Credit Card Budget Worksheet

Credit card budget worksheets are essential tools for individuals who are seeking to gain control of their finances and manage their credit card expenses effectively. These worksheets provide a comprehensive overview of all credit card transactions, allowing users to track their spending, monitor their balances, and plan for future payments. With a credit card budget worksheet, individuals can stay organized, avoid overspending, and ultimately achieve their financial goals.

Table of Images 👆

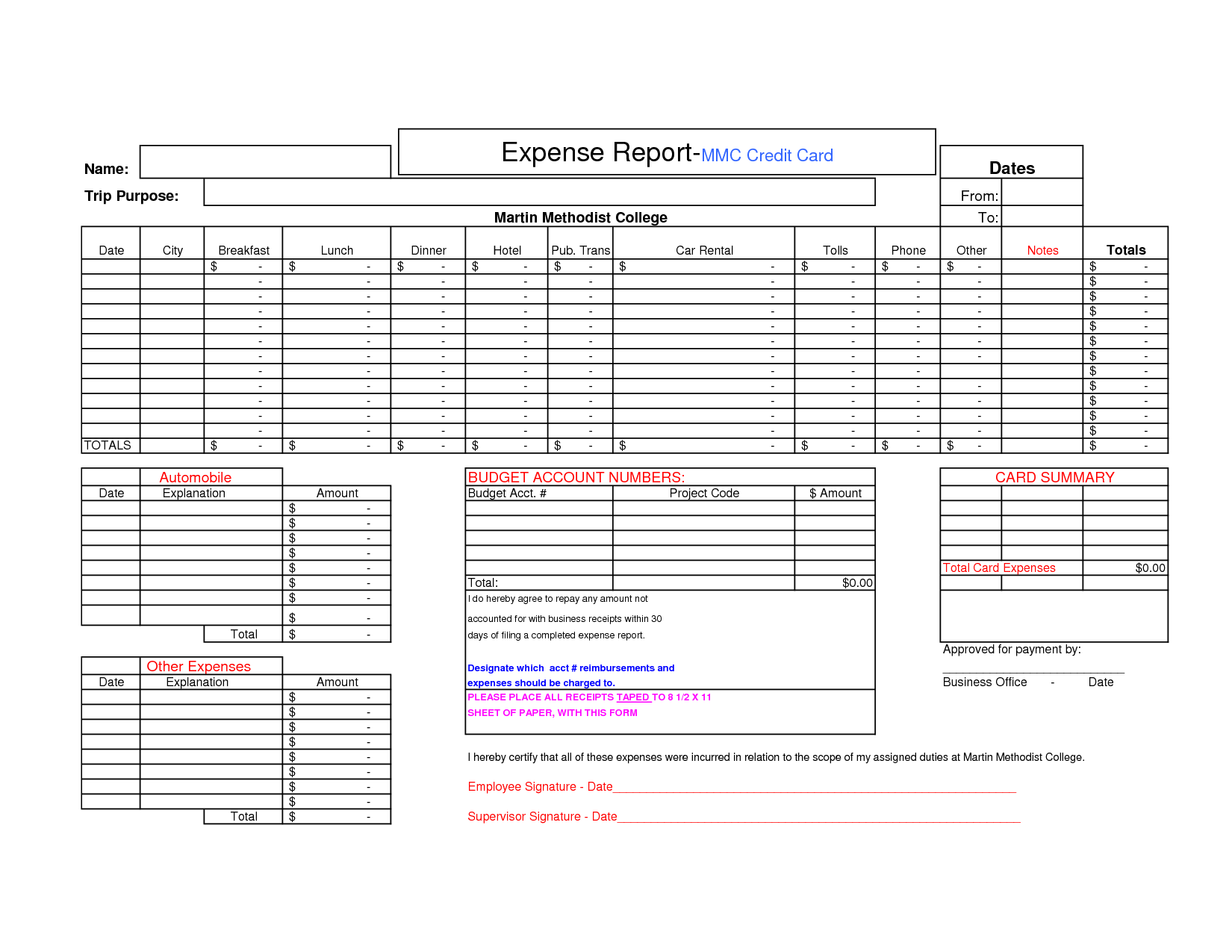

- Credit Card Expense Report Template

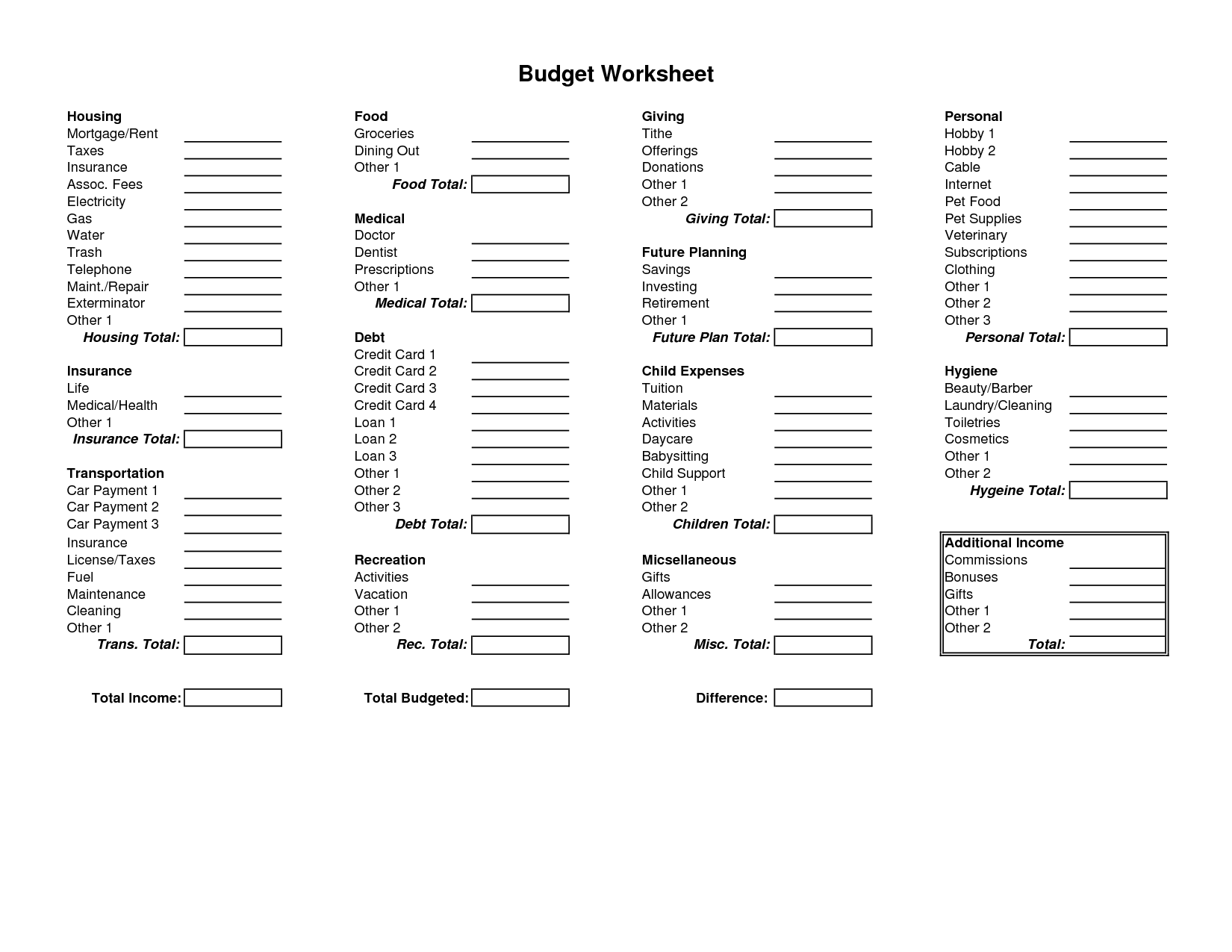

- Mortgage Budget Worksheet

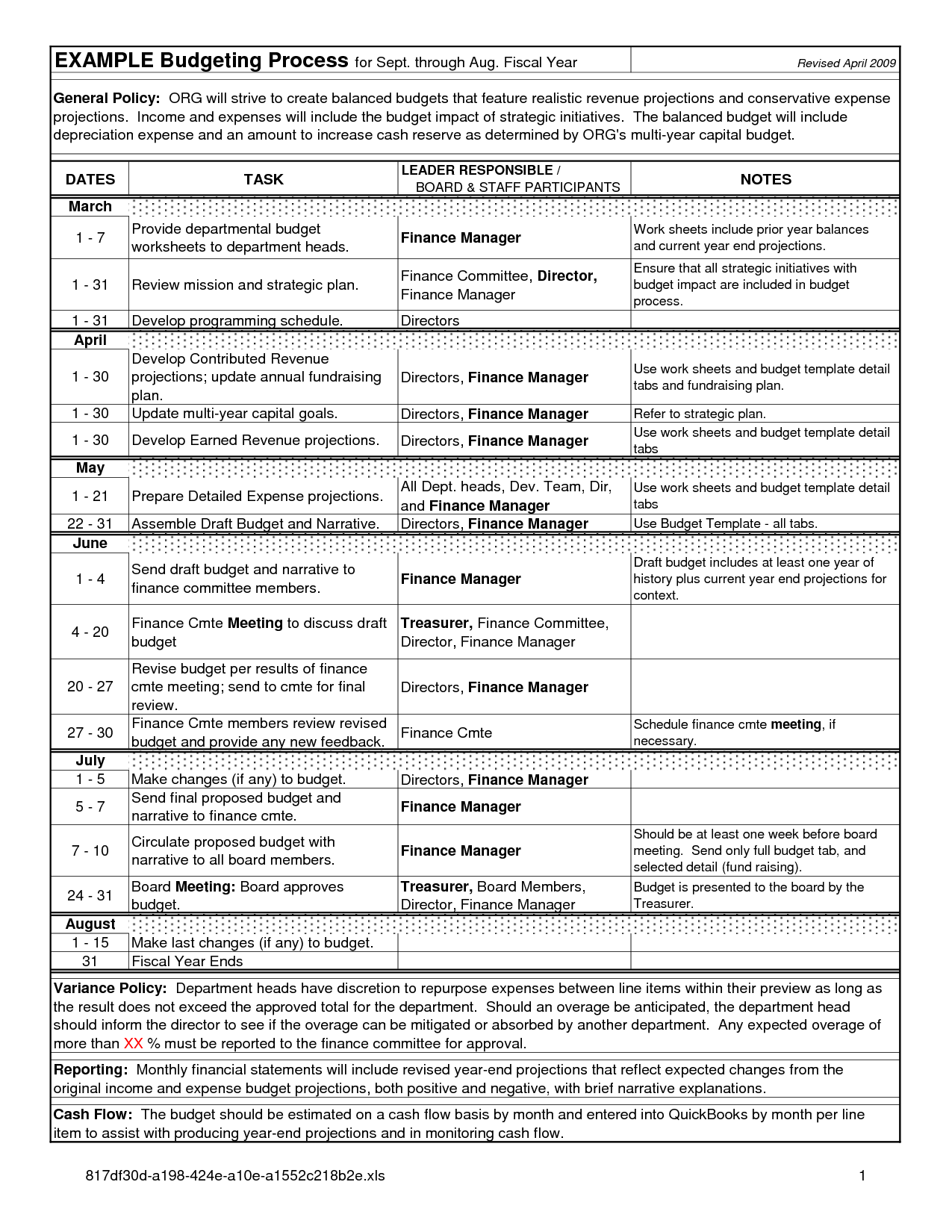

- Non-Profit Budget Sample

- Appraisal Order Form Template

- Credit Card Payment Form Template

- Free Printable Dave Ramsey Budget Worksheets

- Free Business Plan Template Worksheet

- EverFi Answers Financing Higher Education

- Non-Cash Contribution Letter

- Free Printable Check Register Form

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a Credit Card Budget Worksheet?

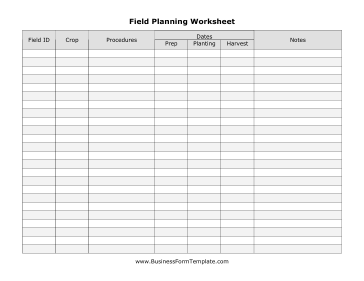

A Credit Card Budget Worksheet is a tool used to track and manage credit card expenses. It typically includes columns for recording: the date of each transaction, a brief description of the purchase, the amount spent, the category of expense, and the payment status (such as pending or cleared). By using a credit card budget worksheet, individuals can monitor their credit card spending, identify any areas where they may be overspending, and stay on top of their financial obligations to avoid debt accumulation.

How can a Credit Card Budget Worksheet help manage finances?

A Credit Card Budget Worksheet can help manage finances by providing a clear overview of income, expenses, and credit card payments. By tracking spending and payments, individuals can stay organized, set goals, and prioritize payments to avoid accruing interest fees and debt. This tool can also highlight areas where spending can be reduced to stay within budget and avoid overspending, ultimately helping to improve financial health and stability.

What are the important components of a Credit Card Budget Worksheet?

The important components of a Credit Card Budget Worksheet include a section for listing all credit card balances and interest rates, a space to record monthly income and expenses, a section for tracking payment due dates and minimum payments, a category for noting any additional payments towards credit card debt, and a section for setting goals and monitoring progress towards paying off the credit card balances.

How can one create a Credit Card Budget Worksheet?

Creating a Credit Card Budget Worksheet involves listing all credit card expenses, including monthly payments, interest rates, due dates, and total credit limits. You can categorize expenses, track spending patterns, compare them with your income, set financial goals, and ensure timely payments to avoid accruing high-interest charges or penalties. Using tools like spreadsheet software or budgeting apps can help simplify the process and provide a clear overview of your credit card finances for effective budgeting and financial management.

What are some common categories to include in a Credit Card Budget Worksheet?

Some common categories to include in a Credit Card Budget Worksheet are: credit card payment amount, payment due date, outstanding balance, interest rate, minimum payment amount, spending categories (such as groceries, dining out, entertainment, shopping), total credit limit, available credit, and any other relevant expenses or financial goals you want to track or allocate funds for.

How often should a Credit Card Budget Worksheet be reviewed and updated?

A Credit Card Budget Worksheet should ideally be reviewed and updated at least once a month. This allows you to keep track of your spending habits, monitor your progress towards financial goals, identify any areas where you may be overspending, and make adjustments accordingly. Regularly reviewing and updating your budget worksheet can help you stay on top of your finances and make informed decisions to improve your financial health.

What are the benefits of using a Credit Card Budget Worksheet?

A Credit Card Budget Worksheet helps you track your spending, manage your finances effectively, stay within your budget limits, and avoid overspending. By using this tool, you can monitor your credit card transactions, categorize your expenses, identify areas where you can cut back, plan for future expenses, and ultimately achieve your financial goals.

How can a Credit Card Budget Worksheet help identify spending patterns?

A Credit Card Budget Worksheet can help identify spending patterns by tracking all transactions made with the credit card. By categorizing and analyzing the data collected on the worksheet, one can see where their money is being spent, how much is being spent in each category, and identify any trends or recurring expenses. This information can provide valuable insights into one's spending habits, allowing them to make informed decisions on where adjustments can be made to better manage their budget and financial goals.

Are there any limitations or challenges to using a Credit Card Budget Worksheet?

Yes, there are limitations and challenges to using a Credit Card Budget Worksheet. Some limitations include inaccuracies due to human error in data entry, oversimplification of financial complexities, and reliance on consistent tracking and updating. Challenges may arise from maintaining discipline to stick to the budget, dealing with unexpected expenses, and adapting the worksheet to changing financial circumstances. Additionally, there may be limitations in addressing varying interest rates, fees, and rewards offered by different credit card companies. It is important to regularly review and adjust the budget worksheet to ensure its effectiveness.

How can a Credit Card Budget Worksheet contribute to overall financial stability?

A Credit Card Budget Worksheet can contribute to overall financial stability by helping individuals track and manage their credit card expenditures. By setting a budget for credit card spending, individuals can avoid overspending, accumulate less debt, and improve their overall financial health. Monitoring expenses, making timely payments, and staying within budget can help individuals avoid high interest charges, build a positive credit history, and ultimately achieve more financial stability.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments