IRS Itemized Deductions Worksheet

The IRS Itemized Deductions Worksheet is a helpful tool for individuals who are looking to maximize their deductions when filing their taxes. By providing a detailed breakdown of various deductible expenses, this worksheet allows taxpayers to accurately calculate their itemized deductions and potentially lower their overall tax liability. Whether you are a homeowner, a small business owner, or someone with significant medical expenses, understanding how to properly utilize this worksheet can make a significant difference in your annual tax return.

Table of Images 👆

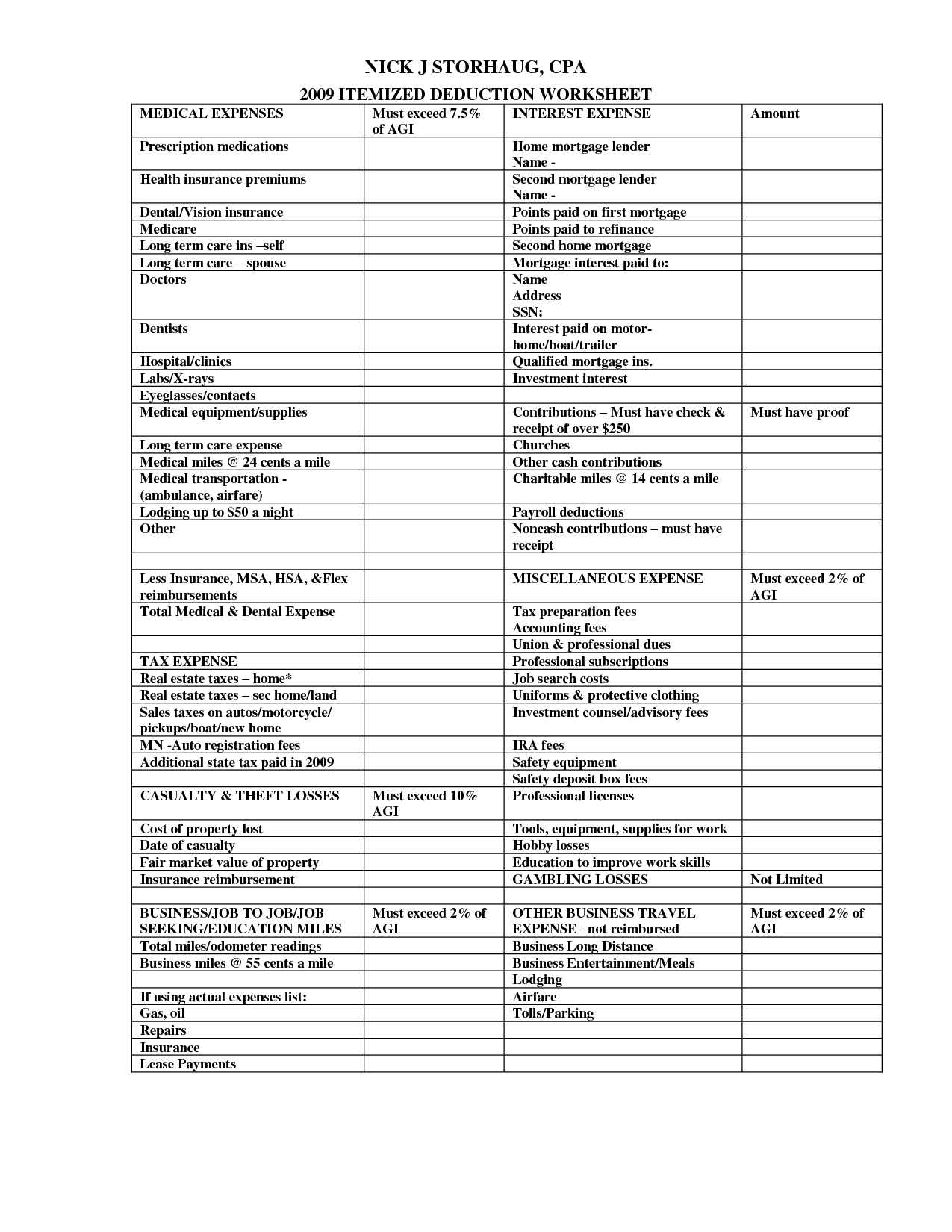

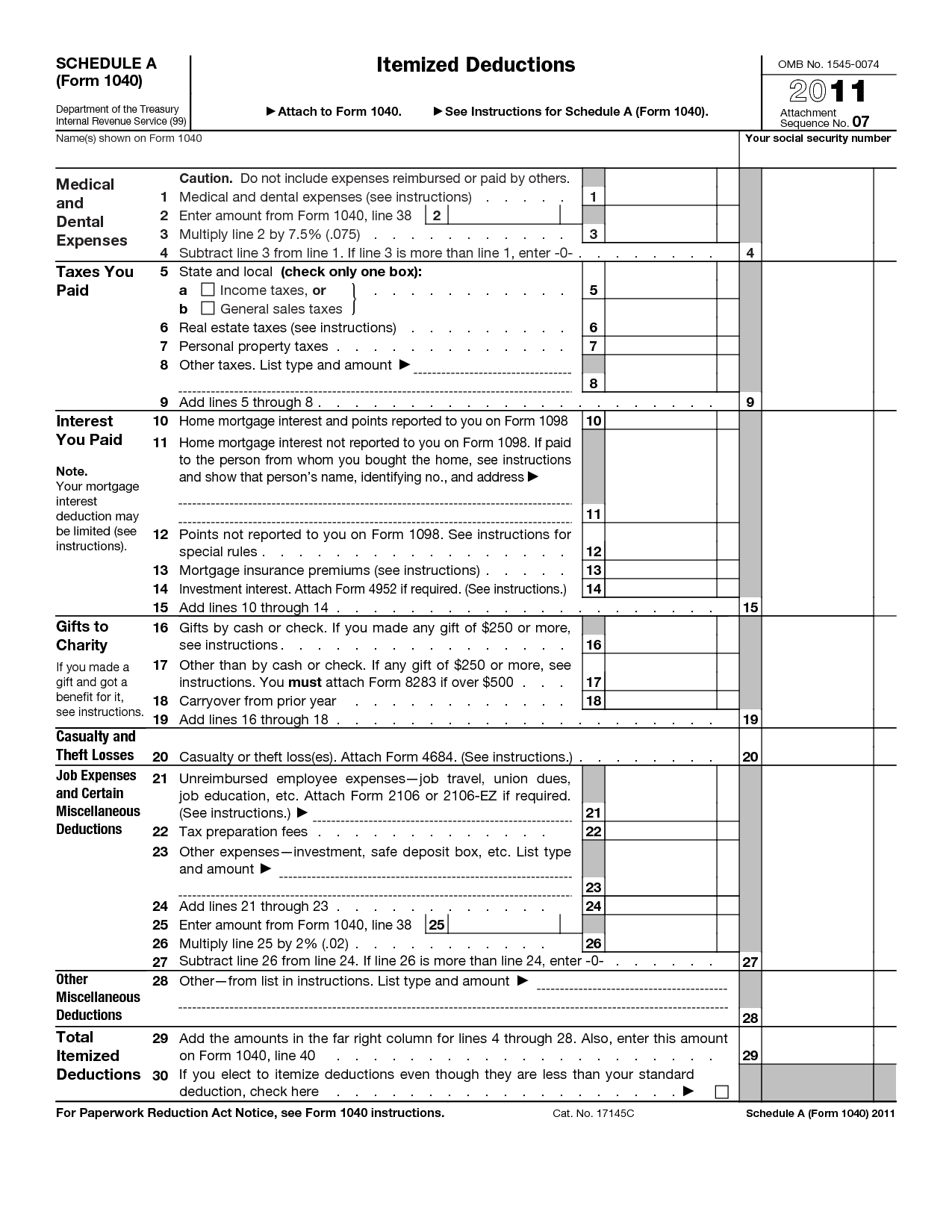

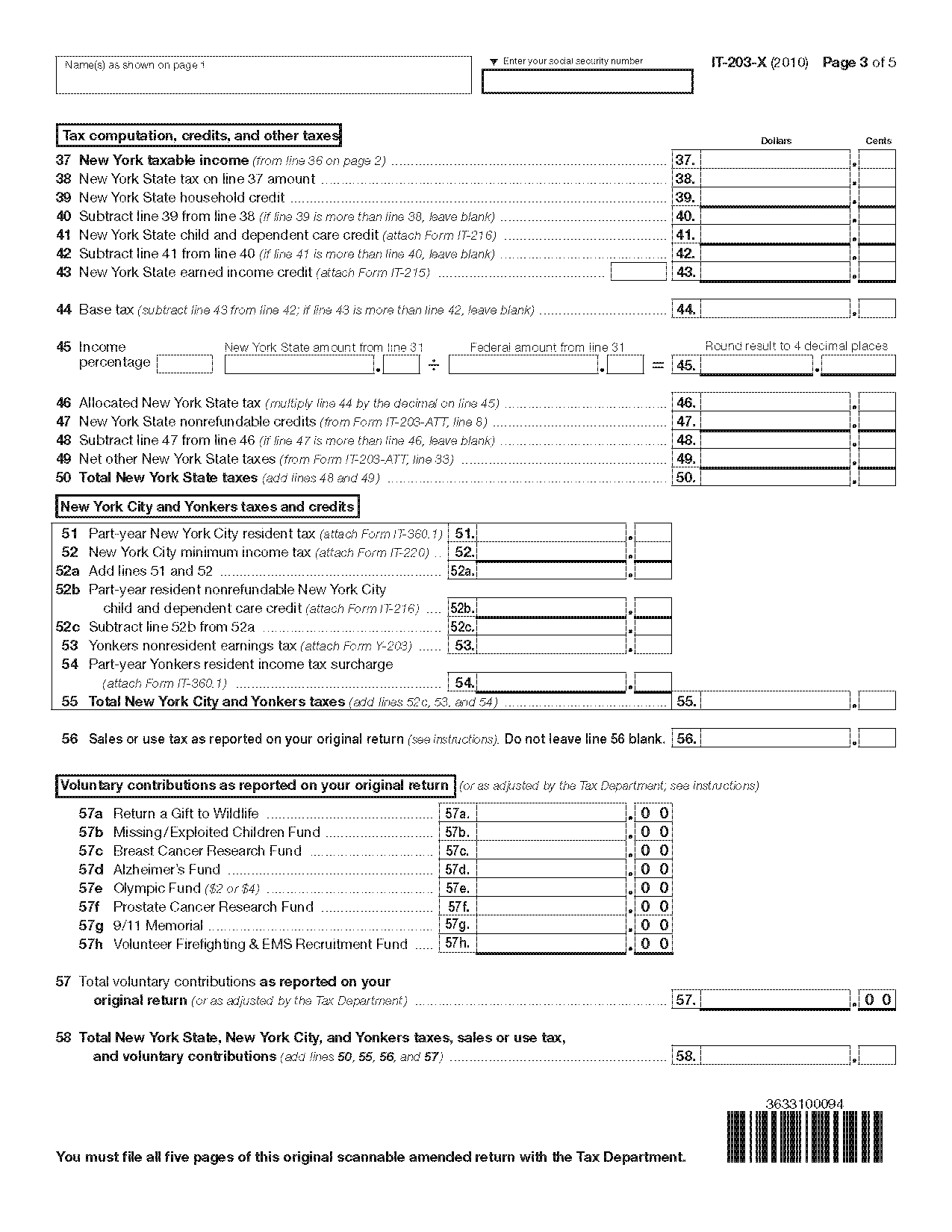

- Tax Itemized Deduction Worksheet

- 2015 Itemized Tax Deduction Worksheet Printable

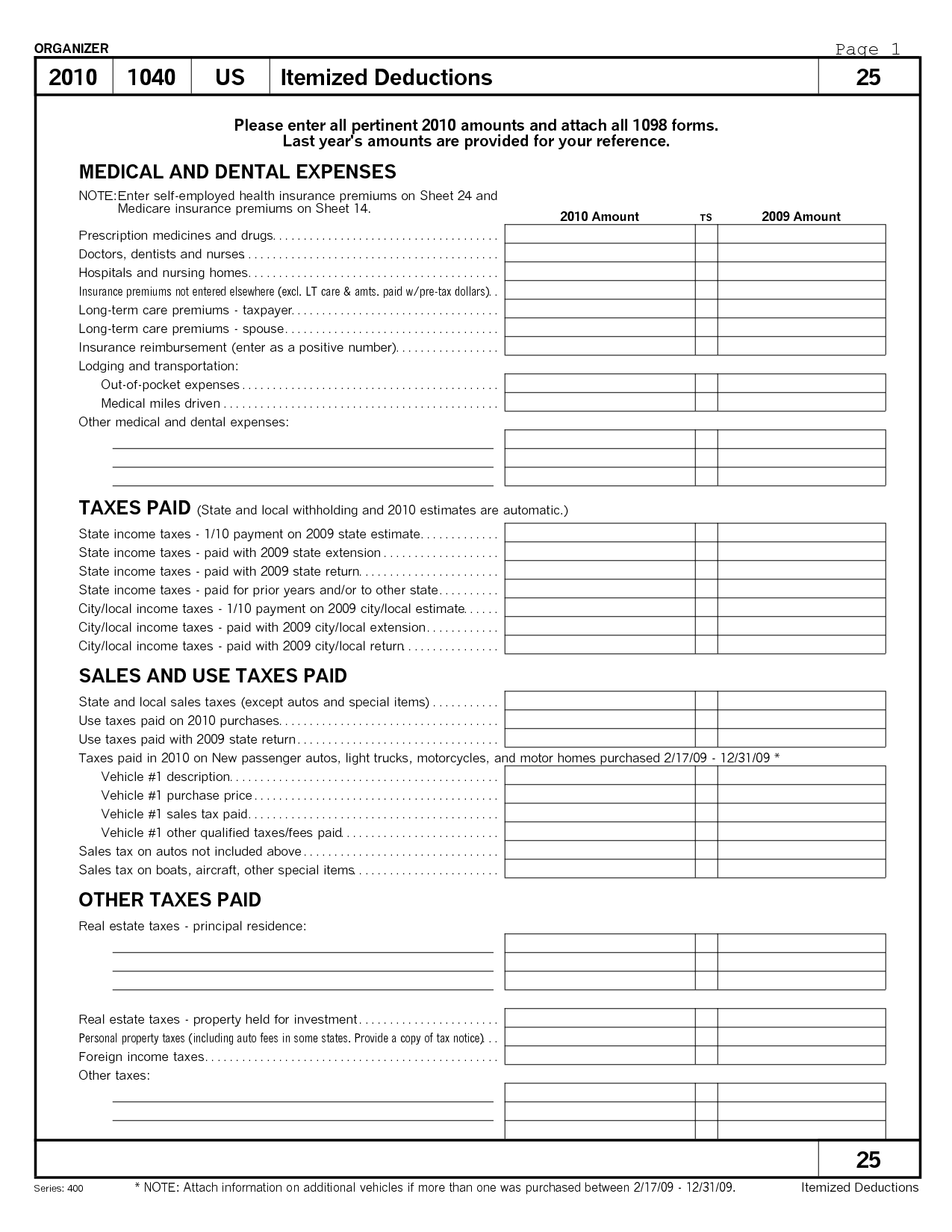

- IRS Itemized Deduction Worksheet Form 2015

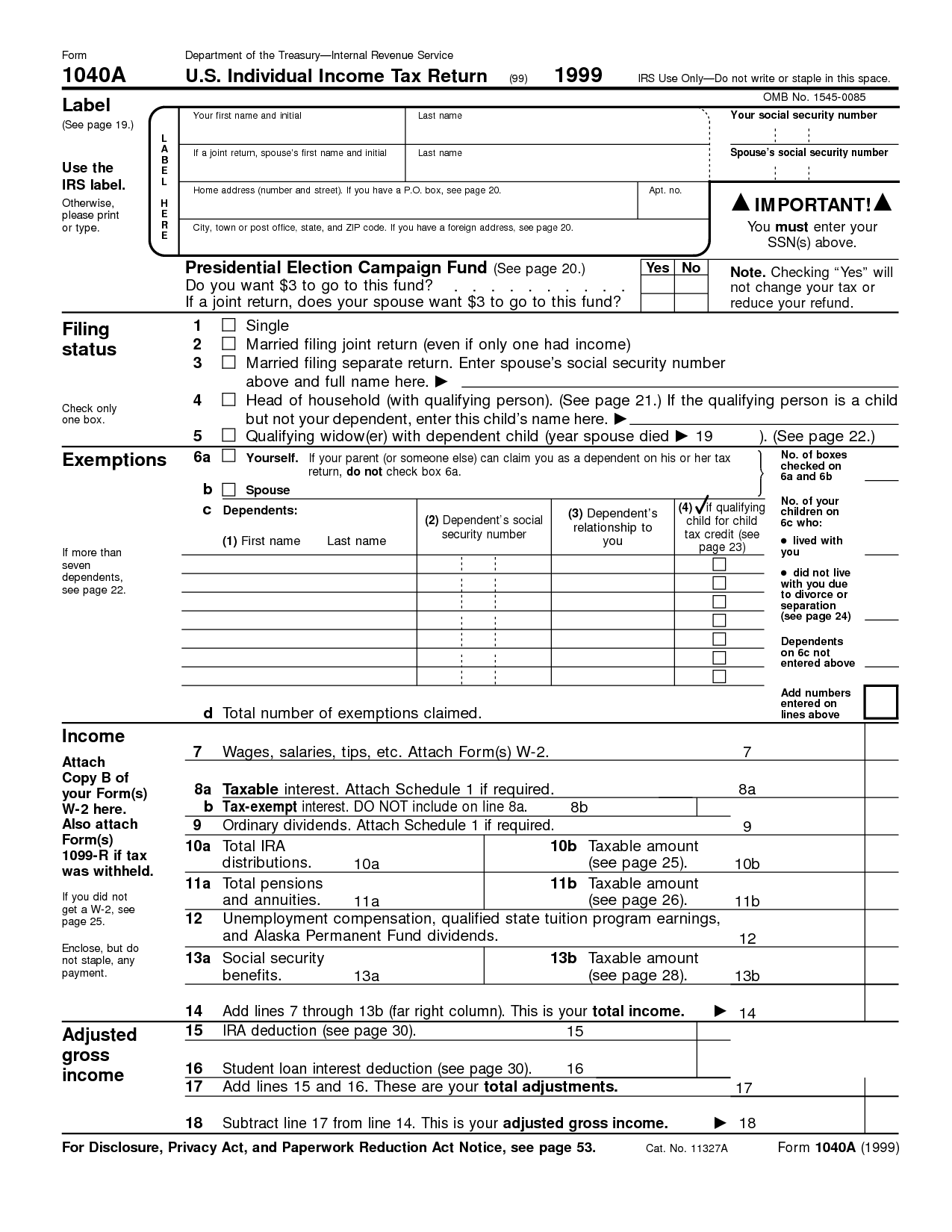

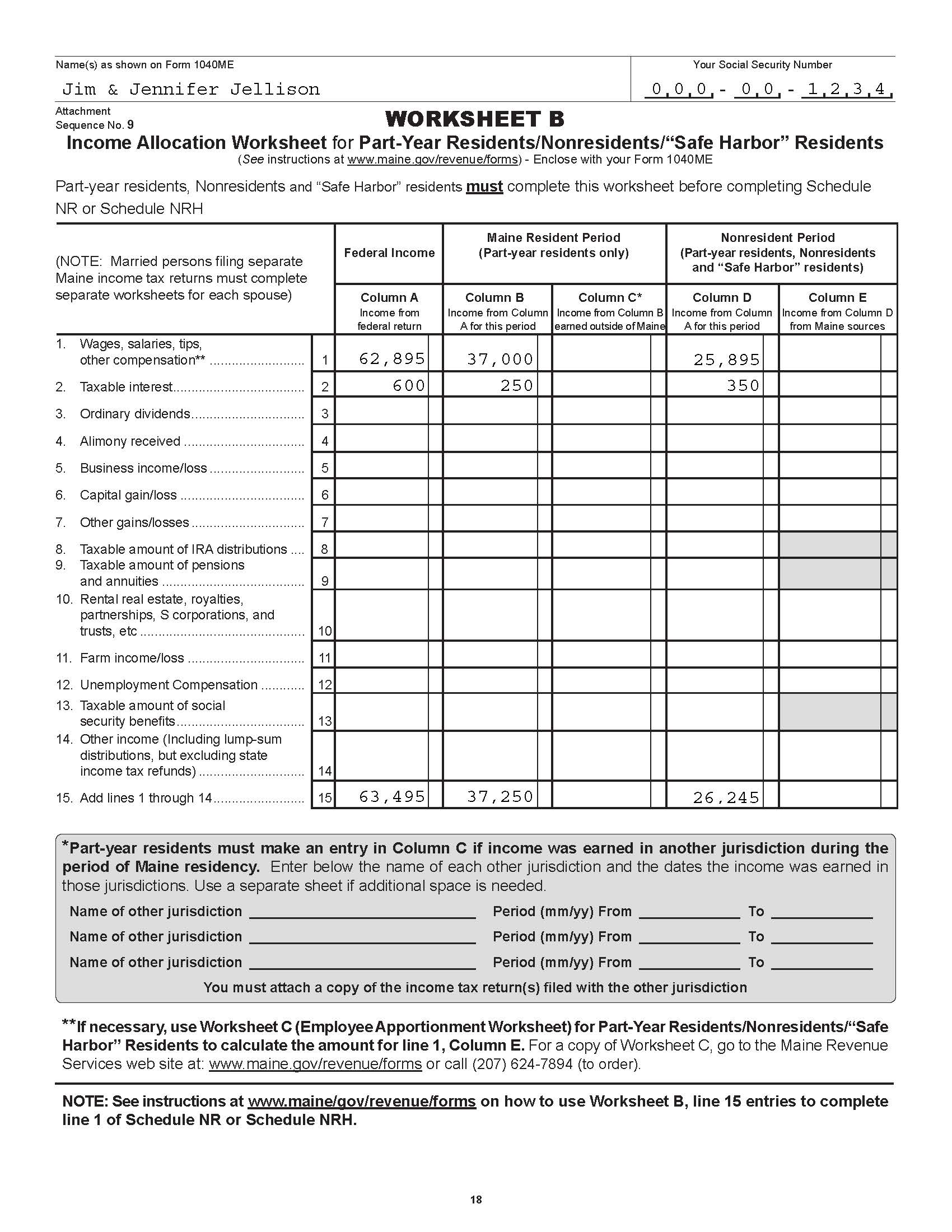

- Federal Income Tax Deduction Worksheet

- 1040 Forms Itemized Deductions Worksheet 2015

- Itemized Deductions Worksheet

- List Itemized Tax Deductions Worksheet

- Printable Itemized Tax Deduction Worksheet

- IRS Form 1040 Itemized Deductions

- 1040 Itemized Deductions Worksheet

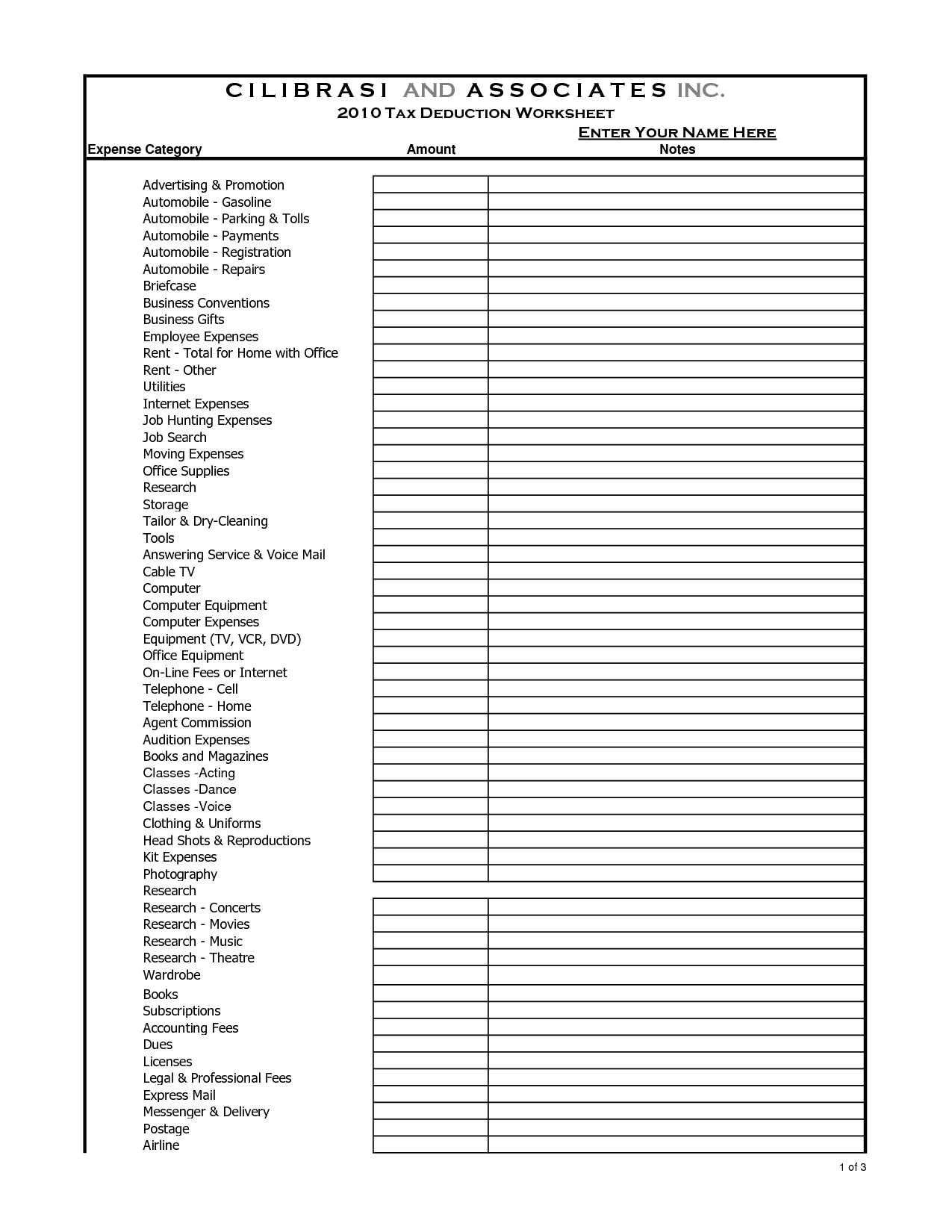

- Tax Deduction Worksheet

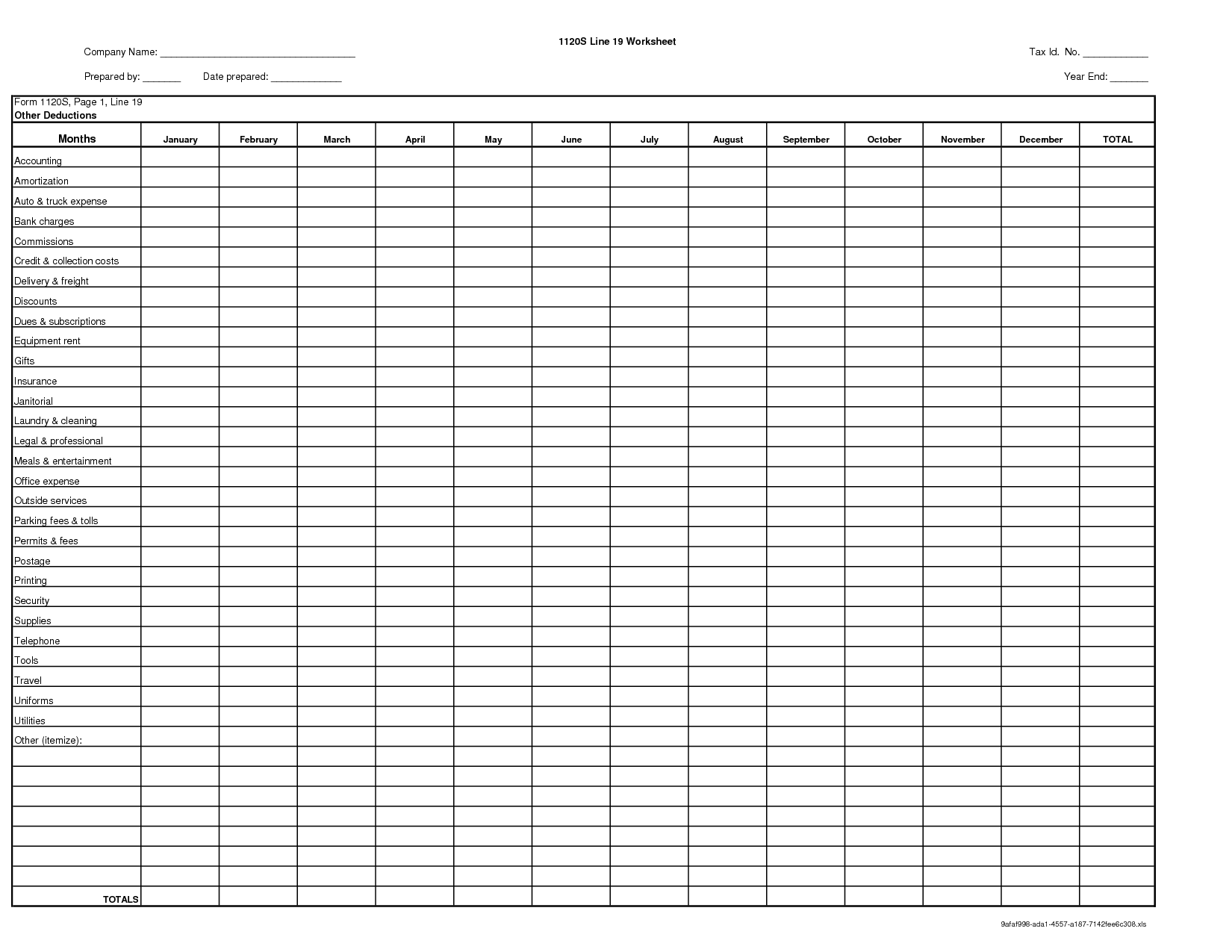

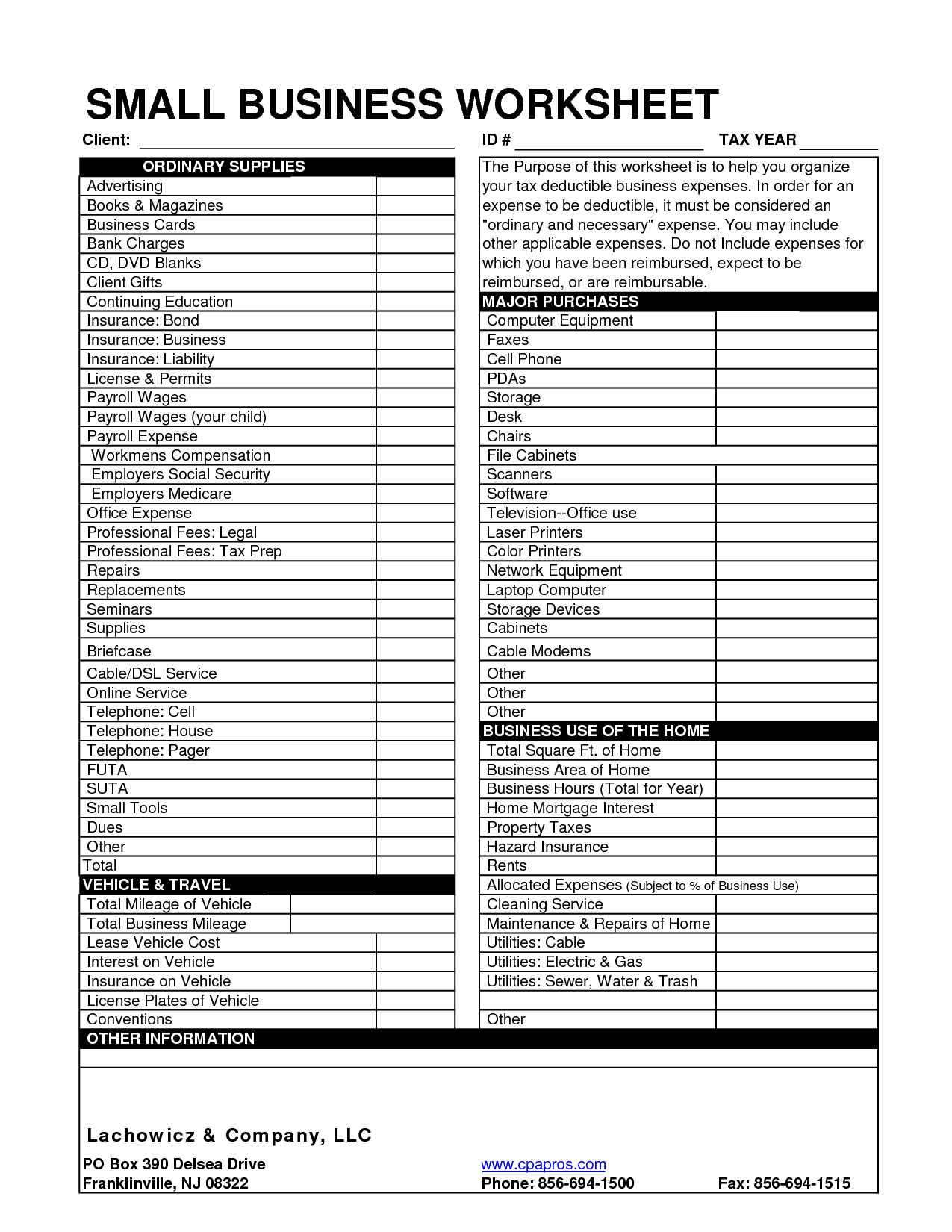

- Business Tax Deductions Worksheet

- 2014 Itemized Deductions Worksheet

- Small Business Tax Deduction Worksheet

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

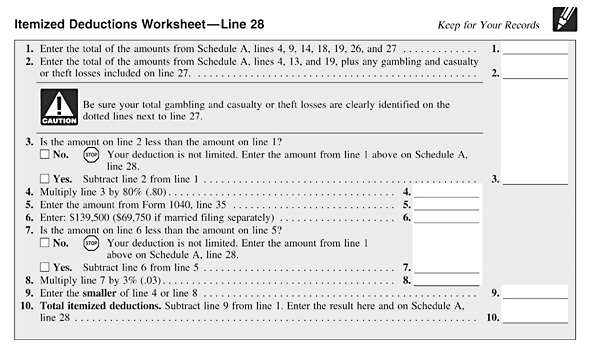

What is the purpose of the IRS Itemized Deductions Worksheet?

The purpose of the IRS Itemized Deductions Worksheet is to help taxpayers calculate their total itemized deductions, such as mortgage interest, medical expenses, and charitable contributions, which can be used to reduce taxable income and potentially lower the amount of taxes owed. It guides taxpayers through the process of determining which expenses qualify as itemized deductions and assists them in calculating the total amount to report on their tax return.

How can the IRS Itemized Deductions Worksheet help in reducing taxable income?

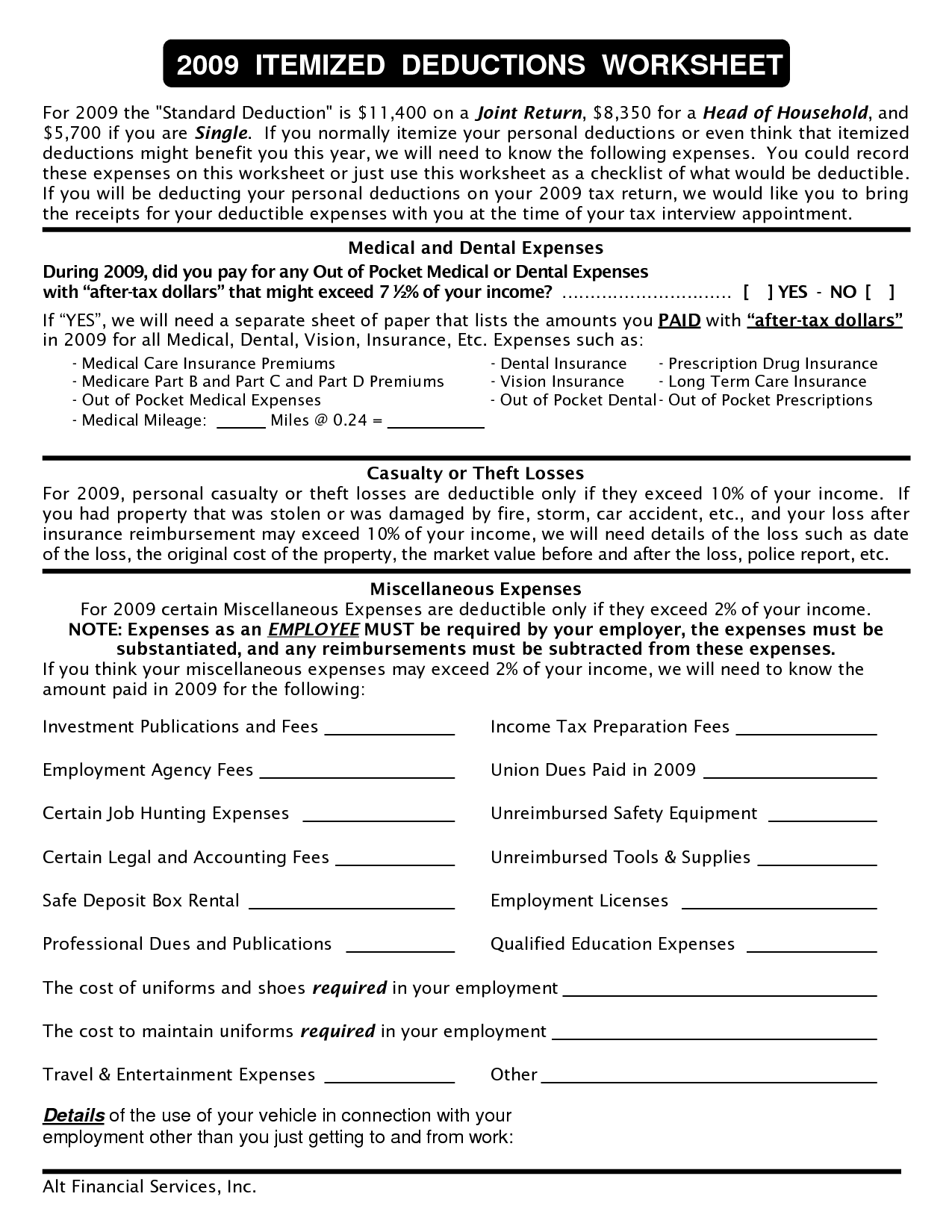

The IRS Itemized Deductions Worksheet can help in reducing taxable income by allowing taxpayers to deduct certain expenses, such as medical expenses, mortgage interest, charitable contributions, and state and local taxes, from their gross income. By listing out and calculating these expenses on the worksheet, taxpayers can determine whether it is more beneficial to itemize deductions rather than take the standard deduction, potentially reducing their taxable income and overall tax liability.

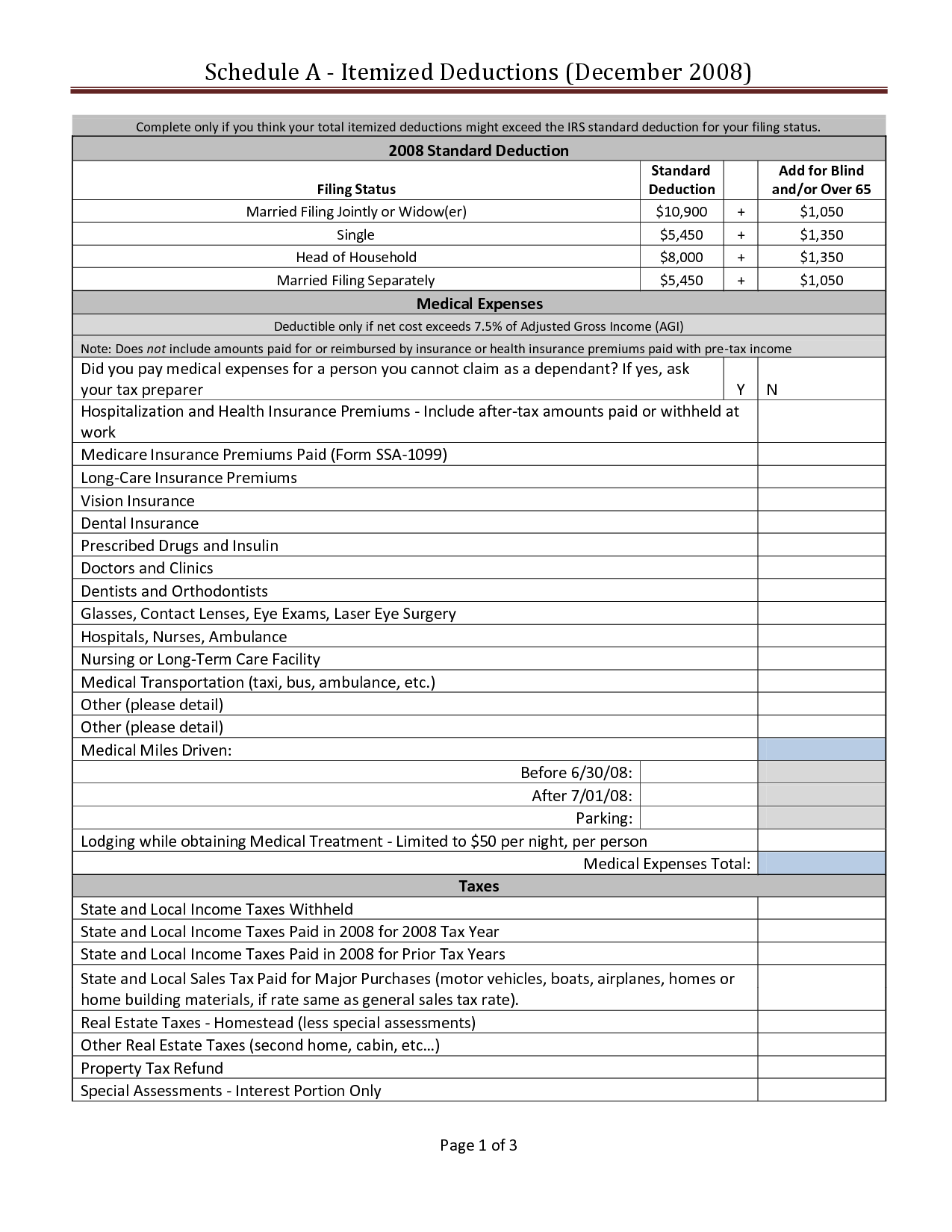

What specific expenses can be itemized using this worksheet?

The worksheet can be used to itemize various expenses, including medical expenses, state and local taxes, mortgage interest, charitable contributions, and business expenses. These specific expenses can be detailed in the worksheet to potentially qualify for tax deductions and credits.

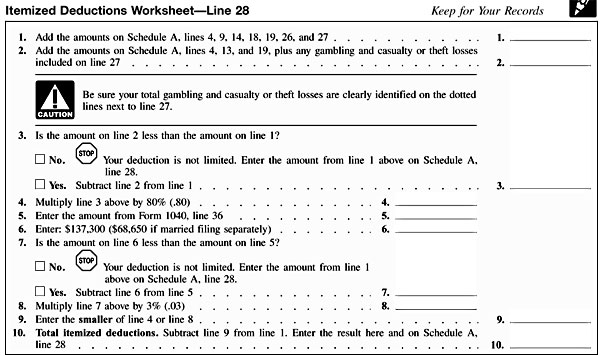

How does the worksheet calculate the total amount of itemized deductions?

The worksheet calculates the total amount of itemized deductions by adding up the individual amounts of deductible expenses such as mortgage interest, property taxes, medical expenses, and charitable contributions. These amounts are then subtracted from the taxpayer's adjusted gross income to determine their taxable income.

Can the worksheet be used for both federal and state tax deductions?

No, the worksheet typically used to calculate deductions is specific to either federal or state taxes, as tax laws and regulations vary between the two levels of government. Separate worksheets are usually provided for federal and state deductions to accurately calculate the amount owed or refunded for each.

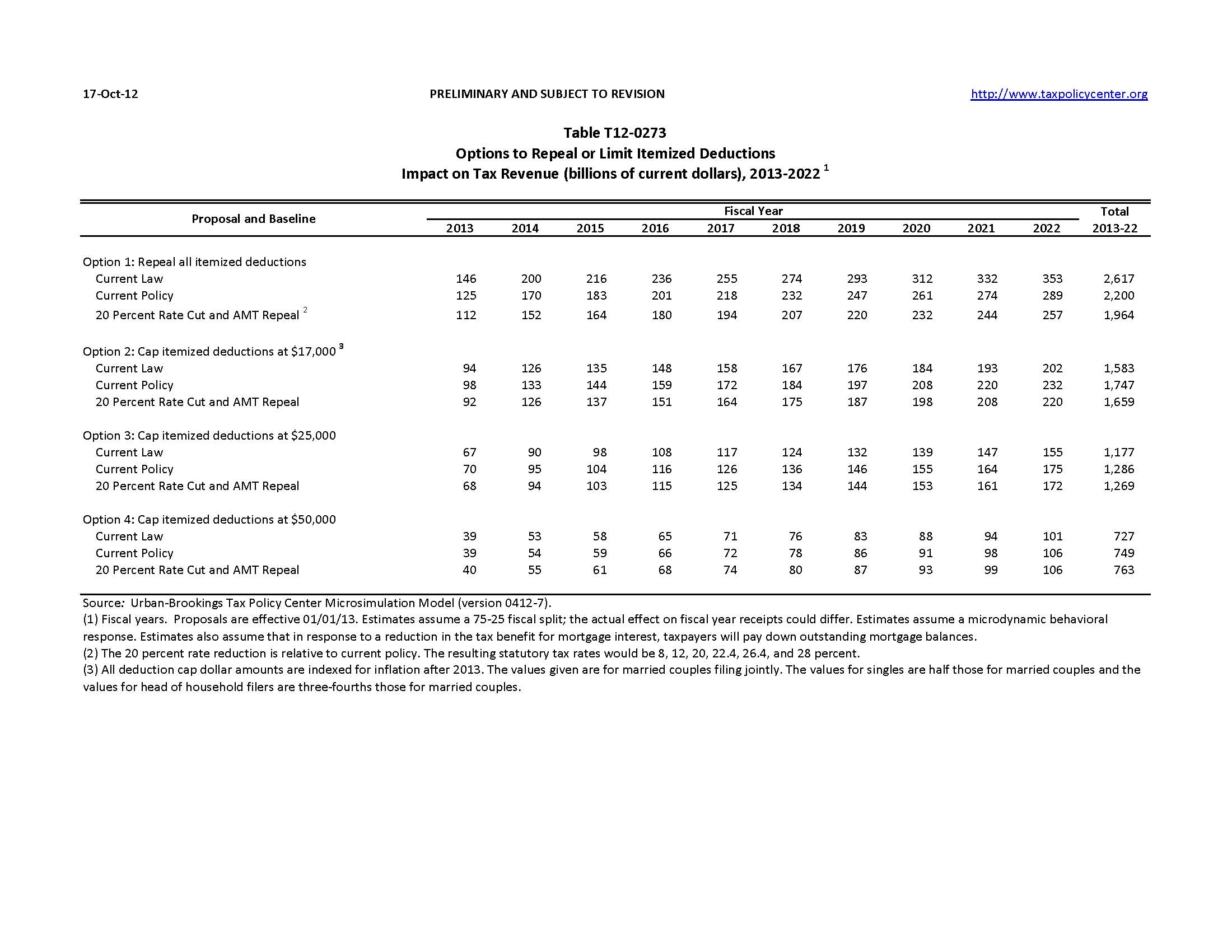

Are there any income limits or restrictions for using the IRS Itemized Deductions Worksheet?

There are no specific income limits or restrictions for using the IRS Itemized Deductions Worksheet. However, in order to benefit from itemizing deductions, your total itemized deductions must exceed the standard deduction amount set by the IRS for the tax year you are filing. It's important to carefully review the qualification requirements and guidelines provided by the IRS to determine if itemizing deductions is the best option for your tax situation.

What documentation or proof is required to support the itemized deductions?

Documentation or proof required to support itemized deductions typically includes receipts, invoices, canceled checks, bank statements, credit card statements, and any other records that show the expenses incurred. It is important to keep accurate and detailed records to substantiate the deductions claimed on your tax return in case of an audit by the IRS.

Does the worksheet differentiate between deductible and non-deductible expenses?

Yes, the worksheet does differentiate between deductible and non-deductible expenses. It helps you track and categorize your expenses accordingly, making it easier for you to identify which expenses can be deducted for tax purposes.

How does the worksheet account for different filing statuses or dependents?

The worksheet typically incorporates different tax filing statuses and dependents by including specific sections or questions that prompt the taxpayer to provide relevant information such as marital status, number of dependents, and any specific circumstances like filing as head of household or claiming certain tax credits or deductions. By gathering this information, the worksheet can calculate the appropriate tax deductions, credits, and liabilities based on the taxpayer's specific situation and ensure an accurate filing process.

Are there any changes or updates to the IRS Itemized Deductions Worksheet each year?

Yes, the IRS Itemized Deductions Worksheet may be updated each year to reflect changes in tax laws, regulations, and forms. It is important to use the most current version of the worksheet provided by the IRS to ensure accurate calculations and eligibility for deductions. Taxpayers should consult the IRS website or a tax professional for the latest information on itemized deductions and related worksheets.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments