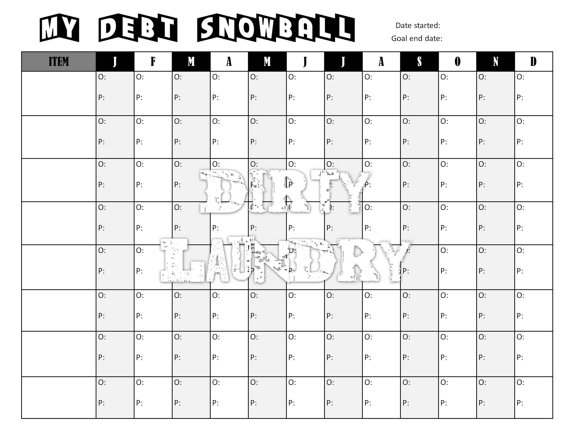

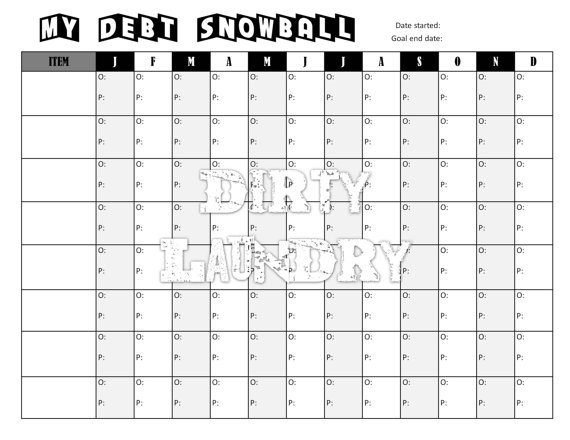

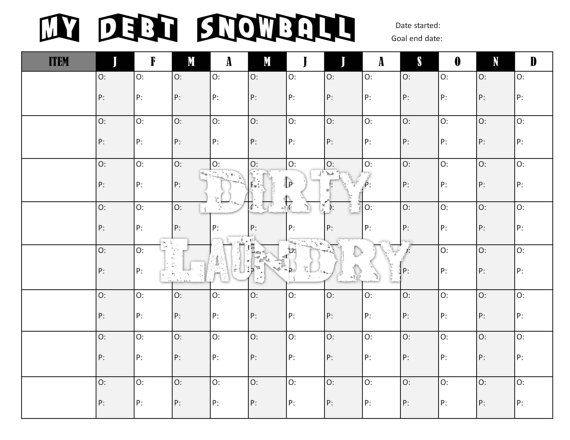

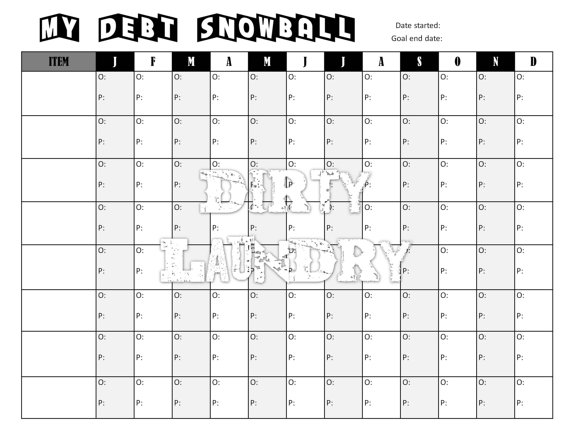

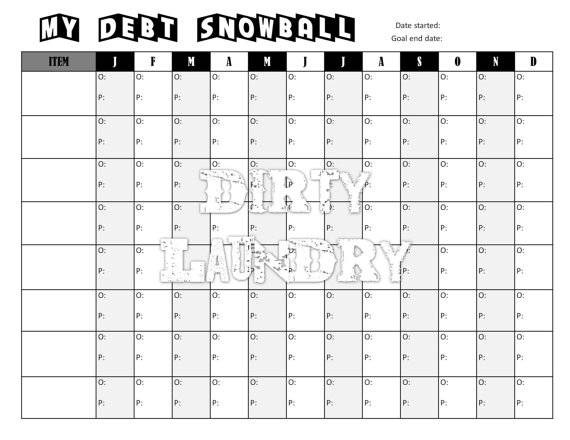

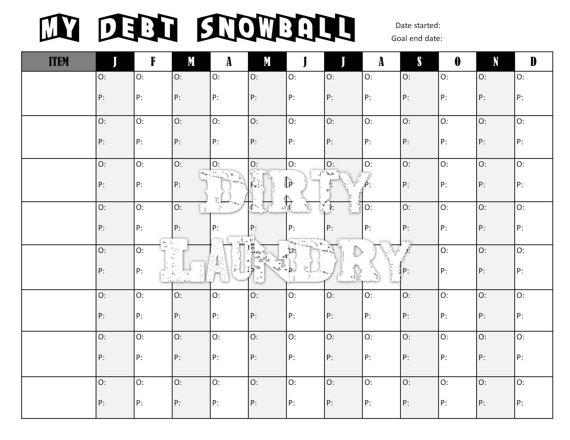

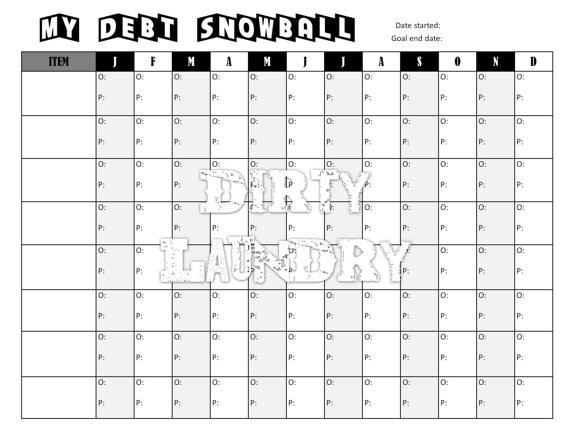

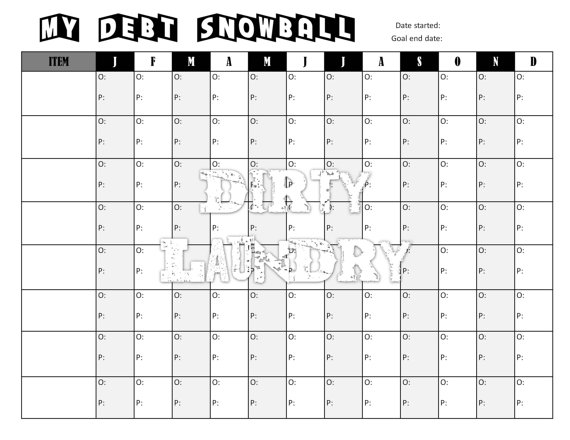

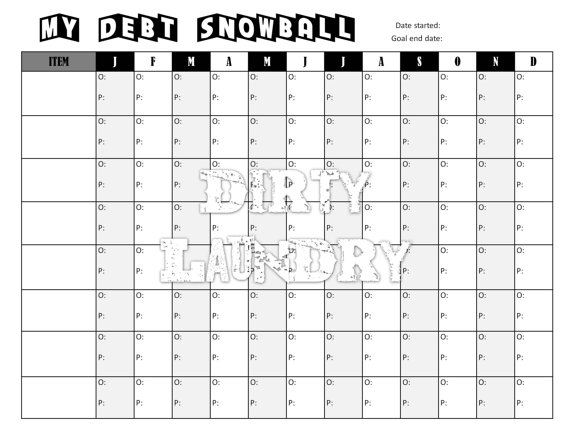

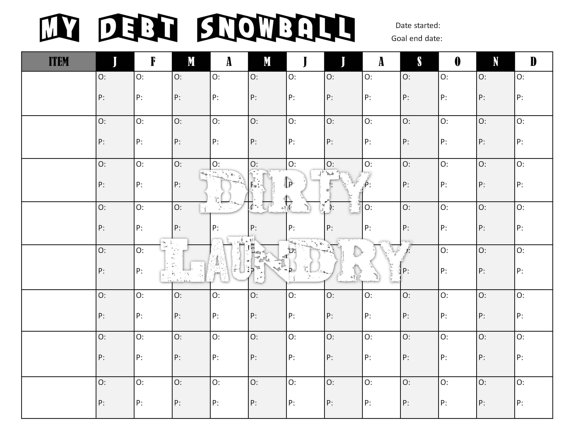

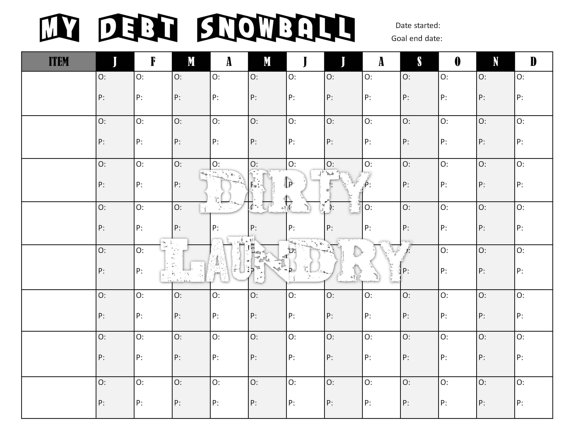

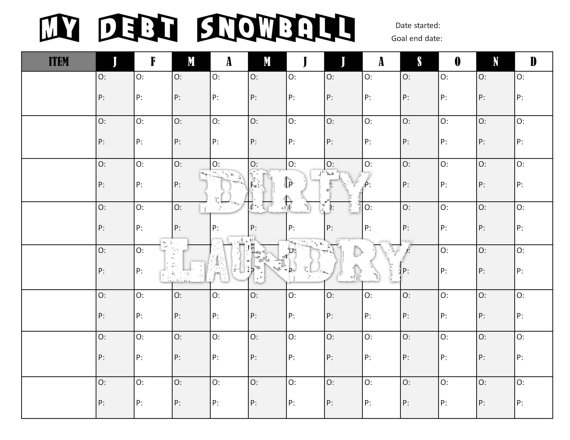

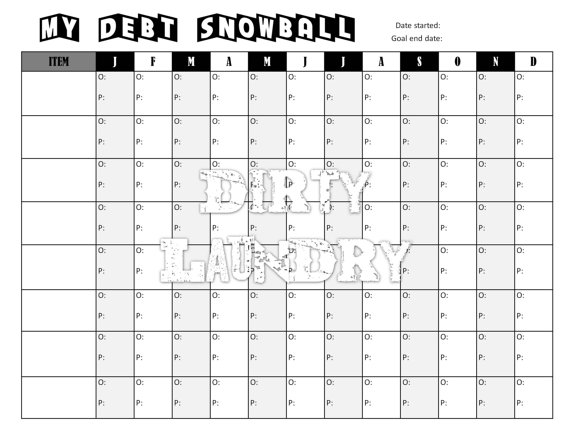

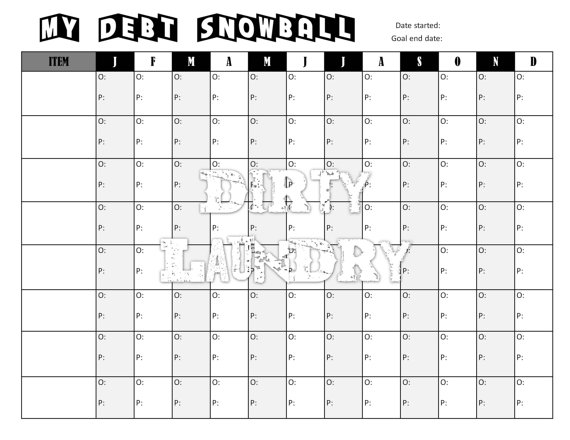

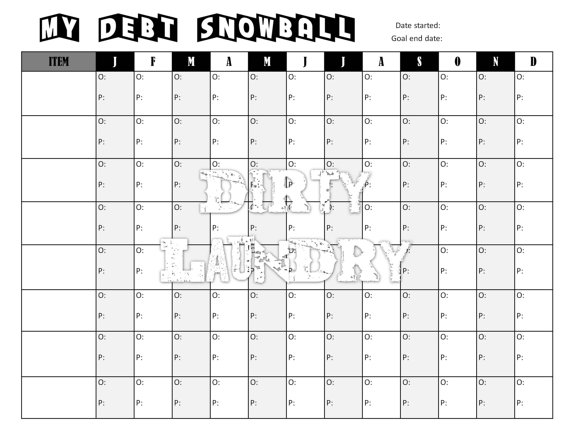

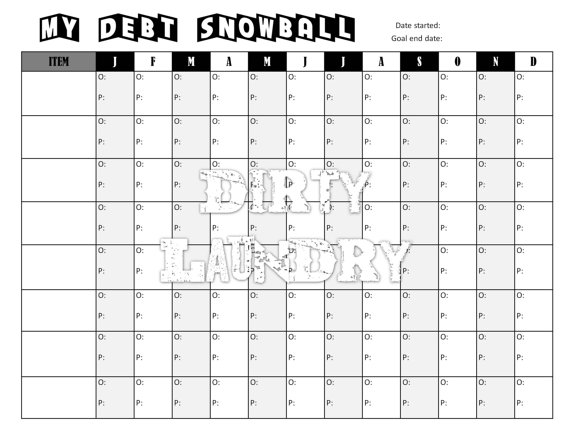

Paying Off Debt Worksheets

If you're looking for a helpful tool to stay organized and focused on paying off your debt, worksheets can be a great resource. Designed to keep track of your financial progress and expenses, these worksheets provide an entity for individuals who want to take control of their debt and work towards financial freedom.

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a paying off debt worksheet?

A paying off debt worksheet is a document used to track and manage debt repayment. It typically includes details such as the amount owed, interest rate, minimum payment, and monthly payment. By using a paying off debt worksheet, individuals can organize their debts, create a repayment plan, monitor progress, and stay motivated towards becoming debt-free.

Why is it important to use a paying off debt worksheet?

Using a paying off debt worksheet is important because it helps you track and prioritize your debts, create a repayment plan, and stay organized in managing your financial obligations. By clearly laying out all your debts, including balances, interest rates, and monthly payments, the worksheet can help you see the bigger picture and make informed decisions on how to allocate your resources effectively to pay off debt faster. Additionally, it can also serve as a motivational tool by showing progress as you pay down each debt, keeping you focused on your financial goals.

How can a paying off debt worksheet help me track my progress?

A paying off debt worksheet can help you track your progress by organizing all your debts in one place, including the amount owed, interest rates, and minimum payments. By regularly updating the worksheet with your payments and seeing the decreasing balances, you can visually track your debt reduction progress over time. This can help you stay motivated, track which debts to focus on next, and make adjustments to your repayment strategy as needed to reach your financial goals sooner.

What types of debts can I include in a paying off debt worksheet?

You can include various types of debts in a paying off debt worksheet, such as credit card debt, personal loans, student loans, medical bills, car loans, mortgage loans, and any other outstanding debts that you may have. By listing all your debts in the worksheet along with details like interest rates, minimum payments, and total balances, you can create a clear plan for paying off debts strategically and efficiently.

What information should be included in a paying off debt worksheet?

A paying off debt worksheet should include the following key information: list of all debts owed including the creditor's name, outstanding balance, interest rate, minimum monthly payment, and due date; total debt amount owed; monthly income and expenses to determine available funds for debt repayment; a plan to allocate extra money towards debt payment; a timeline for when each debt will be paid off; and a tracking mechanism to monitor progress and make adjustments as needed.

How can I prioritize my debts using a paying off debt worksheet?

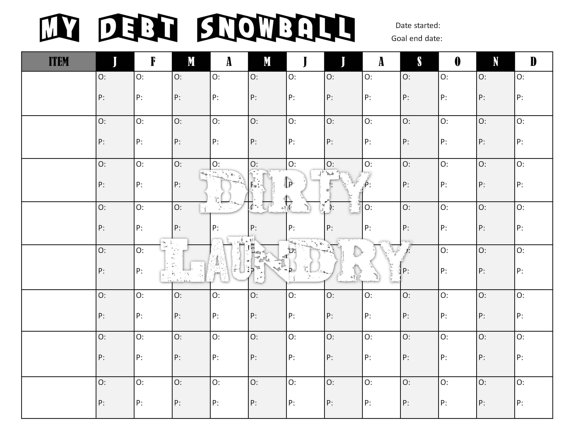

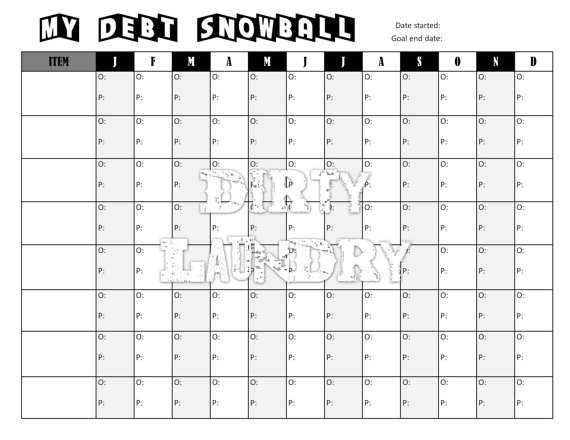

To prioritize your debts using a paying off debt worksheet, list all your debts including the total amount owed, outstanding balance, interest rates, and minimum monthly payments. Then, consider using either the debt avalanche method (paying off debts with the highest interest rates first) or the debt snowball method (paying off debts with the smallest balances first). Allocate any extra funds you have towards the highest priority debt while making minimum payments on the rest. Regularly updating your worksheet as you make payments will help you stay on track and motivated to reach your debt payoff goals.

Can a paying off debt worksheet help me create a budget?

Yes, a paying off debt worksheet can help you create a budget by providing a structured way to track your debts, income, and expenses. By identifying how much you owe and how much you earn, you can prioritize paying off debts and allocate funds for other expenses. This visual representation can help you make informed decisions to effectively manage your finances and work towards achieving your financial goals.

Are there different types of paying off debt worksheets available?

Yes, there are various types of paying off debt worksheets available, such as debt snowball worksheets, debt avalanche worksheets, and debt payoff calendars. These tools help individuals track their debts, organize their payments, and create a plan to eliminate debt efficiently. It's important to choose a worksheet that aligns with your financial goals and preferences to effectively manage and pay off your debts.

What strategies can I use with a paying off debt worksheet to pay off debt faster?

To pay off debt faster using a debt payoff worksheet, you can start by adding up all your debts and their interest rates, then prioritize them by either the snowball method (paying off the smallest debt first) or the avalanche method (paying off the debt with the highest interest rate first). Next, allocate a specific amount of money from your budget to pay towards your debts each month and stick to it. Additionally, consider cutting back on expenses or finding ways to increase your income to allocate more money towards debt repayment. Regularly update and track your progress on the debt payoff worksheet to stay motivated and focused on reaching your goal of becoming debt-free faster.

How often should I update my paying off debt worksheet?

It is recommended to update your paying off debt worksheet at least once a month to track your progress accurately and stay motivated towards your financial goals. By reviewing and updating your worksheet regularly, you can identify any changes in your debt balance, income, or expenses, and adjust your repayment strategy accordingly to stay on track and make necessary improvements.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments