Self -Employment Worksheet

Are you a self-employed individual looking for a practical tool to help you effectively manage and organize your business finances? Look no further! In this blog post, we will introduce you to the benefits of using a self-employment worksheet as an essential resource for tracking your income, expenses, and other financial aspects of your business.

Table of Images 👆

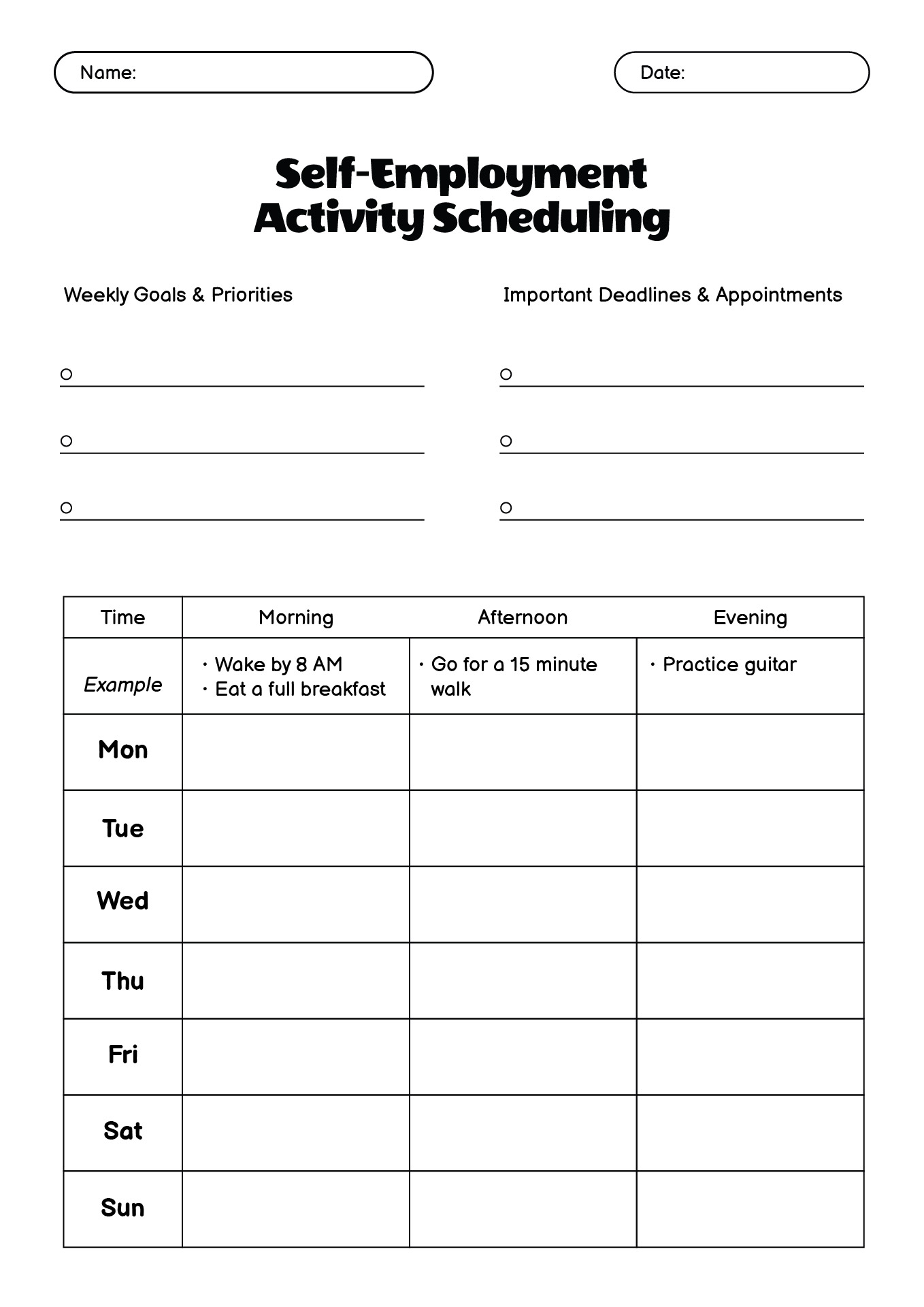

- Activity Scheduling Worksheet

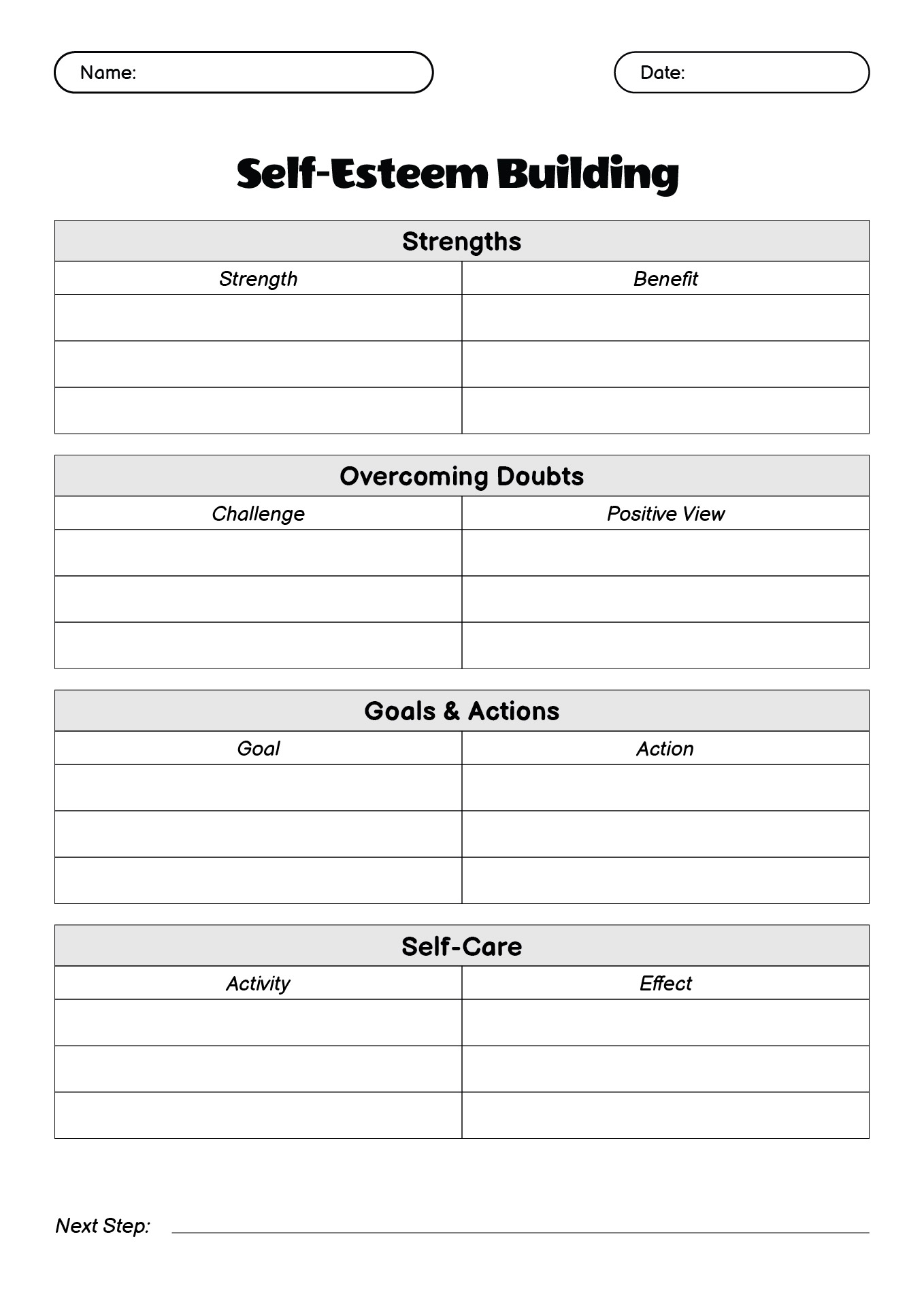

- Self-Esteem Building Worksheets

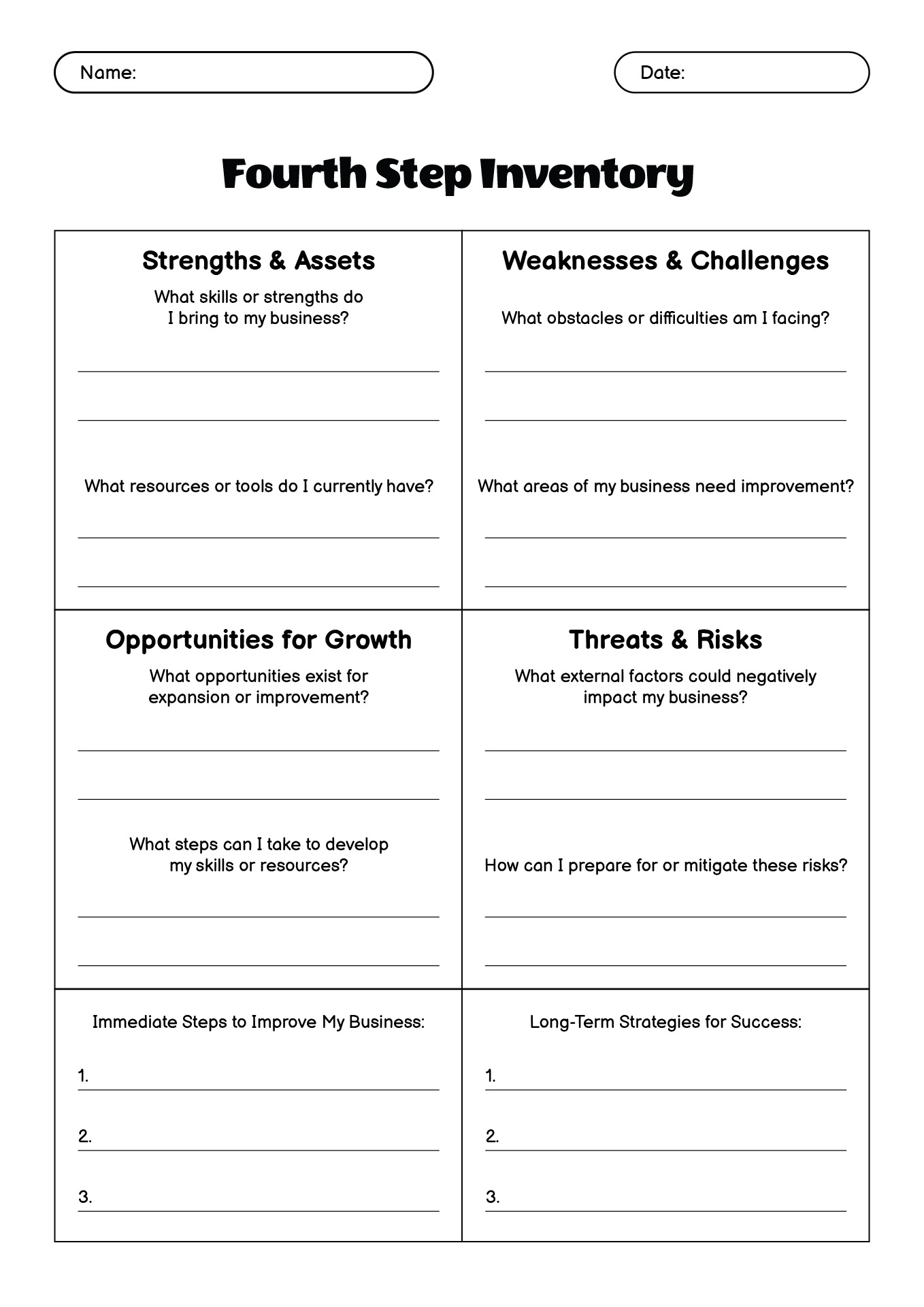

- Fourth Step Inventory Worksheet

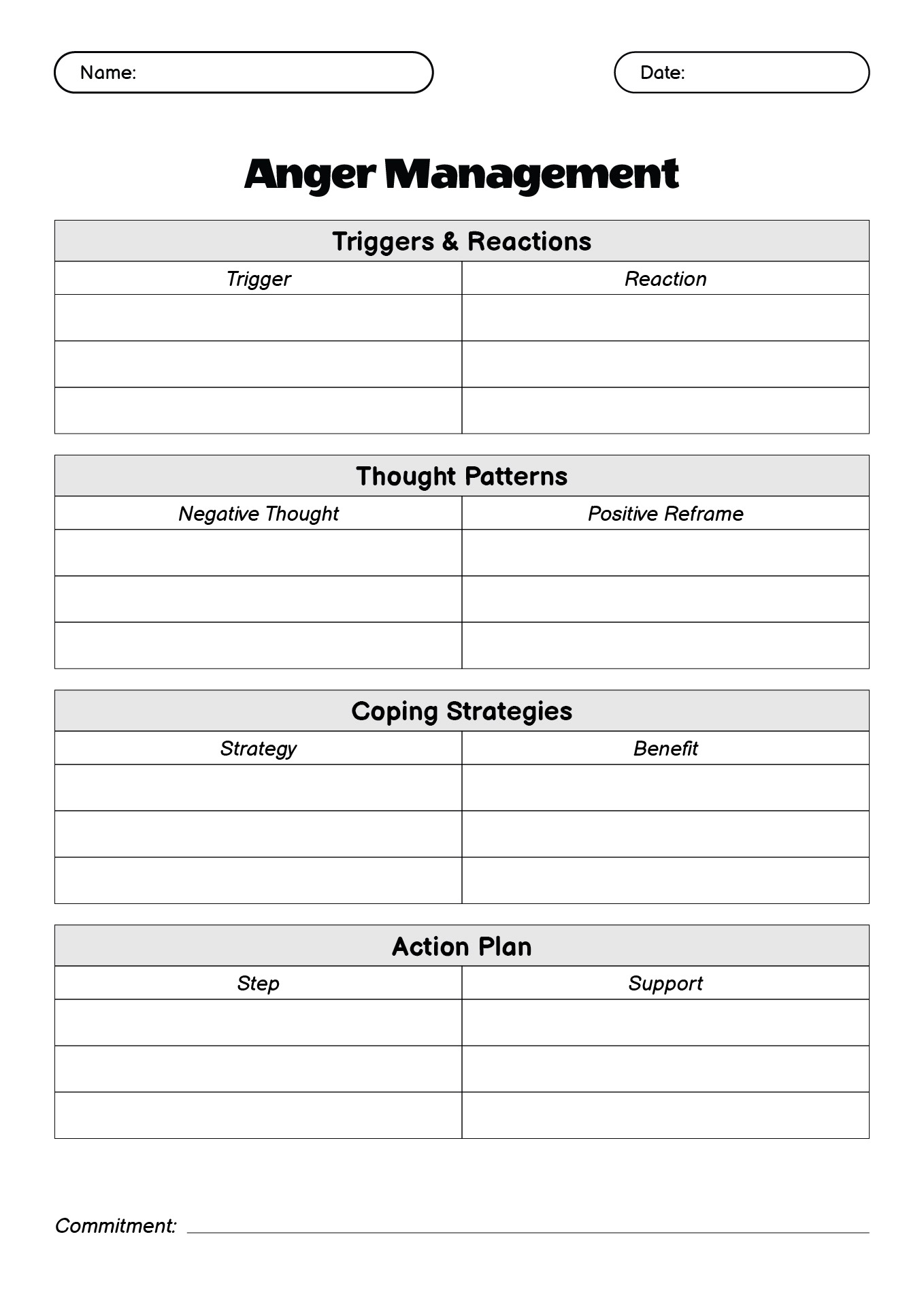

- Anger Management Skills Worksheets for Adults

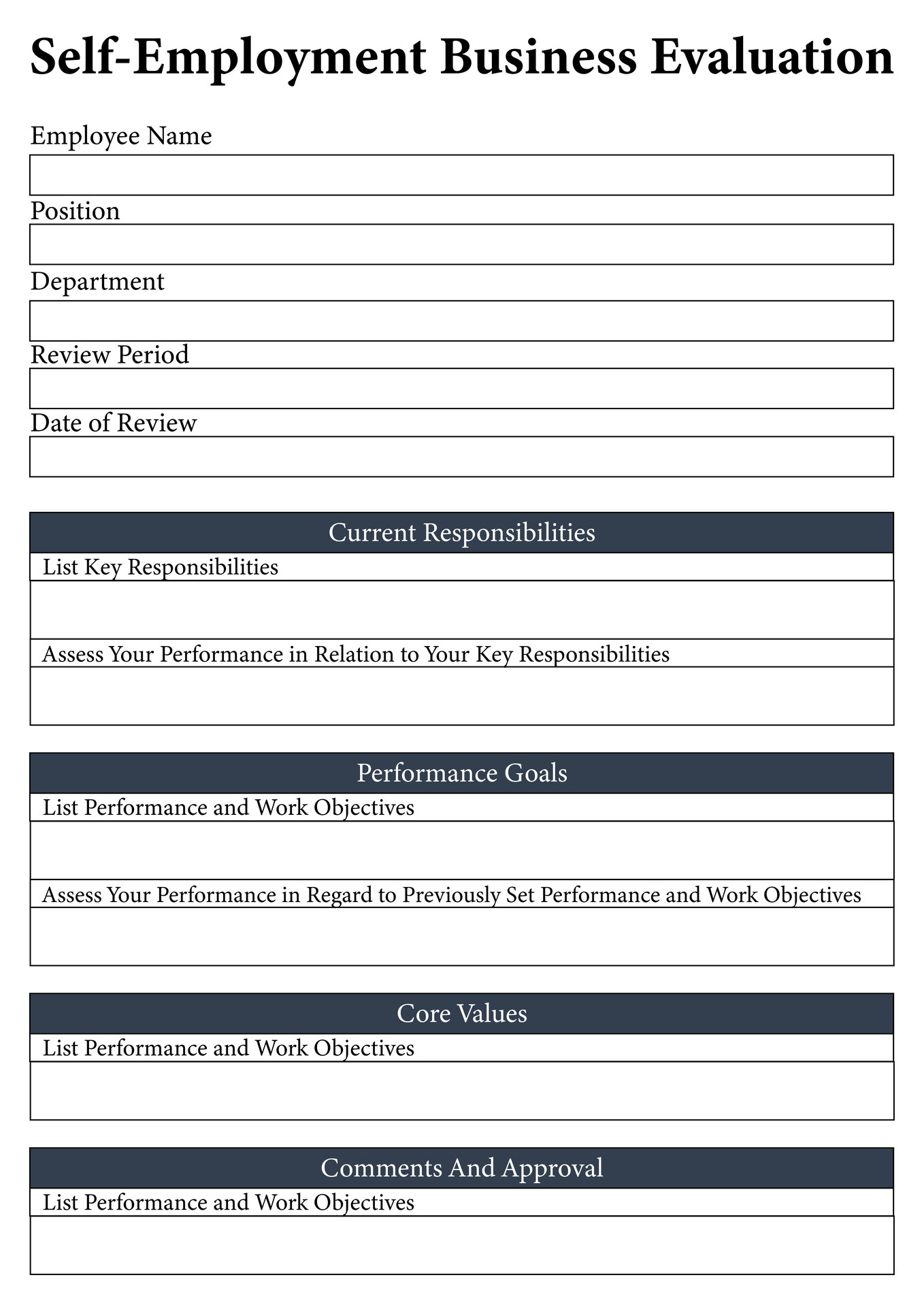

- Self-Employment Business Evaluation Worksheet

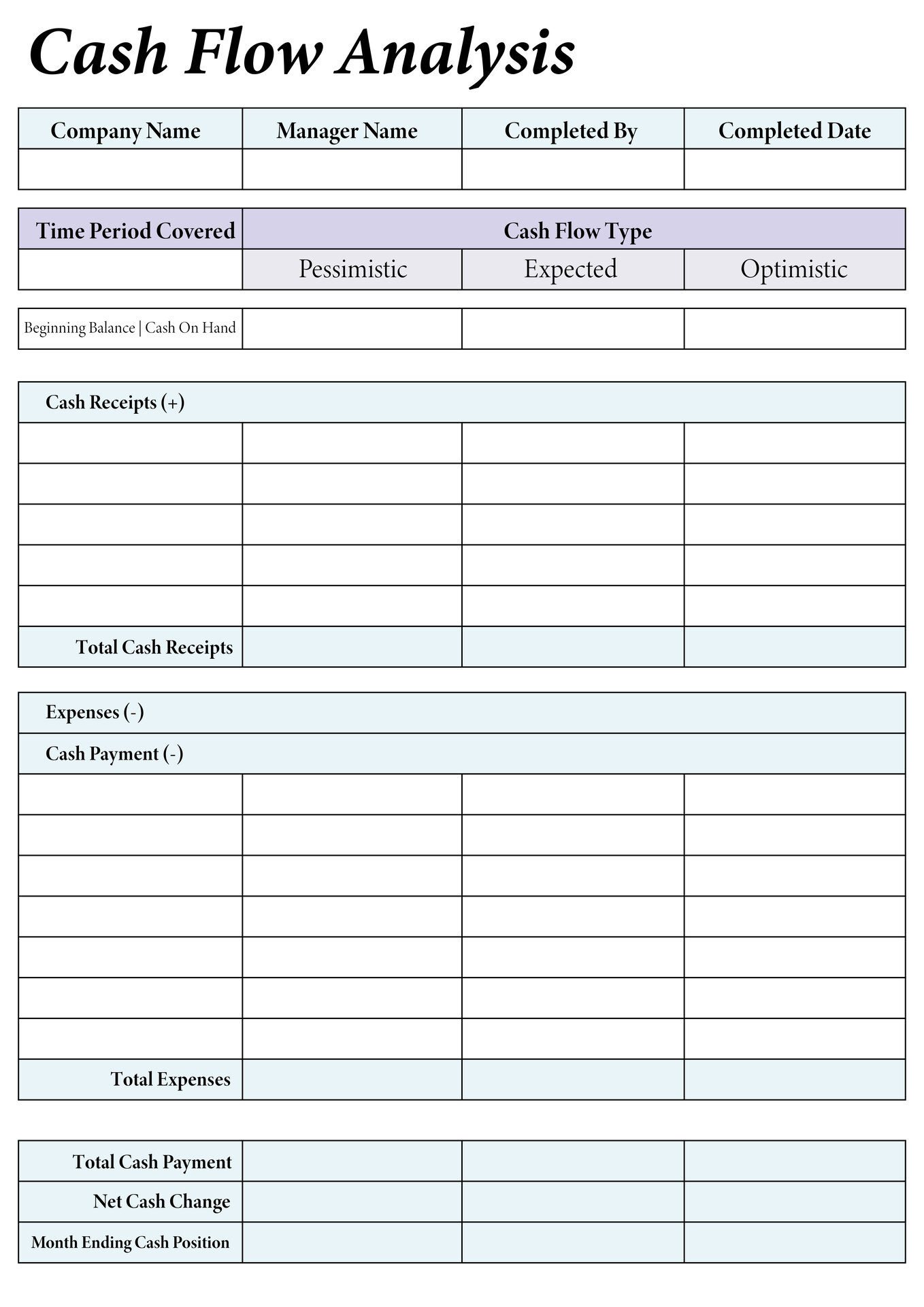

- Self-Employment Cash Flow Analysis Worksheet

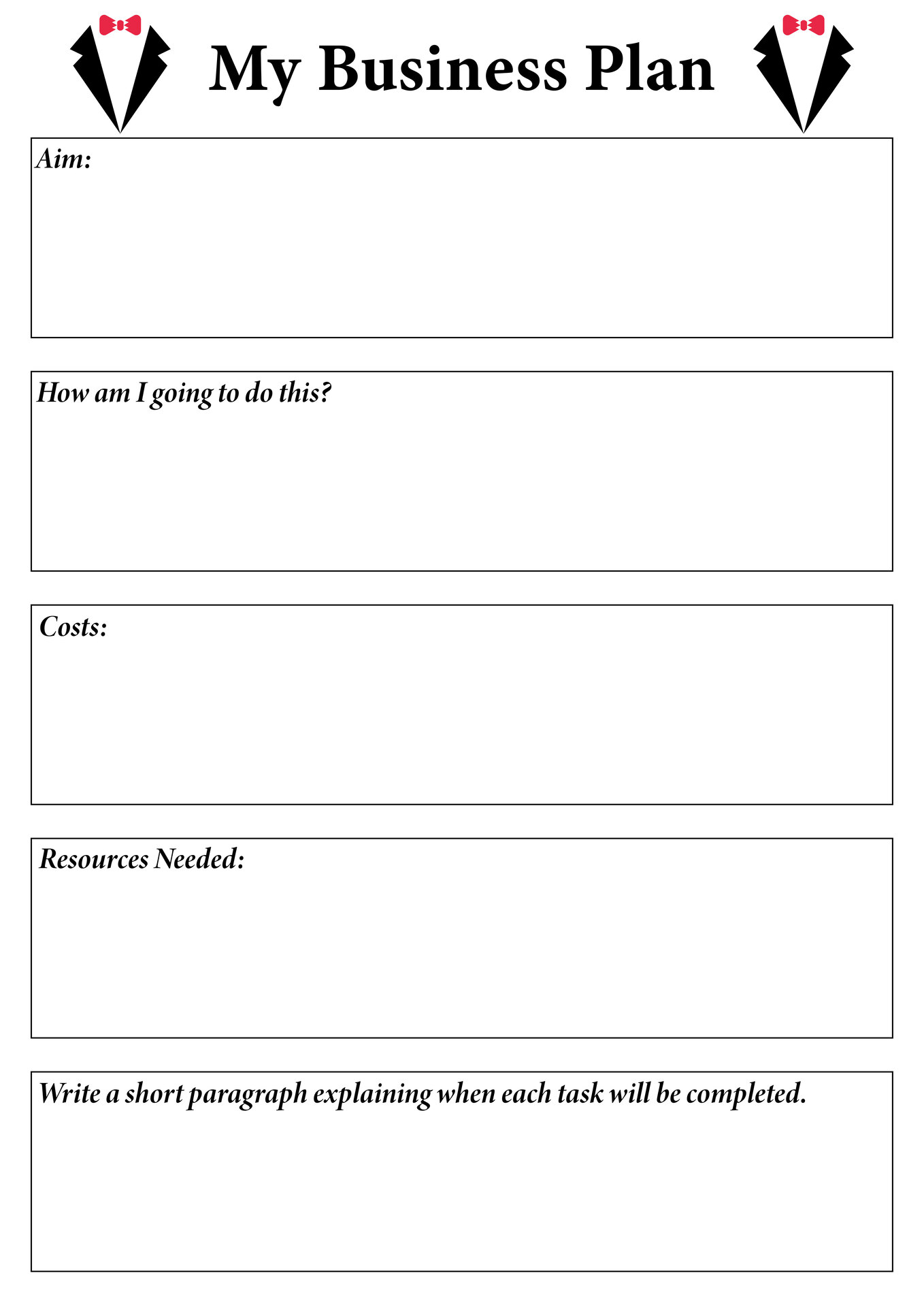

- Self-Employment Business Planning Worksheet

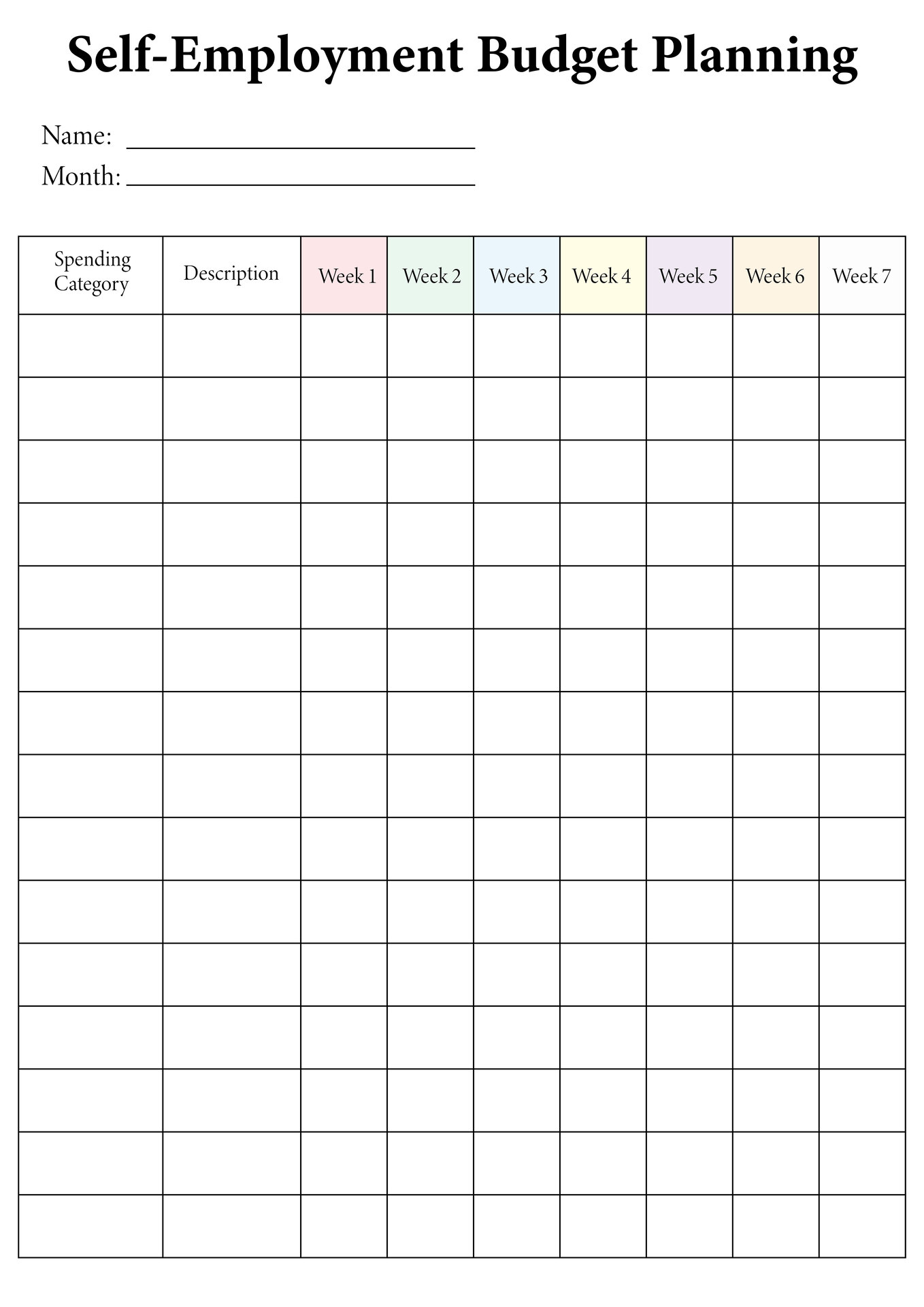

- Self-Employment Budget Planning Worksheet

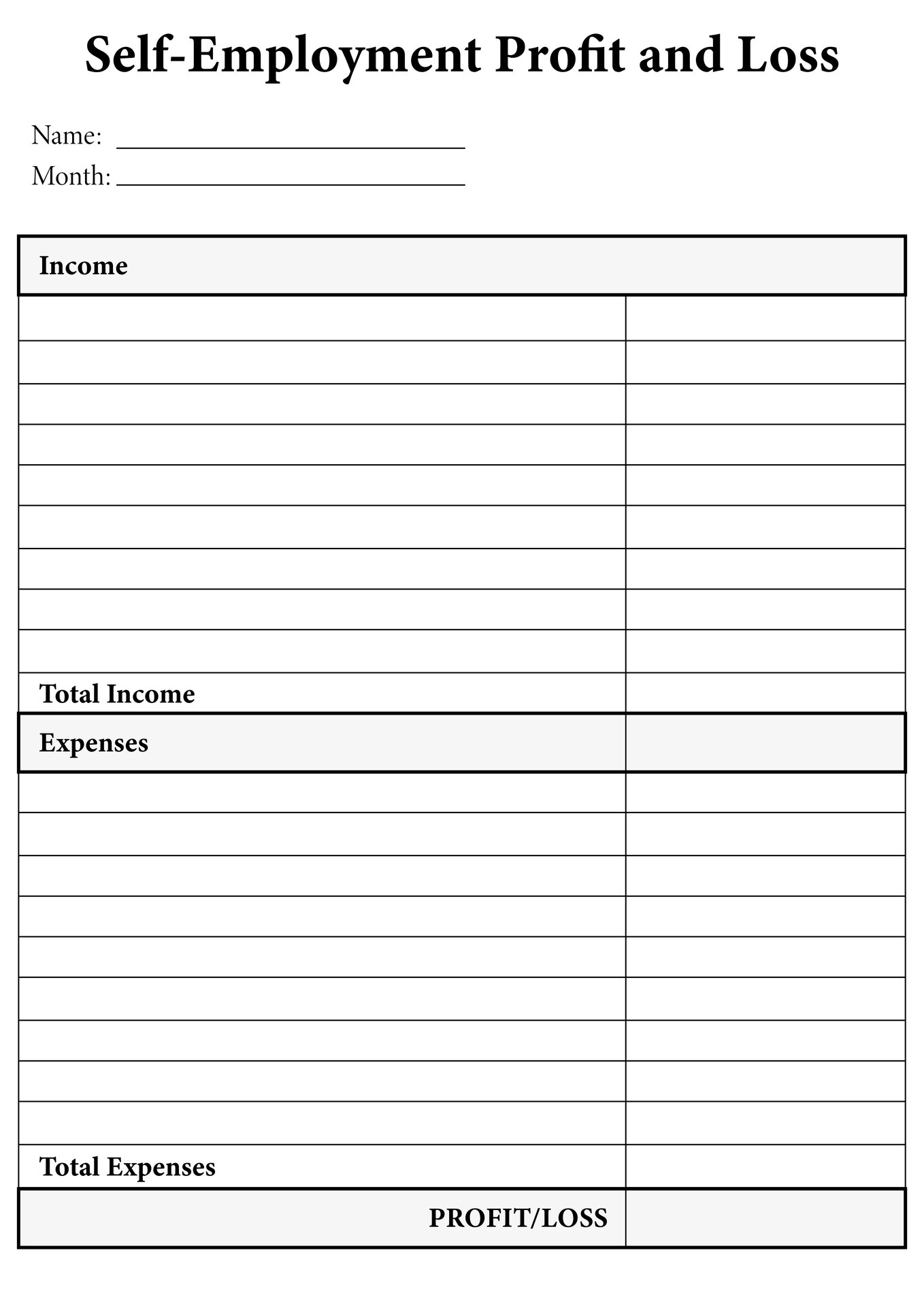

- Self-Employment Profit and Loss Worksheet

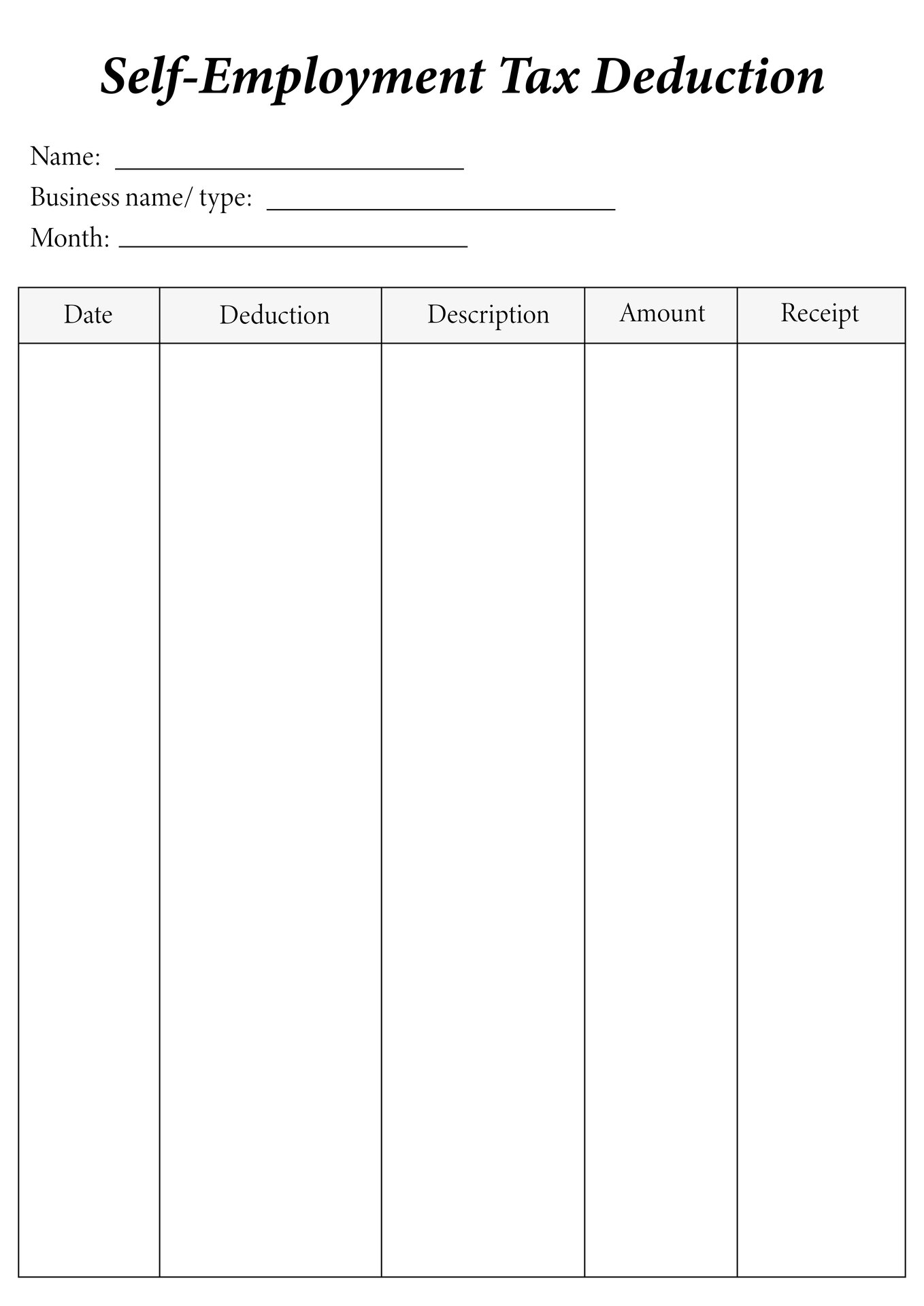

- Self-Employment Tax Deduction Worksheet

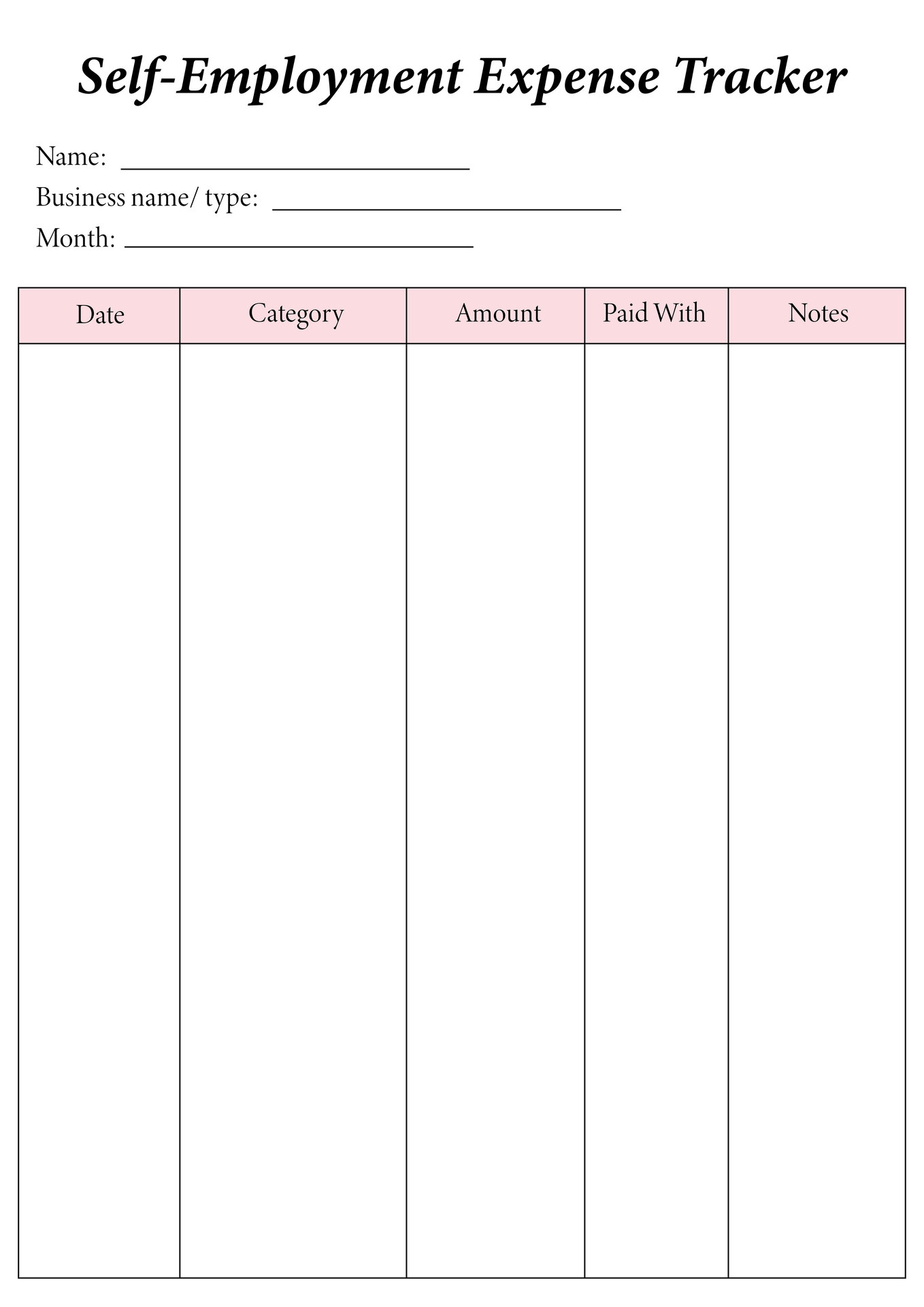

- Self-Employment Expense Worksheet

- Self-Employment Income Tracking Worksheet

- Self-Employment Income Tracking Worksheet

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Spring Clothes Worksheet

Healthy Eating Plate Printable Worksheet

Cooking Vocabulary Worksheet

My Shadow Worksheet

Large Printable Blank Pyramid Worksheet

Relationship Circles Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

What is the purpose of a Self-Employment Worksheet?

The purpose of a Self-Employment Worksheet is to help individuals who are self-employed track and organize their business income and expenses for reporting to the Internal Revenue Service (IRS). It serves as a tool for calculating net profit or loss, determining tax obligations, and maintaining accurate financial records for tax preparation and business planning purposes.

How do you calculate your self-employment income?

To calculate your self-employment income, you would subtract your business expenses from your total revenue generated through self-employment activities. This will give you your net income. You can then use this net income to determine your taxable self-employment income. It's important to keep accurate records of all income and expenses related to your self-employment to ensure accurate calculations and reporting to the appropriate tax authorities.

What expenses can be deducted as business expenses?

Common business expenses that can be deducted from your taxable income include office rent, utilities, office supplies, equipment, employee salaries, marketing and advertising costs, insurance, professional fees (such as legal or accounting services), travel expenses related to business trips, and vehicle expenses if you use your vehicle for business purposes. It’s important to keep thorough records and receipts to support these deductions. Always consult with a tax professional or accountant for guidance on specific deductions applicable to your business.

How do you calculate your net self-employment income?

To calculate your net self-employment income, begin by adding together all your self-employment earnings for the year. Next, deduct any allowable business expenses such as supplies, equipment, marketing costs, and utilities. Subtract these expenses from your total earnings to determine your net self-employment income. It's essential to keep detailed records of both income and expenses throughout the year to accurately calculate your net self-employment income come tax time.

What are the tax implications of being self-employed?

Being self-employed means that you are responsible for paying self-employment taxes, which include both the employer and employee portions of Social Security and Medicare taxes. You also have to pay estimated taxes quarterly to the IRS since taxes are not withheld from your income throughout the year. Additionally, you may be able to deduct business expenses to reduce your taxable income. It is important to keep accurate records and seek the guidance of a tax professional to ensure compliance with tax laws and to maximize your tax advantages as a self-employed individual.

How do you distinguish between a business and a hobby?

The distinction between a business and a hobby lies in the intention and approach towards generating income. A business is established with the primary purpose of making a profit, whereas a hobby is pursued for enjoyment and personal satisfaction. Business activities are typically systematic, planned, and aimed at achieving financial goals, while hobbies are usually done in one's spare time without the expectation of significant financial gain. Additionally, businesses are often registered, have a specific target market, and require more time and effort dedicated to them compared to hobbies.

What records should you keep as a self-employed individual?

As a self-employed individual, you should keep records of your income and expenses, including receipts, invoices, bank statements, and other financial documents. You should also keep track of any business-related mileage, travel expenses, and home office expenses if applicable. Additionally, it is important to maintain records of any contracts, agreements, and client communications. Keeping thorough and organized records will not only help you track your business performance but also assist you in filing taxes accurately and efficiently.

How do you estimate your self-employment taxes?

To estimate your self-employment taxes, you can use the following steps: Calculate your net self-employment income by subtracting your business expenses from your business revenue. Then, multiply this amount by 15.3%, which is the total self-employment tax rate for Social Security and Medicare. Remember that you may also need to pay income tax on your self-employment income, so it's advisable to set aside a portion of your earnings for that as well. Keep track of your income and expenses throughout the year to accurately estimate and plan for your self-employment taxes.

What are the advantages and disadvantages of self-employment?

Self-employment offers advantages such as flexibility, autonomy, potential for higher income, and the ability to pursue passion projects. However, it also comes with disadvantages such as inconsistent income, lack of benefits like healthcare or retirement plans, the need to handle all aspects of the business oneself, and potential for higher stress levels due to uncertainty and responsibility.

How can you pay yourself as a self-employed person?

As a self-employed person, you can pay yourself by either setting up a regular salary for yourself and submitting payroll taxes or by taking profits from your business as a draw or distribution. It is important to keep track of your income and expenses for tax purposes and ensure that you are setting aside enough money for taxes and other business obligations. Consulting with a tax professional or financial advisor can help you determine the best way to pay yourself as a self-employed individual.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments