Form 1040EZ Worksheet Line F 2015

The Form 1040EZ worksheet line F for 2015 is designed to help individual taxpayers determine the appropriate filing status for their federal income tax return. This worksheet allows taxpayers to easily identify their entity and subject, enabling them to accurately report their income and claim any applicable deductions or credits.

Table of Images 👆

More Line Worksheets

Lines of Symmetry WorksheetsLine Drawing Art Worksheets

Drawing Contour Lines Worksheet

Blank Printable Timeline Worksheets

2 Lines of Symmetry Worksheets

Linear Equations Worksheet 7th Grade

Rounding Decimals Number Line Worksheet

College Essay Outline Worksheet

Texture Line Drawing Techniques Worksheet

Outline Format Worksheet

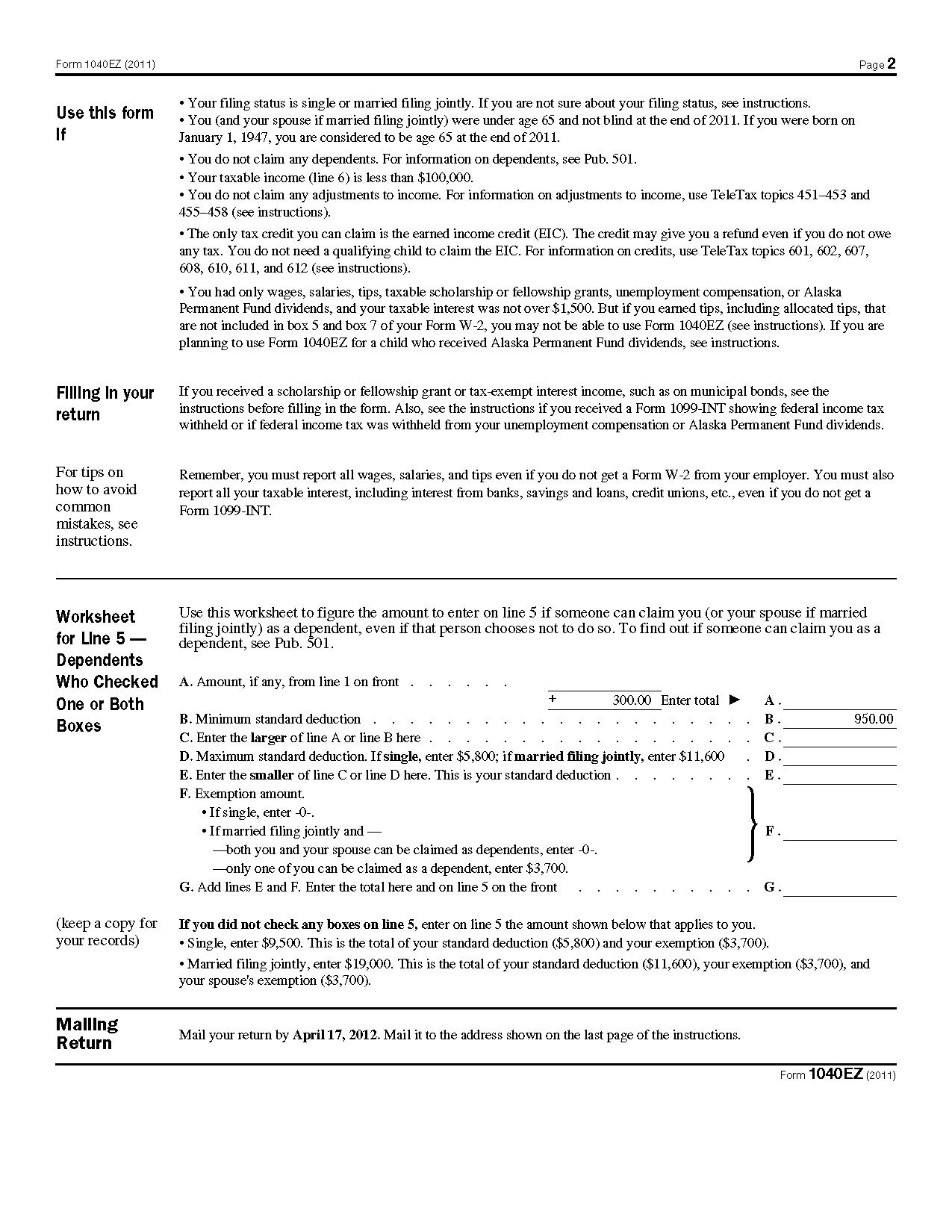

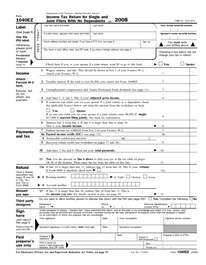

What is Form 1040EZ?

Form 1040EZ is a simplified version of the tax return form used by single and joint filers with no dependents and with only income from wages, salaries, tips, and taxable scholarships or fellowship grants. It allows for easy and straightforward reporting of income and deductions with fewer options and calculations compared to the standard Form 1040.

What is the purpose of the Form 1040EZ Worksheet Line F?

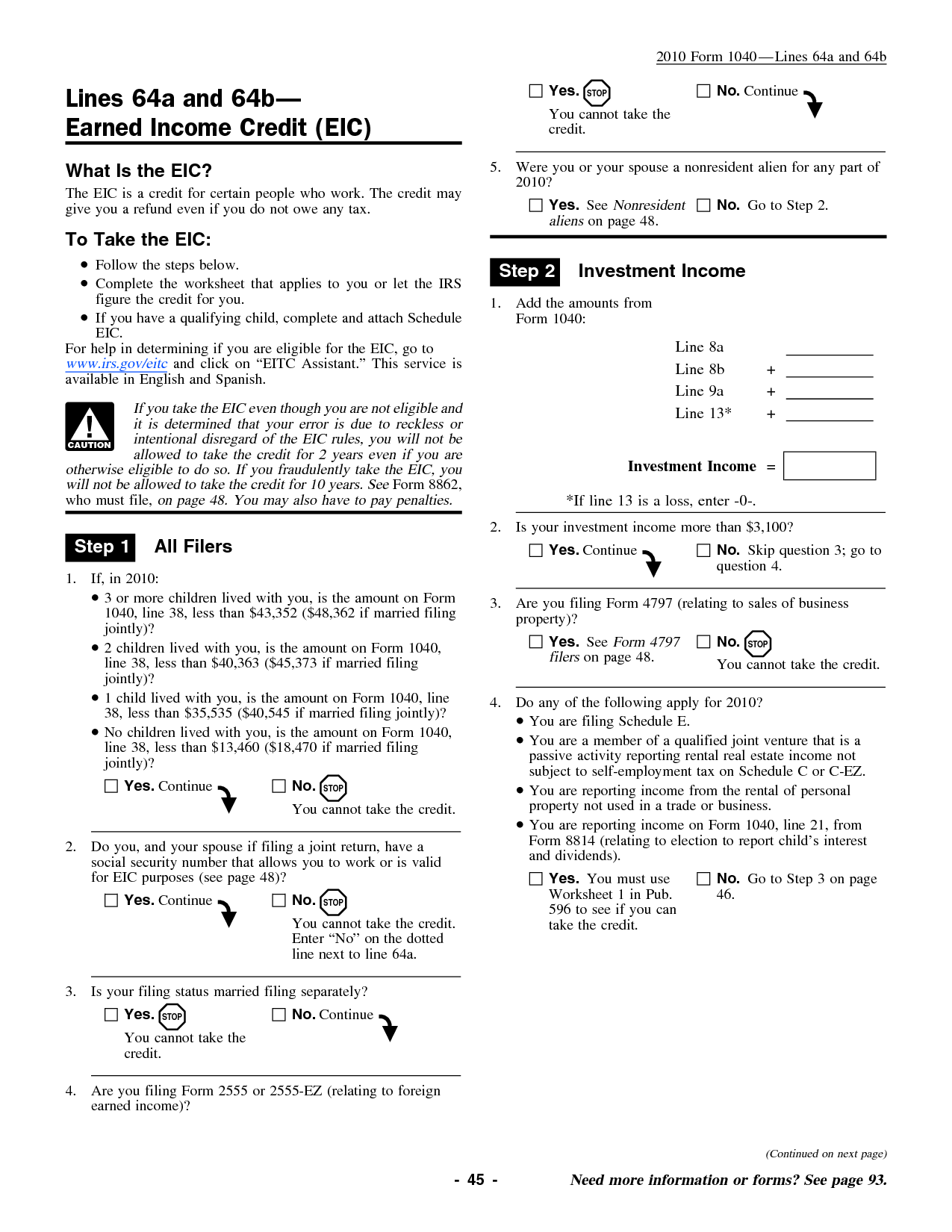

Line F on the Form 1040EZ worksheet is used to calculate the total earned income credit for taxpayers who meet certain requirements. It helps determine if a taxpayer is eligible for the earned income credit, which is a tax credit for low to moderate income individuals and families. The amount calculated on Line F affects the final tax liability or refund amount for the taxpayer.

How do you determine the total amount for Line F on the Form 1040EZ Worksheet?

To determine the total amount for Line F on the Form 1040EZ Worksheet, you need to add together any additional income that is not already included in your wages reported on Line 1 of the form. This can include items like capital gains, unemployment compensation, or alimony received. Once you have identified all applicable additional income, simply sum them up and enter the total amount on Line F.

Are there any specific requirements or criteria for Line F on the Form 1040EZ Worksheet?

Yes, Line F on the Form 1040EZ Worksheet generally pertains to certain adjustments to income such as educator expenses, student loan interest deduction, or tuition and fees deduction. Requirements or criteria for Line F may vary depending on the specific adjustment being claimed, so it is important to refer to the IRS instructions for the Form 1040EZ or consult a tax professional for assistance in determining eligibility for these deductions.

What items are included in the calculation for Line F on the Form 1040EZ Worksheet?

Line F on the Form 1040EZ Worksheet includes the total amount of standard deduction for the taxpayer, spouse (if applicable), and any dependents claimed on the tax return. This deduction is based on the filing status chosen by the taxpayer and any additional deduction for being blind or over the age of 65.

Is Line F related to income or deductions on the Form 1040EZ Worksheet?

Line F on the Form 1040EZ Worksheet typically refers to Adjusted Gross Income (AGI), which is a total income amount after certain deductions are taken into account. Deductions are used to reduce income before calculating AGI. So, Line F is related to income and deductions on the Form 1040EZ Worksheet.

Can Line F be left blank or is it mandatory to fill in?

It is not mandatory to fill in Line F, as it may be left blank if it does not apply to your situation or if the information is not available.

Are there any special considerations for Line F if you have dependents?

Yes, if you have dependents, you may be eligible for certain deductions and credits that can impact Line F on your tax return. You should ensure that you accurately account for your dependents when calculating your taxable income and claiming any applicable tax benefits, such as the Child Tax Credit, Earned Income Tax Credit, or other dependent-related deductions. Be sure to review the eligibility criteria and guidelines for each deduction or credit to maximize your tax savings.

Is there a limit or cap to the amount that can be entered on Line F?

Yes, there is a limit or cap on the amount that can be entered on Line F. The specific limit or cap may vary depending on the context or form you are referring to, so it's important to check the instructions or guidelines provided for that specific line in the relevant document or form.

Are there any specific instructions or resources available for completing Line F on the Form 1040EZ Worksheet?

Unfortunately, the Form 1040EZ has been discontinued, so there are no specific instructions or resources available for completing Line F on the Form 1040EZ Worksheet. If you are looking for guidance on a different tax form or assistance with your taxes, you may want to consult the IRS website or seek advice from a tax professional for personalized help.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments