Writing Checks Worksheets

Worksheets are a valuable tool for individuals who want to learn more about writing checks and managing their finances. Whether you're a student studying personal finance or an adult looking to improve your money management skills, worksheets provide a structured format to practice writing checks and understand the fundamentals of financial transactions.

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a writing checks worksheet?

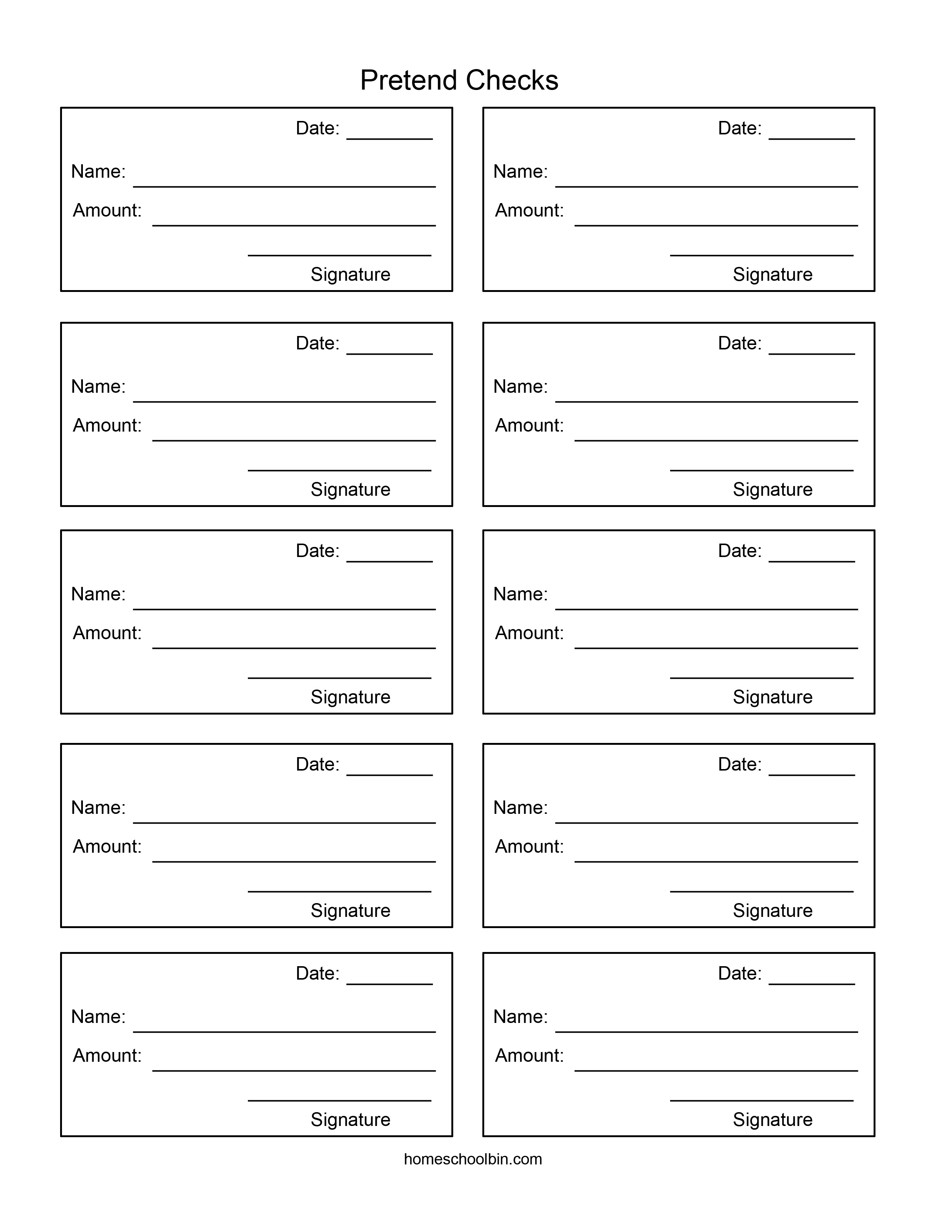

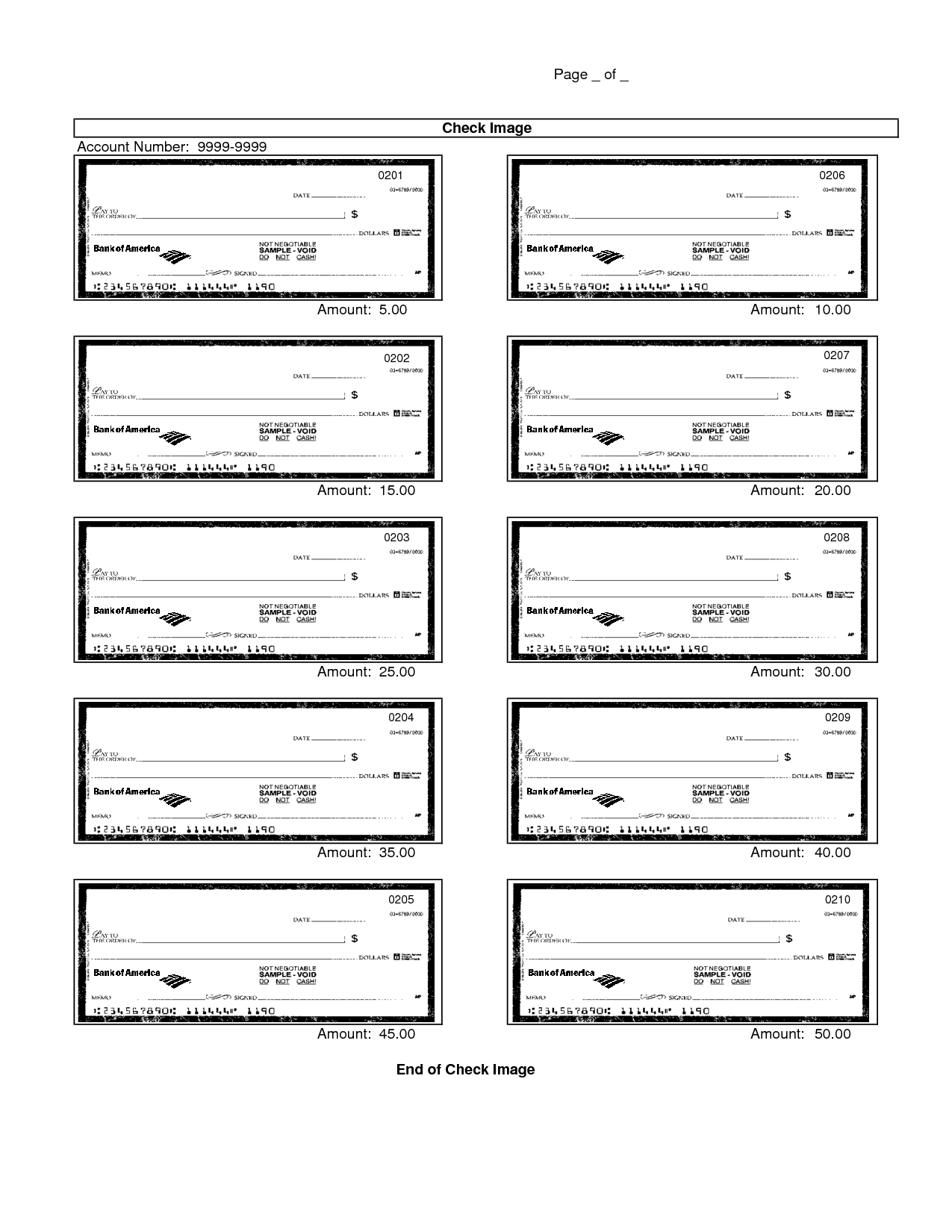

A writing checks worksheet is a tool used to practice and improve one's ability to write checks accurately. It typically includes simulations of check transactions that require the individual to fill out the necessary fields on a check, such as payee name, date, amount in words and numbers, memo, and signature. This helps in developing proficiency in writing checks correctly and understanding the importance of accurately managing personal finances.

How is a writing checks worksheet used?

A writing checks worksheet is used to practice and reinforce the skills needed to accurately write and record checks. It typically includes space to fill out the date, payee, numerical and written amounts, memo, and signature. By completing this worksheet, individuals can improve their understanding of the check-writing process, ensure accuracy in recording financial transactions, and enhance their overall financial literacy.

What information is typically included on a writing checks worksheet?

A writing checks worksheet typically includes spaces for the name of the payee, the amount of the check in both numeric and written form, the date, the check number, the purpose of the payment, and a space for a signature. It may also include a running balance of the checkbook to help monitor transactions and maintain accurate financial records.

Why is a writing checks worksheet important for personal financial management?

A writing checks worksheet is important for personal financial management because it helps individuals track their spending, keep a record of payments made, and maintain a balanced checkbook. By using the worksheet, individuals can monitor their transactions, avoid overspending, and ensure that they do not exceed their budget or available funds. This tool provides better organization and visibility into one's financial activities, promoting responsible financial habits and effective money management.

How can a writing checks worksheet help prevent overdrawn accounts?

A writing checks worksheet can help prevent overdrawn accounts by providing a structured way for individuals to track and plan their spending before writing checks. By recording the date, payee, purpose, and amount for each transaction on the worksheet, individuals can have a clear overview of their current balance and upcoming expenses, helping them avoid writing checks for amounts exceeding their available funds and potentially causing an overdraft. This proactive approach to managing finances can help individuals stay organized, make informed decisions, and avoid costly overdraft fees.

What calculations or balances are typically tracked on a writing checks worksheet?

A writing checks worksheet typically tracks the date a check was written, the payee's name, the check number, the purpose or description of payment, the amount of the check, the account from which the funds are being withdrawn, and the current balance in that account after the transaction.

How does a writing checks worksheet help with record-keeping?

A writing checks worksheet helps with record-keeping by providing a structured template for documenting each check written, including details such as the date, payee, purpose of payment, and the amount. This organized method allows individuals to accurately track their spending, monitor their account balances, and reconcile their bank statements effectively, thereby aiding in financial management and budgeting.

What are some common categories or sections found on a writing checks worksheet?

Common categories or sections found on a writing checks worksheet include the date, payee or recipient's name, amount in numerical and written form, memo line for additional information, and signature line for the account holder to authorize the transaction. Additionally, some worksheets may have sections for account number, check number, and record of the transaction for tracking and budgeting purposes.

How can a writing checks worksheet help with budgeting and expense tracking?

A writing checks worksheet can help with budgeting and expense tracking by providing a visual record of all transactions made through check payments. By recording details such as the payee, amount, and purpose of the check, individuals can better track where their money is going and identify any patterns or areas where they may be overspending. This worksheet can also serve as a tool for reconciling bank statements, ensuring that all expenses are accounted for and helping to maintain an accurate budget.

Are there any potential drawbacks or limitations to using a writing checks worksheet?

One potential drawback of using a writing checks worksheet is that it may not accurately reflect real-life scenarios since writing checks has become less common with the rise of electronic payments. Additionally, worksheets may not account for various factors such as fees associated with bounced checks, which could provide a misleading understanding of the actual cost of writing a check. It is important to use such worksheets as a learning tool and supplement them with real-world examples and experiences to gain a comprehensive understanding of managing finances.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments