Car Expenses Worksheet

Managing your car expenses can be a challenging task, especially when it comes to keeping track of all the details. If you're seeking an efficient way to organize and monitor your car expenses, look no further than a car expenses worksheet. This tool is designed to help individuals and families keep a record of their vehicle-related costs, making it ideal for anyone who wants to gain a better understanding of their car expenses and take control of their budget.

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a Car Expenses Worksheet?

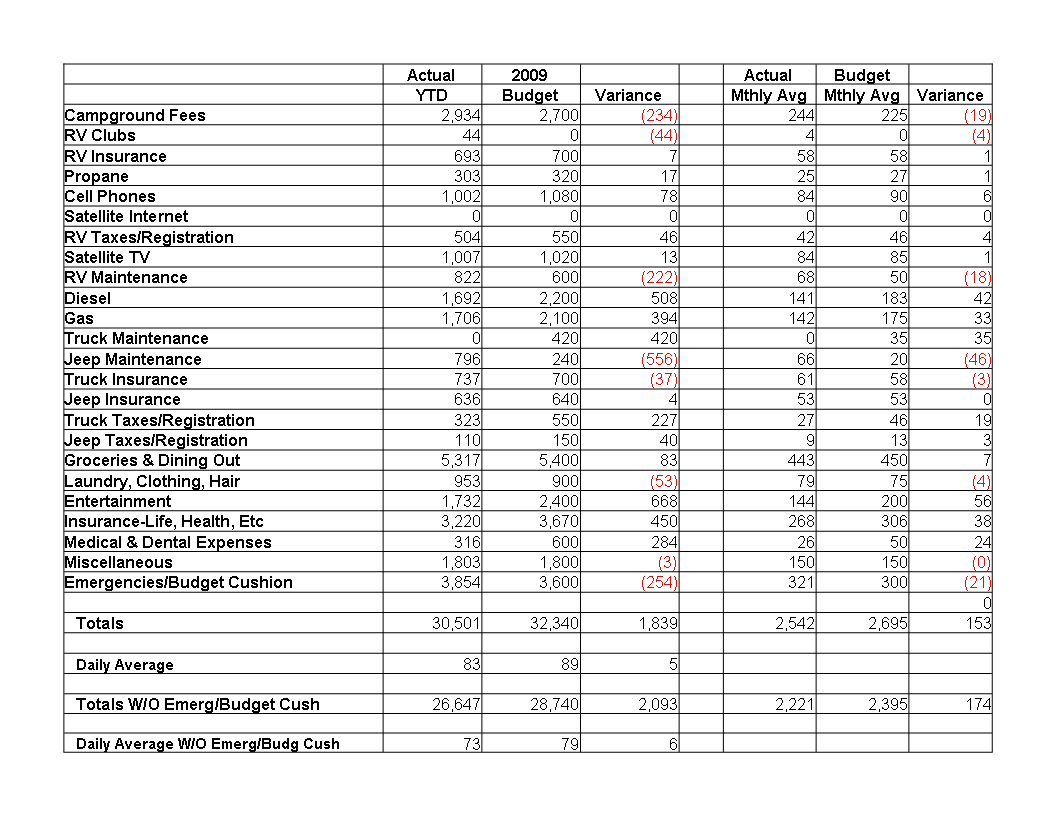

A Car Expenses Worksheet is a document used to track and organize all expenses related to owning and operating a car. This may include costs such as gasoline, maintenance and repairs, insurance, registration fees, and any other expenses associated with owning a vehicle. By keeping a detailed record with a Car Expenses Worksheet, individuals can better manage their car-related finances and make informed decisions on how to reduce costs or budget more effectively.

What is the purpose of a Car Expenses Worksheet?

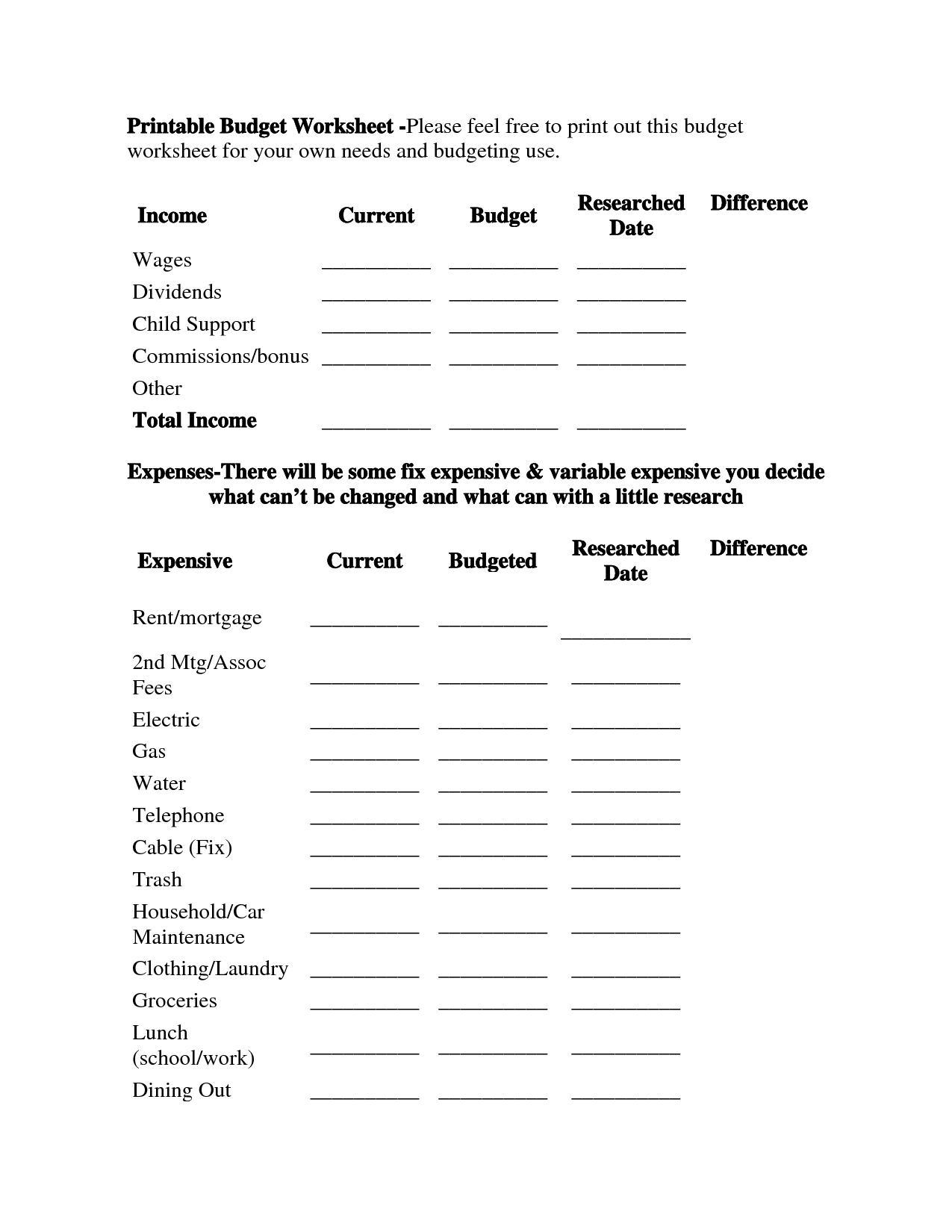

The purpose of a Car Expenses Worksheet is to track and monitor all expenses related to owning and maintaining a vehicle. This includes costs such as fuel, maintenance, repairs, insurance, registration fees, and depreciation. By keeping track of these expenses in an organized manner, individuals can better manage their budget, identify areas where they can potentially save money, and have a clear picture of the overall cost of owning a vehicle.

What information should be included in a Car Expenses Worksheet?

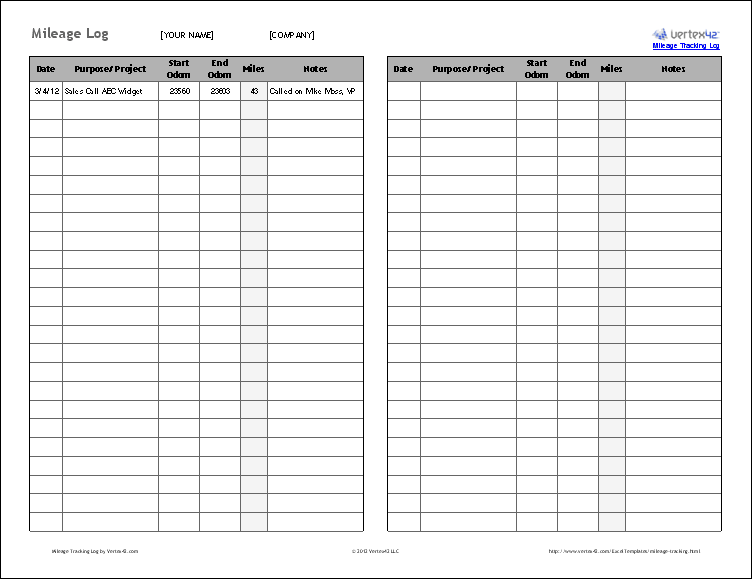

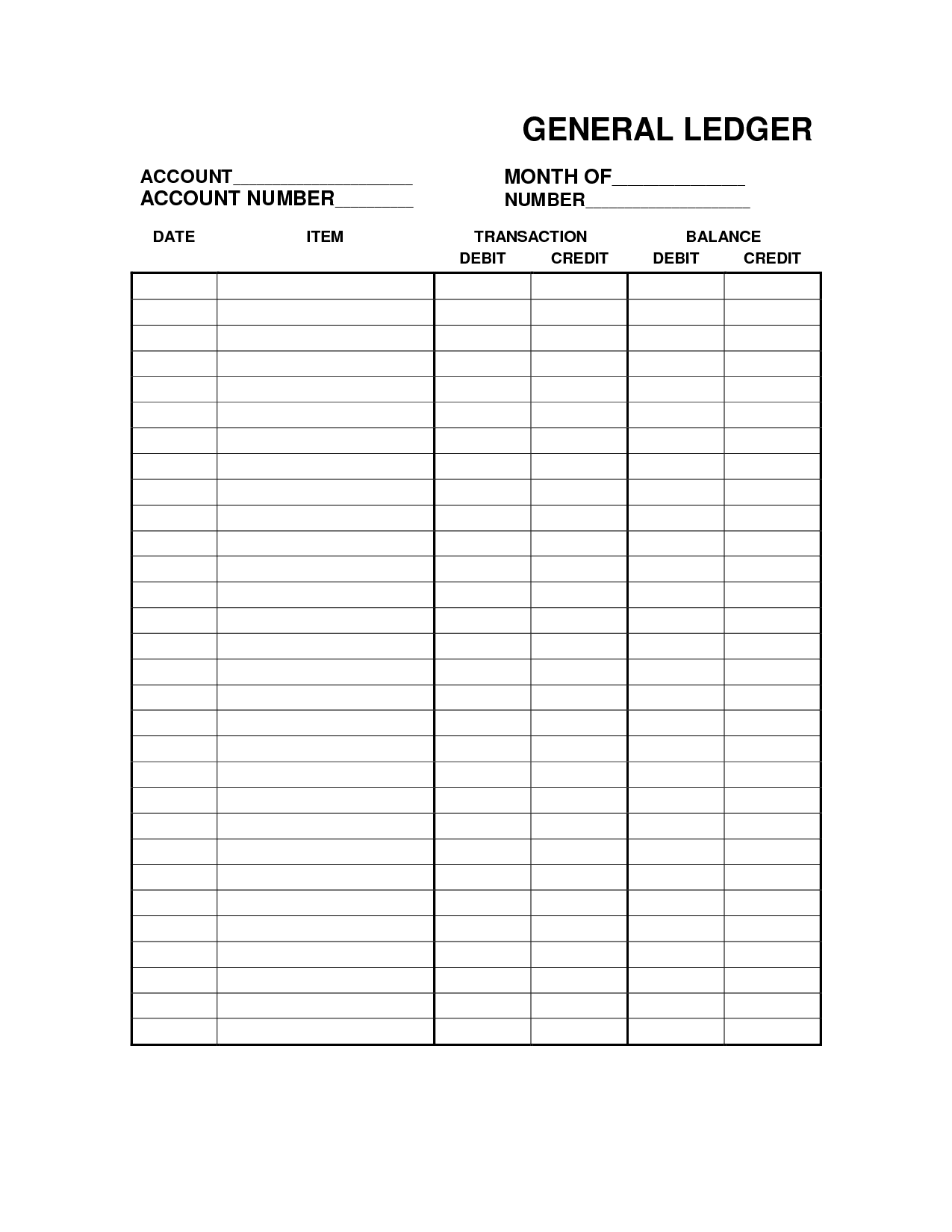

A car expenses worksheet should include detailed information such as date of expense, description of expense (e.g., fuel, maintenance, repairs), amount spent, odometer reading at the time of expense, vendor or service provider, and any additional notes or comments. Keeping track of these details will help provide a clear overview of car expenses, track spending, and maintain a record for budgeting and tax purposes.

How often should a Car Expenses Worksheet be completed?

A Car Expenses Worksheet should ideally be completed on a monthly basis to accurately track and monitor the expenses related to your vehicle. This frequency allows for better budgeting, identifying trends in spending, and making informed decisions to effectively manage your car-related costs.

What types of expenses can be listed in a Car Expenses Worksheet?

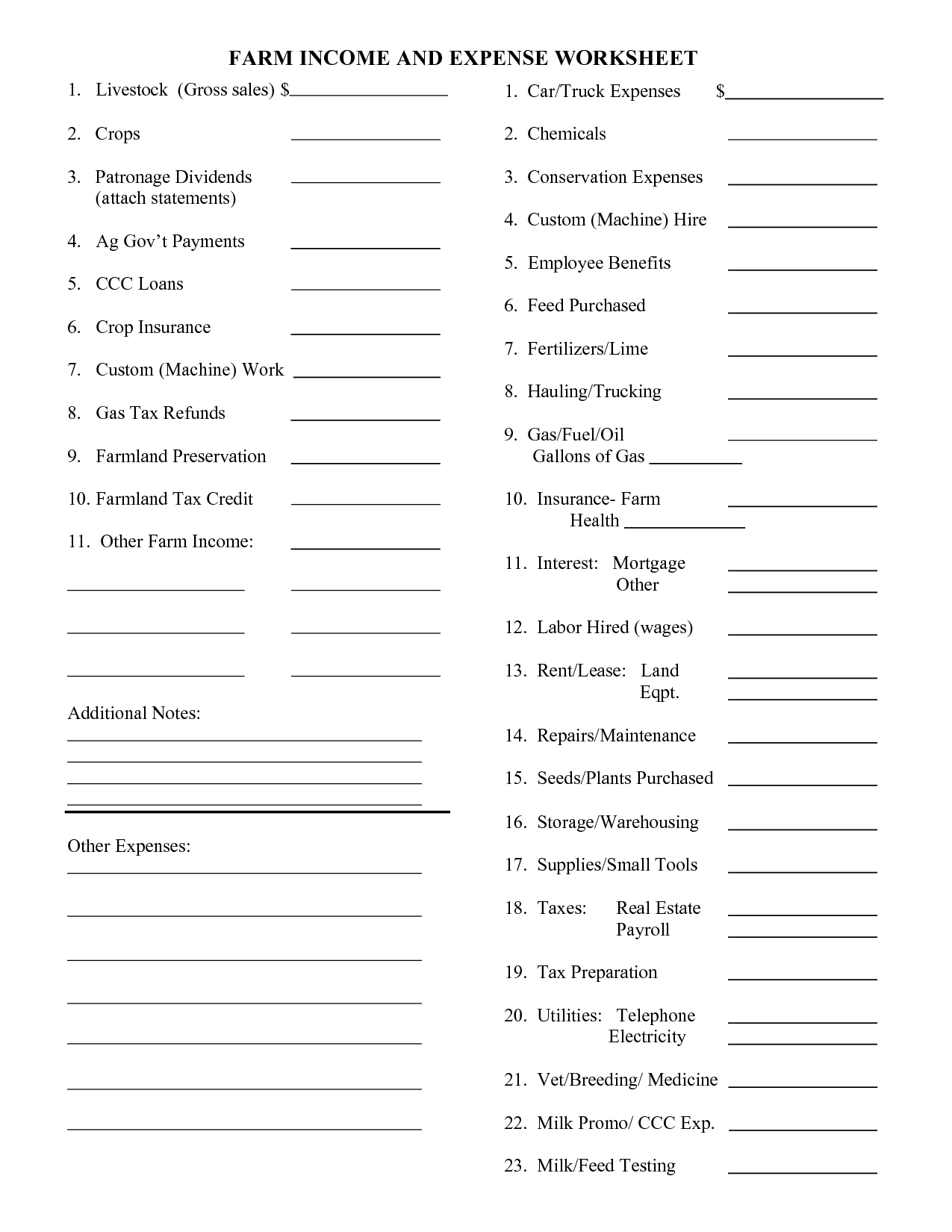

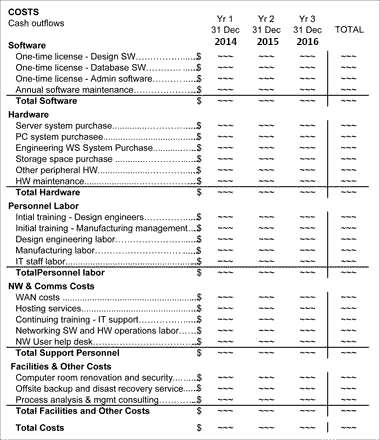

Expenses that can be listed in a Car Expenses Worksheet typically include costs related to fuel, maintenance and repairs, insurance, registration fees, loan or lease payments, depreciation, parking fees, and tolls. Other expenses may include car washes, annual inspections, road assistance services, and any other costs directly related to owning or operating a vehicle.

How can a Car Expenses Worksheet help with budgeting?

A Car Expenses Worksheet can help with budgeting by allowing individuals to track and categorize all car-related expenses, such as fuel, maintenance, insurance, and registration fees. By keeping a detailed record of these expenses, individuals can accurately assess how much they are spending on their car each month and identify potential areas for cost-saving measures. This worksheet can provide valuable insights into one's spending habits, enabling them to create a more realistic and effective budget for their car-related expenses.

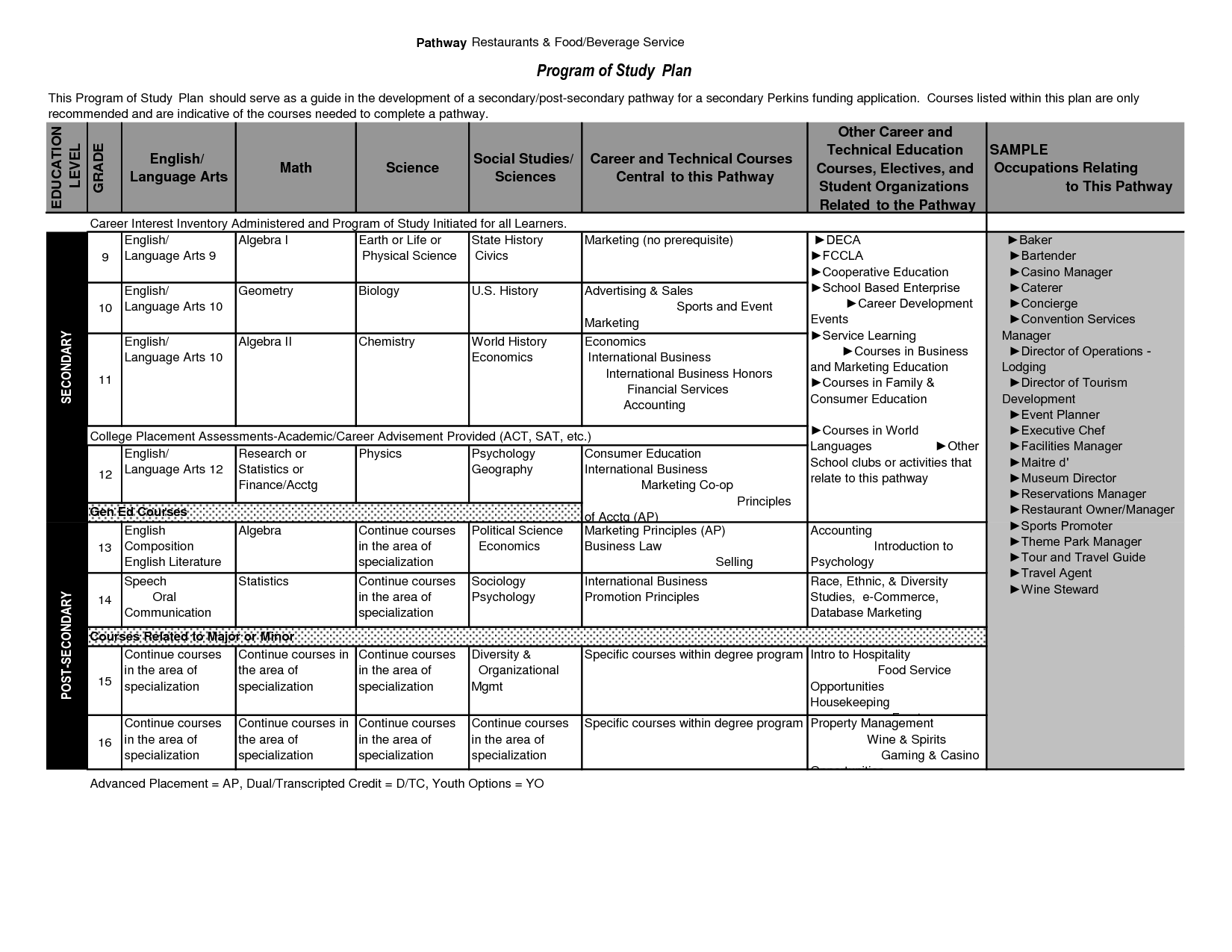

Are there any specific categories that should be used in a Car Expenses Worksheet?

Yes, there are several common categories that can be used in a Car Expenses Worksheet. These may include categories such as fuel, maintenance and repairs, insurance, registration and licensing fees, loan or lease payments, depreciation, parking and tolls, and any additional accessories or upgrades. You can customize the categories based on your individual needs and expenses to track all car-related costs accurately.

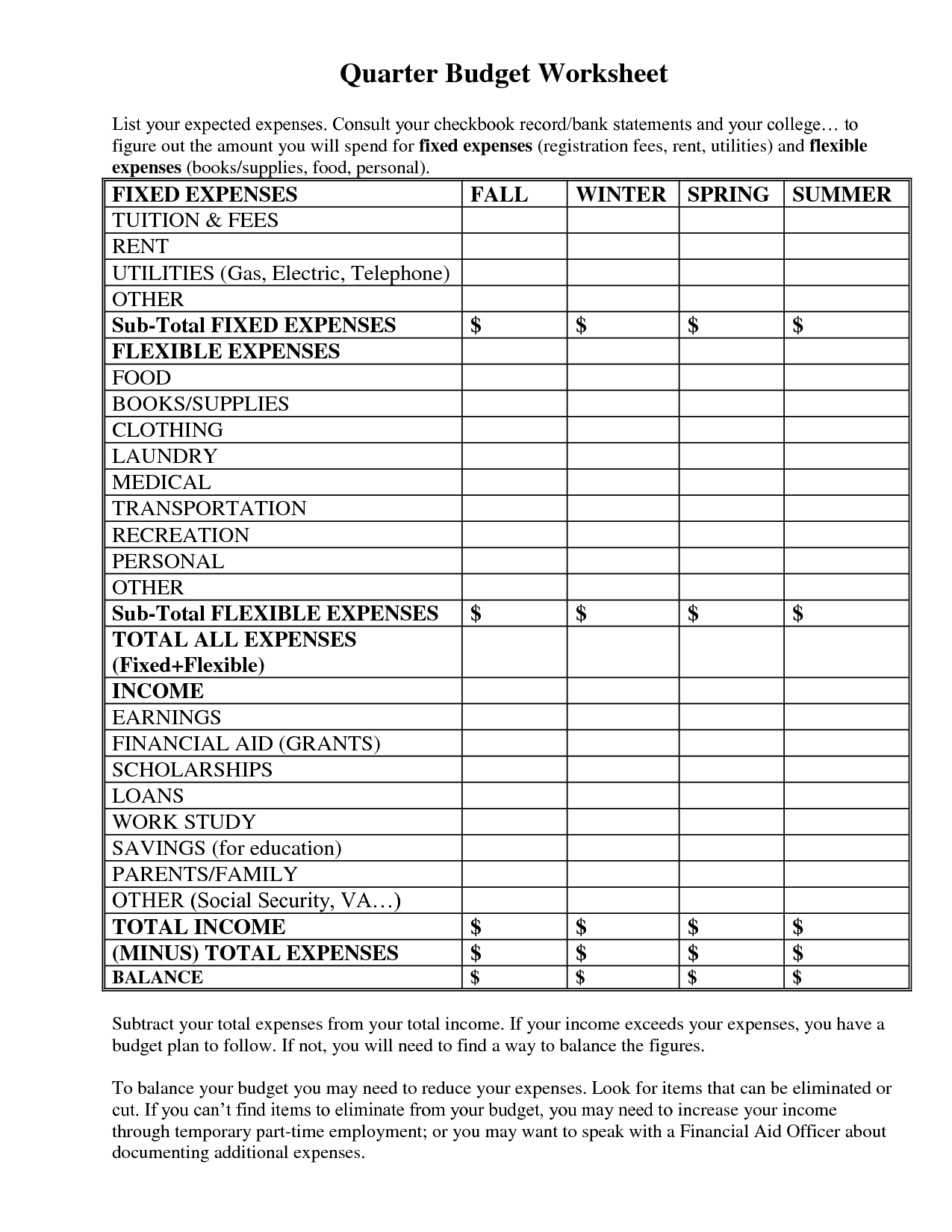

Should a Car Expenses Worksheet include both fixed and variable expenses?

Yes, a Car Expenses Worksheet should include both fixed and variable expenses. Fixed expenses are regular, ongoing costs like loan payments, insurance, and registration fees, while variable expenses are more unpredictable costs like maintenance, repairs, and fuel. Including both types of expenses allows for a comprehensive overview of all costs associated with owning and operating a car.

Can a Car Expenses Worksheet be used for multiple vehicles?

No, a Car Expenses Worksheet is typically designed to track expenses for a single vehicle. If you need to track expenses for multiple vehicles, it would be more efficient to create separate worksheets for each vehicle to ensure accurate records and organization.

How can a Car Expenses Worksheet be used for tax purposes?

A Car Expenses Worksheet can be used for tax purposes by tracking and documenting all car-related expenses, such as fuel, maintenance, insurance, and registration fees. This information can be used to calculate the deductible portion of these expenses for business use of the vehicle, which can help reduce taxes owed. It is important to keep detailed records and receipts to support any deductions claimed on a tax return.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments