Budget Worksheet Financial Aid

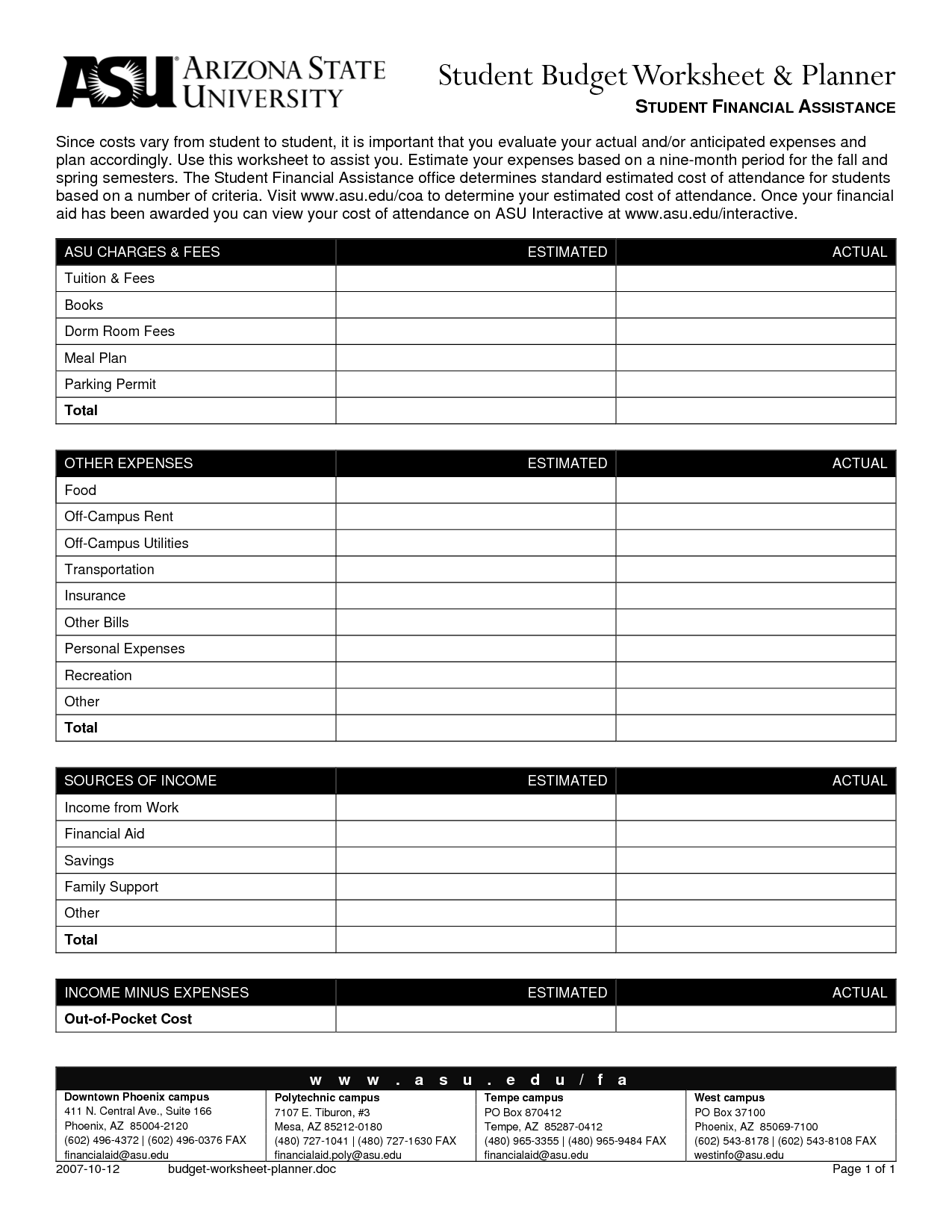

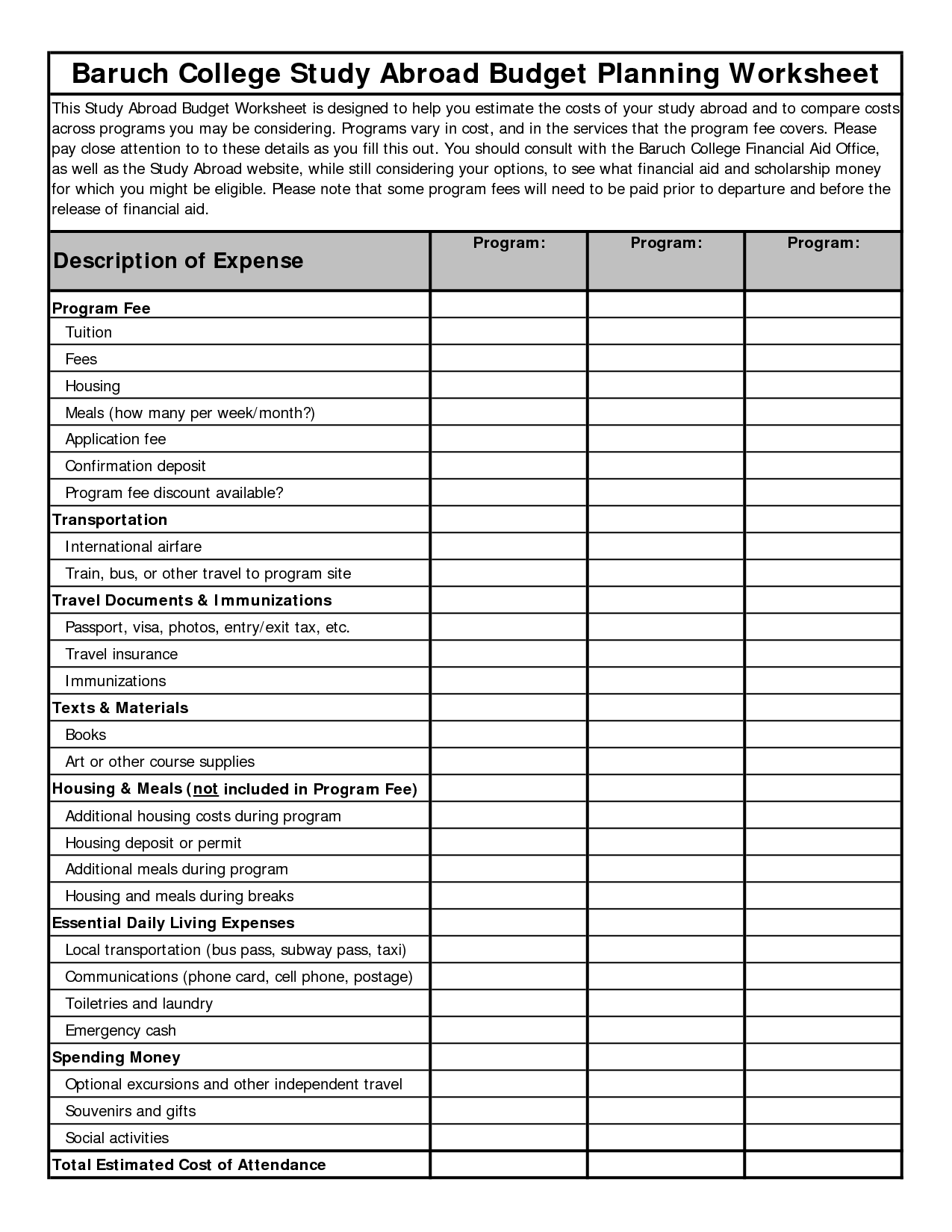

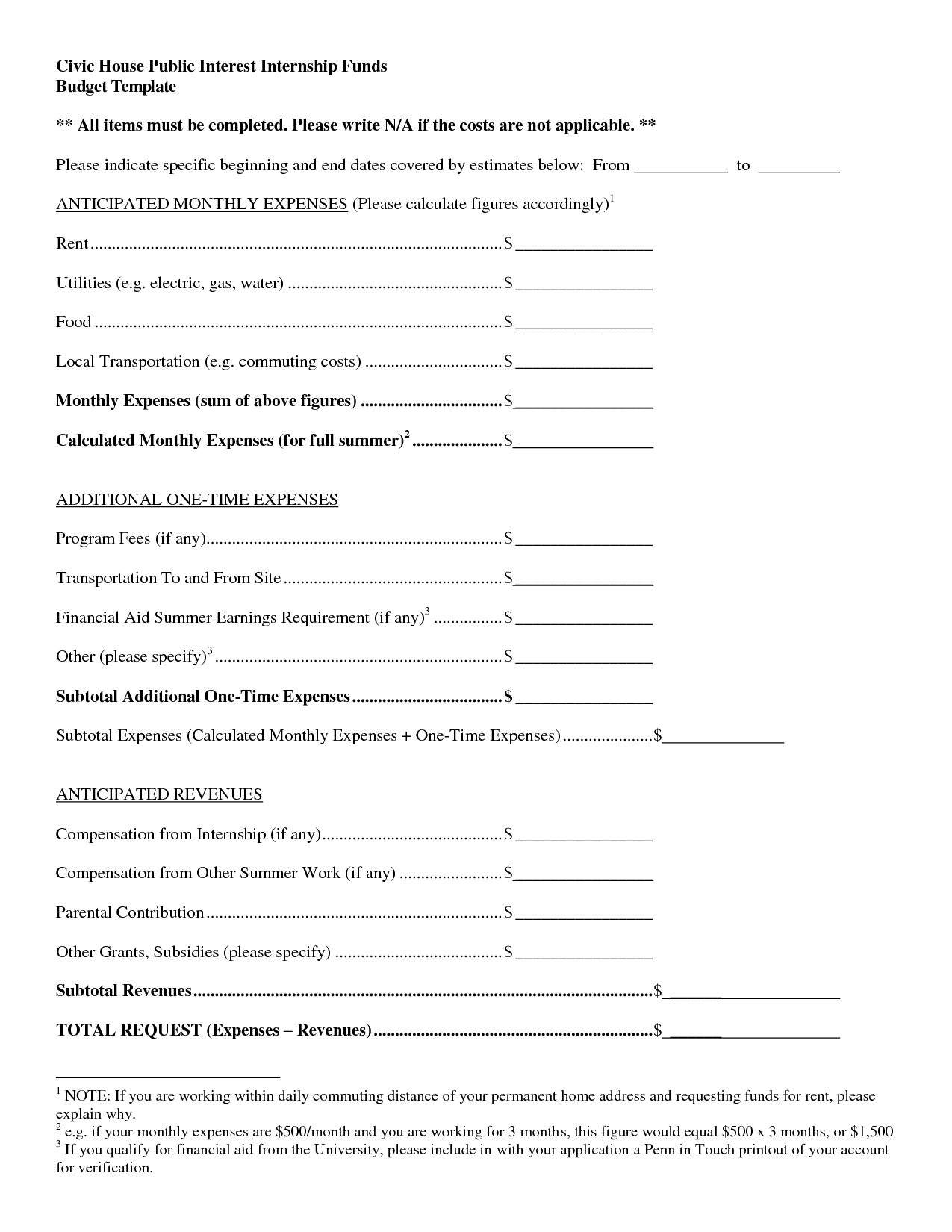

Creating a budget worksheet can be a valuable tool for anyone seeking to manage their finances more effectively. Whether you are a college student trying to stretch your financial aid as far as possible or an individual looking to gain control over your spending, a budget worksheet can provide the structure and organization needed to track expenses and allocate funds appropriately. By taking the time to create this simple yet impactful document, you can gain a clear understanding of your financial situation and make informed decisions about where your money goes.

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a budget worksheet?

A budget worksheet is a tool used to track and manage your income and expenses. It typically consists of various sections where you can input your sources of income, fixed and variable expenses, savings goals, and other financial information. By using a budget worksheet, individuals can gain a better understanding of their financial situation, identify areas where they can cut costs or save money, and ultimately work towards achieving their financial goals.

How can a budget worksheet benefit financial aid recipients?

A budget worksheet can benefit financial aid recipients by helping them track and manage their expenses, identify areas where they can cut costs, and prioritize their spending to make the most of their limited funds. By creating a clear picture of their financial situation, recipients can make informed decisions that help them stretch their aid further and avoid overspending. Additionally, a budget worksheet can also help recipients plan for future expenses, set savings goals, and ensure they are staying on track with their financial responsibilities.

What information should be included in a budget worksheet?

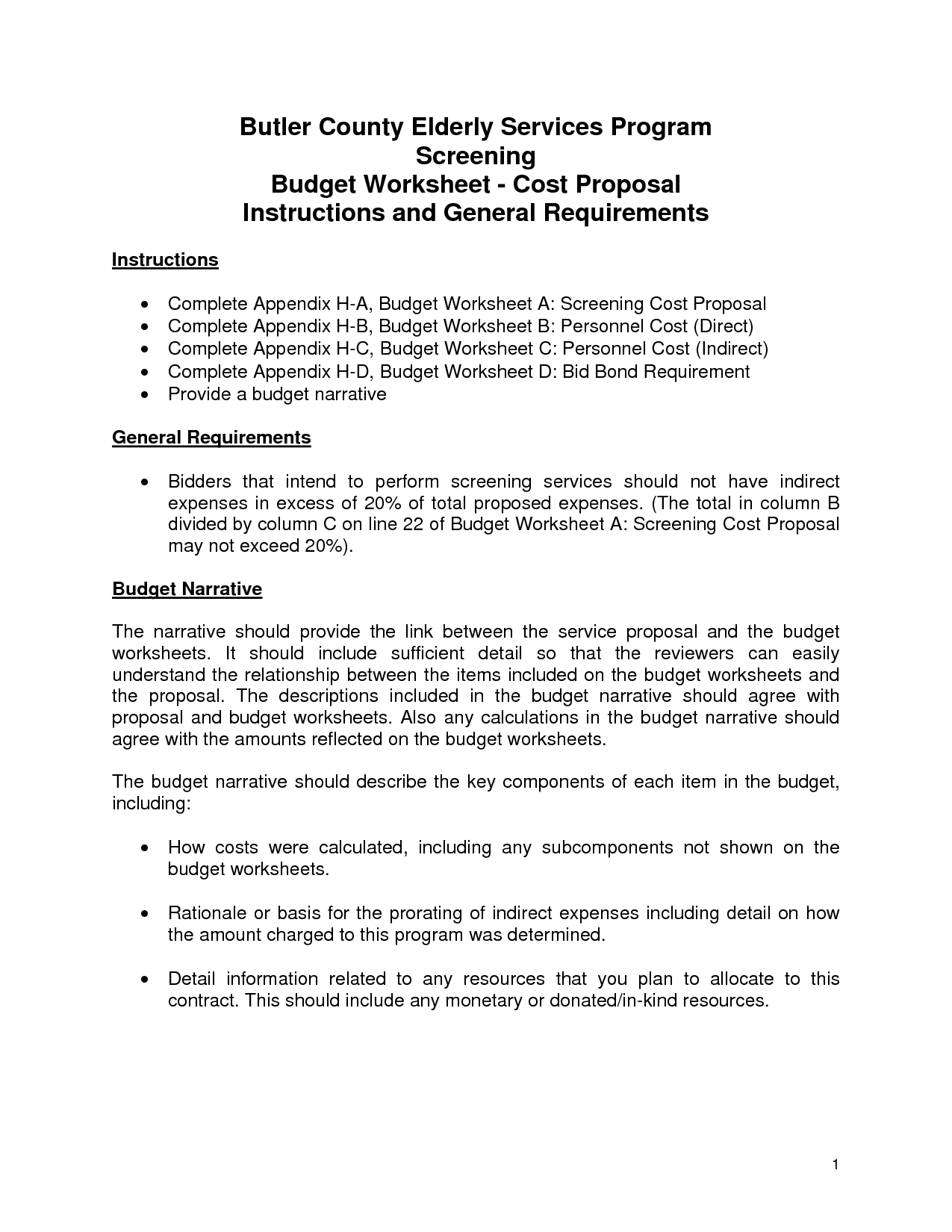

A budget worksheet should include all sources of income, such as salary or investment returns, as well as all expenses categorized by fixed costs (e.g. rent, loan payments) and variable costs (e.g. groceries, entertainment). It should also account for savings goals, debts, and any irregular or one-time expenses that may arise. Additionally, it should track progress over time and allow for adjustments to ensure financial stability and planning for the future.

How can a budget worksheet help in tracking expenses?

A budget worksheet can help in tracking expenses by providing a structured format to record all income and expenses in an organized manner. By categorizing expenditures such as bills, groceries, entertainment, and savings, individuals can easily see where their money is going and identify areas where they can cut back or adjust their spending. This visual representation of their financial activities can help individuals make informed decisions to better manage their money and reach their financial goals.

Why is it important to categorize expenses in a budget worksheet?

Categorizing expenses in a budget worksheet is important because it allows for a clear understanding of where money is being spent, helps in identifying areas where spending can be reduced or reallocated, enables better decision-making when it comes to financial priorities, and contributes to better overall financial management and planning for the future.

How can a budget worksheet assist in identifying potential areas of cost-saving?

A budget worksheet can assist in identifying potential areas of cost-saving by providing a clear overview of all expenses and income, allowing for a detailed analysis of where money is being spent. By comparing actual spending against budgeted amounts, patterns and trends can be observed that highlight areas where costs can be reduced or eliminated. Additionally, a budget worksheet can help prioritize expenses and identify unnecessary or frivolous spending, enabling better decision-making for reallocating funds to more important areas or savings.

What role does a budget worksheet play in the financial aid application process?

A budget worksheet is a crucial tool in the financial aid application process as it helps students and their families calculate and organize their finances, including income, expenses, savings, and assets. By completing a budget worksheet, applicants can provide a clear and accurate overview of their financial situation, which is essential for determining financial aid eligibility and award amounts. It allows financial aid offices to assess a student's need for assistance and make informed decisions on the types and amounts of aid to award.

How often should a budget worksheet be reviewed and updated?

A budget worksheet should ideally be reviewed and updated on a regular basis, such as monthly or at least every few months. This allows you to track your income and expenses accurately, identify any changes in your financial situation, and make necessary adjustments to stay on track with your financial goals. The frequency of reviewing and updating your budget worksheet may also depend on any significant life changes or financial events that occur.

What strategies can be employed to stay within the budget outlined in the worksheet?

To stay within the budget outlined in the worksheet, you can employ strategies such as tracking expenses regularly to monitor progress, prioritizing spending on essential items, cutting down on discretionary expenses, negotiating discounts or finding cheaper alternatives, setting realistic financial goals, seeking additional sources of income, and adjusting the budget as needed to accommodate unexpected expenses. Sticking to the budget and making conscious spending decisions are key to successfully managing your finances within the outlined limits.

How does maintaining a budget worksheet coincide with overall financial wellness?

Maintaining a budget worksheet is essential for overall financial wellness because it allows individuals to track their income, expenses, and savings goals. By creating a budget and sticking to it, individuals can better manage their money, avoid overspending, prioritize savings, and eventually reach their financial goals. It helps in identifying areas where money is being unnecessarily spent, making adjustments to achieve a balanced financial situation, and ultimately gaining control over their finances for a secure future.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments