Personal Finance Worksheets for Students

Are you a student looking for a practical way to manage your personal finances? Look no further! Our personal finance worksheets are designed specifically for students to help them gain control over their money and make smart financial decisions. With these worksheets, you'll be able to track your income, expenses, savings, and more, all in one convenient place. Whether you're budgeting for college expenses or saving up for a future goal, these worksheets can be a valuable tool to guide you on your financial journey.

Table of Images 👆

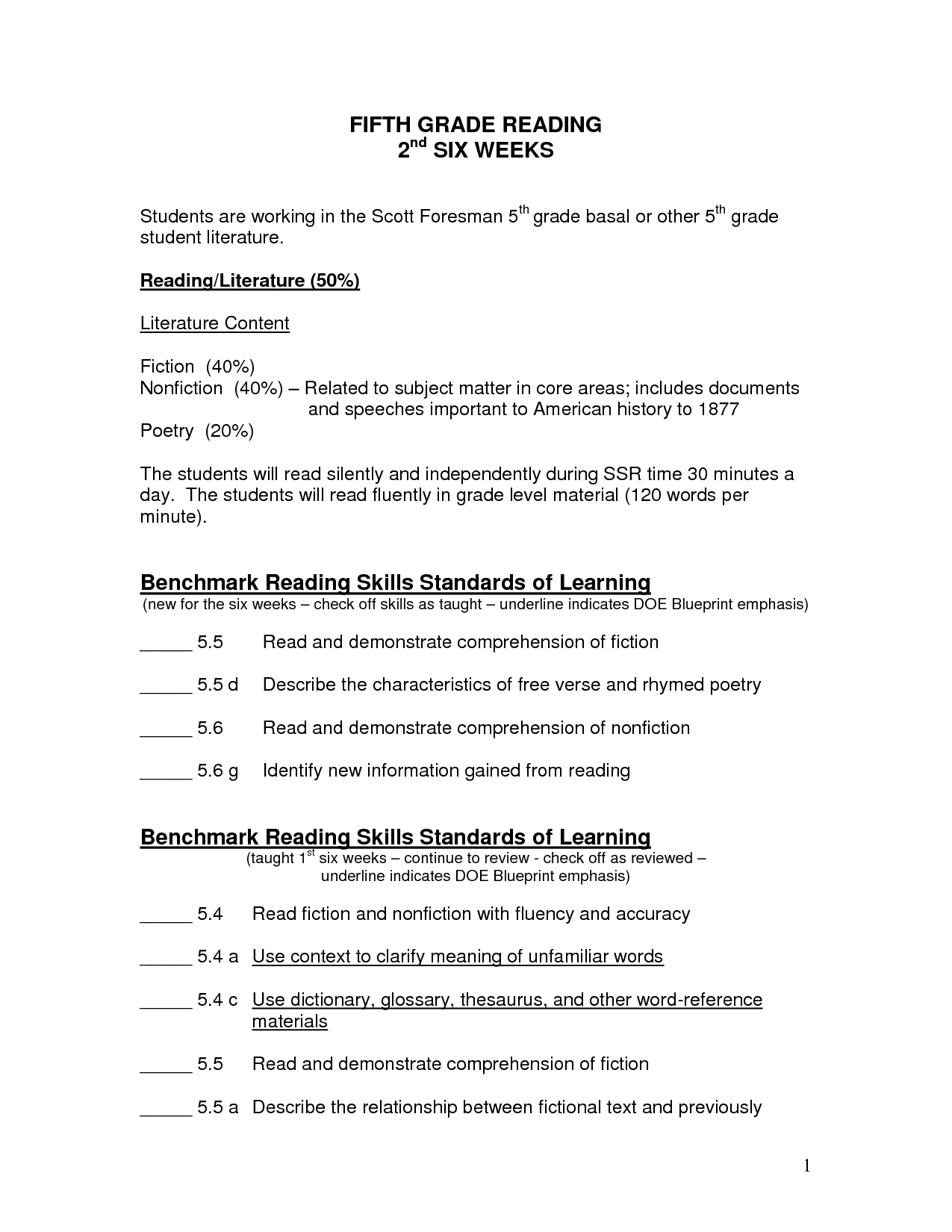

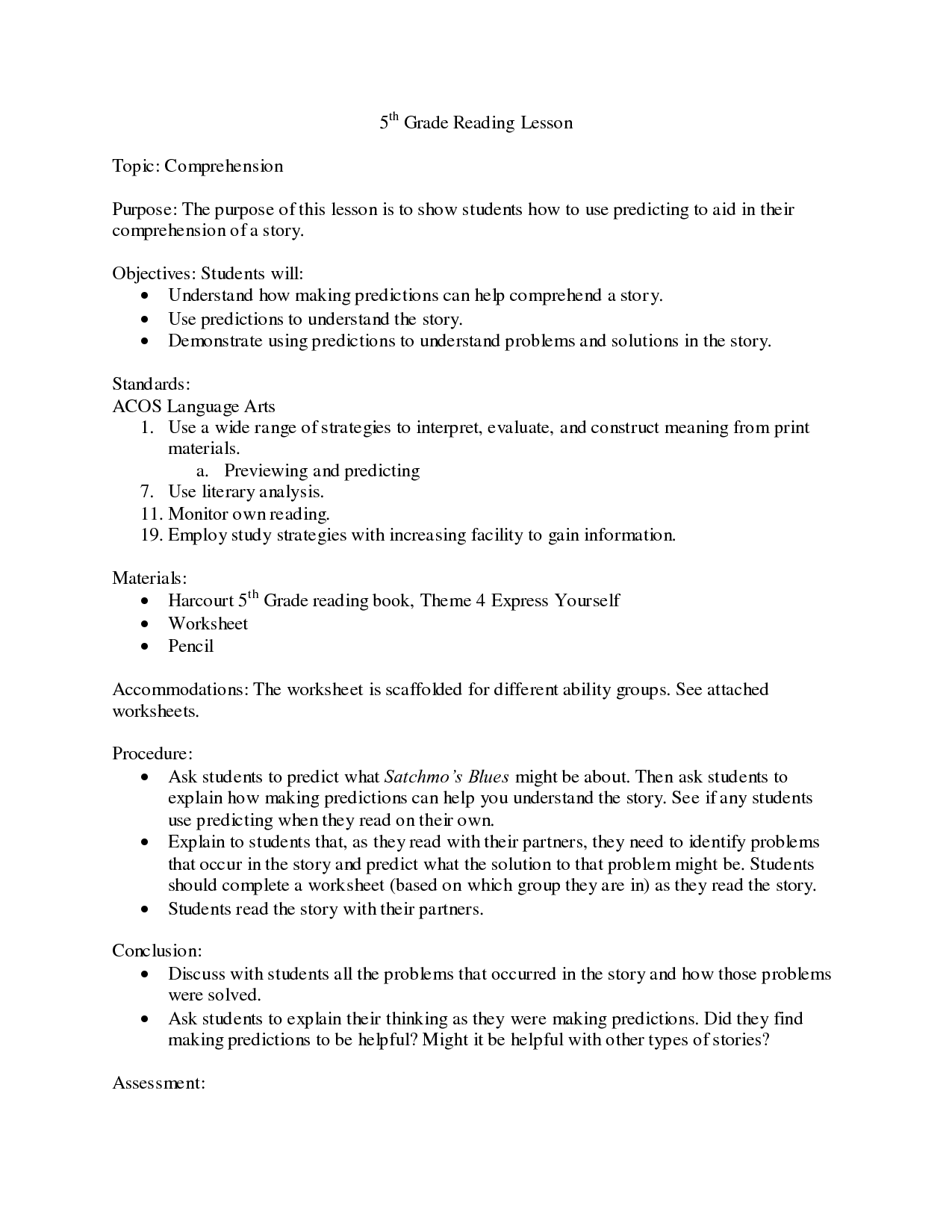

- 5th Grade Dol Worksheets

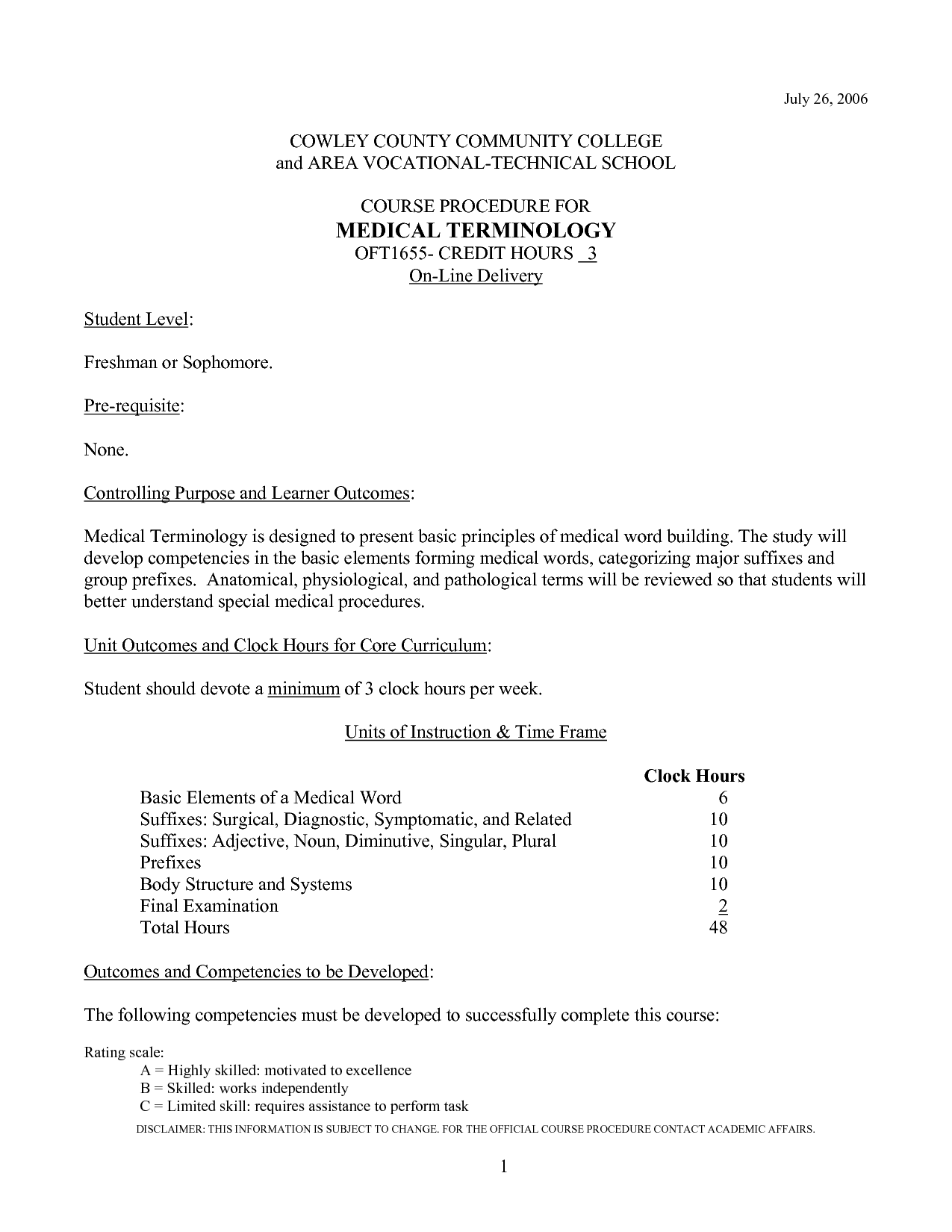

- Free Printable Medical Terminology Worksheets

- Pearson Education Math Worksheet Answers

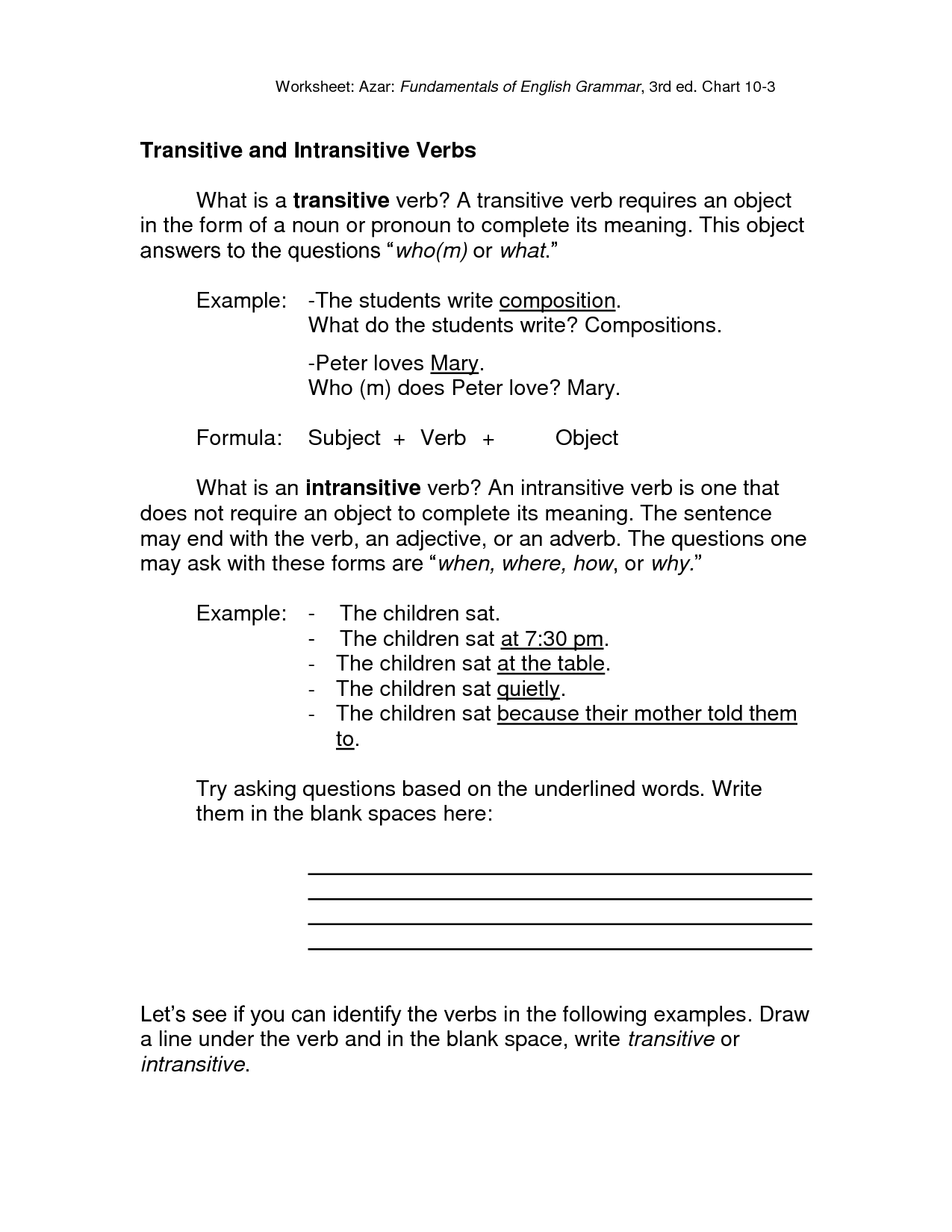

- Transitive and Intransitive Verbs Worksheets

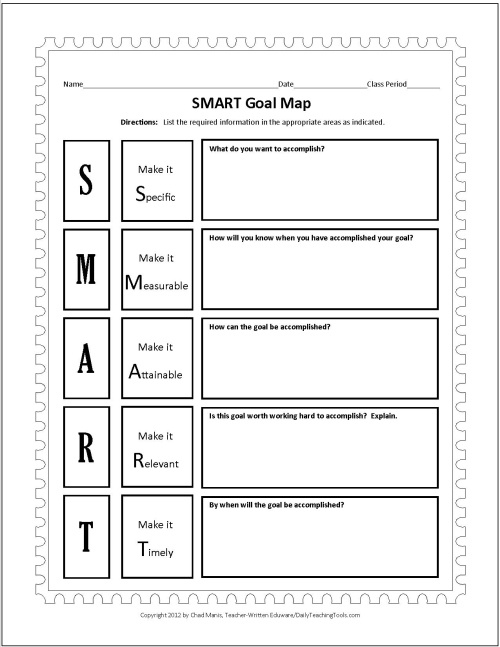

- Smart Goal Setting Worksheet Template

- 5th Grade Language Arts Worksheets

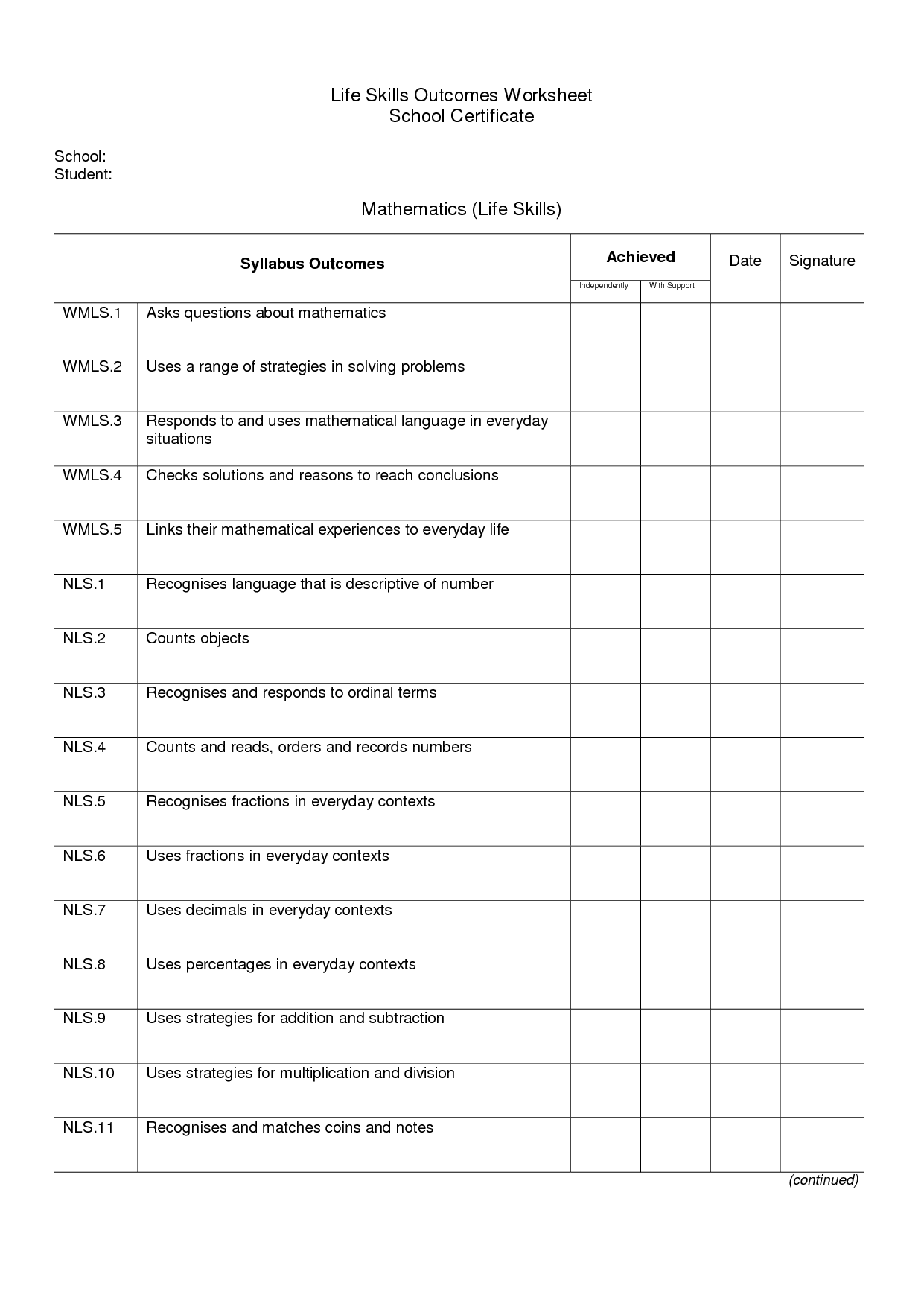

- Life Skills Printable Worksheets for Teens

- 5th Grade Reading Skills Worksheets

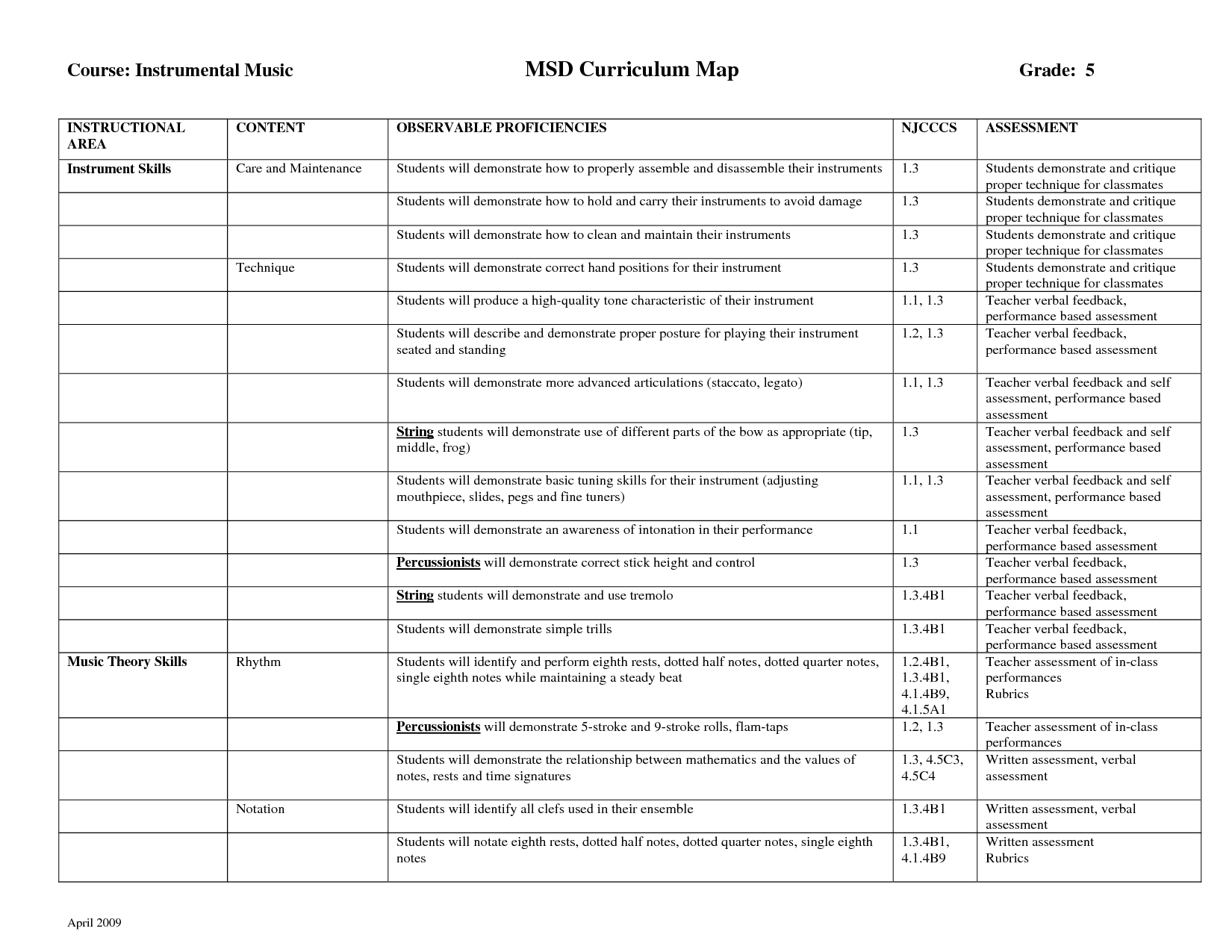

- Transformation 8th Grade Math Worksheets

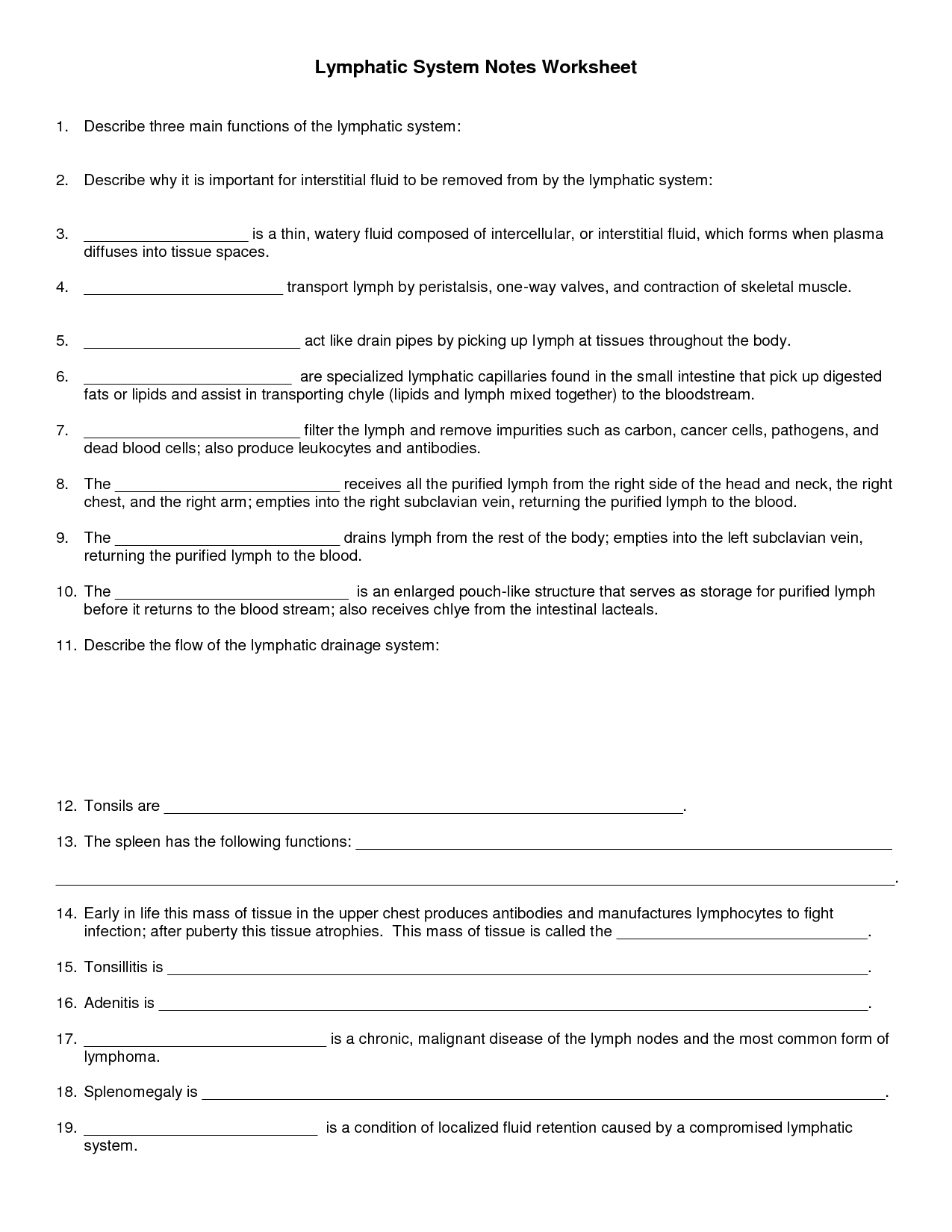

- Lymphatic System Notes Worksheet Answer Key

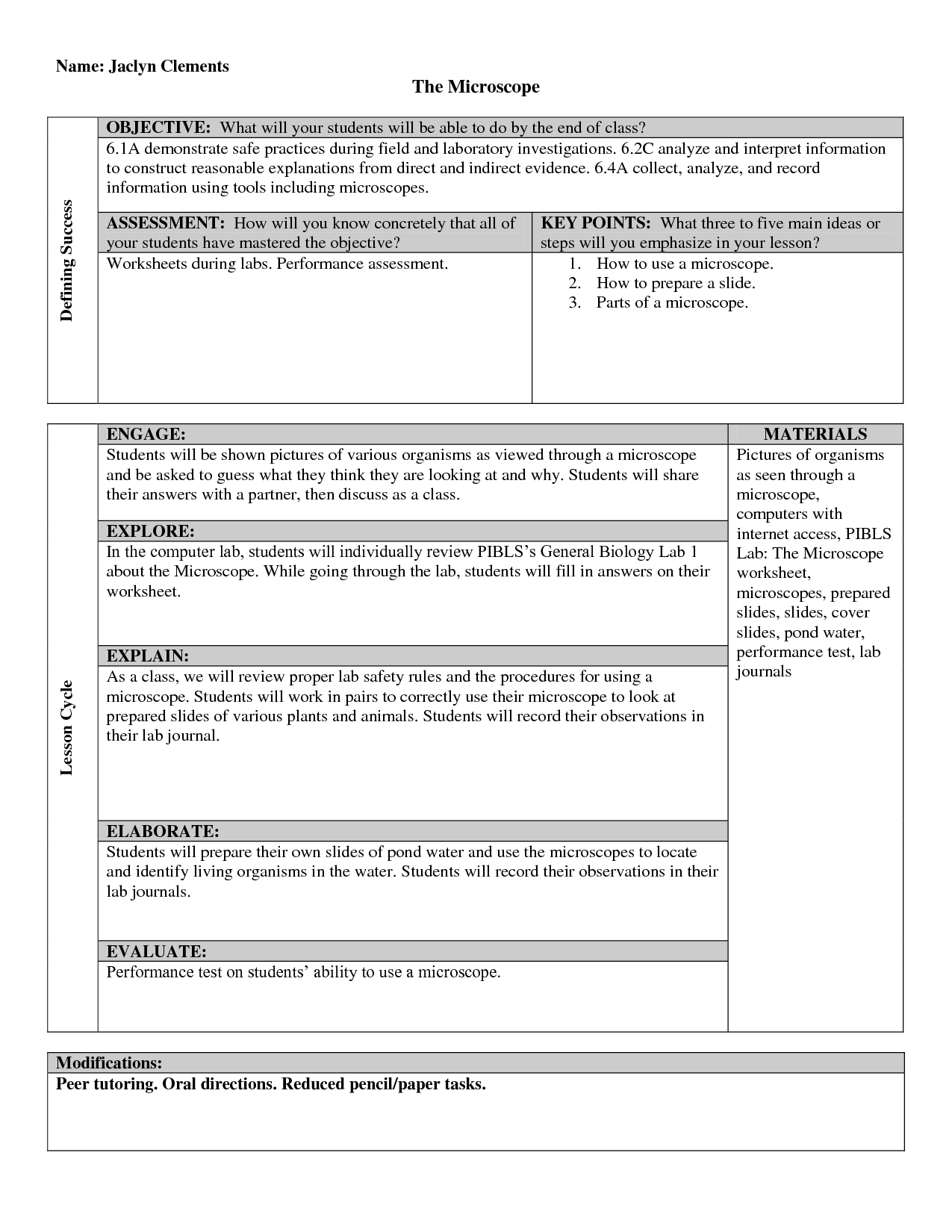

- Objective Microscope Worksheet

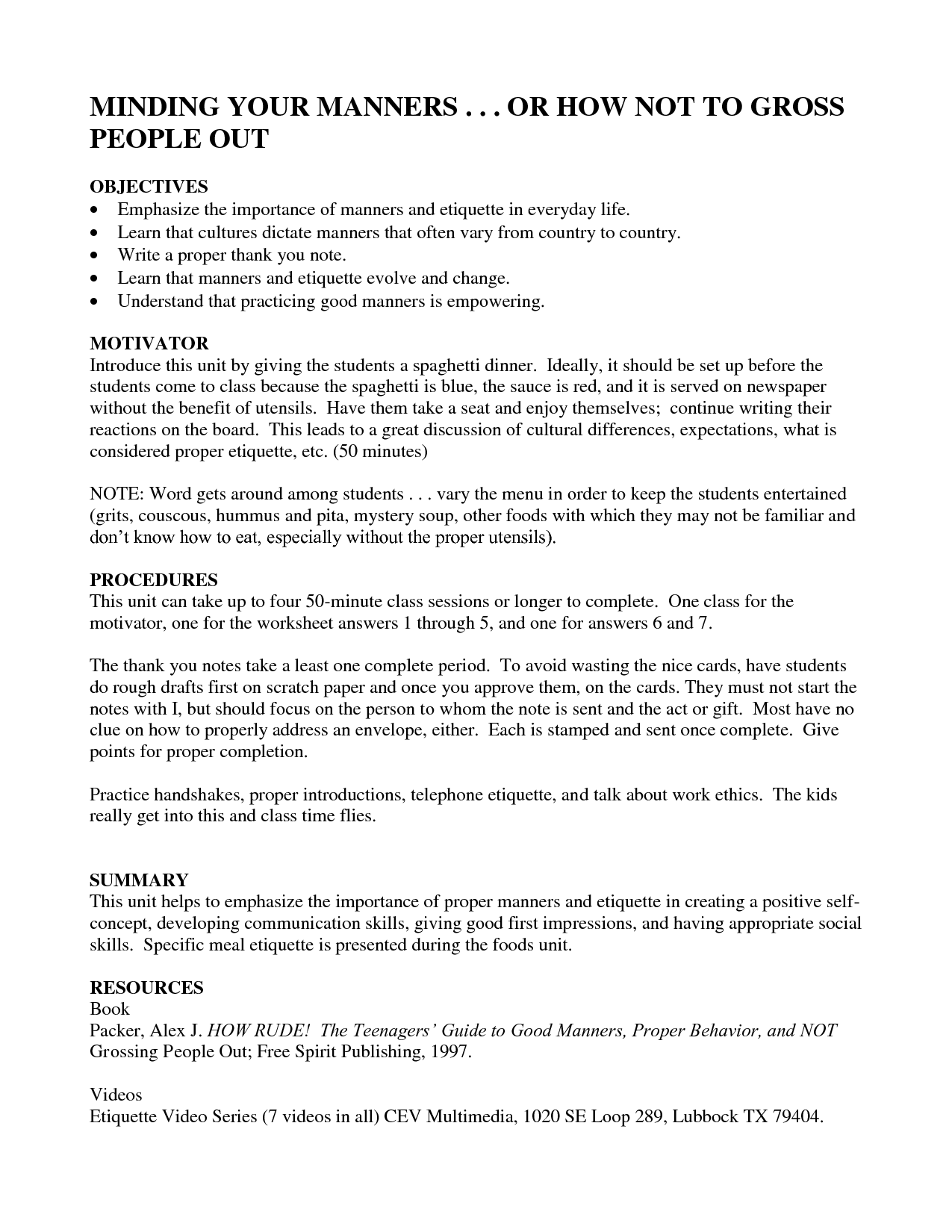

- Printable Worksheets Good Manners

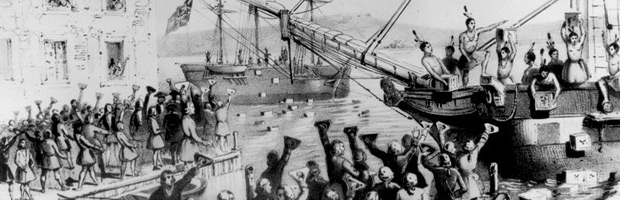

- Colonial Taxation without Representation

More Student Worksheets

Middle School Student Goals WorksheetWho I AM Student Worksheet

High School Student Information Worksheet

Student Art Critique Worksheet

Student Getting to Know You Worksheet

Daily Journal Worksheet for Students

Star Student Printable Worksheet

Self-Esteem Worksheets for Students

Career Planning Worksheets for Students

What is a personal finance worksheet?

A personal finance worksheet is a document or tool used to track and manage an individual's financial activities and goals. It typically includes sections for income, expenses, savings, debts, and financial goals, allowing individuals to monitor their financial health, create budgets, and plan for the future. This tool helps users to organize their finances, identify areas for improvement, and make informed decisions to achieve their financial objectives.

How can personal finance worksheets help students manage their money?

Personal finance worksheets can help students manage their money by providing them with a structured way to track and organize their income, expenses, savings, and financial goals. These worksheets can help students gain a better understanding of their financial situation, make informed decisions about their spending habits, identify areas where they can cut costs or save more, and create a budget that aligns with their financial goals. By using personal finance worksheets, students can develop good money management habits, improve their financial literacy, and gain control over their finances.

What information should be included in a personal finance worksheet?

A personal finance worksheet should include details such as income sources and amounts, monthly expenses (including fixed and variable costs), savings contributions, debts owed, and their respective interest rates and payment schedules. Additionally, it can also track short-term and long-term financial goals, present net worth, and monitor progress towards achieving financial objectives.

How often should students update their personal finance worksheets?

Students should aim to update their personal finance worksheets at least once a month to ensure they have an accurate and up-to-date view of their financial situation. This regular monitoring can help them track their expenses, income, savings, and investments, allowing them to make necessary adjustments and stay on top of their financial goals.

What are the benefits of setting financial goals on a personal finance worksheet?

Setting financial goals on a personal finance worksheet helps individuals to visualize and track their progress towards achieving those goals. It provides a clear roadmap for managing expenses, saving money, and investing wisely. By breaking down long-term financial objectives into smaller, achievable milestones, individuals can stay motivated and focused on their financial success. Additionally, using a personal finance worksheet can help identify areas where spending can be reduced, enabling better financial decision-making and ultimately leading to greater financial security and prosperity.

How can students track their expenses using a personal finance worksheet?

Students can track their expenses using a personal finance worksheet by creating categories for different types of expenses such as rent, utilities, groceries, transportation, entertainment, etc. They can then input their expenses in each category, along with the date and amount spent. It's important to regularly update the worksheet, review spending patterns, and adjust budgeting as needed. Additionally, students can set financial goals and monitor their progress towards achieving them using the worksheet.

What are some strategies for budgeting effectively with a personal finance worksheet?

Some strategies for budgeting effectively with a personal finance worksheet include tracking all sources of income and expenses, categorizing expenses to see where money is being spent, setting clear financial goals and priorities, adjusting the budget as needed to stay on track, and regularly reviewing and analyzing the budget to identify areas for improvement and saving opportunities. Additionally, implementing strategies such as the 50/30/20 rule (50% for needs, 30% for wants, 20% for saving and debt repayment) can help ensure a balanced approach to managing finances.

How can personal finance worksheets help students make informed spending decisions?

Personal finance worksheets can help students make informed spending decisions by providing a clear overview of their income, expenses, savings, and financial goals. By organizing their financial information into categories and tracking their spending habits, students can identify areas where they may be overspending or not saving enough. This awareness can empower them to adjust their spending patterns, set realistic budgets, and prioritize their financial goals, ultimately leading to more informed and responsible spending decisions.

What types of financial calculations can students perform using a personal finance worksheet?

Students can use a personal finance worksheet to perform various financial calculations such as budgeting monthly expenses, calculating savings goals, tracking income and expenses, determining net worth, estimating retirement savings needs, analyzing debt repayment schedules, comparing different loan options, forecasting investment returns, and evaluating the impact of interest rates on borrowing. These calculations help students gain a better understanding of their financial situation and make informed decisions about money management.

How can personal finance worksheets prepare students for future financial planning and decision-making?

Personal finance worksheets can prepare students for future financial planning and decision-making by helping them understand key financial concepts, practice budgeting and goal-setting, track expenses, and analyze spending patterns. By engaging with these worksheets, students can develop essential skills such as disciplined saving habits, critical thinking about financial choices, and awareness of the consequences of their financial decisions. This hands-on approach allows students to apply theoretical knowledge to real-world situations, empowering them to make informed financial decisions and build a solid foundation for their future financial well-being.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments