Pay Down Debt Worksheet

If you're looking for a practical and effective way to manage your debt, look no further than a pay down debt worksheet. This simple tool is designed to help individuals or households track their financial obligations and create a plan to repay their debts in a systematic manner. With a clear focus on entity and subject, a pay down debt worksheet is a suitable resource for anyone seeking to take control of their finances and work towards a debt-free future.

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a Pay Down Debt Worksheet?

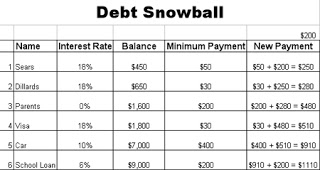

A Pay Down Debt Worksheet is a tool used to organize and track different debts owed by an individual, such as credit cards, loans, or other financial obligations. Typically, it includes details such as the outstanding balance, interest rate, minimum monthly payment, and a plan for paying off debts efficiently. By using a Pay Down Debt Worksheet, individuals can better manage their debt, track their progress, and make informed decisions on how to reduce and eliminate their debt over time.

Why should someone use a Pay Down Debt Worksheet?

A Pay Down Debt Worksheet can be a useful tool for individuals looking to effectively manage and prioritize their debt repayment process. By detailing all debts, interest rates, and minimum payments in one central document, individuals can gain an overview of their financial obligations and develop a clear strategy to pay off their debts efficiently. This worksheet can also help track progress, set goals, and motivate individuals to stay on track with their debt repayment plan.

How can a Pay Down Debt Worksheet help individuals track their debt repayment progress?

A Pay Down Debt Worksheet can help individuals track their debt repayment progress by listing out all their debts, including balances, interest rates, minimum payments, and total amount owed. By inputting monthly payments made towards each debt, individuals can see the reduction in balances over time, track the total amount paid off, and visualize their progress towards becoming debt-free. This visual representation can motivate individuals to stay on track with their debt repayment plan and make more informed decisions about their finances.

What categories or sections typically exist on a Pay Down Debt Worksheet?

A typical Pay Down Debt Worksheet may include categories such as the name of the creditor, the type of debt (e.g., credit card, student loan), the total amount owed, the minimum monthly payment, the interest rate, the due date, and any additional notes or considerations. These sections help individuals track and prioritize their debts as they work towards paying them off.

Are there any recommended strategies for using a Pay Down Debt Worksheet effectively?

To use a Pay Down Debt Worksheet effectively, start by listing all of your debts, including the current balances and interest rates. Next, prioritize your debts by either highest interest rate or smallest balance, depending on your financial goals. Dedicate a set amount of money each month towards paying off your debts, focusing on one debt at a time while making minimum payments on the others. As you pay off each debt, roll over the money you were putting towards that debt into paying off the next one. Regularly update the worksheet to track your progress and stay motivated.

Can a Pay Down Debt Worksheet be customized to fit individual needs?

Yes, a Pay Down Debt Worksheet can be customized to fit an individual's specific needs by adjusting the categories, amounts, and payment schedules to align with their unique financial situation and goals. This customization allows individuals to track their progress, prioritize debts, and create a tailored plan for paying down debt effectively.

How does a Pay Down Debt Worksheet assist in prioritizing which debts should be paid off first?

A Pay Down Debt Worksheet assists in prioritizing which debts should be paid off first by helping individuals track and organize all their debts in one place. By listing out each debt along with key details such as interest rates, minimum payments, and outstanding balances, individuals can then compare and analyze which debts are costing them the most in terms of interest and fees. This enables them to focus on paying off high-interest debts first to save money in the long run and ultimately accelerate their journey to becoming debt-free.

Is it possible to visualize a timeline or goal progress using a Pay Down Debt Worksheet?

Yes, it is possible to visualize a timeline or goal progress using a Pay Down Debt Worksheet. By tracking your debt payments over time in the worksheet, you can create a visual representation of your progress towards paying down your debt. This can help you stay motivated and focused on achieving your financial goals. Additionally, seeing the timeline or progress chart can provide a clear picture of how far you have come and how much closer you are to becoming debt-free.

Are there any additional features or tools that can be included in a Pay Down Debt Worksheet?

Yes, some additional features or tools that can be included in a Pay Down Debt Worksheet are a debt snowball calculator to help prioritize which debts to pay off first, a debt payoff tracker to monitor progress over time, and budgeting tools to allocate funds towards debt repayment. Additionally, incorporating a monthly payment calendar can help individuals stay organized and on track with their debt payment schedule.

Can a Pay Down Debt Worksheet help individuals stay motivated and focused on their debt repayment journey?

Yes, a Pay Down Debt Worksheet can greatly help individuals stay motivated and focused on their debt repayment journey. By visually tracking their progress and seeing the debts decrease over time, individuals can feel a sense of accomplishment and motivation to continue working towards their financial goals. The worksheet can also serve as a reminder of their commitment to paying off debts, helping them stay focused on making regular payments and avoiding unnecessary expenses.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments