Free Financial Planning Worksheets

Financial planning is an essential practice for anyone who wants to take control of their money and work towards achieving their financial goals. That's why having access to free financial planning worksheets can be a valuable tool in helping you organize and manage your finances effectively. Whether you're a student looking to get a handle on your expenses or a professional striving to save for retirement, these worksheets can provide a structured framework to track your income, expenses, savings, and investments.

Table of Images 👆

- Debt Free Printable Bill Payment Sheet

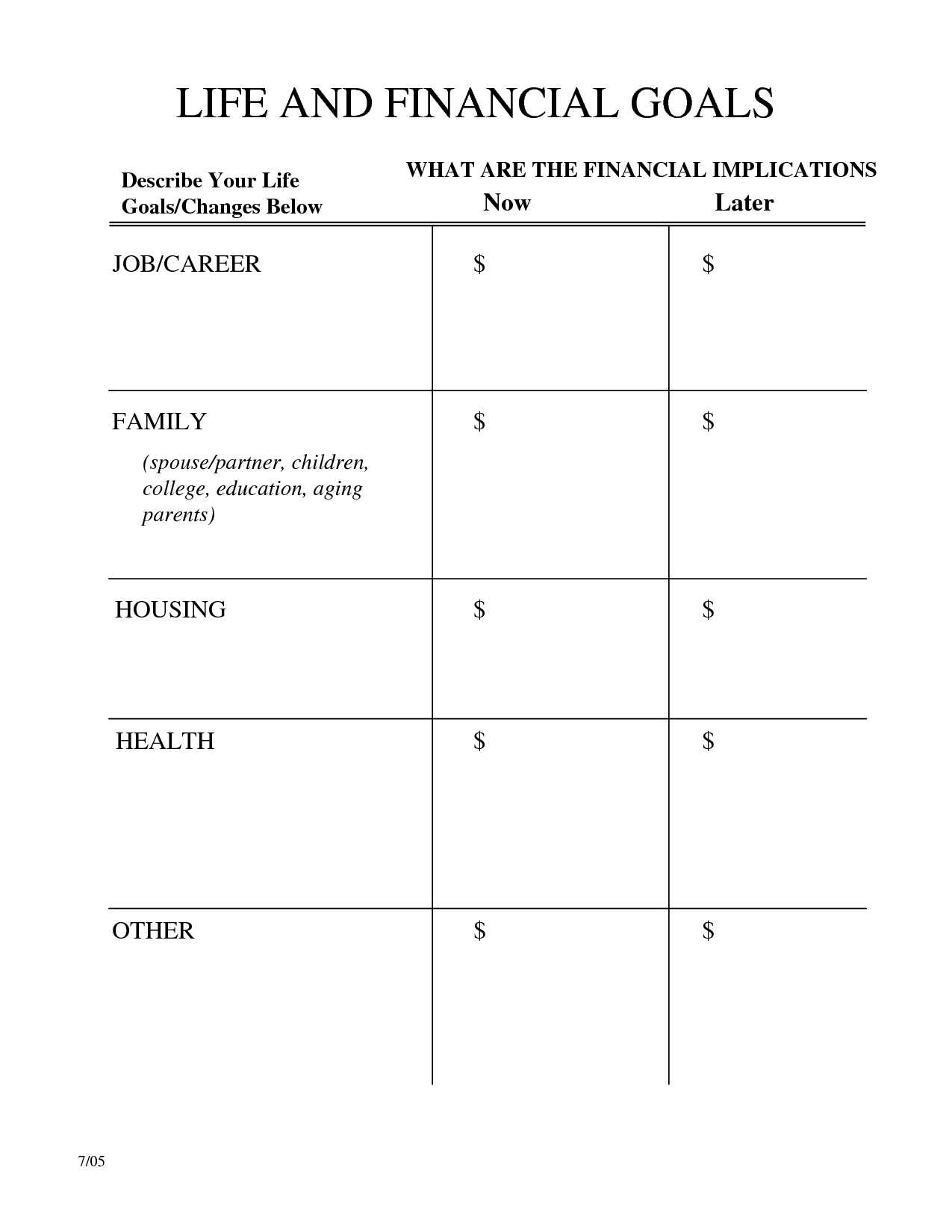

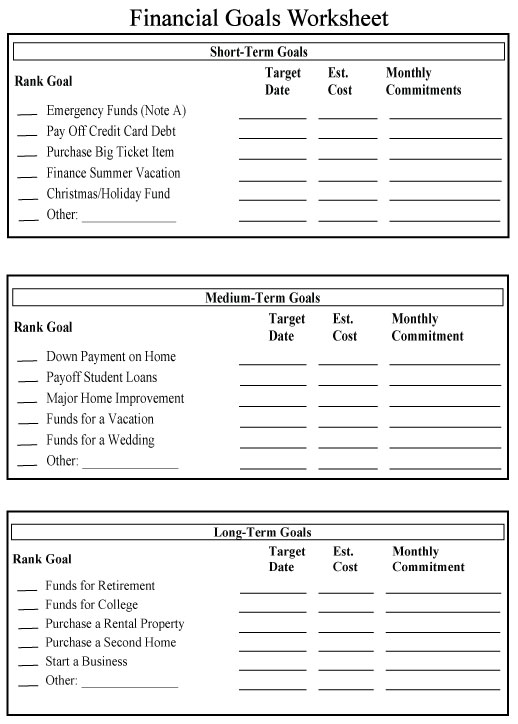

- Financial Planning Goals Worksheet

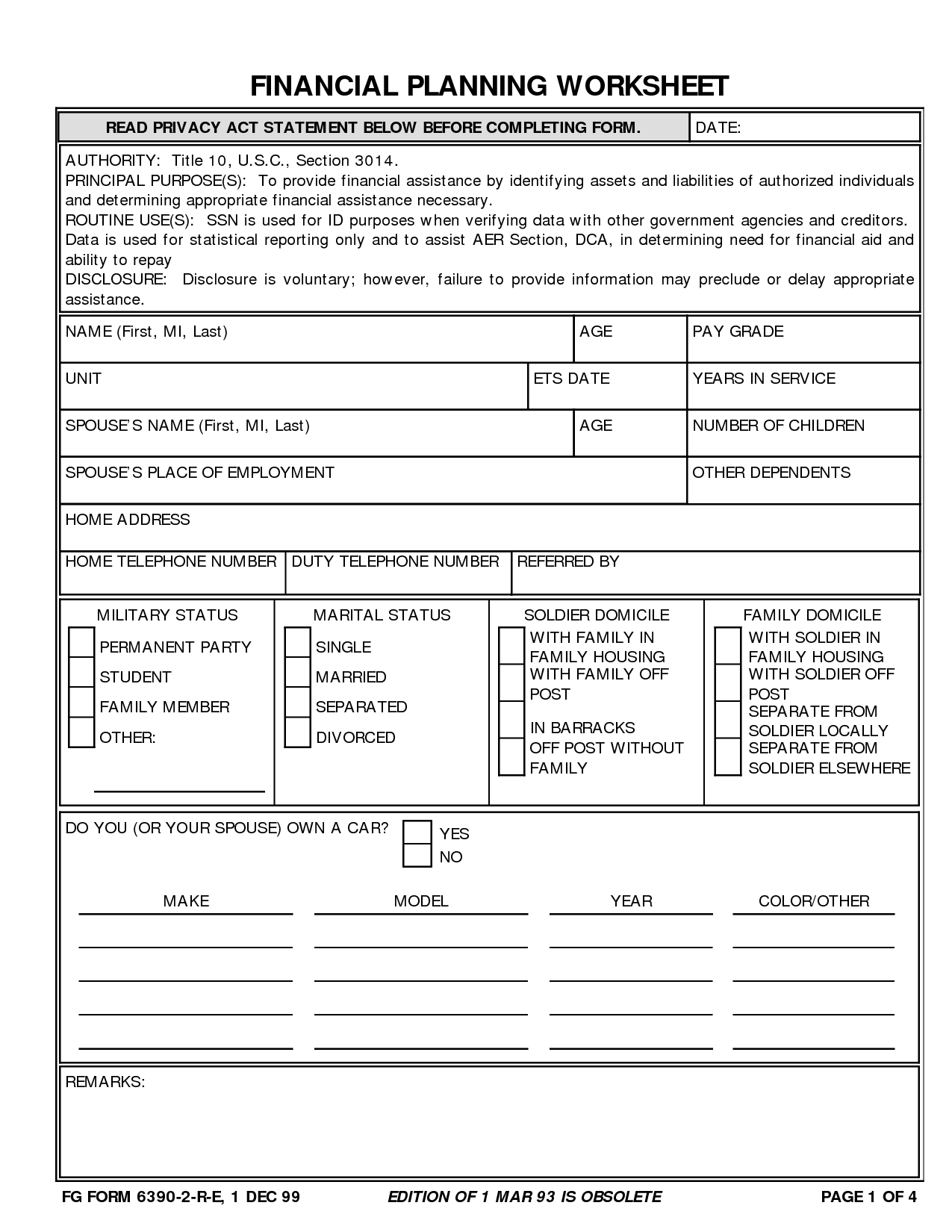

- Financial Planning Worksheets

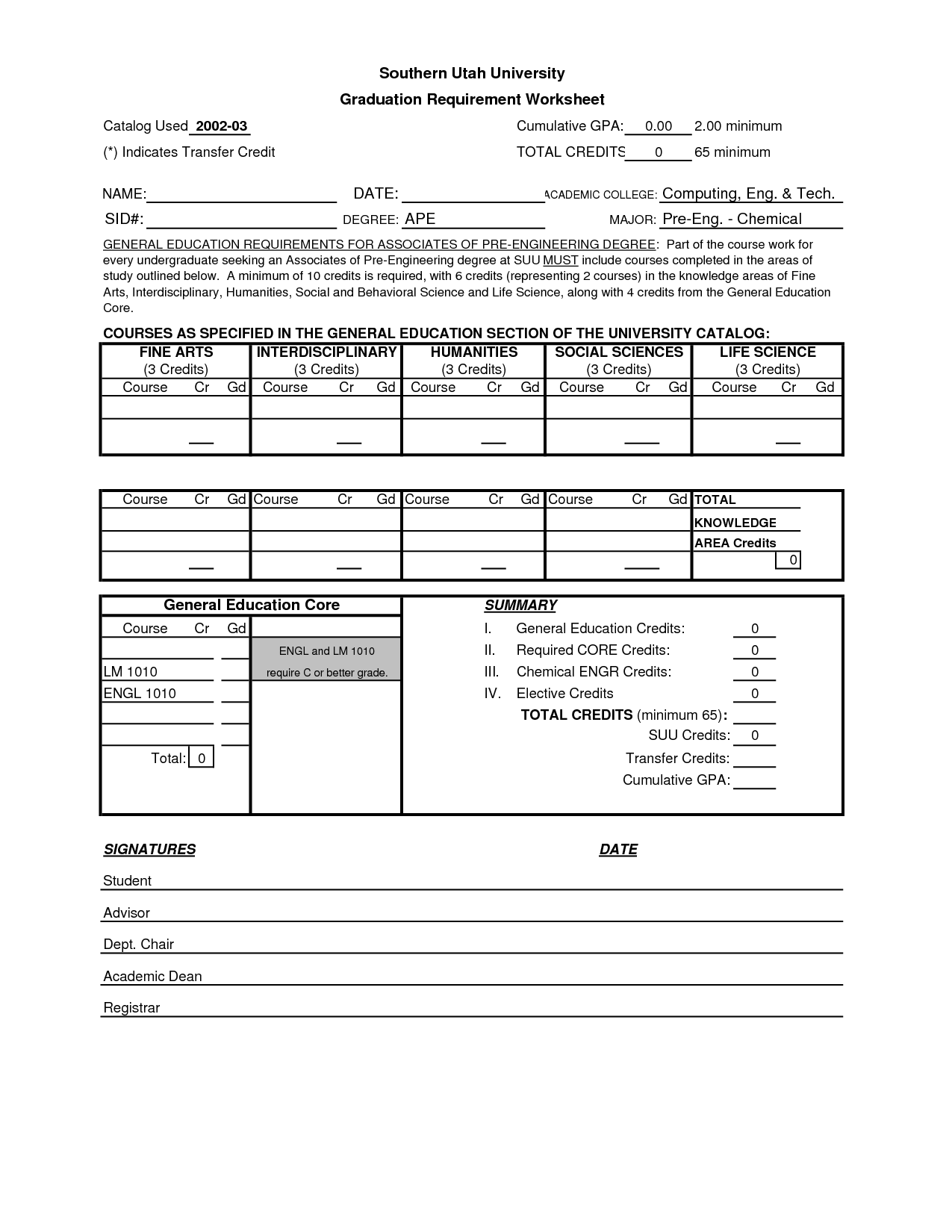

- Free Printable College Worksheets

- Free Event Planning Worksheets

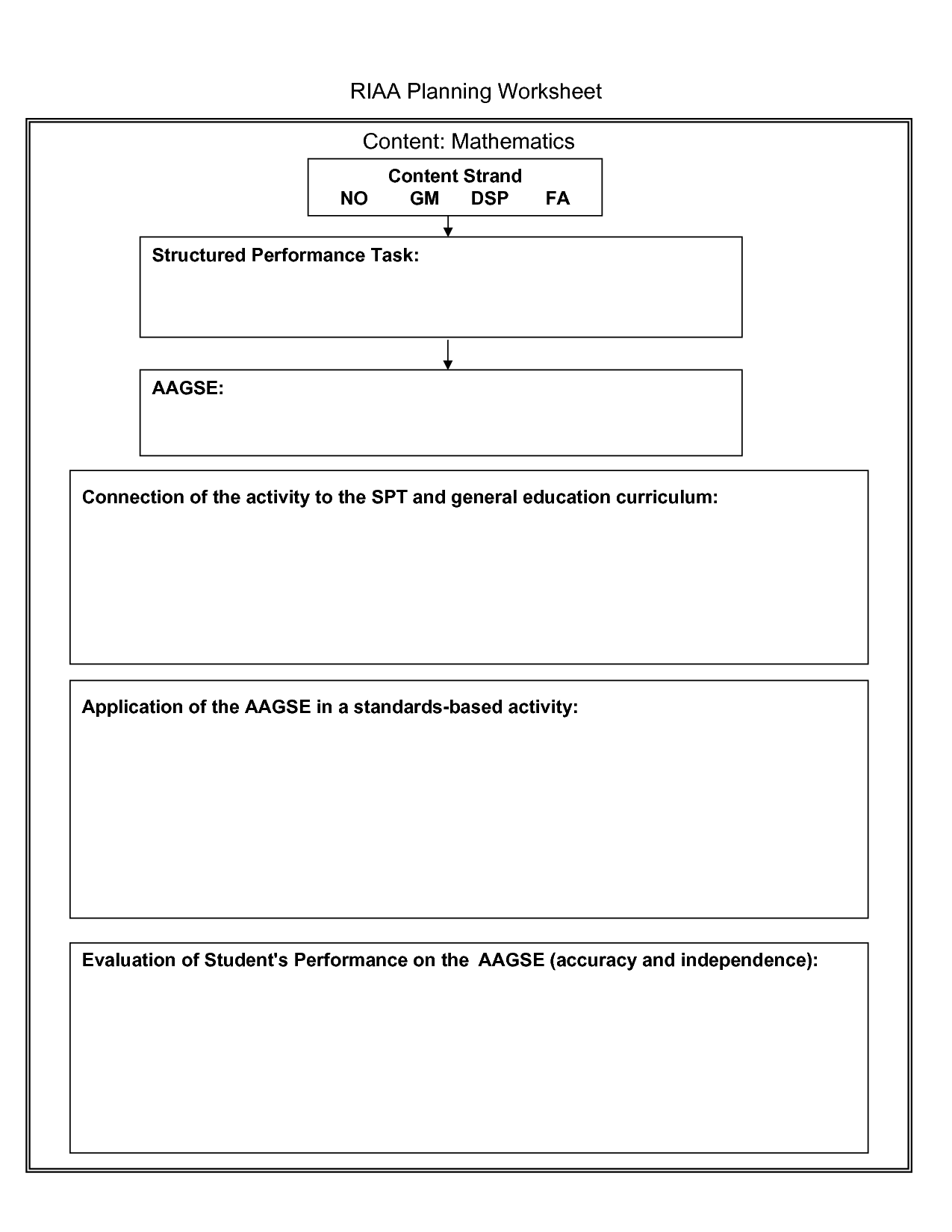

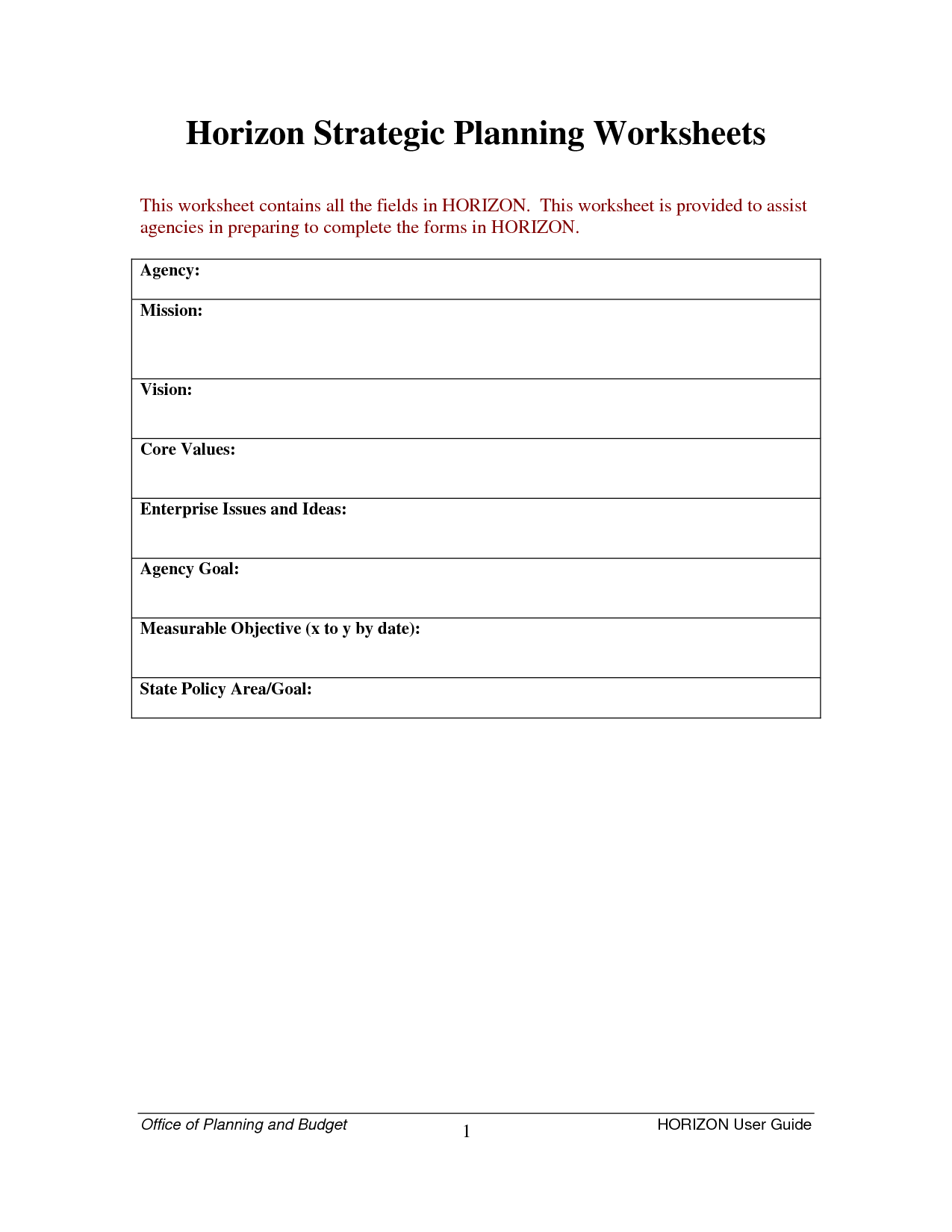

- Strategic Planning Worksheet

- Financial Assessment Worksheet

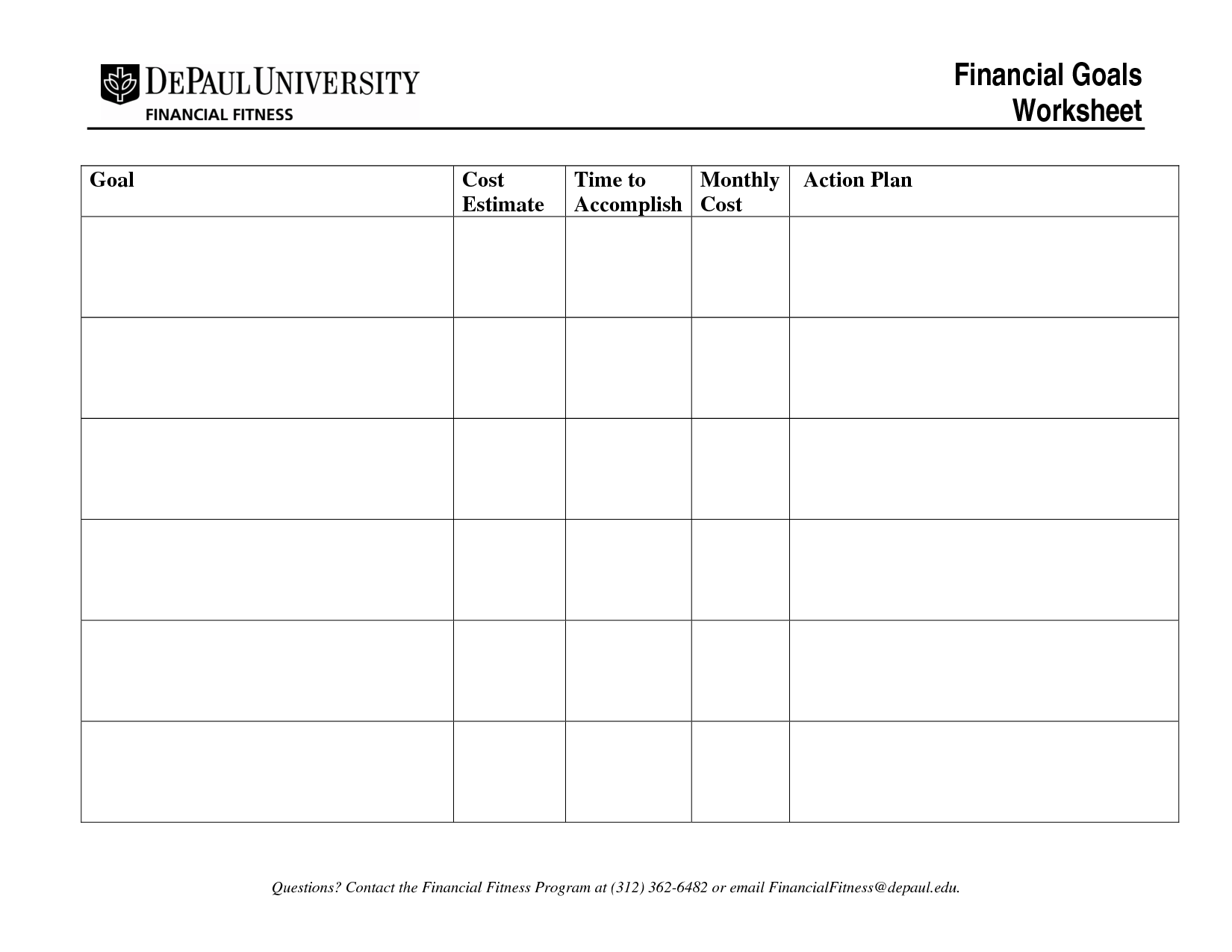

- Goals and Action Plan Template

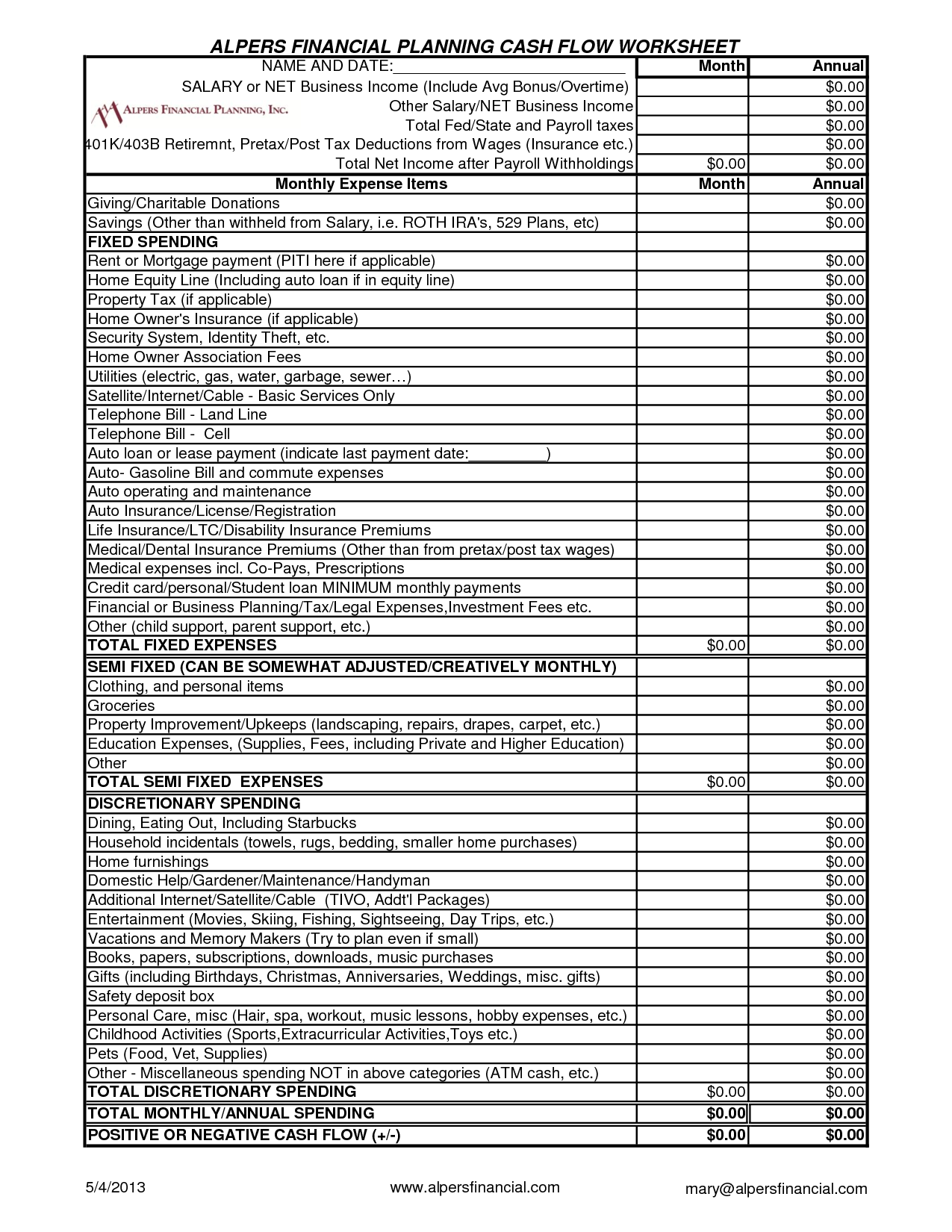

- Cash Flow Planning Worksheets

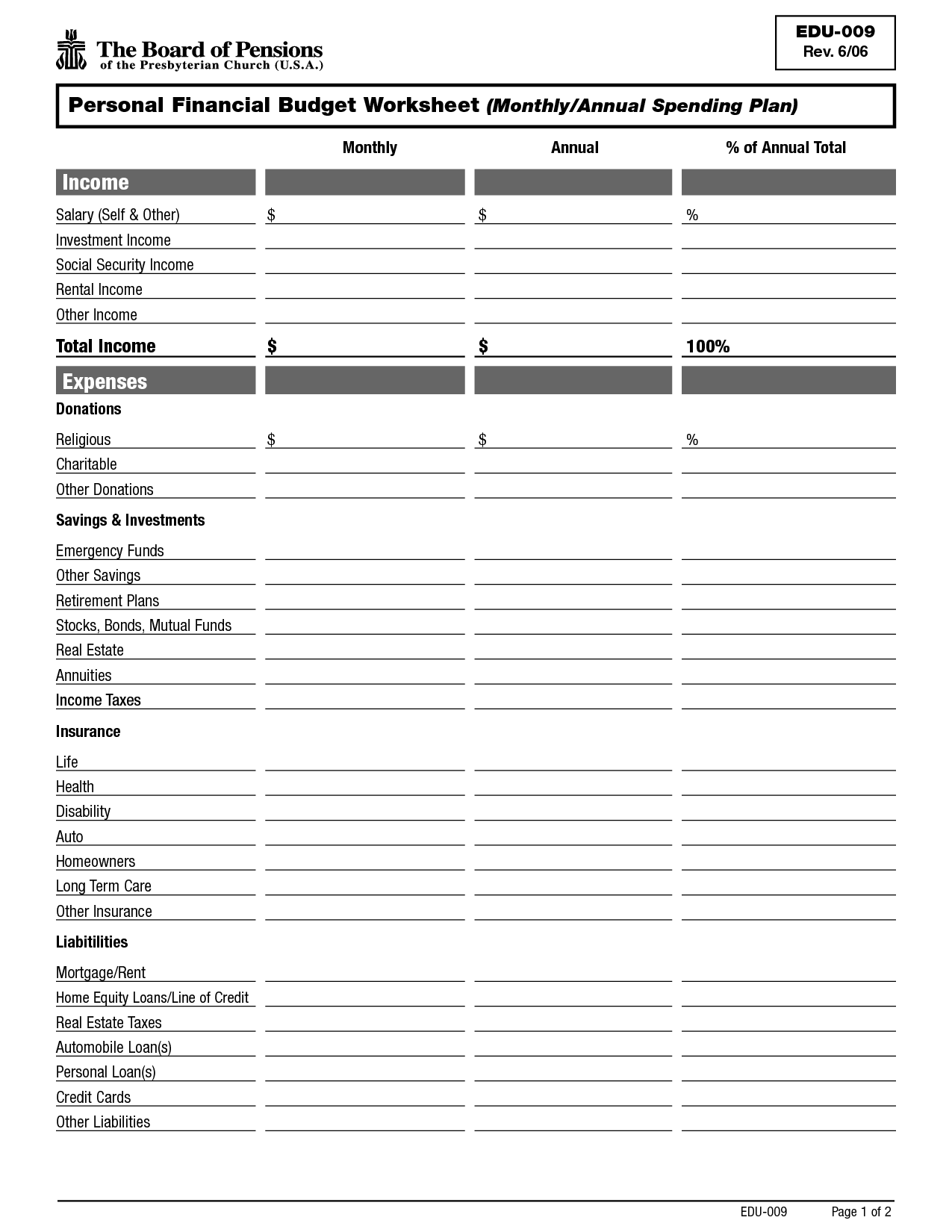

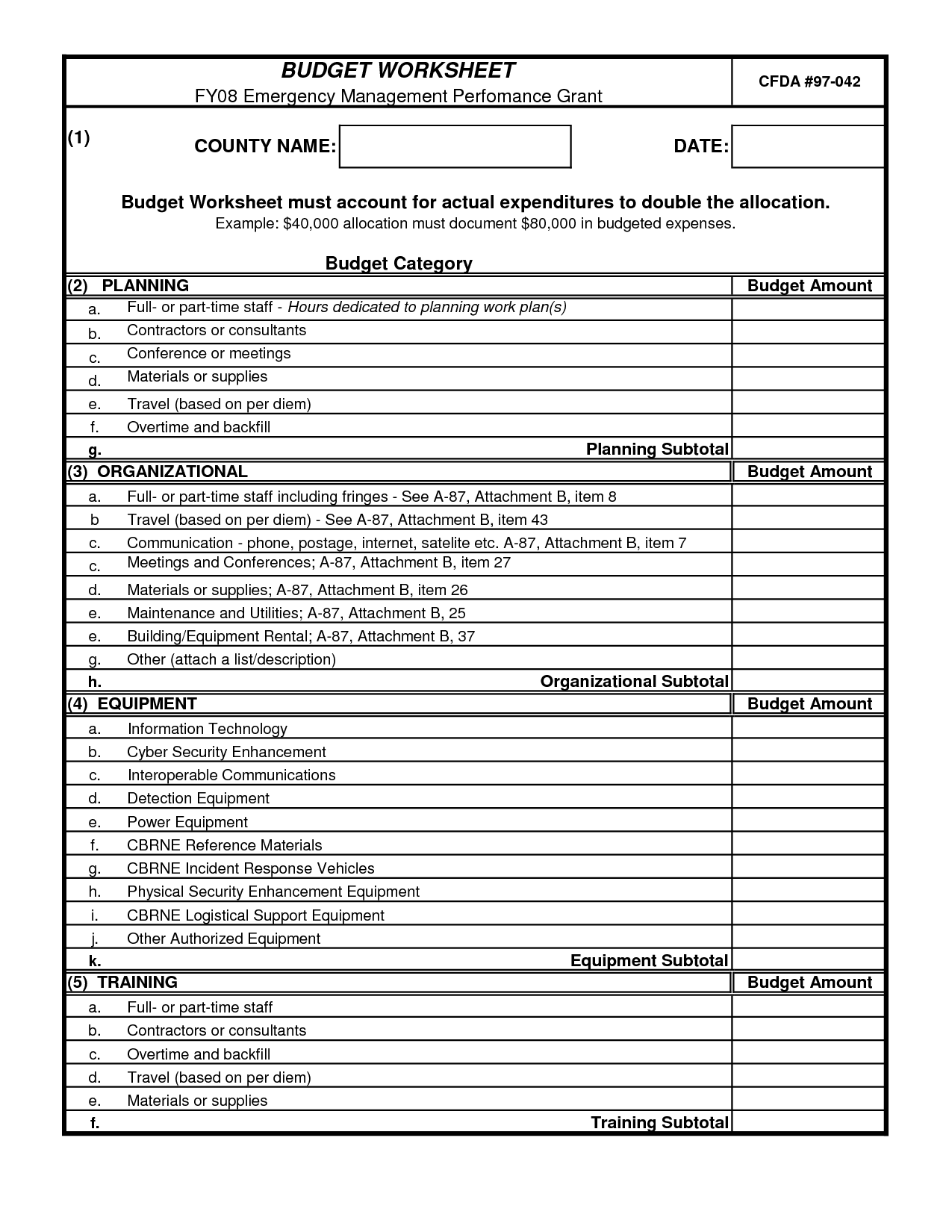

- Monthly Financial Budget Worksheet

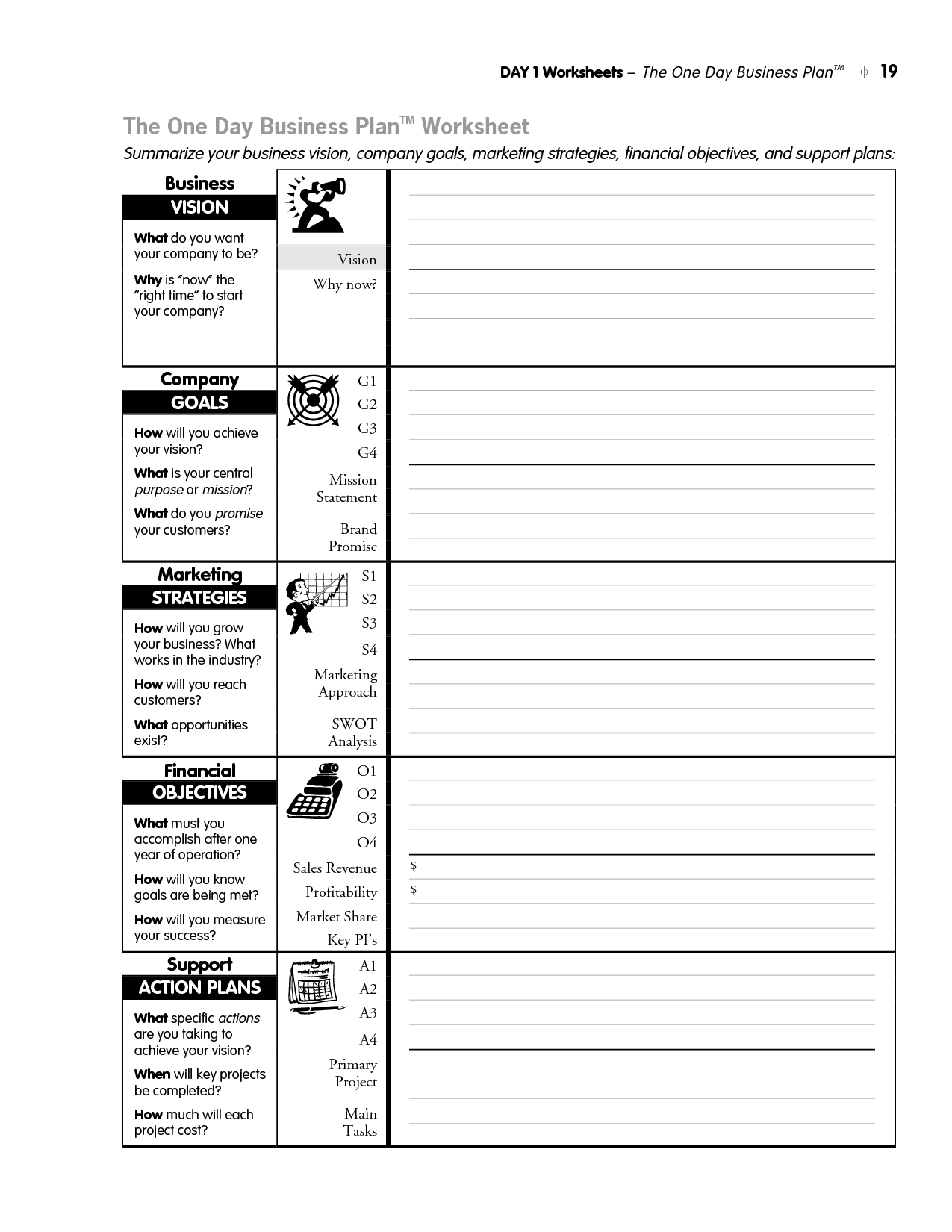

- Business Plan Worksheet PDF

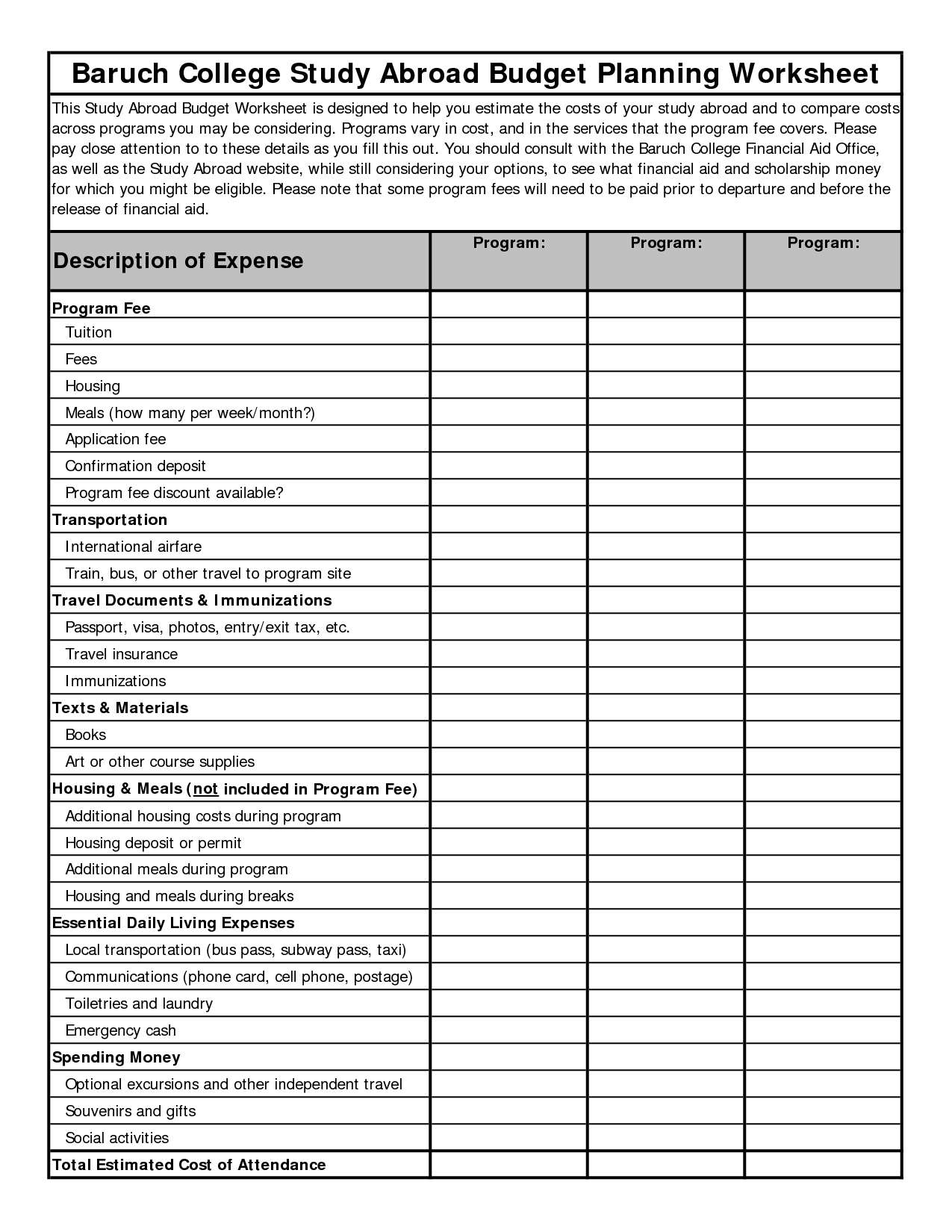

- Budget Planning Worksheet

- Free Printable Monthly Budget Worksheet

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a free financial planning worksheet?

A free financial planning worksheet is a tool that helps individuals organize their financial information and create a comprehensive plan for managing their money. These worksheets typically include sections for income, expenses, savings goals, debts, investments, and retirement planning. By using a financial planning worksheet, individuals can track their progress towards their financial goals and make informed decisions about their money management.

How can a financial planning worksheet help me with my finances?

A financial planning worksheet can help you with your finances by providing a structured framework to track your income, expenses, savings, and investments. By using a worksheet, you can create a clear picture of your financial situation, set achievable goals, plan for future expenses, and monitor your progress over time. This tool can help you make better financial decisions, prioritize your spending, identify areas where you can save money, and ultimately work towards improving your overall financial health.

What are the key components of a financial planning worksheet?

A financial planning worksheet typically includes key components such as income and expenses tracking, goal setting, budgeting, debt management, savings plan, investment strategy, retirement planning, insurance coverage, and estate planning. These components help individuals organize their financial information, set financial goals, create a comprehensive financial plan, and make informed decisions to achieve their financial objectives.

How do I use a financial planning worksheet to set financial goals?

To use a financial planning worksheet to set financial goals, start by reviewing your current financial situation, including income, expenses, savings, debts, and assets. Then identify your short-term and long-term financial goals, such as saving for a vacation, buying a home, or retiring comfortably. Calculate how much you need to achieve each goal and prioritize them based on importance and feasibility. Next, break down each goal into smaller, manageable steps with deadlines and specific action plans to track your progress. Adjust your budget and savings plan accordingly to reach your financial goals effectively. Regularly review and update your financial planning worksheet to stay on track and make necessary adjustments as your goals and circumstances change.

Can a financial planning worksheet help me track my expenses?

Yes, a financial planning worksheet can be a helpful tool in tracking your expenses. By recording your income and expenses on a worksheet, you can visually see where your money is going and identify areas where you may need to adjust your spending. This can give you a clearer picture of your financial situation and help you make more informed decisions about your budget and saving goals.

Are there different types of financial planning worksheets available?

Yes, there are different types of financial planning worksheets available, tailored for specific purposes such as budgeting, retirement planning, investment tracking, debt repayment, and more. These worksheets help individuals organize their finances, set goals, and track their progress towards financial stability and success. They can be found online or provided by financial advisors and institutions to assist individuals in managing their money effectively.

How can a financial planning worksheet help me create a budget?

A financial planning worksheet can help you create a budget by providing a structured and organized way to list and track your income, expenses, savings goals, and debts. By inputting all your financial information into the worksheet, you can clearly see where your money is going, identify areas where you can cut back or save, set realistic financial goals, and ultimately create a comprehensive and manageable budget plan that aligns with your financial objectives and priorities.

Can a financial planning worksheet help me determine my net worth?

Yes, a financial planning worksheet can help you determine your net worth by listing all your assets (such as savings, investments, and properties) and subtracting your liabilities (such as debts and loans). By adding up your assets and subtracting your liabilities, you can calculate your net worth and get a clear picture of your financial situation.

Are there any online tools or software that offer free financial planning worksheets?

Yes, there are several online tools and software that offer free financial planning worksheets. Some popular options include Mint, Personal Capital, and NerdWallet. These platforms offer a range of tools to help you create budgets, track expenses, set financial goals, and more. Additionally, many financial institutions also provide free resources and tools on their websites to assist with financial planning.

How often should I update my financial planning worksheet?

It is recommended to update your financial planning worksheet at least once a year or whenever there are significant changes in your financial situation such as a change in income, expenses, or financial goals. Regularly reviewing and updating your financial planning worksheet ensures that your plans are aligned with your current financial circumstances and helps you stay on track to meet your financial goals.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments