Saving Account Worksheets

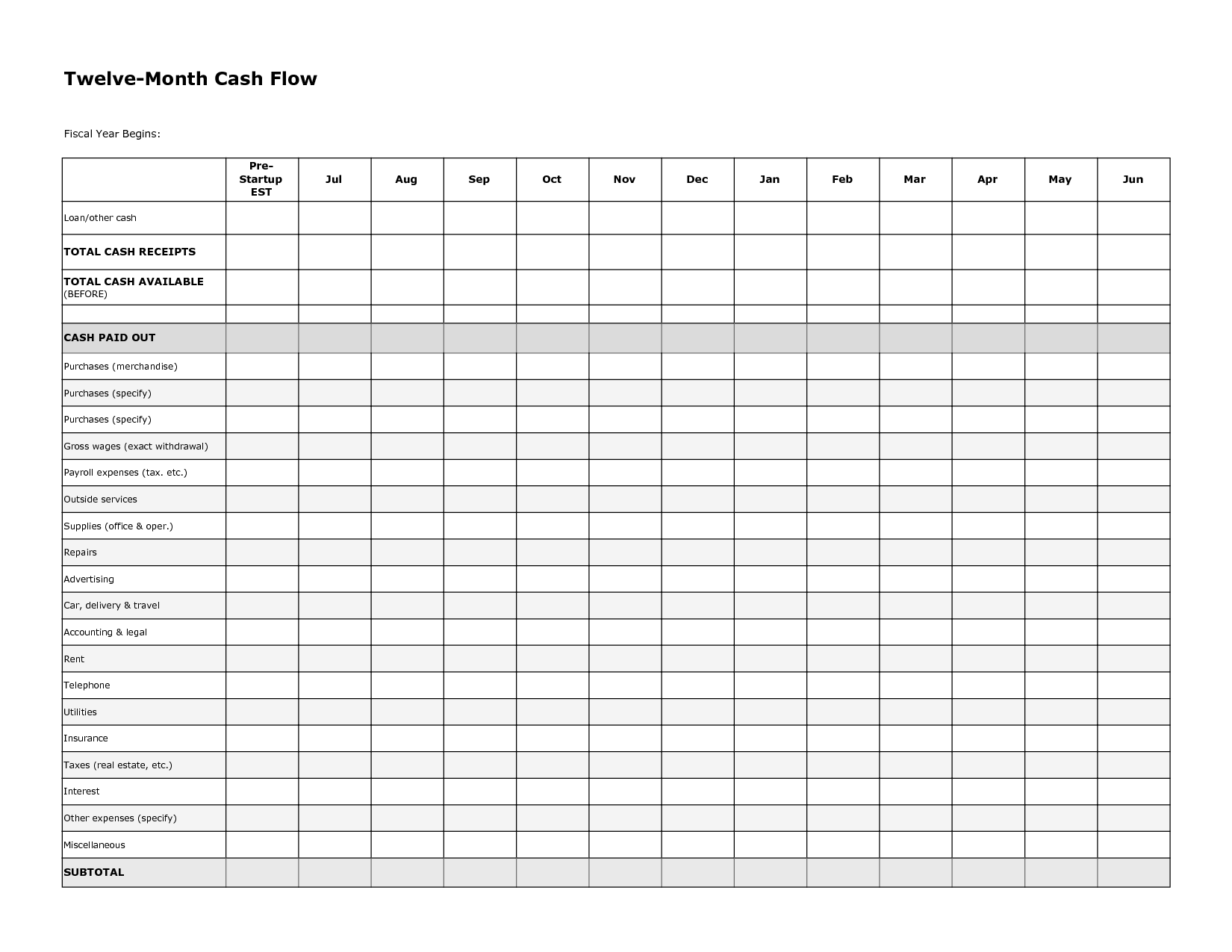

Worksheets are a valuable tool for individuals who are interested in organizing, monitoring, and maximizing their savings accounts. These documents provide a structured format to track savings goals, analyze spending habits, and evaluate progress towards financial objectives. With easy-to-use templates and clear instructions, worksheets empower users to take control of their financial health and make informed decisions about their savings strategies.

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a saving account worksheet?

A savings account worksheet is a tool used to track and manage savings goals, deposits, withdrawals, and interest earned in a savings account. It helps individuals to monitor their progress toward financial objectives and budget effectively for future expenses or investments.

What information is typically included in a saving account worksheet?

A saving account worksheet typically includes details such as the account holder's name, account number, initial deposit amount, date of account opening, interest rate, current balance, deposits made, withdrawals made, accrued interest, and ending balance. It serves as a record of all transactions and balances related to the savings account.

How can a saving account worksheet help in managing personal finances?

A saving account worksheet can help in managing personal finances by providing a clear overview of income, expenses, and savings goals. By tracking regular deposits, withdrawals, interest earned, and setting financial objectives, individuals can stay organized, monitor progress towards savings targets, and make informed decisions about their money. This tool can also highlight areas where adjustments may be needed to improve saving habits and financial stability over time.

What are the benefits of using a saving account worksheet?

A savings account worksheet can help individuals track their savings goals, monitor progress, and budget effectively. It can also provide insight into spending habits, identify areas where expenses can be reduced, and encourage regular savings contributions. Additionally, using a savings account worksheet can help individuals stay organized, reduce financial stress, and ultimately achieve financial stability and security in the long run.

How often should one update their saving account worksheet?

It is generally recommended to update your savings account worksheet at least once a month. This will help you stay on track with your savings goals, monitor your progress, and make any necessary adjustments to your budget or saving habits. Regularly updating your worksheet can also help you identify any discrepancies or errors in your finances and ensure that you are staying within your budget and saving targets.

Can a saving account worksheet be used for multiple saving accounts?

No, a savings account worksheet typically is designed to track details and progress of a single savings account. If you have multiple savings accounts, it would be recommended to have a separate worksheet for each account to keep track of individual goals, balances, and transactions accurately. Mixing multiple accounts on one worksheet could lead to confusion and make it difficult to monitor the progress of each account effectively.

Are there any specific formulas or calculations involved in a saving account worksheet?

Yes, there are common formulas and calculations involved in a savings account worksheet. These may include calculating compound interest using the formula A = P(1 + r/n)^(nt), where A is the amount accumulated, P is the principal amount, r is the annual interest rate, n is the number of times that interest is compounded per year, and t is the number of years. Other calculations may involve tracking deposits, withdrawals, interest accrued, and the overall balance over time. It's important to understand these formulas to effectively track and manage your savings account.

Can a saving account worksheet help track savings goals?

Yes, a savings account worksheet can help track savings goals by allowing you to set specific targets, track your progress, and adjust your saving habits accordingly. By entering your starting balance, setting a goal amount, and regularly inputting your savings amount, you can visually see how close you are to reaching your target and make any necessary adjustments to meet your goals.

Is it possible to customize a saving account worksheet to fit individual needs?

Yes, it is possible to customize a savings account worksheet to fit individual needs by including specific categories for income, expenses, and savings goals, as well as adjusting formulas and calculations to reflect personal financial situations and goals. This customization can help individuals track their progress, make adjustments as needed, and stay motivated to achieve their saving objectives.

Are there any online tools or apps available for creating and maintaining a saving account worksheet?

Yes, there are several online tools and apps available for creating and maintaining a savings account worksheet. Some popular options include Mint, YNAB (You Need A Budget), Personal Capital, and PocketGuard. These tools can help you track your saving goals, budget your expenses, and monitor your progress towards achieving financial milestones. Additionally, many banks also offer online tools and apps that can help you manage your savings account and track your transactions.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments