Example of Budget Worksheet

A budget worksheet is a practical tool that assists individuals in organizing their finances. This simple yet effective entity allows users to track their income, expenses, and savings in a systematic manner. With a budget worksheet, individuals can gain a better understanding of their financial situation and make informed decisions about their spending habits. Whether you are a college student, a young professional, or a family seeking to manage their finances, a budget worksheet can serve as a valuable resource to help you stay on track and achieve your financial goals.

Table of Images 👆

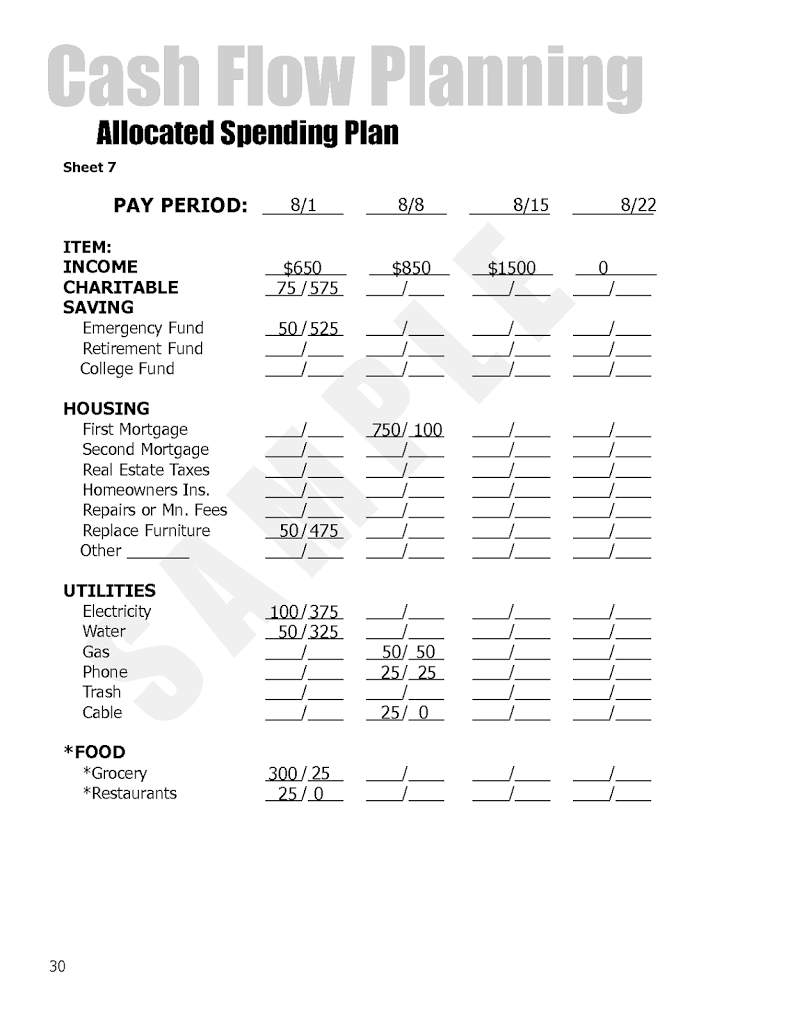

- Dave Ramsey Allocated Spending Plan Budget

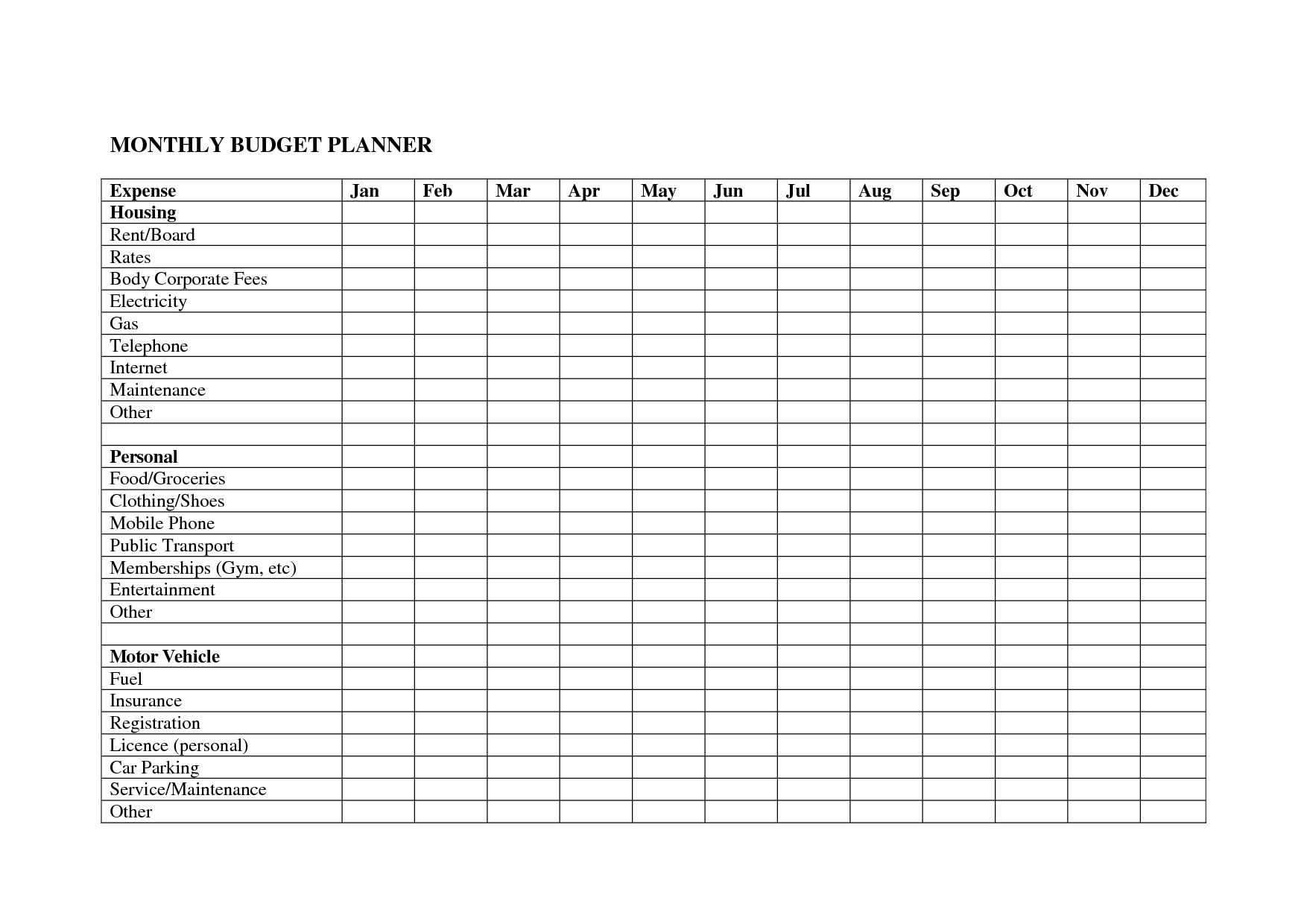

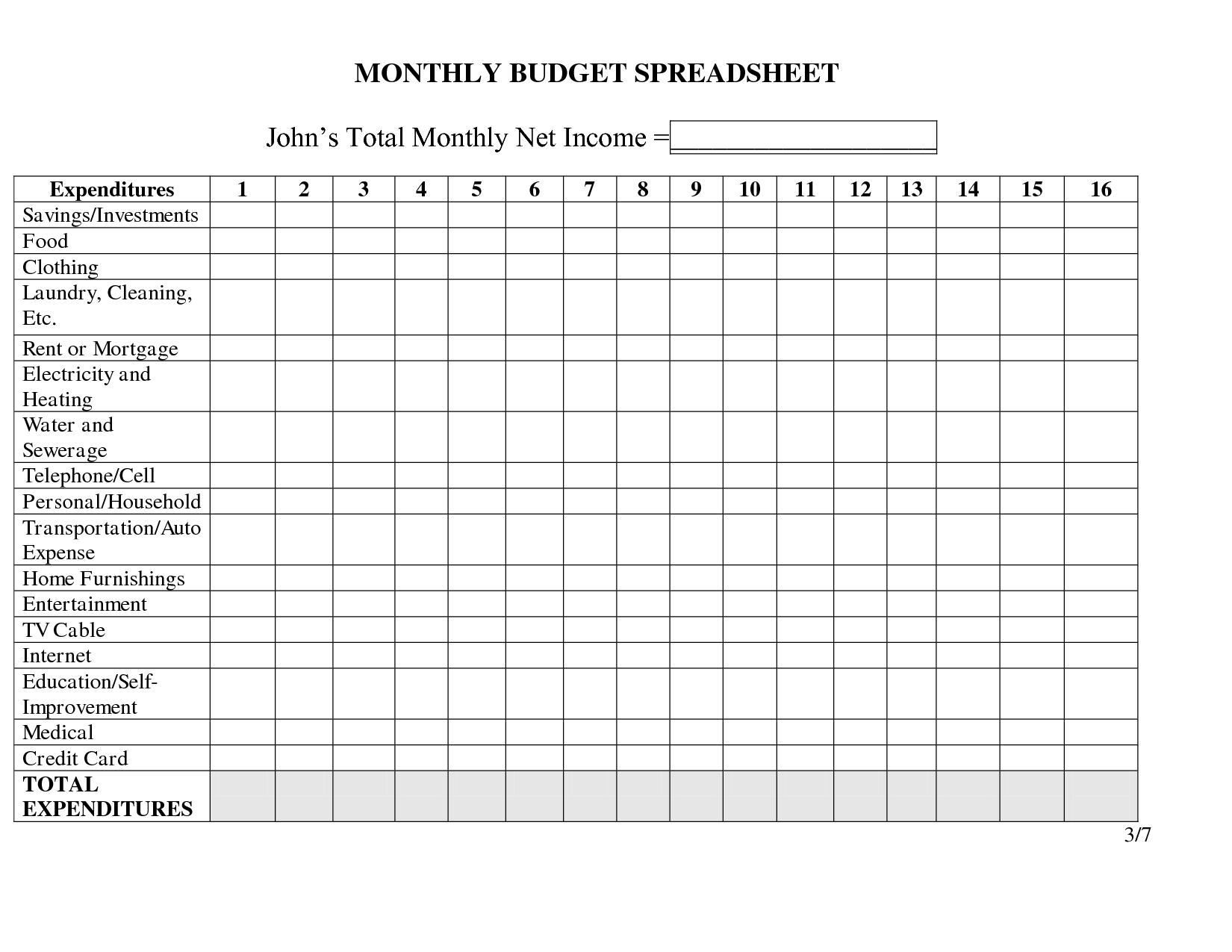

- Blank Monthly Budget Spreadsheet

- Free Printable Weekly Budget Template

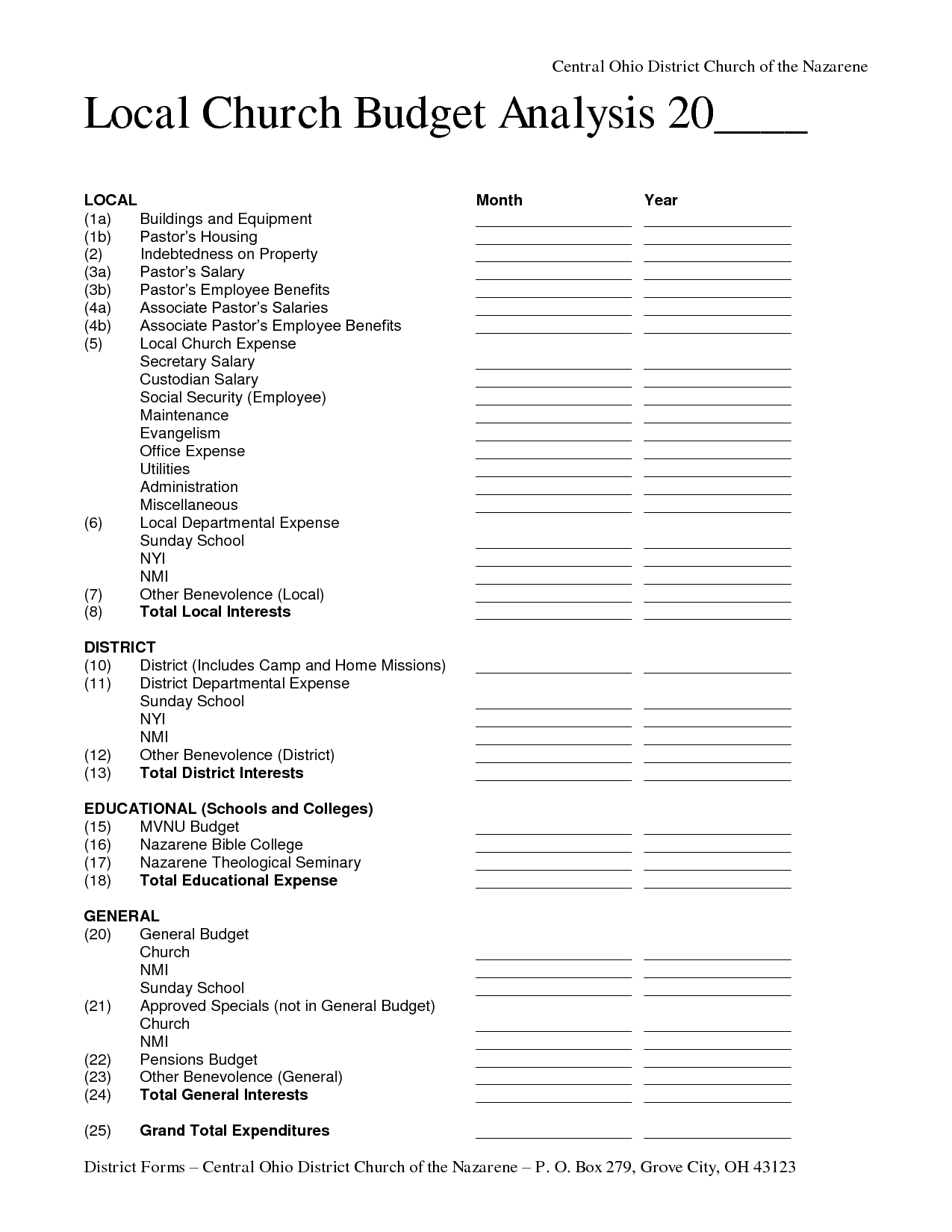

- Sample Church Budget Template

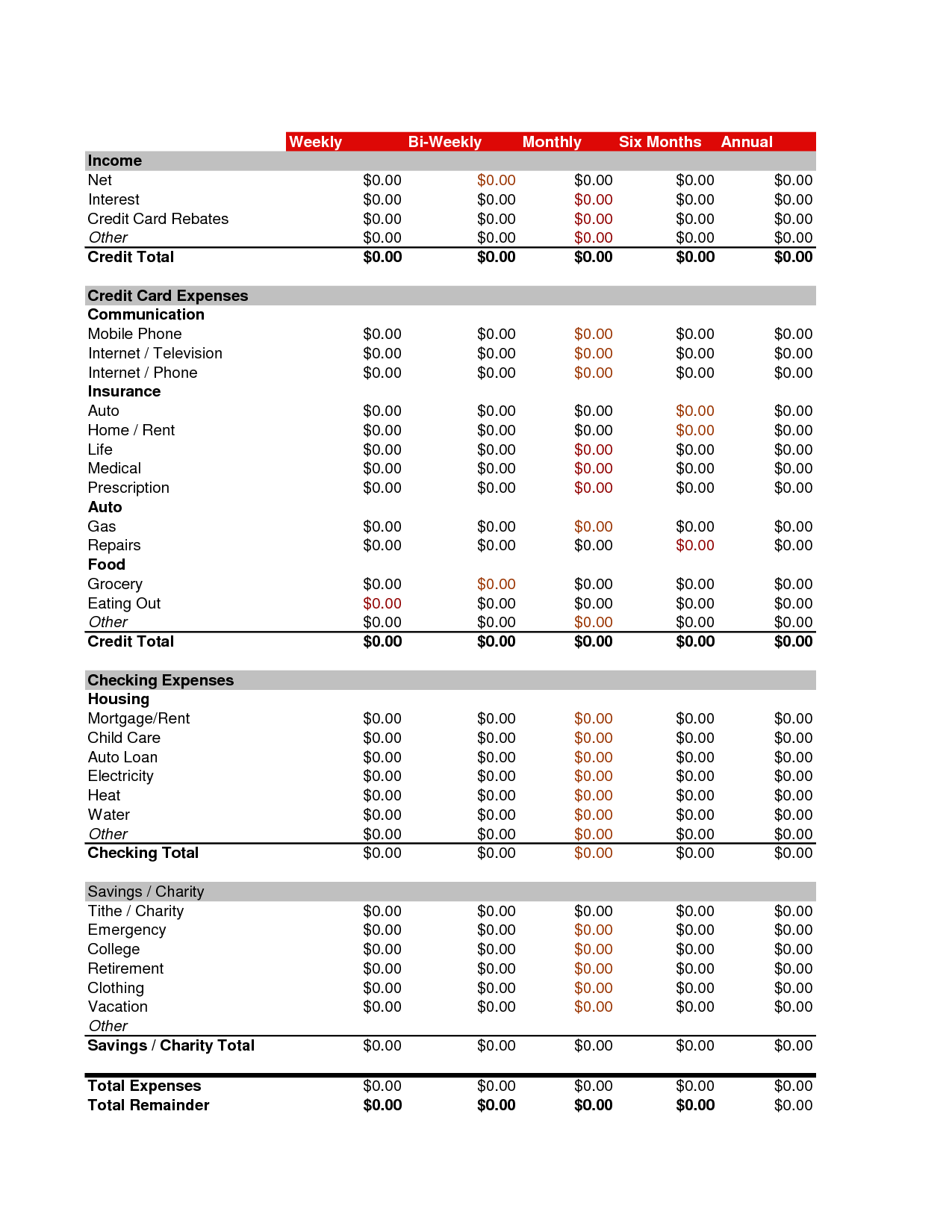

- Household Budget Template Excel

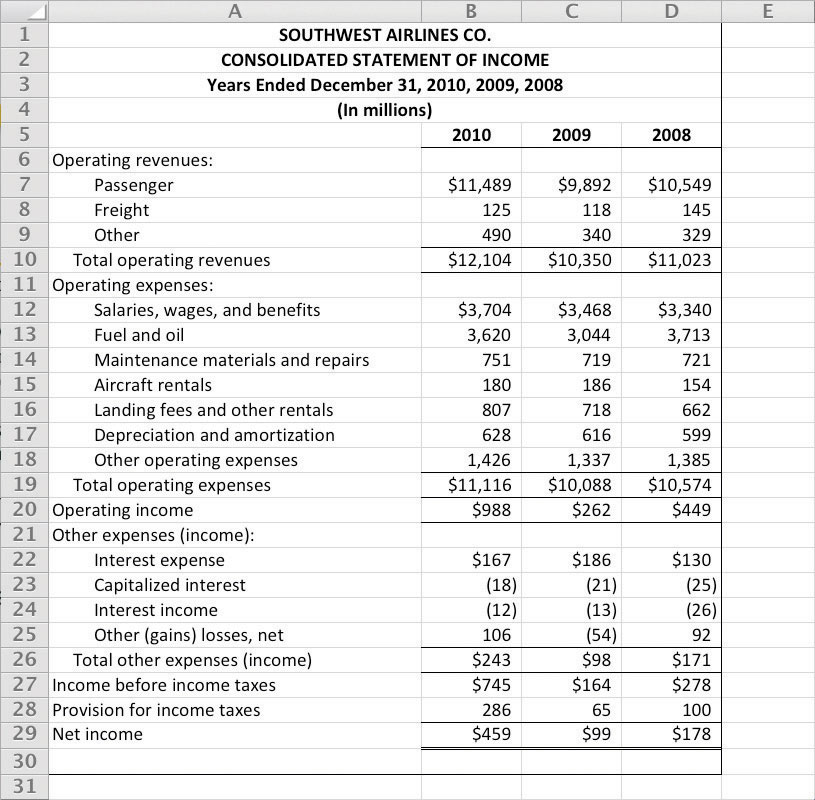

- Excel Spreadsheet Income Statement

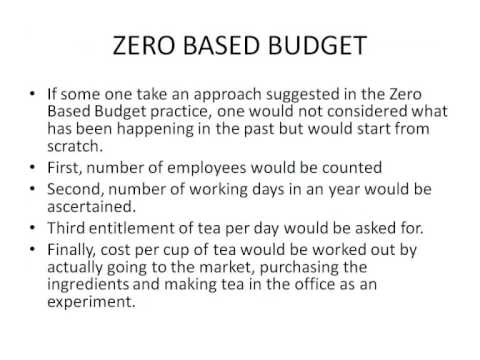

- Zero-Based Budget Spreadsheet

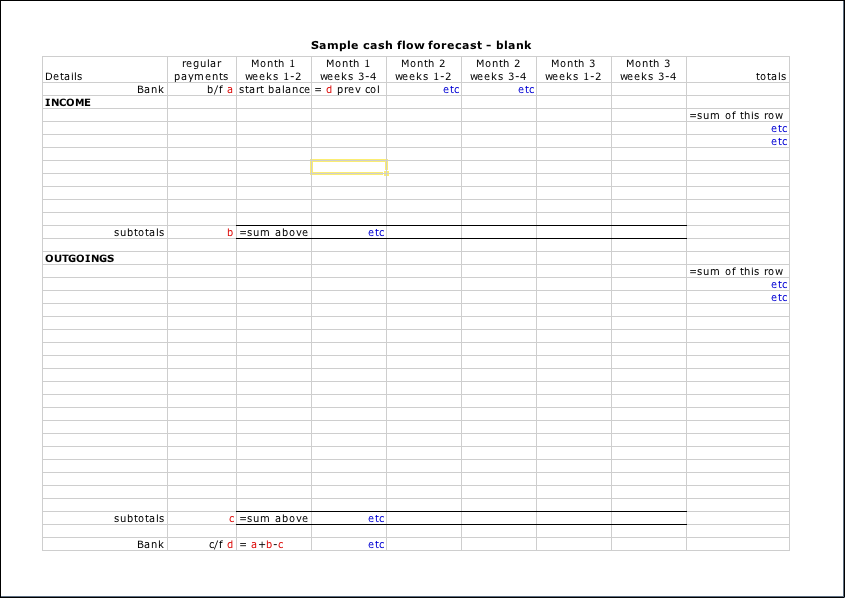

- Blank Cash Flow Statement Templates

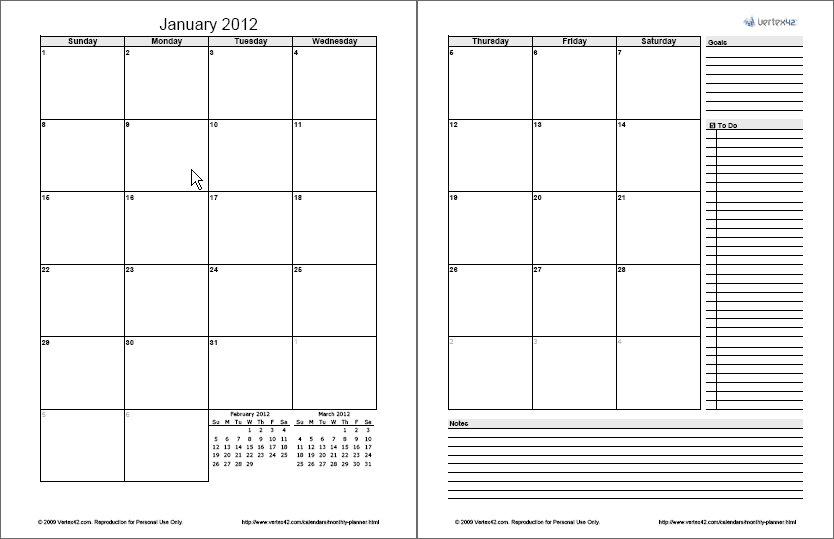

- Free Printable Monthly Planner Calendar Template

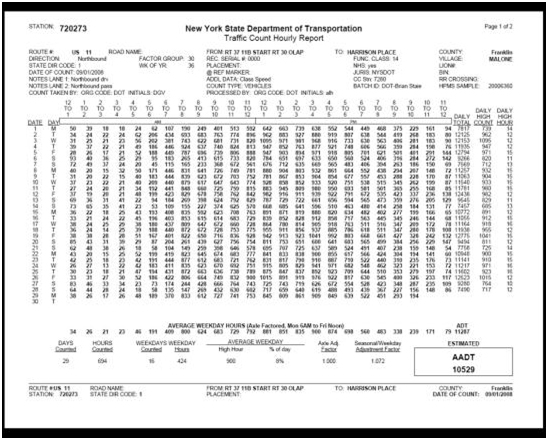

- Example of Prescription Pick Up Sheet

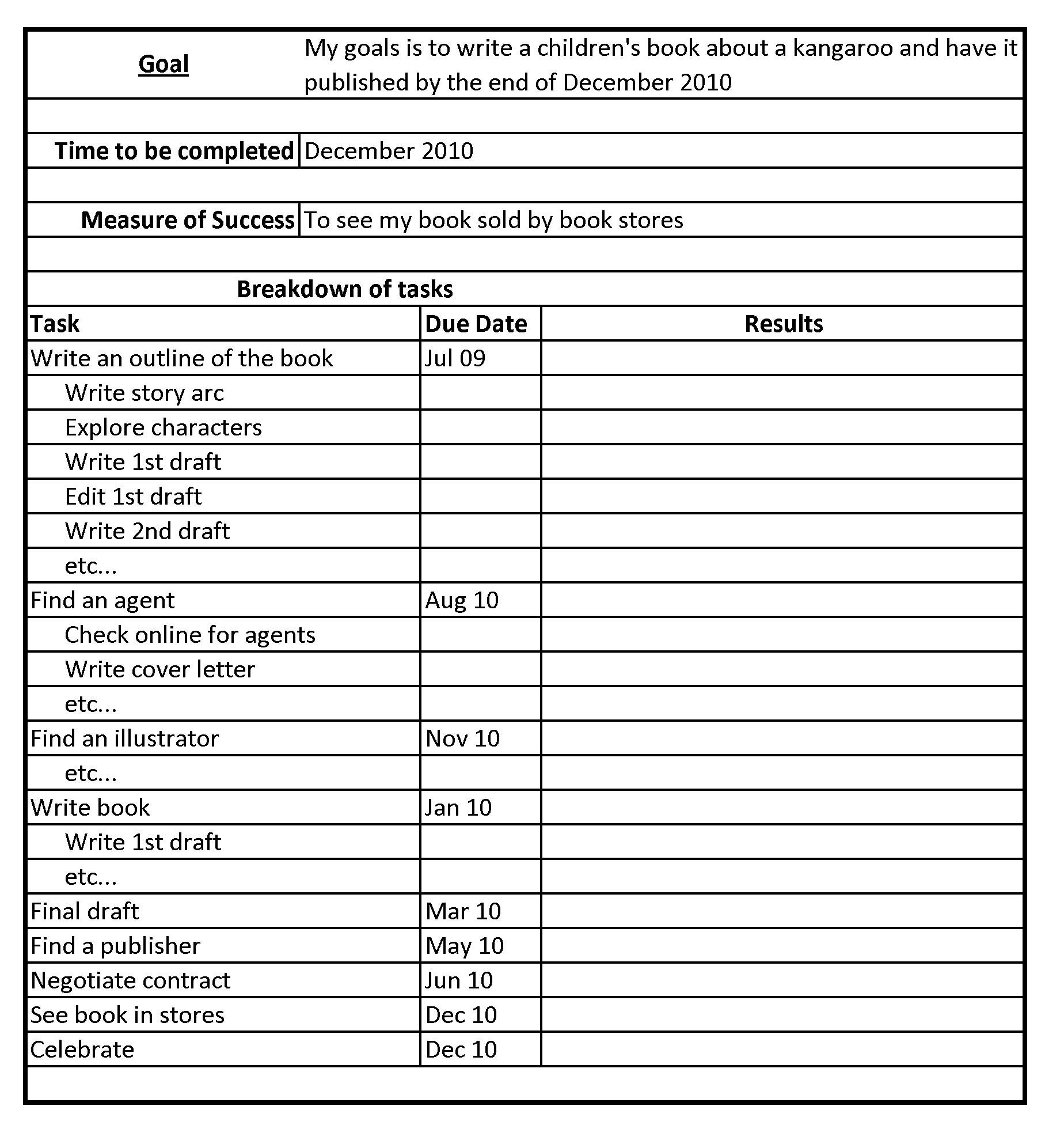

- Goal Setting Worksheet

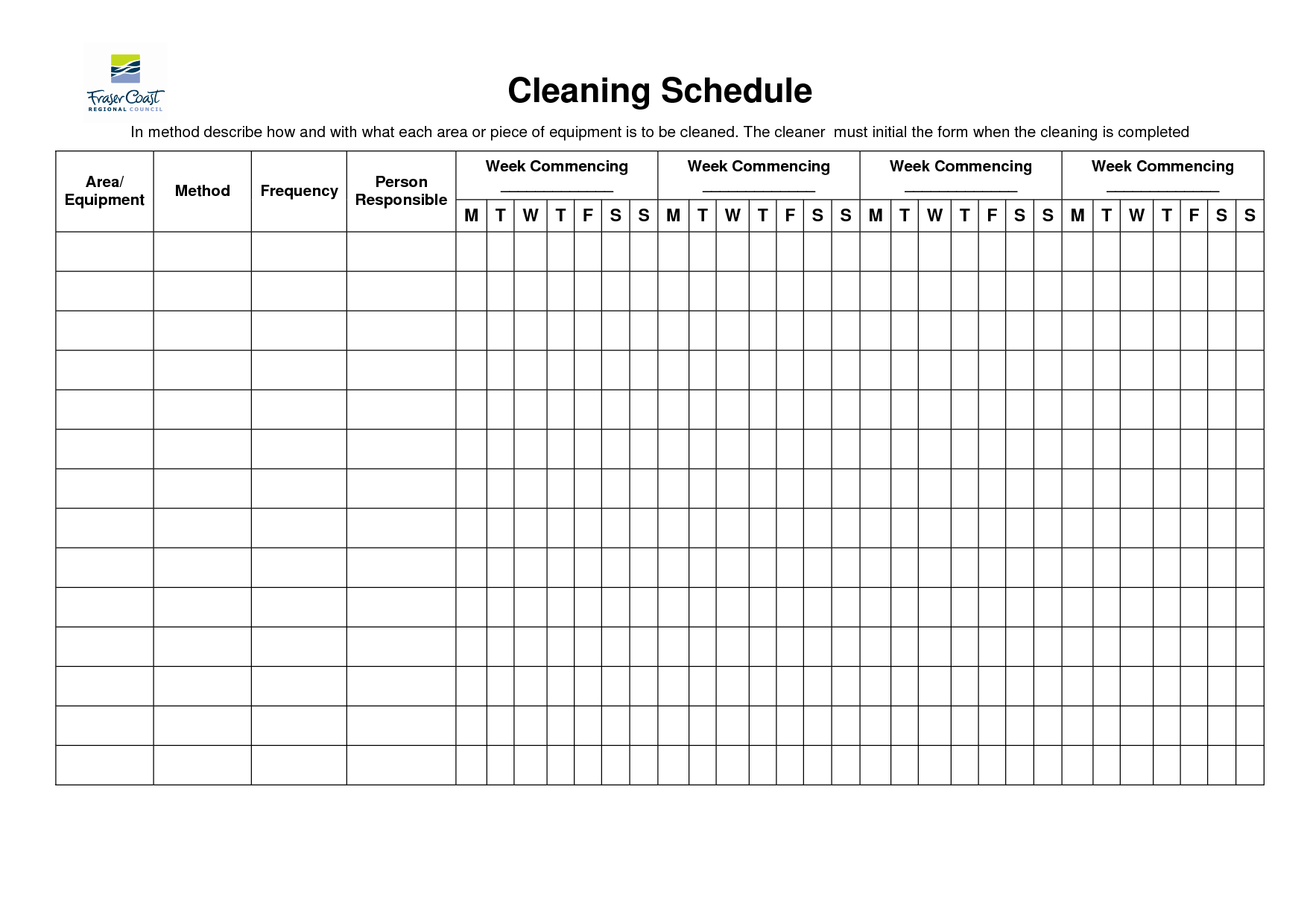

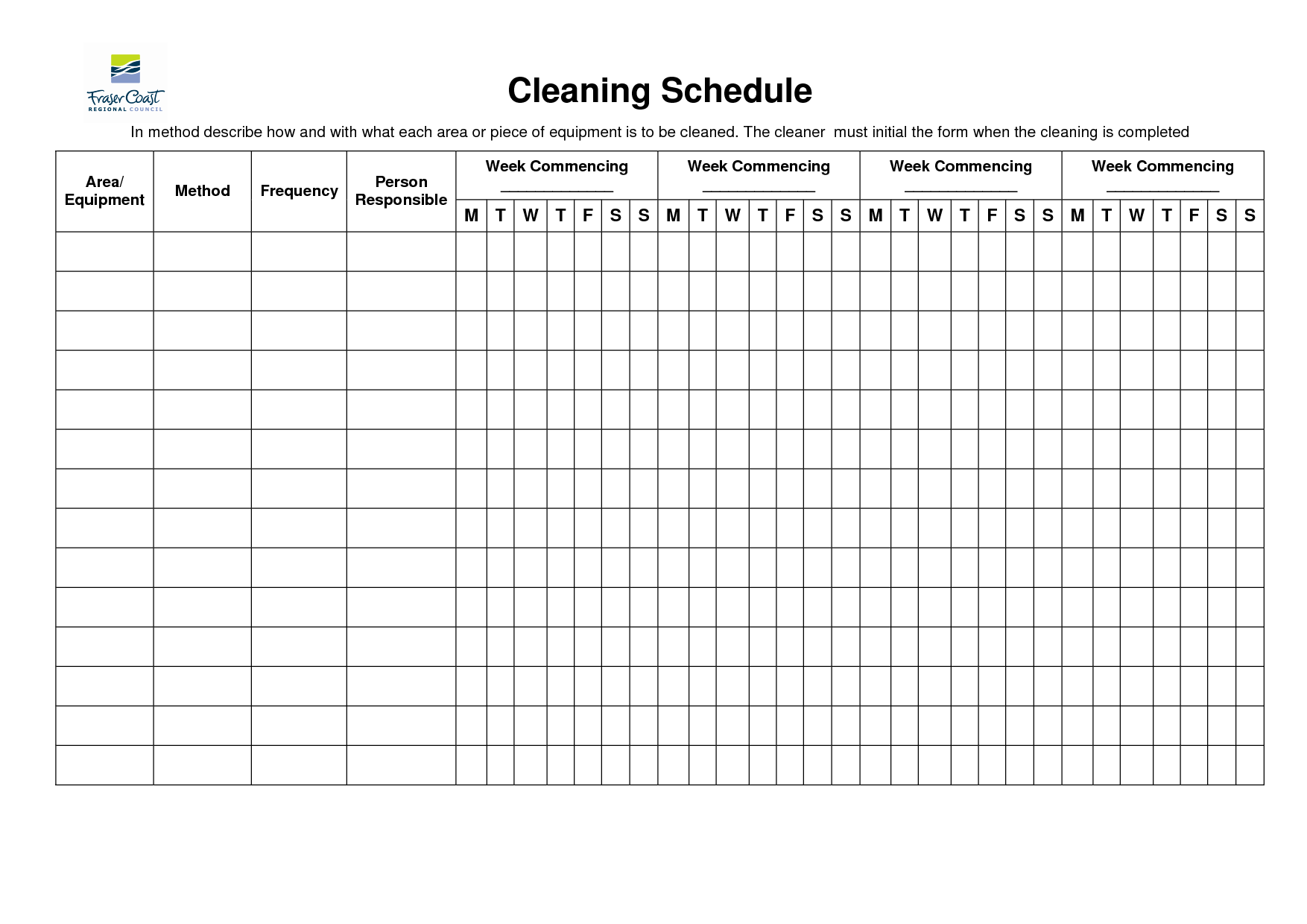

- House Cleaning Weekly Schedule Template

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a budget worksheet?

A budget worksheet is a tool used to track and manage one's income and expenses in order to create a financial plan. It typically lists all sources of income and all expenses, allowing individuals to analyze and categorize their spending habits, identify areas for potential savings or cuts, and ultimately work towards achieving their financial goals.

How can a budget worksheet be helpful in managing finances?

A budget worksheet can be helpful in managing finances by providing a clear snapshot of income and expenses, helping individuals track where their money is going, identify areas where they can cut back or save, set financial goals, prioritize spending, and ultimately, stay on track with their financial plan. By regularly updating and reviewing a budget worksheet, individuals can make informed decisions, avoid overspending, and take control of their finances for a more secure future.

What elements are typically included in a budget worksheet?

A budget worksheet typically includes categories such as income, expenses, savings, and debts. Under these categories, specific line items such as salary, rent/mortgage, utilities, groceries, transportation, entertainment, insurance, and loan repayments are listed. Other elements may include projected income, actual income, projected expenses, actual expenses, and a column for notes or comments. The worksheet is used to track and manage one's financial situation effectively.

How can a budget worksheet assist in setting financial goals?

A budget worksheet can assist in setting financial goals by providing a clear overview of income, expenses, and savings. By tracking spending habits and identifying areas where money can be saved or allocated towards specific goals, individuals can set realistic financial milestones and create a plan to achieve them. The visibility and organization offered by a budget worksheet enable individuals to prioritize their financial objectives, track progress, and make adjustments as needed to reach their desired outcomes.

Why is it important to track expenses and income on a budget worksheet?

Tracking expenses and income on a budget worksheet is important because it helps you understand where your money is going and how much you are earning. By keeping a record of your financial transactions, you can identify areas where you may be overspending or where you can cut back, ultimately helping you make more informed financial decisions, save more effectively, and work towards achieving your financial goals.

How can a budget worksheet help identify areas of overspending or underspending?

A budget worksheet can help identify areas of overspending or underspending by tracking and categorizing all expenses and income in one place. By comparing the actual spending to the planned budget amounts, individuals can easily see where they are spending more than anticipated (overspending) or where they are spending less than planned (underspending). This visual representation allows for a clear understanding of financial habits and enables adjustments to be made to ensure better money management and alignment with financial goals.

Can a budget worksheet help in planning for large purchases or investments?

Yes, a budget worksheet can be incredibly helpful in planning for large purchases or investments. By tracking income, expenses, and savings over time, individuals can better understand their financial capabilities and set realistic goals for future purchases or investments. It provides a clear overview of finances and helps in making informed decisions on how to allocate funds towards achieving those goals.

How often should a budget worksheet be updated?

A budget worksheet should ideally be updated at least once a month to track expenses, compare against budgeted amounts, and make adjustments as needed to stay on track with financial goals.

Are there any specific strategies or tips to use a budget worksheet effectively?

When using a budget worksheet, it is crucial to track all income and expenses accurately, categorize expenses, set realistic financial goals, review and update the budget regularly, and prioritize saving and debt repayment. Additionally, it can be helpful to utilize budgeting apps or tools for automation and convenience, seek professional guidance if needed, and stay committed and disciplined in sticking to the budget to achieve financial stability and success.

Can a budget worksheet help in saving money or reducing debt?

Yes, a budget worksheet can definitely help in saving money or reducing debt. By tracking income and expenses, a budget worksheet allows you to see where your money is going and where you can make cuts or adjustments to save more or pay off debt faster. It helps you prioritize your spending and set goals for both saving and debt reduction, leading to better financial decision-making and improved financial stability.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments