Budgeting Skills Worksheet

Having solid budgeting skills is essential for anyone who wants to manage their finances effectively. If you're an individual or a small business owner looking for a helpful tool to improve your budgeting skills, you may find worksheets to be a valuable resource. Worksheets provide a structured format for organizing your expenses and income, allowing you to track your spending and saving habits more efficiently.

Table of Images 👆

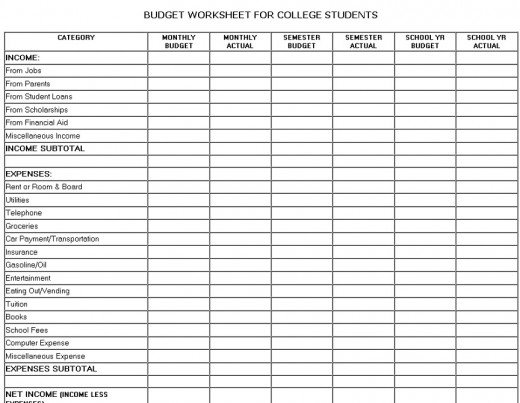

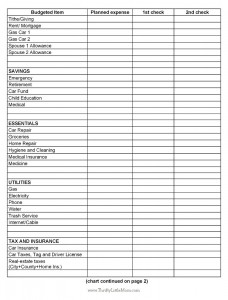

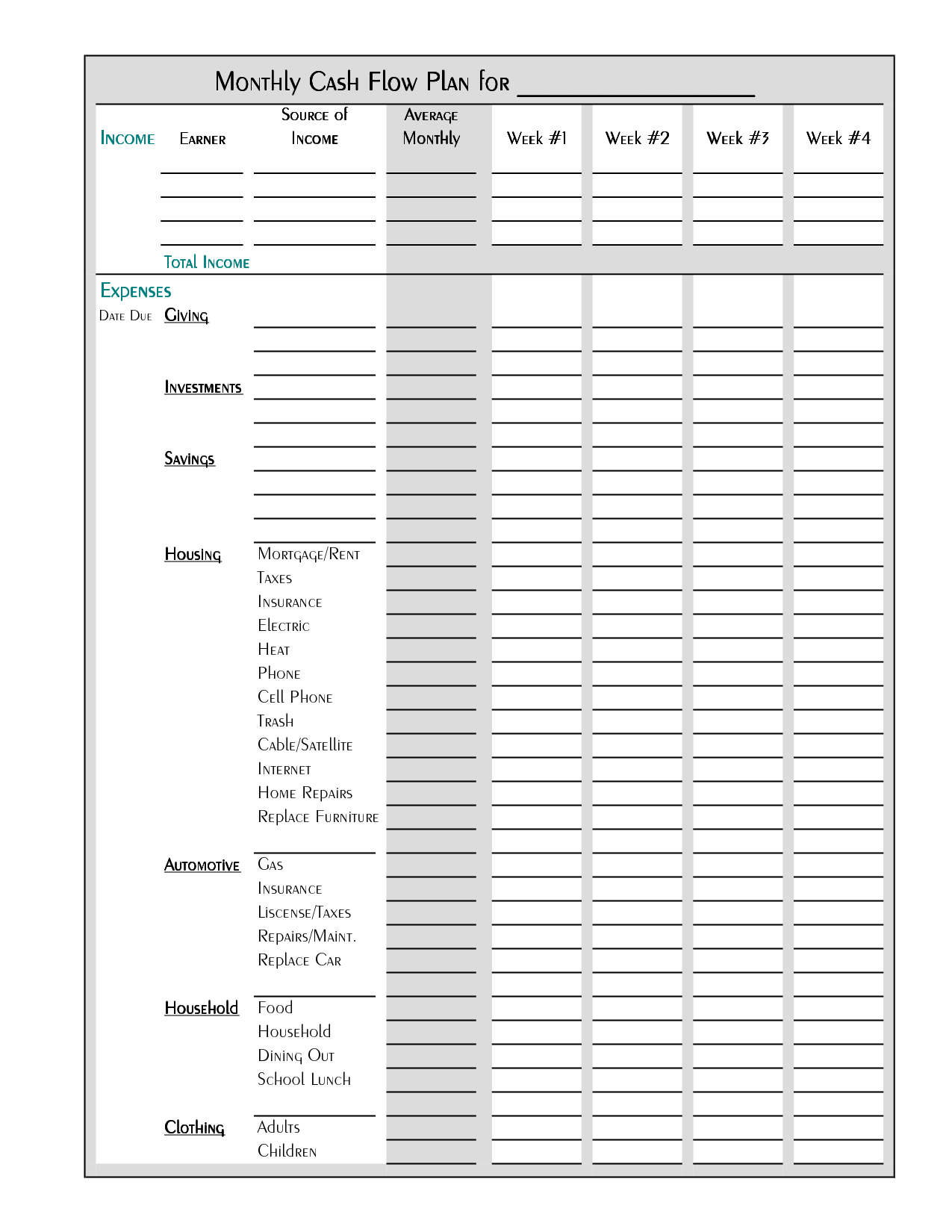

- Money Budget Worksheet

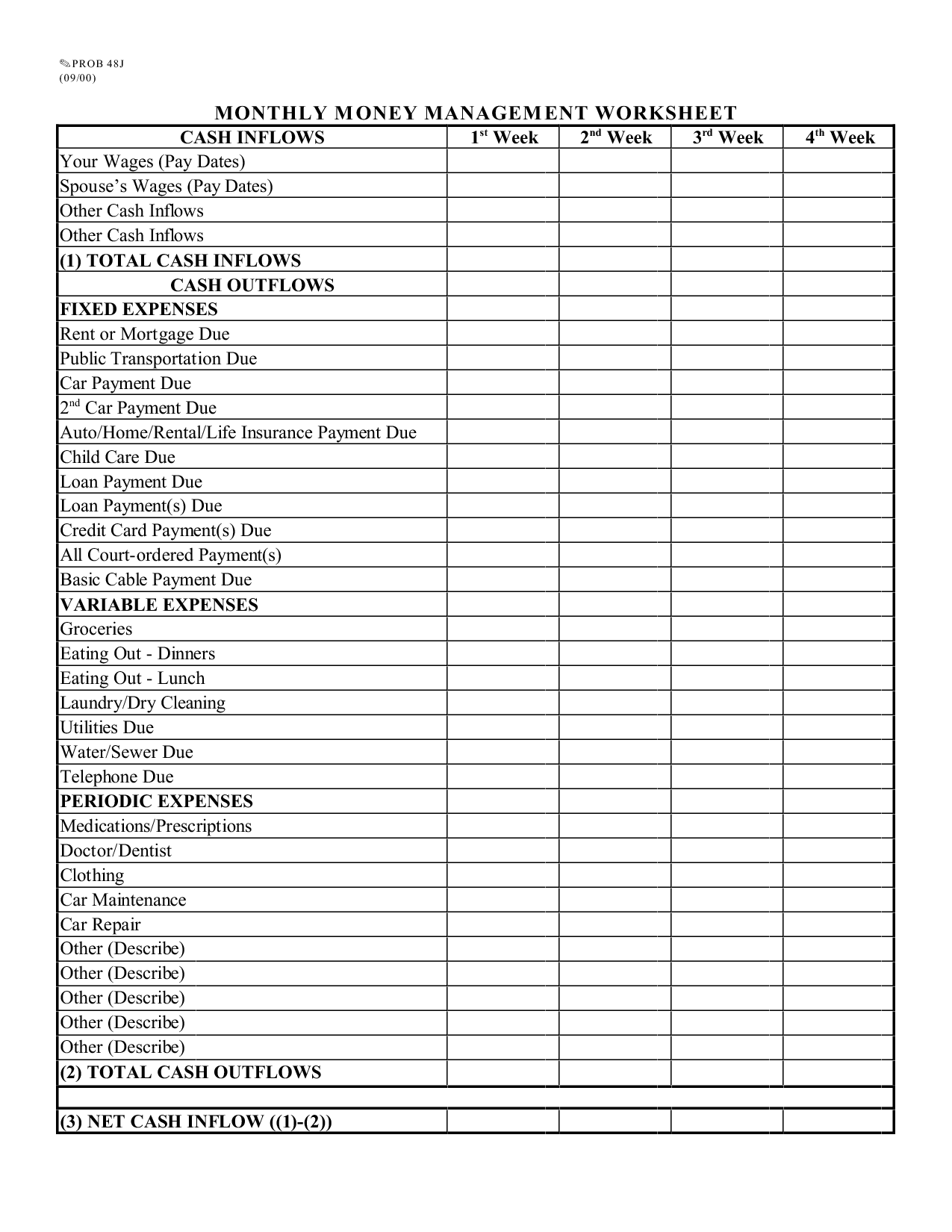

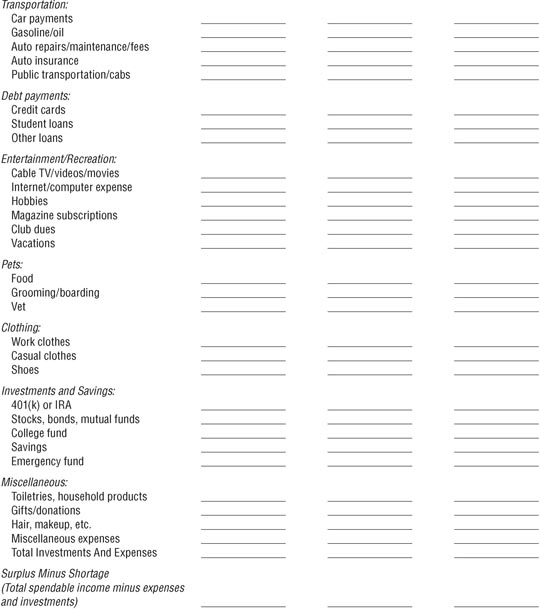

- Monthly Money Management Worksheet

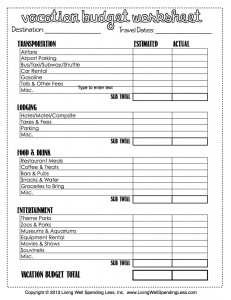

- Vacation Budget Worksheet Printable

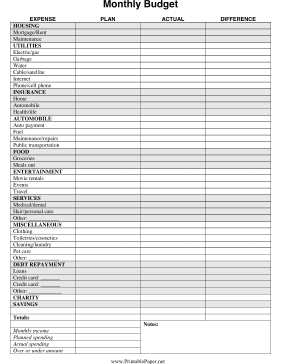

- Printable Monthly Budget Paper

- Budget Worksheet Template for Young Adults

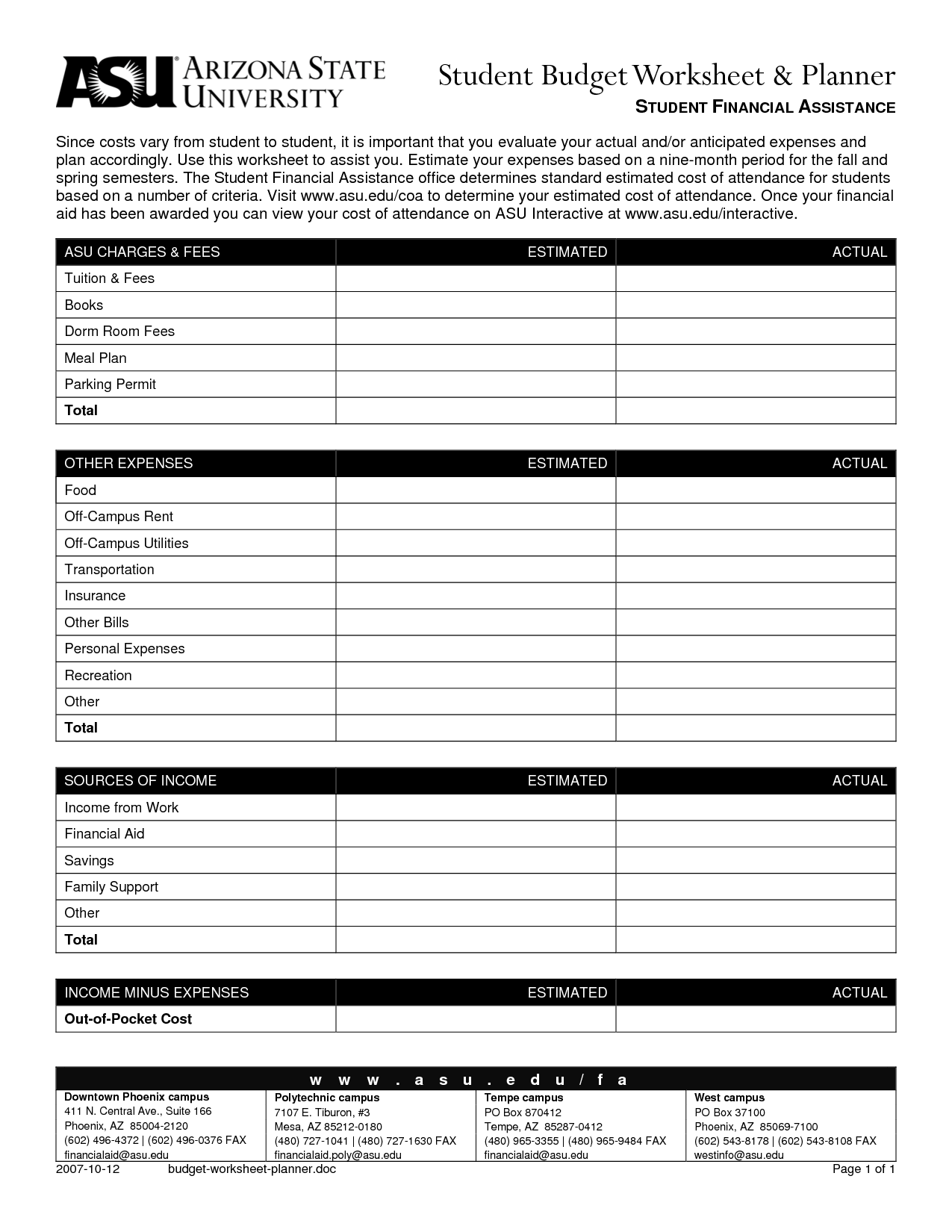

- College Student Budget Worksheet Printable

- College Student Budget Worksheet

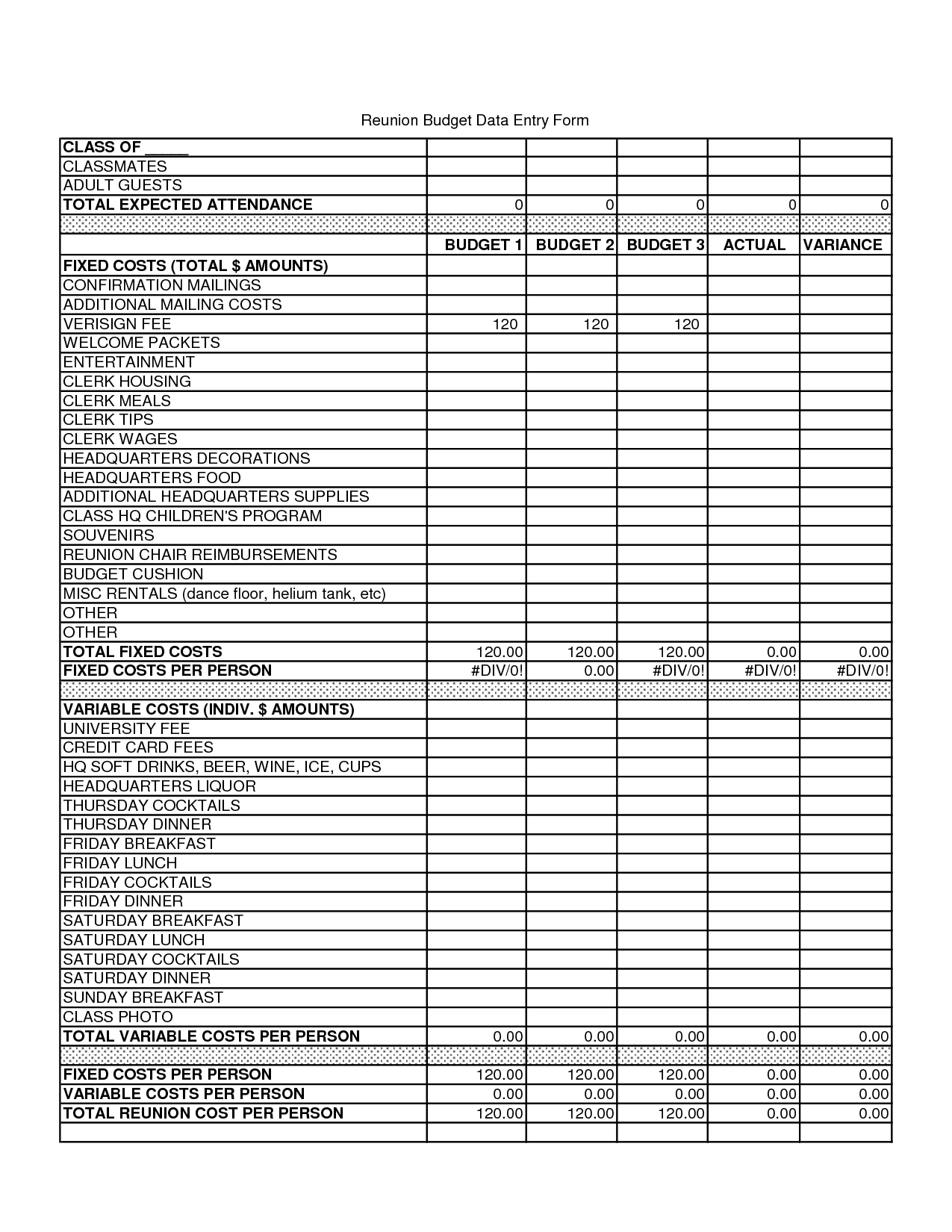

- Family Reunion Budget Worksheet

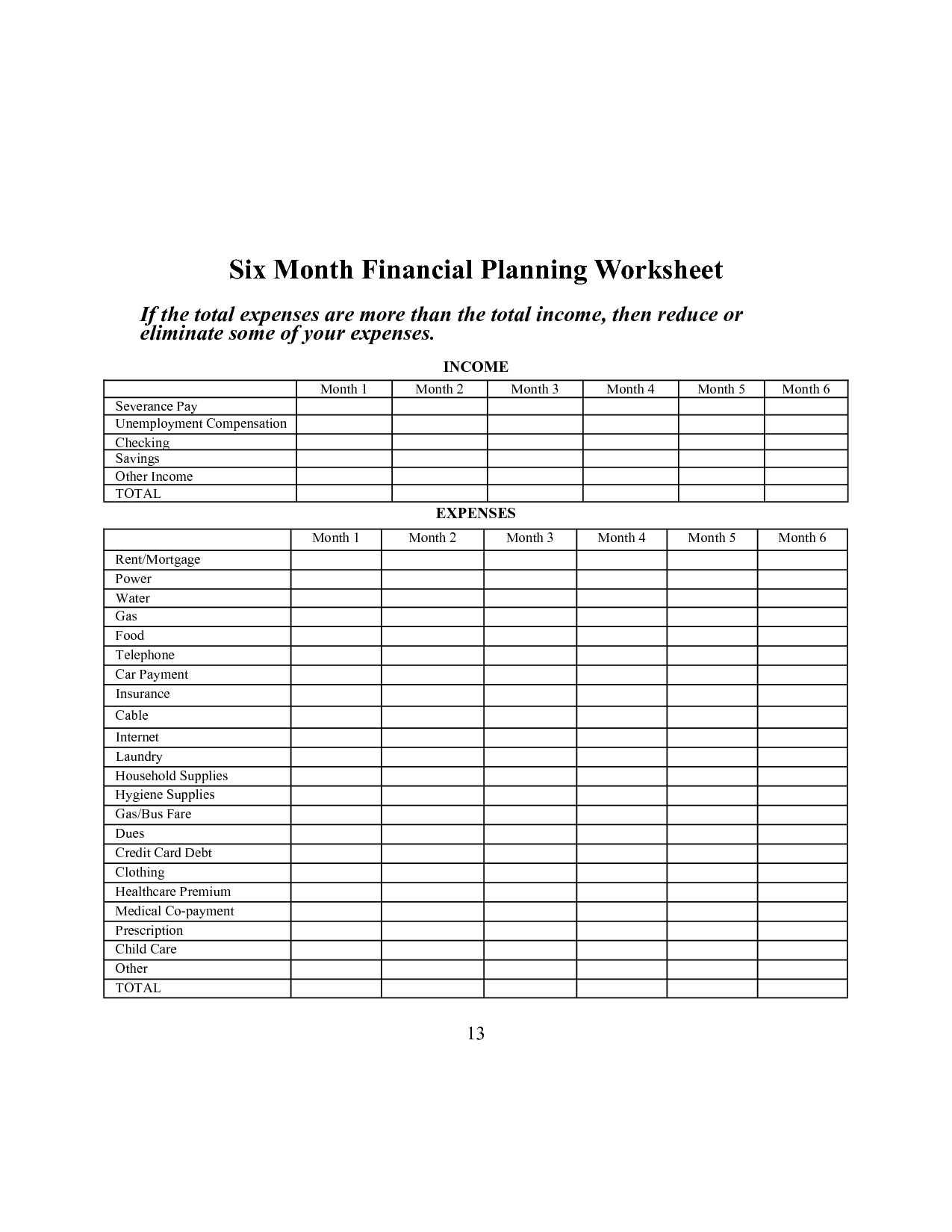

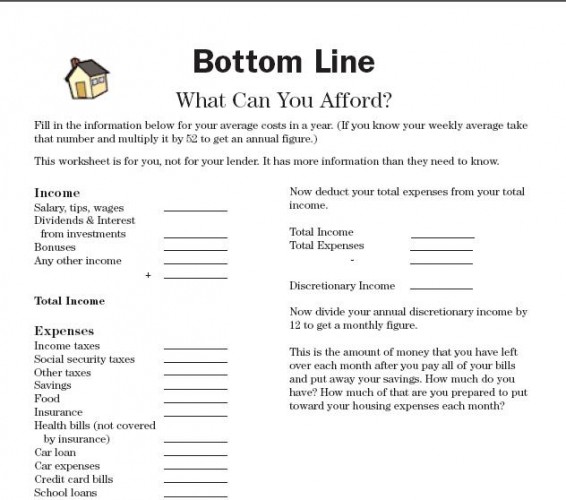

- Financial Planning Worksheets

- Spending Plan Worksheet

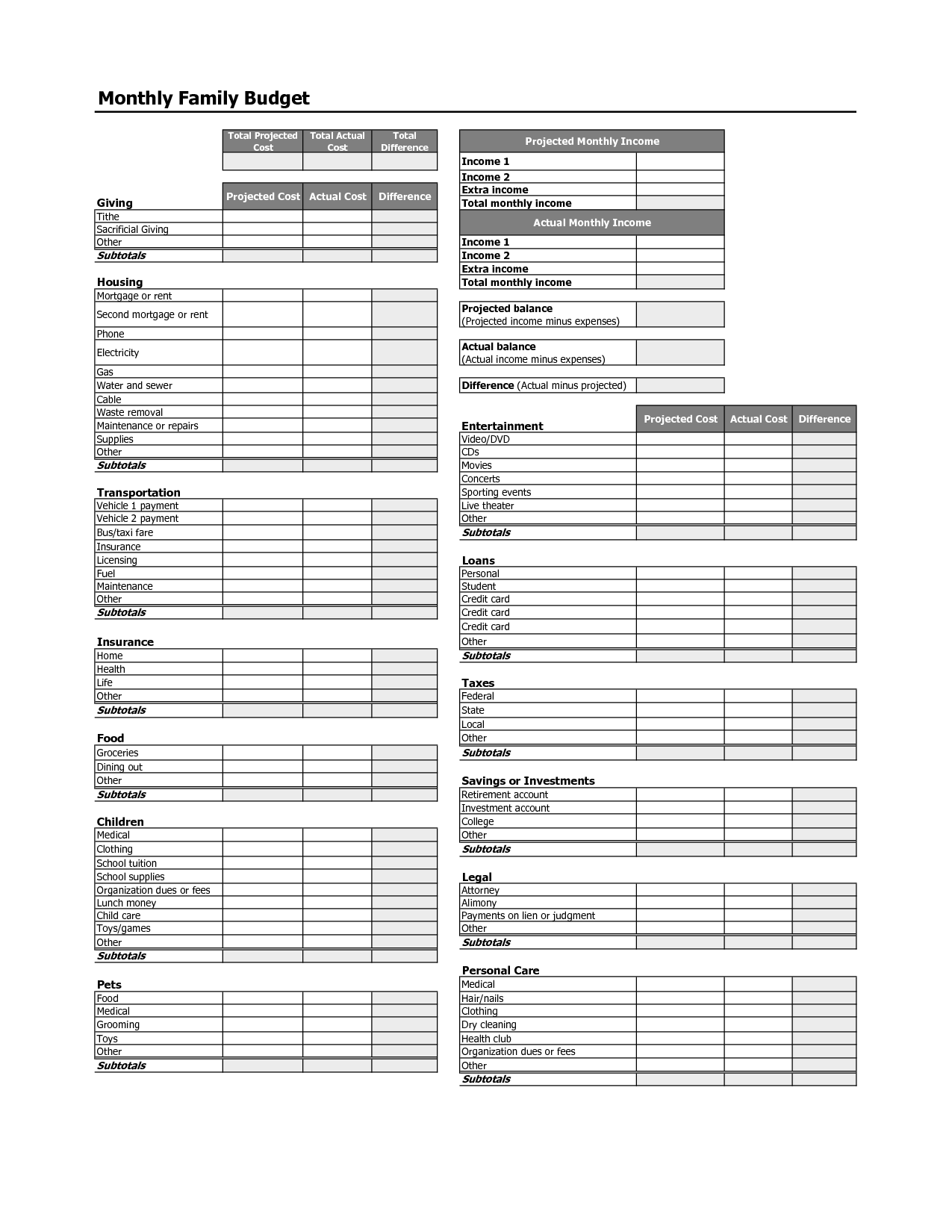

- Printable Family Budget Worksheet

- Make a Budget Worksheet

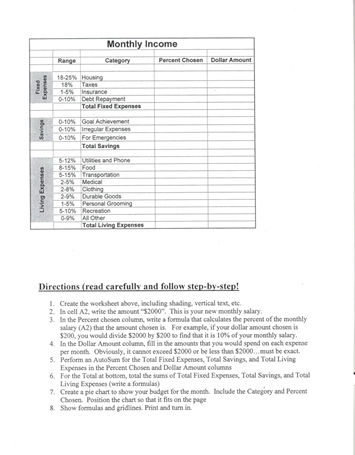

- Excel Budget Worksheet

- Free Printable Budget Worksheet Template

- Free Printable Dave Ramsey Budget Worksheets

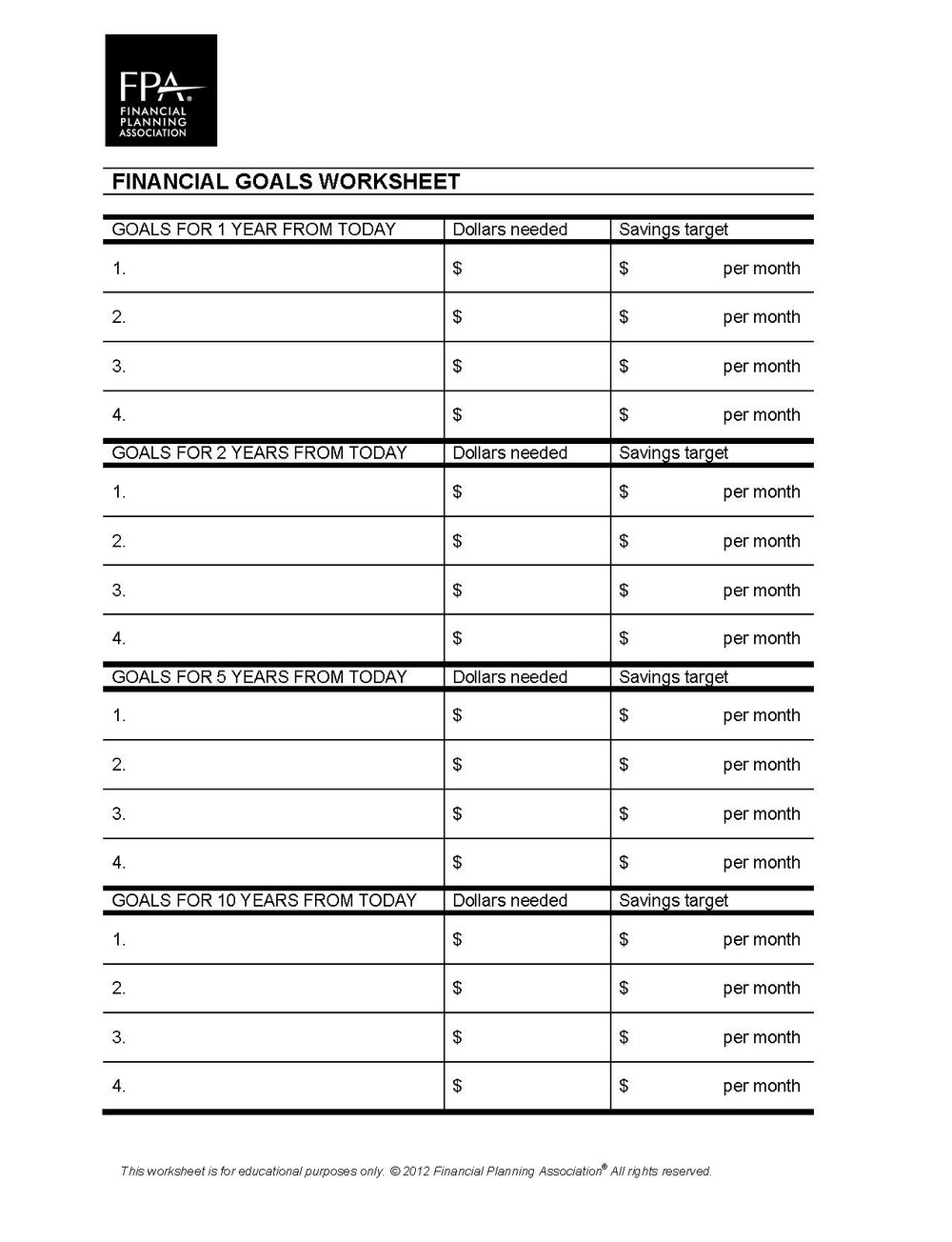

- Financial Planning Goals Worksheet

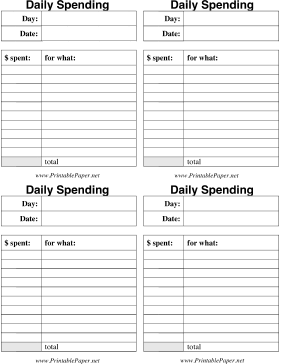

- Daily Spending Budget Worksheet

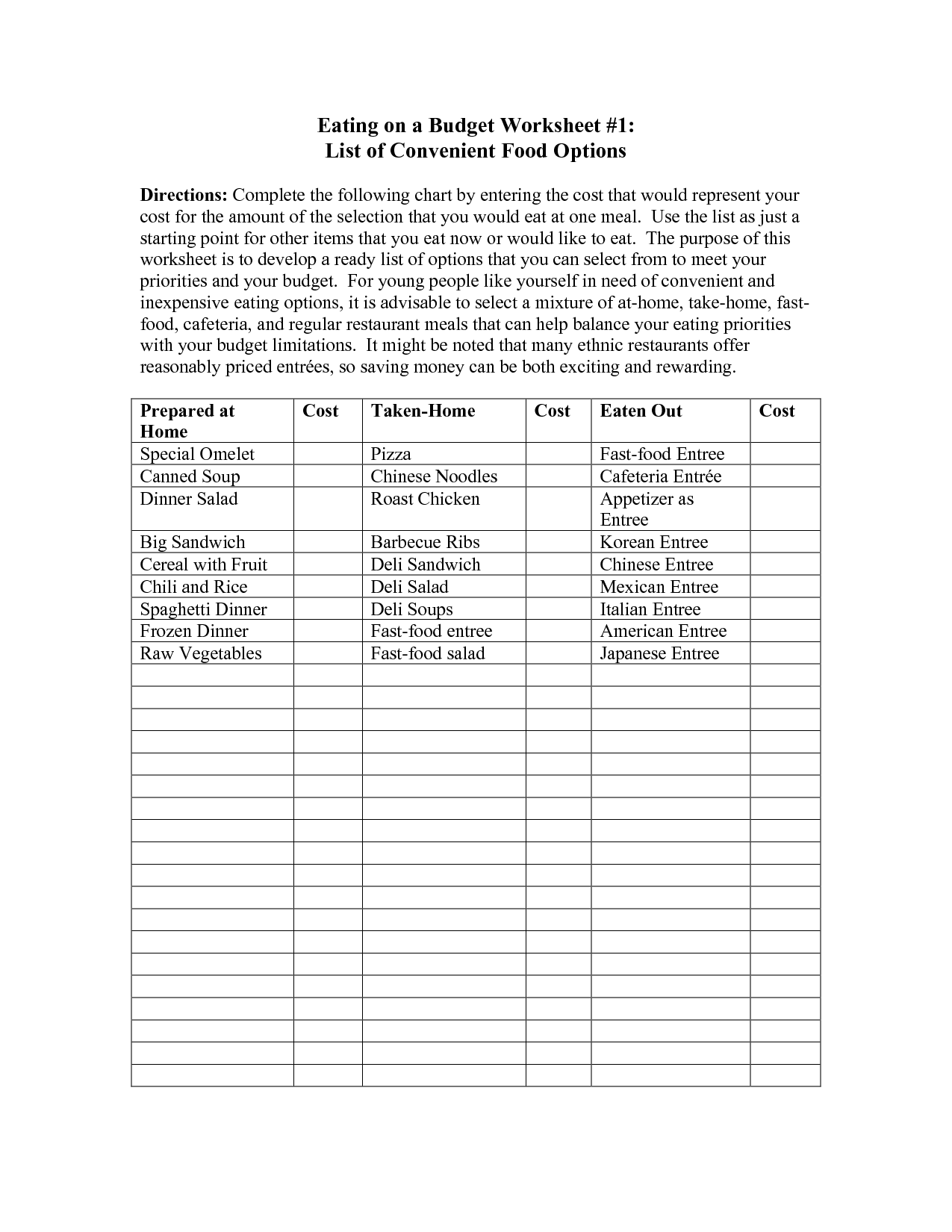

- Sample Food Budget Worksheet

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a budget?

A budget is a financial plan that outlines how much money is allocated for different expenses, such as housing, transportation, groceries, and savings, over a specific period of time. It helps individuals or organizations manage their income and spending to ensure that they are able to meet their financial goals and obligations. Budgets typically include both income and expenses to provide a clear picture of one's overall financial situation.

Why is budgeting important?

Budgeting is important because it helps individuals and organizations manage their finances effectively by setting limits on spending, tracking income and expenses, and planning for the future. It allows for better control over financial decisions, prioritizing of expenses, and saving for goals, ultimately leading to financial stability and success. Budgeting also helps in identifying areas where money can be saved or invested, reducing financial stress and ensuring long-term financial security.

How do you create a budget?

To create a budget, start by listing all sources of income and then categorize and prioritize expenses such as bills, groceries, savings, and debt payments. Track spending habits to identify areas for potential savings and make adjustments accordingly. Set financial goals and allocate money towards each goal. Review and adjust the budget regularly to ensure it aligns with financial priorities and makes room for unexpected expenses.

What are the different types of expenses to consider when budgeting?

When budgeting, it's important to consider both fixed expenses such as rent, mortgage, and insurance that remain constant each month, and variable expenses like groceries, entertainment, and transportation that may fluctuate. Additionally, one should factor in occasional expenses like vacations or holidays, as well as irregular costs such as medical emergencies or car repairs. It's also wise to include savings goals in your budget to build an emergency fund or save for long-term goals like retirement.

How do you track and monitor your expenses?

I track and monitor my expenses by using a budgeting app that allows me to categorize my expenses, set spending limits, and receive notifications when I approach or exceed those limits. I also regularly review my bank and credit card statements, keep digital and physical receipts, and update an Excel sheet to manually track my expenses in detail.

What are some common budgeting mistakes to avoid?

Some common budgeting mistakes to avoid include not tracking expenses accurately, not creating a realistic budget based on income and expenses, failing to account for irregular expenses and emergencies, overlooking savings and debt repayment in the budget, and not adjusting the budget as needed. It's also important to avoid impulse spending, not setting financial goals, and not reviewing and analyzing your budget regularly to make necessary changes.

How do you set financial goals within your budget?

To set financial goals within your budget, start by assessing your current financial situation, including income, expenses, debts, and savings. Identify your short-term and long-term financial goals, such as saving for a vacation or retirement. Prioritize these goals based on their importance and feasibility. Create a budget that allocates funds towards achieving these goals while still covering essential expenses. Regularly review and adjust your budget to track progress and make necessary changes. Consider using tools like budgeting apps or spreadsheets to help stay organized and on track with your financial goals.

What are some strategies for saving money within your budget?

Some strategies for saving money within your budget include setting a specific savings goal, tracking your expenses to identify areas where you can cut back, creating a budget and sticking to it, automating savings deposits, meal planning and cooking at home, finding ways to reduce utility costs, comparison shopping for major purchases, avoiding impulse buys, and looking for discounts or coupons before making purchases. Additionally, consider reassessing subscriptions or services you may no longer need, and prioritize paying off high-interest debt to save on interest fees. Remember that small changes can add up over time to help you achieve your savings goals.

How does budgeting help with financial decision-making?

Budgeting helps with financial decision-making by providing a clear overview of income and expenses, allowing individuals and businesses to prioritize where to allocate their funds. It helps in setting financial goals, tracking progress, identifying areas where expenses can be reduced, and ensuring that resources are managed efficiently. By following a budget, individuals can make informed decisions on how to save, invest, or spend their money wisely, ultimately leading to better financial stability and security.

How can budgeting skills improve your overall financial well-being?

Budgeting skills can improve your overall financial well-being by helping you track and control your expenses, allocate funds towards savings and investments, avoid debt accumulation, and reach financial goals. By creating a budget, you can better understand your financial situation, identify areas where you can cut back on spending, and prioritize your expenses. This proactive approach to managing money leads to better financial stability, reduced stress, and the ability to build long-term wealth and security.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments