Keeping a Check Register Worksheets

Check registers are an essential tool for anyone looking to maintain accurate financial records. Whether you are a small business owner managing your expenses or an individual tracking your personal finances, check register worksheets provide a clear and organized way to monitor your spending and keep track of your account balances. By providing a comprehensive overview of your transactions and allowing for easy reconciliation, these worksheets are an indispensable entity for anyone seeking to maintain financial stability and clarity.

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a check register worksheet?

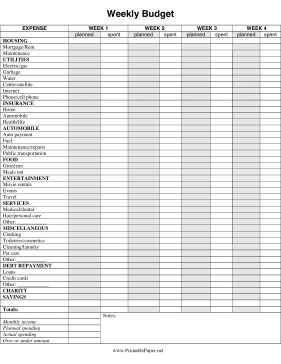

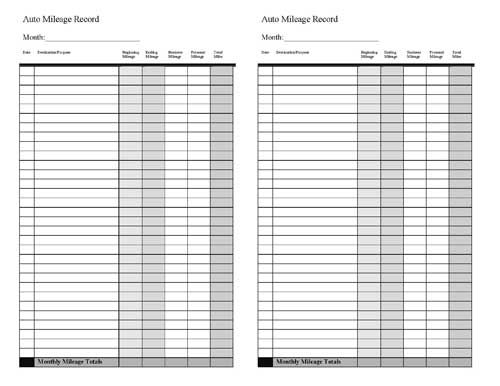

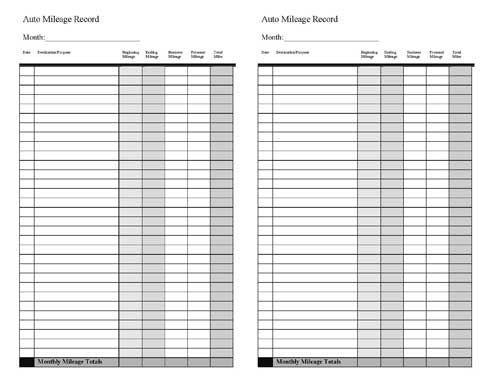

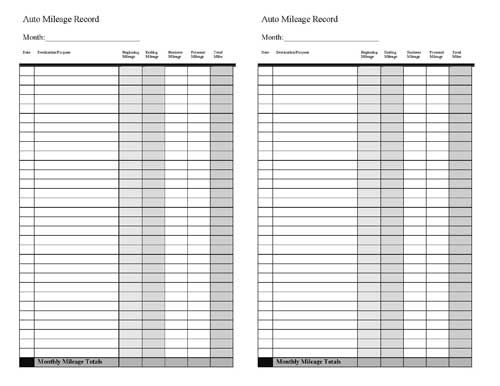

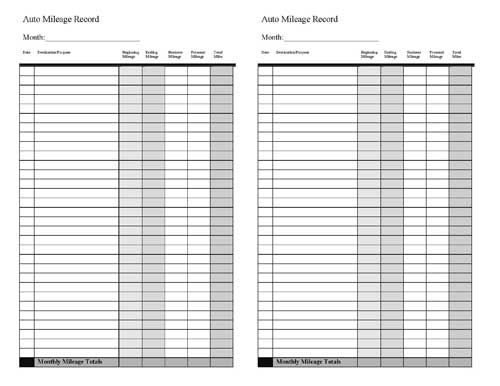

A check register worksheet is a document used to track and manage transactions made through a checking account. It typically includes columns to record the date, description of the transaction, check number, debit or credit amount, and the running balance of the account. This worksheet helps individuals to monitor their spending, reconcile their account with their bank statement, and identify any discrepancies or errors in their financial records.

Why is it important to keep track of transactions in a check register?

Keeping track of transactions in a check register is important because it helps you maintain an accurate record of your finances, ensuring that you know exactly how much money you have available in your account at any given time. By recording all transactions, including deposits and withdrawals, you can avoid overspending, prevent overdrafts, identify any discrepancies, and easily track your expenses for budgeting purposes. Additionally, having a detailed record of transactions can help you identify any fraudulent activity on your account and protect yourself from financial loss.

How do you record deposits in a check register worksheet?

To record deposits in a check register worksheet, you should enter the date of the deposit, the source or description of the deposit (such as the name of the payer or reason for the deposit), and the amount of the deposit. Make sure to categorize the deposit as a credit to your account balance and include any relevant check or transaction numbers for reference. Keep a running total of your account balance by adding the deposit amount to the previous balance to accurately track your financial transactions.

What information should be included when recording a check in the register?

When recording a check in the register, you should include the check number, the date the check was written, the payee (who the check is made out to), the amount of the check, and a memo indicating the purpose of the payment. Additionally, you should deduct the amount of the check from the account balance to keep an accurate record of your finances.

How do you calculate the current balance in a check register?

To calculate the current balance in a check register, you start with the previous balance and then add any deposits made, subtract any checks written, fees or other withdrawals. This will give you the new current balance that reflects all recent transactions and adjustments you have made in the register.

Why is it necessary to reconcile the check register with bank statements?

It is necessary to reconcile the check register with bank statements to ensure that all transactions recorded in the register match the ones processed by the bank. This process helps identify discrepancies, errors, or fraudulent activities, allows the correction of mistakes, ensures accurate financial records, and helps in monitoring cash flow and budgeting effectively. By reconciling the two, you can avoid overdrafts, minimize risks, and maintain the integrity of your financial records.

What are the benefits of using a check register worksheet?

A check register worksheet helps in tracking and managing finances by providing a clear record of transactions, including checks written, deposits made, and account balances. It helps monitor spending, prevent overdrafts, identify errors, reconcile accounts, and budget effectively. Additionally, it serves as a backup documentation for financial records and assists in detecting any fraudulent activities or discrepancies in the account. Overall, a check register worksheet is a valuable tool for maintaining financial organization and control.

How often should you update your check register?

It is recommended to update your check register frequently, ideally daily or every time you make a transaction. This practice helps you keep an accurate record of your finances, monitor your spending, and avoid overdrawing your account. Regularly updating your check register ensures that you have an up-to-date understanding of your current financial situation.

How can using a check register worksheet help with budgeting and financial planning?

A check register worksheet can help with budgeting and financial planning by providing a detailed and organized record of income and expenses. By tracking all transactions in one place, individuals can easily monitor their cash flow, identify spending patterns, and establish a clear picture of their financial standings. This information can then be used to create budgets, set financial goals, and make informed decisions on managing expenses and saving for the future.

Are there any tips or best practices for effectively maintaining a check register worksheet?

Some tips for effectively maintaining a check register worksheet include consistently recording transactions as they occur, reconciling the register with bank statements regularly to catch any discrepancies, organizing transactions by category for easier tracking and budgeting, and ensuring accuracy by double-checking entries. Additionally, it's helpful to use software or templates to streamline the process and make it easier to update and maintain the register.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments