Debt Budget Worksheet Printable

If you're searching for an effective tool to help you manage your finances and track your debt, look no further than a debt budget worksheet. Designed to assist individuals or households in organizing their financial obligations, a debt budget worksheet is a valuable resource for anyone looking to gain control over their debt. Whether you're a recent college graduate trying to stay on top of student loans or a family looking to reduce credit card debt, utilizing a debt budget worksheet can provide useful insights into your financial situation and aid in creating a successful plan to pay off debts.

Table of Images 👆

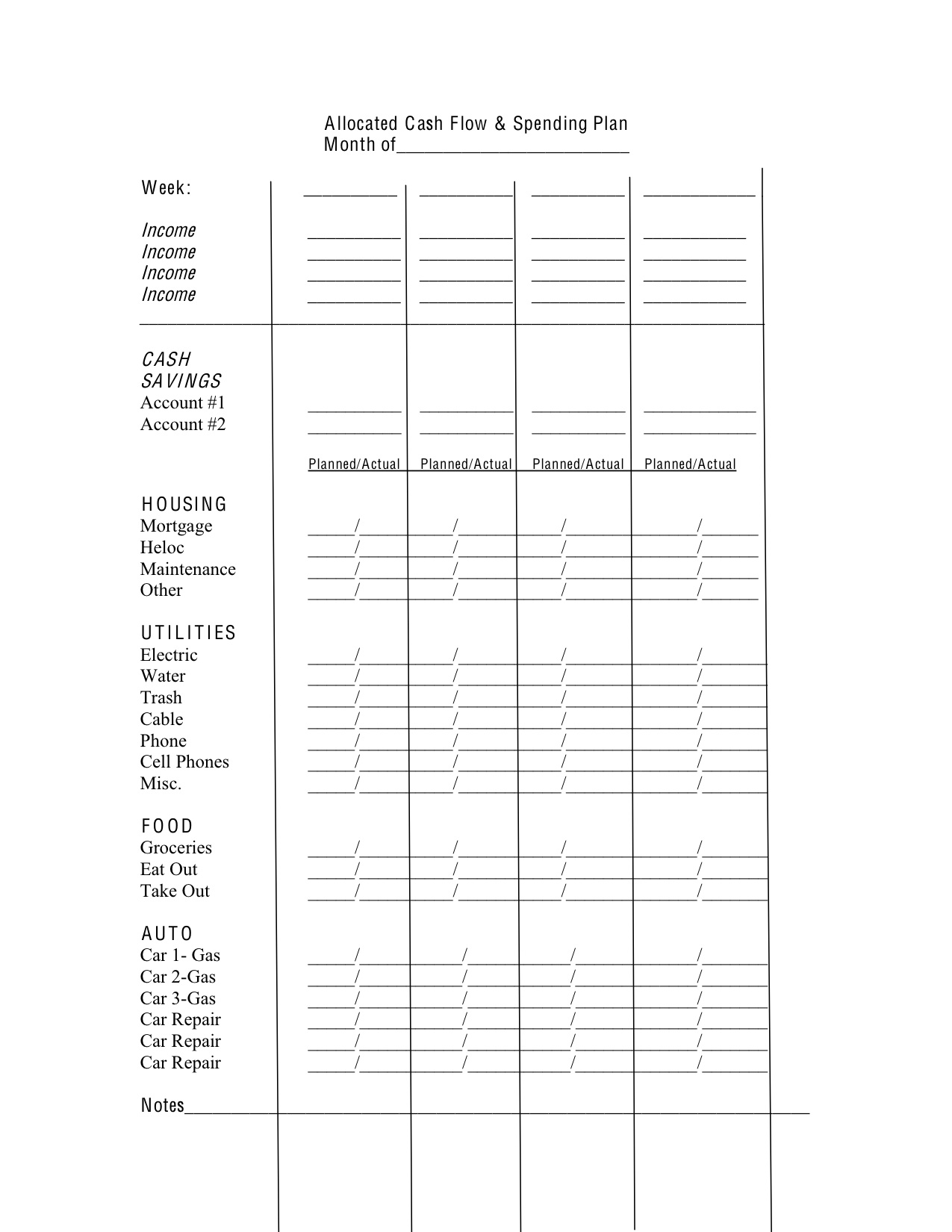

- Blank Worksheet Budget Sheet

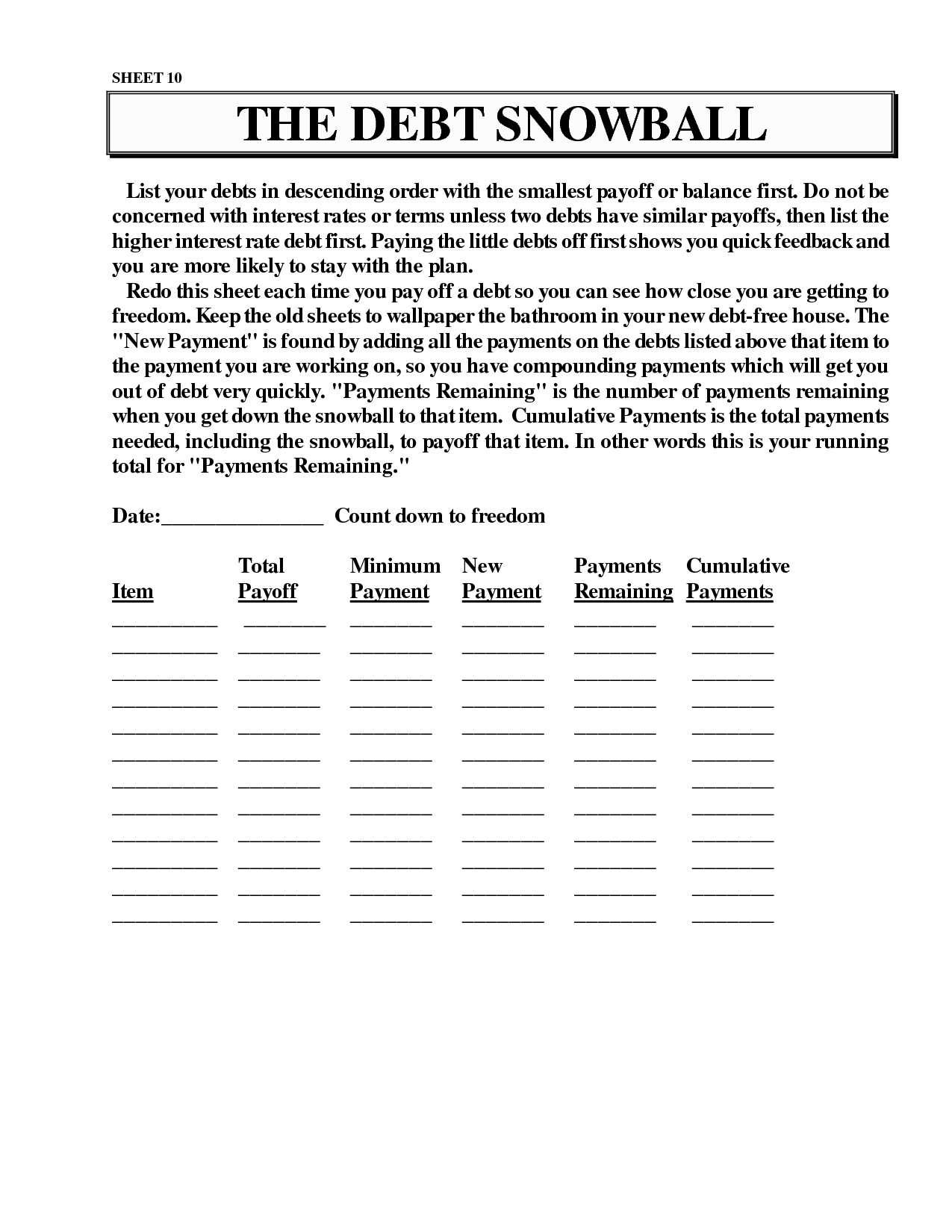

- Dave Ramsey Debt Snowball Worksheet

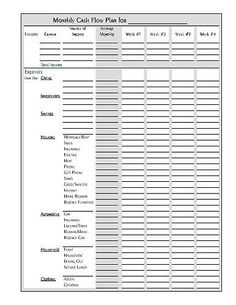

- Free Printable Dave Ramsey Budget Worksheets

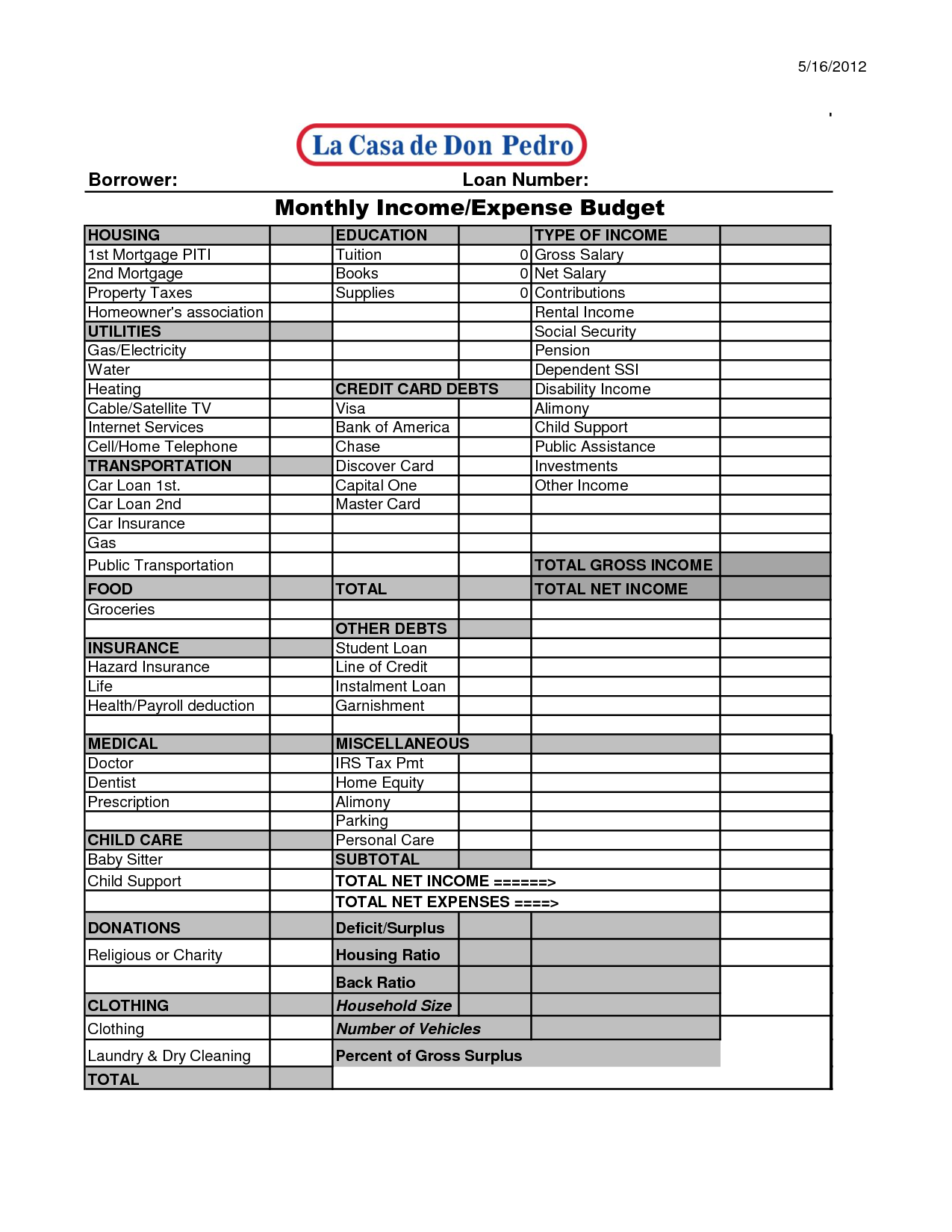

- Financial Budget Worksheet Blank

- Debt Snowball Worksheet Printable

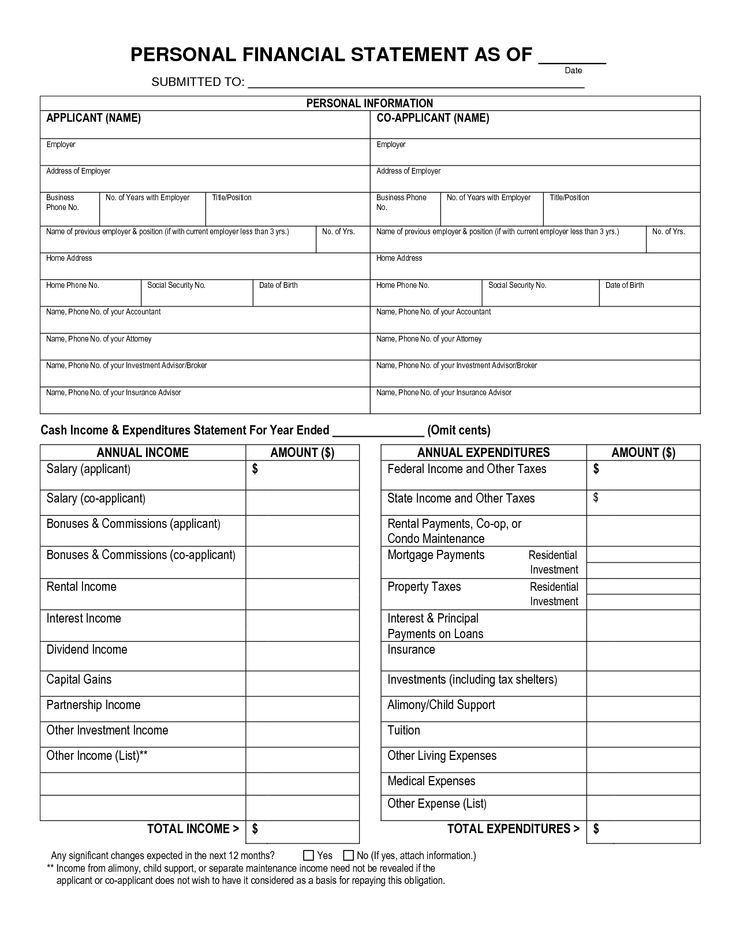

- Free Printable Personal Financial Statement Form

- Free Printable Bill Payment Planner

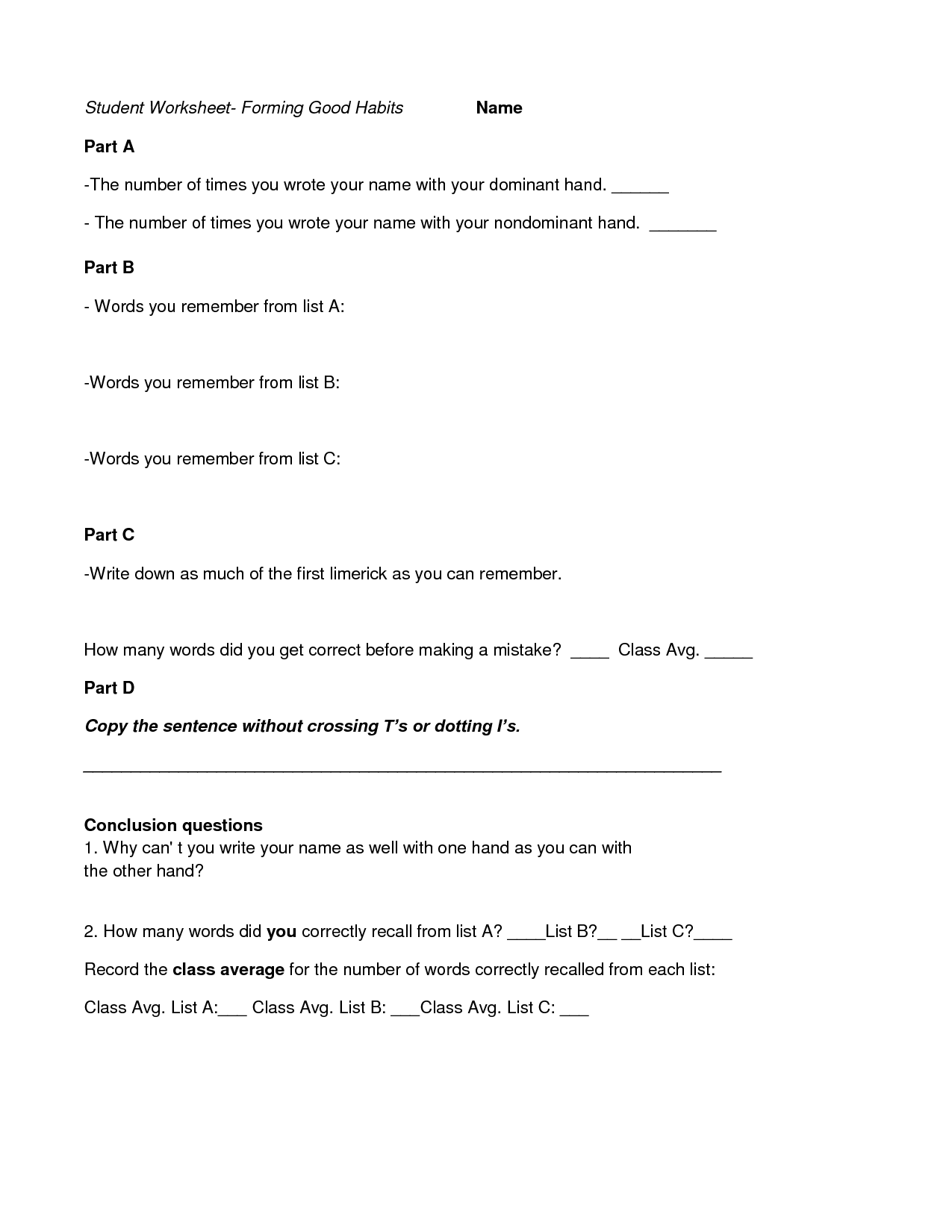

- Good Work Habit Worksheets

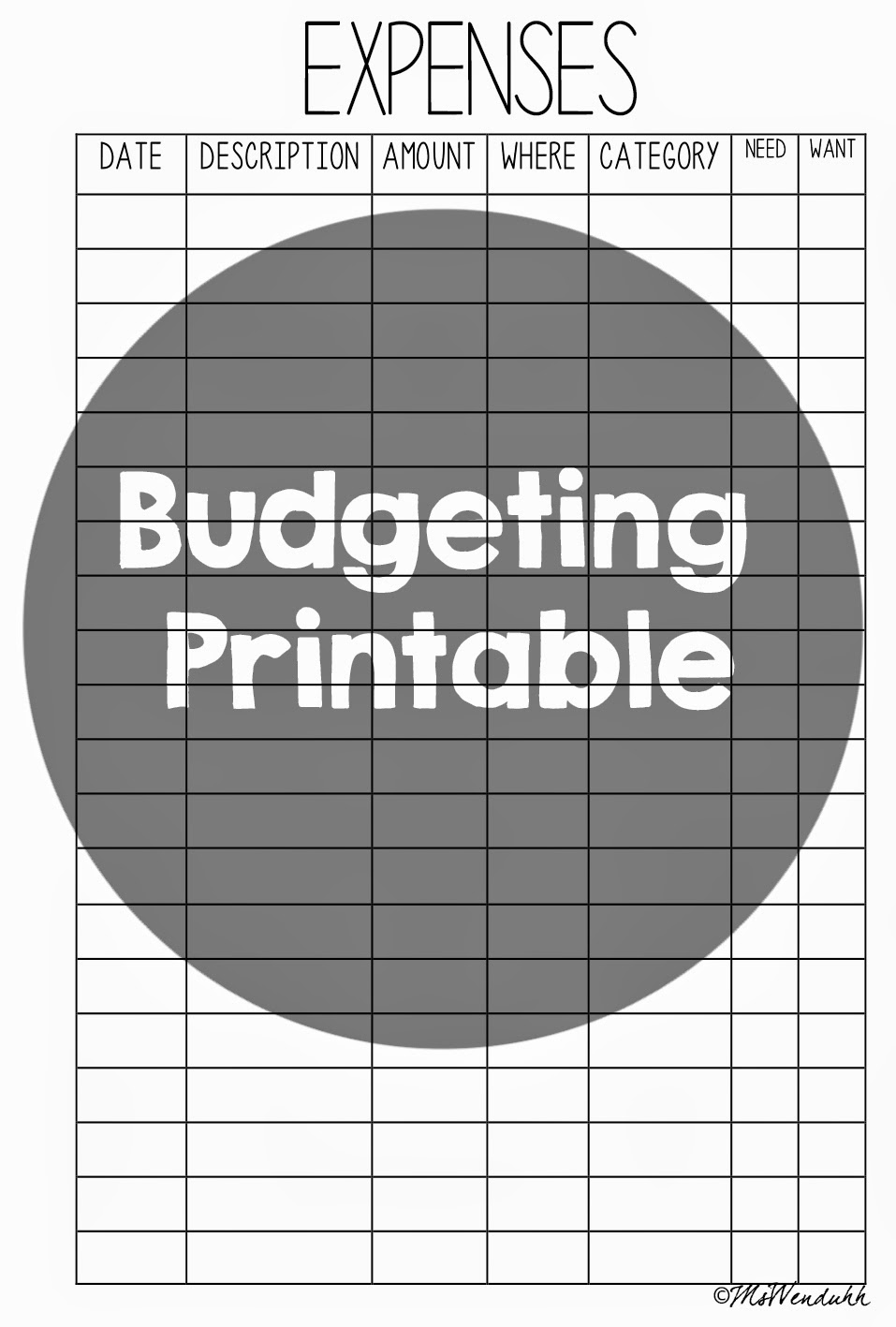

- Money Management Worksheets

- Printable Monthly Budget Planner

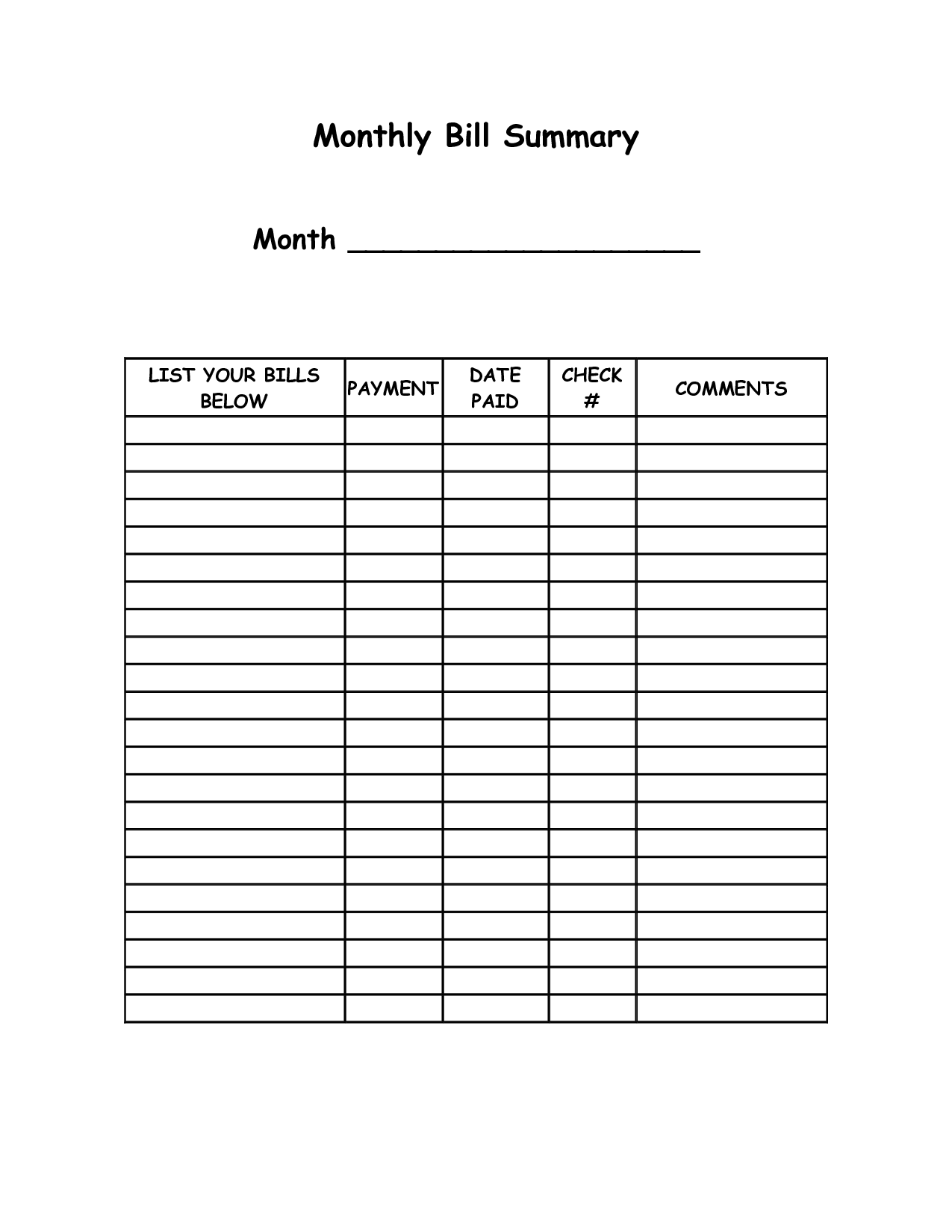

- Monthly Bill Organizer Template

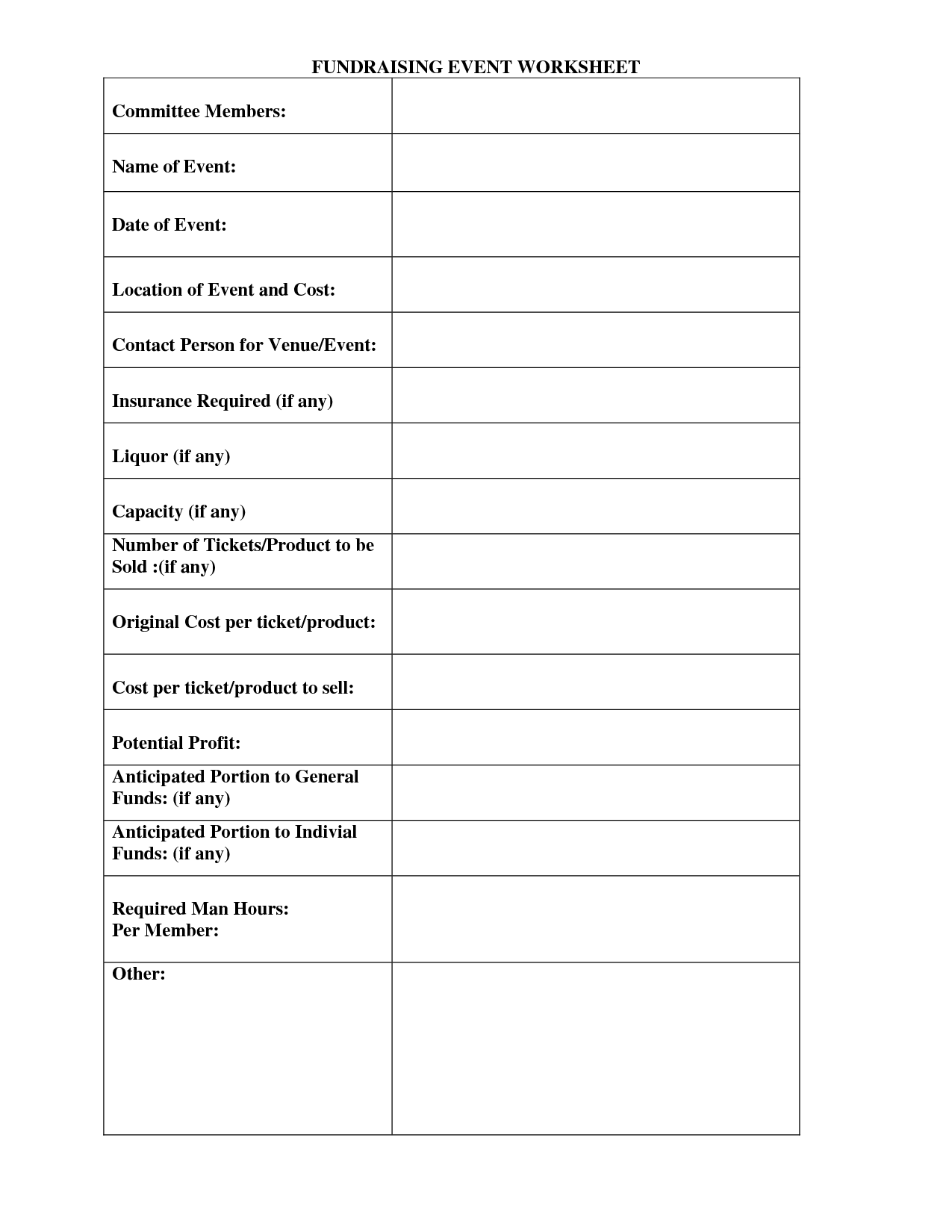

- Current Events Worksheet Template

- Free Printable Personal Planner Inserts

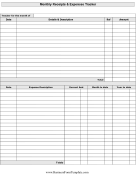

- Blank Monthly Receipt Template

- Free Printable Check Register Form

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a debt budget worksheet printable?

A debt budget worksheet printable is a tool that helps individuals organize and track their debts, including details such as creditor information, outstanding balances, interest rates, monthly payments, and progress on repayment. It provides a visual representation of one's debt situation, making it easier to create a structured repayment plan and manage finances effectively.

How can a debt budget worksheet printable help managing personal finances?

A debt budget worksheet printable can help managing personal finances by providing a clear overview of all debts owed, including amounts, due dates, and interest rates. By using this tool, individuals can track their progress in paying off debt, prioritize which debts to pay off first, and create a structured plan for managing and reducing debt over time. This worksheet can also help individuals visualize their financial situation, identify areas for cost-cutting or increased income, and ultimately work towards achieving financial stability and freedom.

How do you use a debt budget worksheet printable to track expenses and income?

To use a debt budget worksheet printable to track expenses and income, first list all sources of income and their amounts. Then, list all expenses and categorize them into fixed (e.g., rent, utilities) and variable (e.g., groceries, entertainment). Subtract total expenses from total income to calculate your disposable income. Next, set debt repayment goals and allocate a portion of your disposable income towards paying off debts. Regularly update the worksheet with actual expenses and income to monitor your financial progress and make adjustments as needed.

What types of financial information should be included in a debt budget worksheet printable?

A debt budget worksheet printable should include all relevant financial information related to debts, such as the total amount owed on each debt, minimum monthly payments, interest rates, due dates, and any additional fees or charges. It should also include information on income sources, expenses, and a breakdown of how much can be allocated towards debt repayment each month. Additionally, it should include a section to track progress, monitor changes in debt balances, and ensure ongoing adherence to the budget.

Are there different templates or formats of debt budget worksheet printables available?

Yes, there are various templates and formats of debt budget worksheet printables available online. Some common formats include monthly debt payment trackers, debt snowball worksheets, debt payoff planners, and debt reduction calculators. These templates can help individuals organize and prioritize their debts, track payments, set goals, and create a plan for reducing and eliminating debt. It's important to find a template that aligns with your financial goals and preferences to effectively manage and pay off your debts.

Where can you find free or affordable debt budget worksheet printables online?

You can find free or affordable debt budget worksheet printables online on websites such as Pinterest, Etsy, or personal finance blogs. Additionally, financial websites like NerdWallet or The Balance offer various budgeting templates and tools for managing debt. Alternatively, you can create your own personalized debt budget worksheet using Microsoft Excel or Google Sheets.

How often should you update your debt budget worksheet printable?

It is recommended to update your debt budget worksheet printable at least monthly or whenever there are changes to your income, expenses, or debts. Regularly reviewing and updating your budget will help you stay on top of your financial situation, identify any areas that may need adjustment, and ensure that you are on track to reaching your financial goals.

Can a debt budget worksheet printable help you identify areas for potential savings or spending cuts?

Yes, a debt budget worksheet printable can help you identify areas for potential savings or spending cuts by providing a detailed breakdown of your income, expenses, and debts. By visually seeing where your money is going, you can pinpoint areas where you may be overspending or where you can make adjustments to save money. Additionally, creating a budget can help you prioritize your spending and focus on paying off your debts efficiently.

What are some common categories or sections included in a debt budget worksheet printable?

Common categories or sections included in a debt budget worksheet printable may include: total debt amount, type of debt (credit card, student loan, mortgage, etc.), minimum monthly payment, interest rate, due date, outstanding balance, and any additional notes or action items. These categories help individuals track and manage their debts more effectively by providing a clear overview of their financial obligations.

Are there any tips or recommendations for effectively using a debt budget worksheet printable?

When using a debt budget worksheet printable, start by accurately recording all your sources of income and expenses. Be specific and detailed to get a comprehensive understanding of your financial situation. Use categories to organize your debts and expenses, such as rent, utilities, groceries, and credit card payments. Regularly update the worksheet as your financial situation changes or you make progress in paying off debts. Set measurable and realistic goals for reducing debt and track your progress to stay motivated. Lastly, seek guidance from financial advisors or counselors to enhance your debt management strategies.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments