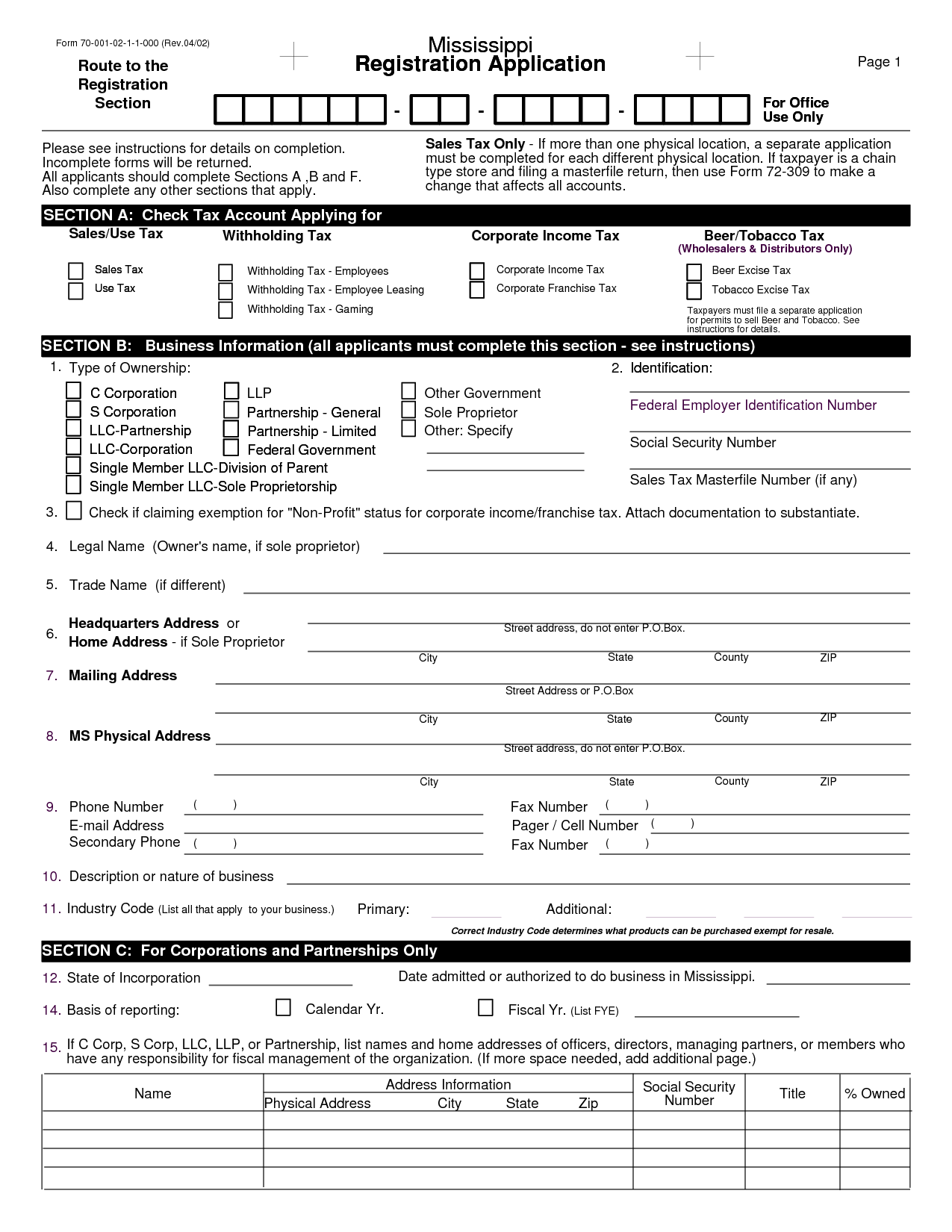

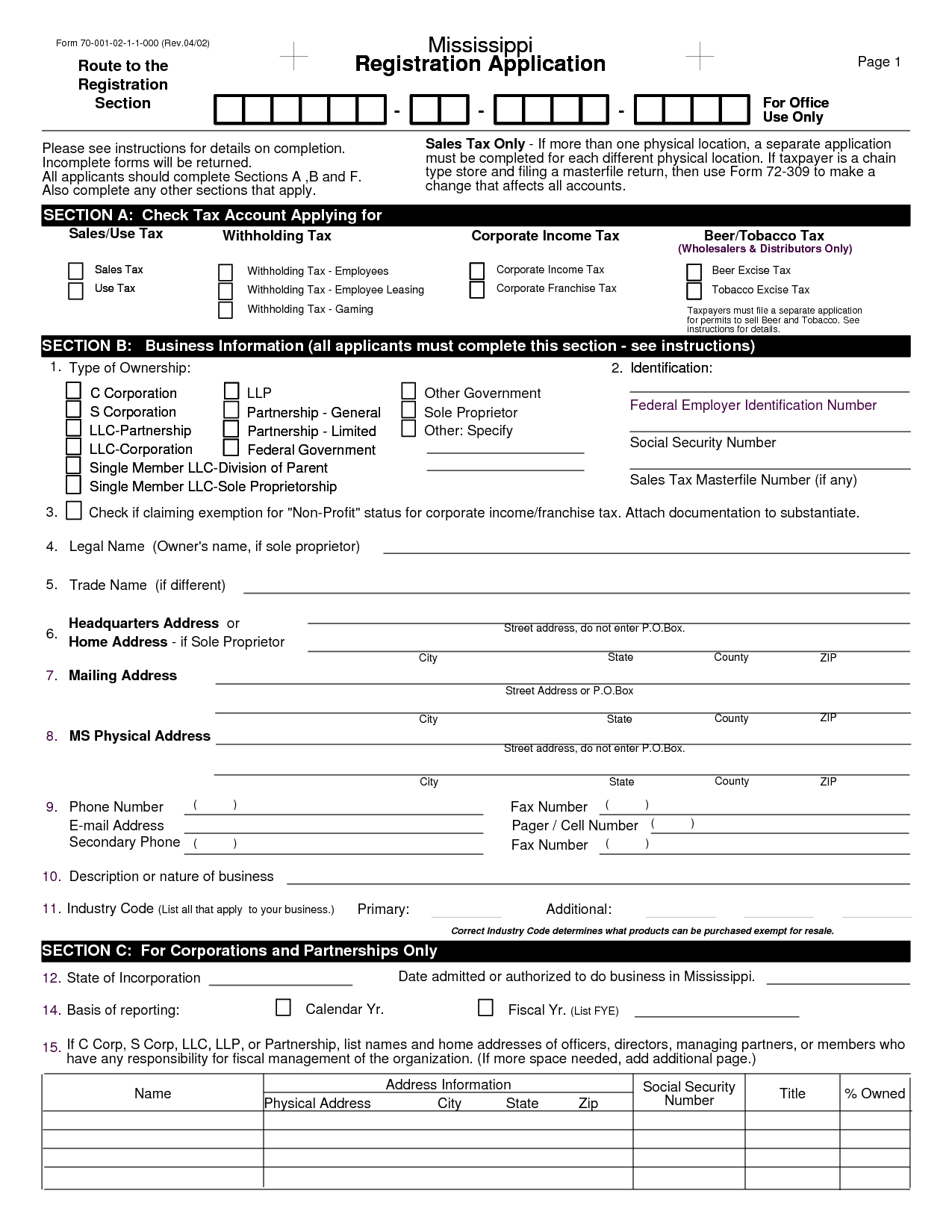

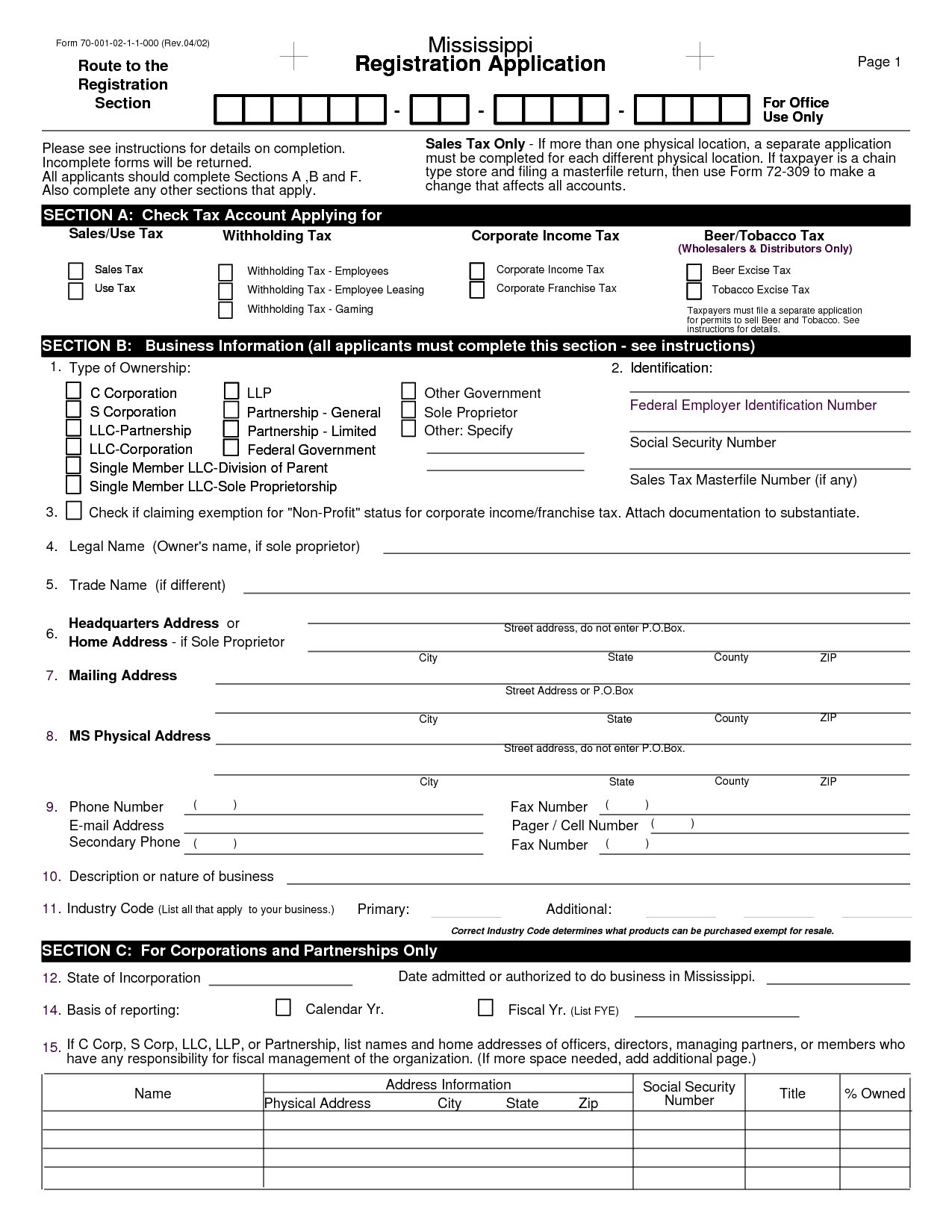

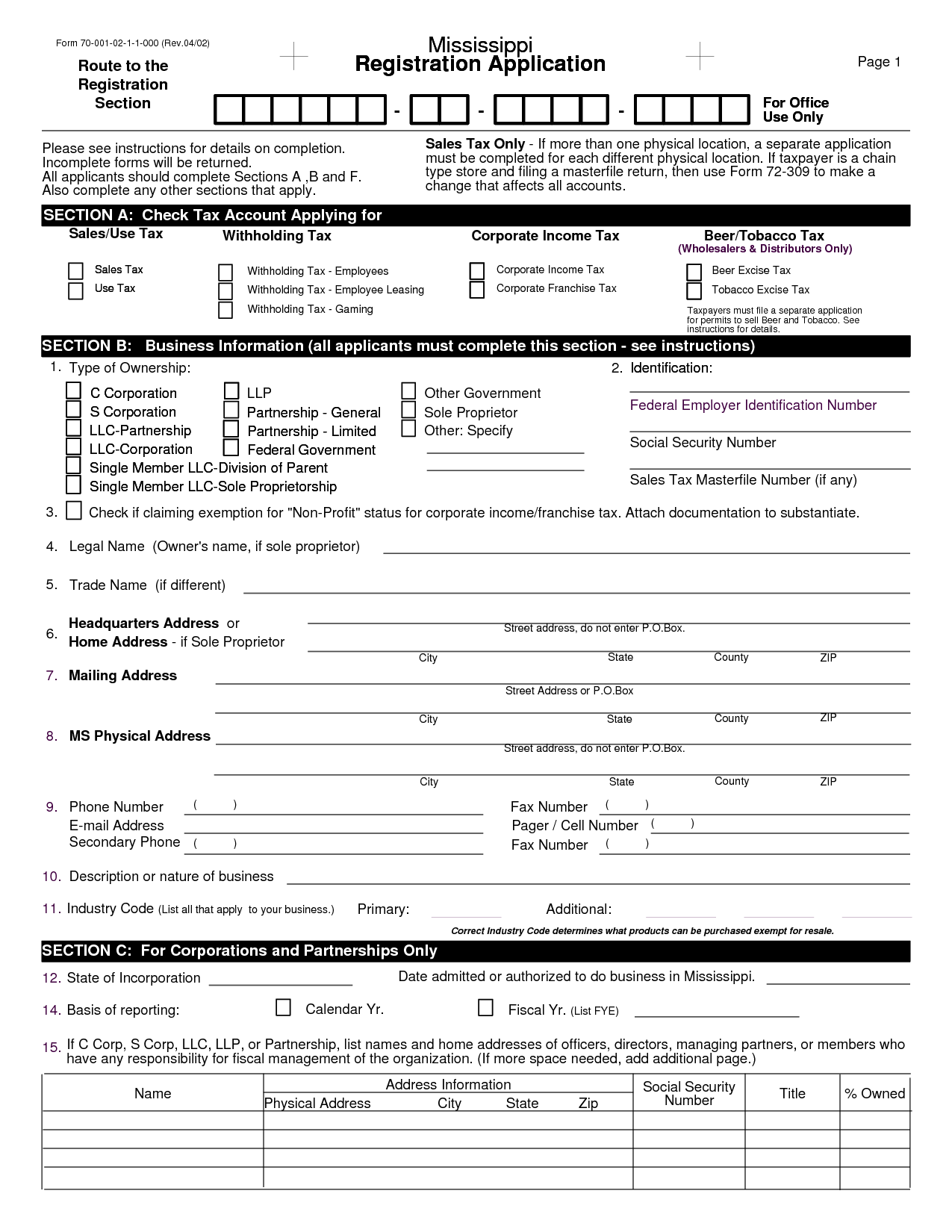

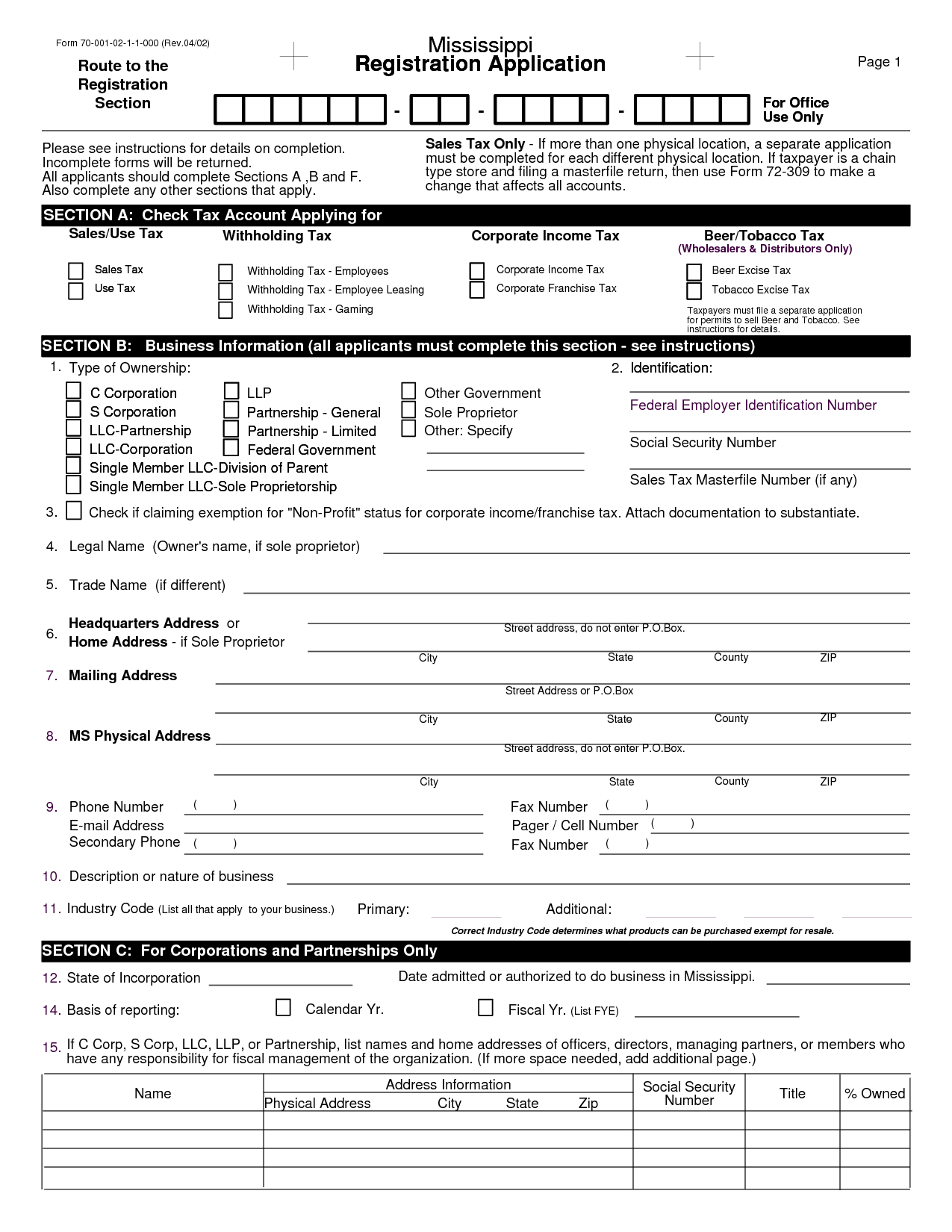

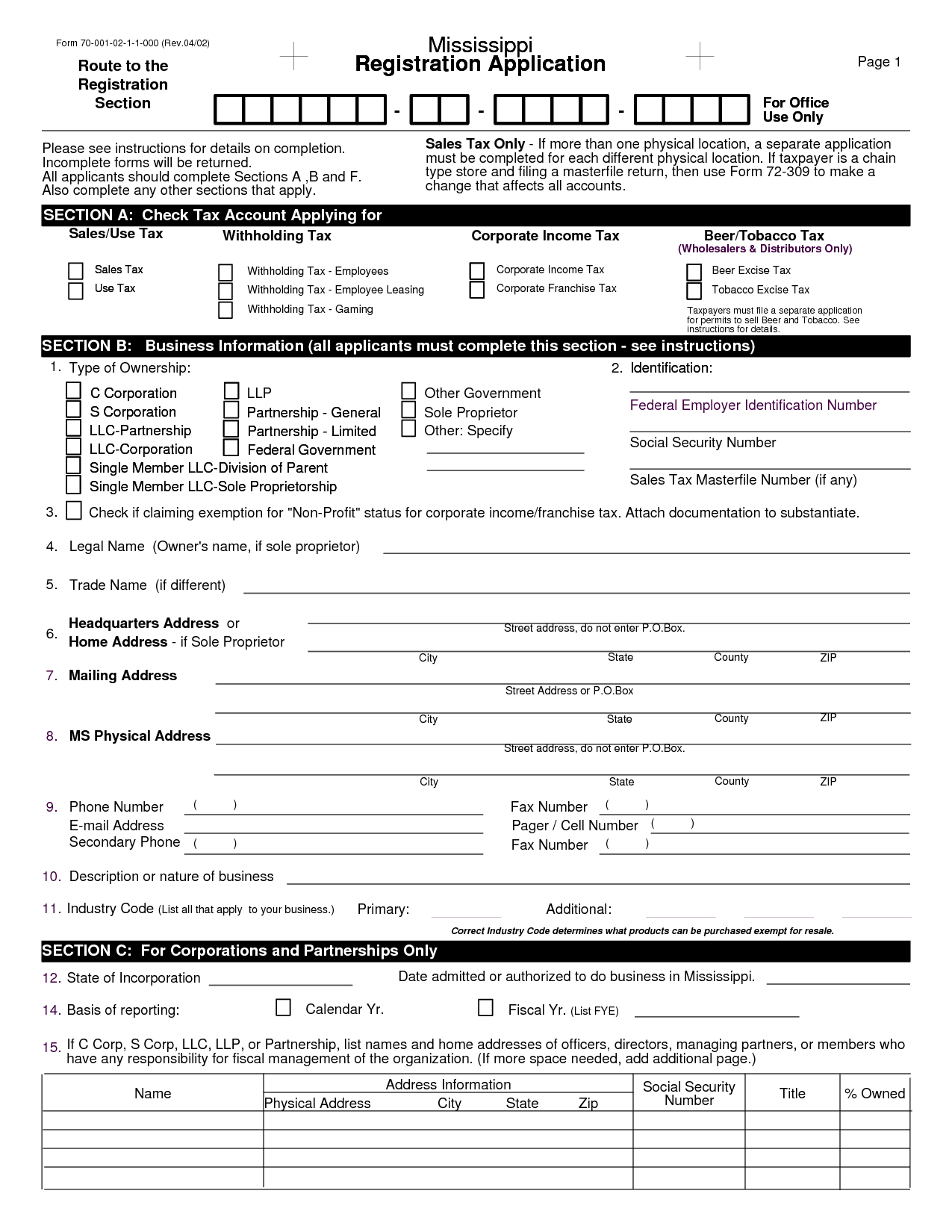

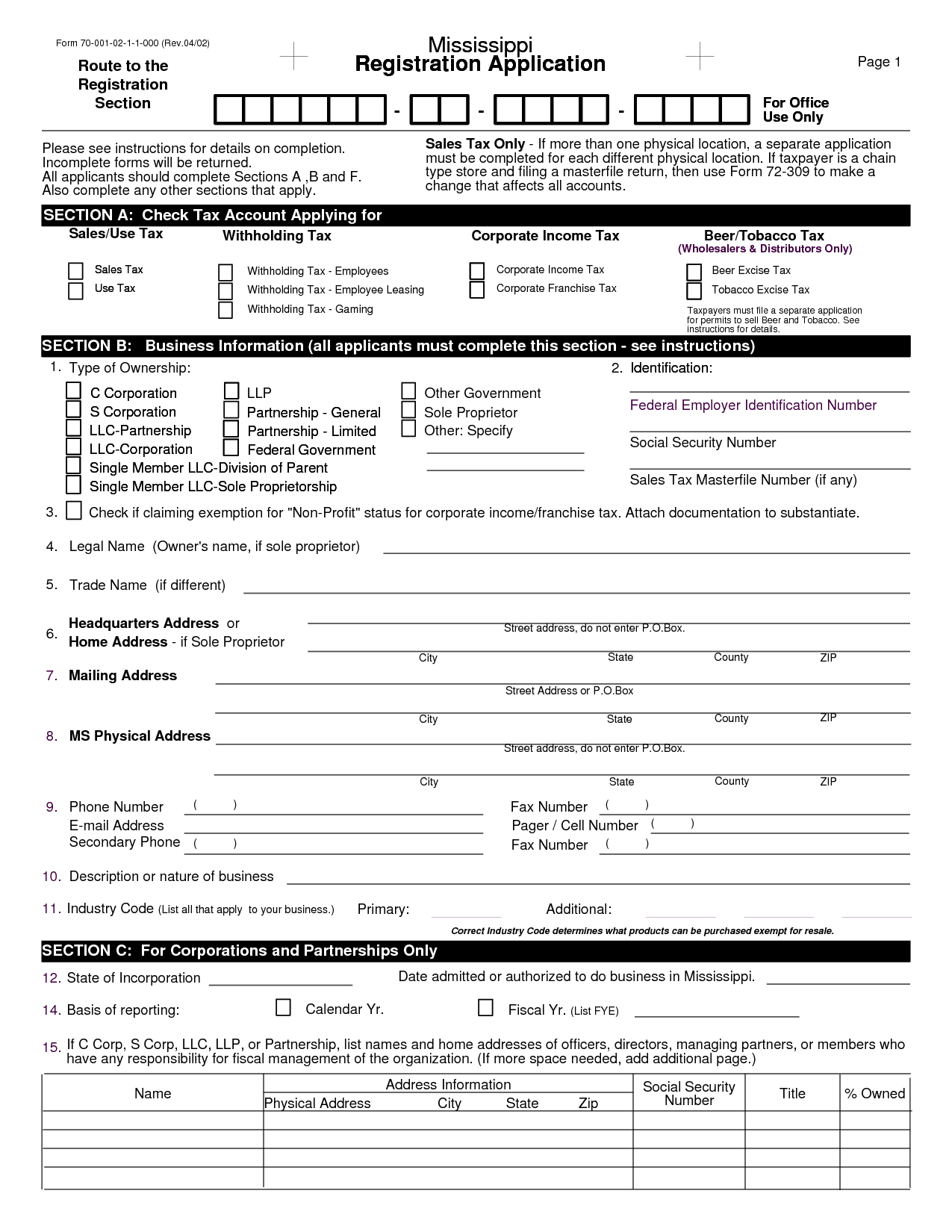

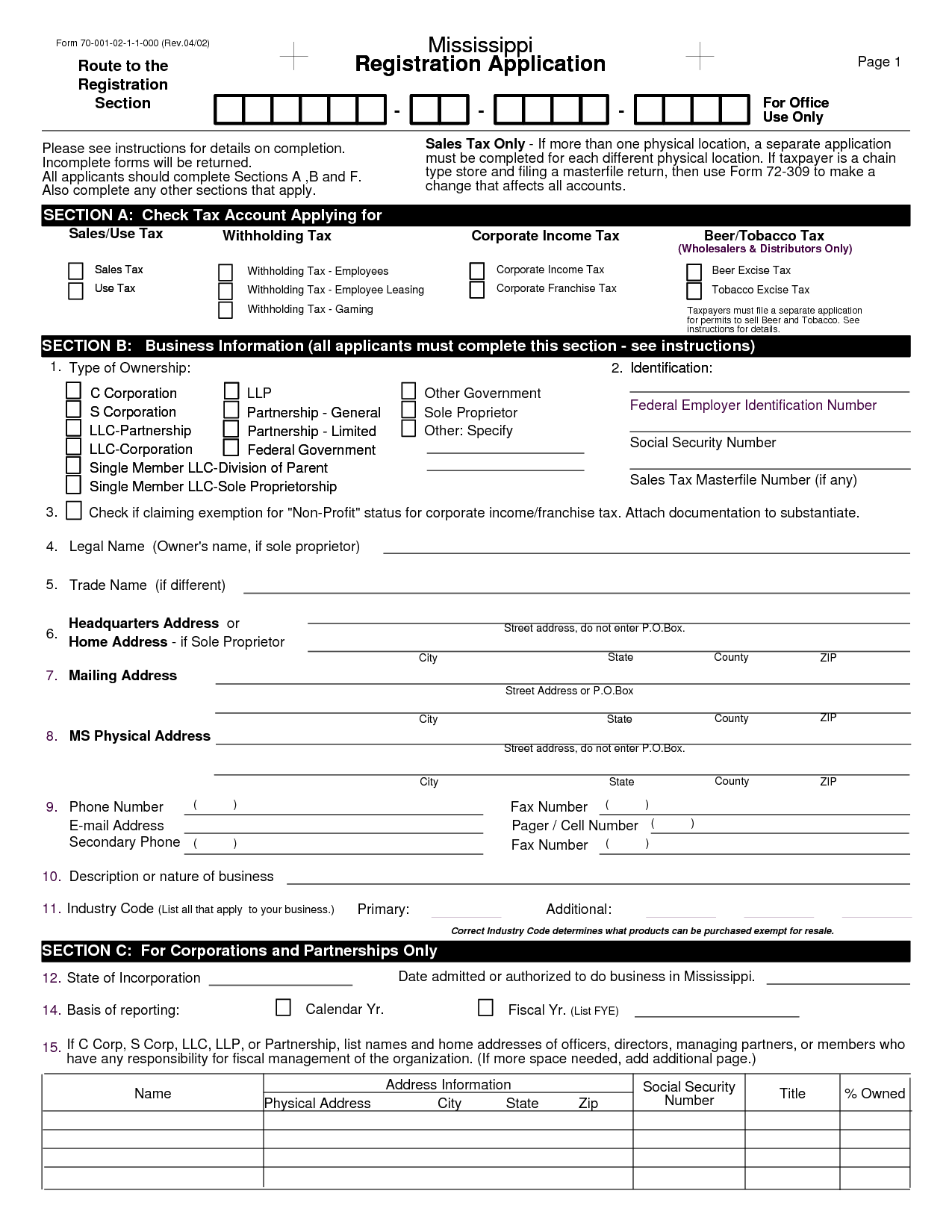

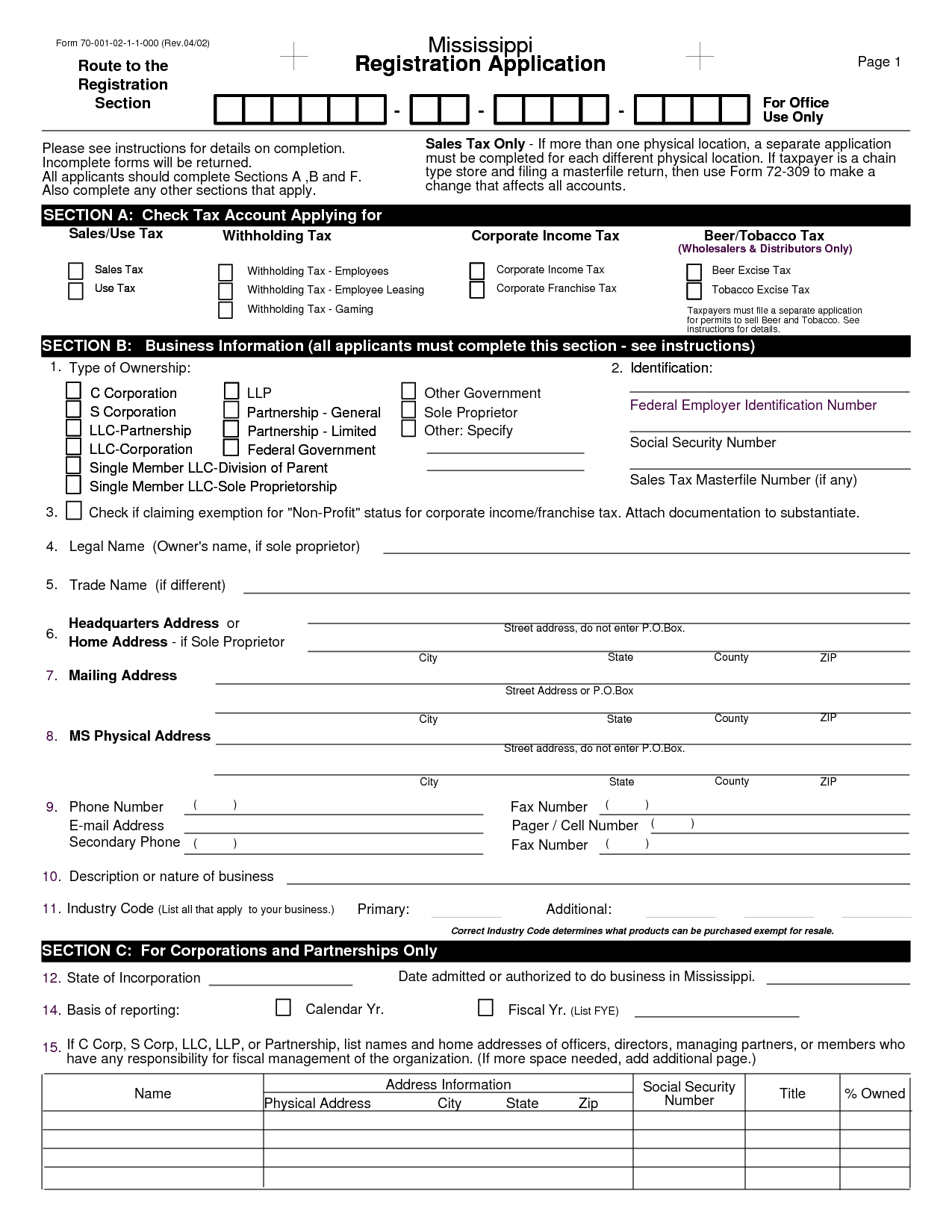

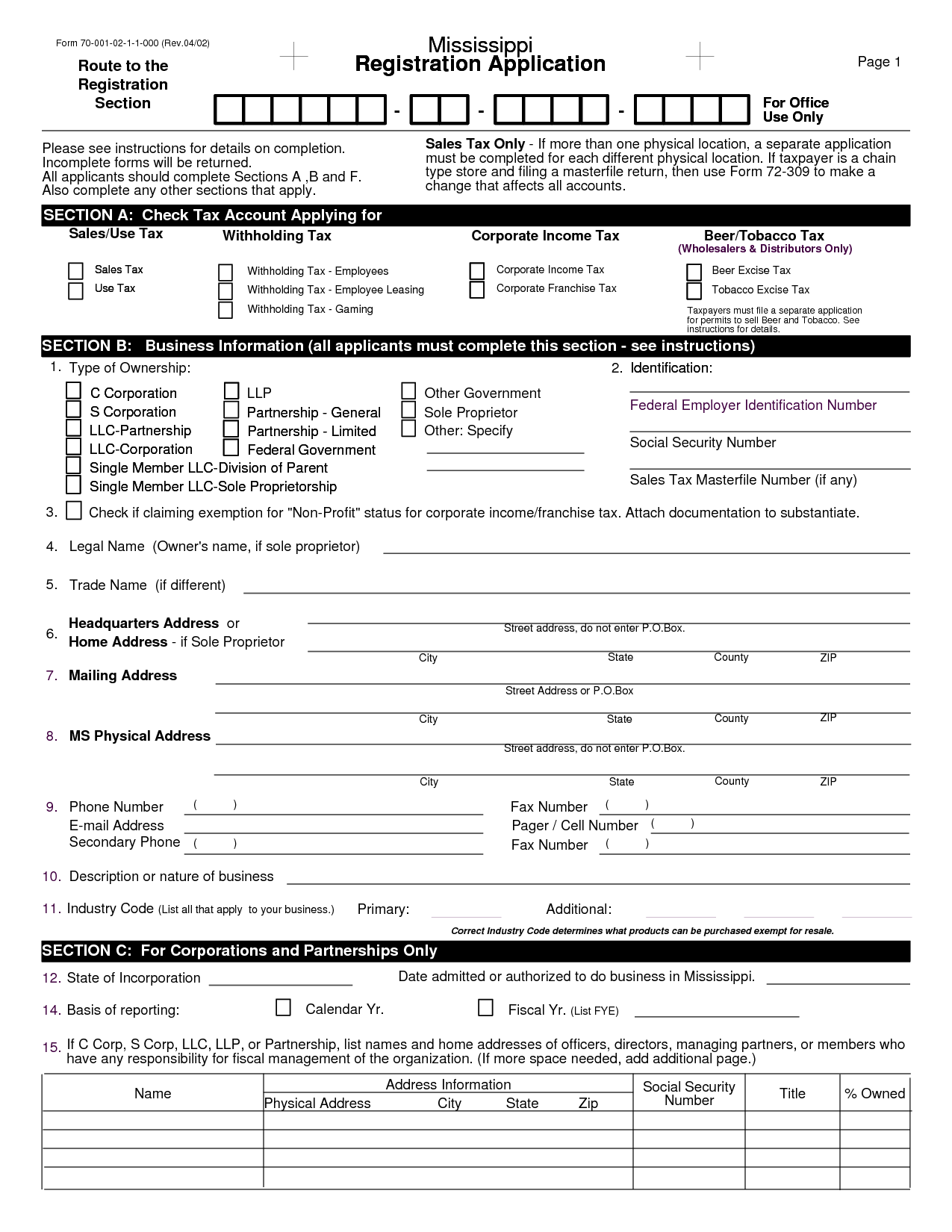

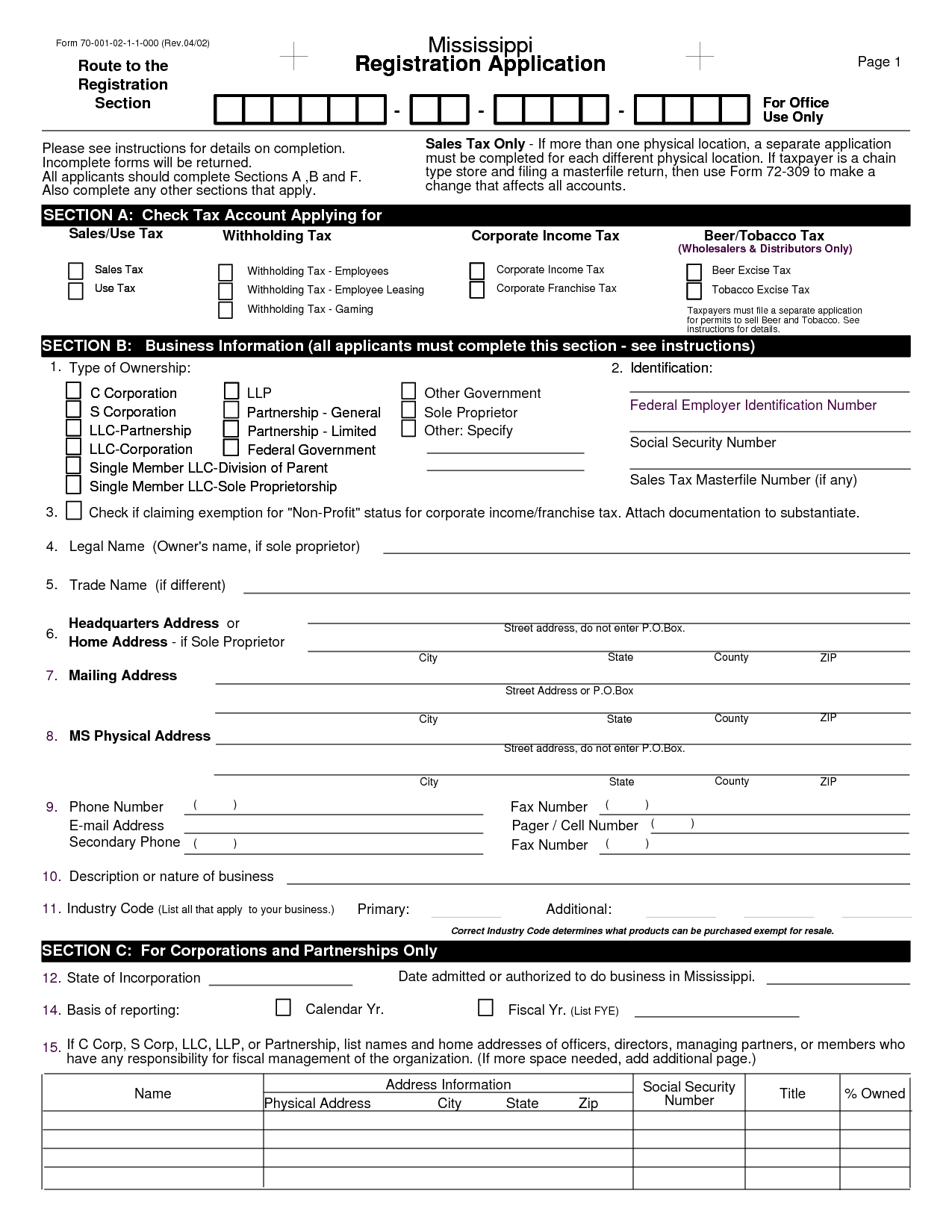

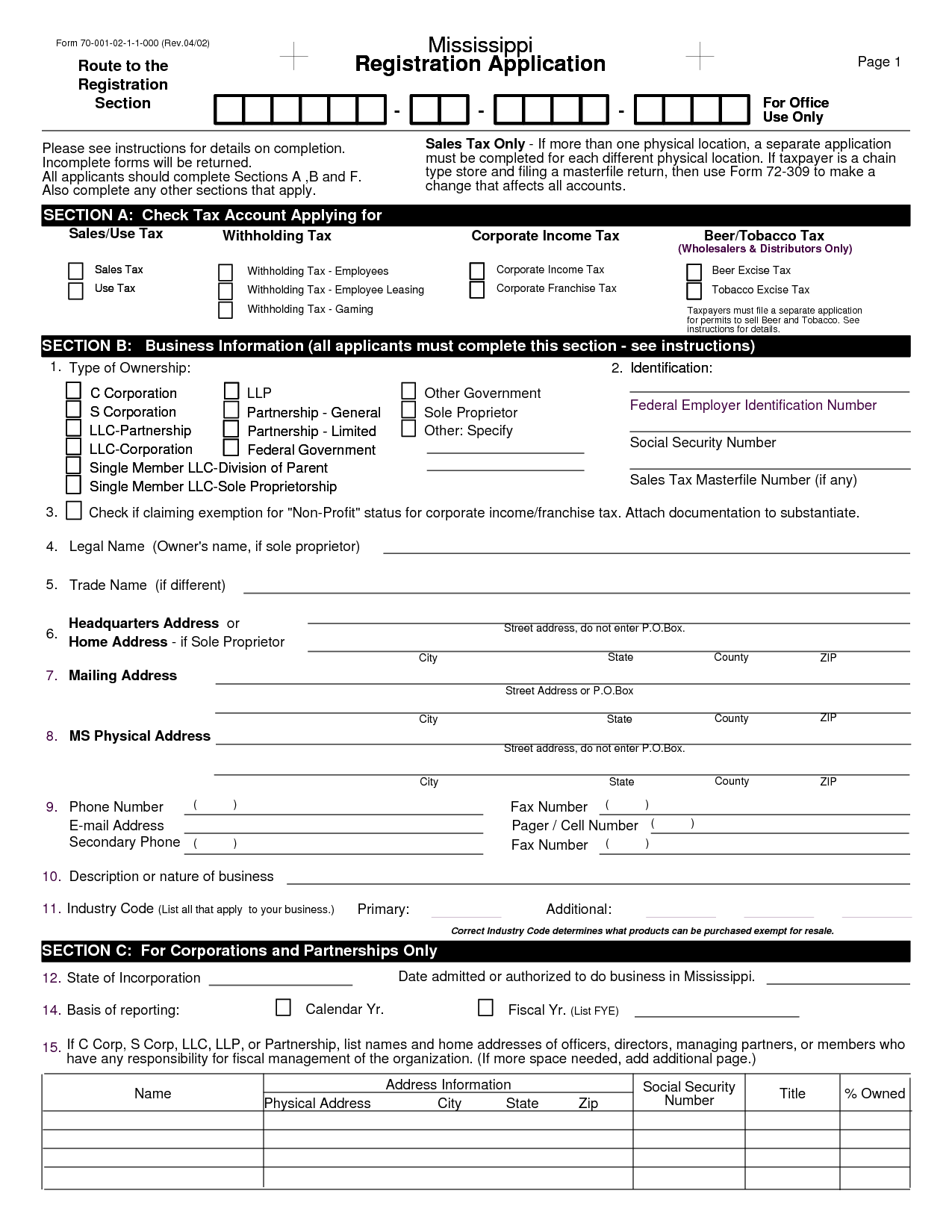

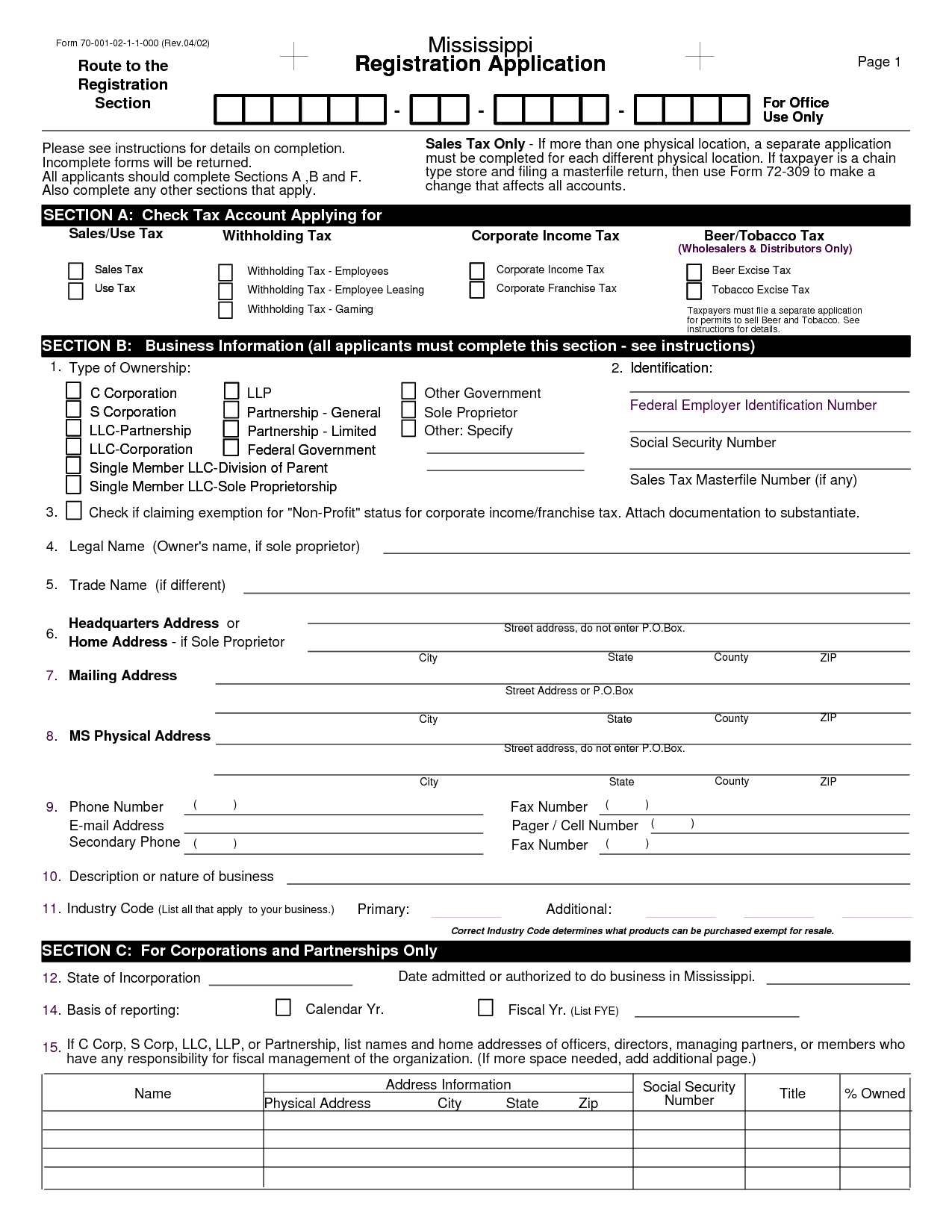

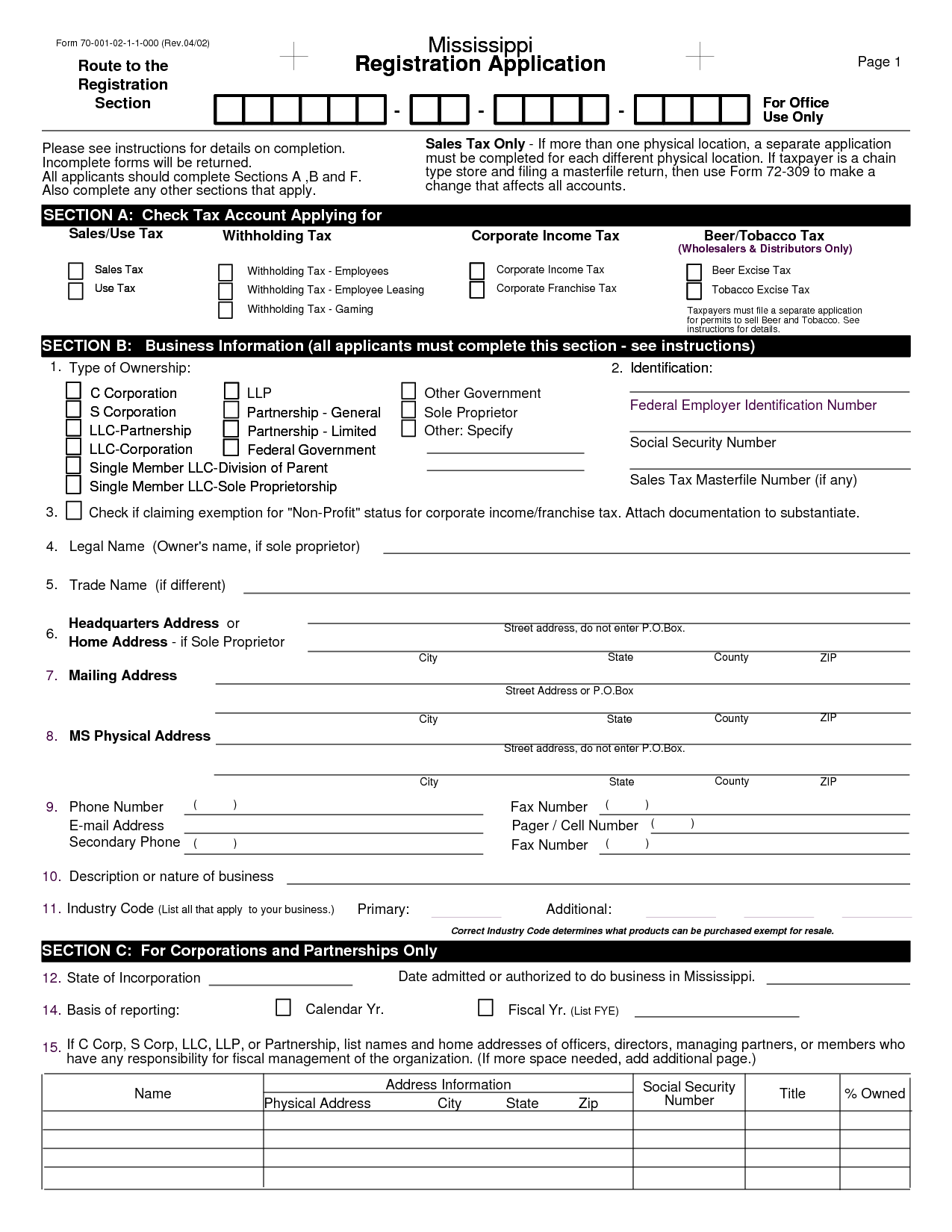

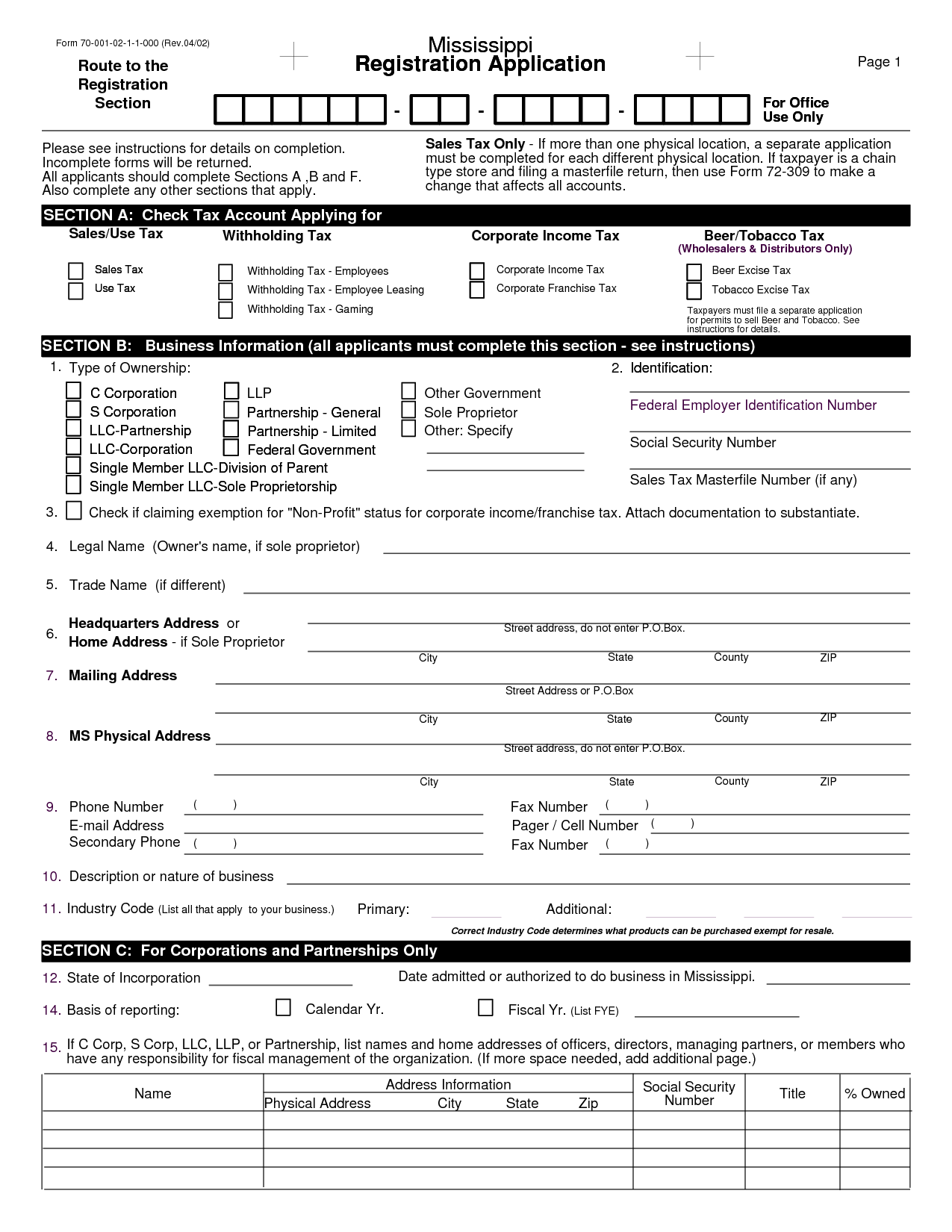

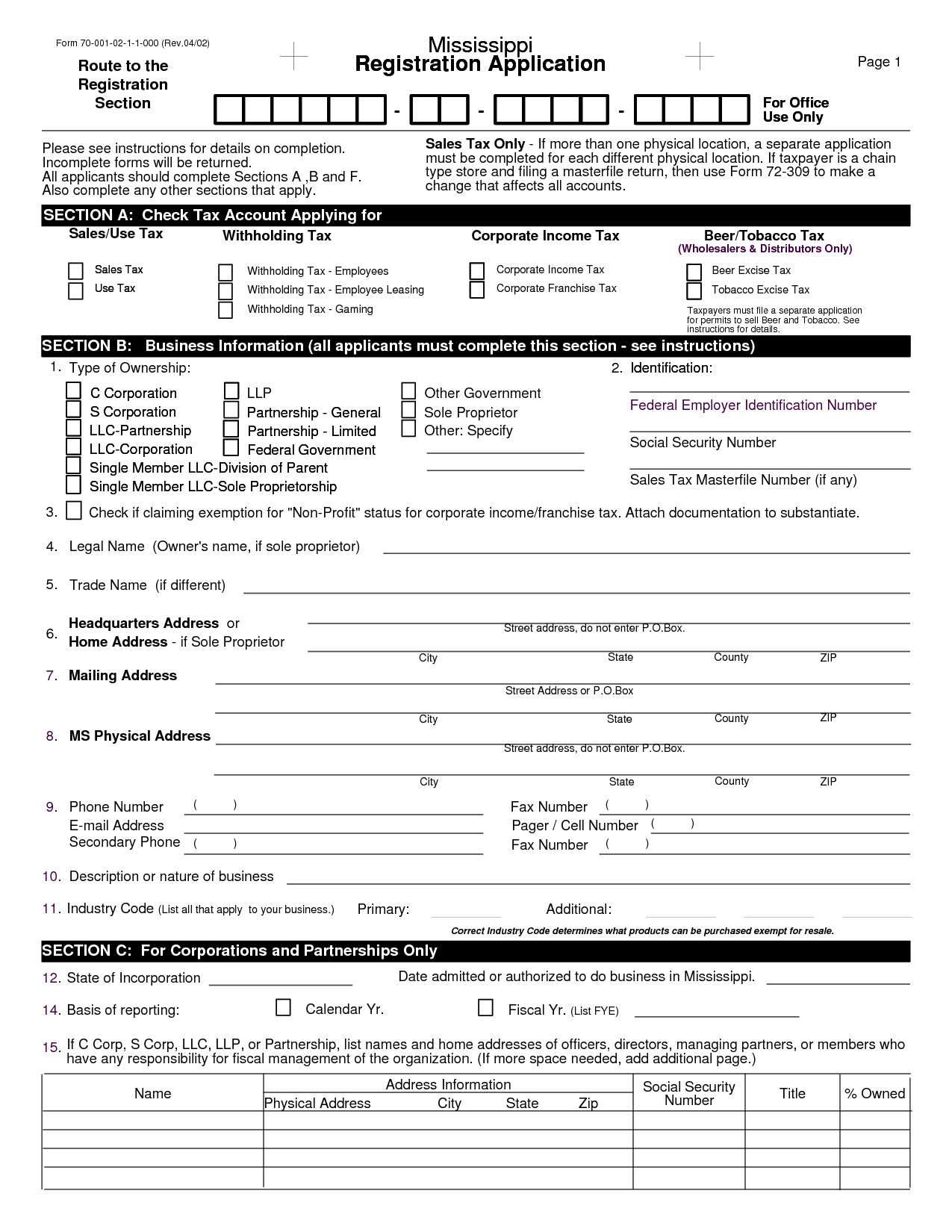

Mississippi Sales Tax Worksheet

Calculating sales tax can be a complicated task, especially for businesses and individuals in Mississippi. Whether you're a small business owner or an individual looking to stay on top of your finances, having a reliable and comprehensive sales tax worksheet can make all the difference. In this blog post, we will explore the importance of having a Mississippi Sales Tax Worksheet and how it can benefit businesses and individuals alike.

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

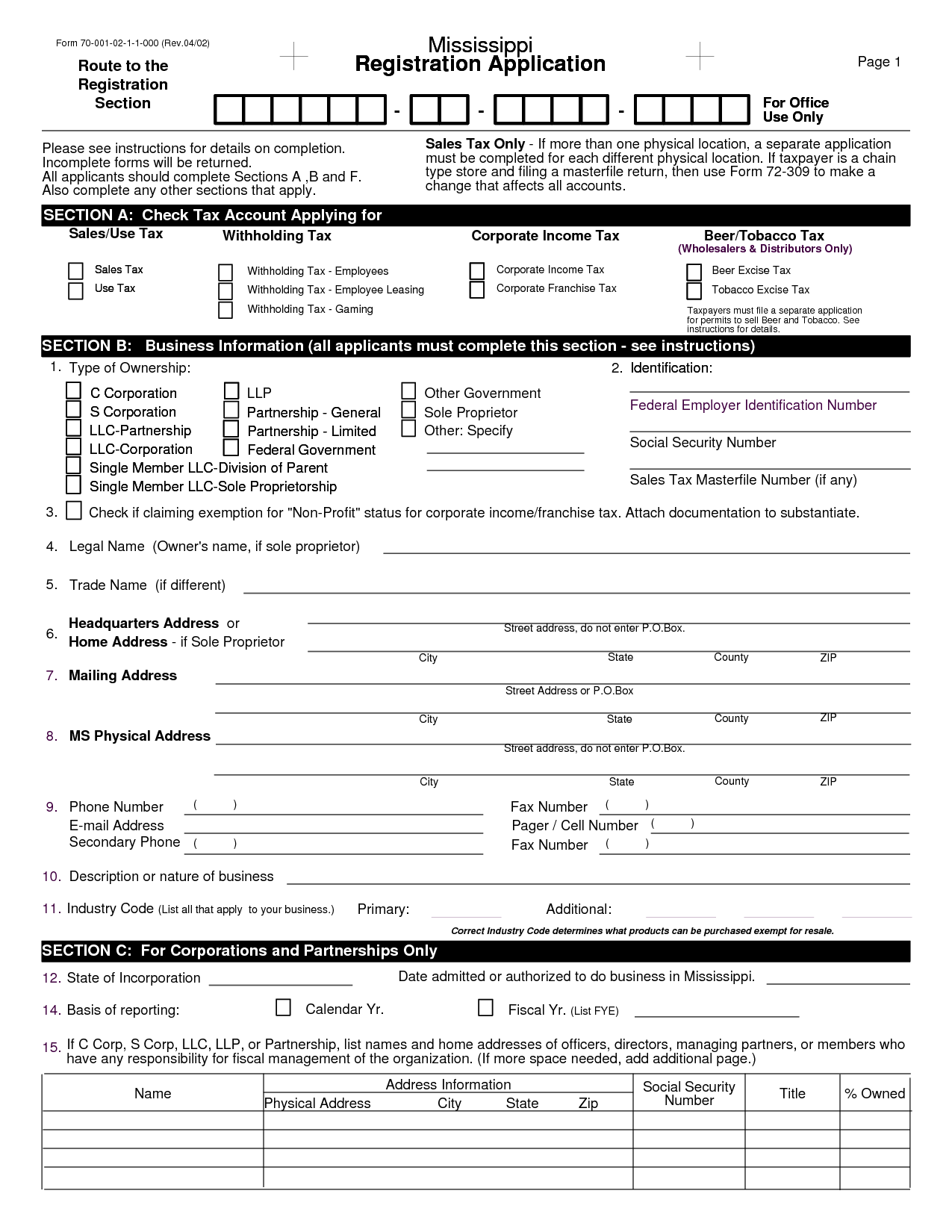

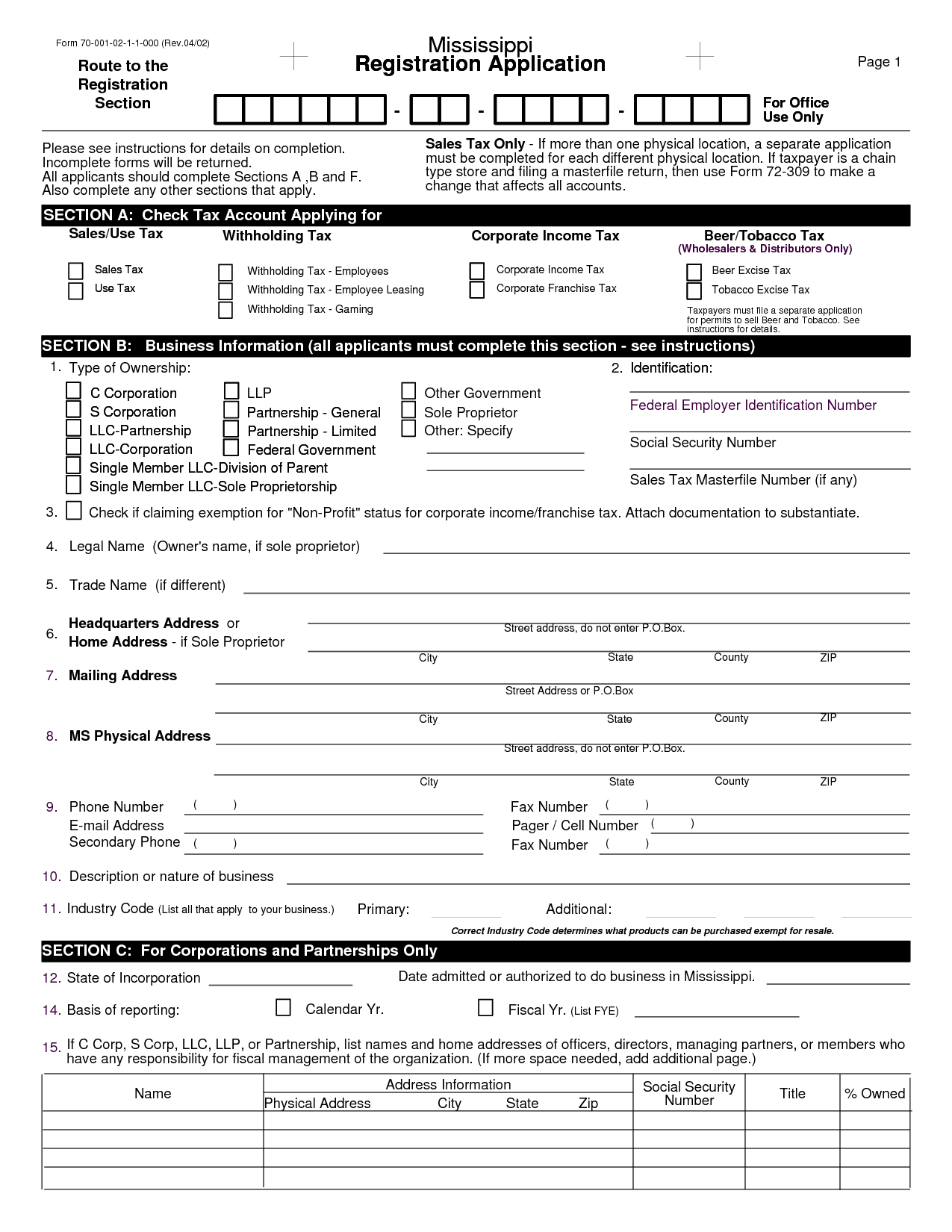

What is the purpose of the Mississippi Sales Tax Worksheet?

The purpose of the Mississippi Sales Tax Worksheet is to help individuals and businesses in Mississippi calculate and report their sales tax liability. It serves as a tool to determine the correct amount of sales tax that needs to be remitted to the Mississippi Department of Revenue based on the total amount of taxable sales made during a specific period.

How is the sales tax rate in Mississippi determined?

The sales tax rate in Mississippi is determined by a combination of state and local sales tax rates. The state sets a base sales tax rate, currently at 7%, and then local municipalities have the option to add on their own sales tax rates on top of the state rate. The total sales tax rate paid by consumers in Mississippi is a combination of the state and local rates.

What types of sales are subject to sales tax in Mississippi?

In Mississippi, sales tax is generally imposed on tangible personal property sold at retail, digital property, and certain services. Retail sales of tangible personal property include items such as clothing, furniture, electronics, and groceries. Digital property encompasses items such as software, music downloads, and e-books. Additionally, specific services subject to sales tax include admissions to entertainment events, rentals of tangible personal property, and certain repairs and installations.

Are there any items or services that are exempt from sales tax in Mississippi?

Yes, in Mississippi, certain items are exempt from sales tax, such as groceries, prescription medications, and most clothing items. Additionally, certain services like healthcare services and educational services are also typically exempt from sales tax in the state. However, it is advised to check with the Mississippi Department of Revenue or a tax professional to get the most up-to-date and accurate information on sales tax exemptions in the state.

How often are businesses in Mississippi required to remit sales tax?

Businesses in Mississippi are required to remit sales tax on a monthly basis.

Can businesses in Mississippi claim any deductions or credits on their sales tax worksheet?

Yes, businesses in Mississippi can claim certain deductions and credits on their sales tax worksheet. Some common deductions and credits include the bad debt deduction, timely filing credit, and agricultural credit. It is important for businesses to carefully review the Mississippi Department of Revenue guidelines and consult with a tax professional to ensure they are maximizing their deductions and credits on their sales tax worksheet.

Are there any specific guidelines or instructions for completing the Mississippi Sales Tax Worksheet?

Yes, there are specific guidelines for completing the Mississippi Sales Tax Worksheet. You should carefully follow the instructions provided by the Mississippi Department of Revenue, including entering accurate sales amounts, exempt sales, and taxable sales, as well as applying the correct tax rates. It is important to double-check your calculations and ensure all necessary information is included to accurately report and remit sales tax.

Do businesses need to keep records of their sales transactions for the purpose of completing the worksheet?

Yes, businesses need to keep records of their sales transactions for the purpose of completing the worksheet. This is necessary for accurately tracking and documenting revenue and expenses, which are essential for preparing financial statements and assessing the overall financial health of the business. Keeping detailed records of sales transactions also helps in monitoring cash flow, identifying trends, and making strategic business decisions.

What happens if a business in Mississippi fails to remit the correct amount of sales tax?

If a business in Mississippi fails to remit the correct amount of sales tax, it could face penalties and fines imposed by the Mississippi Department of Revenue. This may include late fees, interest charges, and possibly even legal action. It's important for businesses to accurately report and remit sales tax to avoid potential financial consequences and maintain compliance with state tax regulations.

Is there any assistance available for businesses in Mississippi that need help with their sales tax filing?

Yes, businesses in Mississippi can seek assistance with their sales tax filing through the Mississippi Department of Revenue. The department offers various resources, including online filing options, guides, tutorials, and a taxpayer education program to help businesses understand and comply with sales tax laws. Additionally, businesses can reach out to the department's taxpayer services hotline for further assistance and guidance with their sales tax filings.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments