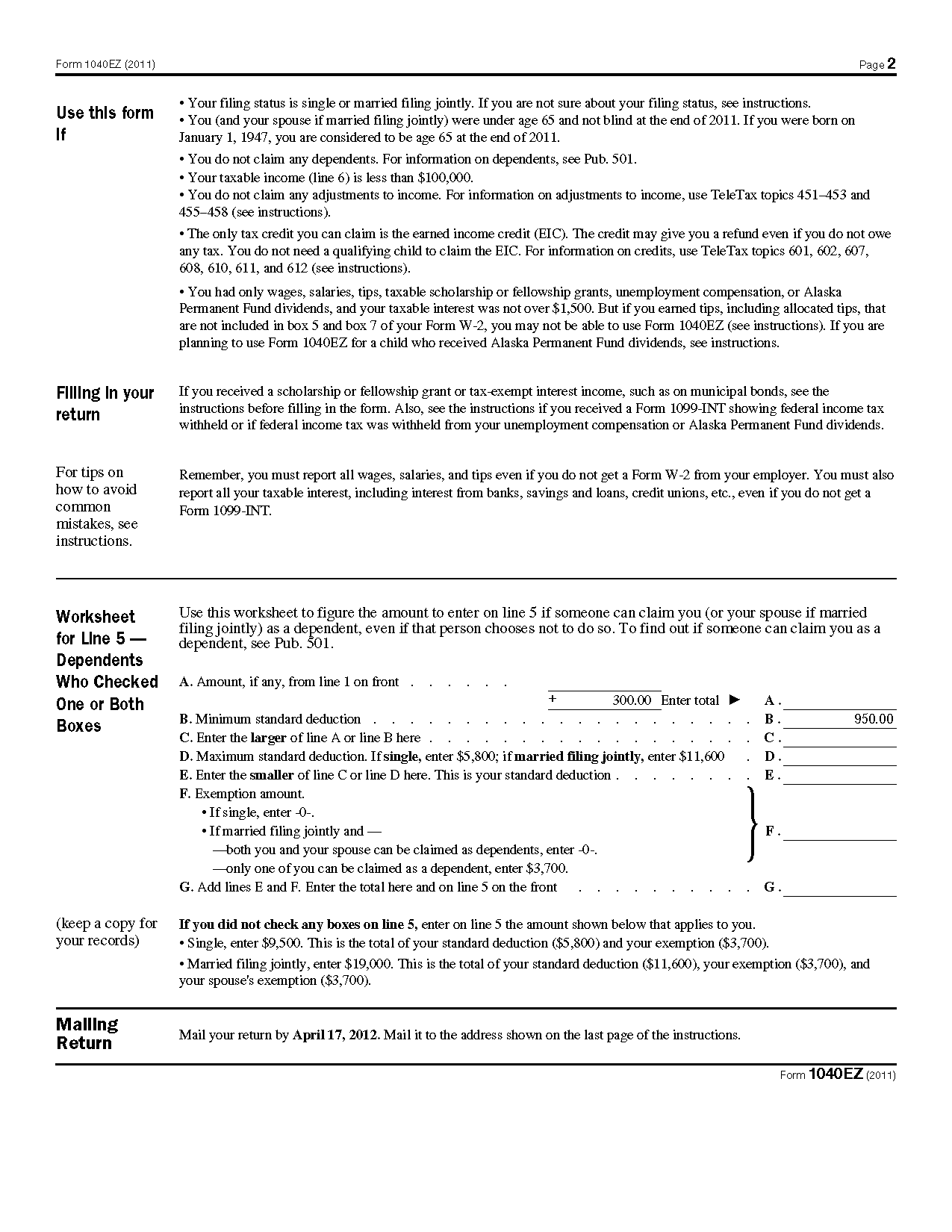

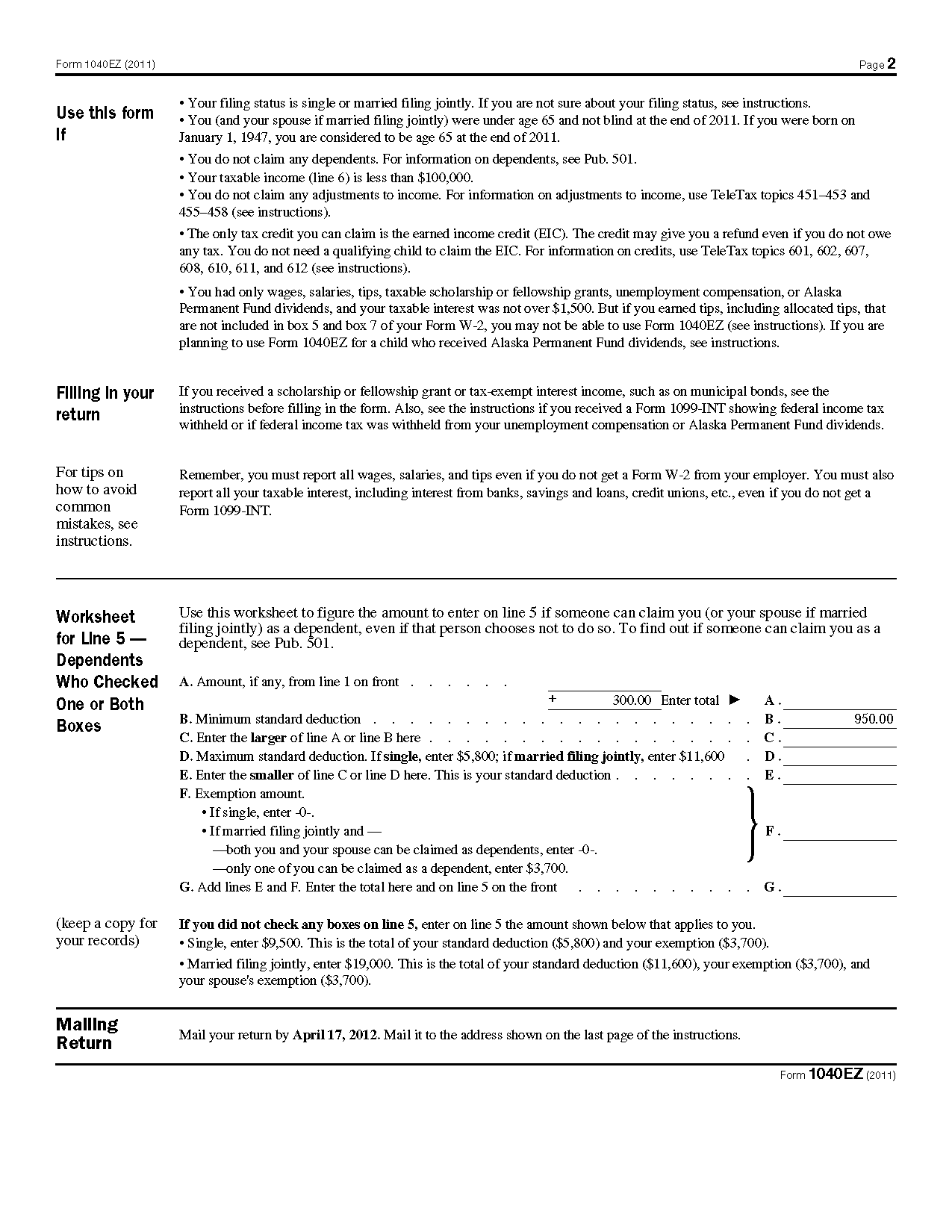

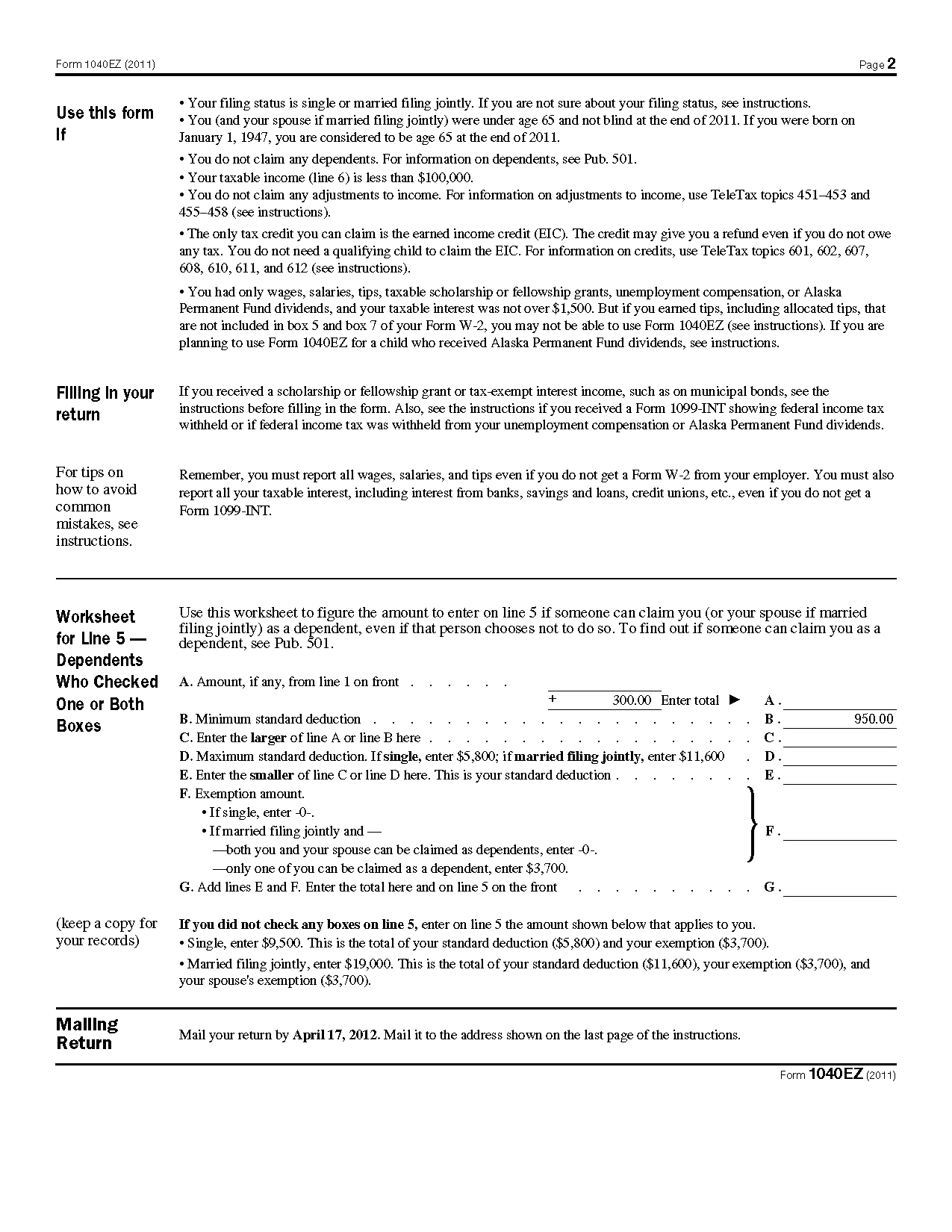

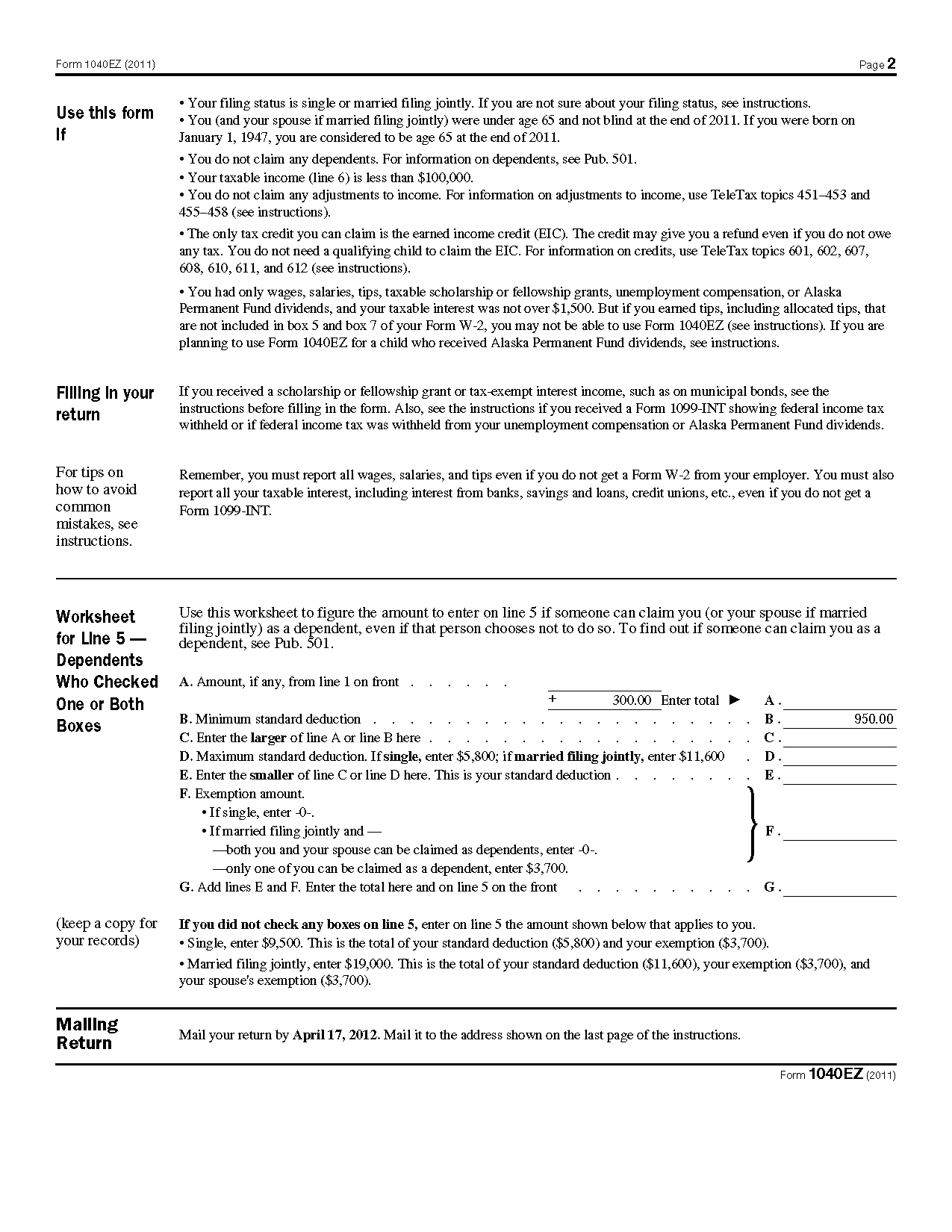

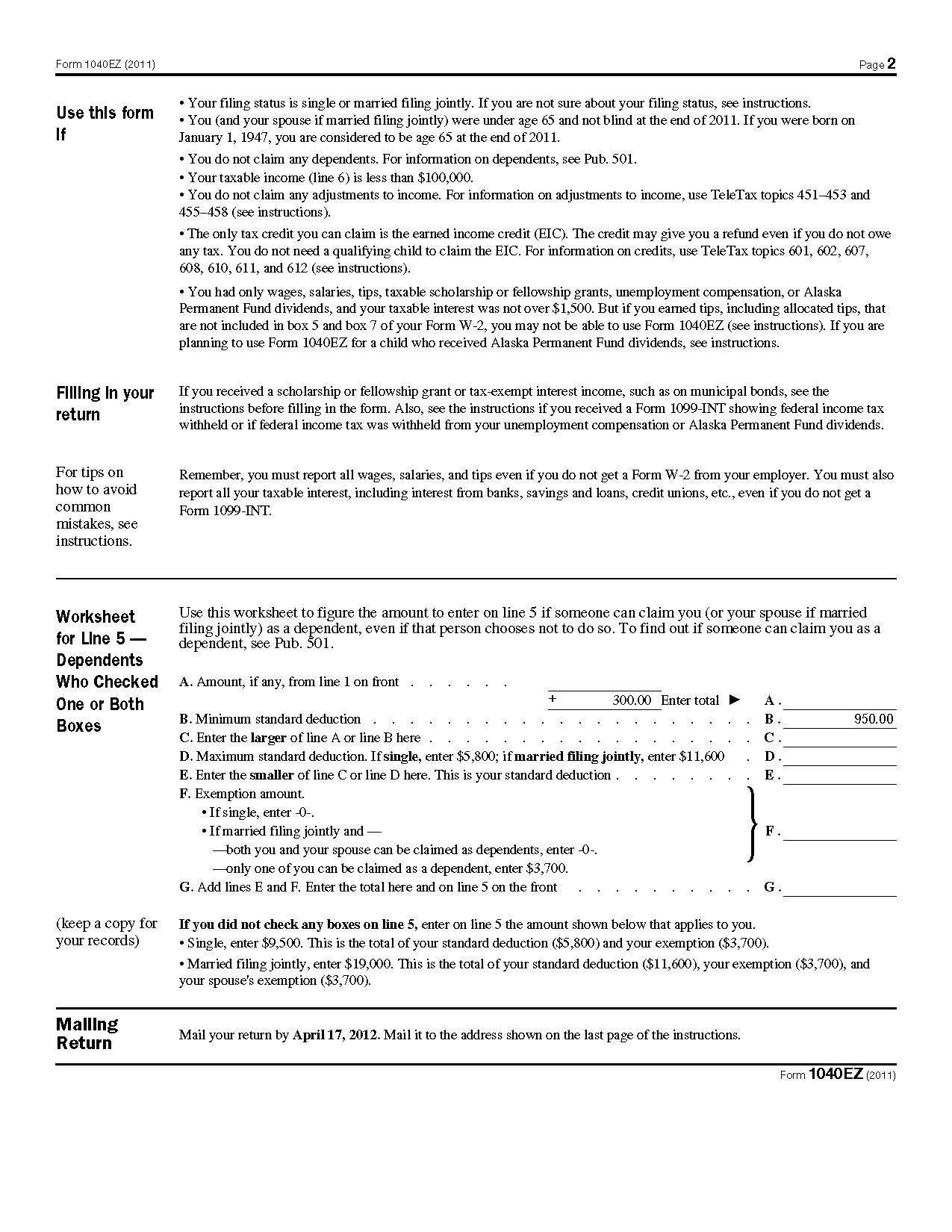

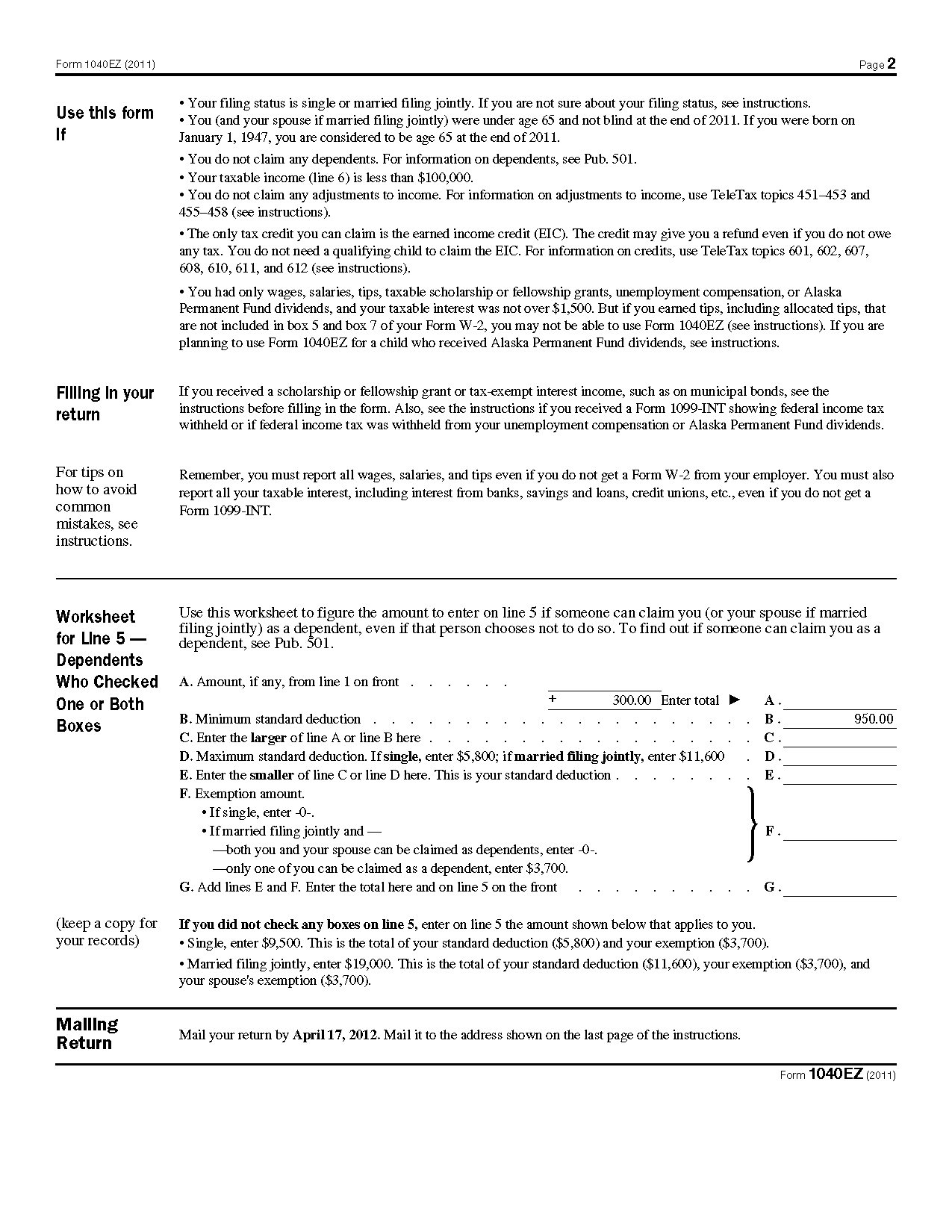

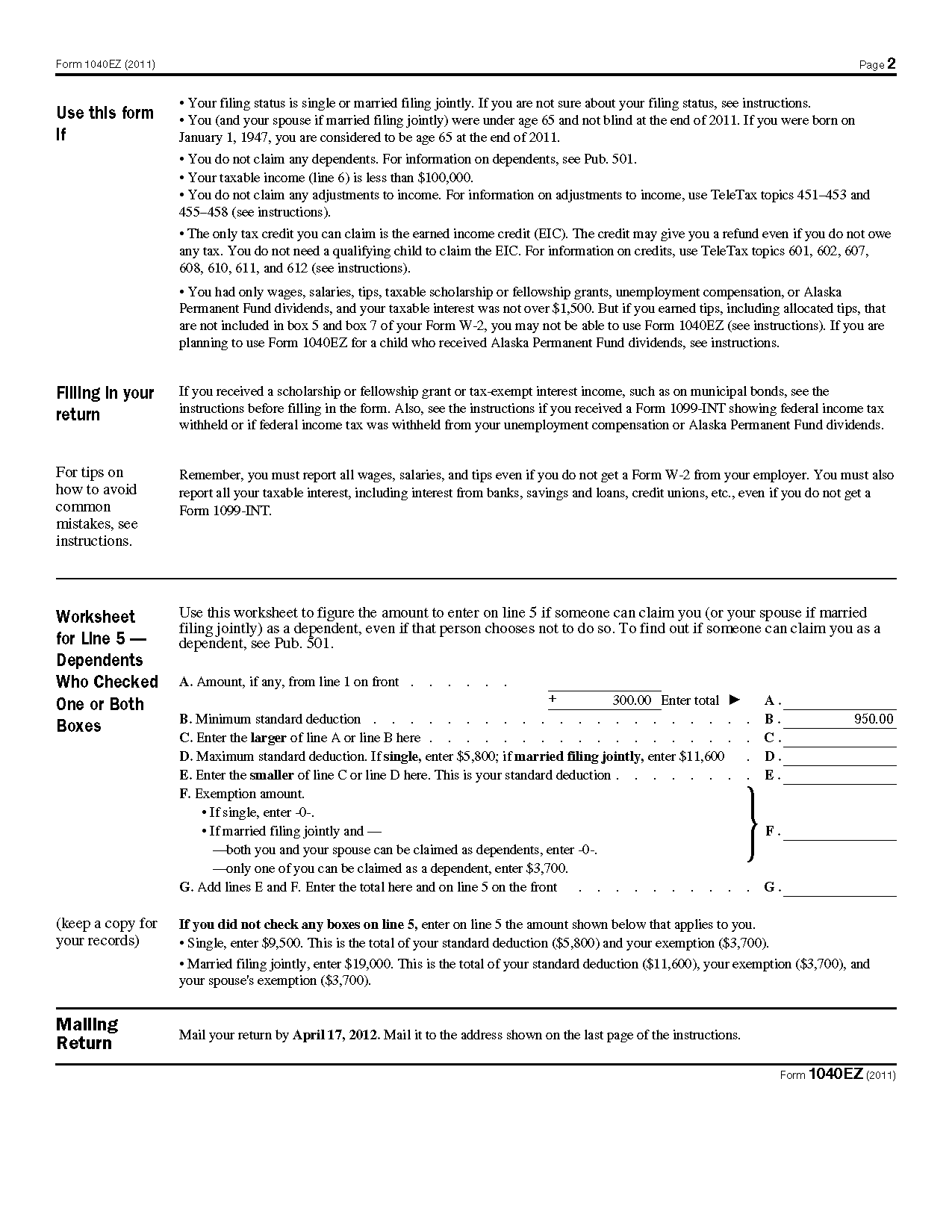

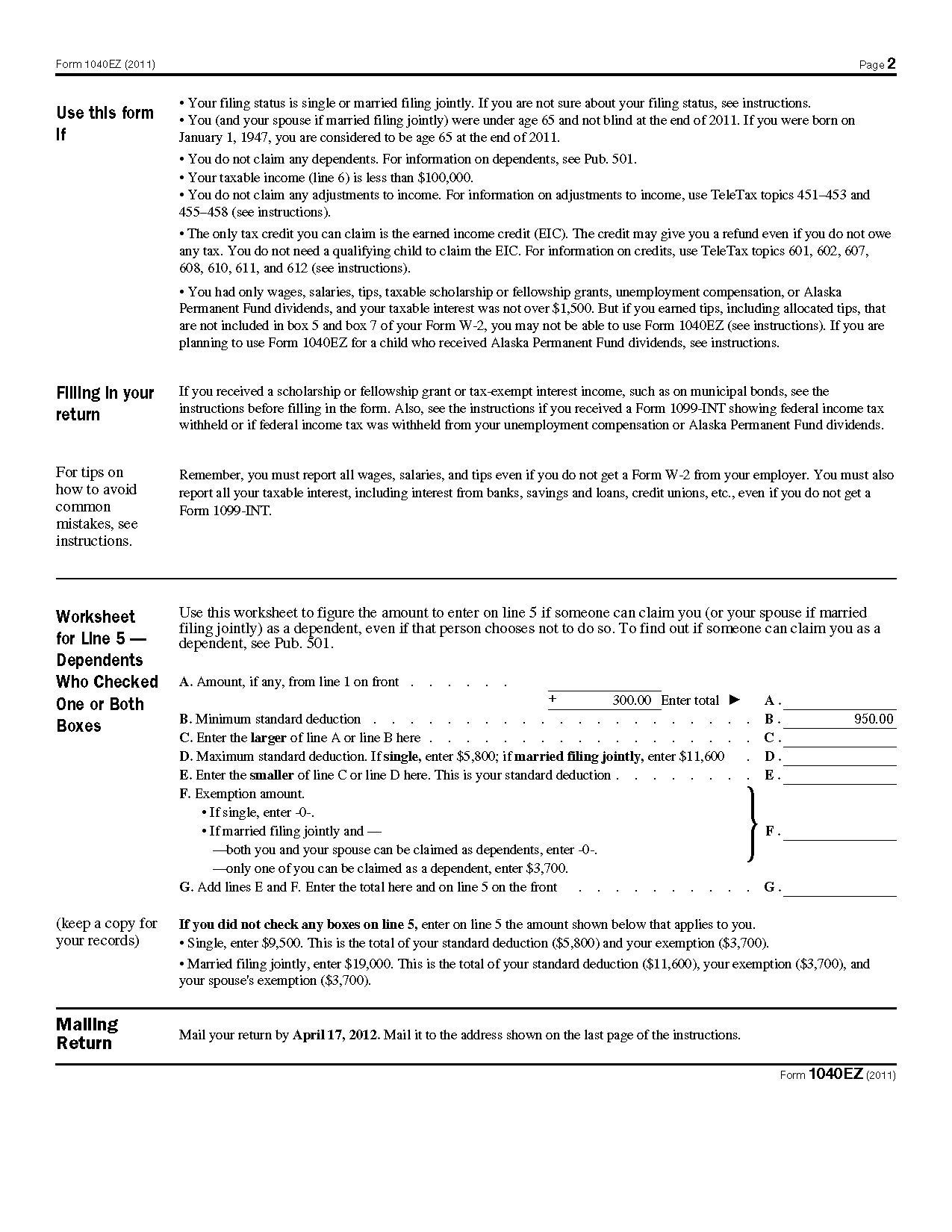

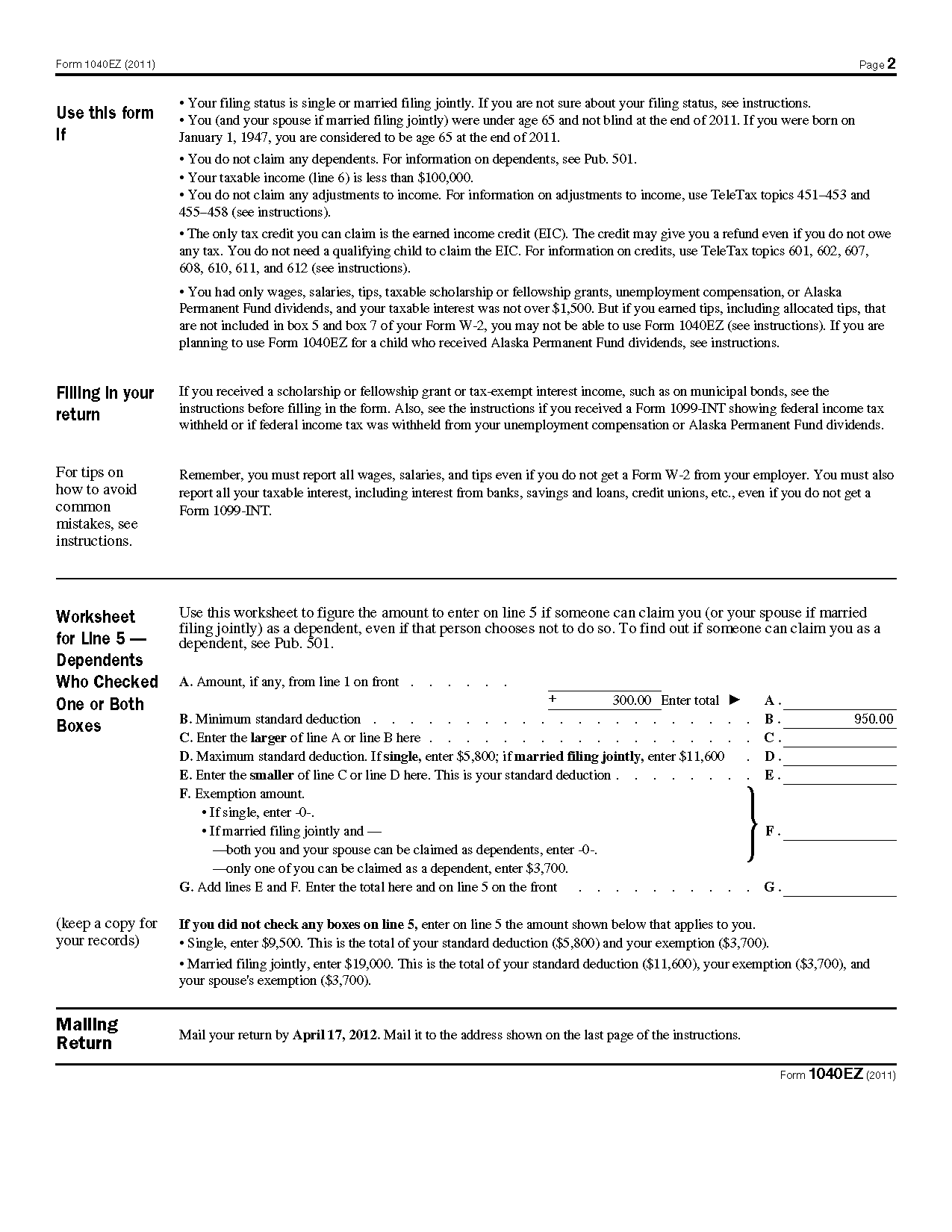

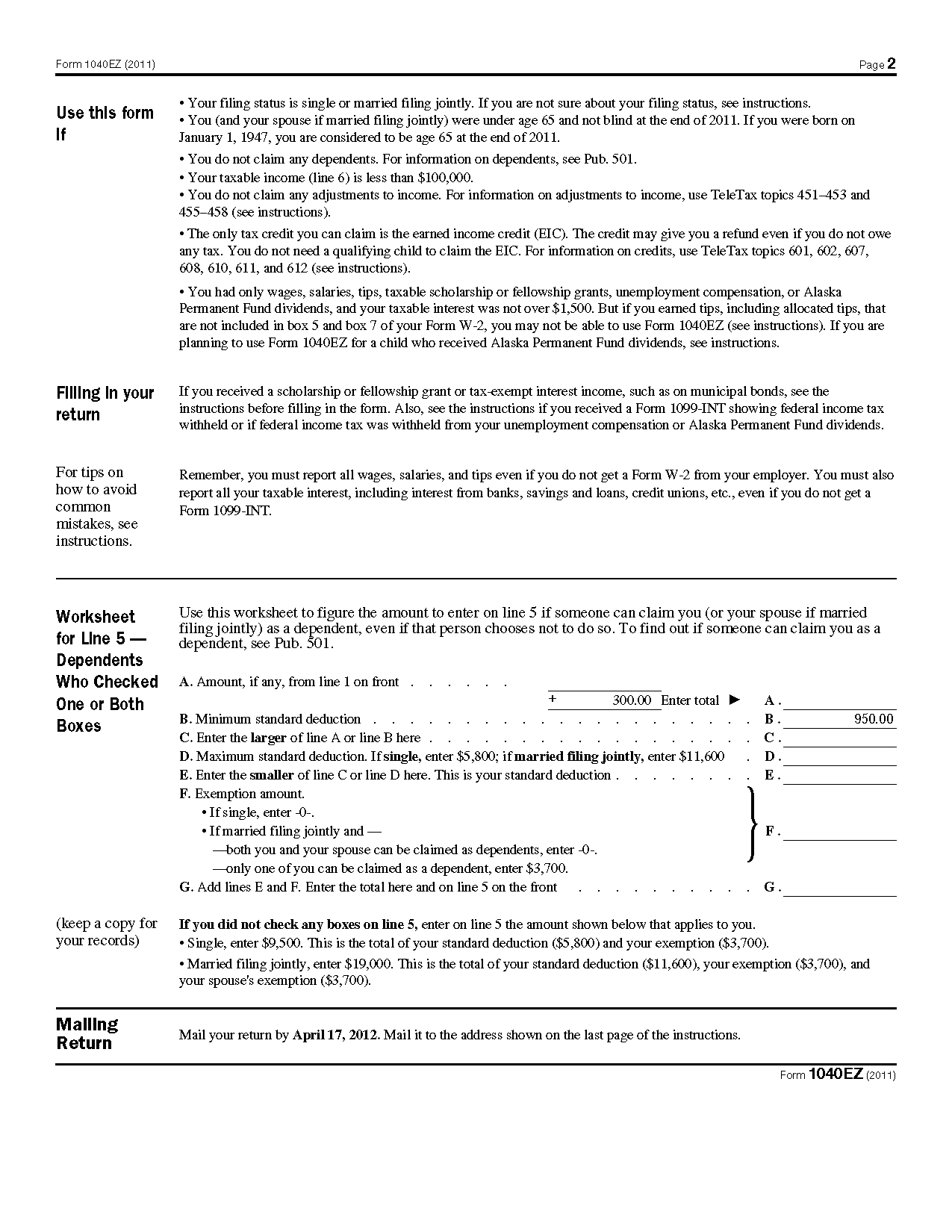

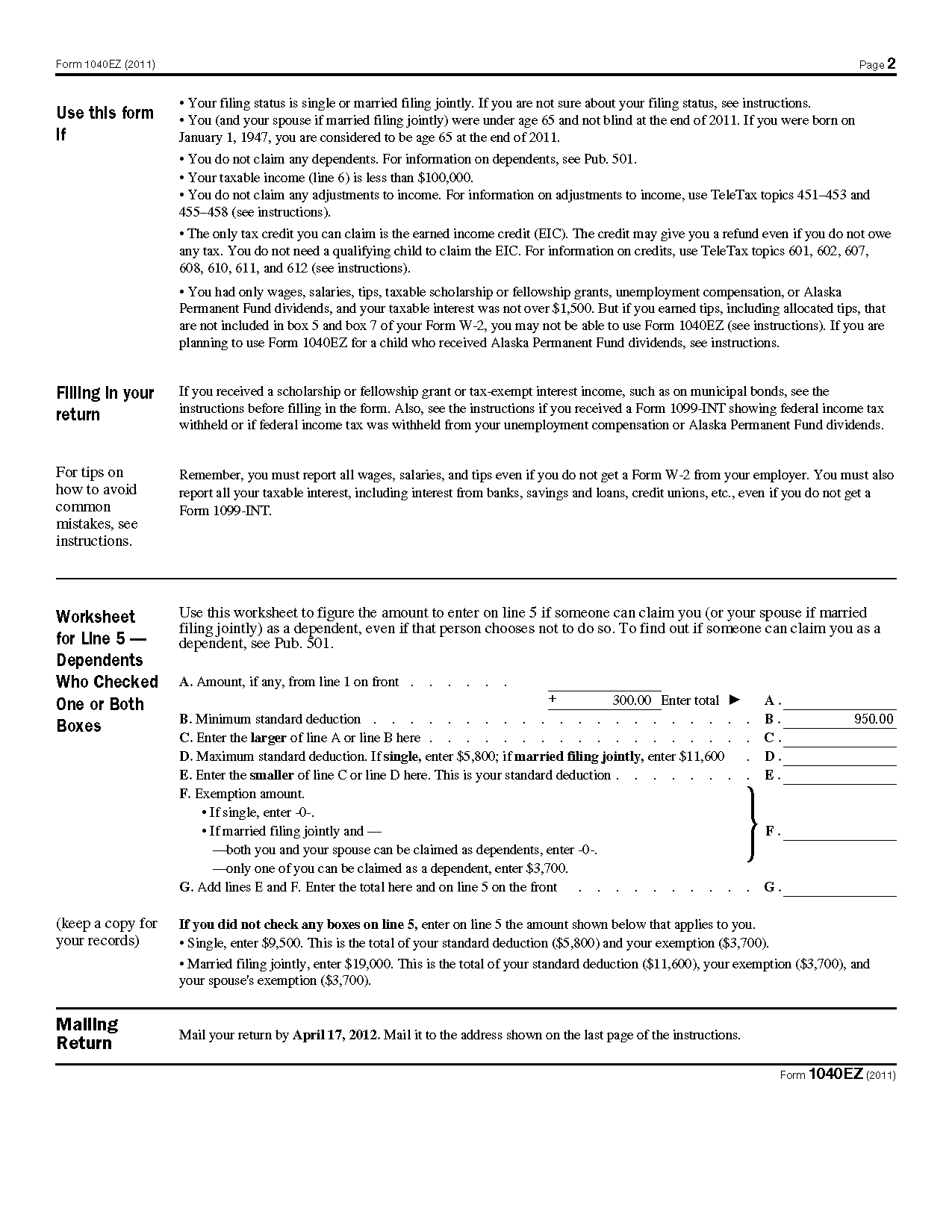

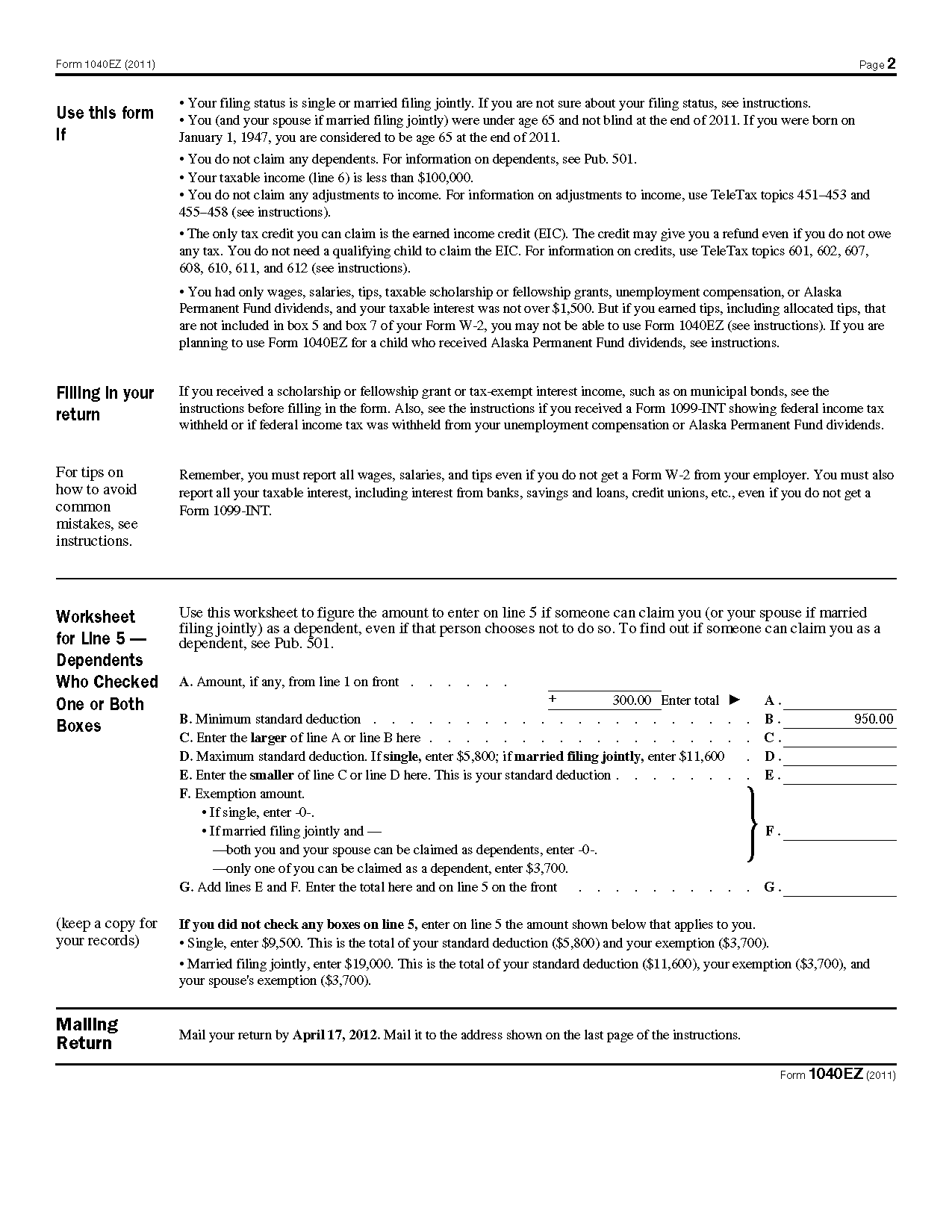

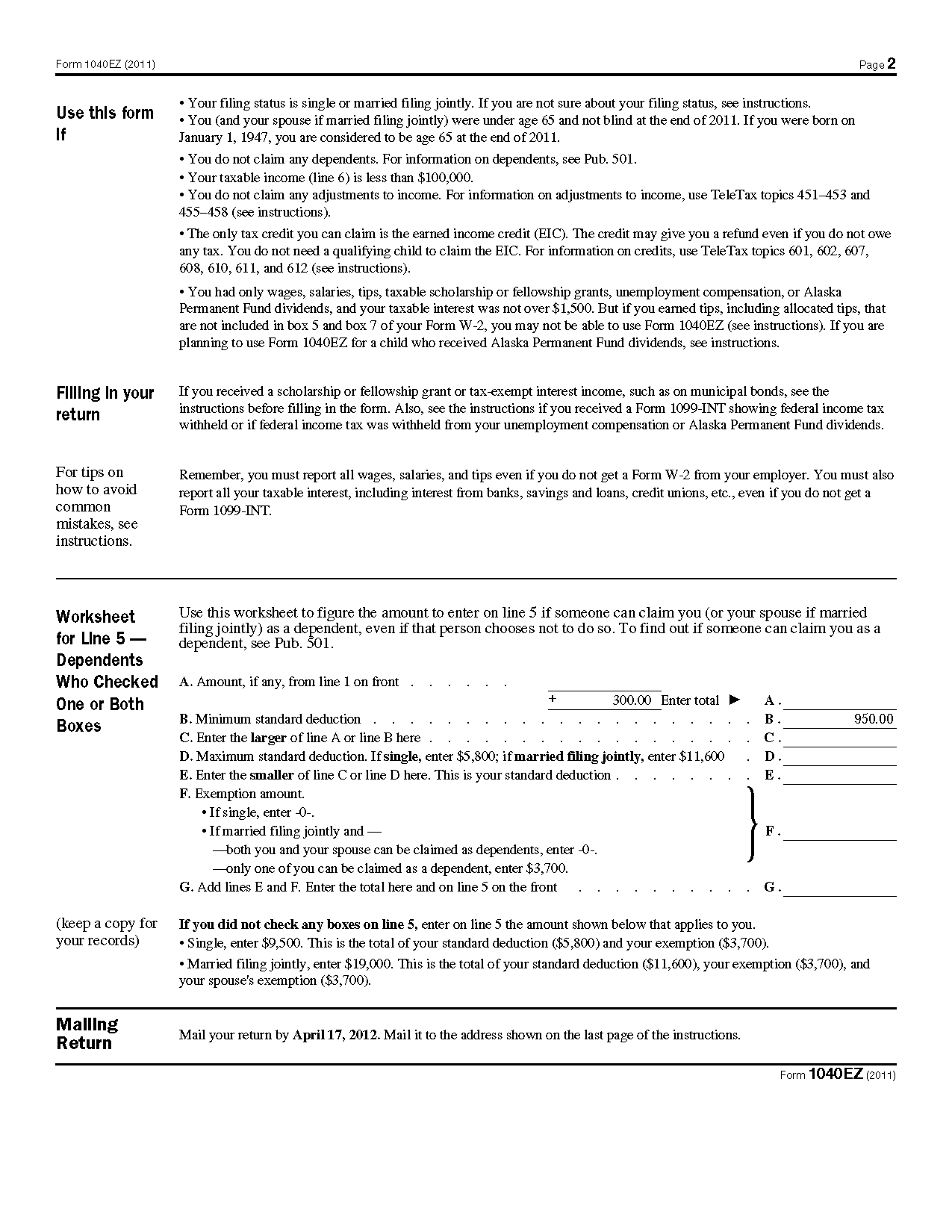

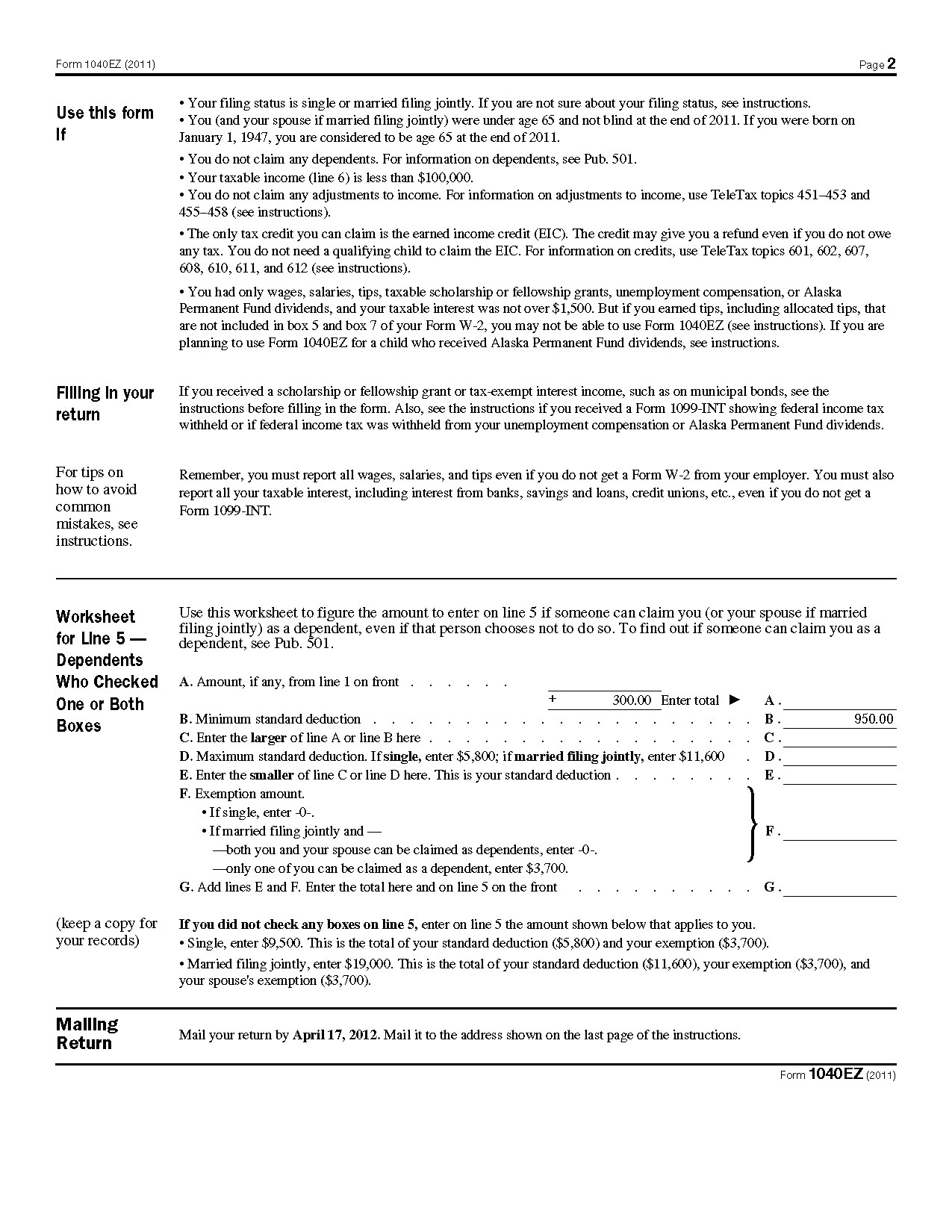

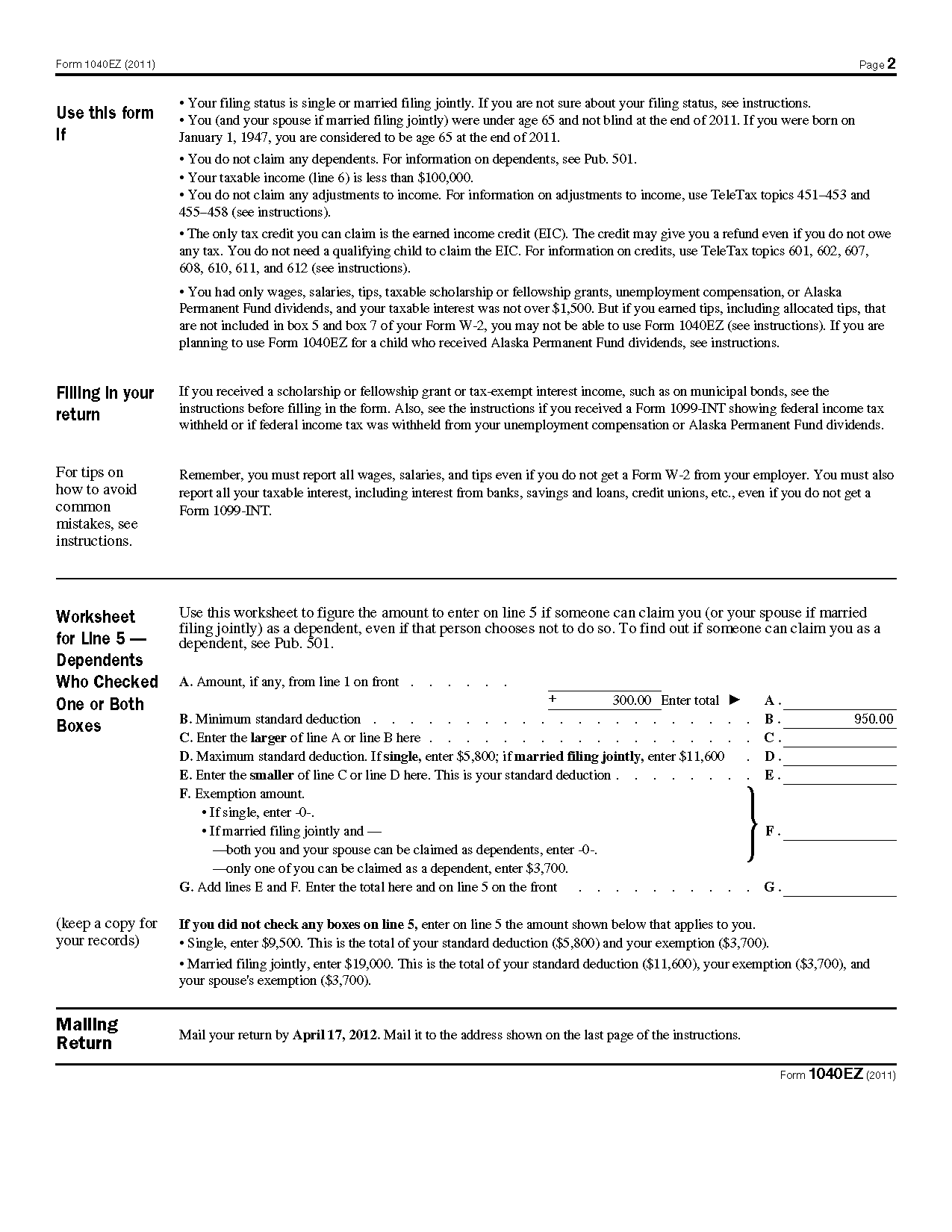

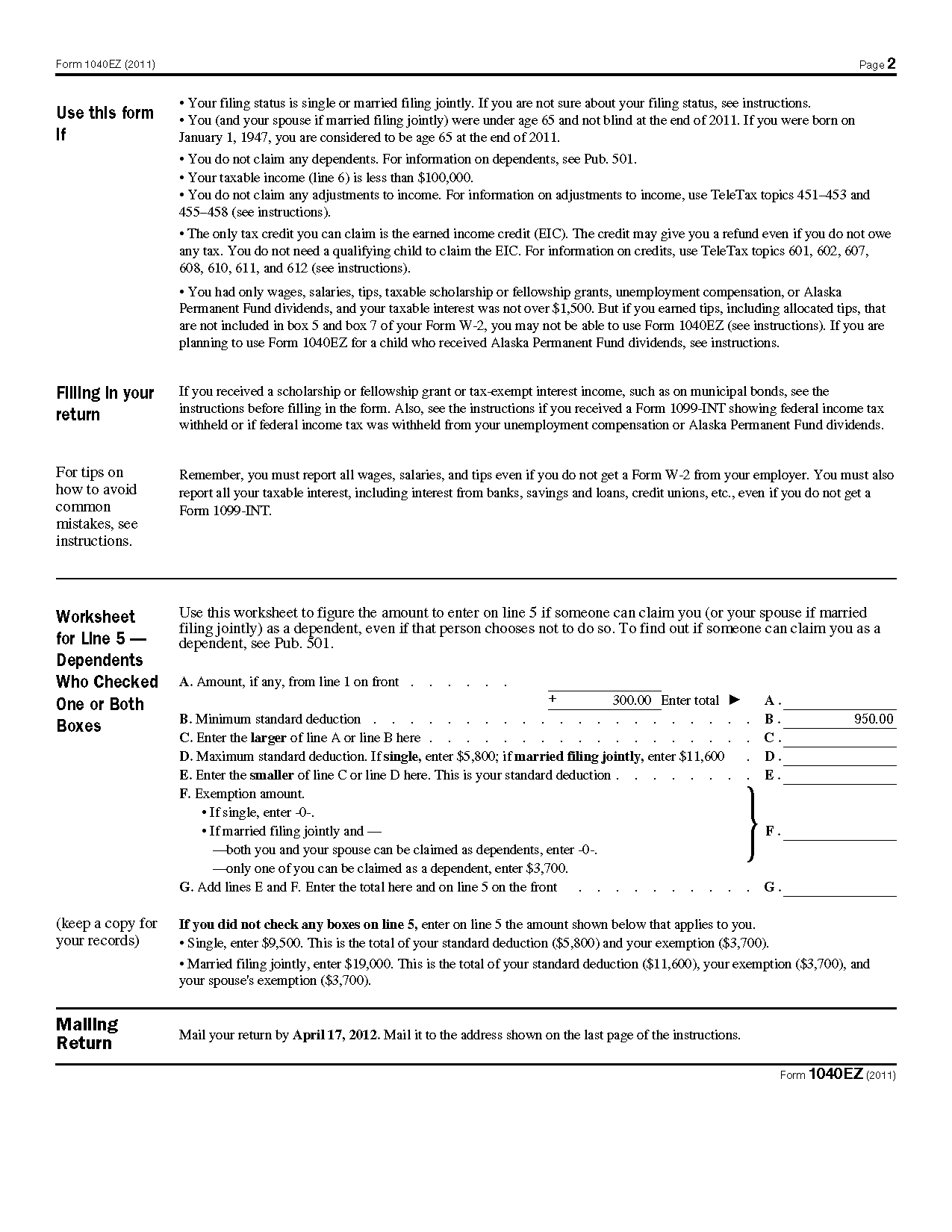

EZ Worksheet Line F FAFSA

Worksheets are an essential tool for anyone navigating the complex world of finance, and EZ Worksheet Line F FAFSA is no exception. Designed to simplify the process of completing the FAFSA (Free Application for Federal Student Aid), this worksheet focuses specifically on the entity and subject of Line F – untaxed income and benefits. If you're a student or parent seeking assistance in accurately reporting your untaxed income, look to EZ Worksheet Line F FAFSA for a user-friendly and comprehensive solution.

Table of Images 👆

More Line Worksheets

Lines of Symmetry WorksheetsLine Drawing Art Worksheets

Drawing Contour Lines Worksheet

Blank Printable Timeline Worksheets

2 Lines of Symmetry Worksheets

Linear Equations Worksheet 7th Grade

Rounding Decimals Number Line Worksheet

College Essay Outline Worksheet

Texture Line Drawing Techniques Worksheet

Outline Format Worksheet

What is FAFSA?

FAFSA stands for Free Application for Federal Student Aid. It is a form that students in the United States fill out to apply for financial aid for college or graduate school. The information provided on the FAFSA is used to determine a student's eligibility for various types of financial aid, including grants, scholarships, loans, and work-study programs.

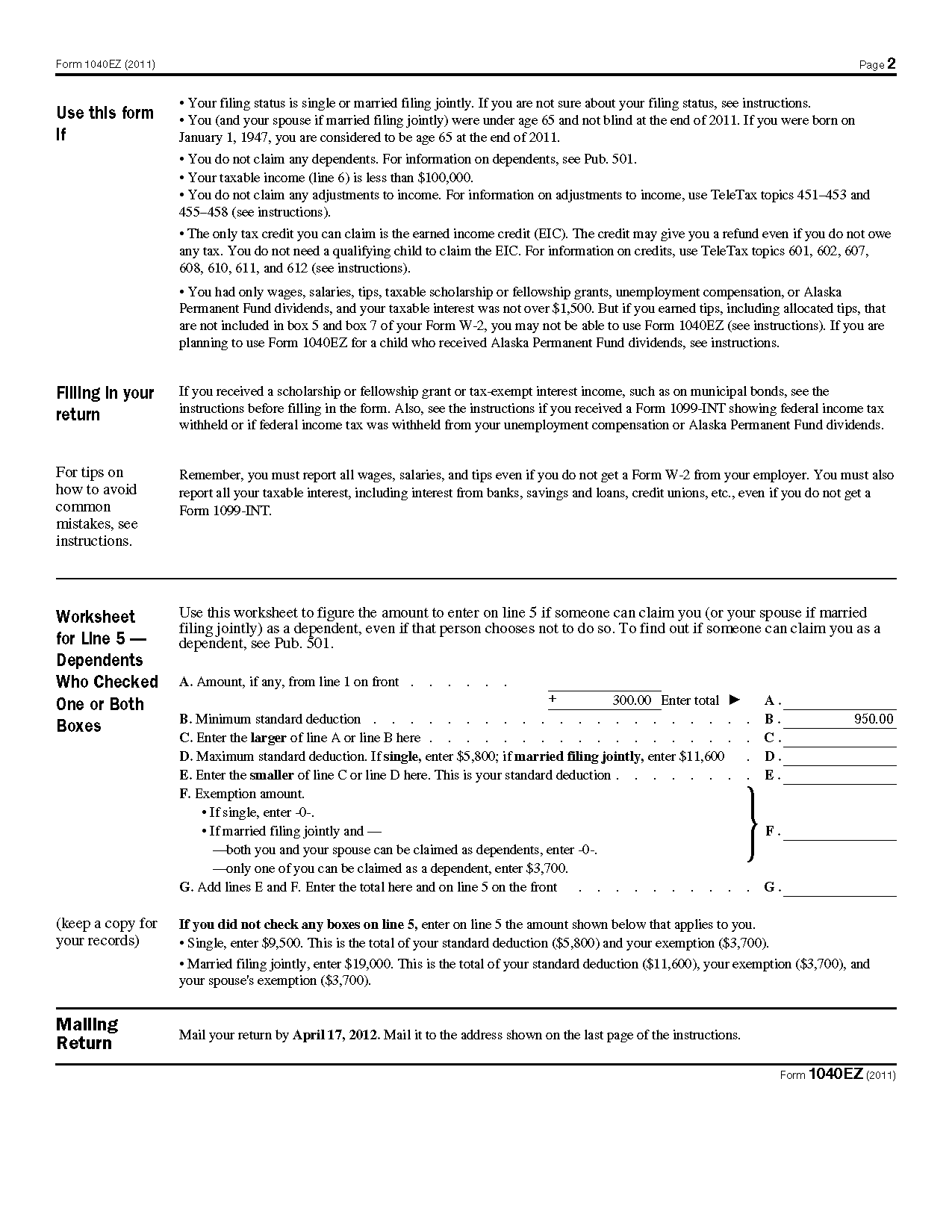

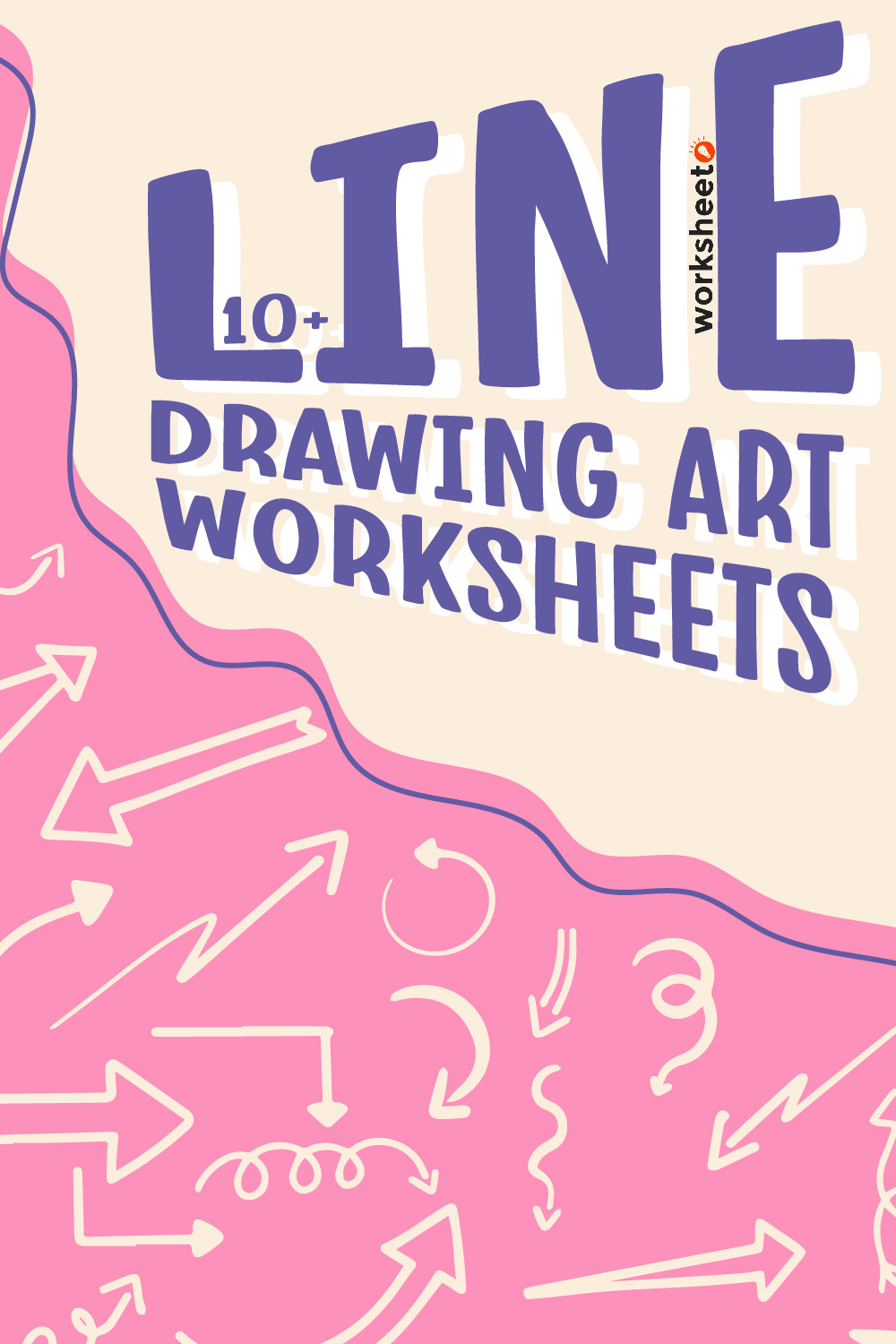

How can I access the EZ Worksheet Line F in FAFSA?

To access EZ Worksheet Line F in FAFSA, you need to log in to your FAFSA account on the official website. Navigate to the "Student Financial Information" section and locate the EZ Worksheet. Line F specifically pertains to the total amount of cash, savings, and checking accounts for you and your parents. Enter the relevant information as requested to complete this section of the FAFSA application.

What information should I provide in Line F of the EZ Worksheet?

In Line F of the EZ Worksheet, you should provide your total income or Adjusted Gross Income (AGI) for the tax year. This includes all sources of income such as wages, salaries, tips, interest, dividends, and any other income earned during the year. It's a key figure used to determine your tax liability and eligibility for certain tax credits and deductions.

Do I need to include information about my parents in Line F?

No, Line F typically pertains to the student's information, such as student income and other financial details. Information about parents is usually included in other sections of a form, such as Line C for parent income and assets.

How do I report income and tax information in Line F?

To report income and tax information in Line F, you will need to provide the amount of total income, adjustments, exemptions, and taxable income in the designated fields. This information can typically be found on your relevant tax documents such as your Form W-2, 1099, or other sources of income documentation. Be sure to accurately input these numbers to ensure proper reporting and calculation of your taxes owed or refunds due.

Should I include all sources of income in Line F?

Yes, you should include all sources of income on Line F of your document to ensure accurate financial reporting. This will provide a comprehensive overview of your total income and help you comply with any applicable laws and regulations regarding income disclosure.

Can I use estimates or do I need exact figures in Line F?

Exact figures are not required in Line F. Estimates are acceptable as long as they closely reflect the actual values or amounts being referenced. It is more important to provide a reasonable and accurate estimate rather than trying to calculate precise figures.

What if my income has changed since the previous tax year?

If your income has changed since the previous tax year, you may need to adjust your tax withholdings, update your income information when filing your taxes, and consider any potential deductions or credits that may apply to your new income level. It is important to report any changes in income accurately to ensure you are meeting your tax obligations and potentially maximizing any tax benefits for which you may be eligible.

Are there any specific documents or forms I need to refer to while completing Line F?

You may need to refer to documents such as previous tax returns, W-2 forms, 1099 forms, and other relevant financial documents when completing Line F of your tax return. It is important to review these documents carefully to ensure accurate reporting of your income and deductions.

Can I make corrections or updates to Line F after submitting my FAFSA?

Yes, you can make corrections or updates to Line F of your FAFSA after submitting it. You can do this by logging back into your FAFSA application and selecting the option to "Make FAFSA Corrections." Remember to review all your information carefully and make sure it is accurate before submitting any changes.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments