IRS Federal Worksheets

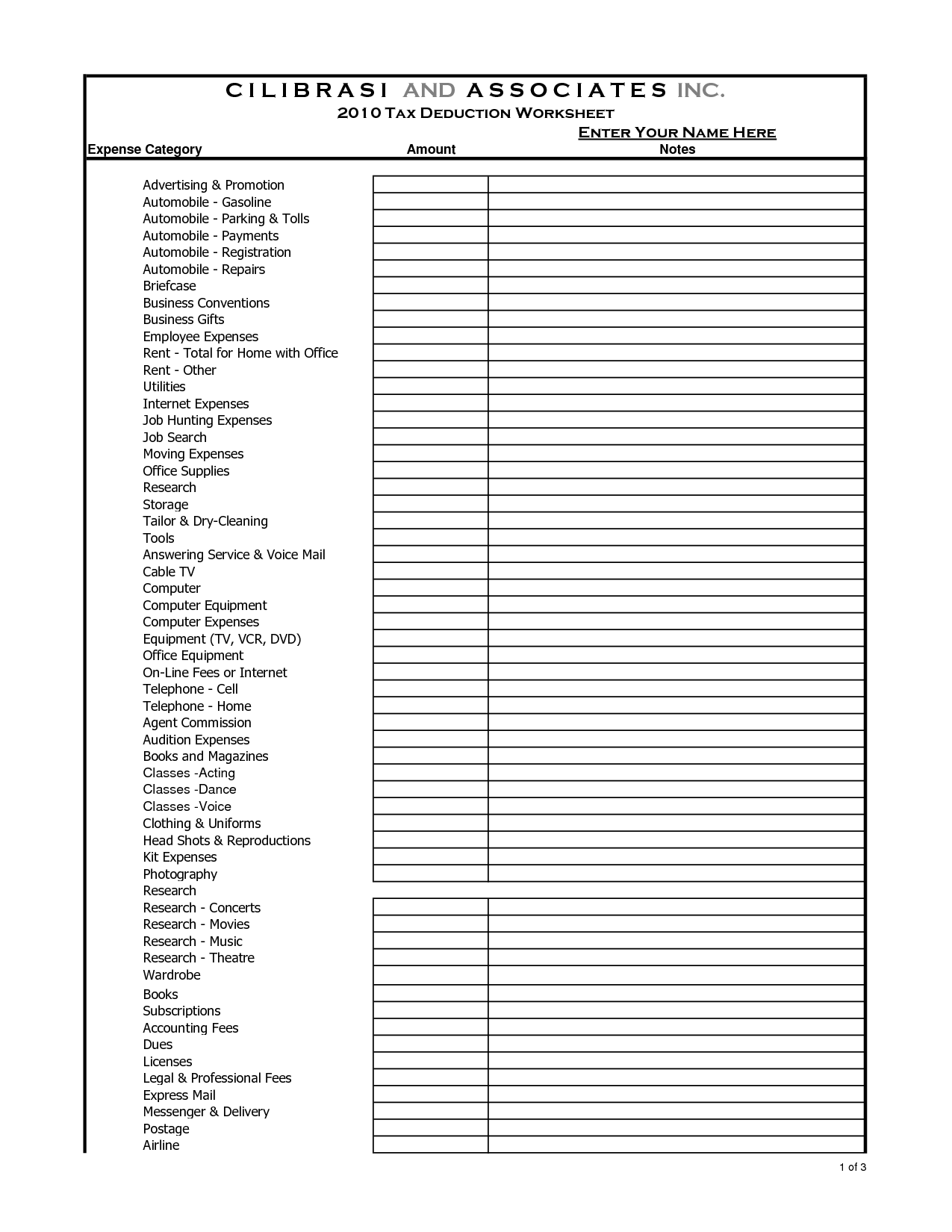

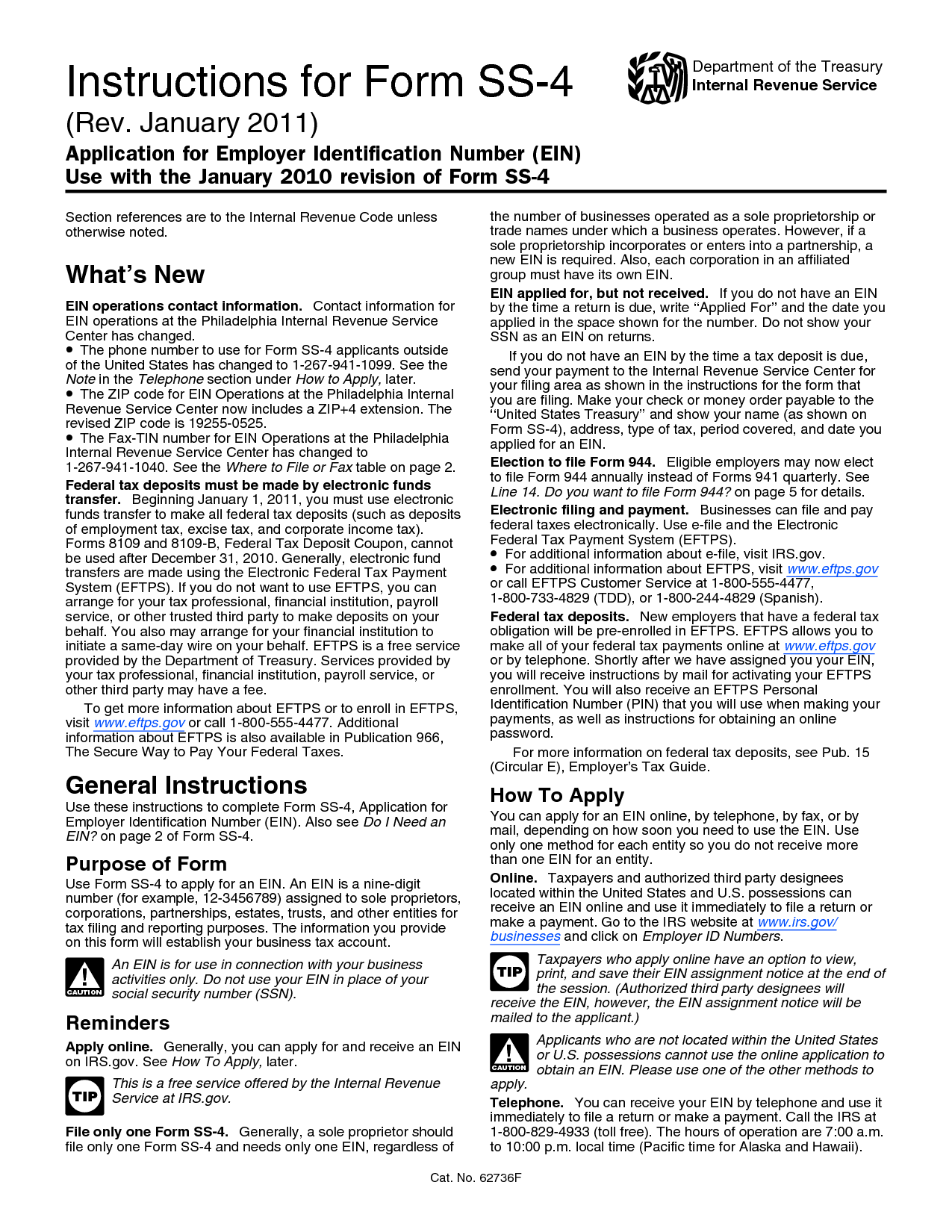

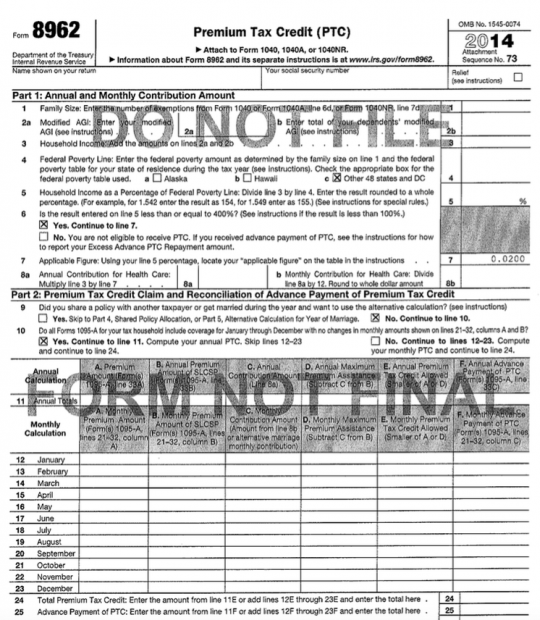

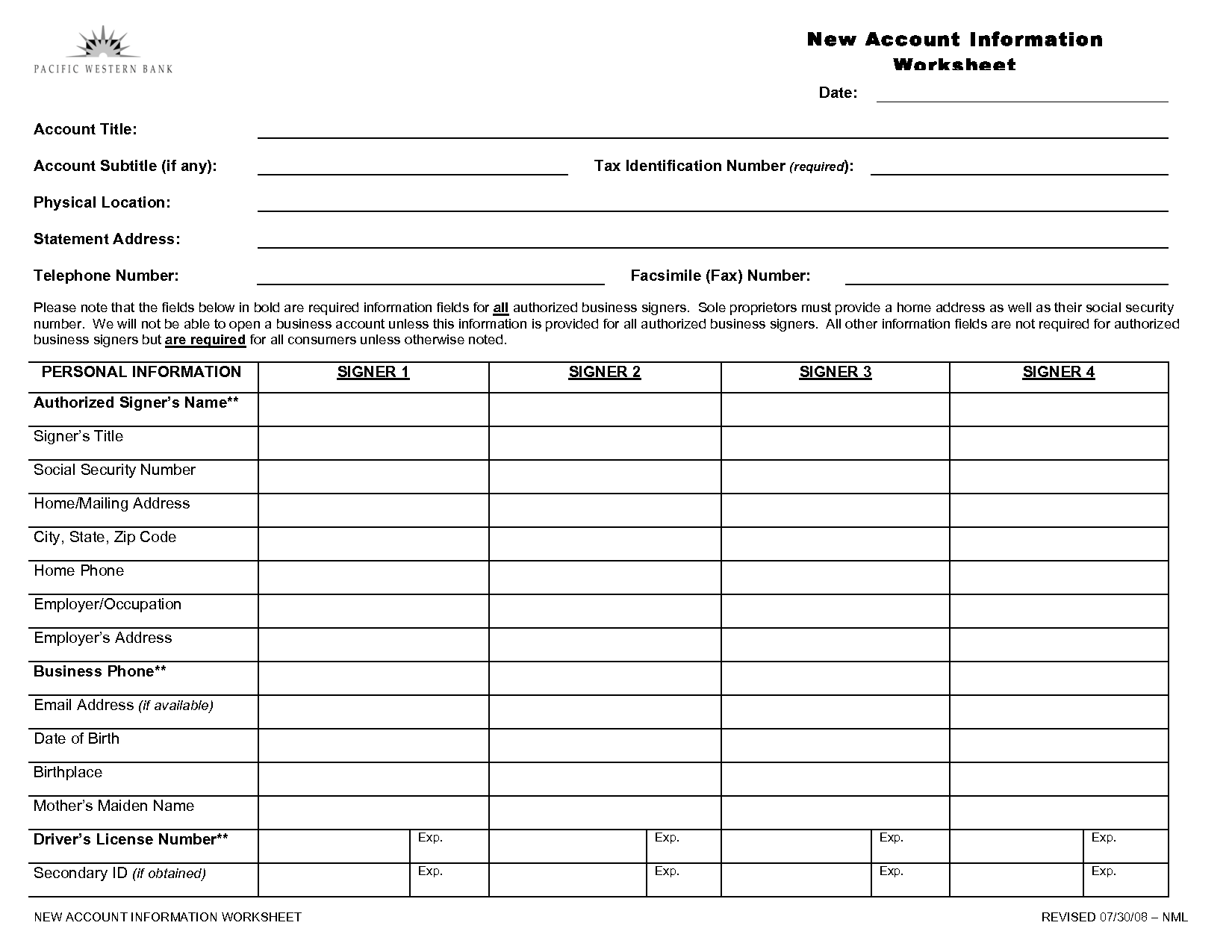

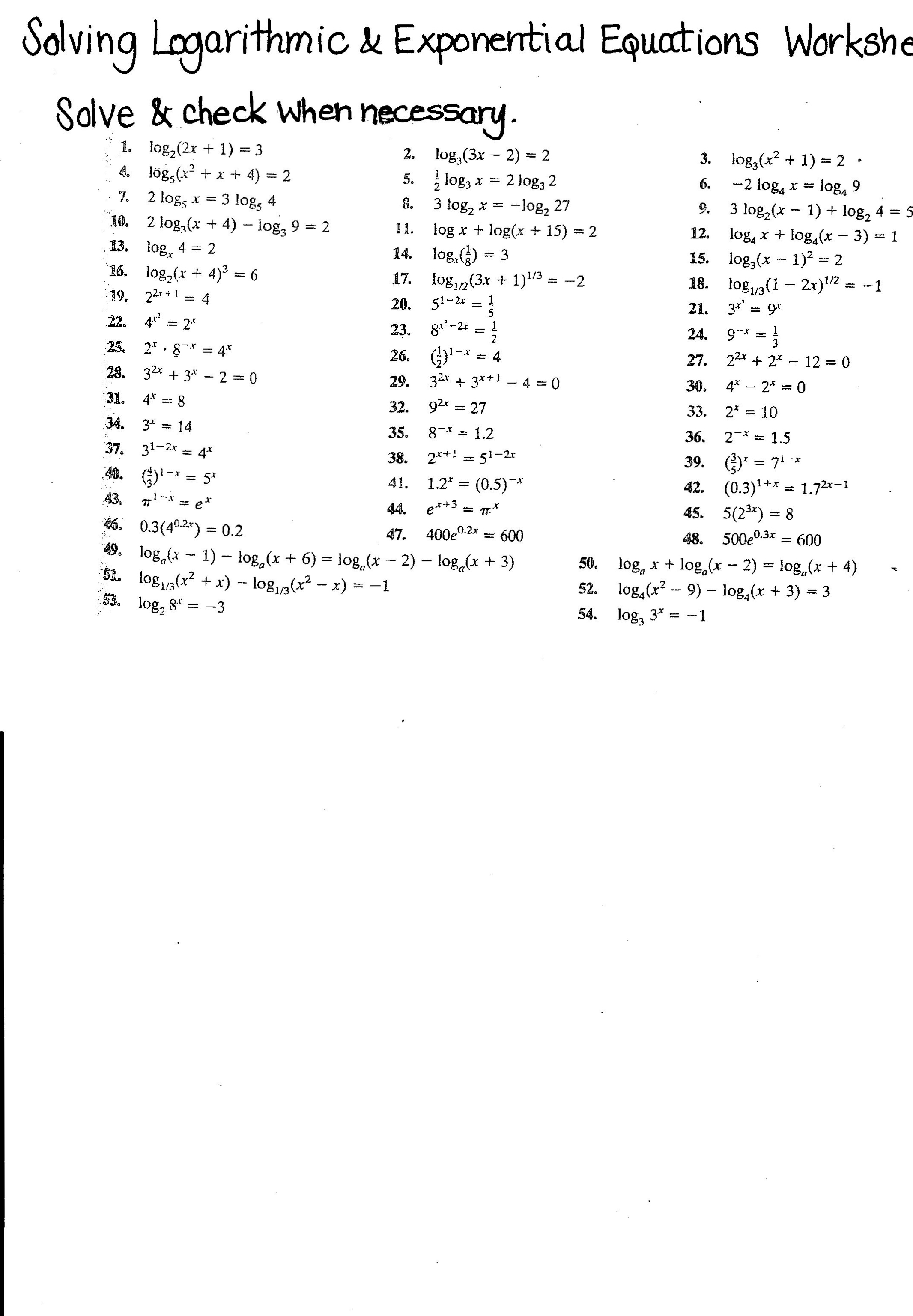

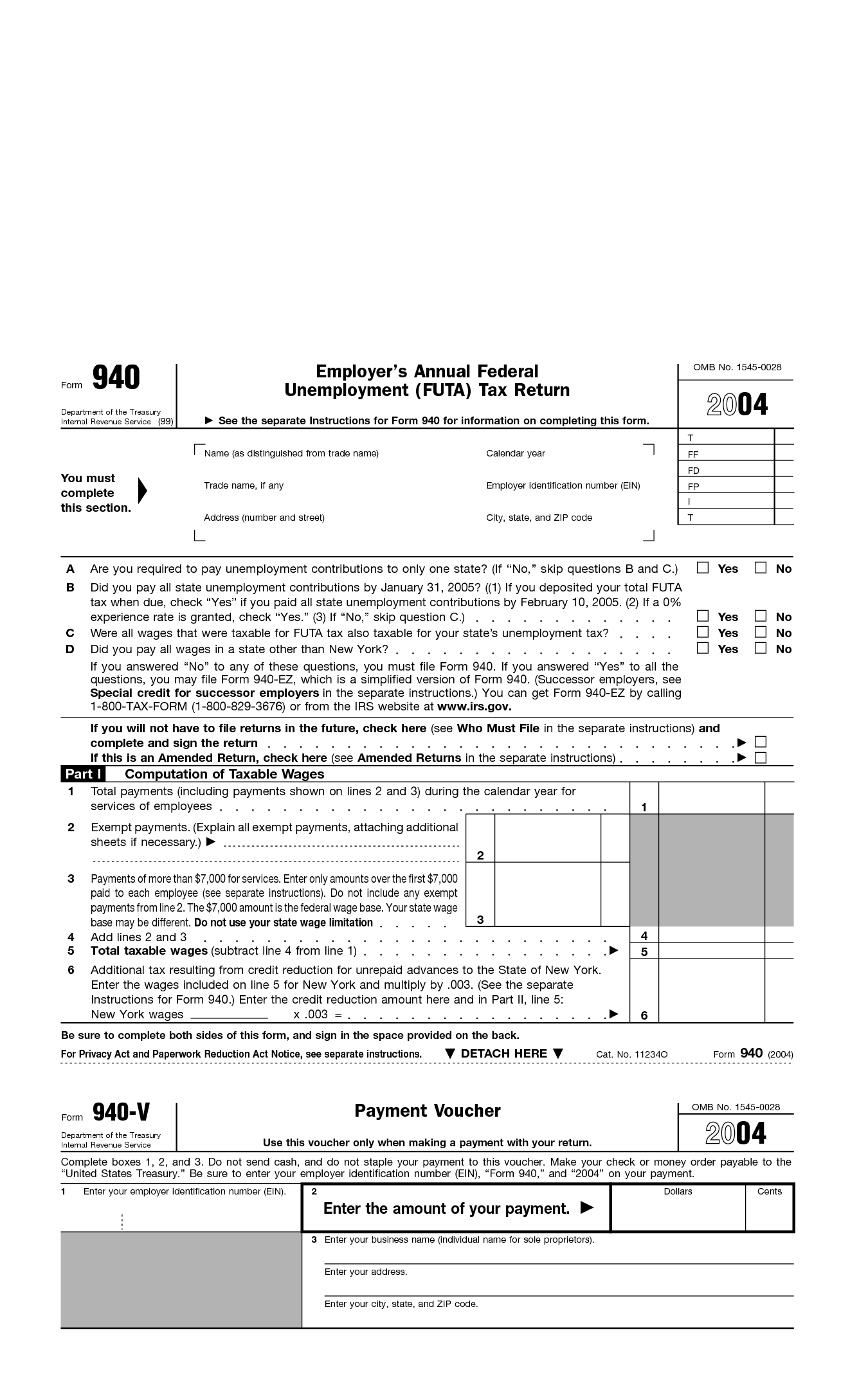

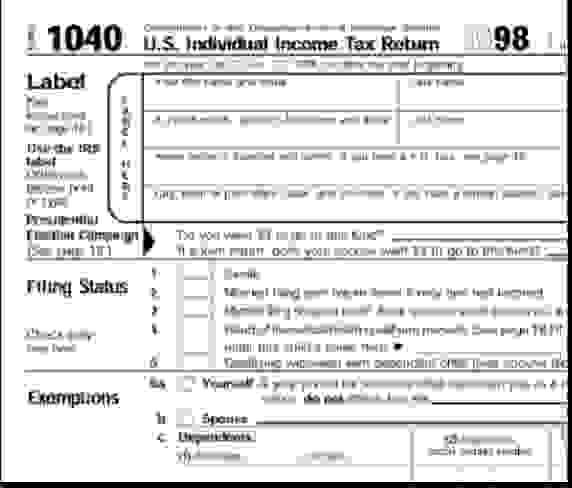

Worksheets are essential tools for individuals and businesses to accurately calculate their taxes. With the complexity of tax laws and regulations, it is crucial to have a clear understanding of the entity and subject you are dealing with. The use of well-designed worksheets can ensure that you remain organized, keeping track of the necessary information and accurately reporting it on your Federal Income Tax return.

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is the purpose of IRS Federal worksheets?

The purpose of IRS Federal worksheets is to help taxpayers calculate certain tax-related figures, deductions, credits, or adjustments accurately. These worksheets provide step-by-step instructions and guidelines to aid individuals or businesses in completing their tax returns correctly and meeting their obligations under the law.

How are IRS Federal worksheets used in tax preparation?

IRS Federal worksheets are used in tax preparation to calculate specific tax credits, deductions, or adjustments to income. These worksheets help taxpayers accurately determine their tax liability and ensure they are taking advantage of all available tax benefits. By following the instructions on these worksheets, taxpayers can properly report income, expenses, and deductions on their tax return, ultimately helping them minimize their tax burden and avoid errors that might trigger an audit.

What types of information are typically included in IRS Federal worksheets?

IRS Federal worksheets typically include information about income, deductions, taxes, credits, and penalties. They may also include calculations for various parts of a tax return, instructions on how to complete certain forms or schedules, and guidelines for determining eligibility for certain tax benefits or exclusions. These worksheets are designed to help taxpayers accurately report their financial information and calculate their tax liability in accordance with IRS regulations.

How do IRS Federal worksheets help with calculating taxable income?

IRS Federal worksheets provide a structured format for taxpayers to organize and calculate various components of their taxable income, such as deductions, credits, and adjustments. These worksheets help individuals identify and claim all eligible tax breaks, ensuring that they accurately determine their taxable income and potentially reduce their tax liability. By following the guidelines and calculations provided on the worksheets, taxpayers can simplify the process of completing their tax returns and ensure compliance with the IRS tax laws.

Are there specific worksheets for different types of income or deductions?

Yes, there are specific worksheets available for different types of income or deductions depending on the tax form being used. For example, Form 1040 includes various worksheets for calculating things like self-employment income, capital gains or losses, and various deductions. Additionally, there are specialized worksheets for certain credits or deductions, such as the Earned Income Credit or the Child and Dependent Care Credit. Taxpayers may need to refer to these worksheets to accurately calculate their tax liability and determine any potential credits or deductions they may qualify for.

Can IRS Federal worksheets be modified or customized by taxpayers?

No, IRS federal worksheets cannot be modified or customized by taxpayers. These worksheets are designed and provided by the IRS to help individuals calculate their tax liabilities accurately in accordance with tax laws. It is important to follow the instructions and fill out the worksheets as directed to ensure compliance with tax regulations and prevent errors in tax calculations.

Do IRS Federal worksheets accommodate different filing statuses?

Yes, IRS Federal worksheets do accommodate different filing statuses. They provide separate worksheets for different filing statuses such as Single, Married Filing Jointly, Married Filing Separately, Head of Household, and Qualifying Widow(er) with Dependent Child. Taxpayers can use the appropriate worksheet based on their filing status to calculate their taxable income, deductions, credits, and other tax-related information.

Are there penalties for errors made on IRS Federal worksheets?

There are typically no specific penalties for making errors on IRS federal worksheets since they are used as tools to help you calculate your tax liability accurately. However, if errors on the worksheets result in incorrect reporting or underpayment of taxes, there may be penalties for inaccuracies or non-compliance with tax laws. It is important to carefully review and double-check your calculations to avoid potential penalties from the IRS.

Are there any limitations or restrictions when using IRS Federal worksheets?

Yes, there may be limitations or restrictions when using IRS Federal worksheets. These worksheets are designed to assist taxpayers in calculating certain tax-related figures and expenses, but they may not cover every situation or be applicable to all taxpayers. It's important to carefully review the instructions and guidelines provided with the worksheets to ensure they are being used correctly and in accordance with IRS regulations. Consulting with a tax professional or advisor can help navigate any complexities or uncertainties related to using IRS Federal worksheets.

How can taxpayers obtain IRS Federal worksheets for their tax returns?

Taxpayers can easily obtain IRS Federal worksheets for their tax returns by visiting the official IRS website at www.irs.gov. They can navigate to the Forms and Publications section where they will be able to search for and download the specific worksheets they need. Additionally, taxpayers can also request these worksheets by calling the IRS directly or visiting a local IRS office for assistance.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments