Business Cash Flow Worksheet

Managing the cash flow of a business is essential for its success and financial stability. With our Business Cash Flow Worksheet, you can effectively track and monitor your company's income and expenses to gain a better understanding of your financial situation. This worksheet is designed specifically for small business owners or entrepreneurs who are seeking a practical tool to help them stay on top of their financials.

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

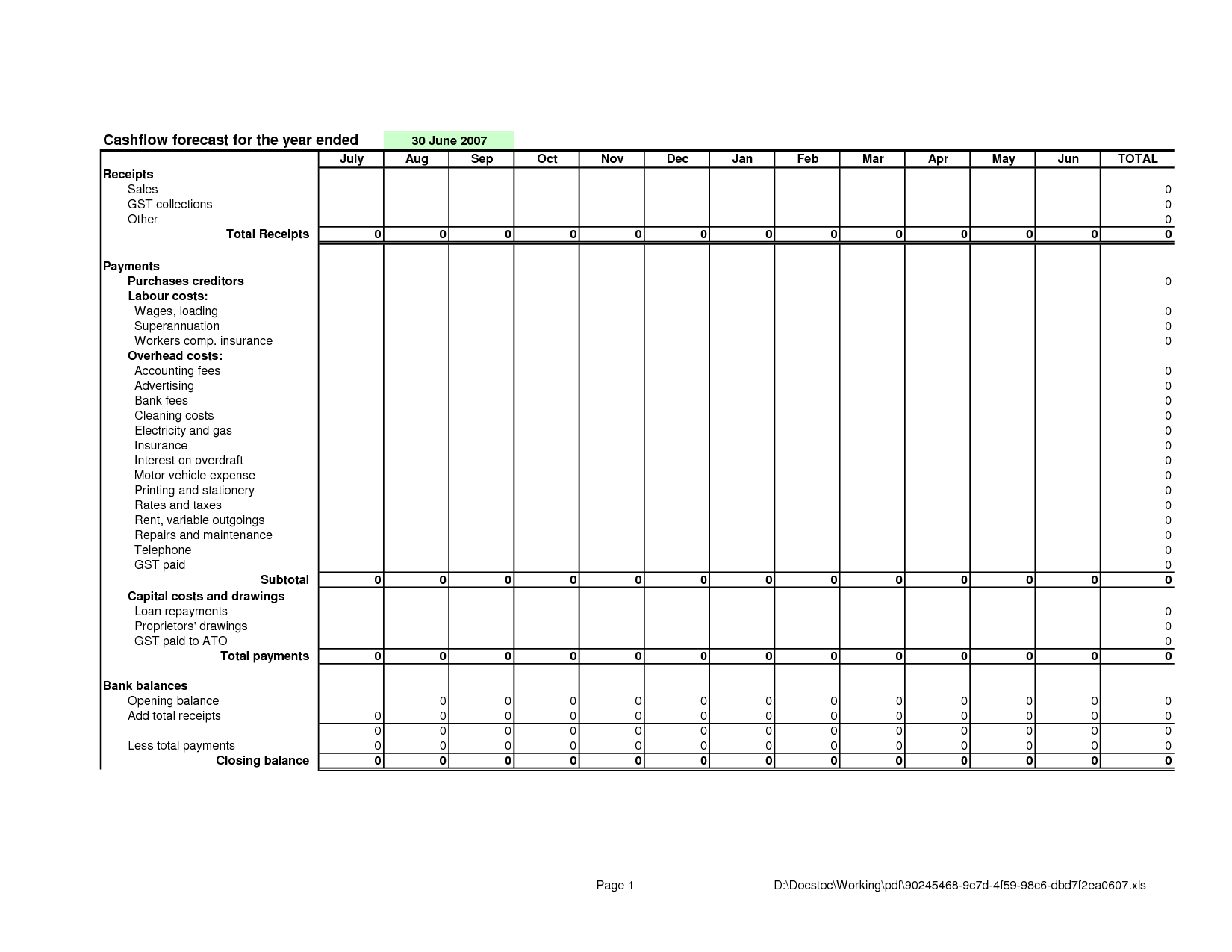

What is a Business Cash Flow Worksheet?

A Business Cash Flow Worksheet is a tool used to track and monitor the movement of cash in and out of a business over a specific period of time. It typically includes details of the business's sources of cash inflows (such as sales revenue, loans, or investments) and cash outflows (such as expenses, salaries, and loan repayments). By creating and regularly updating a cash flow worksheet, businesses can better manage their finances, identify potential cash shortages or surpluses, and make more informed decisions to improve their financial health and stability.

Why is a Business Cash Flow Worksheet important for a business?

A Business Cash Flow Worksheet is important for a business because it helps track and manage the inflow and outflow of cash, allowing the business to understand its financial health and make informed decisions. By monitoring cash flow regularly, businesses can identify trends, anticipate shortfalls, allocate resources efficiently, and plan for future expenses or investments. This tool is essential for budgeting, forecasting, and ensuring the business has enough liquidity to meet its obligations and support growth.

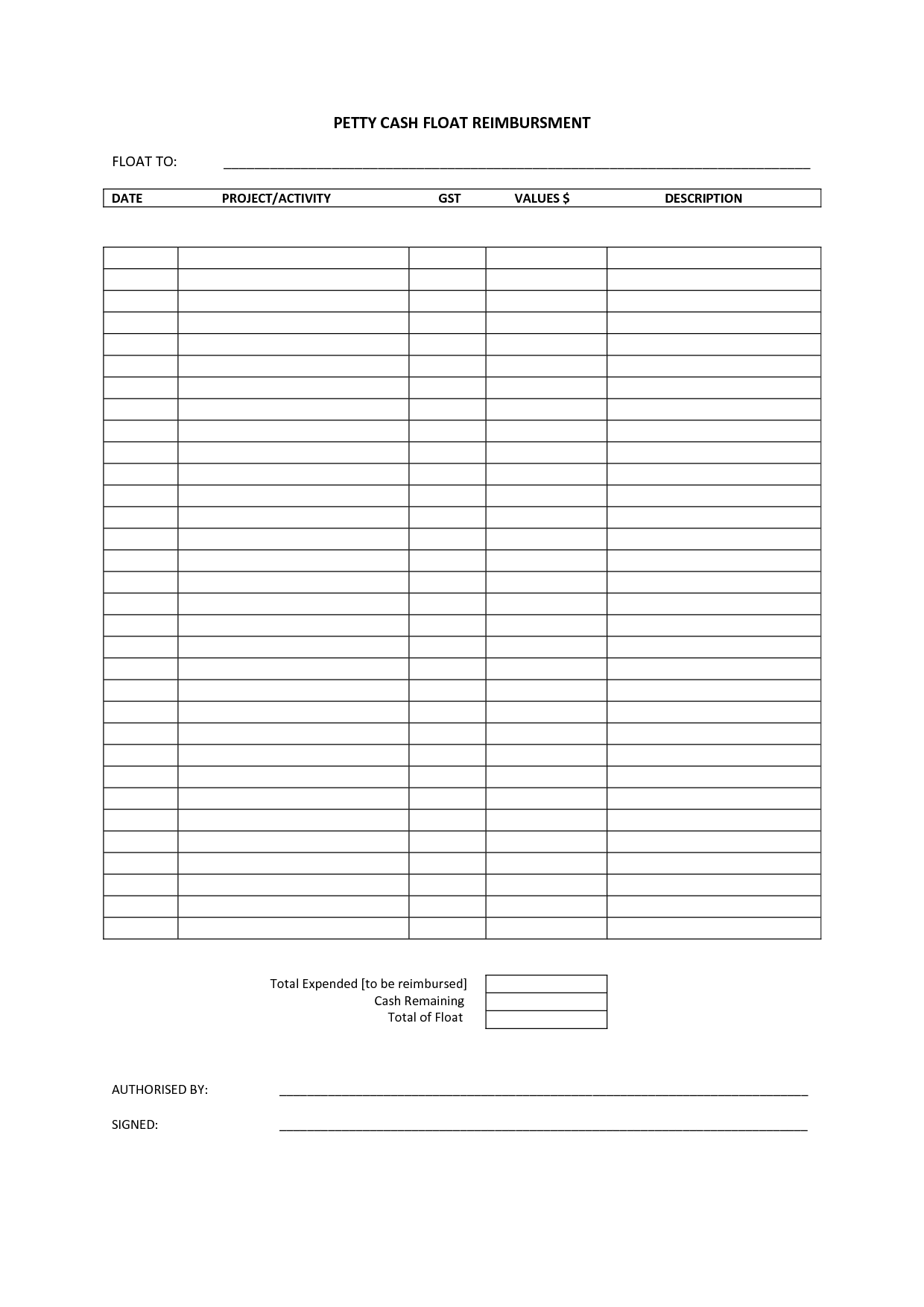

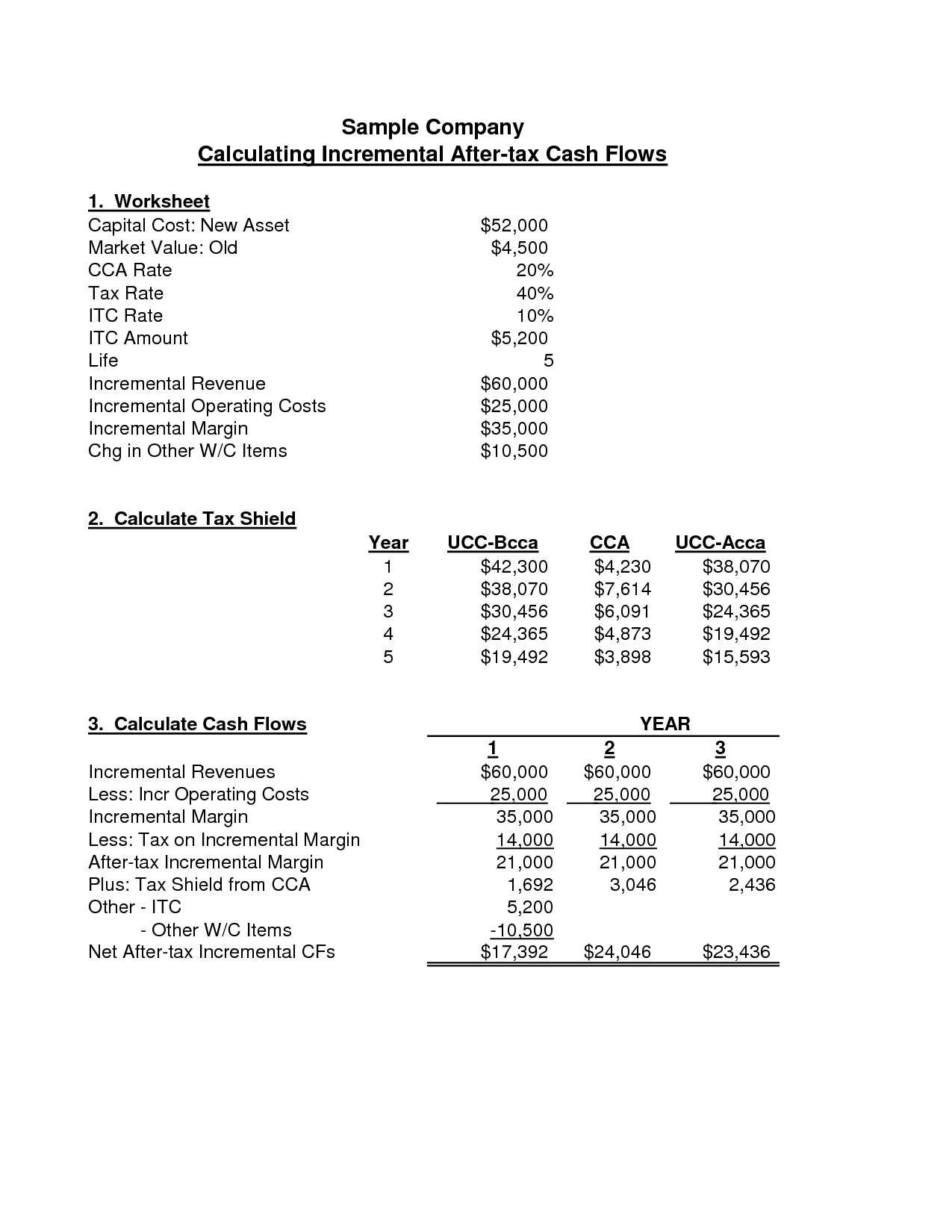

What information is typically included in a Business Cash Flow Worksheet?

A Business Cash Flow Worksheet typically includes information on all incoming and outgoing cash transactions over a specific period. This may include details on sources of revenue, operating expenses, loan payments, investments, taxes, and other financial activities that impact the business's liquidity. The worksheet helps businesses track and manage their cash flow to ensure they have enough funds to cover operational expenses and make any necessary adjustments to improve financial health.

How can a Business Cash Flow Worksheet help with financial planning?

A Business Cash Flow Worksheet can help with financial planning by providing a clear understanding of a company's incoming and outgoing cash over a specific period. By tracking and analyzing cash flow, businesses can identify trends, anticipate future financial needs, manage expenses, evaluate liquidity, and make informed decisions regarding investments, loans, and expenditures. This tool allows businesses to proactively address potential cash shortages, optimize cash flow, and improve overall financial stability and performance.

What are the main components of a Business Cash Flow Worksheet?

A Business Cash Flow Worksheet typically includes sections for listing the sources of income, such as sales revenue and loans; detailing fixed expenses like rent and utilities; outlining variable expenses such as inventory or marketing costs; projecting cash inflows and outflows for each month; calculating the net cash flow by subtracting total expenses from total income; and highlighting any cash reserves or overdraft protection to manage potential shortfalls or unexpected expenses.

How can a Business Cash Flow Worksheet help identify cash flow issues?

A Business Cash Flow Worksheet can help identify cash flow issues by providing a detailed breakdown of all the cash inflows and outflows within a specific period. By comparing the expected cash flow with the actual cash flow, discrepancies or patterns that indicate potential issues such as late payments, insufficient revenue, or high expenses can be easily spotted. This tool allows businesses to pinpoint where cash flow problems are originating from and take necessary steps to address them before they escalate.

How often should a Business Cash Flow Worksheet be updated?

A Business Cash Flow Worksheet should ideally be updated on a monthly basis to ensure accuracy and reflect any new financial transactions or changes in the business's cash position. This regular monitoring allows for better financial planning, identifying trends, and adjusting strategies to improve cash flow management.

What are some common challenges faced when using a Business Cash Flow Worksheet?

Some common challenges faced when using a Business Cash Flow Worksheet include inaccuracies in data input leading to flawed calculations, difficulty in predicting future cash flows accurately due to unforeseen circumstances or market fluctuations, the complexity of tracking multiple sources of income and expenses, and the time-consuming nature of updating and maintaining the worksheet regularly to reflect the latest financial information. Additionally, challenges can arise from discrepancies between projected and actual cash flow figures, making it challenging to make informed financial decisions based on the data provided by the worksheet.

How can a Business Cash Flow Worksheet help with decision-making and forecasting?

A Business Cash Flow Worksheet can help with decision-making and forecasting by providing a clear and organized overview of a company's incoming and outgoing cash. By tracking and analyzing cash flow on a regular basis, businesses can identify trends, anticipate potential financial issues, and make informed decisions about managing expenses, investing in growth opportunities, and planning for the future. This tool allows businesses to forecast future cash flows, set realistic financial goals, and make adjustments to their operations to ensure optimal financial health and stability.

Are there any tools or software available to assist with creating a Business Cash Flow Worksheet?

Yes, there are several tools and software available to assist in creating a Business Cash Flow Worksheet. Some popular options include Microsoft Excel, Google Sheets, QuickBooks, FreshBooks, and Xero. These platforms offer templates and features that can help you organize and analyze your cash flow data effectively. Additionally, there are online resources and tutorials that can guide you through the process of creating a comprehensive cash flow worksheet for your business.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments