Cash Flow Budget Worksheet

A cash flow budget worksheet is a valuable tool for individuals or businesses to track and manage their finances. This worksheet allows you to clearly visualize and organize your income, expenses, and savings, providing a comprehensive snapshot of your financial health. With an emphasis on entity and subject, this blog post aims to guide small business owners and individuals in effectively utilizing a cash flow budget worksheet to make informed financial decisions.

Table of Images 👆

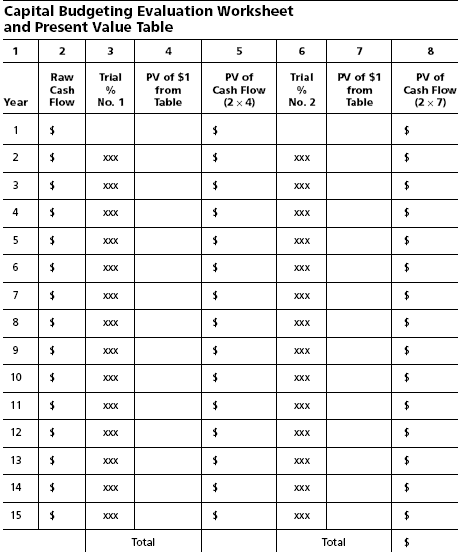

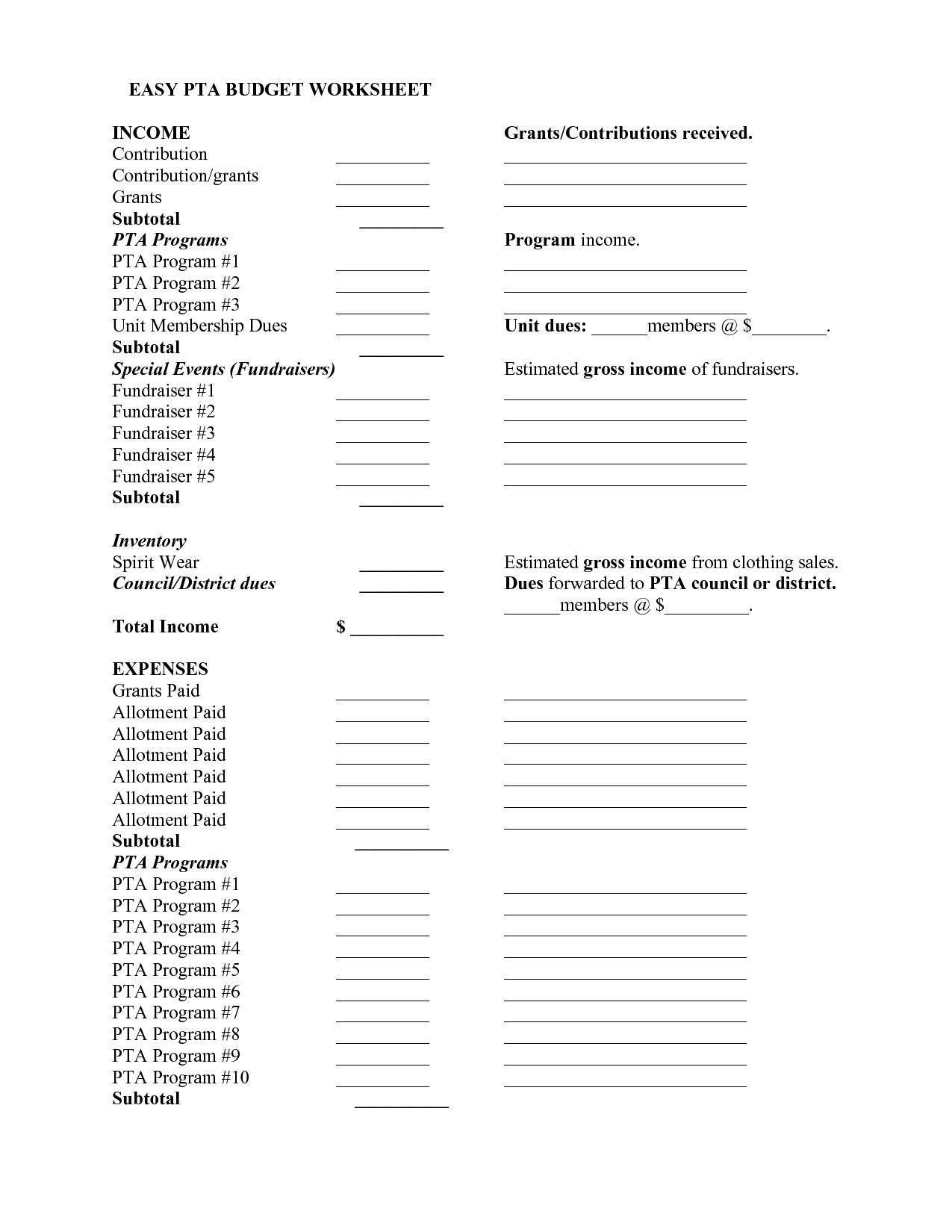

- Capital Budget Worksheet

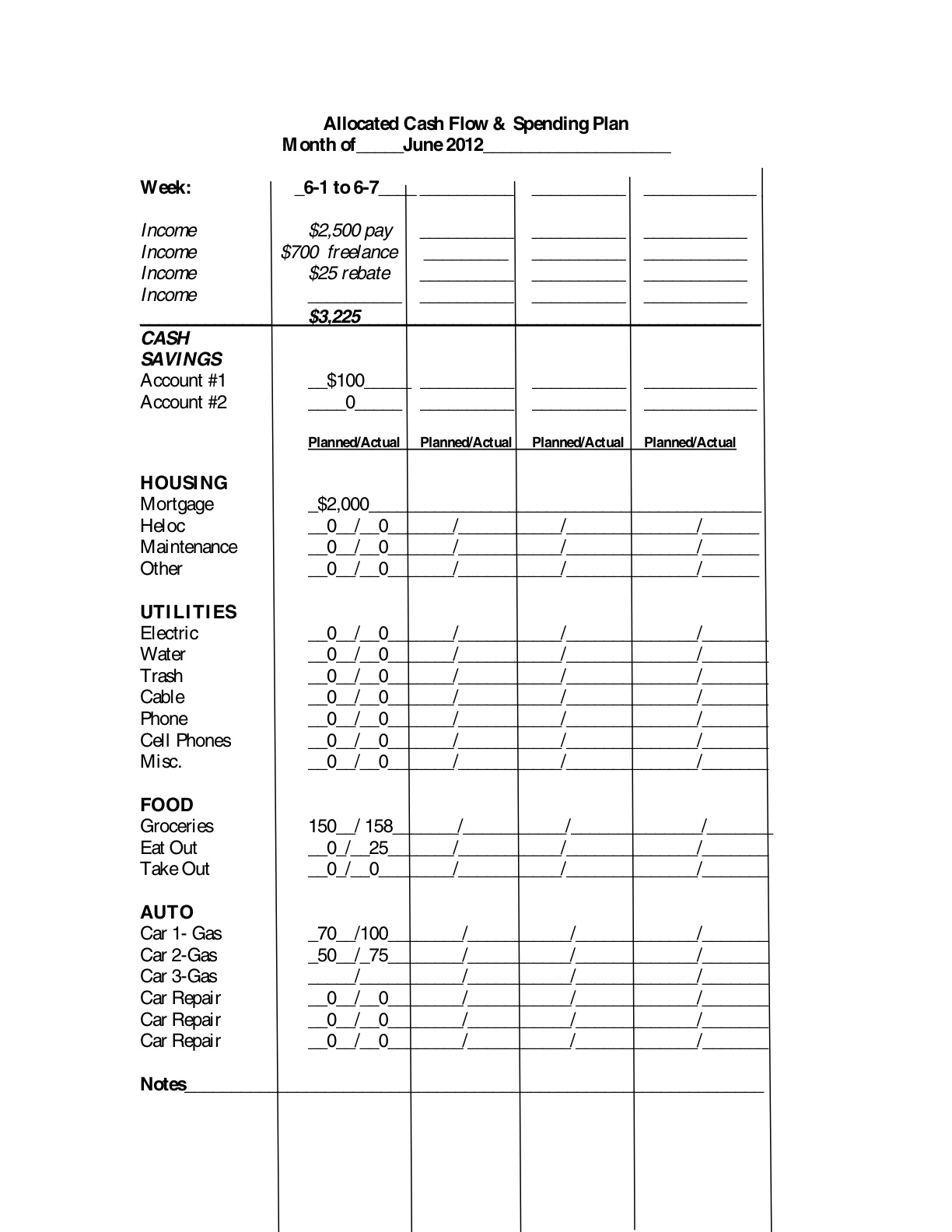

- Dave Ramsey Allocated Spending Plan Budget

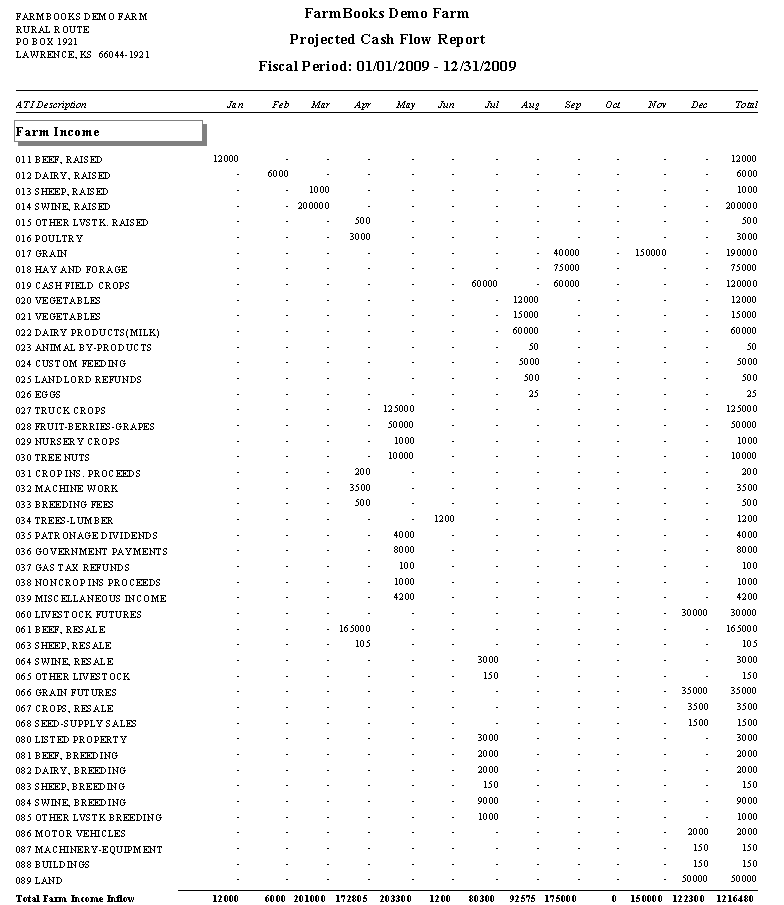

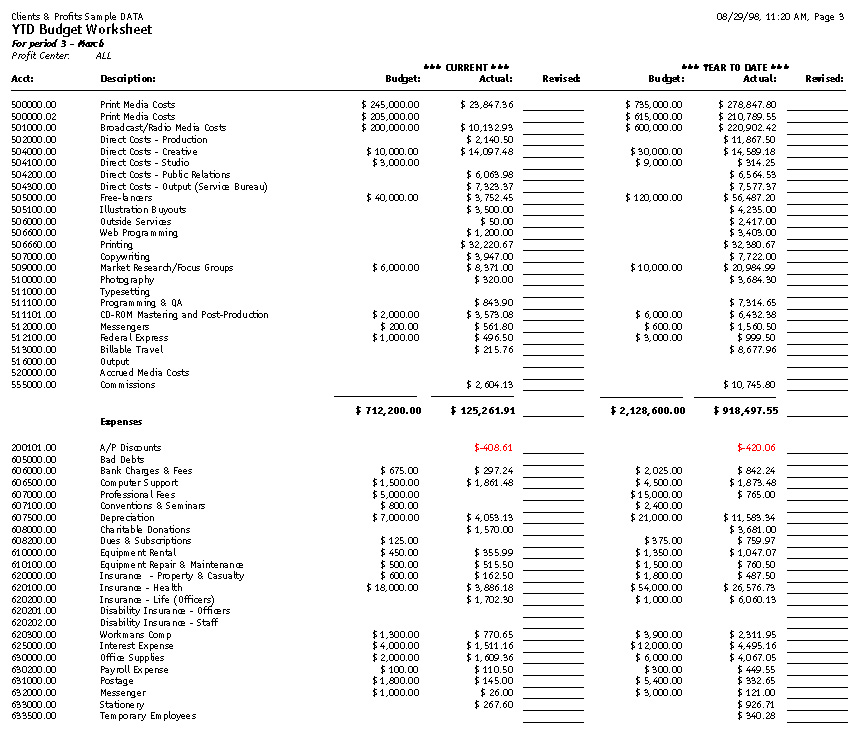

- Projected Monthly Cash Flow Statement

- Monthly Income Profit Loss Statement Worksheet

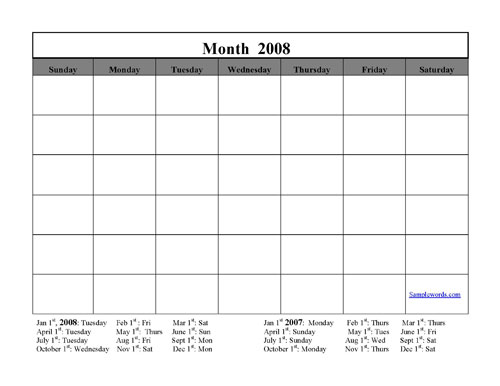

- Blank Monthly Calendar Print Out Templates

- Sample Grant Budget Worksheet

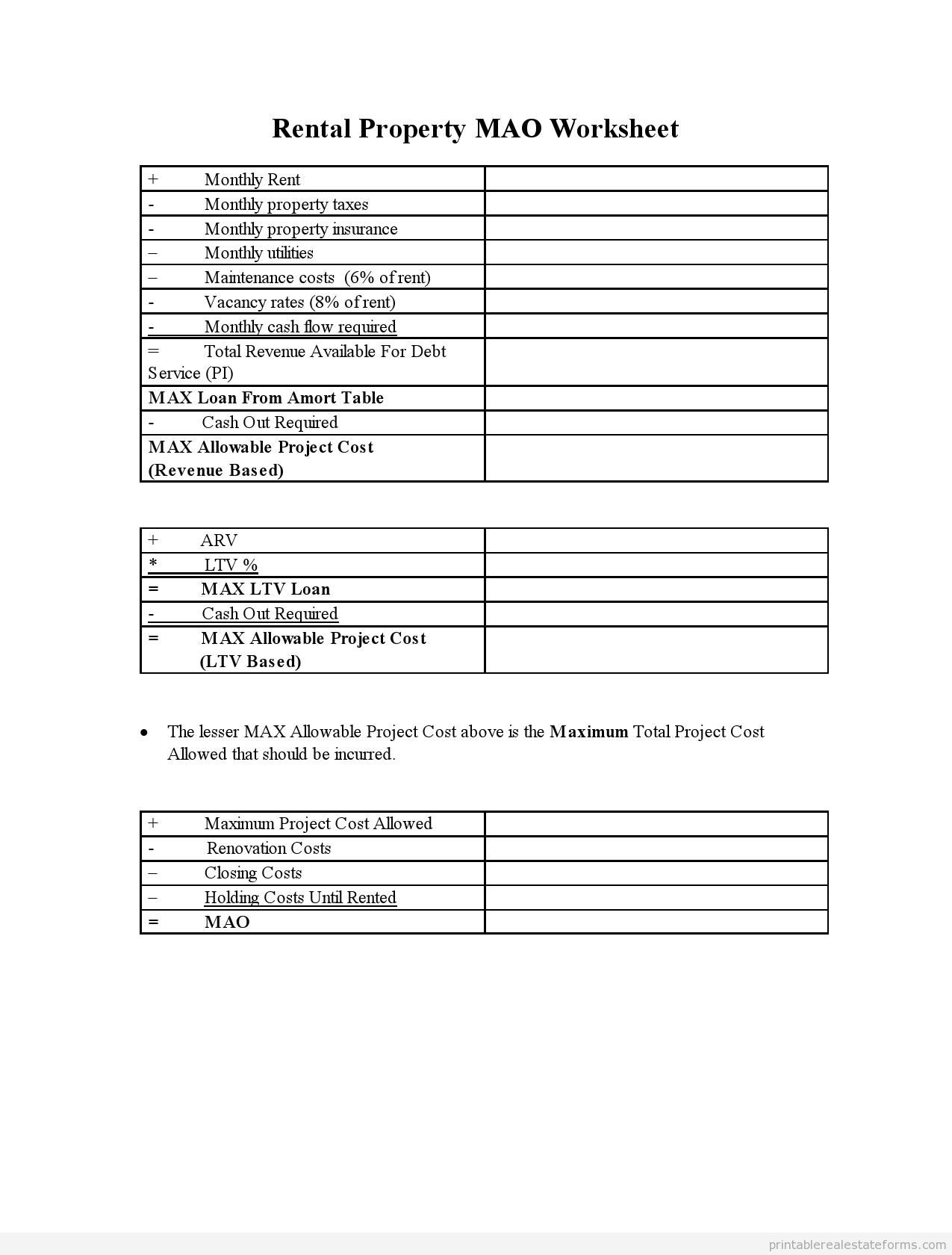

- Real Estate Rental Forms Free

- Blank Worksheet Budget Sheet

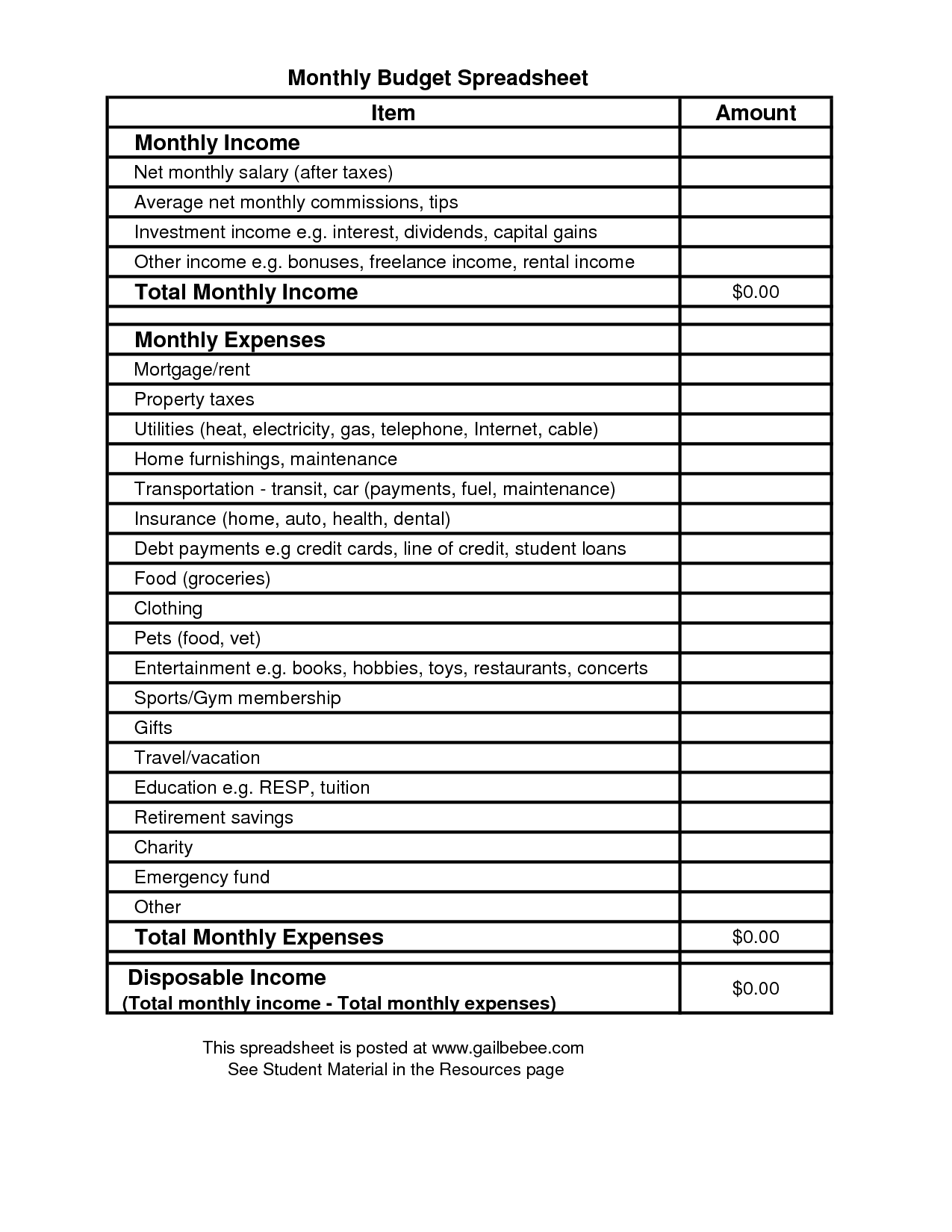

- Monthly Income Spreadsheet Template

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a cash flow budget worksheet?

A cash flow budget worksheet is a financial tool used to track and forecast a person or organization's incoming and outgoing cash flow over a period of time. It helps to plan and manage expenses, identify potential cash shortages or surpluses, and make informed financial decisions. The worksheet typically includes sections for income sources, expenses, and a calculation of the net cash flow for each period.

Why is it important to have a cash flow budget for a business?

Having a cash flow budget for a business is essential because it helps in understanding and planning for the flow of money in and out of the business. It provides insights into when cash will be received and when payments are due, enabling better management of expenses, investments, and savings. By having a clear view of the company's financial health, cash flow budgeting allows businesses to anticipate and prepare for any potential cash shortages or surpluses, ultimately aiding in making informed decisions that contribute to the overall success and sustainability of the business.

How does a cash flow budget worksheet help with financial planning?

A cash flow budget worksheet helps with financial planning by tracking and forecasting the flow of money in and out of a person or company’s finances. It allows for a detailed understanding of income and expenses, enabling better management of cash flow, identification of potential financial gaps or surpluses, and making informed decisions about spending, saving, and investments. This tool helps to prioritize financial goals, anticipate and plan for future expenses, and ultimately, achieve greater financial stability and success.

What are the key components of a cash flow budget worksheet?

The key components of a cash flow budget worksheet include income sources, such as revenue from sales or services, expense categories like rent, utilities, and payroll, cash inflows and outflows, beginning cash balance, projected ending cash balance, and any anticipated financing activities. It is important to track and project accurately all these components to manage cash flow effectively and make informed financial decisions for a business or individual.

How can a business use a cash flow budget worksheet to monitor cash inflows and outflows?

A business can use a cash flow budget worksheet to monitor cash inflows and outflows by forecasting and tracking the timing of expected revenues and expenses. By inputting estimated amounts for upcoming transactions, the worksheet can provide a clear picture of how much cash is expected to come in and go out over a certain period. By comparing actual cash flows to the budgeted amounts, businesses can identify any discrepancies and take proactive measures to ensure that they have enough cash on hand to cover expenses and make strategic financial decisions.

What are some common challenges in creating and maintaining an accurate cash flow budget worksheet?

Common challenges in creating and maintaining an accurate cash flow budget worksheet include keeping track of all sources of income and expenses, accurately forecasting variable expenses such as utility bills and unforeseen costs, ensuring all transactions are recorded in a timely manner, adjusting the budget as financial circumstances change, and reconciling inconsistencies between projected and actual cash flows. Additionally, staying disciplined in sticking to the budget and regularly reviewing and updating the worksheet are key factors in accurately managing cash flow.

How can a cash flow budget worksheet help with decision-making and strategic planning?

A cash flow budget worksheet can help with decision-making and strategic planning by providing a detailed overview of a company's expected cash inflows and outflows over a specific period. By forecasting cash flows, businesses can anticipate potential shortfalls or surpluses, enabling them to make informed decisions about investments, expenses, and financing options. This tool assists in identifying opportunities for growth, understanding liquidity needs, and establishing realistic financial goals, ultimately supporting proactive and effective strategic planning to ensure the financial health and sustainability of the organization.

What are the benefits of regularly reviewing and updating a cash flow budget worksheet?

Regularly reviewing and updating a cash flow budget worksheet ensures that you have an accurate understanding of your financial situation at all times. This allows you to make informed decisions, identify trends or issues early, and adjust your spending or investments as necessary. It also helps in setting realistic financial goals, tracking progress, and making necessary adjustments to stay on track with your financial objectives. Overall, maintaining an up-to-date cash flow budget worksheet promotes financial stability, transparency, and control over your finances.

How can a cash flow budget worksheet assist with identifying and resolving cash flow issues?

A cash flow budget worksheet can assist with identifying and resolving cash flow issues by providing a clear and organized overview of all inflows and outflows of cash. By tracking and categorizing expenses and revenues, it becomes easier to pinpoint where potential cash flow problems lie. This tool allows businesses to forecast cash inflows and outflows, identify areas where costs can be reduced, assess the timing of payments, and plan for any potential shortfalls. By having a visual representation of the financial landscape, businesses can proactively address any cash flow issues before they become critical and make informed decisions to improve their financial health.

What are some tips for effectively managing cash flow based on the information in a cash flow budget worksheet?

Some tips for effectively managing cash flow based on a cash flow budget worksheet include: regularly updating the budget with accurate data, identifying and prioritizing expenses to ensure essential ones are covered first, tracking cash inflows and outflows to anticipate any potential shortfalls or surpluses, setting aside reserves for unexpected costs or emergencies, negotiating extended payment terms with suppliers or vendors when possible, and actively managing accounts receivable to ensure timely payments from customers. Additionally, periodic reviews of the cash flow budget can help in making necessary adjustments to improve overall financial stability and liquidity.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments