Tax Preparation Worksheet

Are you in need of a helpful tool to simplify your tax preparation process? Look no further than the Tax Preparation Worksheet. This comprehensive worksheet is designed to assist individuals or small business owners in organizing their financial information and ensuring accuracy when filing taxes. Whether you are an individual taxpayer or a business owner, this worksheet provides a clear layout for documenting income, expenses, deductions, and credits, making tax season a stress-free experience.

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a tax preparation worksheet?

A tax preparation worksheet is a document that helps individuals organize their financial information and calculate their taxes. It typically includes sections for income, deductions, credits, and other relevant tax-related information needed to complete a tax return accurately. Tax preparation worksheets are commonly used by individuals to gather and summarize their tax-related data before they file their tax returns with the relevant tax authorities.

How does a tax preparation worksheet help with tax preparation?

A tax preparation worksheet serves as a helpful tool to organize and document all necessary information and figures needed for tax preparation. It prompts taxpayers to gather and input details such as income sources, deductions, credits, and expenses in an organized manner. By using a tax preparation worksheet, individuals can ensure they have all the relevant information on hand when completing their tax return, which can help in accurately calculating their tax liability and potentially identifying any tax-saving opportunities.

What information is typically included in a tax preparation worksheet?

A tax preparation worksheet typically includes personal information such as name, Social Security number, and address, as well as income details like W-2 forms, 1099 forms, and any other sources of income. It will also include deductions such as mortgage interest, property taxes, medical expenses, and charitable contributions, which can help reduce taxable income. Additionally, the worksheet may outline tax credits for things like education expenses or adopting a child. Overall, the worksheet is designed to gather all necessary information needed to accurately prepare and file an individual's tax return.

How can a tax preparation worksheet help in organizing financial documents?

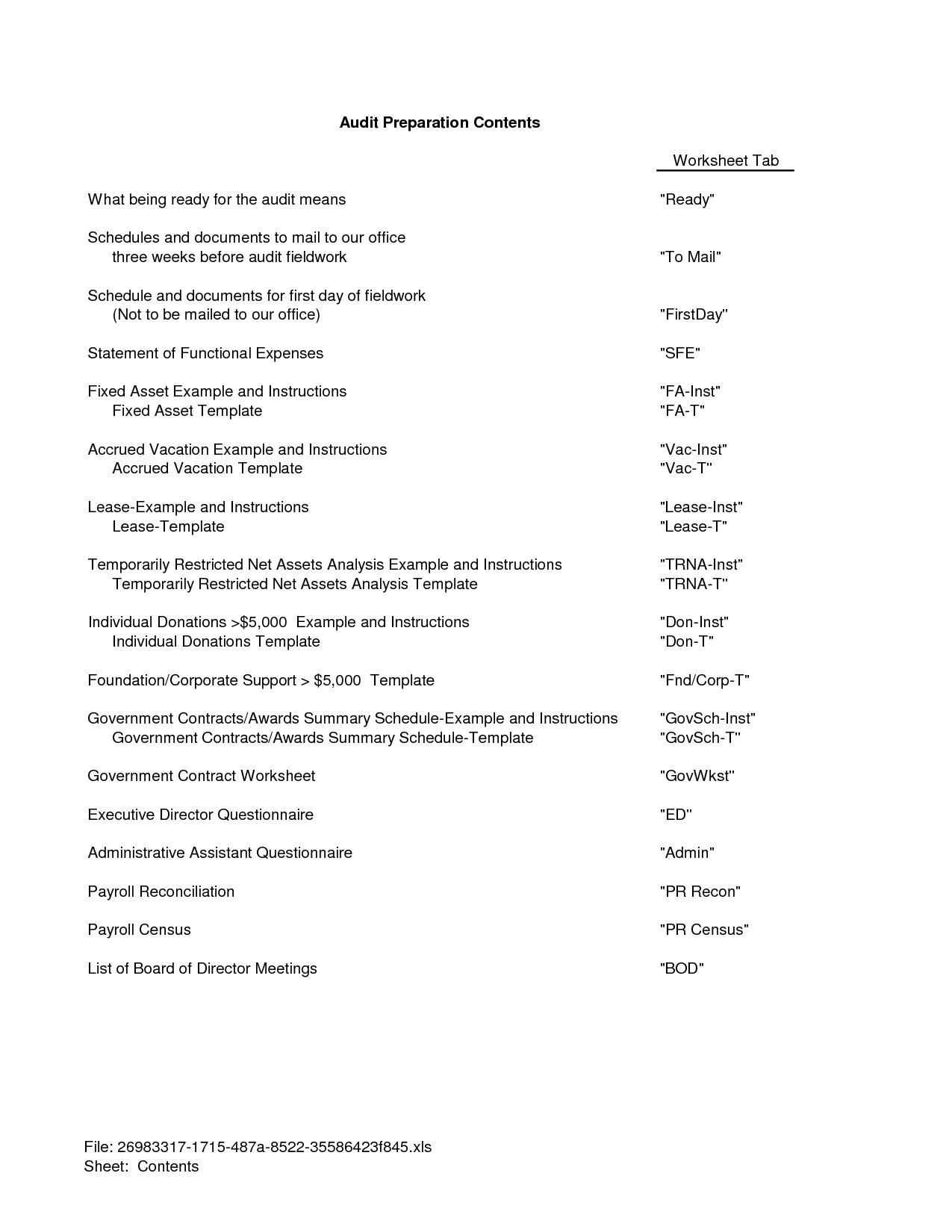

A tax preparation worksheet can help in organizing financial documents by providing a structured template to list all necessary information such as income sources, expenses, deductions, and credits. It serves as a guide to ensure that all relevant documents are gathered and information is accurately recorded, making the tax filing process more systematic and efficient. By using a tax preparation worksheet, individuals can easily keep track of their financial details and ensure that they are well-prepared for meeting tax obligations.

What are the benefits of using a tax preparation worksheet?

A tax preparation worksheet can help organize and track all necessary tax-related information, such as income, deductions, and credits, making the tax filing process more efficient and accurate. It can also serve as a reference when working with a tax professional or software, ensuring that all relevant information is considered and accounted for, potentially increasing tax savings and reducing the risk of errors or audits.

Can a tax preparation worksheet assist in identifying potential tax deductions or credits?

Yes, a tax preparation worksheet can assist in identifying potential tax deductions or credits by prompting the taxpayer to provide detailed information about their income, expenses, and financial transactions, which can help tax professionals or software accurately determine eligibility for various deductions and credits available under the tax laws.

How does a tax preparation worksheet facilitate the calculation of taxable income?

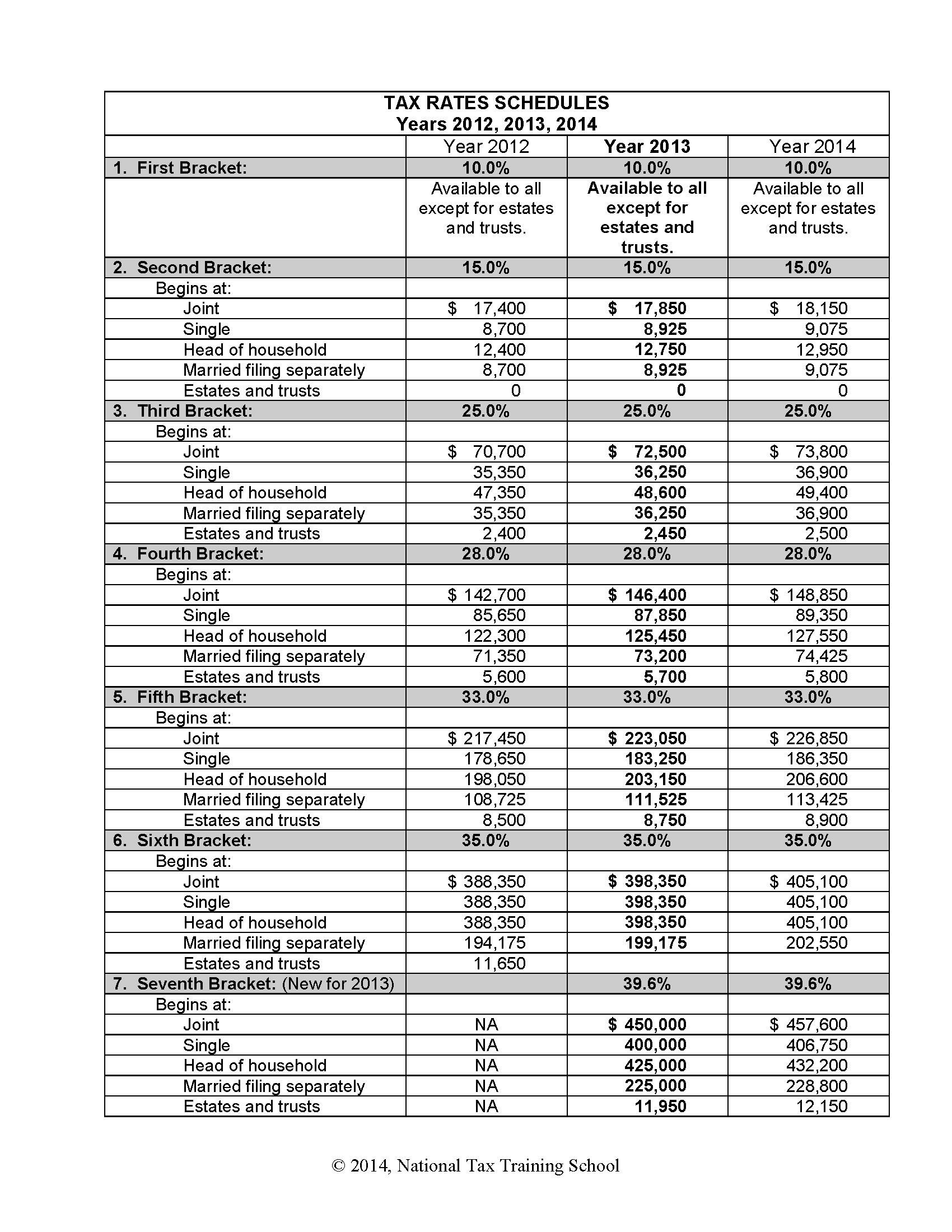

A tax preparation worksheet helps in calculating taxable income by organizing and summing up all sources of income, deductions, and credits. By listing each income stream separately and deducting allowable expenses and credits, the worksheet provides a clear picture of the taxpayer's overall financial situation. This organization makes it easier to identify taxable income, apply the relevant tax rates, and accurately calculate the final tax liability.

Can a tax preparation worksheet be used for multiple tax years?

No, a tax preparation worksheet should not be used for multiple tax years because tax laws and regulations can change from year to year, which could result in inaccurate calculations if the same worksheet is used for different tax years. It is recommended to create a new tax preparation worksheet each year to ensure accurate and updated information for that specific tax year.

How can a tax preparation worksheet help in ensuring accuracy when filing taxes?

A tax preparation worksheet can help ensure accuracy when filing taxes by providing a systematic way to gather all necessary financial information, such as income, deductions, and credits. By organizing and categorizing this information, individuals can easily spot any missing or inaccurate data, reducing the likelihood of errors in their tax return. Additionally, using a tax preparation worksheet can help individuals take advantage of all available tax deductions and credits, ultimately ensuring they pay the correct amount of taxes owed.

Is a tax preparation worksheet necessary, or can it be substituted by other methods?

A tax preparation worksheet is not strictly necessary, as there are other methods available for organizing and calculating your tax information. You can use accounting software, online tax preparation tools, or simply organize your documents in a file or folder. However, a tax preparation worksheet can be helpful in ensuring you have all the necessary information in one place and may make the process of filling out your tax return easier and more organized. Ultimately, the method you choose depends on your personal preference and how comfortable you are with organizing your tax information.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments