Net Income Worksheet

Net income worksheets are essential financial tools that help individuals or businesses calculate their net income. These worksheets serve as a reliable method to track and evaluate income and expenses, offering a clear understanding of the entity's financial standing. Whether you are a small business owner, an independent contractor, or an individual looking to manage your personal finances effectively, using a net income worksheet can provide you with valuable insights into your financial health.

Table of Images 👆

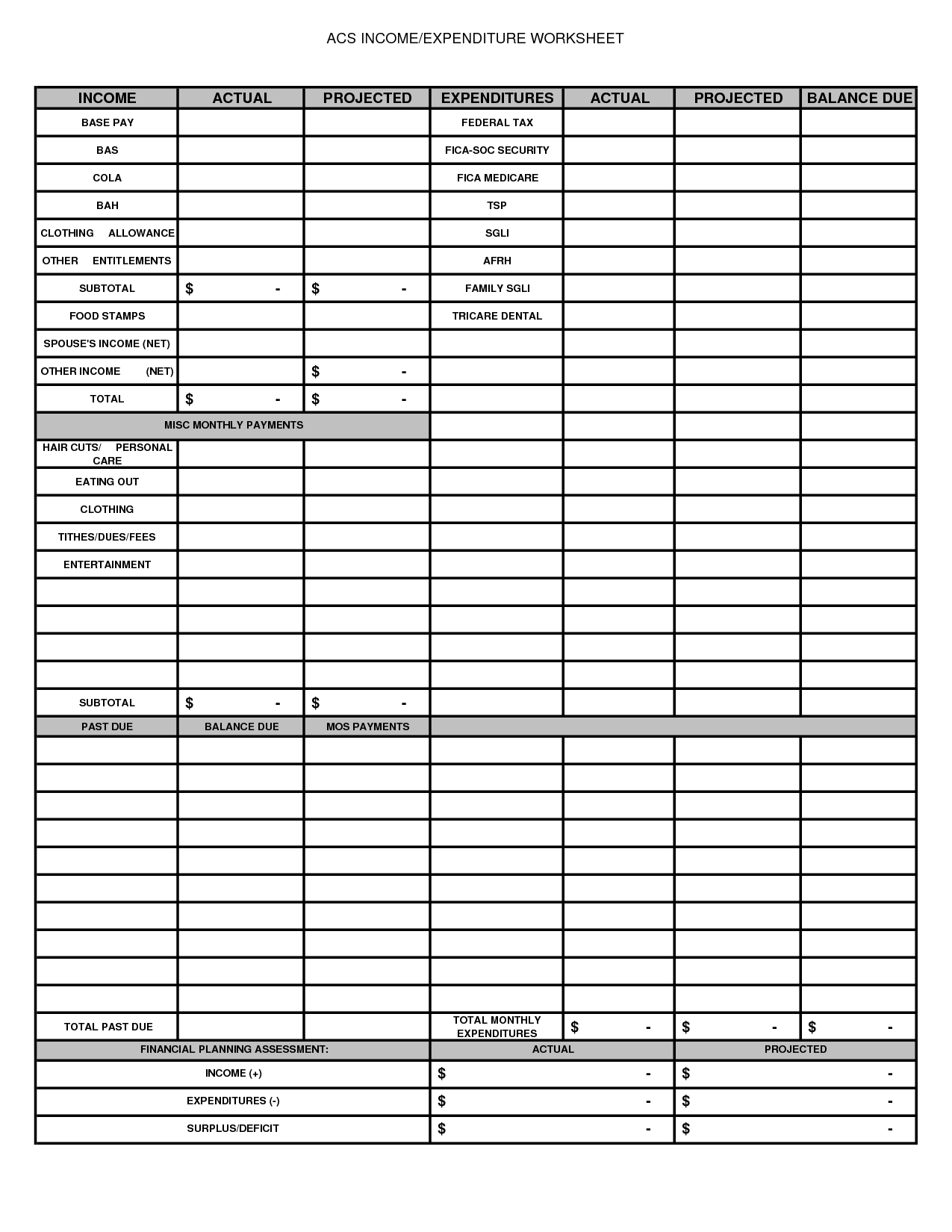

- Income and Expenditure Worksheet

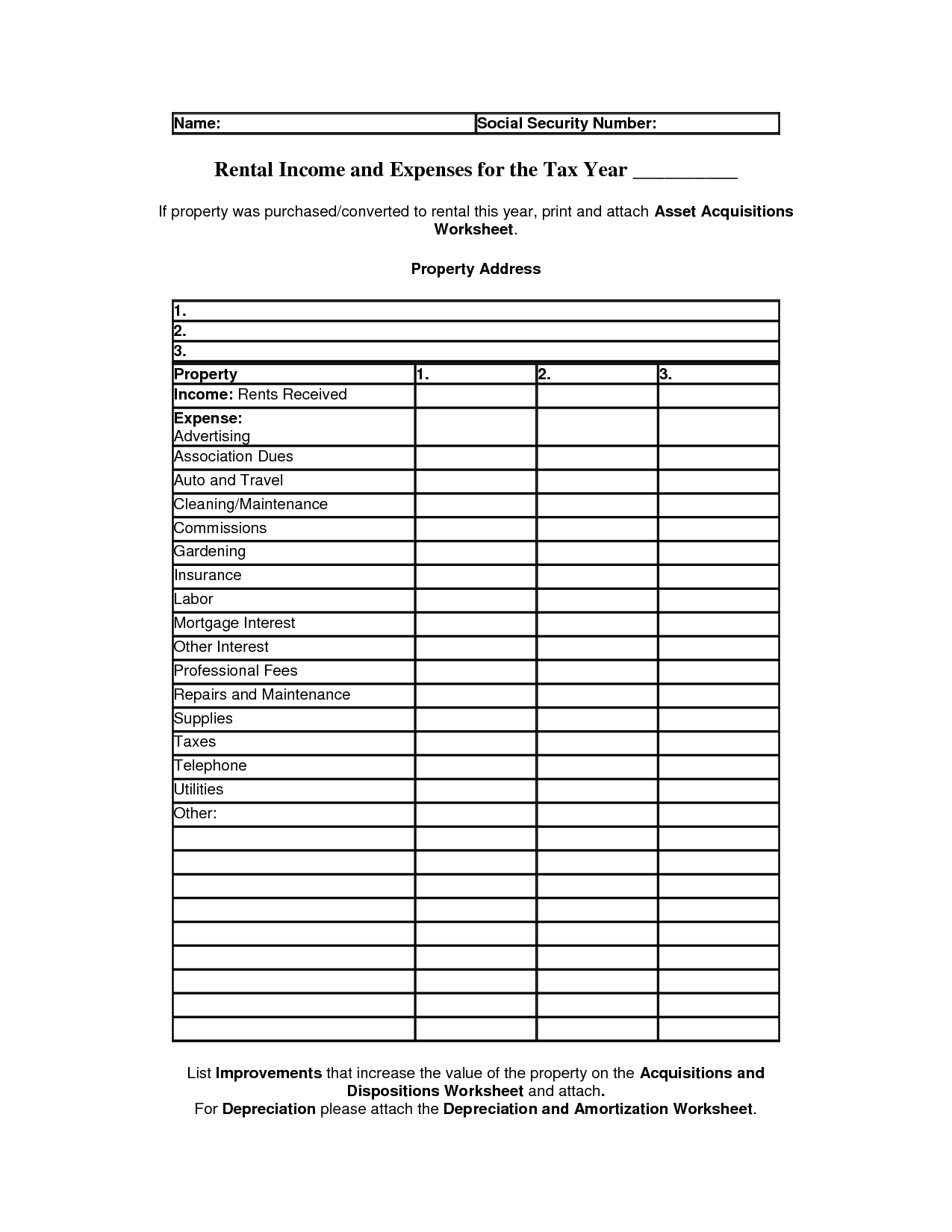

- Rental Property Income and Expense Worksheet

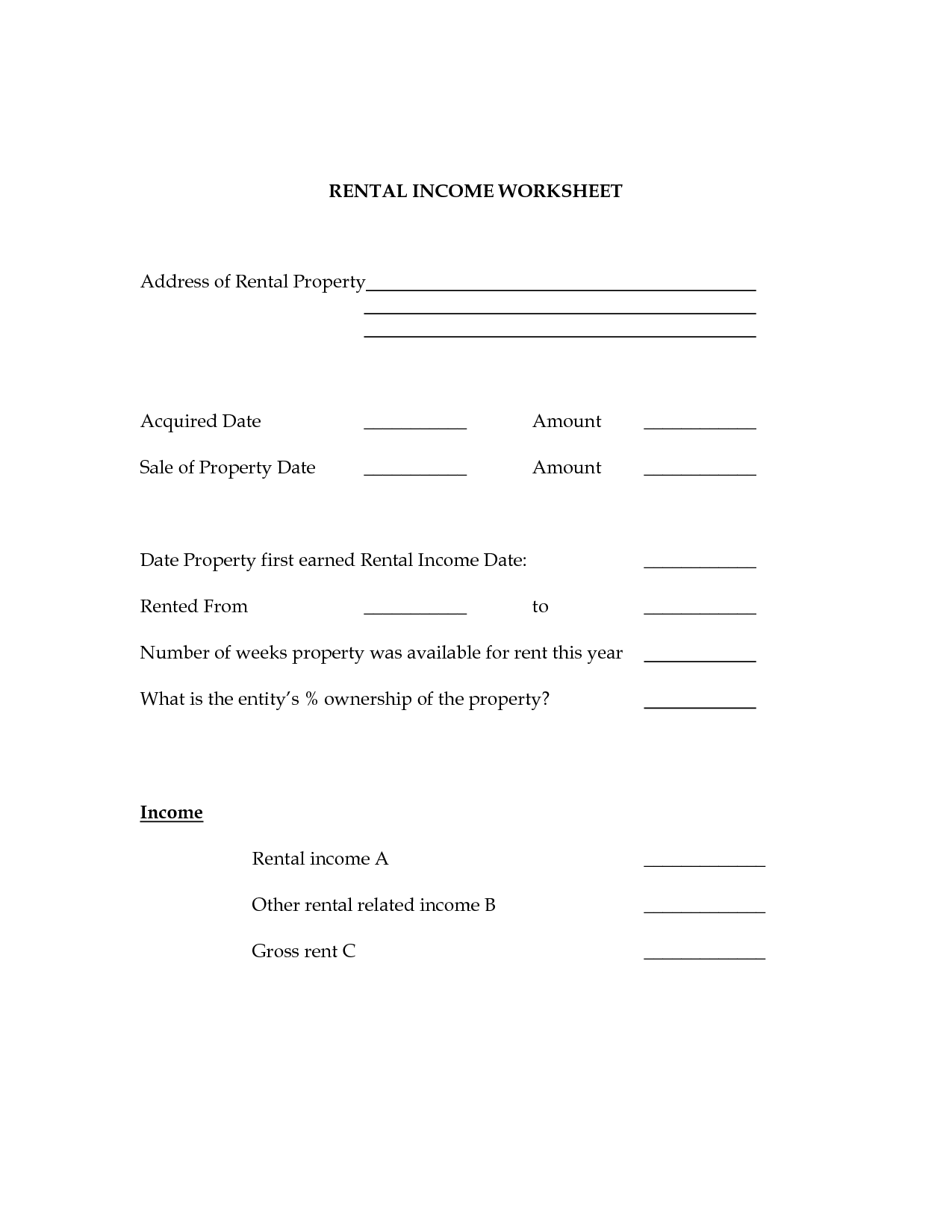

- Rental Income Calculation Worksheet

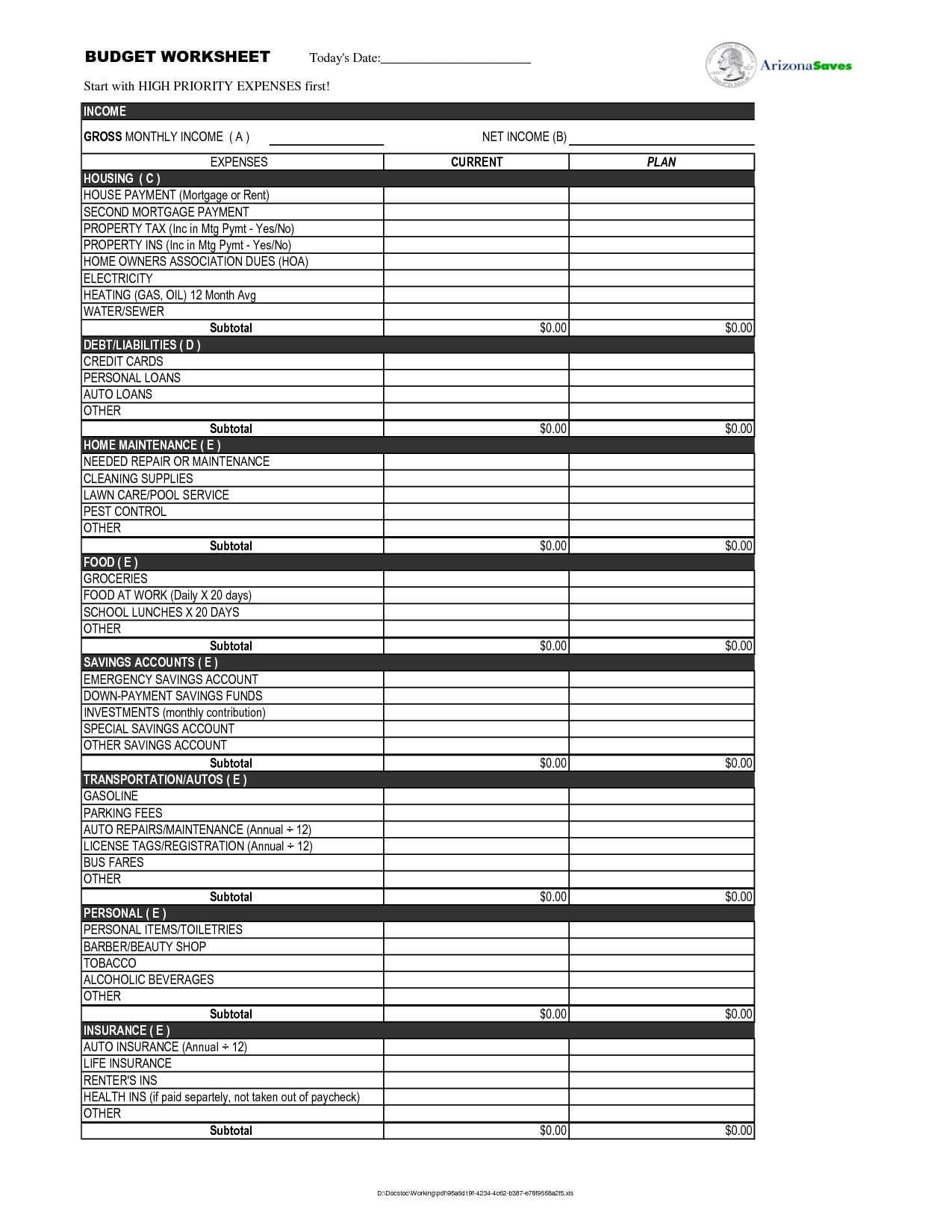

- Monthly Income Expense Worksheet

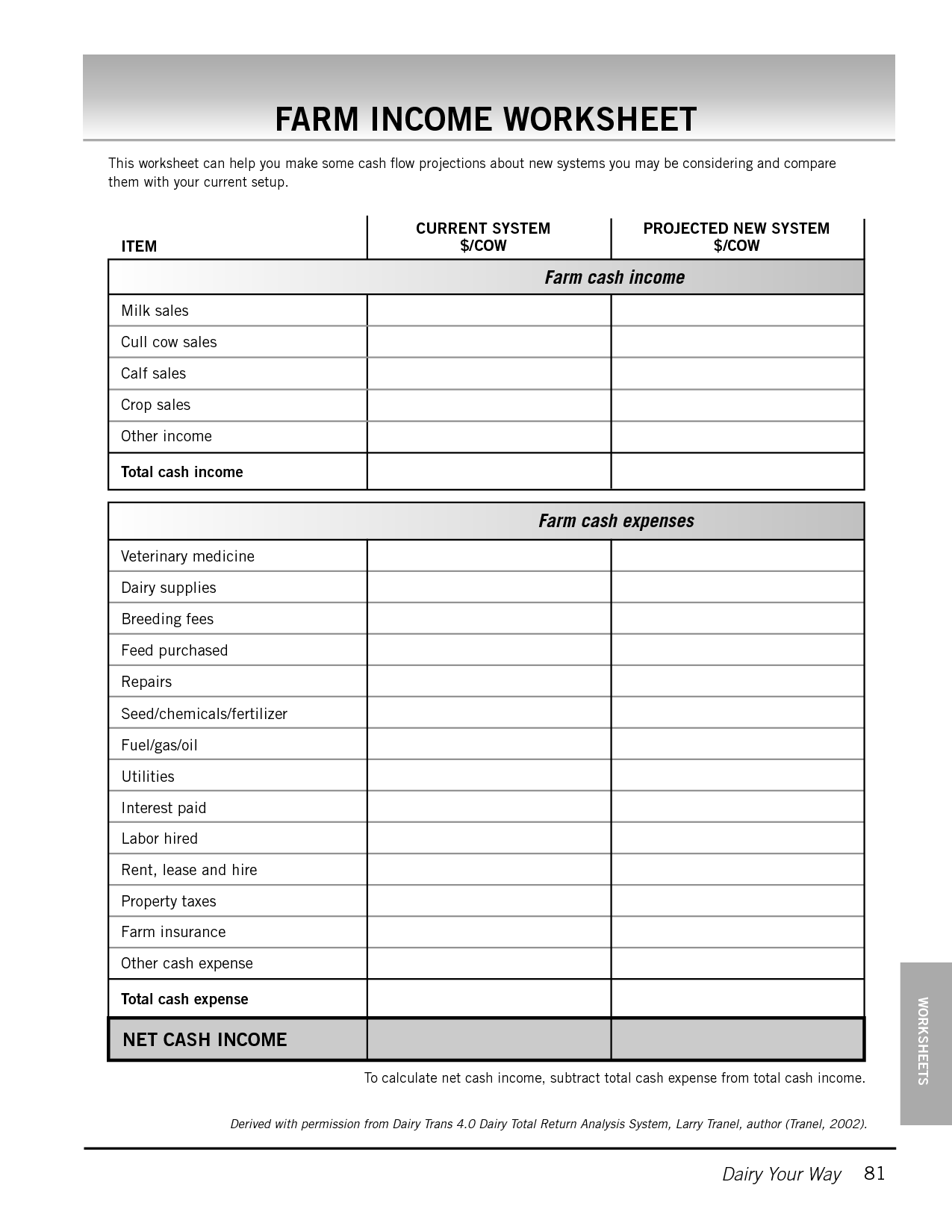

- Farm Income and Expense Worksheet

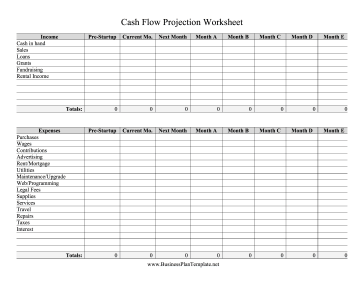

- Cash Flow Projection Worksheet Template

- Accounting Equation Example

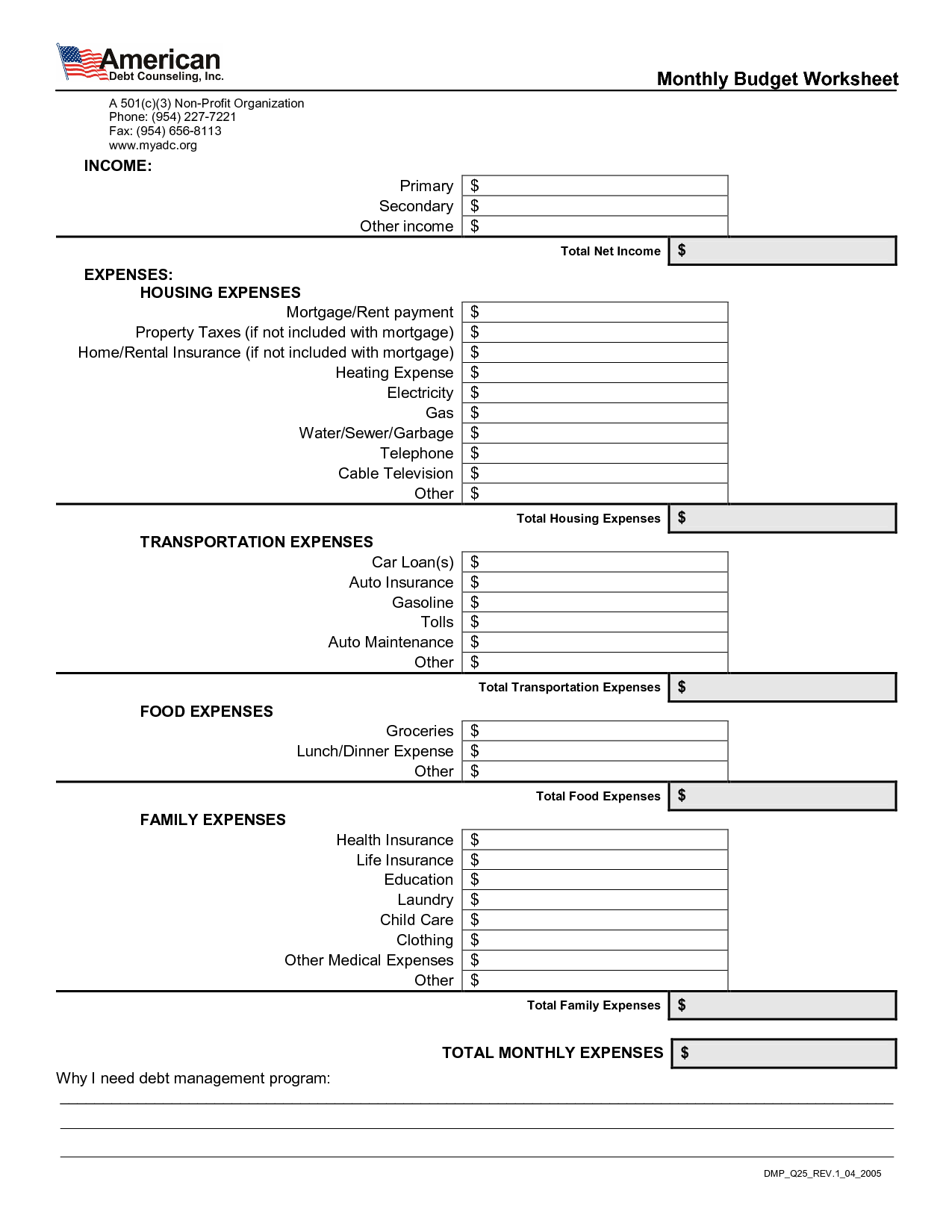

- Non-Profit Budget Worksheet

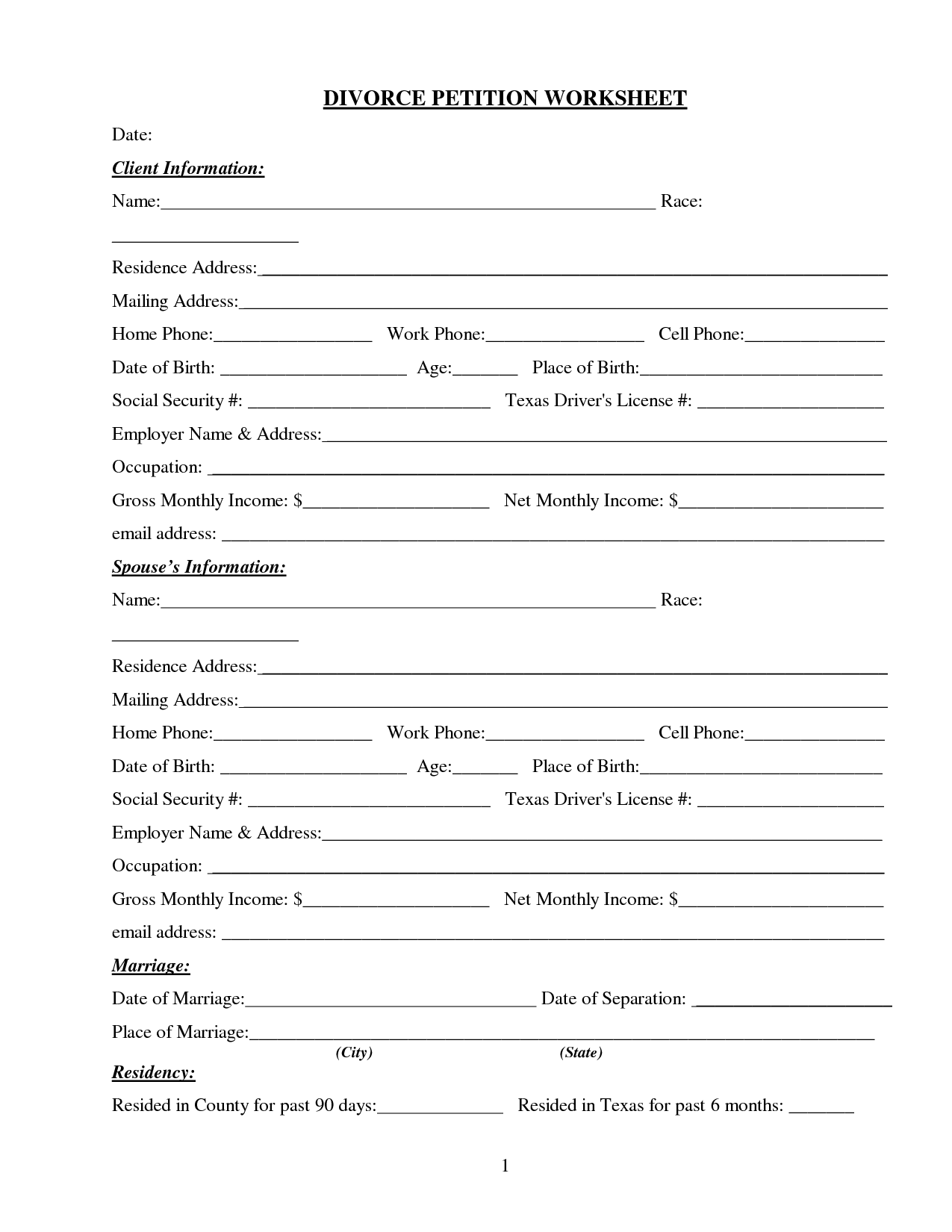

- Printable Divorce Worksheet

- Business Forms Template.net

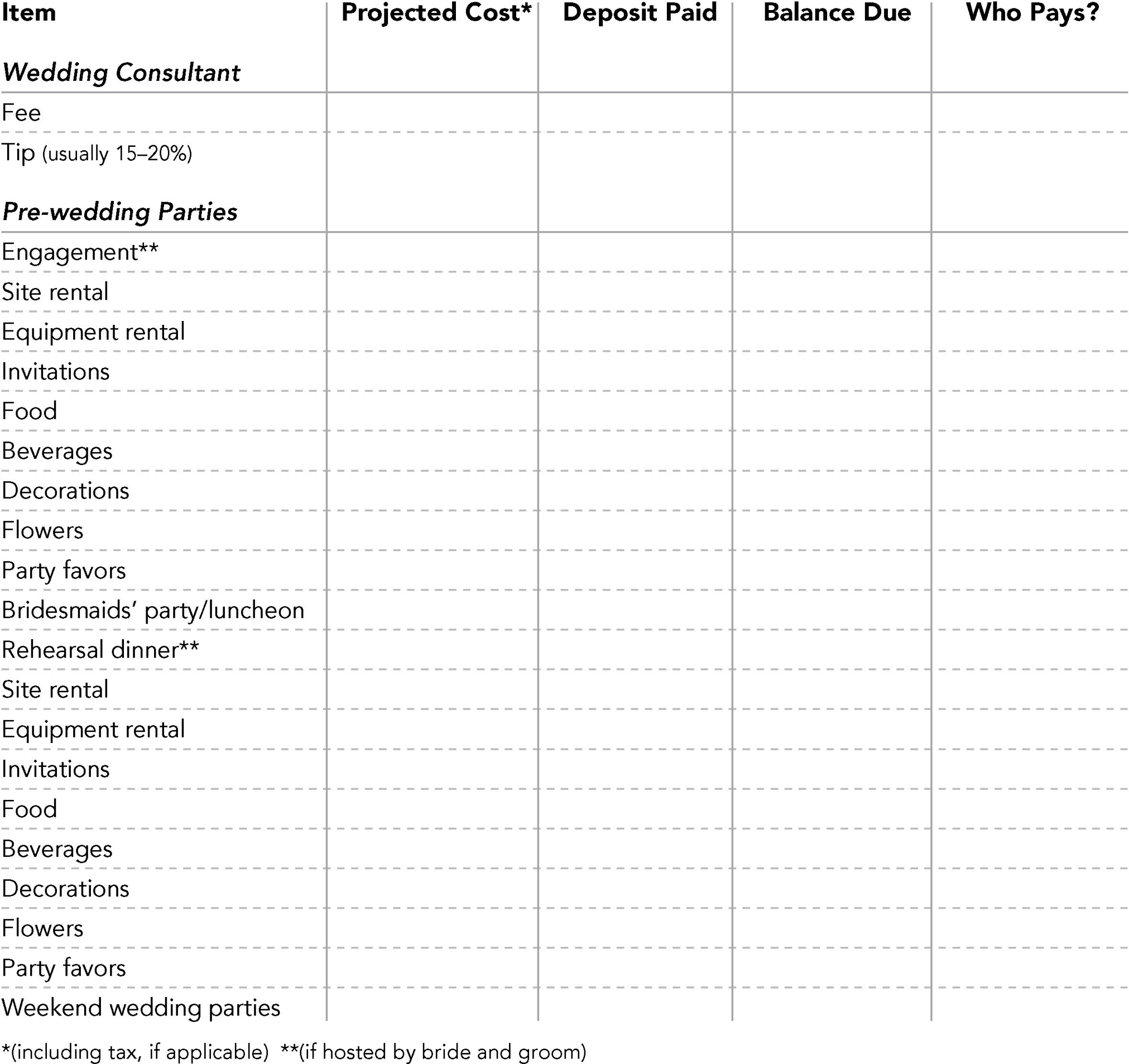

- Wedding Budget Worksheet

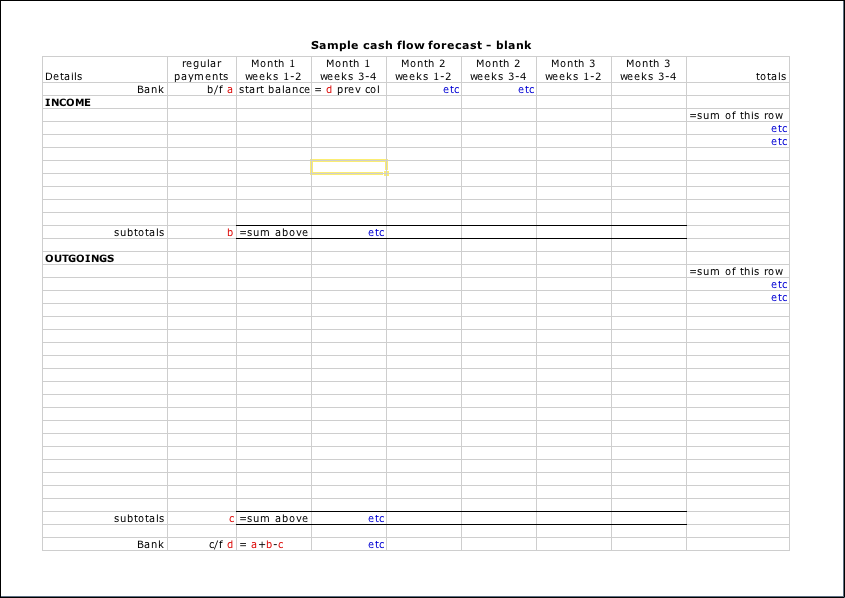

- Blank Cash Flow Statement Templates

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a Net Income Worksheet?

A Net Income Worksheet is a financial document that calculates a company's net income by subtracting total expenses from total revenues. It typically includes sections for listing all sources of income and listing all expenses incurred during a specific period. The purpose of this worksheet is to provide a clear overview of the company's financial performance and to help in determining the profitability of the business.

How is a Net Income Worksheet used in financial analysis?

A Net Income Worksheet is used in financial analysis to calculate the net income of a company by deducting all expenses and taxes from its total revenue. This worksheet helps analysts and investors understand the profitability of a business by providing a clear breakdown of the company's earnings after all costs have been accounted for. It allows users to track changes in profitability over time, evaluate financial performance, and make informed decisions based on the company's financial health.

What are the main components included in a Net Income Worksheet?

A Net Income Worksheet typically includes components such as revenues, expenses, cost of goods sold, operating income, non-operating income, taxes, interest expenses, and ultimately the net income figure. This worksheet is used to calculate and analyze the financial performance of a business by subtracting all expenses from the total revenues to arrive at the net income, which represents the profitability of the company.

How can a Net Income Worksheet be used to calculate profitability?

A Net Income Worksheet can be used to calculate profitability by subtracting total expenses from total revenues to determine the net income of a business. This net income figure represents the amount of revenue left over after all expenses have been deducted. By comparing this net income to the total revenue generated, businesses can assess their profitability and make informed decisions on managing costs, increasing revenues, and improving overall financial performance.

What role does revenue play in a Net Income Worksheet?

Revenue is a key component in a Net Income Worksheet as it represents the total income generated by a business before deducting expenses. Revenue is typically the top line item in the worksheet, and it is used to calculate the net income by subtracting all expenses and taxes from the total revenue. Essentially, revenue provides insight into a company's financial performance and profitability, serving as a crucial factor in determining the final net income figure on the worksheet.

How are expenses recorded and categorized in a Net Income Worksheet?

Expenses are recorded and categorized in a Net Income Worksheet by listing them under different expense categories such as cost of goods sold, operating expenses, interest expense, and income tax expense. Each expense category is then totaled up to calculate the total expenses for the period, which is subtracted from the total revenue to arrive at the net income. The Net Income Worksheet provides a clear breakdown of expenses incurred by the business, helping to analyze and monitor the financial performance of the company.

How is the concept of gross profit utilized in a Net Income Worksheet?

The concept of gross profit is utilized in a Net Income Worksheet by subtracting the cost of goods sold from total revenue to calculate the gross profit. This gross profit figure is then used as the starting point for further deductions, such as operating expenses and taxes, in order to arrive at the final net income figure. Essentially, gross profit is a key component in determining the overall profitability of a business before factoring in additional expenses.

What is the significance of operating income in a Net Income Worksheet?

Operating income, also known as operating profit, is a crucial component in a Net Income Worksheet because it represents the profit generated from a company's core business operations before taking into account interest and taxes. It plays a key role in assessing a company's operational efficiency and profitability as it focuses solely on the revenue and expenses directly related to the primary activities of the business, providing a clear indication of how well a company is performing in its day-to-day operations. This metric helps investors, analysts, and management evaluate the company's ability to generate profits from its core business activities.

How are taxes and interest expenses incorporated into a Net Income Worksheet?

Taxes are generally deducted from the gross income to calculate the net income in a Net Income Worksheet. Interest expenses, on the other hand, are typically accounted for as an operating expense and deducted separately from the gross income before arriving at the net income figure. By subtracting both taxes and interest expenses from the gross income, a company can determine its final net income on the worksheet.

How does a Net Income Worksheet contribute to the overall financial reporting process?

A Net Income Worksheet helps to calculate the net income of a company by deducting all expenses from revenues, which is a crucial step in preparing financial statements. This worksheet provides a detailed breakdown of all income and expenses, allowing for accurate financial reporting and analysis. It helps organize and summarize financial data, ensuring that the company's financial performance is accurately reflected in reports like the income statement and balance sheet, ultimately aiding stakeholders in making informed decisions about the business.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments