Tax Discount Percent Worksheets

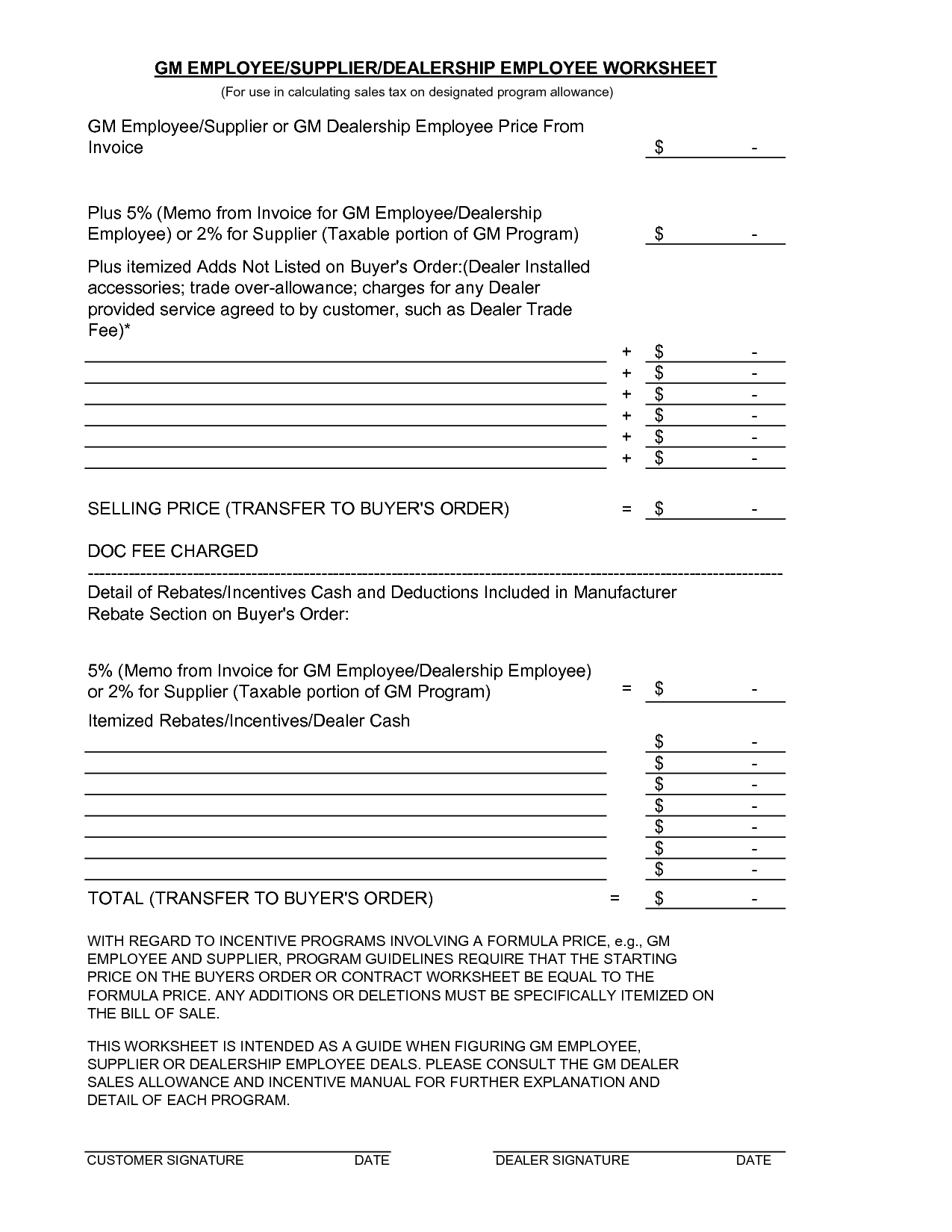

Tax discount percent worksheets are useful tools for individuals or businesses who need to calculate the amount of tax discount they can avail. These worksheets provide a structured format for organizing and calculating the tax discount percentage based on the designated entity or subject. By utilizing these worksheets, users can simplify the process of determining the tax discount, making it more efficient and accurate.

Table of Images 👆

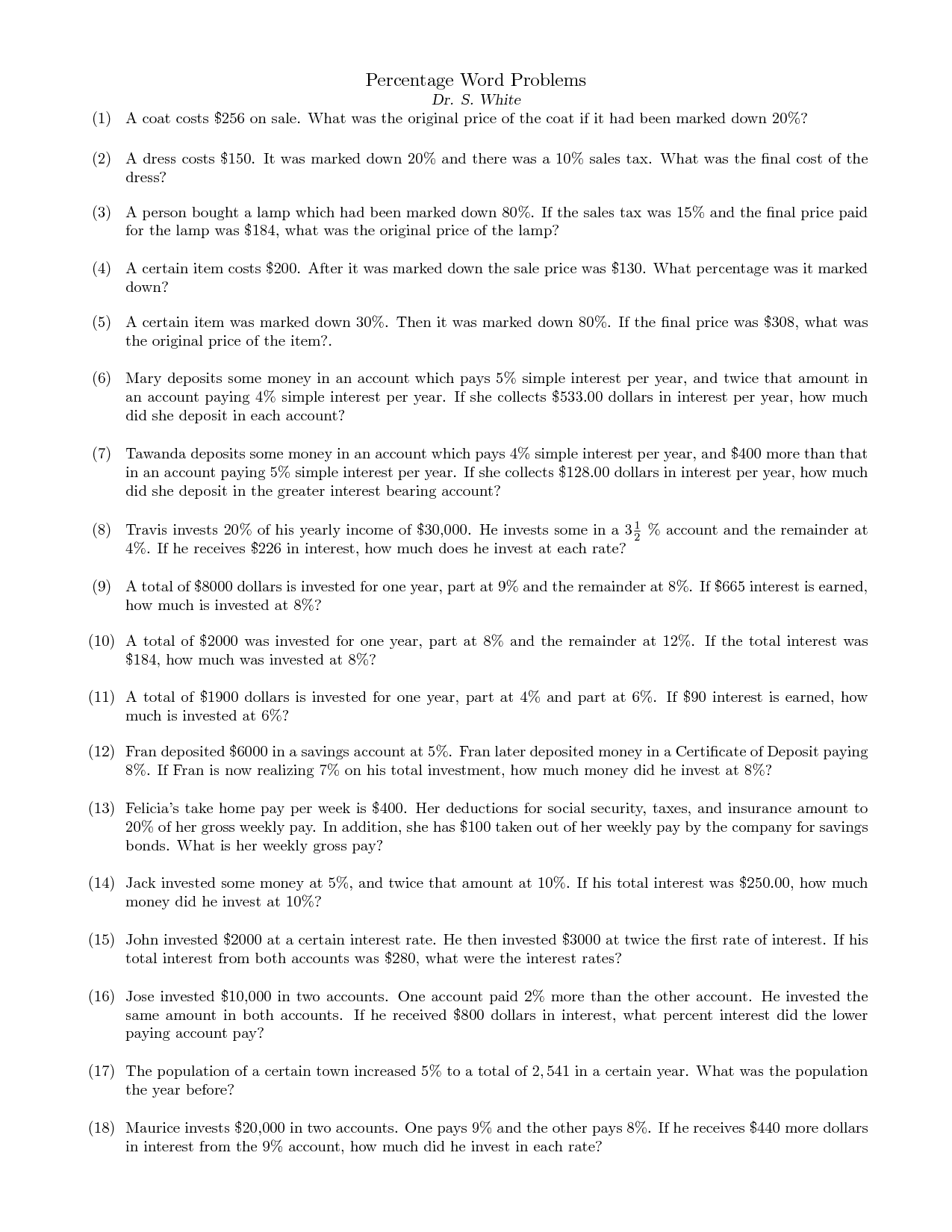

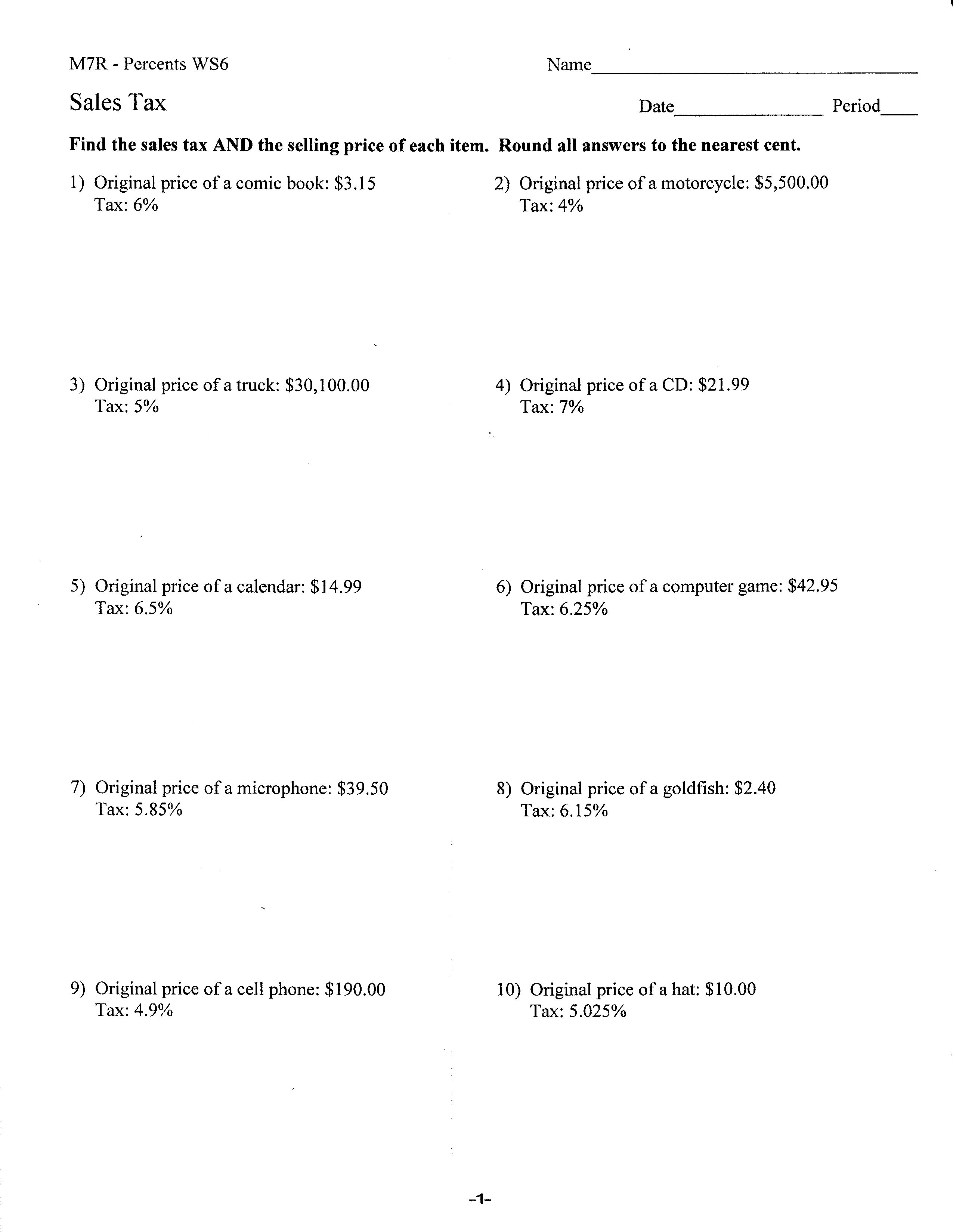

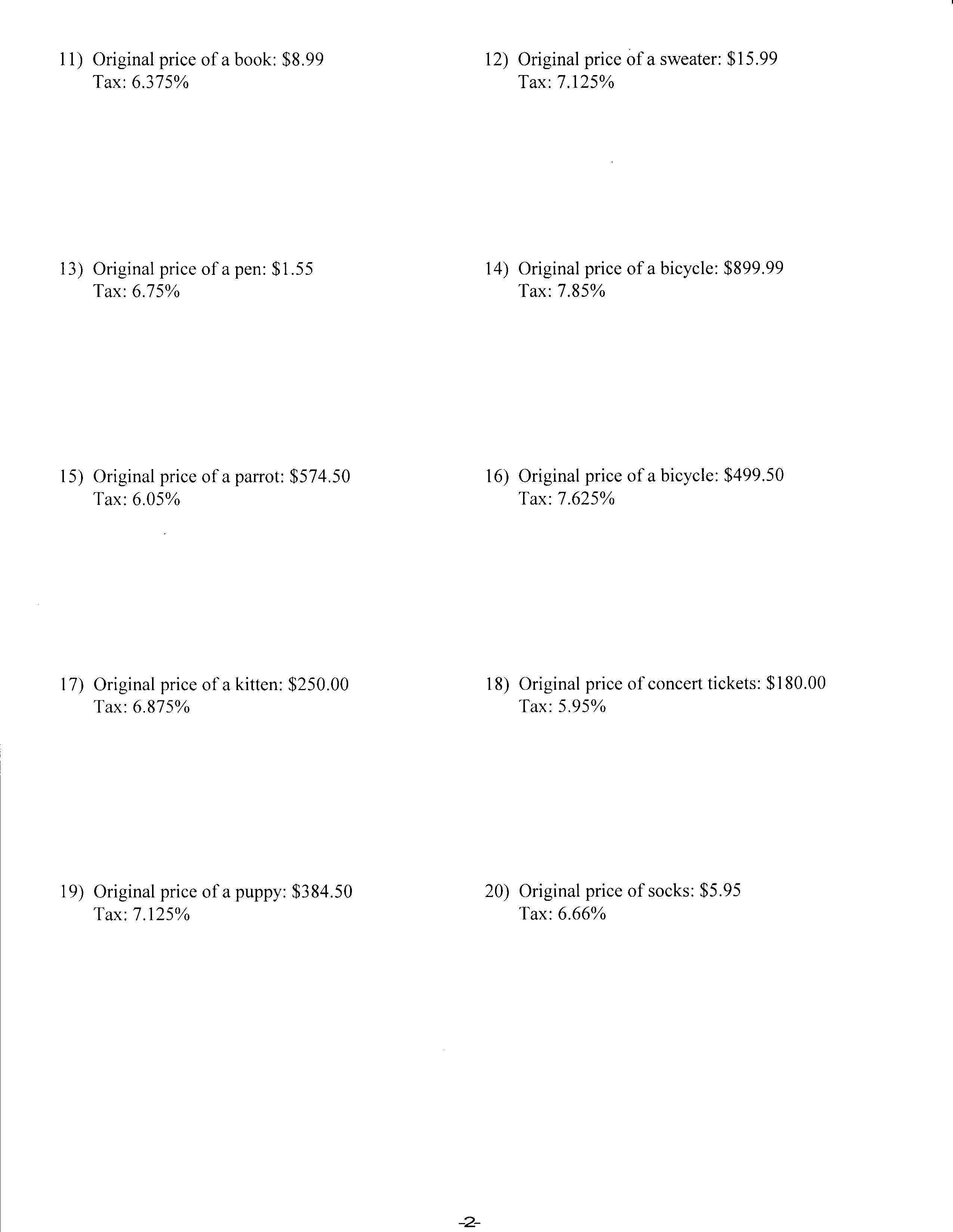

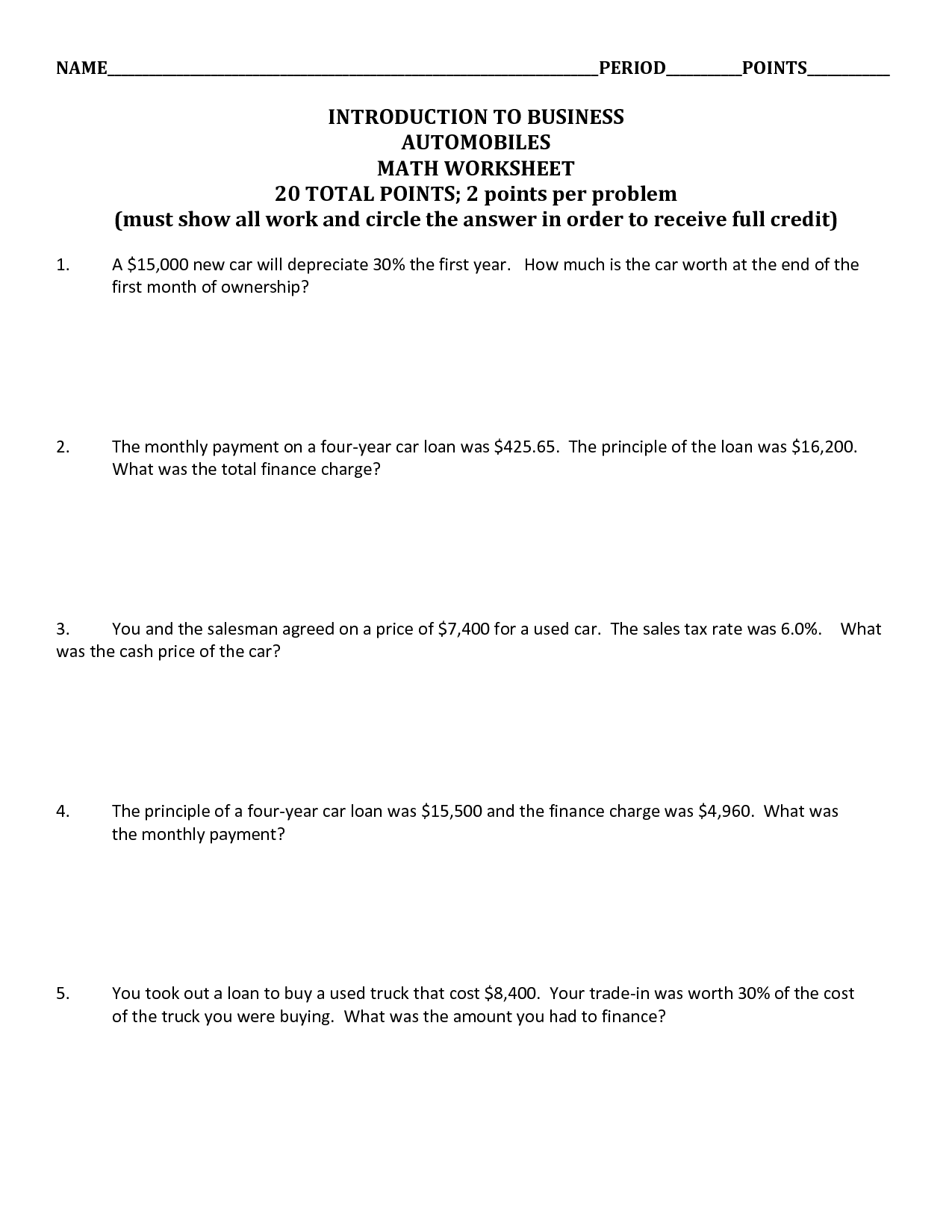

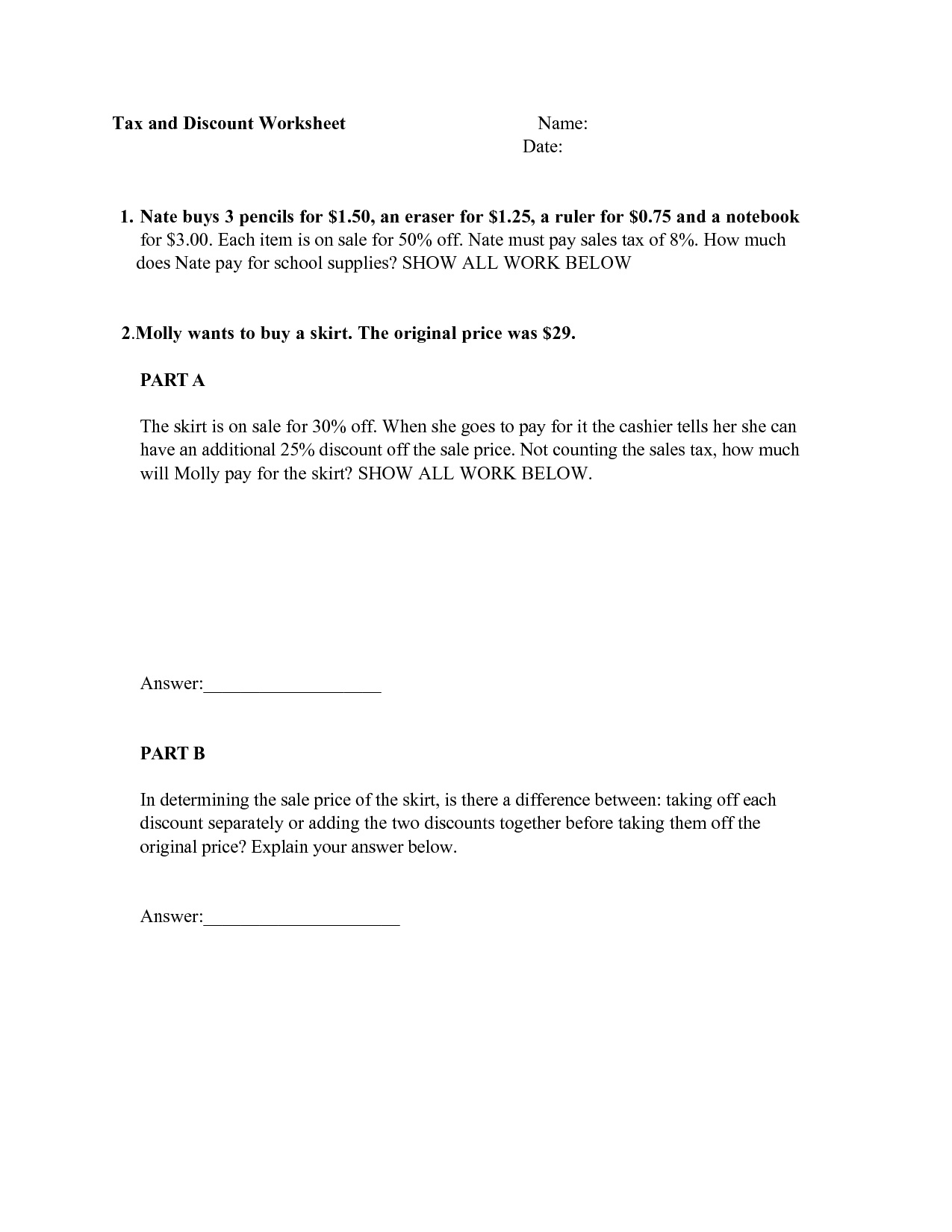

- Percent Word Problems Worksheets

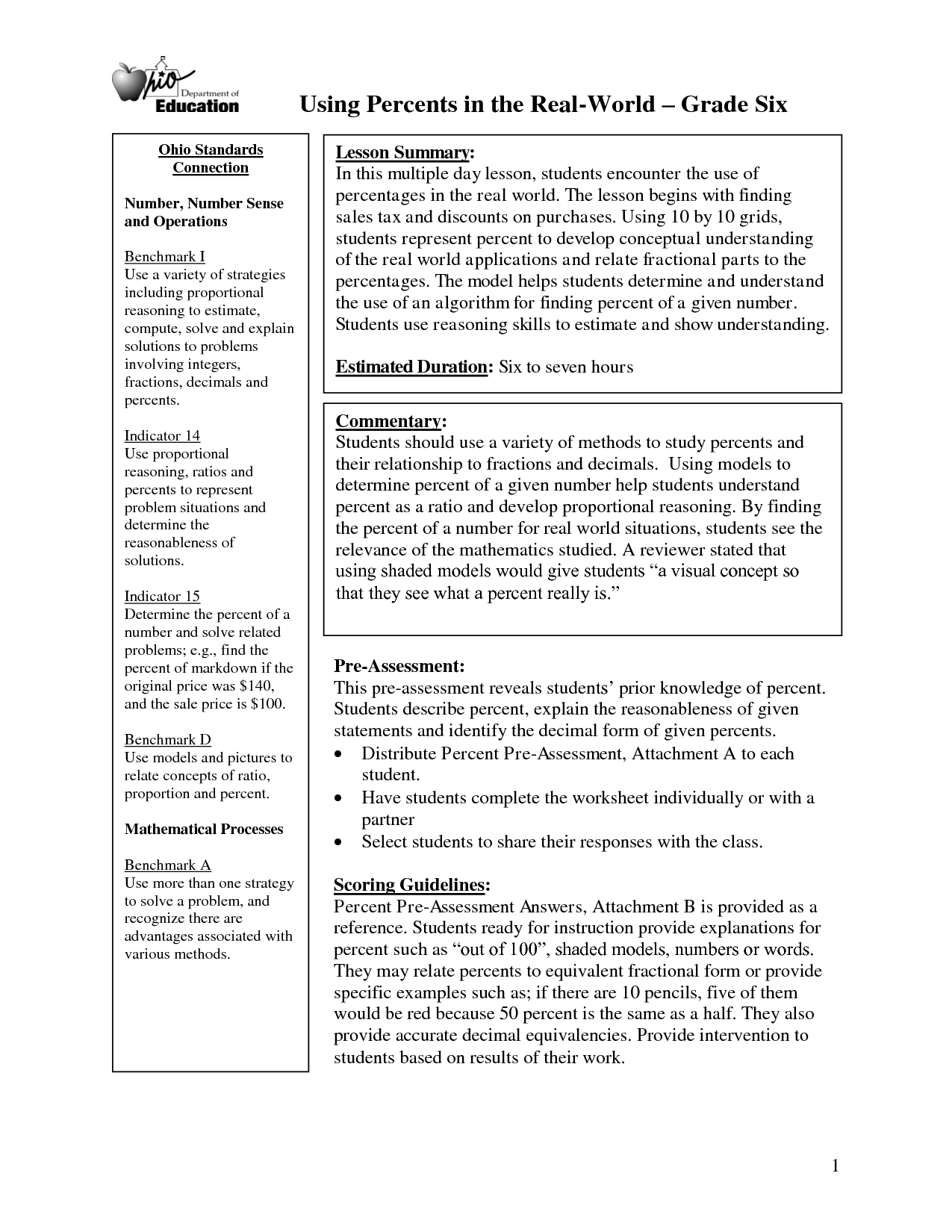

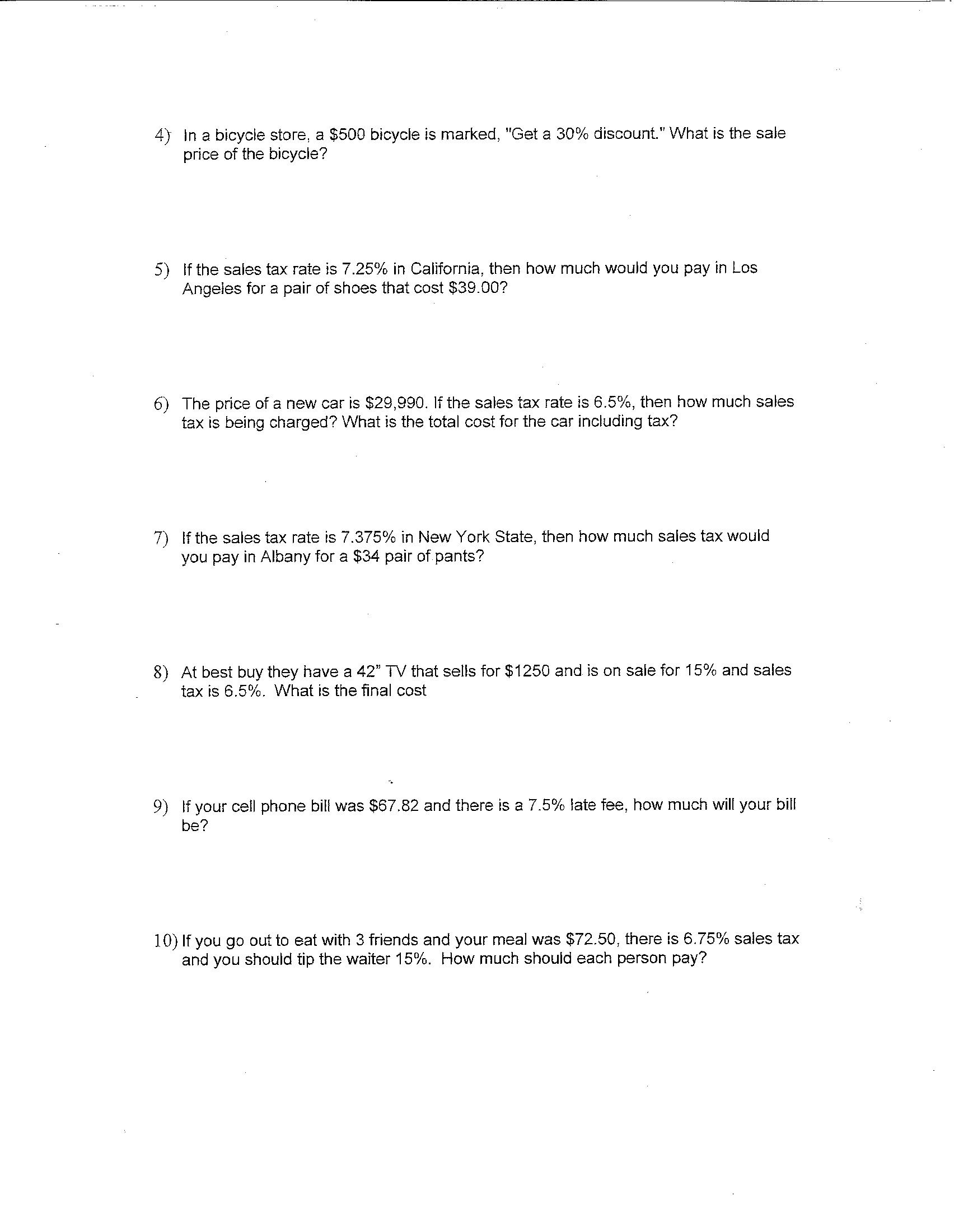

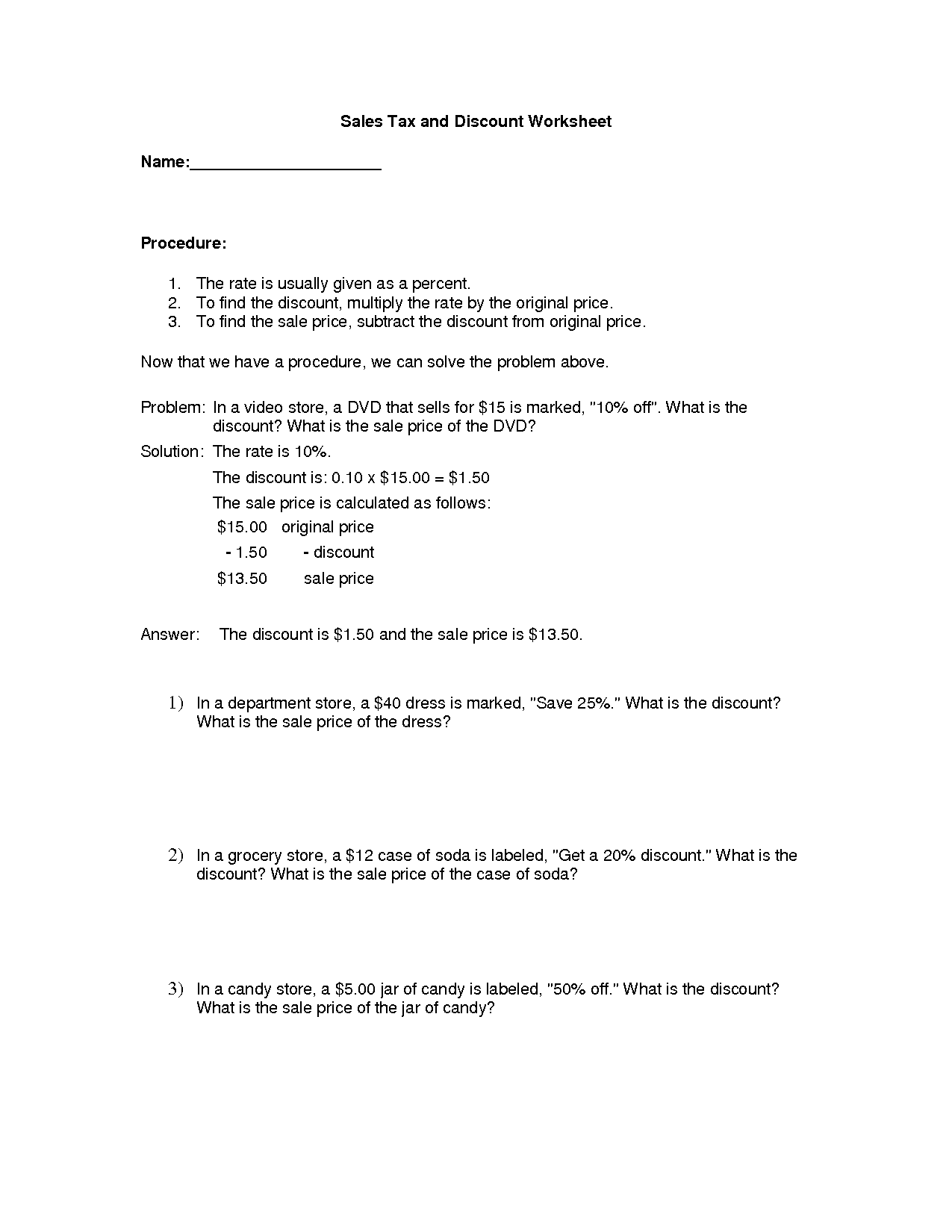

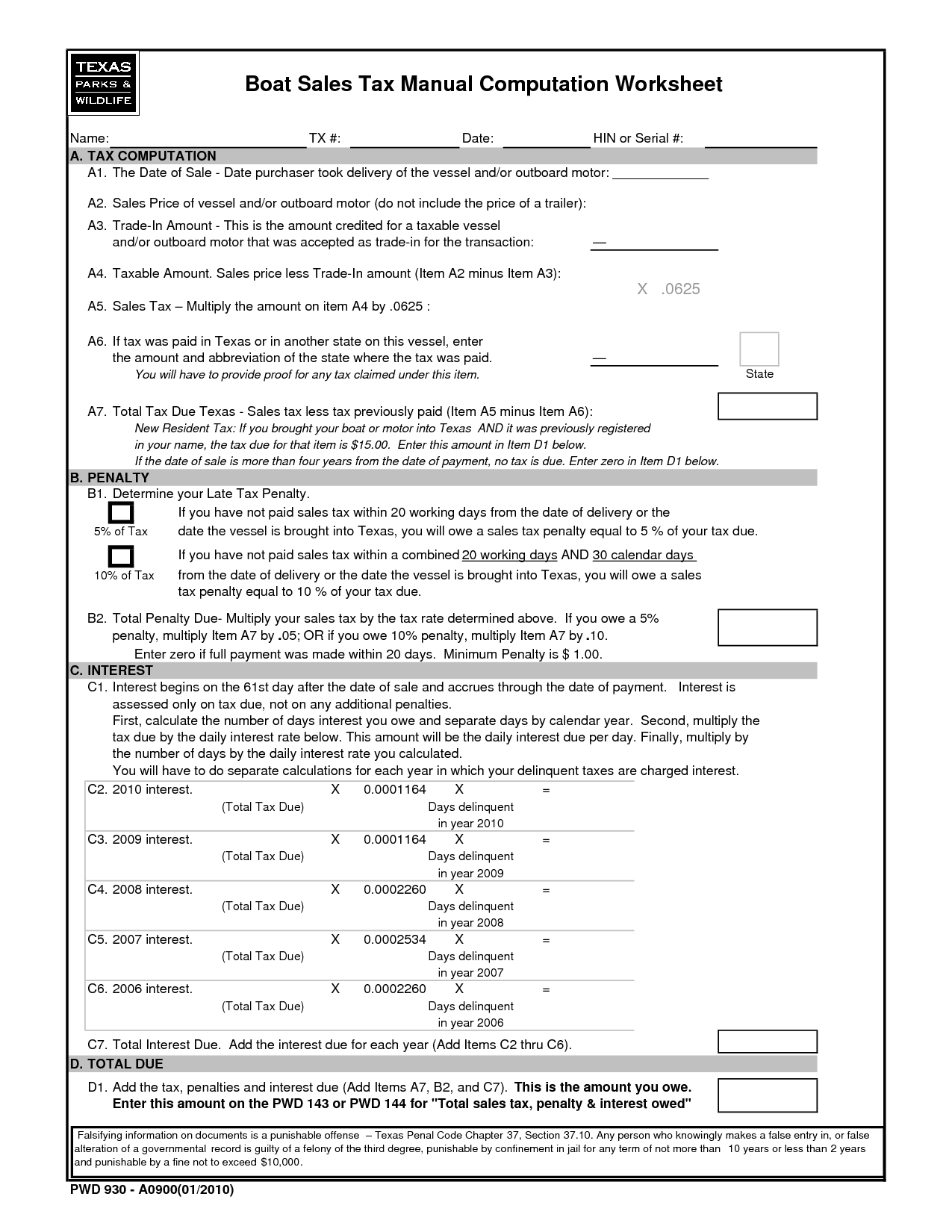

- Tips Tax and Sales Discounts Worksheets

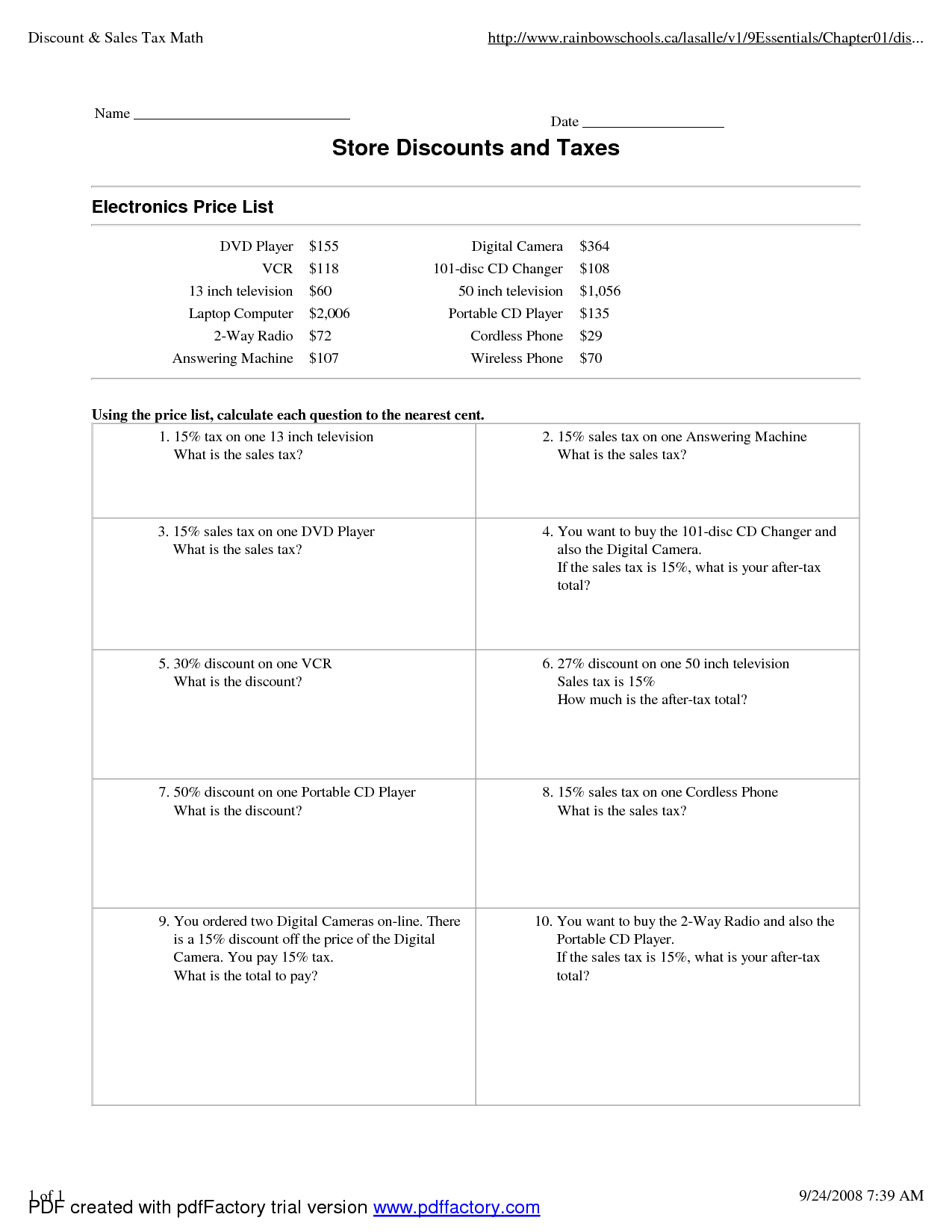

- Sales Tax and Discount Worksheets

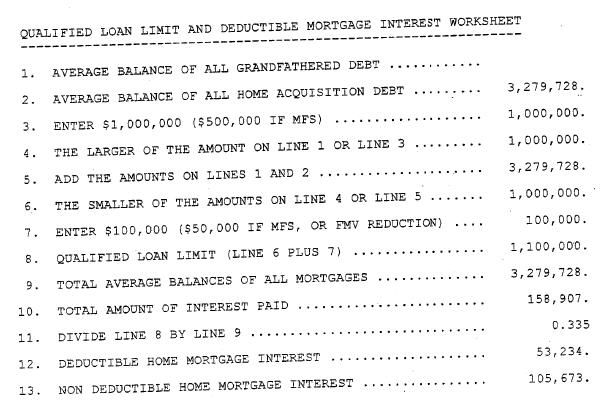

- Percent Tax Tip Discount Word Problems Worksheet Answers

- Percent Increase and Decrease Worksheets

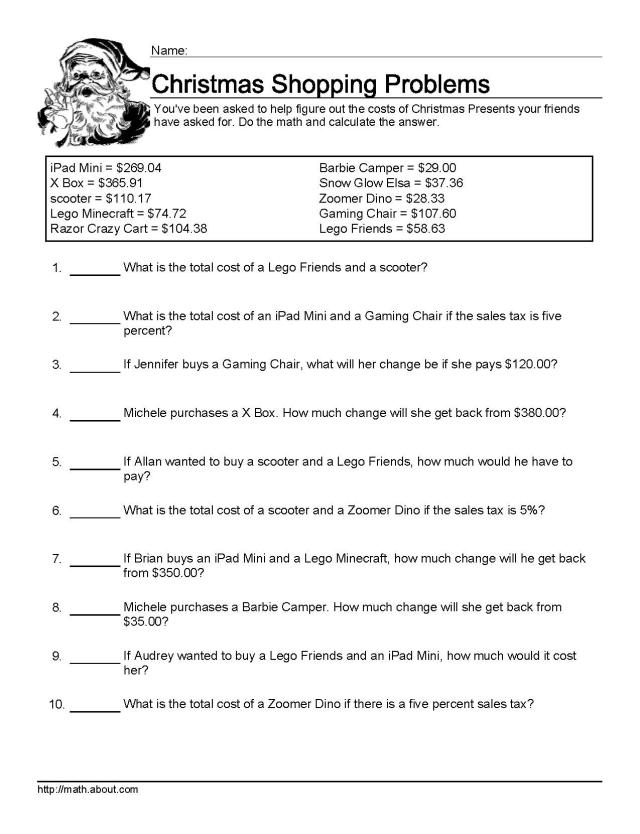

- Christmas Math Word Problems Worksheet

- Printable Sales Tax Worksheets

- Sales Tax Math Problems Worksheets

- 7th Grade Math Worksheets Percentages

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a tax discount percent worksheet?

A tax discount percent worksheet is a tool used to calculate the percentage discount applied to a tax bill based on certain criteria, such as income level or property value. It helps individuals or businesses determine the amount of savings they can receive on their tax liability by qualifying for a discount or exemption. This worksheet is useful for budgeting and financial planning by providing a clear breakdown of the discount percentage and the resulting tax savings.

How is the tax discount percent calculated?

The tax discount percent is typically calculated by dividing the amount of the tax discount by the original tax amount and then multiplying by 100 to get the percentage. The formula is: Tax Discount Percent = (Tax Discount Amount / Original Tax Amount) * 100. This calculation helps determine the proportion of tax saved through the discount offered.

What information is required to complete a tax discount percent worksheet?

To complete a tax discount percent worksheet, you would need the total amount of the discount, the original price of the item, and the percentage of the discount. With this information, you can calculate the discount amount and the final price after the discount has been applied.

Why is it important to accurately calculate the tax discount percent?

It is important to accurately calculate the tax discount percent because it can impact financial planning and budgeting. Inaccurate calculations can lead to underestimating or overestimating tax liabilities, which can result in financial penalties, missed savings opportunities, or incorrect decision-making. Additionally, accurate tax calculations are necessary for regulatory compliance and to ensure transparency in financial reporting.

How does a tax discount percent worksheet help with financial planning?

A tax discount percent worksheet helps with financial planning by allowing individuals to estimate their tax savings based on various deductions and credits. By inputting their income and tax information, individuals can see the effect of potential deductions and credits on their overall tax liability. This information can then be used to make informed decisions about financial strategies, such as adjusting withholdings, maximizing deductible expenses, or planning for tax-efficient investments. Ultimately, the worksheet aids in optimizing tax savings and creating a more effective financial plan.

What are some common mistakes to avoid when completing a tax discount percent worksheet?

Some common mistakes to avoid when completing a tax discount percent worksheet include not entering accurate figures for income and expenses, failing to include all eligible deductions and credits, miscalculating the discount percentages, and overlooking any changes in tax laws or regulations that could impact the final discount amount. It is important to carefully review all information entered on the worksheet to ensure accuracy and maximize the potential tax savings.

How can a tax discount percent worksheet be used to compare different financial scenarios?

A tax discount percent worksheet can be used to compare different financial scenarios by inputting the relevant data for each scenario, such as income, expenses, tax rates, and deductions. By adjusting the tax discount percent in the worksheet, one can quickly see how each scenario affects the overall tax burden and compare the outcomes to make informed financial decisions. This tool allows for a side-by-side comparison of different scenarios, helping individuals or businesses to choose the most tax-efficient option and optimize their financial strategies.

What are some potential limitations of using a tax discount percent worksheet?

Some potential limitations of using a tax discount percent worksheet include the possibility of inaccuracies in calculations if the data input is incorrect, reliance on accurate and up-to-date tax rates which may change frequently, limitations in accommodating complex tax scenarios or deductions, and the risk of overlooking certain tax laws or regulations that may impact the overall discount calculation. Additionally, tax discount percent worksheets may not take into account individual circumstances or special tax considerations that could affect the accuracy of the discount calculation.

Are there any special considerations for different types of taxes or jurisdictions when using a tax discount percent worksheet?

Yes, there are special considerations when using a tax discount percent worksheet for different types of taxes or jurisdictions. Factors such as varying tax rates, regulations, deductions, and exemptions may impact the calculation of discounts on taxes. It's essential to understand the specific rules and guidelines applicable to the type of tax and jurisdiction you are working with to ensure accurate calculations and compliance with laws. Consulting with a tax professional or using specialized software can help navigate these complexities effectively.

Can tax discount percent worksheets be used for both personal and business expenses?

Tax discount percent worksheets are typically used for personal expenses to calculate the reduction in tax owed based on certain deductions or credits. For business expenses, tax professionals usually use more complex methods and software specific to business tax calculations. While some principles may overlap, it is recommended to use appropriate tools and resources tailored to personal or business tax circumstances to ensure accurate and compliant calculations.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments