Financial Expenditure Budget Worksheet

Are you in need of a practical tool to help you keep track of your financial expenditure? Look no further than the Financial Expenditure Budget Worksheet! This worksheet is designed to assist individuals and households in managing their expenses effectively. With a clear focus on entities and subjects such as income, expenses, and savings, this worksheet is an invaluable resource for anyone seeking to gain better control over their finances.

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a Financial Expenditure Budget Worksheet?

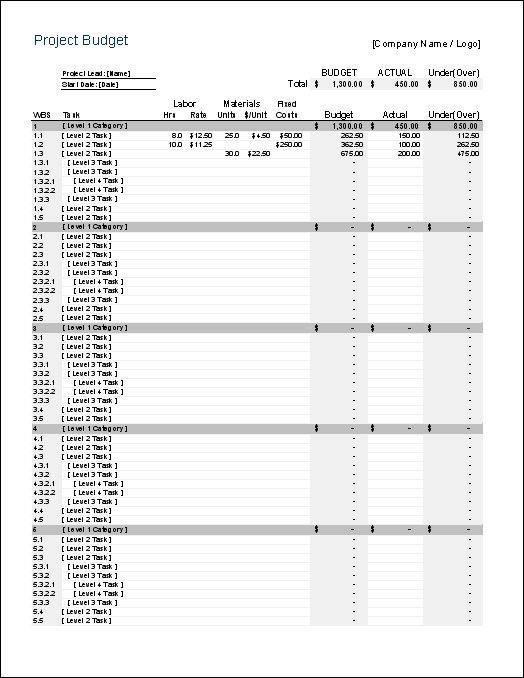

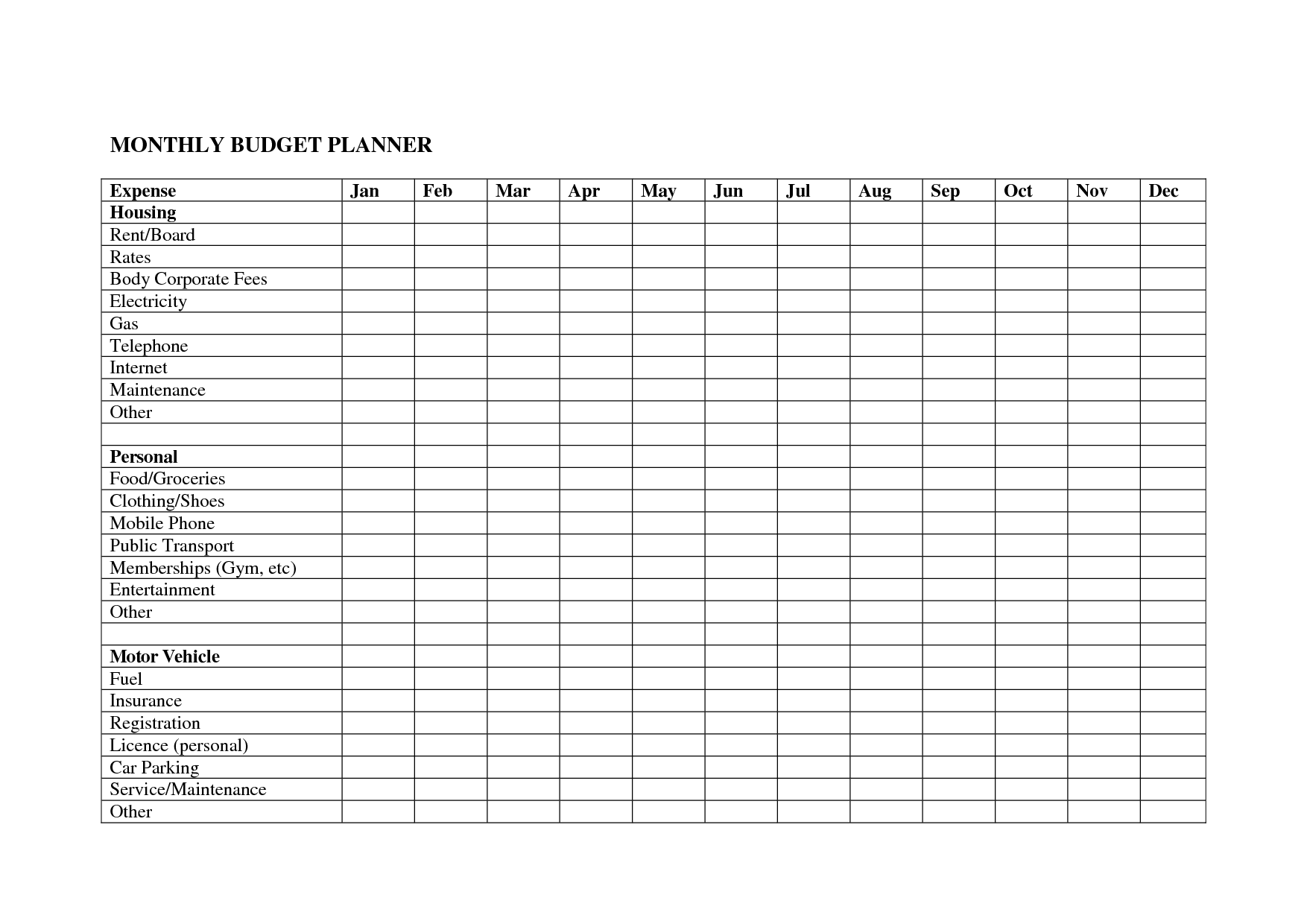

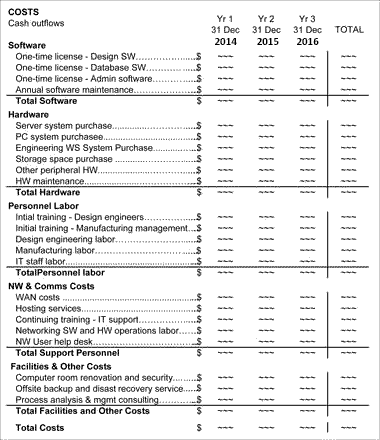

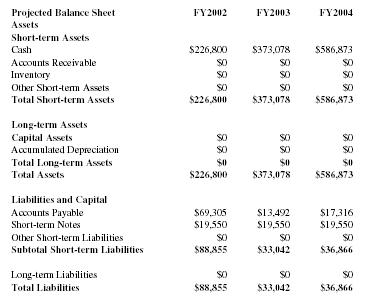

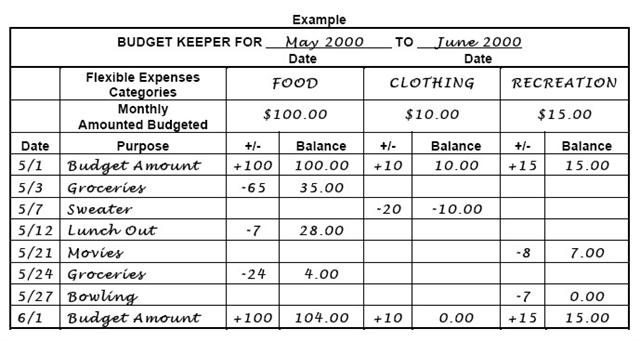

A Financial Expenditure Budget Worksheet is a tool used to track and plan for expenses within a given period. It typically includes categories such as income, fixed expenses (e.g., rent, utilities), variable expenses (e.g., groceries, entertainment), savings, and any other financial goals. By detailing expected income and allocating funds to various expense categories, individuals can effectively manage their finances and make informed decisions about their spending habits.

What is the purpose of a Financial Expenditure Budget Worksheet?

A Financial Expenditure Budget Worksheet is used to track and plan for expected expenses across different categories such as bills, groceries, entertainment, and savings. It allows individuals to monitor their spending, identify areas for potential savings, and ensure that their expenses align with their financial goals. Additionally, it helps in creating a realistic budget that can guide financial decision-making and help in achieving financial stability and security.

What information does a Financial Expenditure Budget Worksheet typically include?

A Financial Expenditure Budget Worksheet typically includes details of all planned expenses within a given time period, such as fixed costs like rent and utilities, variable costs like groceries and entertainment, debt repayments, savings goals, and any other expenditure categories relevant to the individual or organization. It helps in tracking and managing expenses effectively, ensuring a better financial outlook and control over spending.

How often should a Financial Expenditure Budget Worksheet be updated?

A Financial Expenditure Budget Worksheet should ideally be updated on a regular basis, such as monthly or quarterly. This frequency allows for monitoring of expenses, adjustments to changing financial circumstances, and alignment with short-term and long-term financial goals. Regular updates ensure that the budget remains accurate and effective in helping to manage and track expenses.

Why is it important to track and monitor financial expenditures?

Tracking and monitoring financial expenditures is crucial for effective budgeting, identifying spending patterns, detecting unnecessary expenses, and making informed financial decisions. It helps individuals and businesses stay within their financial limits, avoid debt, plan for future expenses, and ultimately achieve their financial goals. By keeping a close eye on financial transactions, one can maintain control over their money, improve financial management skills, and secure a stable financial future.

How can a Financial Expenditure Budget Worksheet help with financial planning?

A Financial Expenditure Budget Worksheet helps with financial planning by providing a clear overview of income, expenses, and spending habits. By tracking and categorizing expenses, individuals can identify areas where they may be overspending or where they can cut costs. This tool enables better budgeting, setting financial goals, and making informed decisions to improve overall financial health and stability.

What are some common categories included in a Financial Expenditure Budget Worksheet?

Common categories included in a Financial Expenditure Budget Worksheet may include housing expenses (rent/mortgage), utilities (electricity, water, gas), transportation (car payment, gas, insurance), groceries, health care costs, entertainment, savings, debt payments, and miscellaneous expenses. These categories help individuals track and manage their spending to ensure they stay within budget and achieve their financial goals.

How can a Financial Expenditure Budget Worksheet be used to identify areas for cost-saving?

A Financial Expenditure Budget Worksheet can be used to identify areas for cost-saving by providing a detailed overview of all expenses, allowing for a clear comparison of planned versus actual expenditures. By closely examining the data on the worksheet, one can pinpoint areas where spending may be exceeding the budget or where funds are being allocated inefficiently. This analysis can help in making informed decisions on where cuts or adjustments can be made to reduce costs and improve financial efficiency.

What is the difference between fixed and variable expenses on a Financial Expenditure Budget Worksheet?

Fixed expenses are costs that remain constant each month, such as rent, mortgage payments, or insurance premiums, while variable expenses are costs that can fluctuate, such as groceries, entertainment, or utilities. On a Financial Expenditure Budget Worksheet, fixed expenses are typically easier to predict and plan for, as they occur regularly and consistently, whereas variable expenses require more flexibility in budgeting as they can vary each month.

How can a Financial Expenditure Budget Worksheet help individuals or businesses make informed financial decisions?

A Financial Expenditure Budget Worksheet can help individuals or businesses make informed financial decisions by providing a clear overview of their income and expenses. By tracking and categorizing all expenditures, it allows for a better understanding of where money is being spent and where potential savings can be made. This tool enables financial planning and budgeting, helps in identifying areas of overspending, and aids in setting realistic financial goals and priorities. Ultimately, it empowers individuals and businesses to make informed decisions about their finances and work towards achieving financial stability and growth.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments