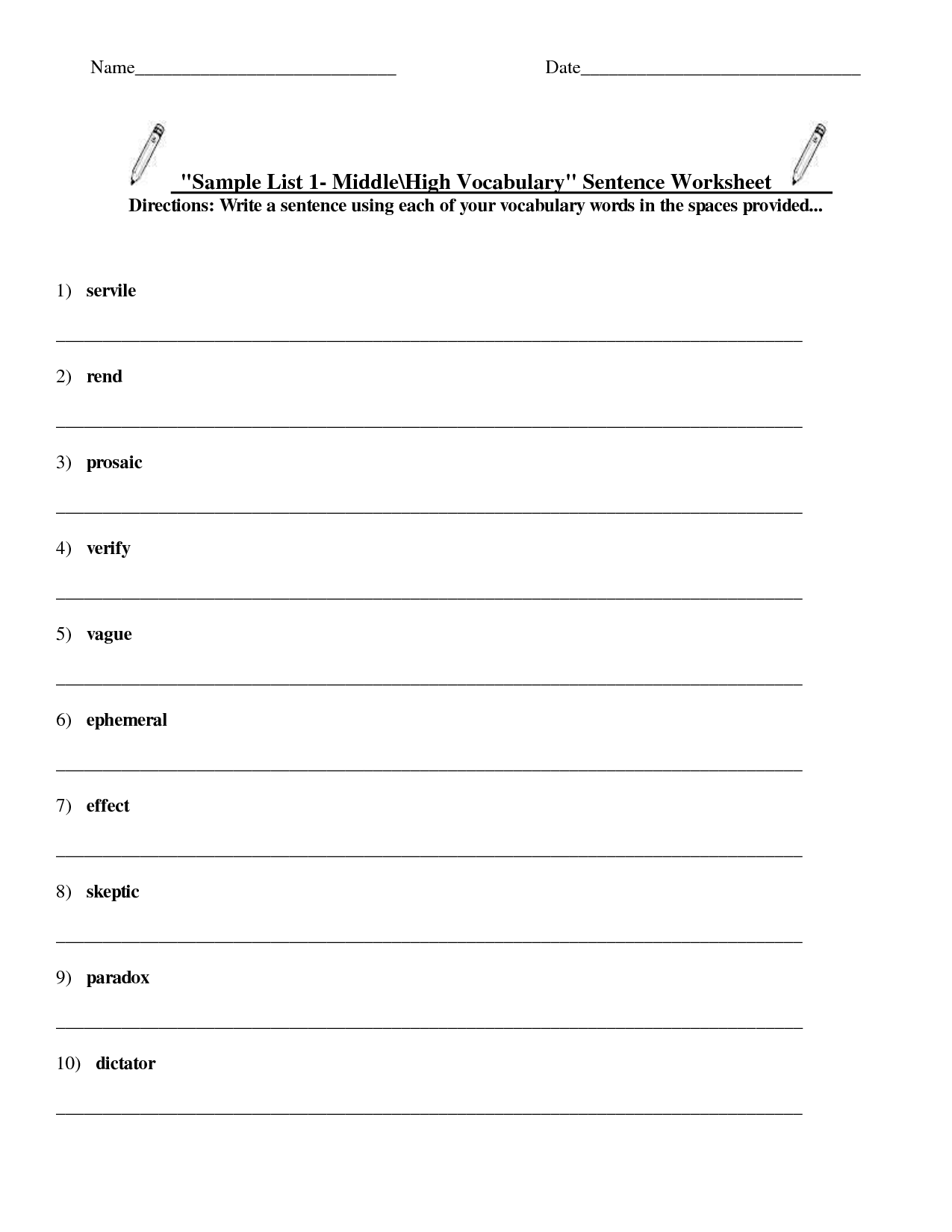

- High School Vocabulary Worksheets

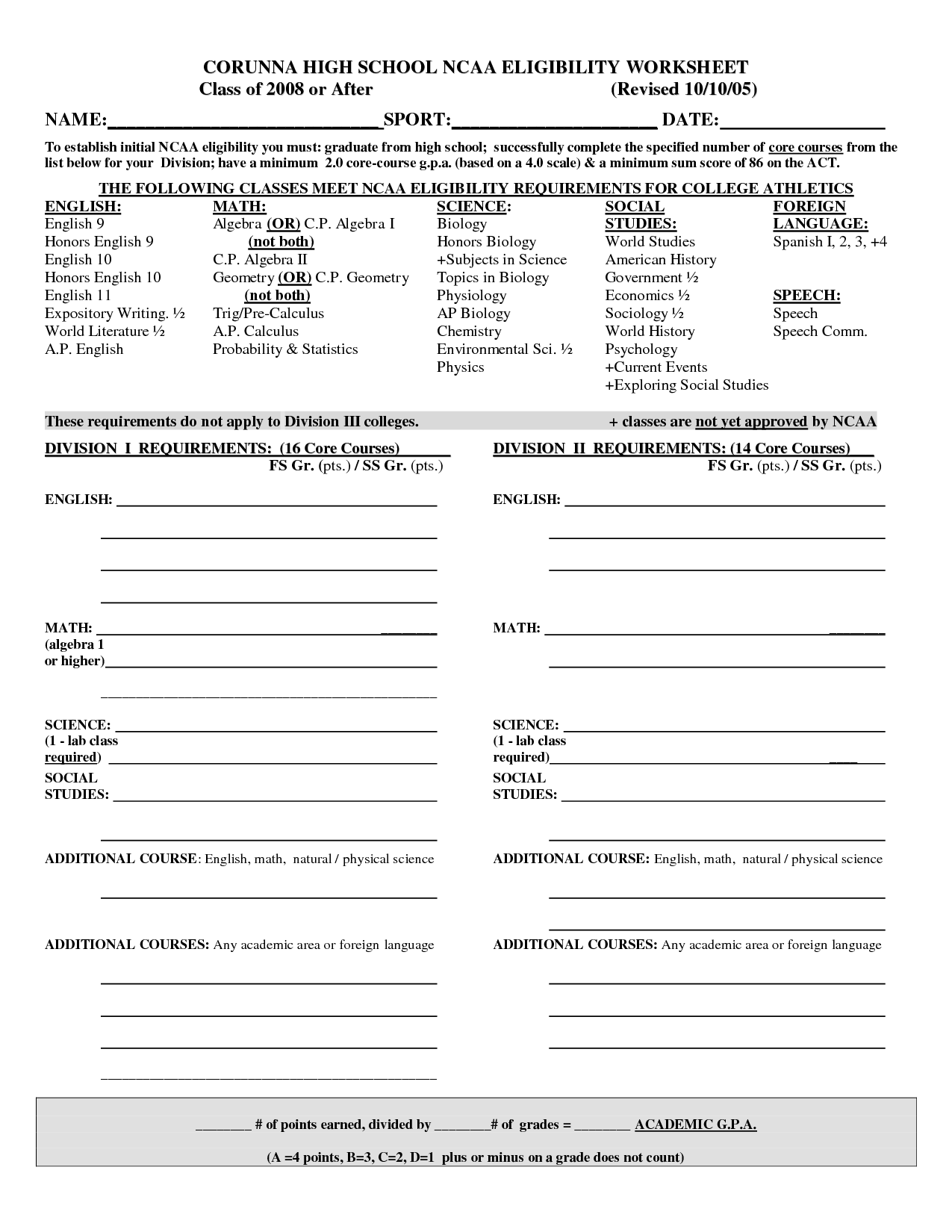

- High School History Worksheets

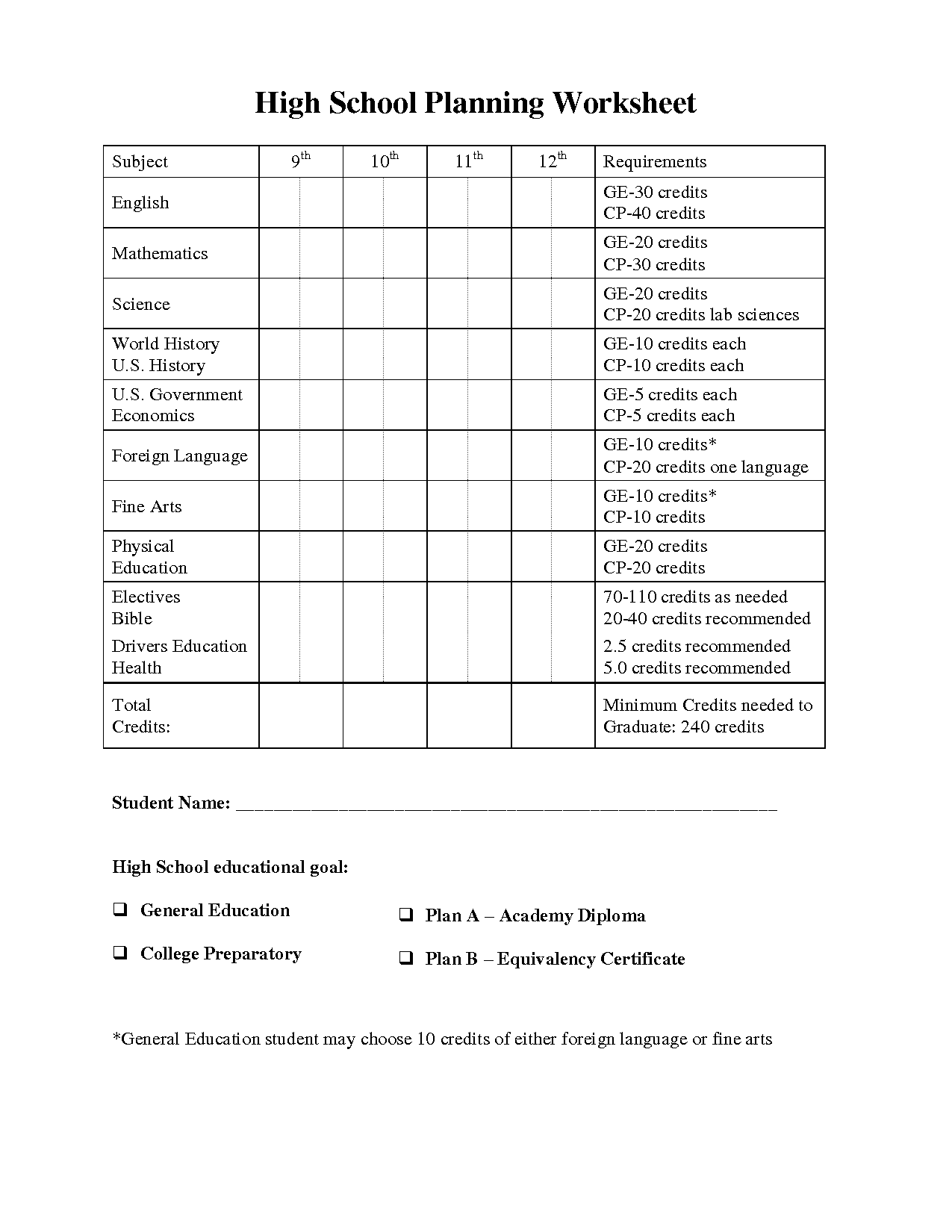

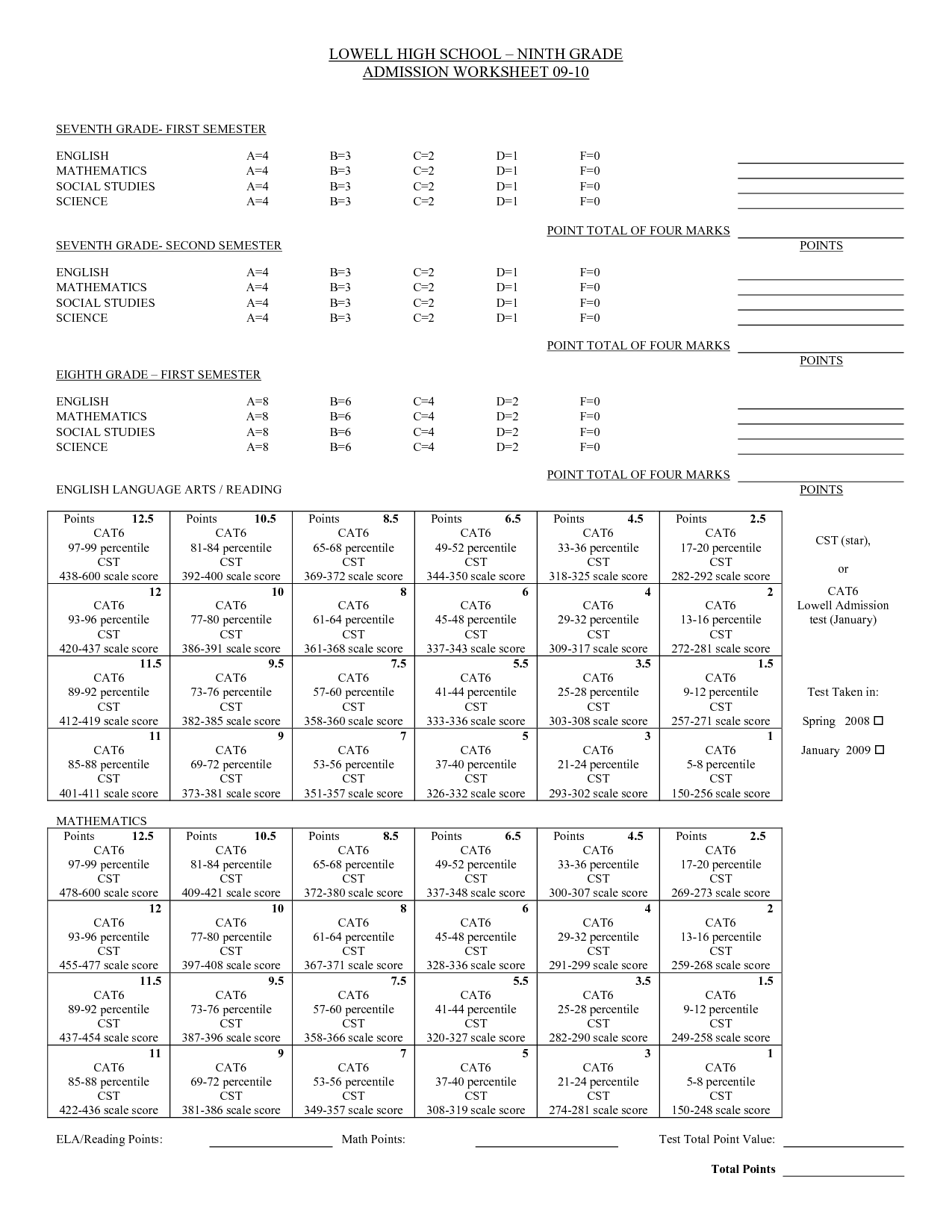

- High School Planning Worksheet

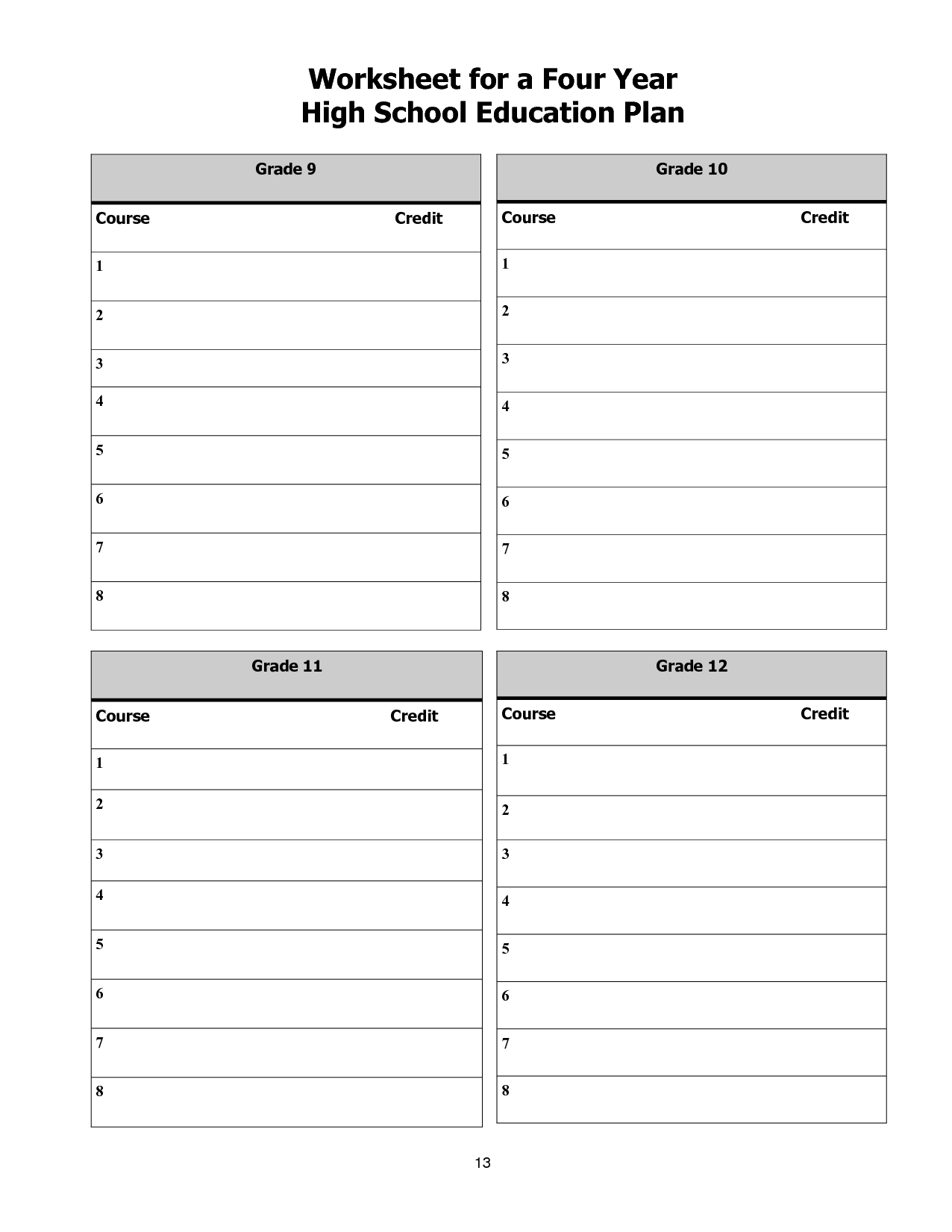

- High School Four-Year Plan Worksheet

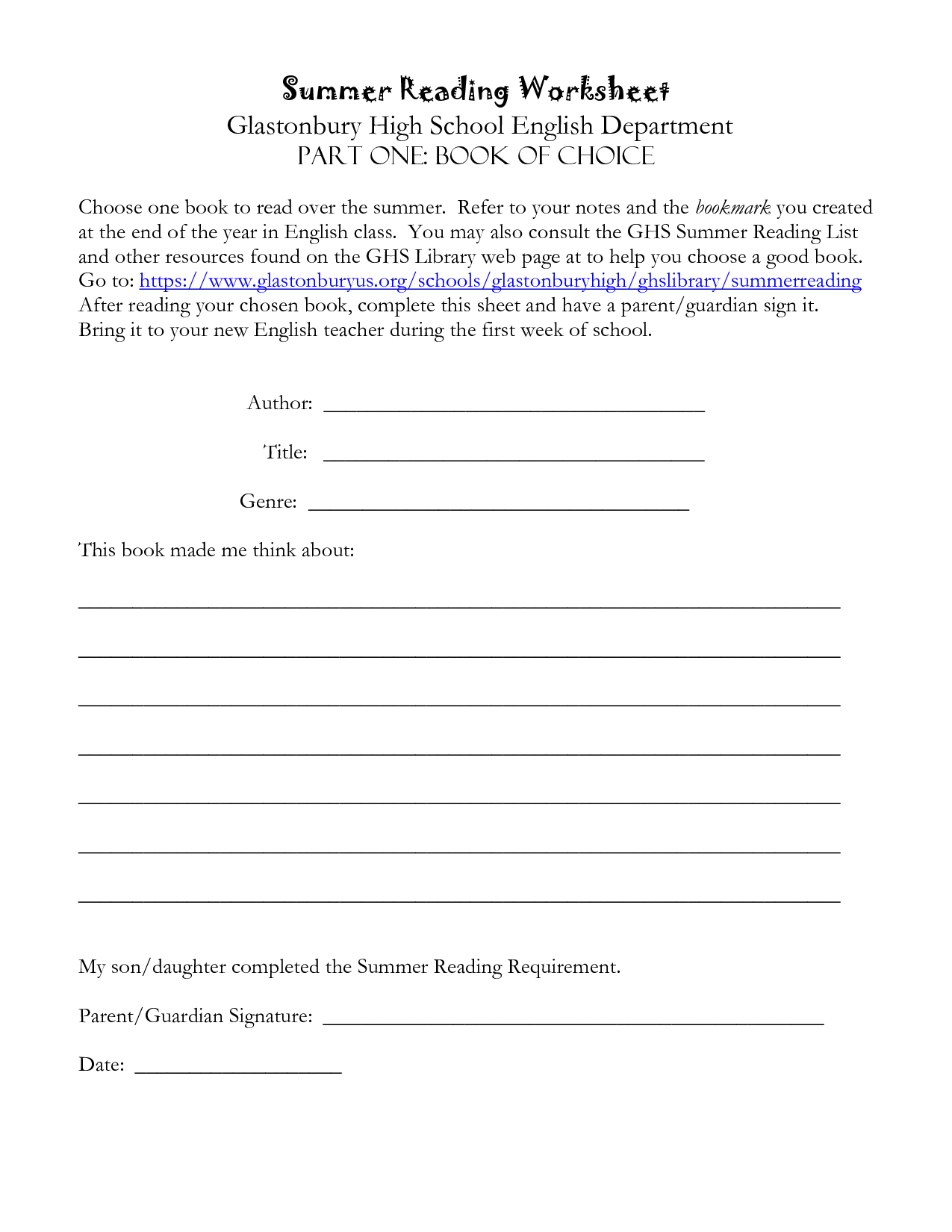

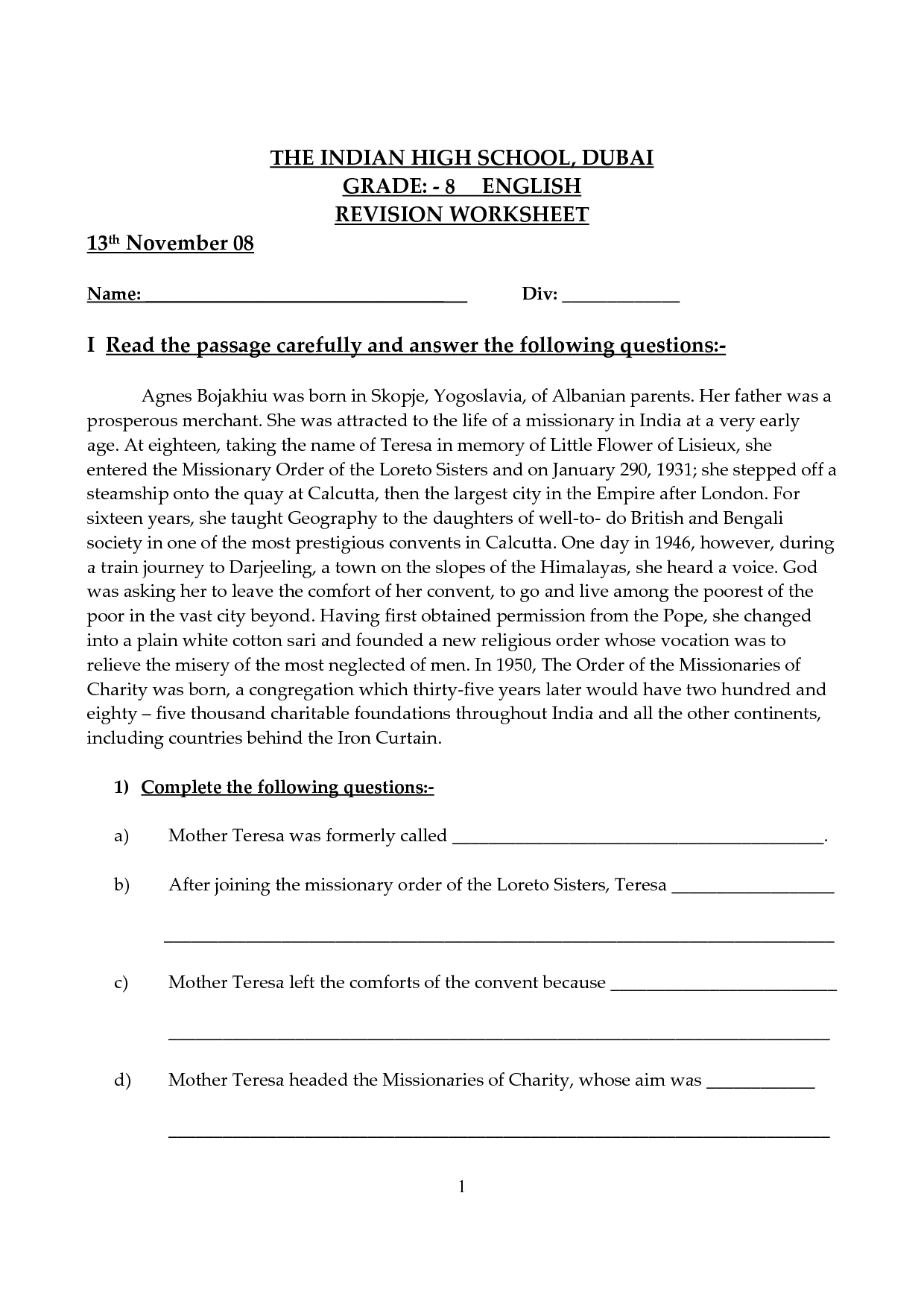

- High School English Worksheets

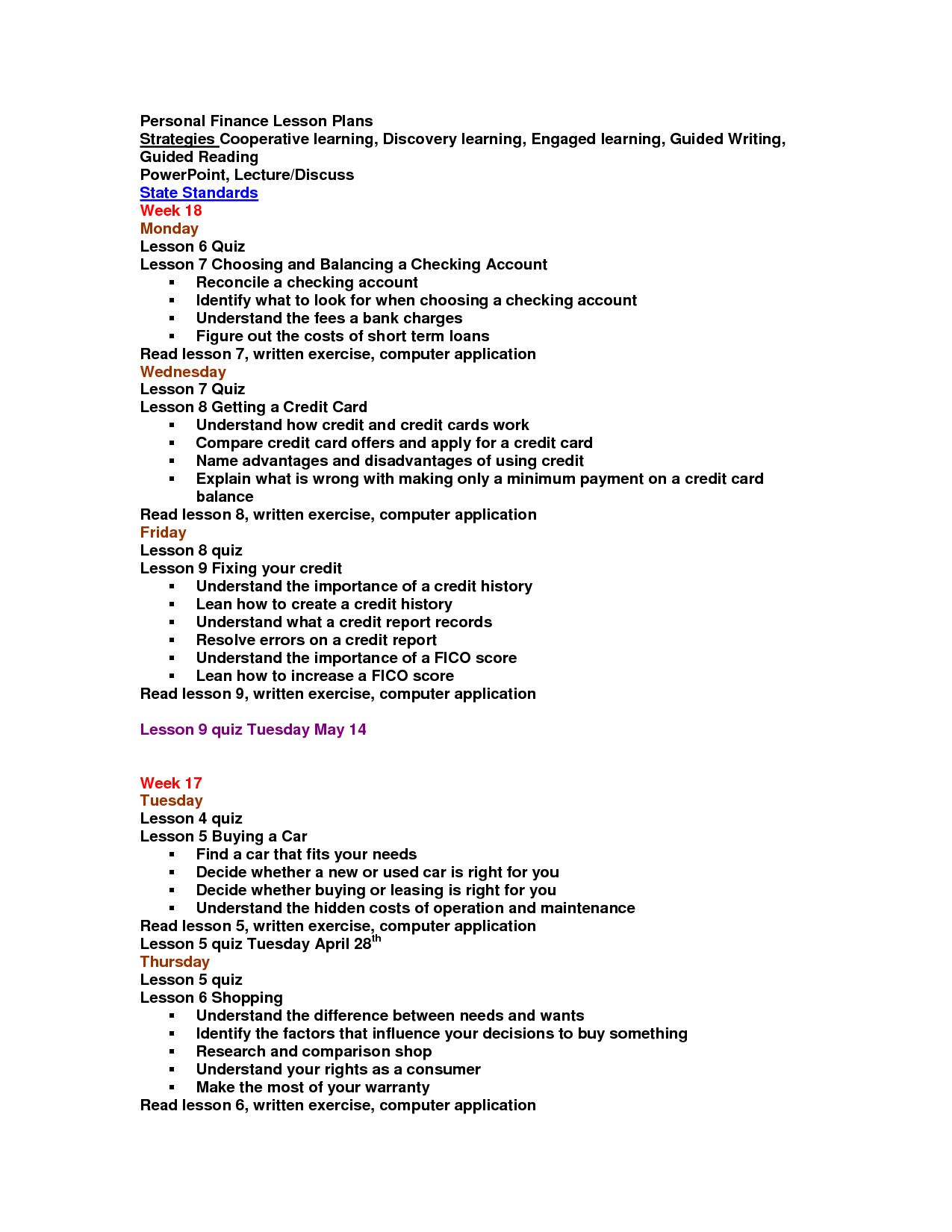

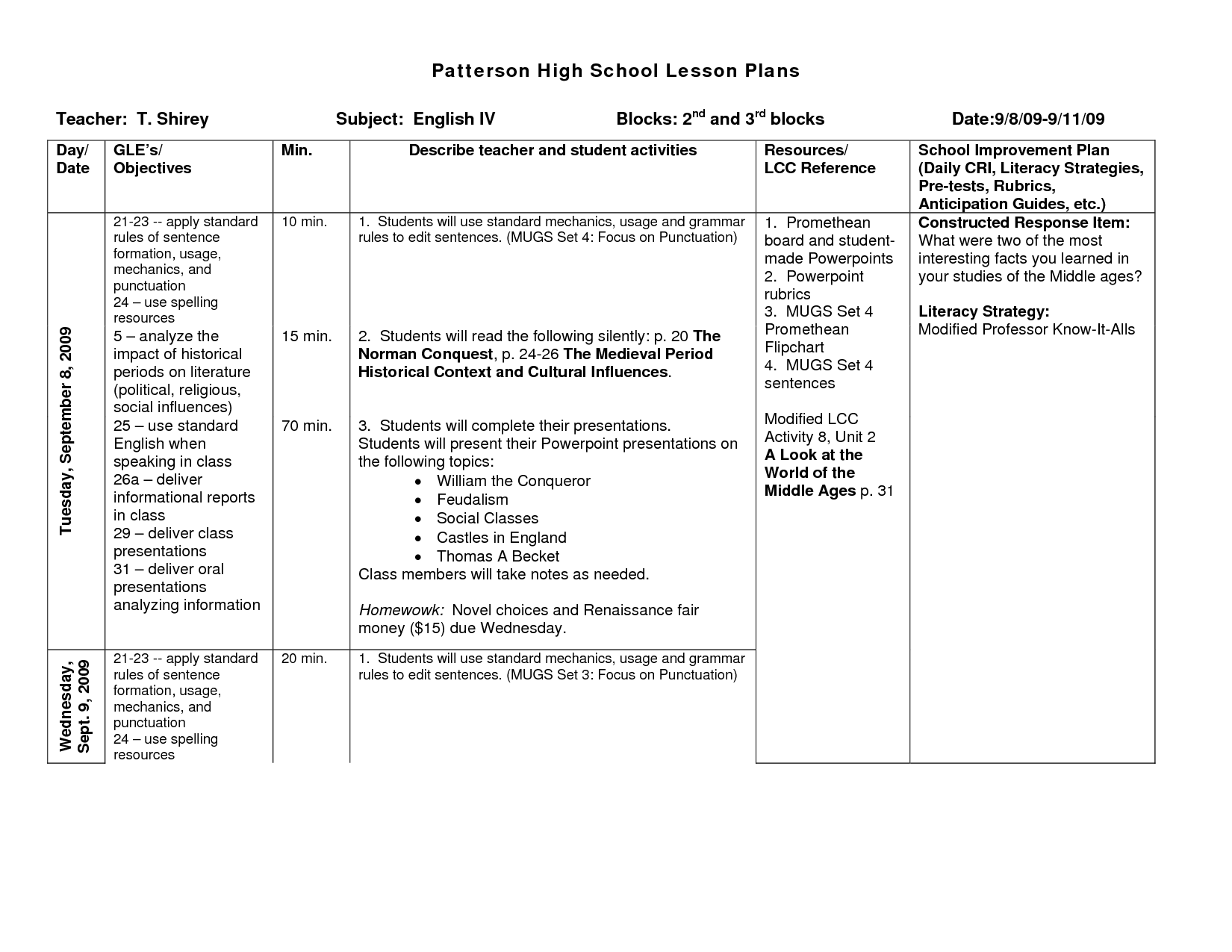

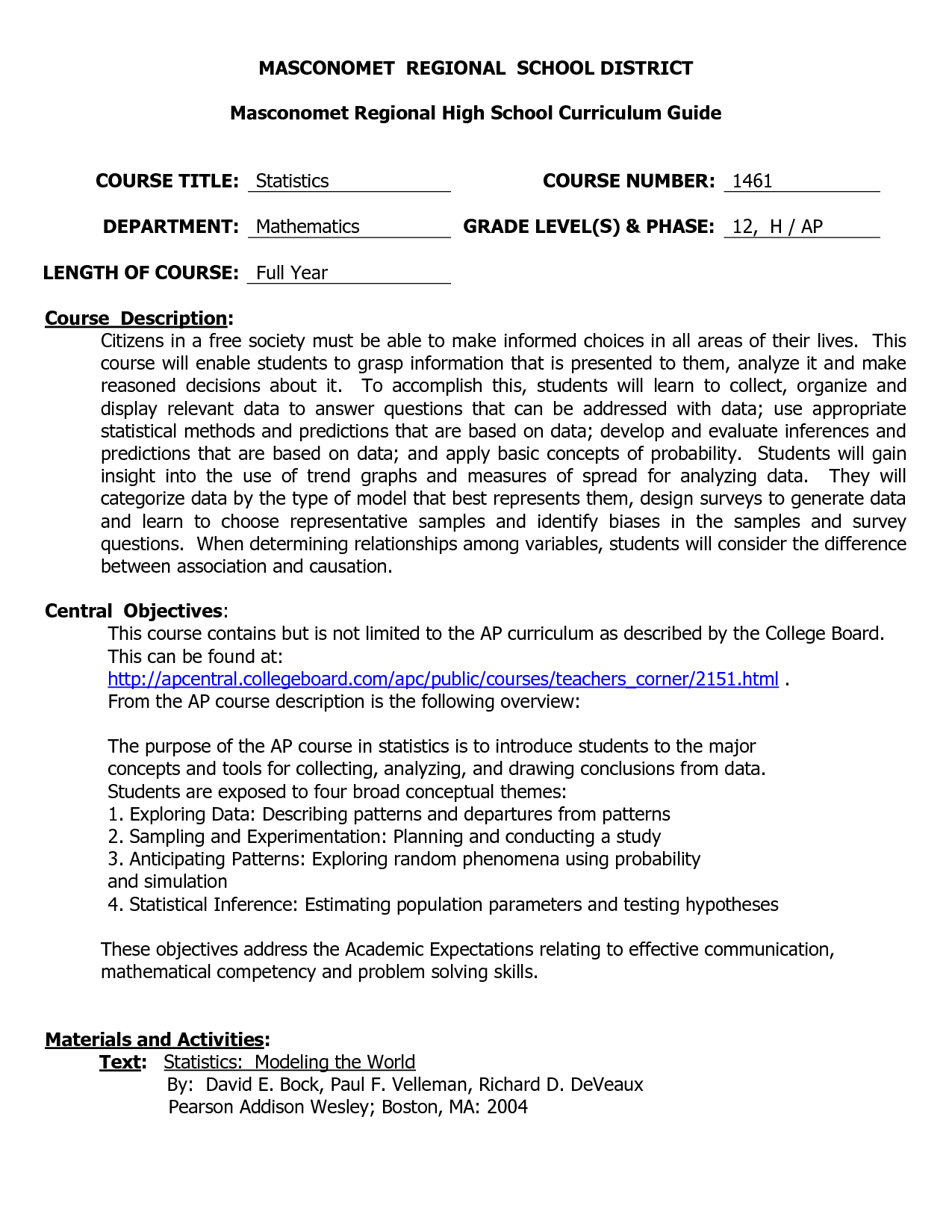

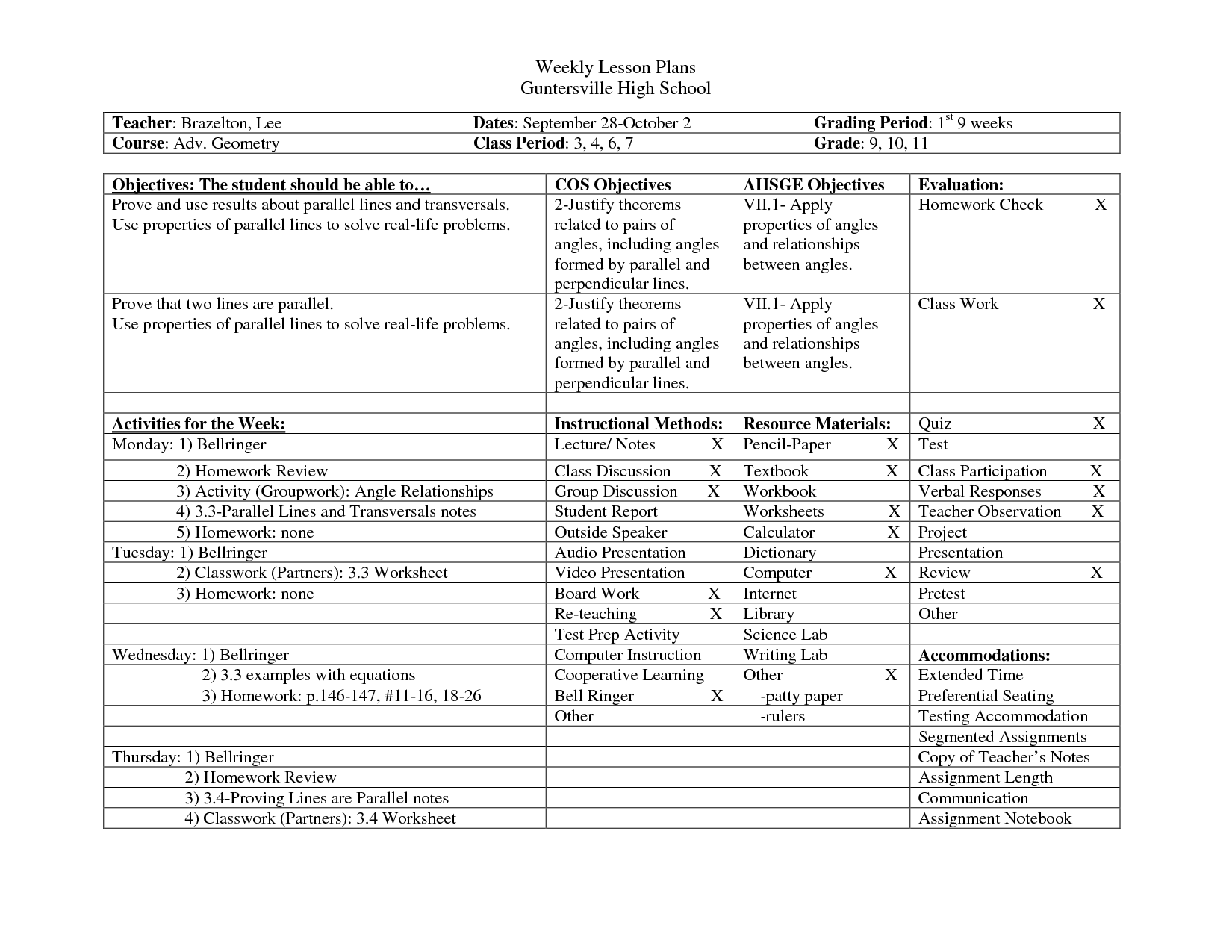

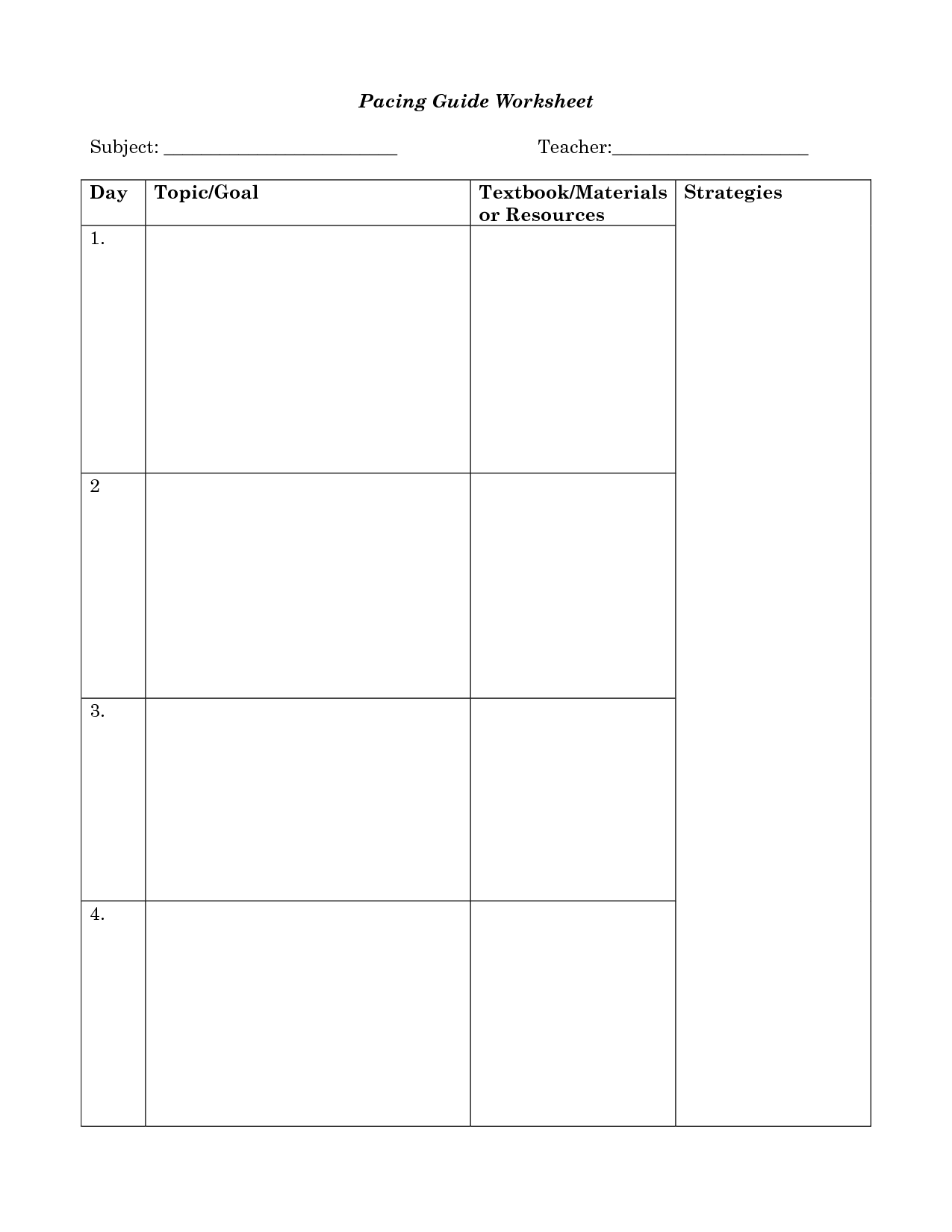

- Lesson Plans for High School Students

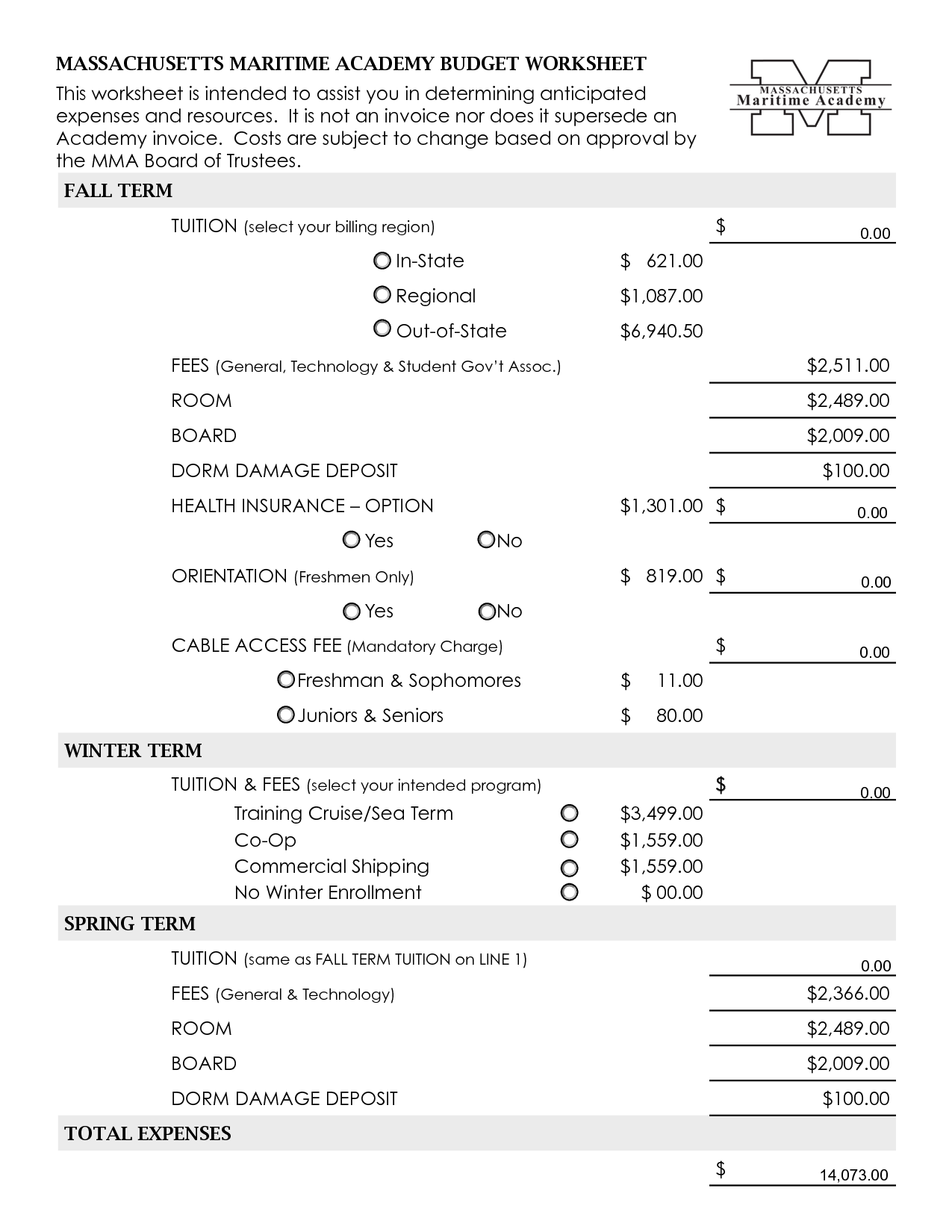

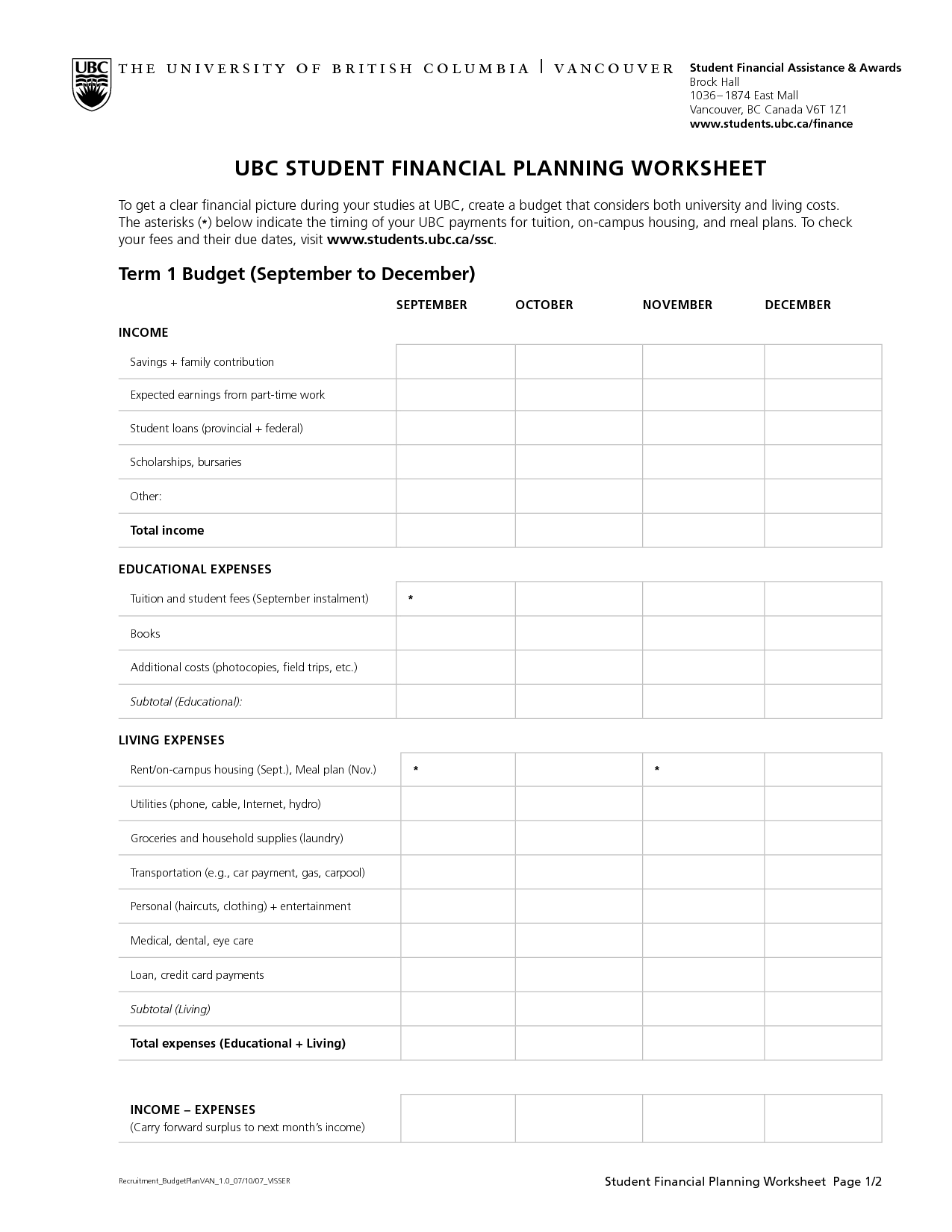

- Personal Budget Worksheet High School

- High School Reading Worksheets Free

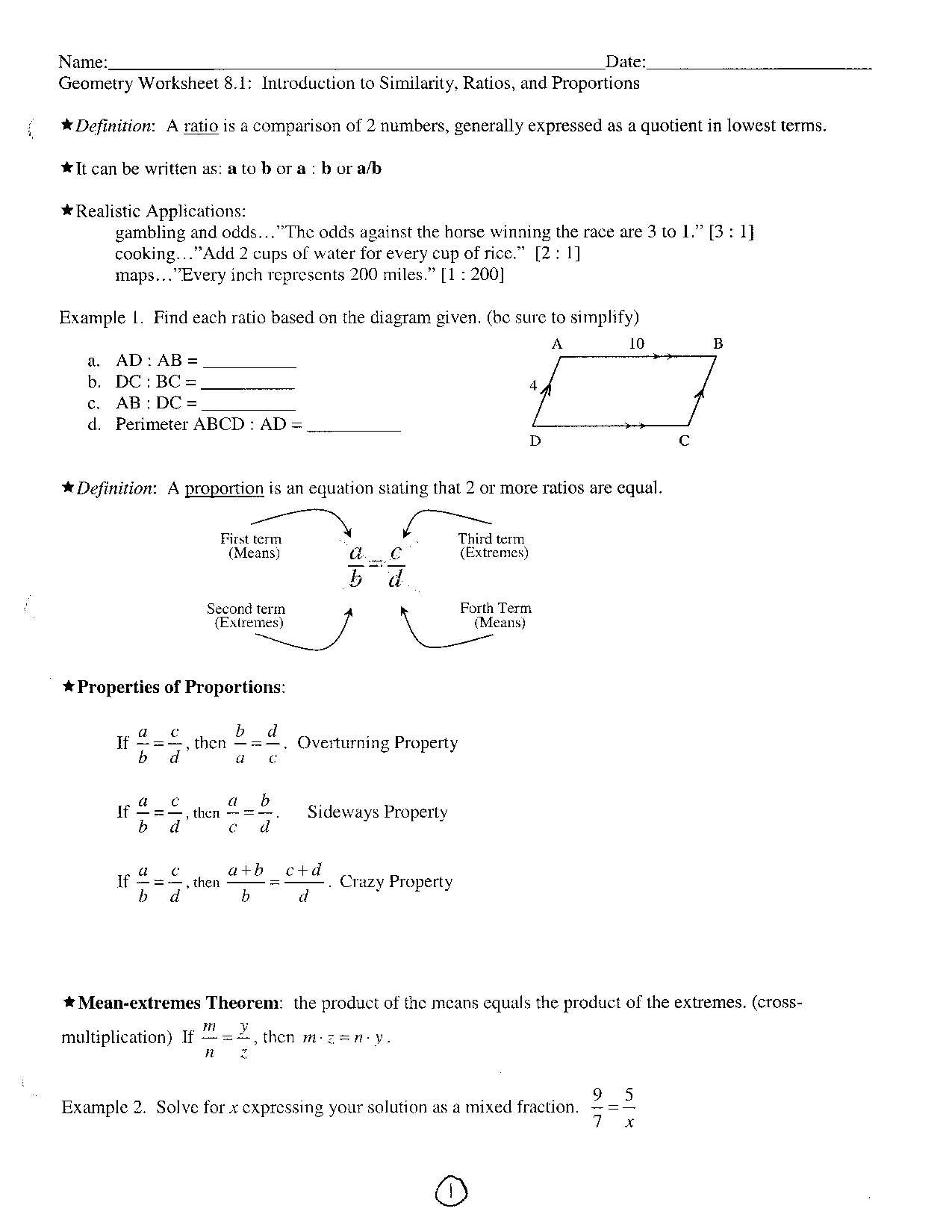

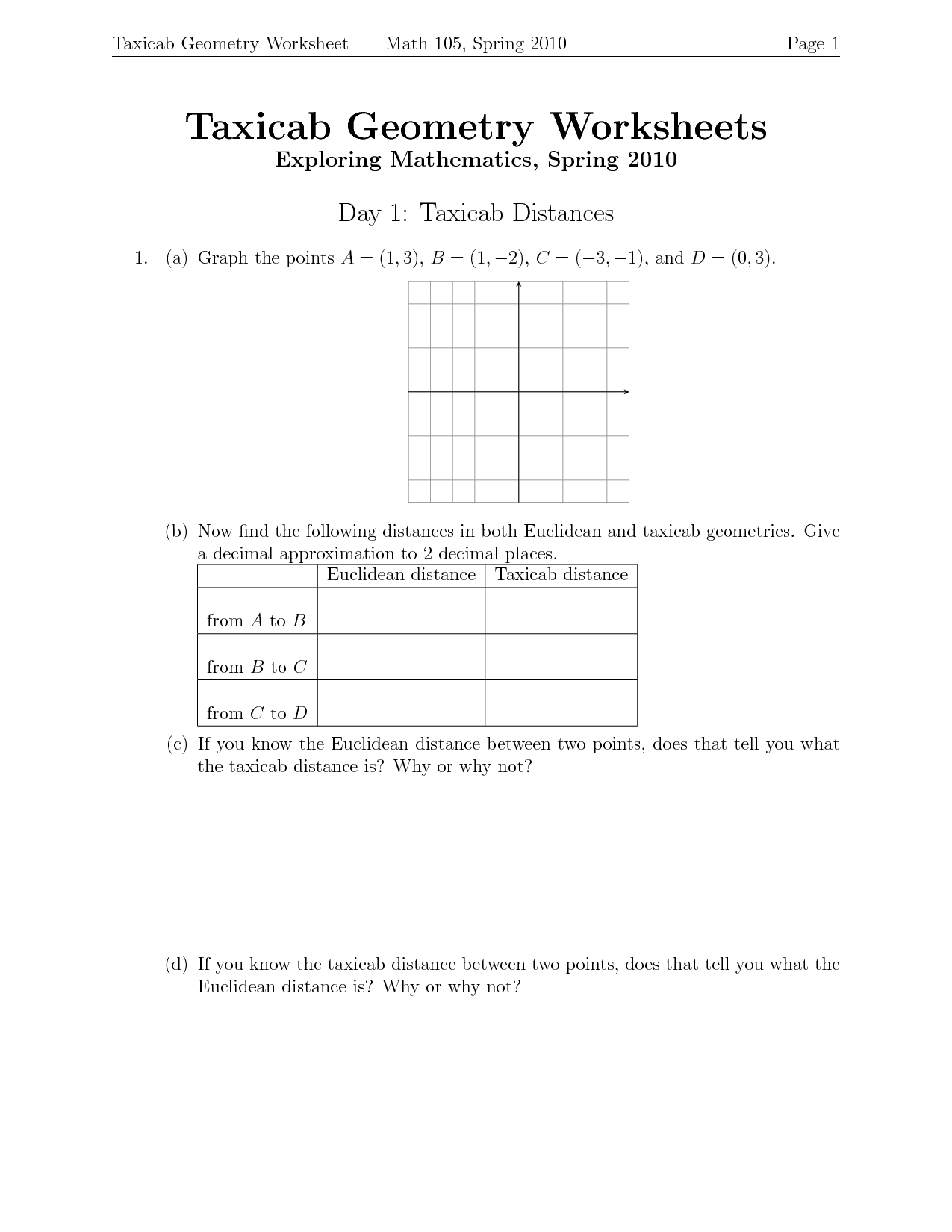

- Rates Ratios and Proportions Worksheet

- Lesson Plans High School

- High School Grade English Worksheets

- Personal Financial Planning Worksheet

- High School Geometry Math Worksheets

- Free Consumer Math Worksheets for High School

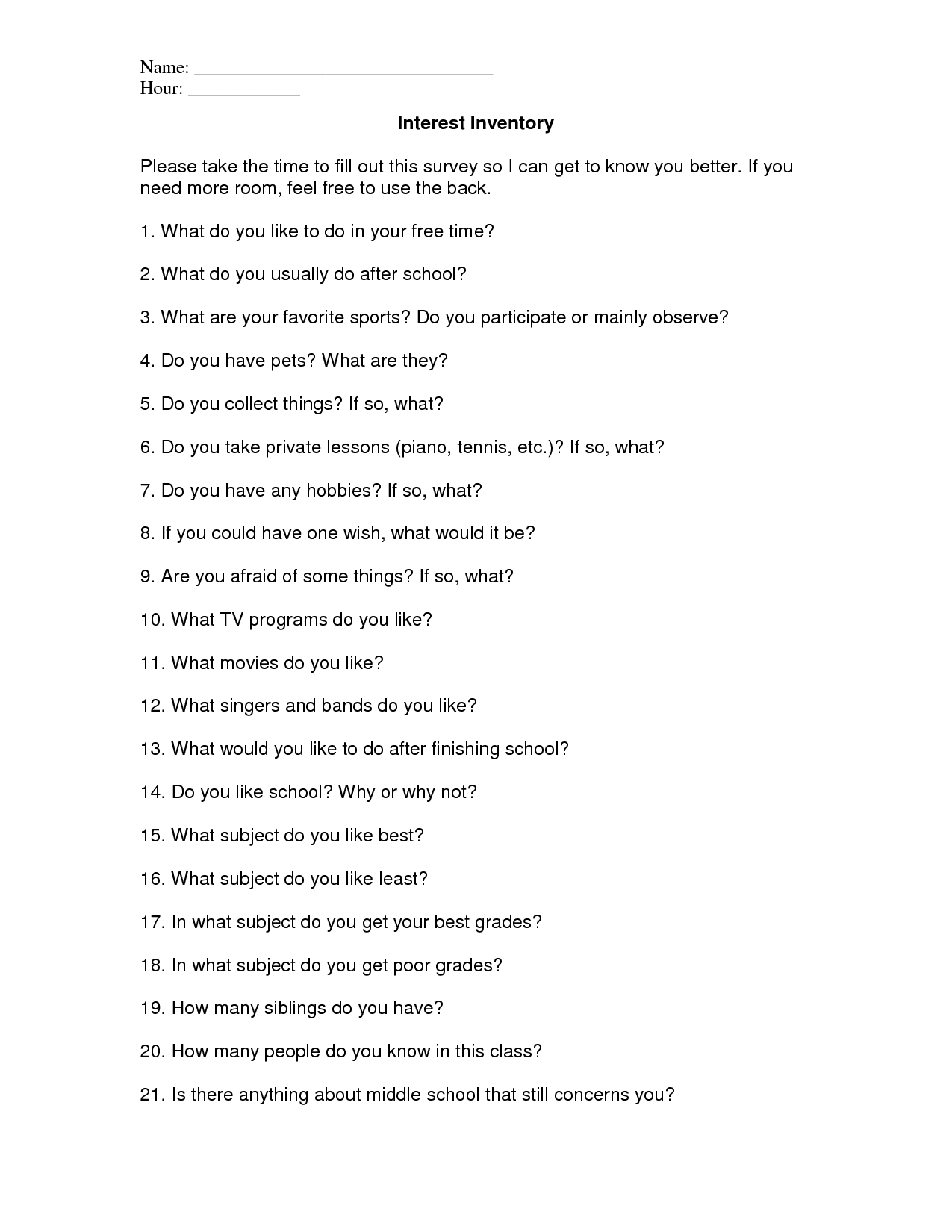

- High School Student Career Interest Inventory

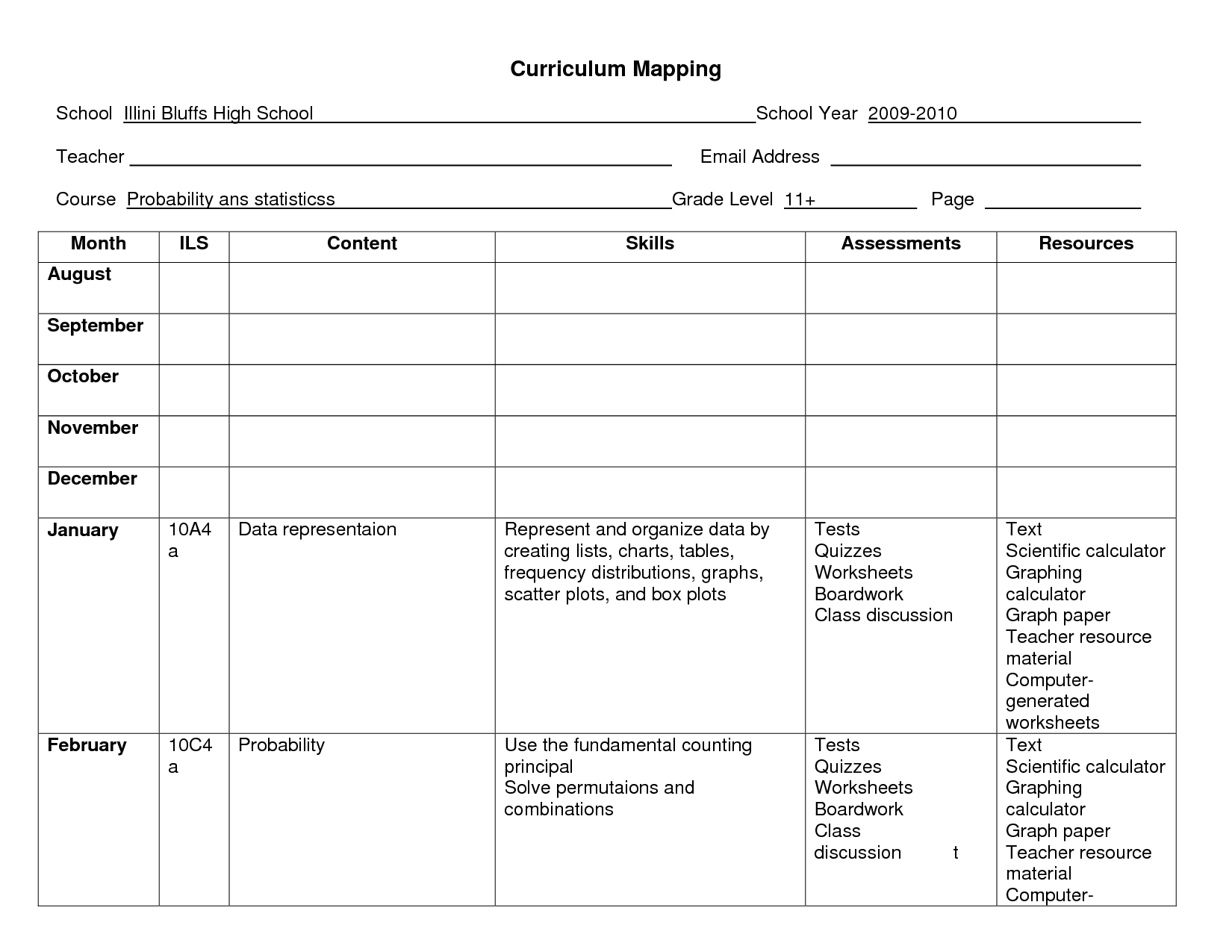

- Probability Worksheets High School

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is the purpose of a personal finance worksheet?

The purpose of a personal finance worksheet is to help individuals track and manage their income, expenses, savings, debts, and financial goals in an organized manner. By using a personal finance worksheet, individuals can gain a better understanding of their financial situation, identify areas where they can improve, and make informed decisions to work towards financial stability and success.

What types of financial information should be included in a personal finance worksheet?

A personal finance worksheet should include information such as income sources (salary, investments, etc.), expenses (bills, groceries, entertainment), savings contributions, debt obligations (loans, credit card balances), assets (savings, investments, property), and liabilities (outstanding debts). Additionally, it is important to track financial goals, emergency funds, and retirement savings contributions in order to have a comprehensive overview of one's financial situation.

How can a personal finance worksheet help students manage their money?

A personal finance worksheet can help students manage their money by providing a clear overview of their income, expenses, and savings goals. By tracking spending habits and setting a budget using a worksheet, students can identify areas where they may be overspending and adjust their financial habits accordingly. Additionally, a worksheet can help students prioritize their financial goals, such as saving for emergencies or future expenses, and track their progress towards achieving them, ultimately leading to better money management skills and financial literacy.

What are some common expenses that should be accounted for in a personal finance worksheet?

Common expenses that should be accounted for in a personal finance worksheet include rent or mortgage payments, utilities (such as electricity, water, and gas), groceries, transportation (such as gas, public transit, or car maintenance), insurance (health, auto, home), debt payments, entertainment, savings, and miscellaneous expenses (such as clothing, gifts, or dining out). It is important to track and budget for these expenses to effectively manage personal finances and achieve financial goals.

How can a personal finance worksheet help students set financial goals?

A personal finance worksheet can help students set financial goals by providing a clear overview of their current financial situation, including income, expenses, and savings. By organizing and tracking their financial information on a worksheet, students can identify areas where they can cut back on spending, increase savings, or prioritize financial goals. This comprehensive view allows students to set realistic and specific financial goals, create a budget to achieve those goals, and track their progress over time, ultimately helping them stay accountable and focused on achieving their financial objectives.

What are some strategies for saving money that can be tracked using a personal finance worksheet?

Some strategies for saving money that can be tracked using a personal finance worksheet include setting a realistic budget, monitoring expenses regularly, prioritizing needs over wants, cutting unnecessary costs, tracking income sources, setting savings goals and automatically transferring a set amount to a savings account each month, and reviewing and adjusting the budget and expenses as needed to stay on track with financial goals.

Why is it important to regularly update and review a personal finance worksheet?

Regularly updating and reviewing a personal finance worksheet is important because it helps you track your financial progress, identify any discrepancies or errors, and make necessary adjustments to your budget or spending habits. By staying up to date with your financial information, you have a clearer understanding of your financial situation, enabling you to make informed decisions and ensure that you are on track to meet your financial goals. Additionally, reviewing your personal finance worksheet regularly can help you identify areas where you may be overspending or where you can potentially save more money, leading to better financial management and stability in the long run.

How can a personal finance worksheet help students understand the concept of budgeting?

A personal finance worksheet can help students understand the concept of budgeting by providing a visual representation of their income, expenses, and savings goals. By inputting their financial information into the worksheet, students can see how much money they have coming in, where their money is going, and how much they have left over to save or spend. This hands-on approach allows them to track their spending habits, identify areas where they may be overspending, and make adjustments to create a balanced budget that aligns with their financial goals. Ultimately, using a personal finance worksheet can help students develop a practical understanding of budgeting and how to manage their money effectively.

How can a personal finance worksheet help students track their income and expenses?

A personal finance worksheet can help students track their income and expenses by providing a organized way to record and categorize their financial transactions. By inputting their sources of income and itemizing their expenses, students can easily see where their money is coming from and where it is going. This tool allows students to analyze their spending patterns, identify areas where they may be overspending, set realistic budgets, and make informed decisions about their finances to ultimately achieve their financial goals.

What are some potential benefits of using a personal finance worksheet as a high school student?

Using a personal finance worksheet as a high school student can offer numerous benefits, such as developing good budgeting habits, tracking expenses, setting financial goals, understanding the importance of saving and investing, and gaining a better overall understanding of personal finances. Additionally, it can help improve financial literacy, encourage responsible spending, and prepare students for managing their money effectively in the future.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments