Pay Off Credit Card Worksheet

Credit card debt can be overwhelming and can feel never-ending. If you are looking for a way to tackle your credit card debt and finally pay it off, a pay off credit card worksheet is exactly what you need. This tool will help you track your progress, set realistic goals, and organize your finances. Whether you are a budget-conscious individual or someone who wants to take control of their financial future, a pay off credit card worksheet can be the key to successfully becoming debt-free.

Table of Images 👆

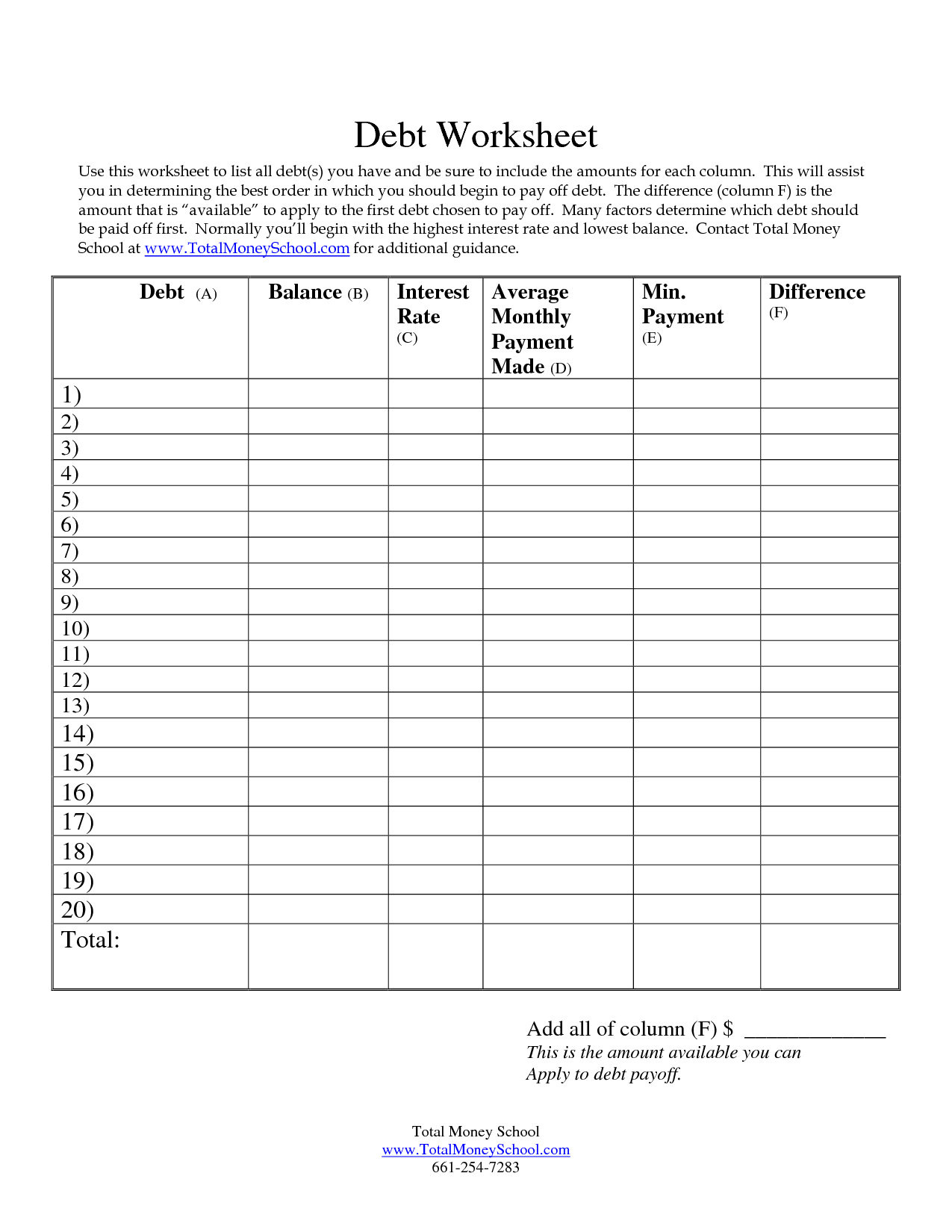

- Debt Free Printable Bill Payment Sheet

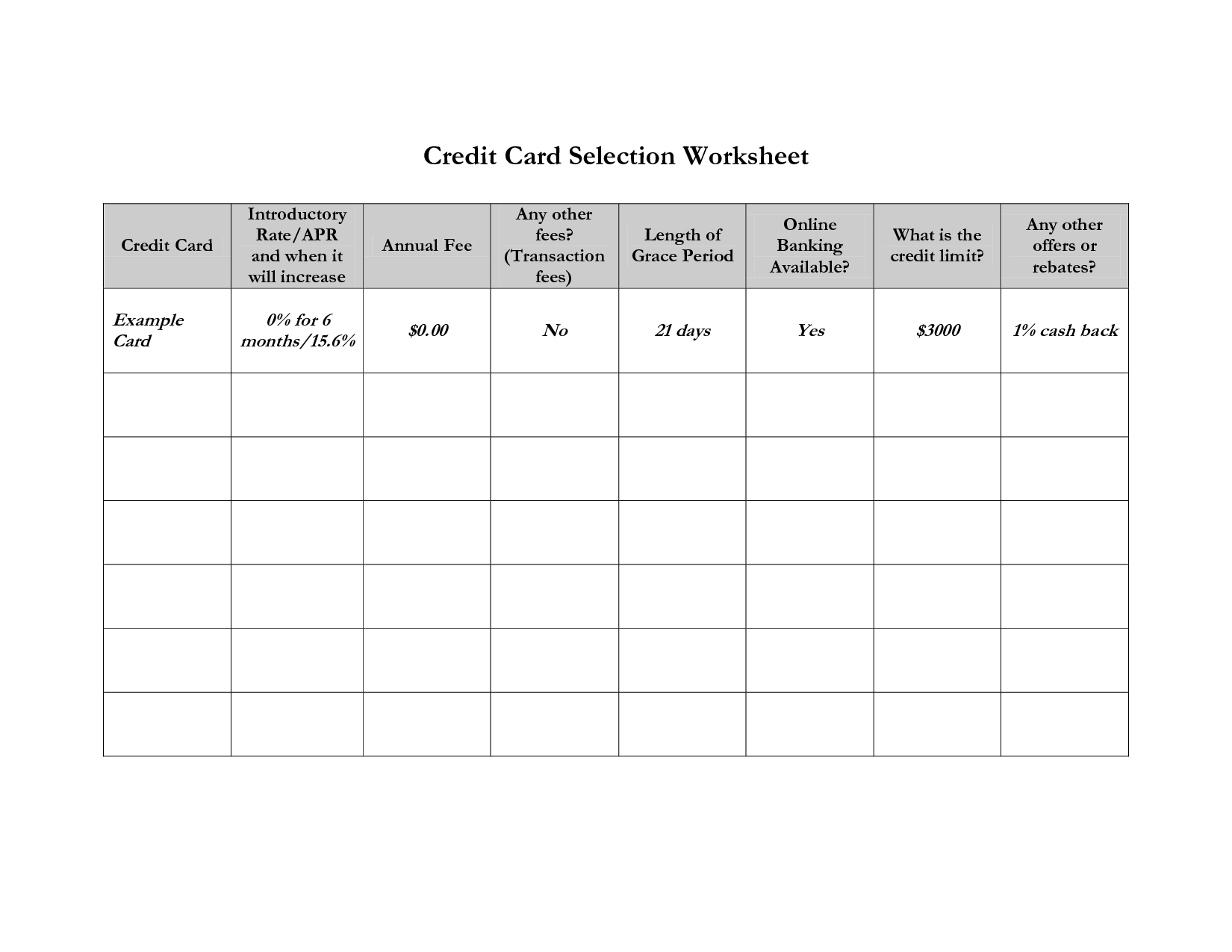

- Printable Credit Card Worksheet

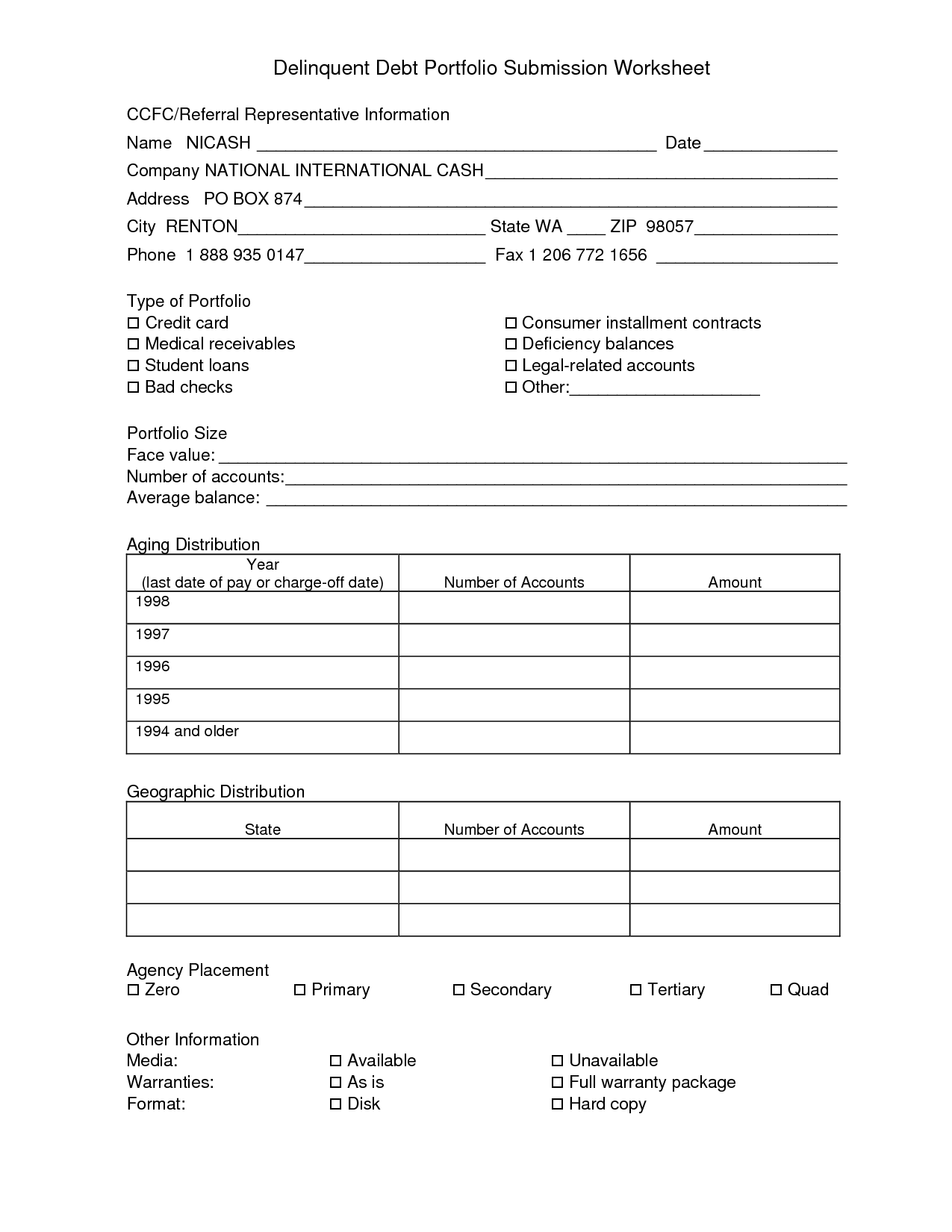

- Credit Card Debt Worksheet

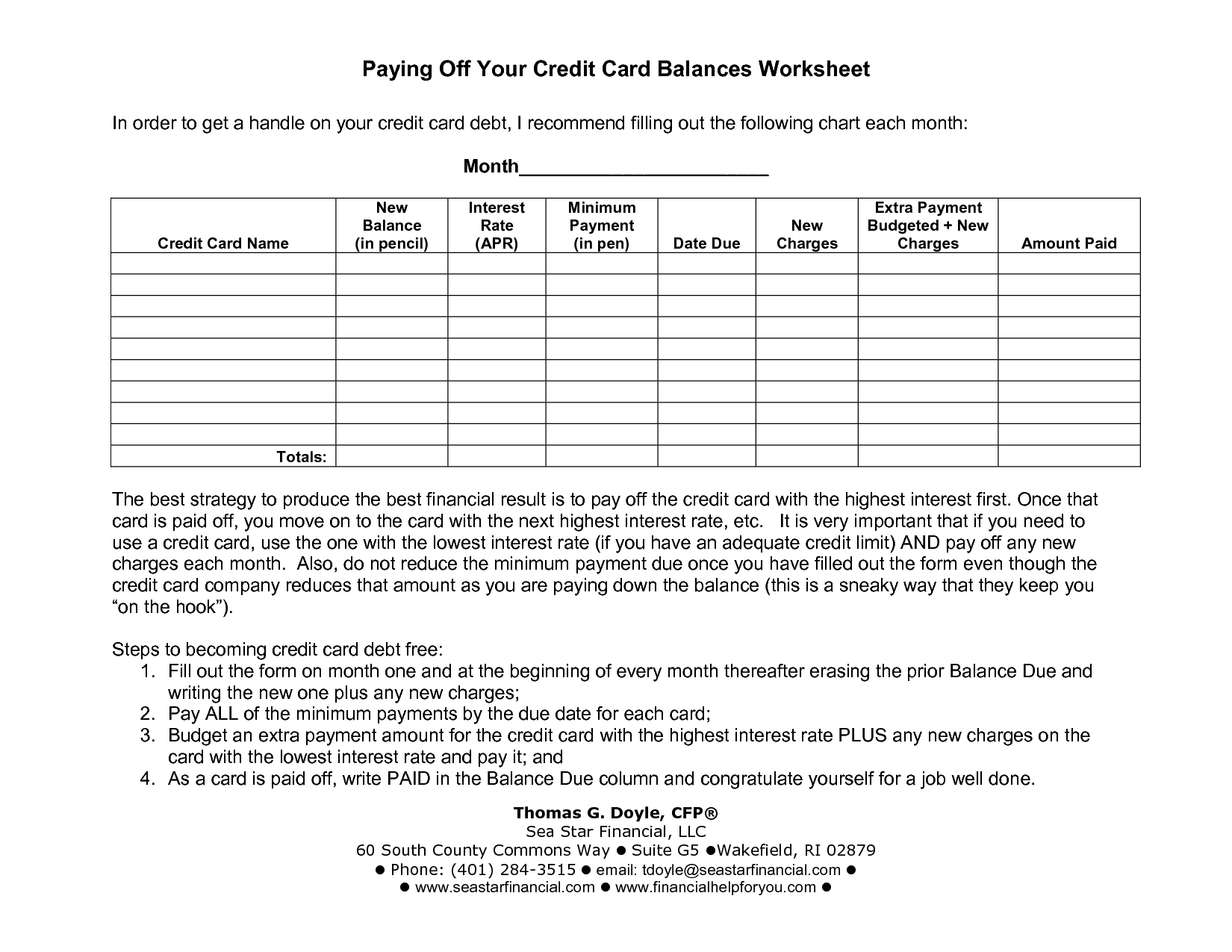

- Credit Card Payment Worksheets

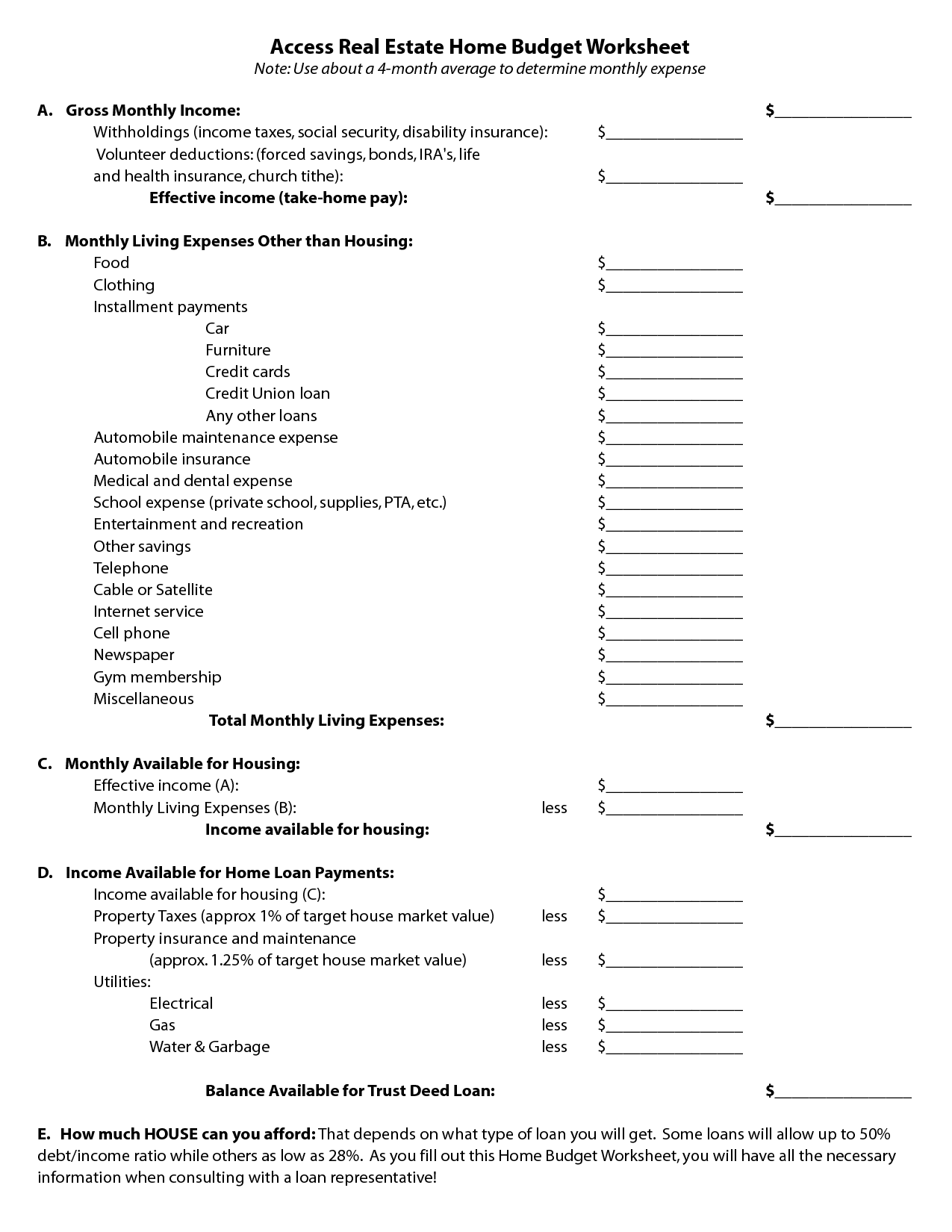

- Credit Card Budget Worksheet

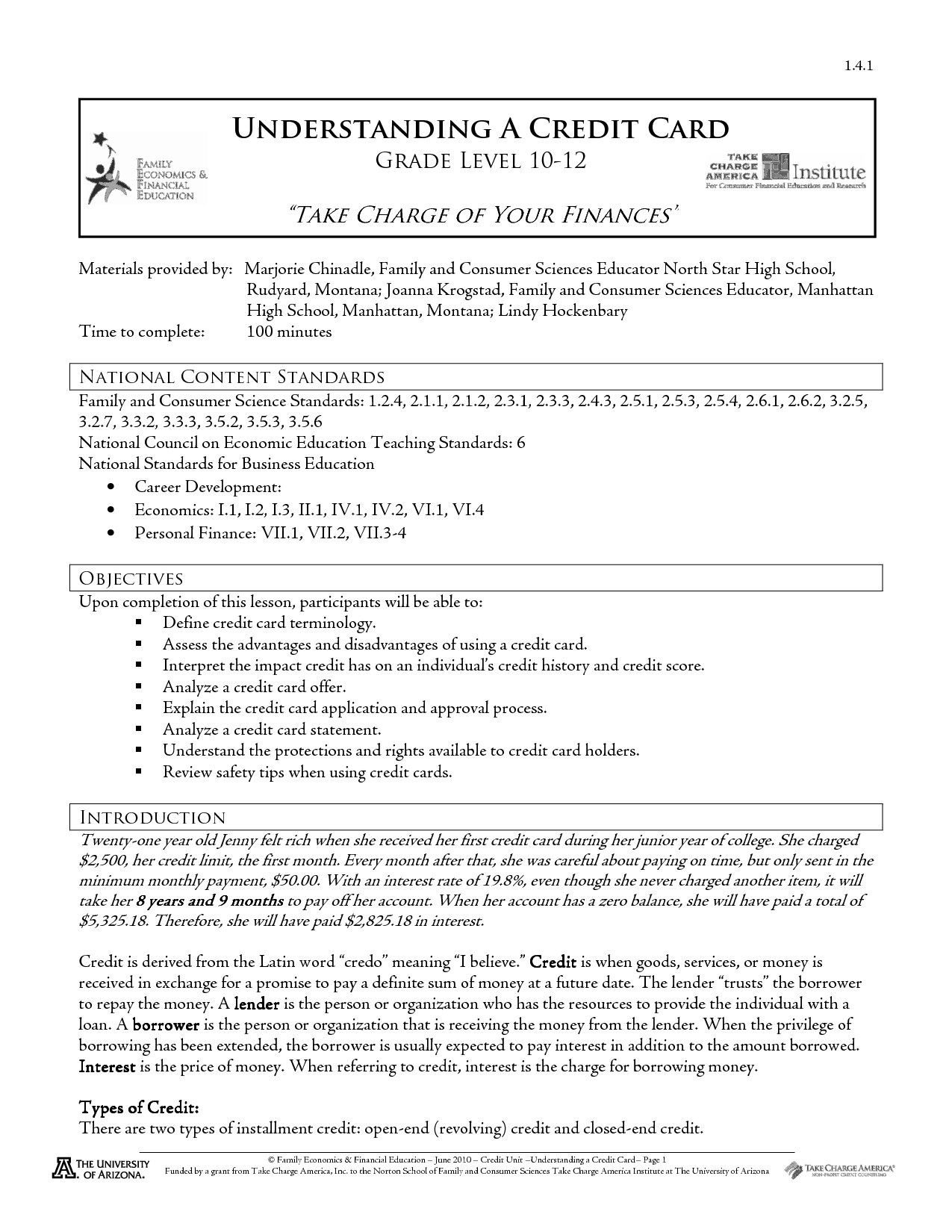

- Family and Consumer Science Worksheets

- Printable Monthly Bill Paying Worksheet

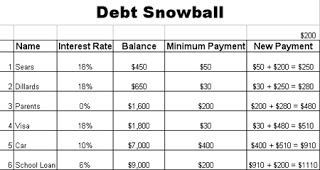

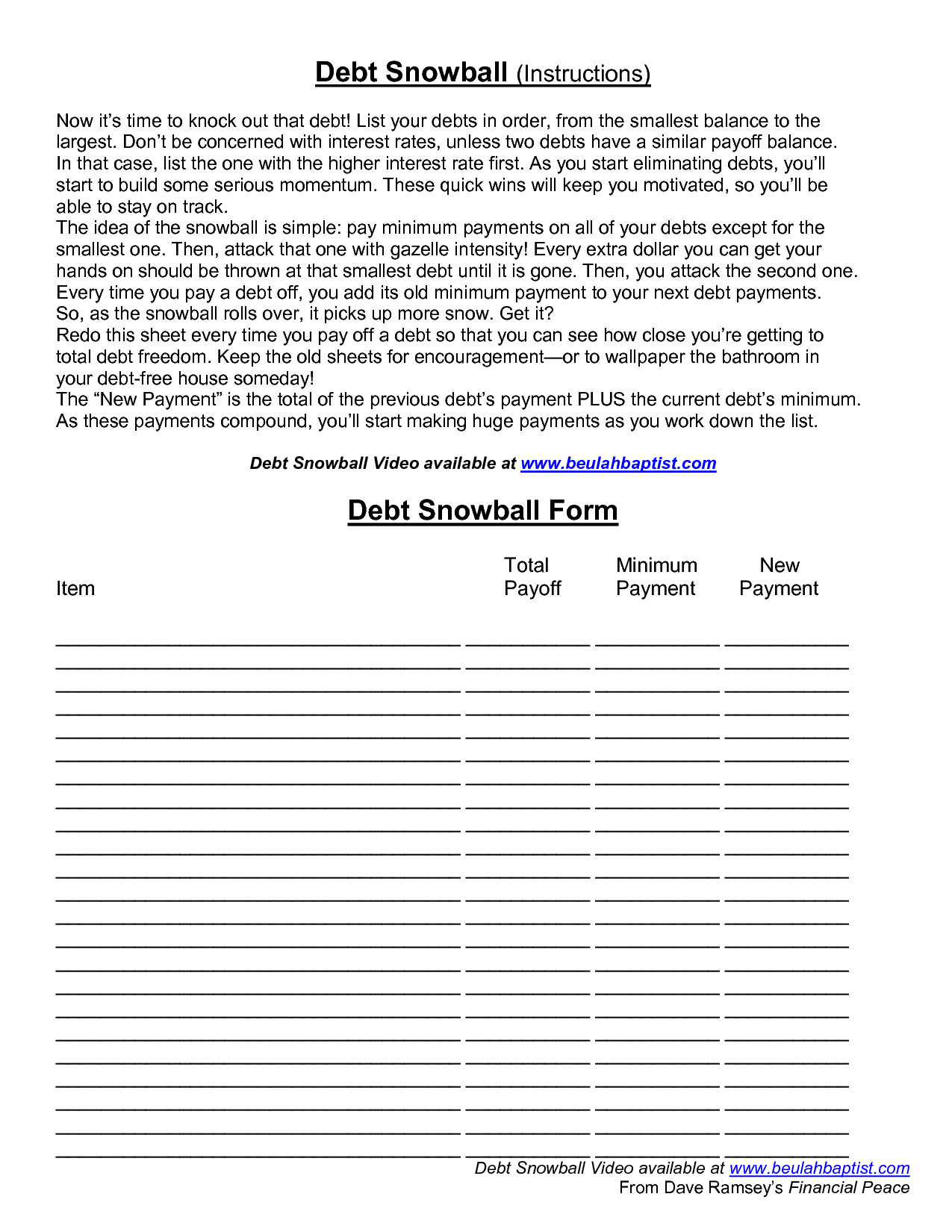

- Dave Ramsey Debt Snowball Form

- Debt Payoff Plan Template

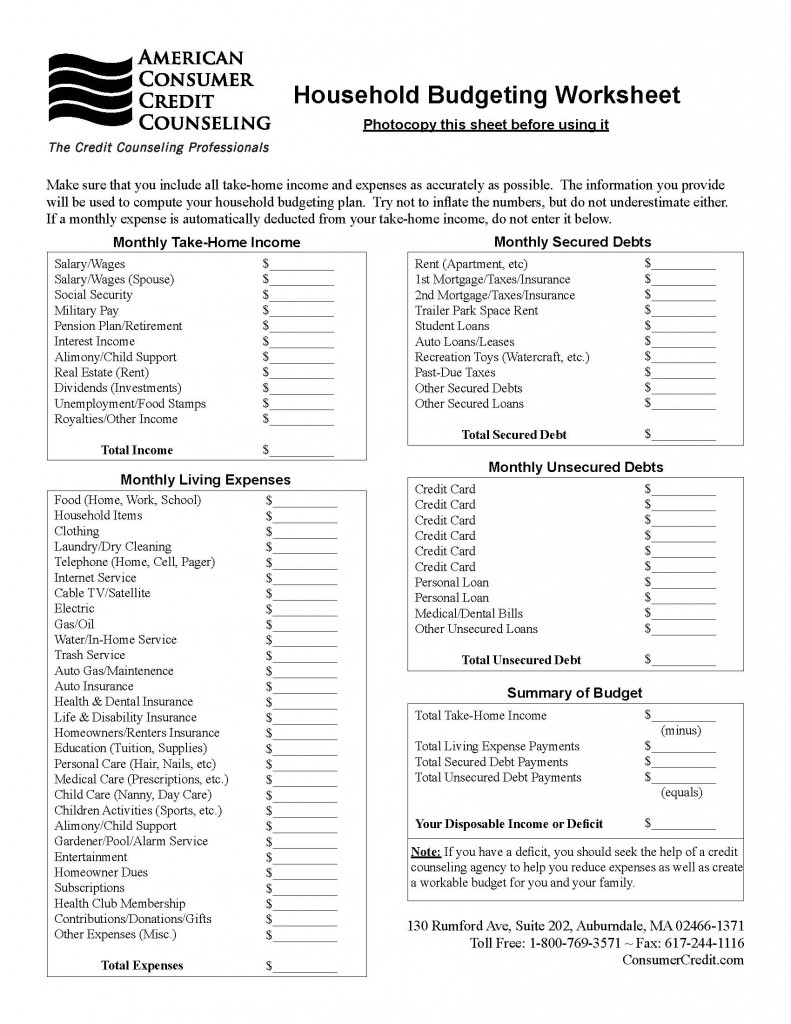

- Monthly Household Budget Worksheet

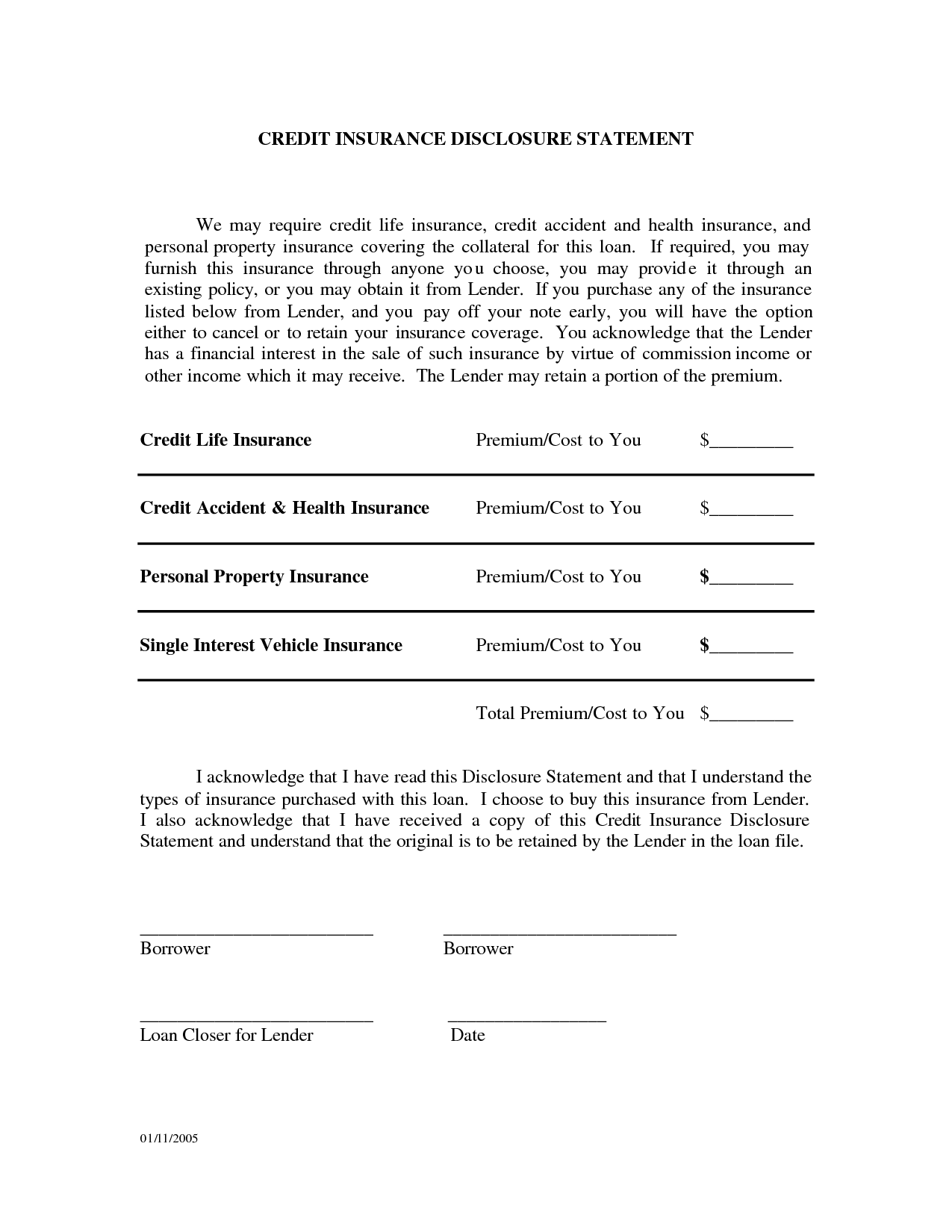

- Loan Payoff Statement Letter Sample

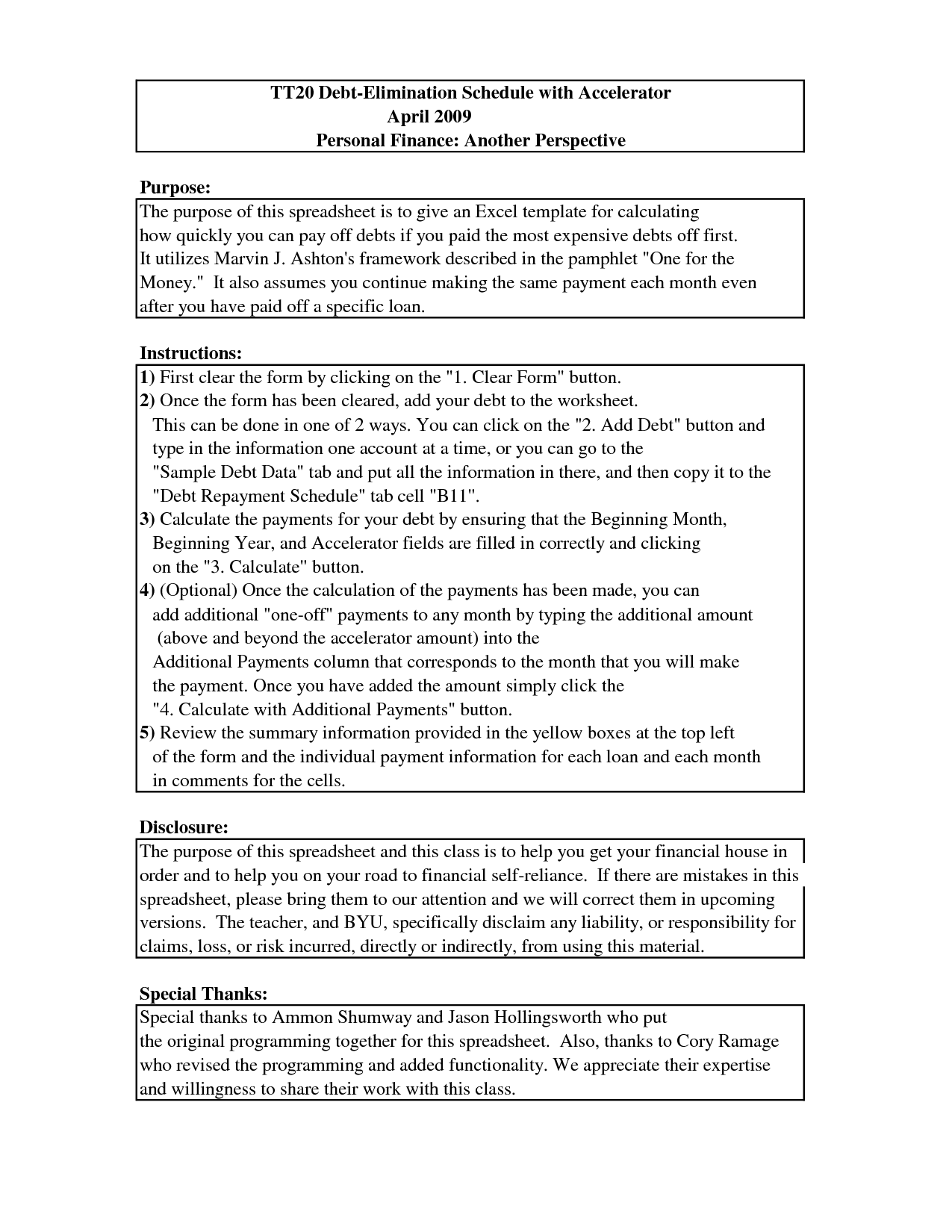

- Sample Debt Elimination Worksheet

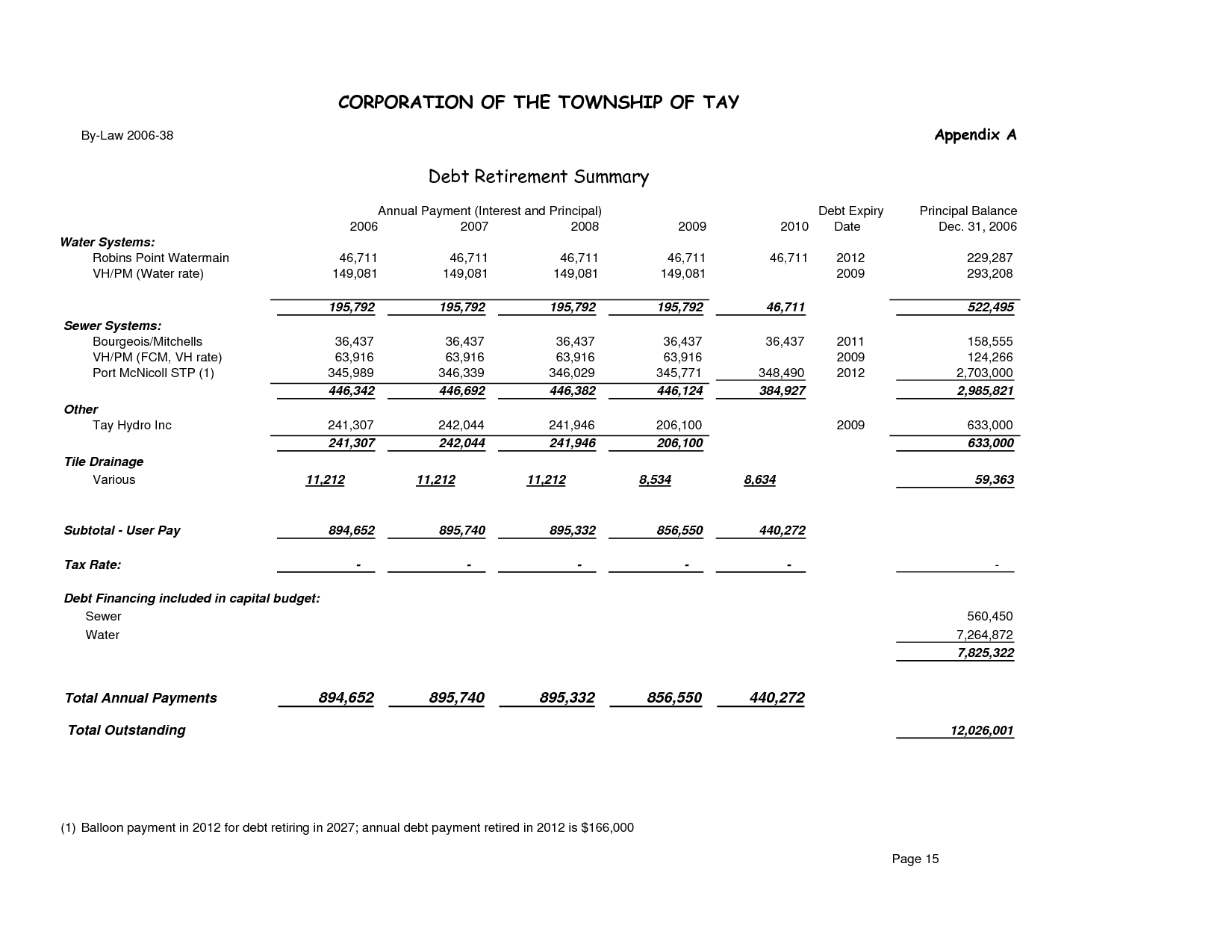

- Business Debt Schedule Template

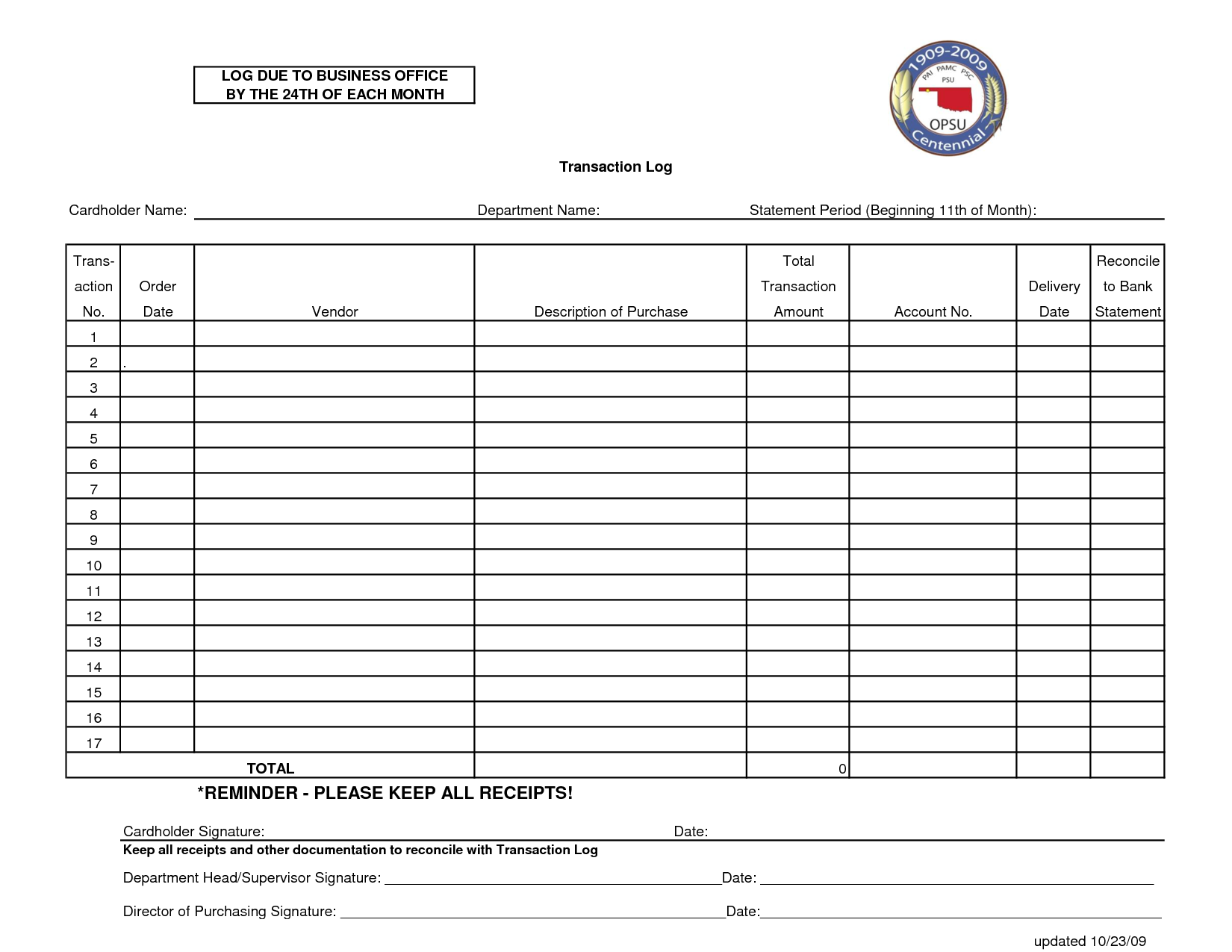

- Credit Card Transaction Log Template

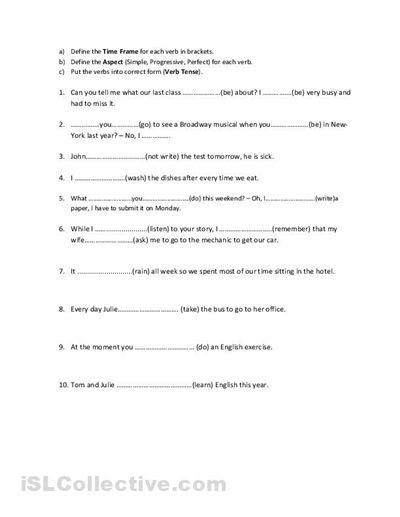

- Verb Tense Worksheet

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a Pay Off Credit Card Worksheet?

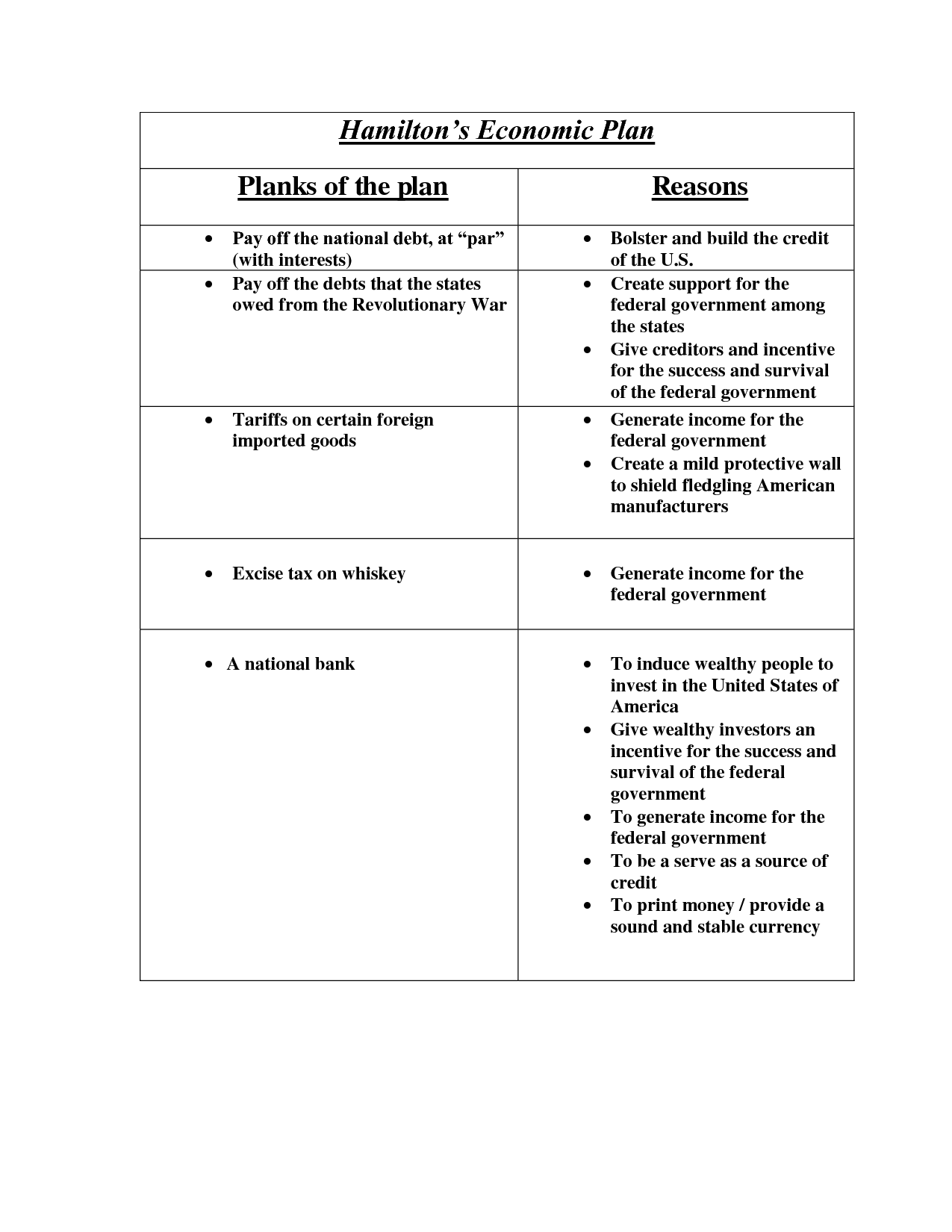

A Pay Off Credit Card Worksheet is a tool that helps individuals track and plan the repayment of their credit card debt. It typically includes information such as the current balance, interest rate, minimum payment, and a strategy for paying off the debt efficiently, such as with a debt snowball or avalanche method. This worksheet can help users visualize their progress and make informed decisions to become debt-free faster.

How does a Pay Off Credit Card Worksheet help in managing credit card debt?

A Pay Off Credit Card Worksheet can help in managing credit card debt by providing a clear overview of current outstanding balances, interest rates, minimum payments, and potential payoff strategies. It allows individuals to create a structured plan to pay off their debt efficiently, track progress, and identify areas where they can reduce spending or increase payments to accelerate the repayment process. This tool enables individuals to take control of their debt and work towards achieving financial freedom.

What information is typically included in a Pay Off Credit Card Worksheet?

A Pay Off Credit Card Worksheet typically includes details such as the outstanding balance on the credit card, the annual interest rate, the minimum monthly payment, the desired time frame for paying off the card, and a detailed plan outlining how much to pay each month to achieve the goal of paying off the card within the specified time frame. It may also include information on additional payments or lump sum payments that can help expedite the pay off process.

How do you calculate the total amount of credit card debt on a Pay Off Credit Card Worksheet?

To calculate the total amount of credit card debt on a Pay Off Credit Card Worksheet, you would add up all the outstanding balances owed on each credit card listed on the worksheet. This involves taking the individual balances on each card and summing them together to get the total amount of debt that needs to be paid off on all the cards combined.

What is the purpose of listing the interest rate for each credit card on the worksheet?

Listing the interest rate for each credit card on the worksheet serves the purpose of providing a clear comparison between different credit card options. Understanding the interest rate helps individuals evaluate the cost of borrowing on each card and make informed decisions on which card may be the most financially suitable for their needs. It allows them to assess the potential expenses associated with carrying a balance and ultimately choose a card with the most favorable terms.

How do you determine the minimum monthly payment for each credit card?

To determine the minimum monthly payment for each credit card, you typically calculate it as a percentage of the outstanding balance or a fixed amount, whichever is greater. The specific calculation method can vary among credit card issuers, but it commonly ranges from 1-3% of the balance. It's crucial to check your credit card terms and conditions or contact your credit card issuer directly to understand the exact formula they use in calculating your minimum monthly payment.

Why is it important to prioritize credit card debt payments on the worksheet?

It is important to prioritize credit card debt payments on the worksheet because credit card debt usually carries high interest rates, which can quickly accumulate and lead to even more financial stress. By prioritizing credit card debt payments, you can minimize the amount of interest you pay over time and work towards reducing your overall debt burden more efficiently. Additionally, maintaining a good payment history on your credit card can help improve your credit score, which can have a positive impact on your financial future.

How does a Pay Off Credit Card Worksheet help in creating a repayment plan?

A Pay Off Credit Card Worksheet helps in creating a repayment plan by organizing all the necessary information in one place, such as the outstanding balance, interest rate, monthly payment, and any extra funds available for repayment. By filling out the worksheet, one can visually see their financial situation and prioritize which credit card to pay off first based on factors like interest rates or balances. This structured approach allows individuals to set specific goals, track progress, and ultimately develop a strategy to pay off the credit card debt efficiently.

What are some common strategies for paying off credit card debt using the worksheet?

Some common strategies for paying off credit card debt using a worksheet include listing all credit card balances, interest rates, and minimum payments; creating a budget to allocate a specific amount towards debt repayment each month; prioritizing debts by either focusing on paying off the one with the highest interest rate first (avalanche method) or the one with the smallest balance (snowball method); cutting down on expenses and increasing income to free up more money towards debt repayment; and regularly monitoring and updating the worksheet to track progress and make adjustments as needed.

How often should you update and review your Pay Off Credit Card Worksheet?

You should update and review your Pay Off Credit Card Worksheet regularly, preferably monthly or whenever there is a significant change in your financial situation. This will help you stay on track with your debt repayment goals, adjust your strategy if needed, and ensure that you are making progress towards becoming debt-free.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments