Cash Flow Projection Worksheet

A cash flow projection worksheet is a valuable tool for businesses and individuals alike. It provides a straightforward way to track and plan your cash inflows and outflows, allowing you to gain a clear understanding of your financial situation. With an organized layout and user-friendly design, this worksheet simplifies the process of analyzing and managing your cash flow. Whether you're a small business owner, an entrepreneur, or simply someone looking to gain better control over your personal finances, this worksheet is an essential entity to help you achieve your financial goals.

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

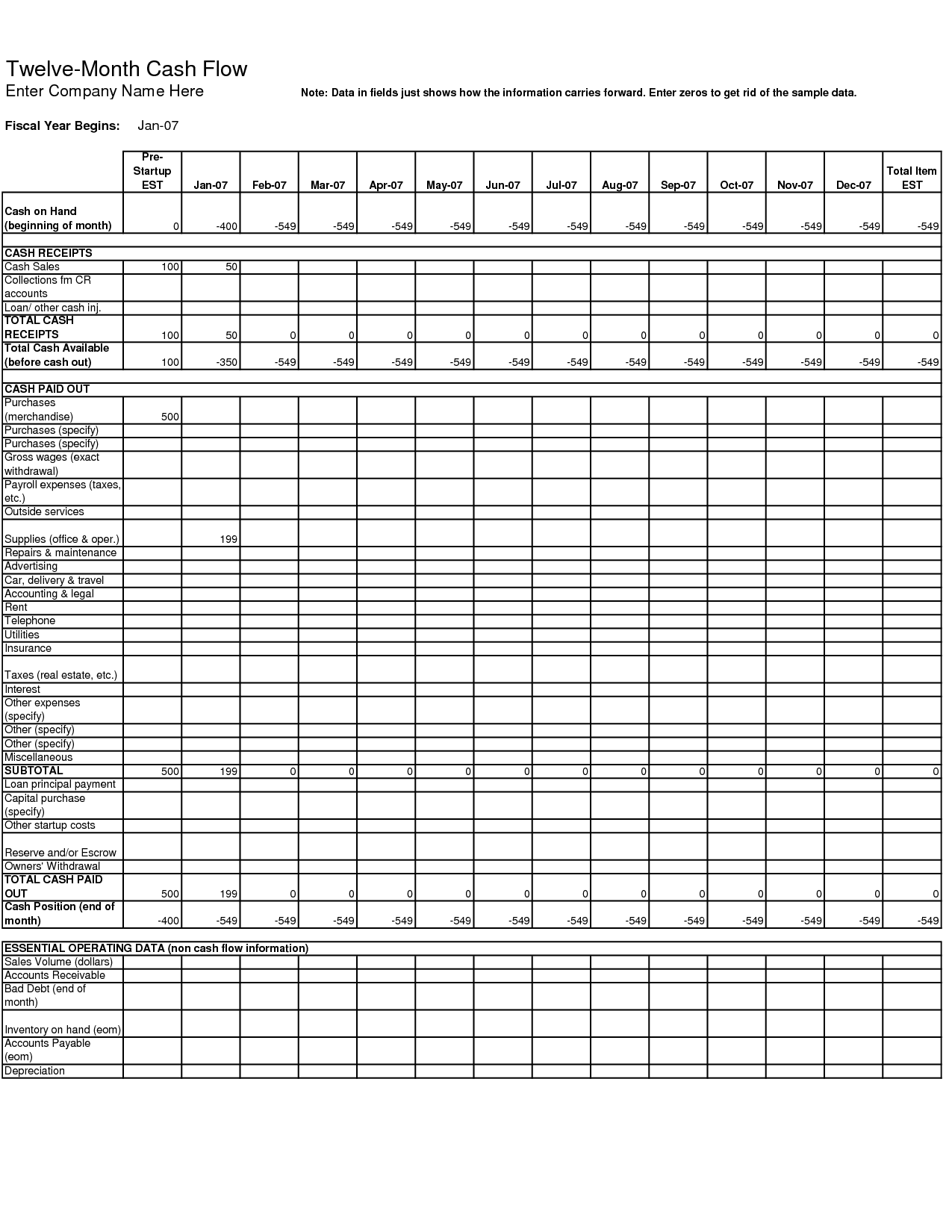

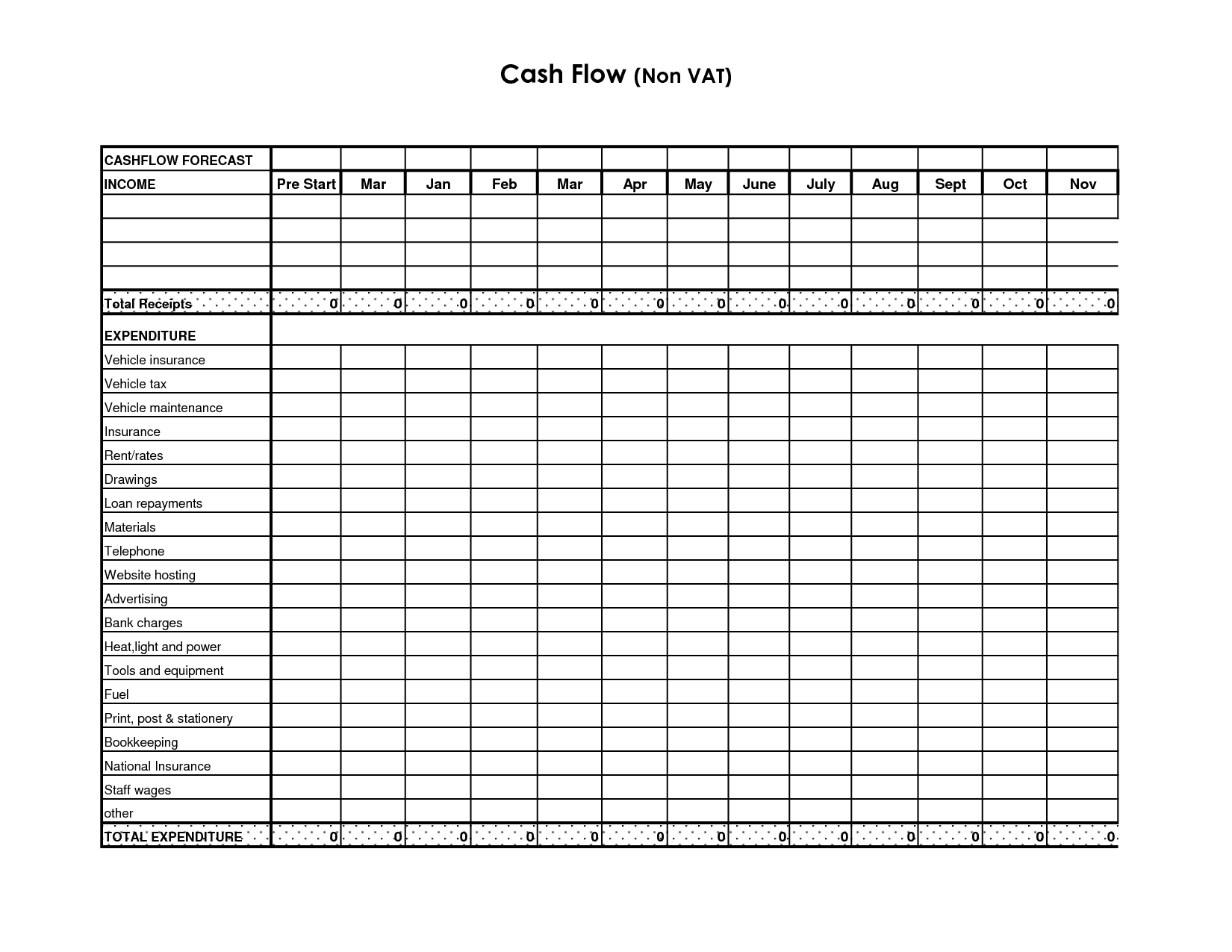

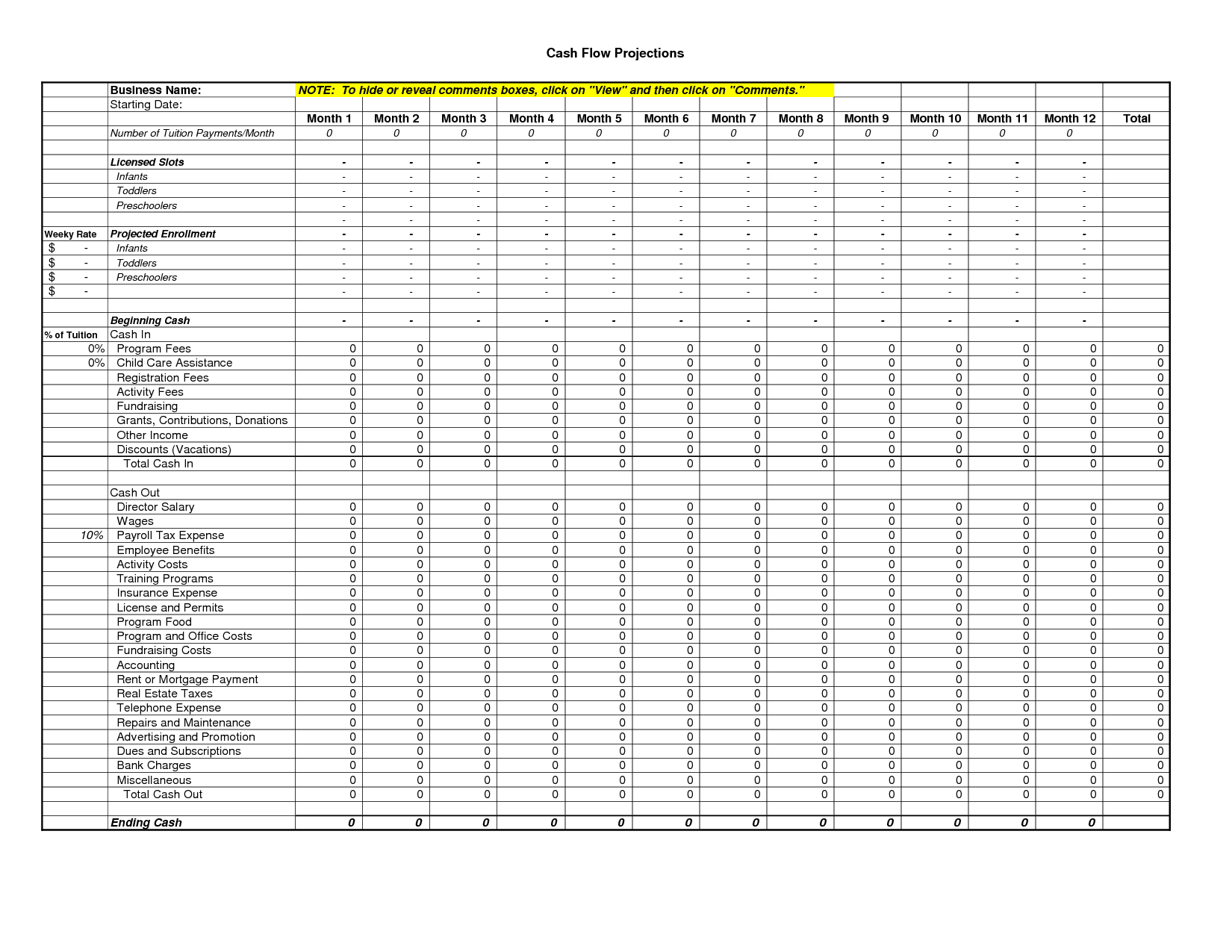

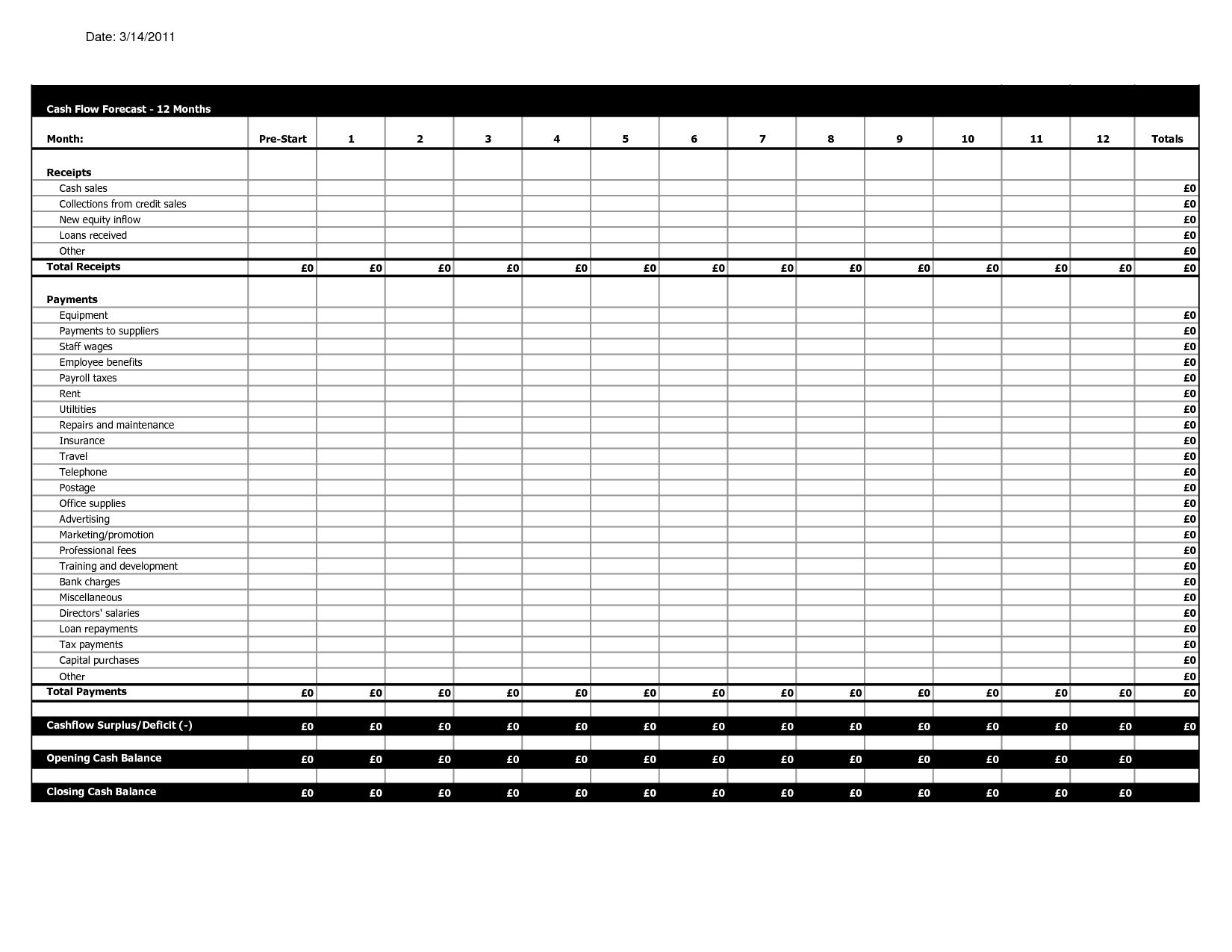

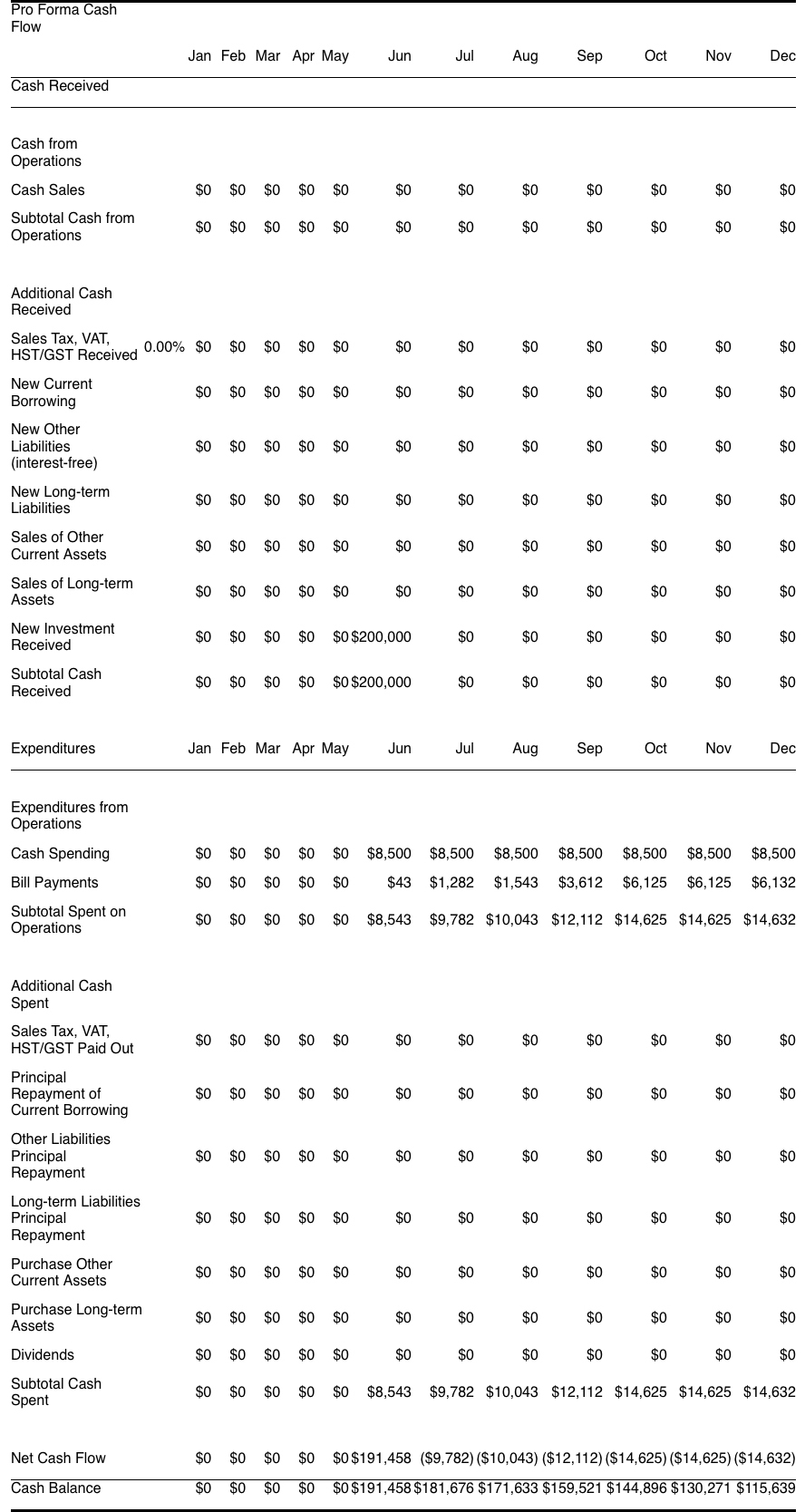

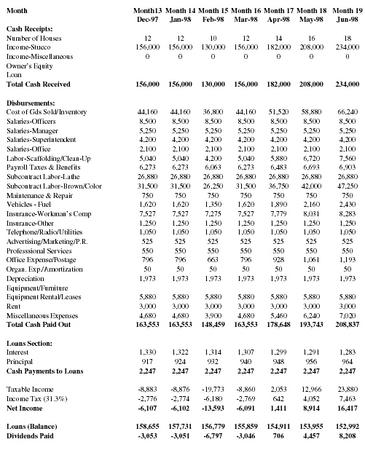

What is a Cash Flow Projection Worksheet?

A Cash Flow Projection Worksheet is a financial tool used to estimate the cash inflows and outflows of a business over a specific period, typically monthly or quarterly. It helps businesses forecast their future cash position by predicting the timing and amount of expected income and expenses. This worksheet is essential for budgeting, planning for future financial needs, and ensuring the business maintains a healthy cash flow to meet its obligations and investment requirements.

How is a Cash Flow Projection Worksheet useful for a business?

A Cash Flow Projection Worksheet is useful for a business as it helps forecast the inflows and outflows of cash over a specific period, enabling better financial planning and decision-making. By estimating future cash balances, a business can anticipate potential cash shortages or surpluses, identify the need for additional financing, plan investments or capital expenditures, and ensure that there is enough liquidity to meet operational requirements. Additionally, it provides insights into the overall financial health of the business and helps in setting realistic financial goals and targets to drive sustainable growth.

What are the key components of a Cash Flow Projection Worksheet?

A Cash Flow Projection Worksheet typically includes key components such as projected cash inflows from sales and other sources, projected cash outflows for expenses and investments, opening cash balance, closing cash balance, net cash flow, and any borrowing or financing activities. Additionally, it may also include a monthly breakdown of these components to provide a detailed forecast of cash flow over a specific period.

How do you accurately estimate cash inflows in a Cash Flow Projection Worksheet?

To accurately estimate cash inflows in a Cash Flow Projection Worksheet, you should start by identifying all sources of income for the period in question, such as sales revenue, investments, loans, or any other cash-generating activities. Forecast these sources based on historical data, market trends, and any upcoming contracts or sales pipelines. Be realistic and conservative in your estimations to account for uncertainties and potential fluctuations. Continuously monitor and update your projections as new information becomes available to ensure accuracy in predicting cash inflows.

What are some common sources of cash inflows in a business?

Some common sources of cash inflows in a business include revenue from sales of goods or services, loans or investments from owners or investors, proceeds from asset sales or investments, and refunds or rebates. Other sources can include royalties, licensing fees, rental income, and government grants.

How do you estimate cash outflows in a Cash Flow Projection Worksheet?

To estimate cash outflows in a Cash Flow Projection Worksheet, you should list all anticipated expenses that your business will incur during a specific period. This includes costs such as rent, utilities, salaries, inventory purchases, loan repayments, taxes, and other operational expenses. By projecting these expenses based on historical data, industry trends, and future plans, you can calculate your total cash outflows and gain insights into your business's financial health. It's essential to be realistic and detailed when estimating cash outflows to ensure accuracy in your cash flow projections.

What are some common categories for cash outflows in a business?

Some common categories for cash outflows in a business include operating expenses (such as rent, utilities, and salaries), inventory purchases, equipment and asset purchases, loan payments, taxes, interest payments, dividends, and other investments in the company. Tracking and managing these cash outflows is crucial for maintaining a healthy financial position for the business.

How can a Cash Flow Projection Worksheet help with financial planning and decision-making?

A Cash Flow Projection Worksheet helps with financial planning and decision-making by providing a forecast of incoming and outgoing cash over a specific period. This tool allows businesses to anticipate cash shortages or surpluses, identify potential funding needs, and make informed decisions on spending, saving, and investing. By using the data from the projection, businesses can adjust their strategies, improve cash management, and ensure financial stability and growth in the long term.

What are the potential challenges or limitations of using a Cash Flow Projection Worksheet?

Some potential challenges or limitations of using a Cash Flow Projection Worksheet include uncertainty in predicting future cash flows accurately, changing market conditions impacting projected numbers, assumptions not aligning with reality, overlooking unexpected expenses or revenue changes, and difficulties in adjusting projections in real-time as circumstances shift. Additionally, reliance solely on a single tool like a Cash Flow Projection Worksheet may lead to a false sense of security or neglect of other important financial factors that could impact cash flow.

What are some best practices for creating and using a Cash Flow Projection Worksheet?

Some best practices for creating and using a Cash Flow Projection Worksheet include regularly updating it with actual data to compare projections with real numbers, including detailed categories for income and expenses, capturing both fixed and variable costs to ensure accuracy, considering various scenarios to anticipate potential cash flow fluctuations, reviewing and adjusting the projection frequently to stay on top of financial health, and using historical data as a reference point to make informed projections.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments