Money Worksheets 1-20

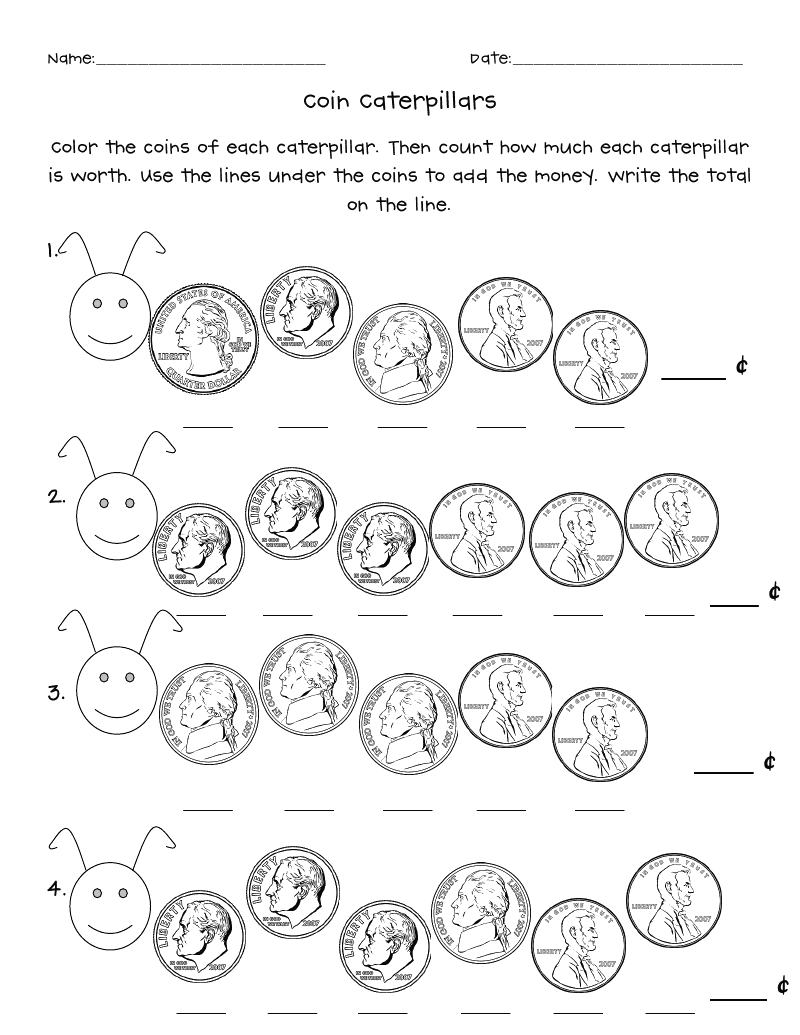

Are you searching for educational resources to teach your young learners about money and help them practice important skills such as counting, identifying coins, and making change? Look no further! We have created a collection of engaging and effective money worksheets for kids aged 1 to 20. With a variety of activities and clear instructions, these worksheets are designed to make learning about money fun and accessible for every child.

Table of Images 👆

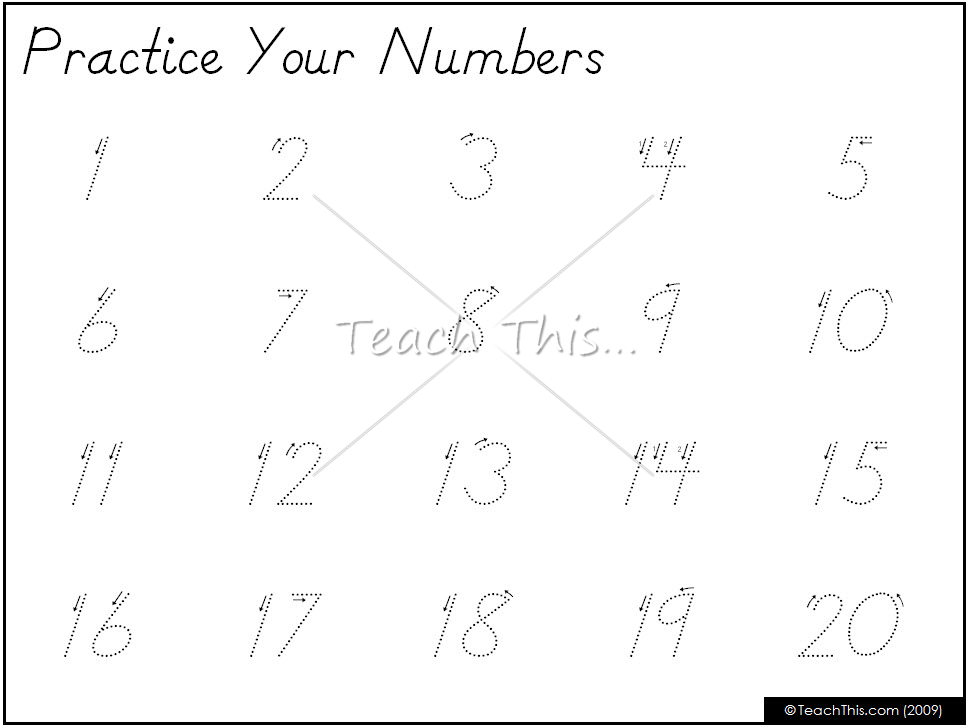

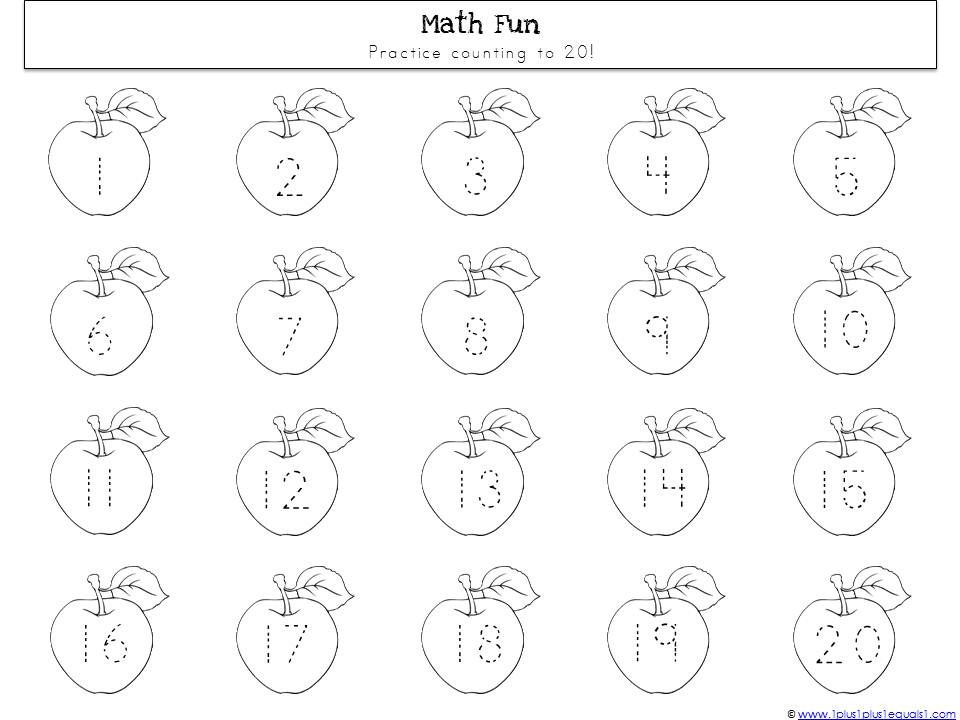

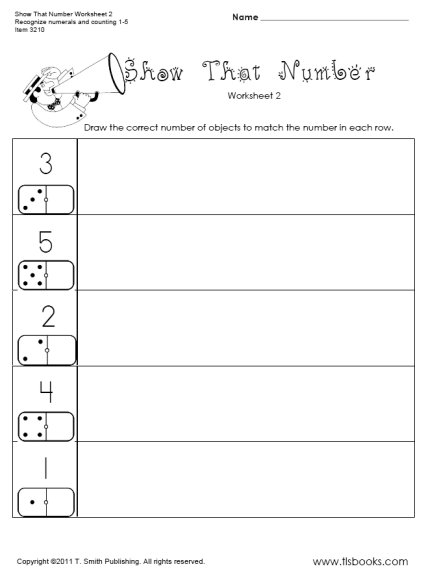

- 20 Number Printable Worksheets

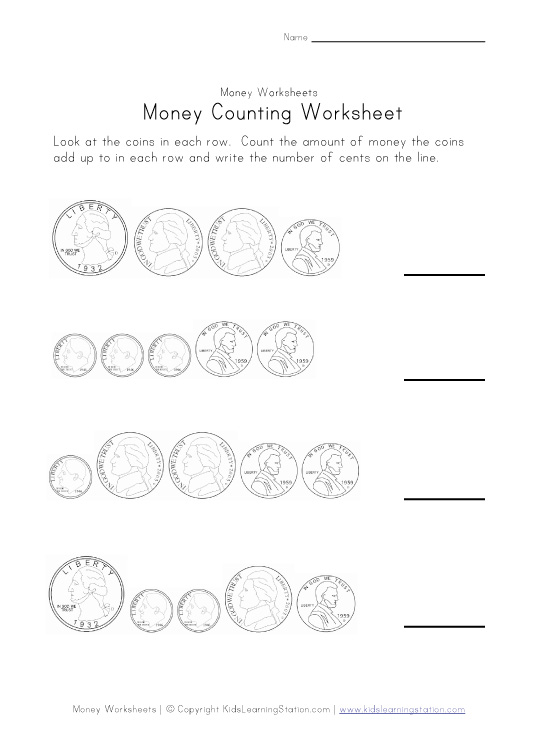

- Money Counting Coins Worksheets

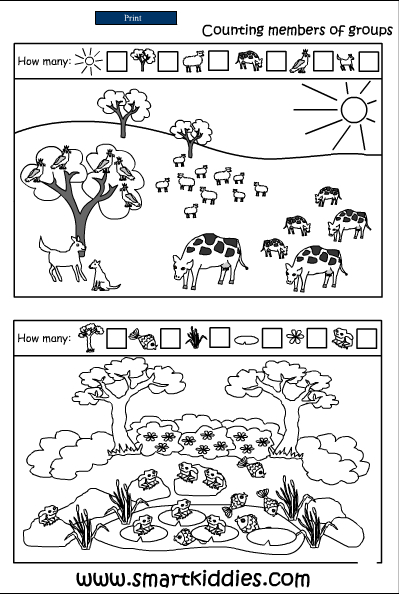

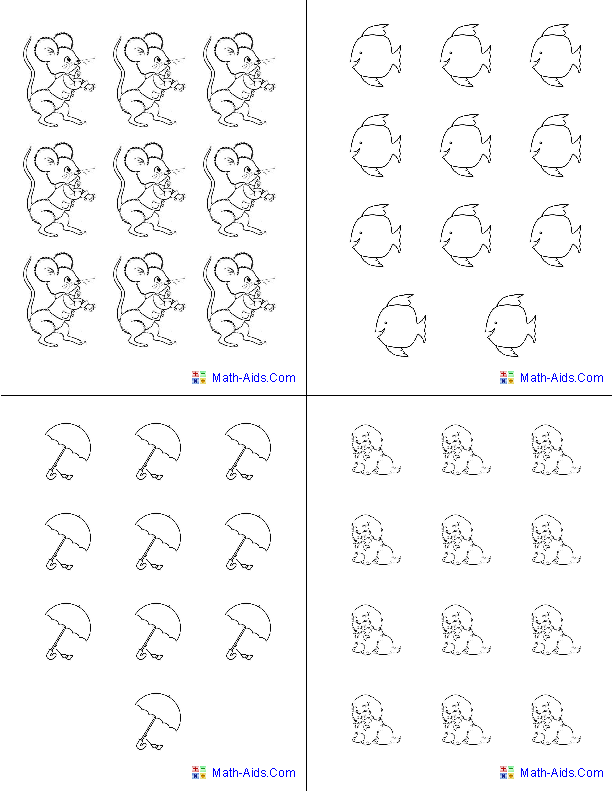

- Counting Numbers 10 20 Worksheets

- Practice Numbers 1-20 Worksheets

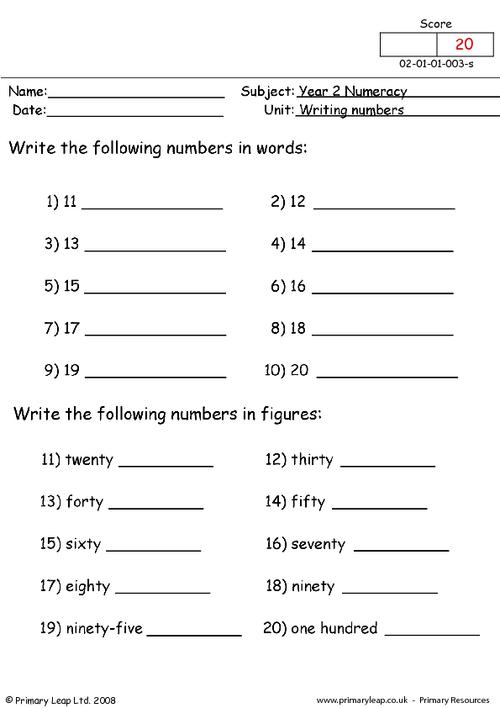

- Writing Numbers as Words Worksheets

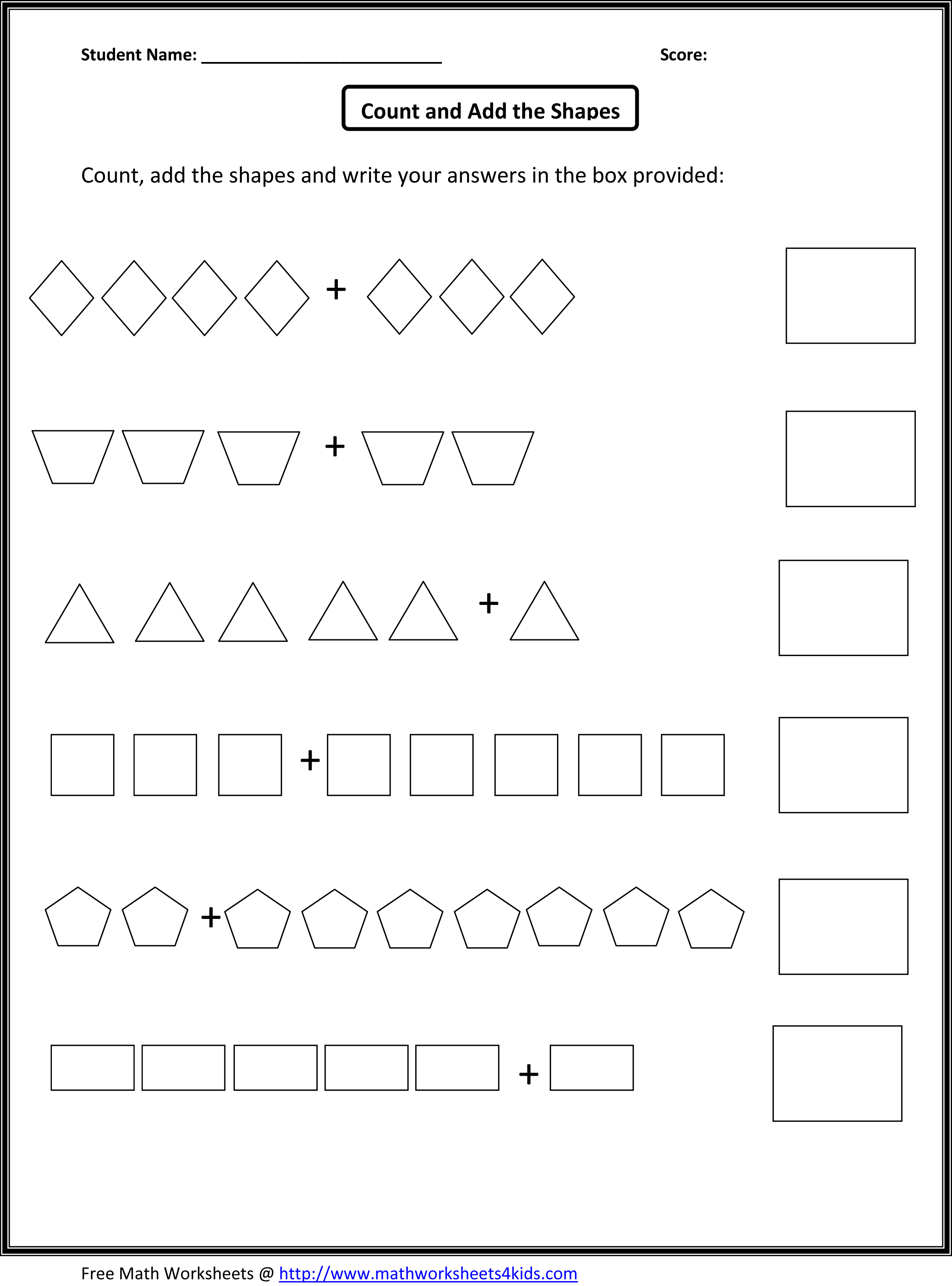

- Kindergarten Math Shapes Worksheets

- Practice Writing Numbers 1 20 Worksheet

- Kindergarten Tracing Number 1 20

- Free Printable Counting Flash Cards

- Number 14 Worksheets

- Missing Number Worksheets 1-20

- Before and After Math Worksheets 1 to 20

- Fill in Missing Numbers Worksheets

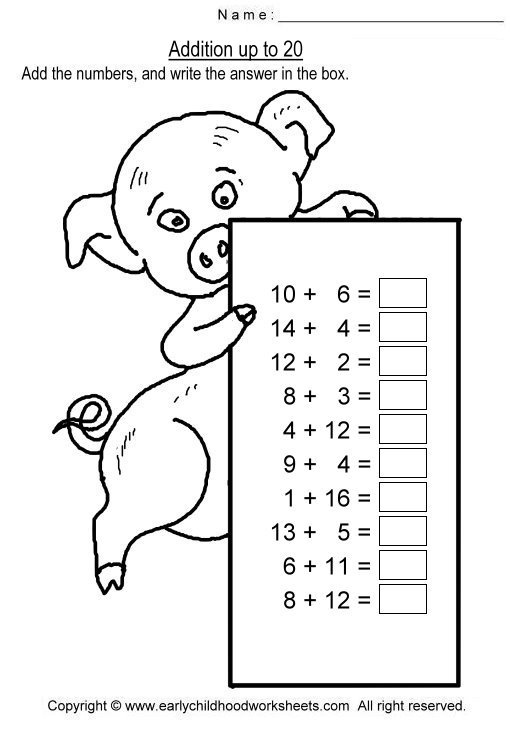

- Addition Worksheets Up to 20

- Trace Numbers 1-20 Worksheets

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is the first step in creating a budget?

The first step in creating a budget is to identify your sources of income, including all sources of money coming in regularly.

How can you track your expenses?

You can track your expenses by creating a budget, keeping receipts or records of purchases, using expense tracking apps or software, categorizing expenses, regularly reviewing and updating your spending, and seeking professional financial advice if needed.

Why is it important to save money?

Saving money is important for several reasons. It provides financial security and stability in times of emergencies or unexpected expenses. Saving money also allows individuals to achieve their short-term and long-term financial goals, such as buying a house, starting a business, or retiring comfortably. Additionally, saving money can help reduce financial stress, provide a cushion against economic uncertainties, and ultimately contribute to a better quality of life by giving individuals more freedom and choices in how they manage their finances.

What are the different types of income?

There are several types of income, including earned income (such as wages and salaries), passive income (such as rental income or dividends), investment income (such as capital gains or interest), and business income (such as profits from self-employment or ownership of a business). Other types of income may include alimony, royalties, pensions, and annuities.

How can you differentiate between needs and wants?

Needs are essential for survival and well-being, such as food, shelter, and clothing, while wants are things that are not necessary but desired for comfort or luxury, like an expensive car or designer clothes. Differentiating between needs and wants involves understanding what is essential for basic needs versus what is a preference or desire that can be considered optional. Prioritizing needs over wants can help individuals make more informed decisions and allocate resources effectively.

What is the difference between a debit card and a credit card?

A debit card is linked to your bank account and allows you to spend money from the funds available in your account, while a credit card allows you to borrow money from the card issuer up to a certain limit. With a debit card, you are using your own money, whereas with a credit card, you are using borrowed money that you need to repay with interest if not paid off in full by the due date.

Why is it important to have an emergency fund?

It is important to have an emergency fund to provide financial stability and security in unexpected situations such as job loss, medical expenses, or home repairs. Having this reserve allows individuals to cover expenses without relying on credit cards or loans, helping to prevent financial stress and potential debt accumulation. An emergency fund acts as a safety net, providing peace of mind and the ability to handle unforeseen circumstances with greater ease and confidence.

What are some common strategies for paying off debt?

Some common strategies for paying off debt include creating a budget to track income and expenses, prioritizing debts by interest rates or balances, negotiating lower interest rates or payment plans with creditors, making extra payments towards debts, and considering debt consolidation or debt management plans. Additionally, cutting back on expenses, increasing income through additional work or selling assets, and seeking financial advice or counseling can also be effective strategies for paying off debt.

How can you make your money work for you through investments?

You can make your money work for you through investments by conducting research to understand different types of investment options, such as stocks, bonds, real estate, and mutual funds, and determining which align with your financial goals. Create a diversified investment portfolio to reduce risk and maximize returns over time, making sure to regularly review and adjust your investments based on market conditions and your objectives. Consider consulting with a financial advisor to develop a personalized investment strategy that suits your risk tolerance and time horizon.

What are some effective ways to teach children about money management?

Some effective ways to teach children about money management include giving them an allowance and encouraging them to budget and save a portion of it, setting a good example by openly discussing financial decisions and responsibilities, involving them in household budgeting and shopping decisions, playing educational games or activities that involve money, and allowing them to earn money through tasks or projects to understand the value of hard work and money earned. By combining practical experience with open communication and education, children can develop strong money management skills from a young age.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments