Check Reconciliation Worksheet

A check reconciliation worksheet is a valuable tool for individuals and businesses seeking to efficiently manage their finances. This worksheet serves as a convenient way to keep track of all the checks issued, ensuring that every transaction is properly recorded and reconciled with bank statements. With easy-to-use columns for important details such as check numbers, dates, payees, and amounts, the check reconciliation worksheet provides a clear and organized overview of financial transactions. Whether you're a small business owner or an individual looking to stay on top of your expenses, this worksheet simplifies the process of managing and balancing your accounts.

Table of Images 👆

- Holy Communion Crossword Puzzle

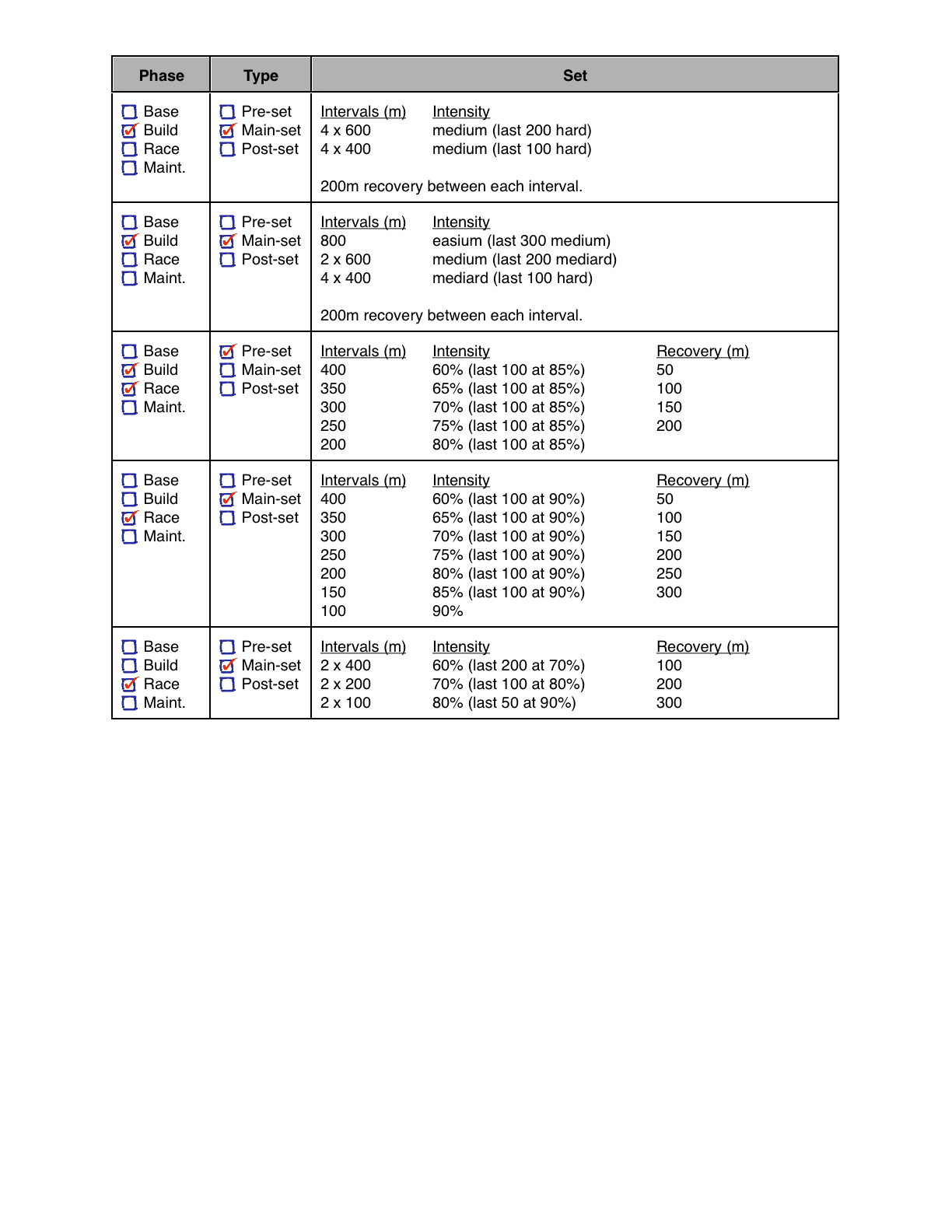

- Track Workout Plan

- Appraisal Order Form Template

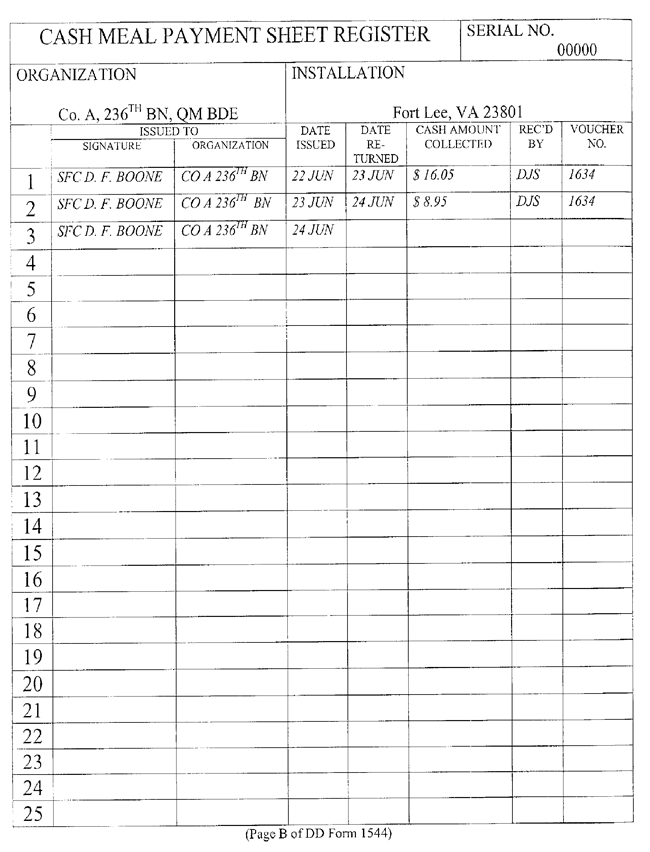

- Cash Register Count Sheet Template

- Business Forms Templates

- GL Account Reconciliation Template Excel

- Blank Monthly Receipt Template

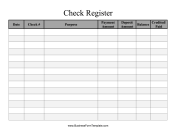

- Free Printable Check Register Form

- Accounting General Journal Template

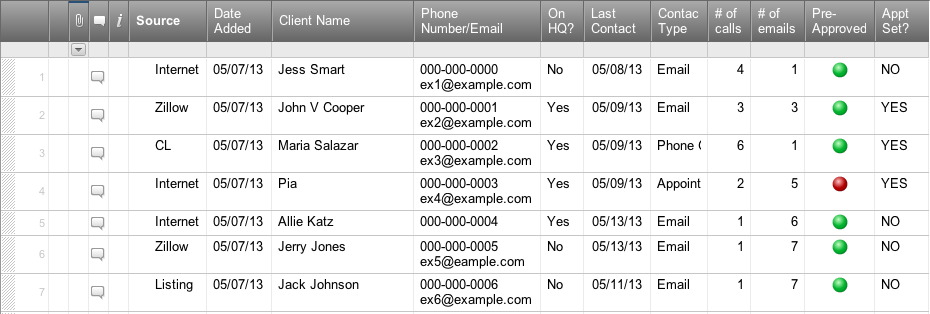

- Real Estate Lead Sheet Template

- Large Check Register Template

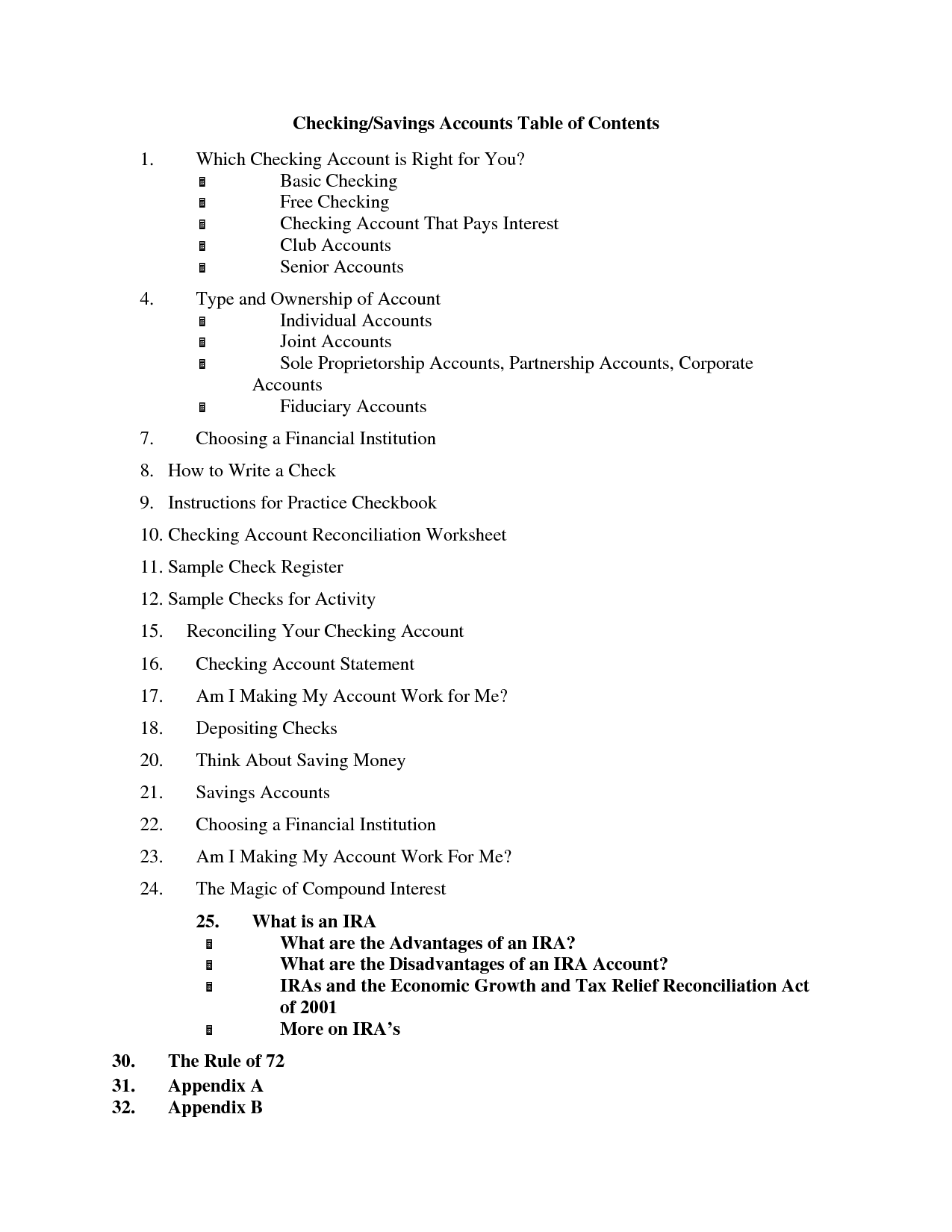

- Savings Checking Account

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

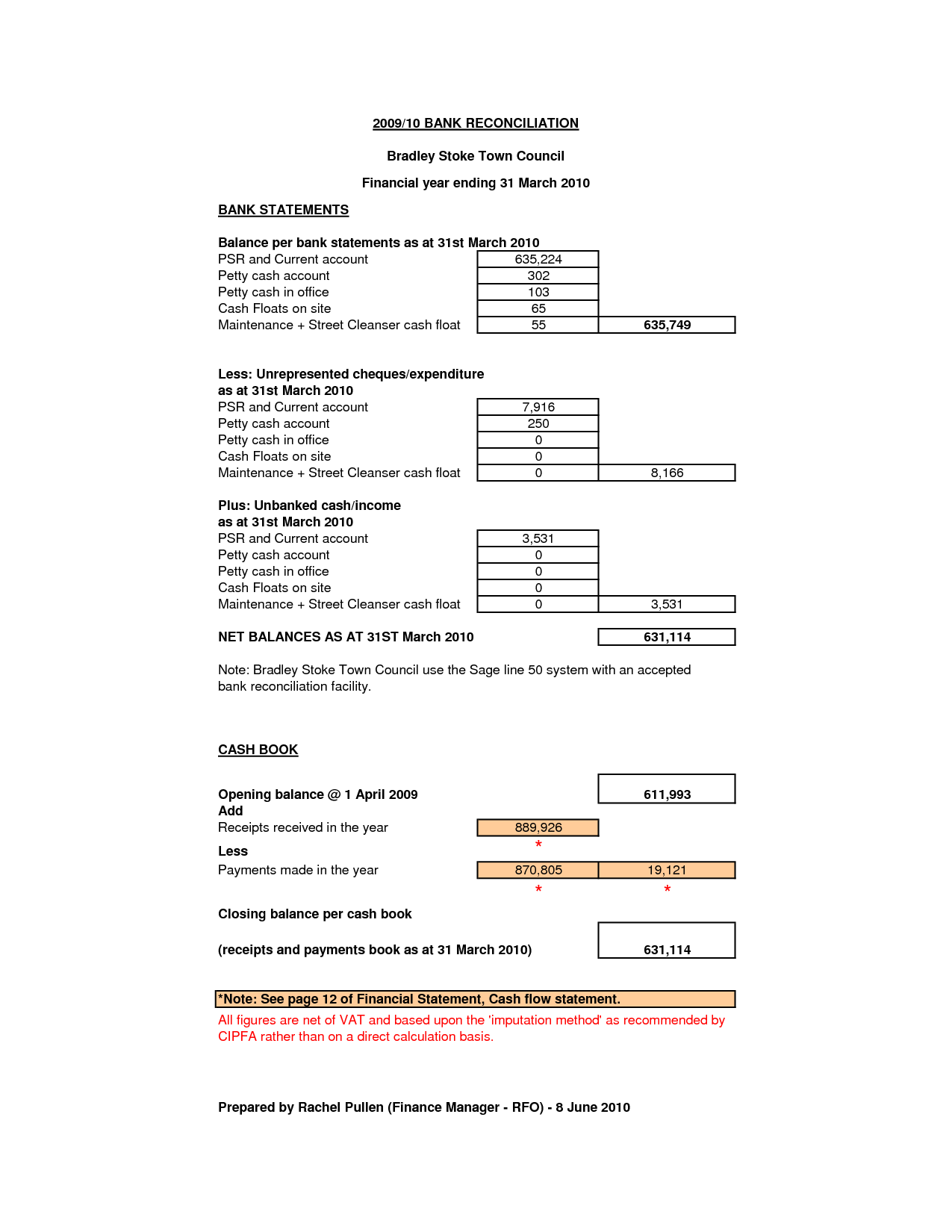

What is a Check Reconciliation Worksheet?

A Check Reconciliation Worksheet is a tool used by businesses to match the bank statement with their internal accounting records in order to ensure that all transactions are accurately recorded and accounted for. It helps to identify any discrepancies or errors between the two sets of records, such as missing checks, deposits, or bank fees, and facilitates the process of reconciling the differences.

What information is typically included in a Check Reconciliation Worksheet?

A Check Reconciliation Worksheet typically includes details such as the bank statement ending balance, outstanding checks, deposits in transit, service charges, interest earned, and any other adjustments needed to reconcile the company's internal records with the bank statement. It helps in identifying discrepancies and ensuring that both sets of records match accurately.

How is a Check Reconciliation Worksheet used in the accounting process?

A Check Reconciliation Worksheet is used in the accounting process to compare the company's internal records of check transactions with the bank's records. It helps identify any discrepancies, errors, or missing entries between the two sets of records. By reconciling these records, the company can ensure that its financial statements accurately reflect its financial position and that any discrepancies are promptly investigated and resolved.

Why is it important to regularly reconcile checks using a Check Reconciliation Worksheet?

Regularly reconciling checks using a Check Reconciliation Worksheet is important for several reasons. It helps ensure that all checks issued by a company are properly accounted for and that there are no discrepancies or fraudulent activities. By comparing the information on the bank statement with the company's records, discrepancies can be identified and resolved promptly, helping prevent potential errors or unauthorized transactions. This process also helps in monitoring cash flow, maintaining accurate financial records, and providing transparency in financial operations, which is crucial for financial planning and decision-making.

What are the steps involved in completing a Check Reconciliation Worksheet?

To complete a Check Reconciliation Worksheet, start by comparing the bank statement with your check register to find any discrepancies. Next, mark off checks and deposits that appear on both the bank statement and register. Reconcile any differences by adjusting for outstanding checks, deposits in transit, bank fees, or errors in the check register. Ensure the ending balance on the worksheet matches the ending balance on the bank statement. Finally, document any adjustments made and reconcile the differences to ensure accuracy.

How does a Check Reconciliation Worksheet help identify discrepancies in check transactions?

A Check Reconciliation Worksheet helps identify discrepancies in check transactions by comparing the company's records of issued checks with the bank's records of cleared checks. By reconciling these two sets of data, any discrepancies such as missing checks, unauthorized transactions, or errors in the recorded amounts can be easily identified. This process ensures that the company's financial records accurately reflect its actual cash transactions and helps prevent fraud or accounting mistakes.

What are some common errors or discrepancies that can be found using a Check Reconciliation Worksheet?

Some common errors or discrepancies that can be found using a Check Reconciliation Worksheet include transposition errors (such as reversing numbers), omission of transactions, duplicate entries, bank errors, timing differences (such as deposits or withdrawals that are not reflected on the statement yet), and errors in recording or posting transactions. It is important to thoroughly review and cross-reference all information on the check reconciliation worksheet to identify and correct any discrepancies to ensure the accuracy of the financial records.

How does a Check Reconciliation Worksheet help ensure accurate financial records?

A Check Reconciliation Worksheet helps ensure accurate financial records by providing a systematic method for cross-referencing and verifying all transactions related to checks issued and cleared. By comparing the information on the worksheet with the bank statement, discrepancies can be identified and resolved promptly, reducing the risk of errors or fraud. This process enhances transparency and accountability in financial management, leading to more precise and reliable record-keeping.

What is the role of a Check Reconciliation Worksheet in preventing fraudulent activity?

A Check Reconciliation Worksheet plays a crucial role in preventing fraudulent activity by providing a detailed comparison of issued checks with cleared checks, helping to identify any discrepancies or potential unauthorized transactions. By regularly reconciling and verifying check transactions, discrepancies can be detected and investigated promptly, reducing the likelihood of fraudulent activity going unnoticed or unaddressed within the organization's financial records.

How often should a business or individual reconcile their checks using a Check Reconciliation Worksheet?

It is recommended that businesses and individuals reconcile their checks using a Check Reconciliation Worksheet on a monthly basis. This ensures that discrepancies are caught early and rectified promptly, helping to prevent fraud and errors in financial records.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments