Tax Preparation Organizer Worksheet

Tax season can be a stressful time for many individuals and businesses. Keeping track of all the necessary documents and information can feel overwhelming. That's where a tax preparation organizer worksheet comes in. This tool is designed to help you gather and organize all the necessary details for filing your taxes accurately and efficiently. Whether you're an independent contractor, a small business owner, or an individual with complex tax situations, having a dedicated worksheet can make the process much smoother.

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is the purpose of a Tax Preparation Organizer Worksheet?

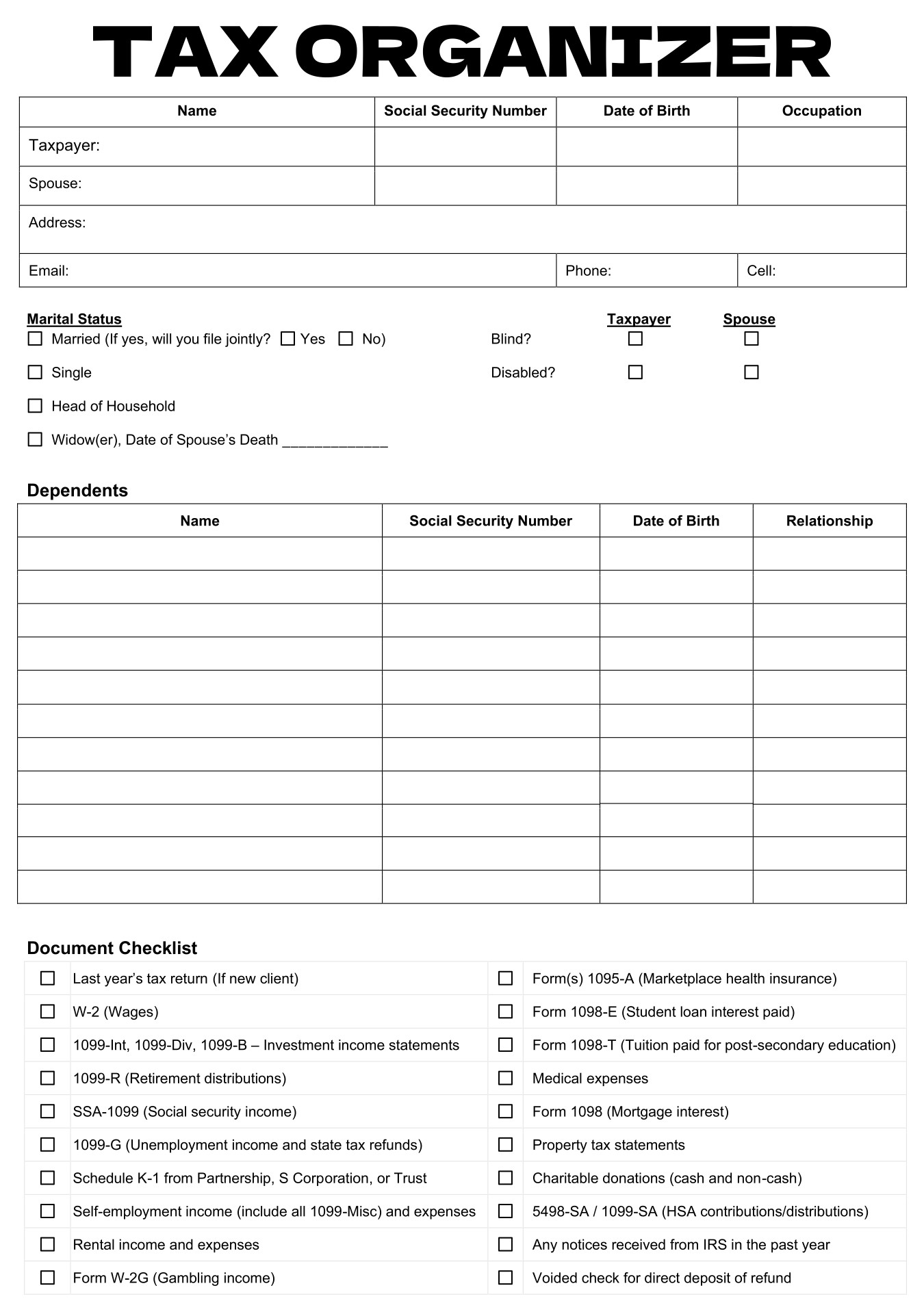

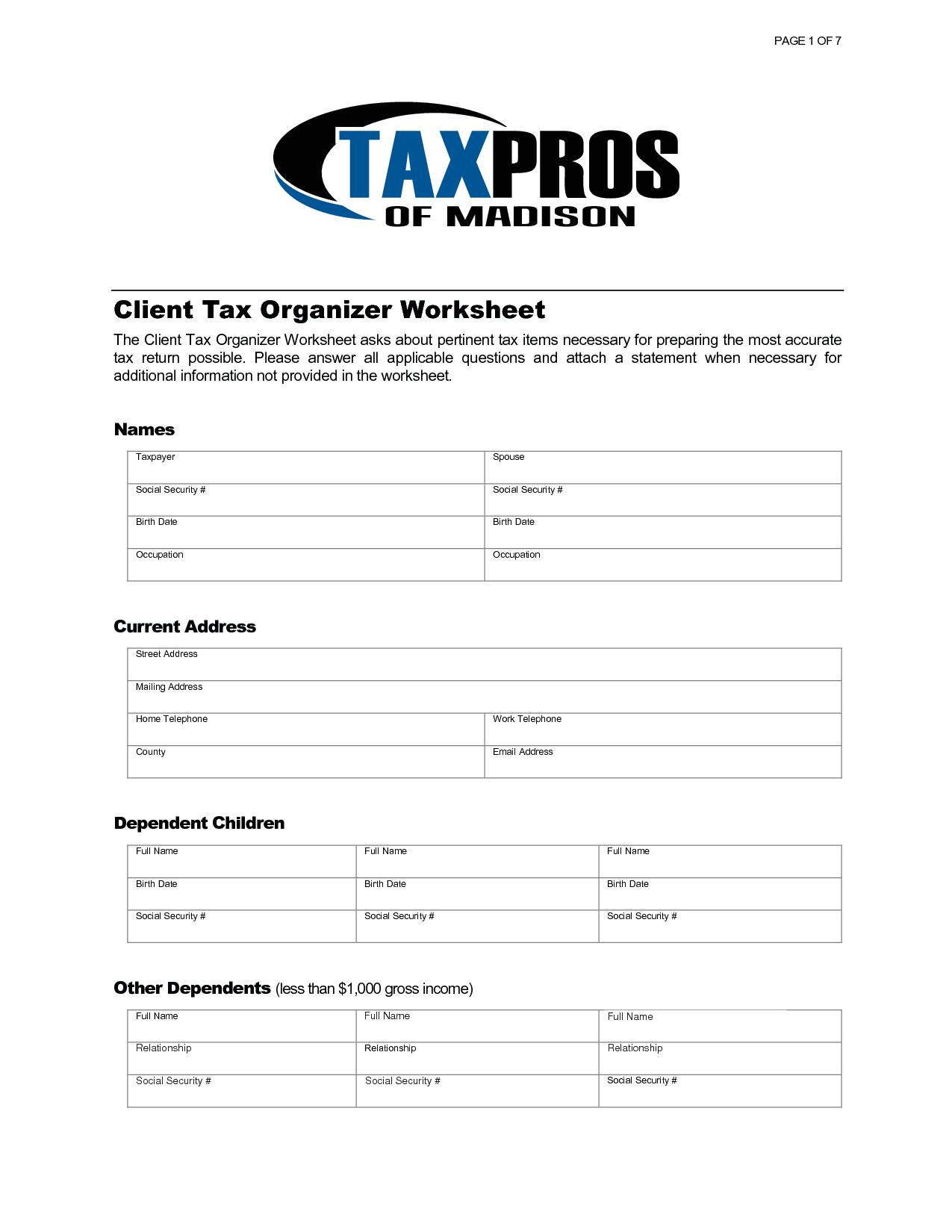

The purpose of a Tax Preparation Organizer Worksheet is to help individuals gather and organize the necessary information needed for completing their tax returns accurately and efficiently. It serves as a guide to ensure that all relevant financial documents, such as income statements, expenses, deductions, and other necessary information, are readily available when preparing to file taxes. By using this worksheet, individuals can streamline the tax preparation process and minimize the chances of overlooking important details that could impact their tax liability.

How can a Tax Preparation Organizer Worksheet help with gathering necessary documents for tax filing?

A Tax Preparation Organizer Worksheet can help streamline the process of gathering necessary documents for tax filing by providing a comprehensive list of the types of documents needed, such as W-2s, 1099s, receipts, and expenses. It helps individuals stay organized and ensures they don't miss any important information when preparing their taxes, saving time and reducing the likelihood of errors. By following the worksheet, individuals can gather all the required documents in one place, making tax filing more efficient and less stressful.

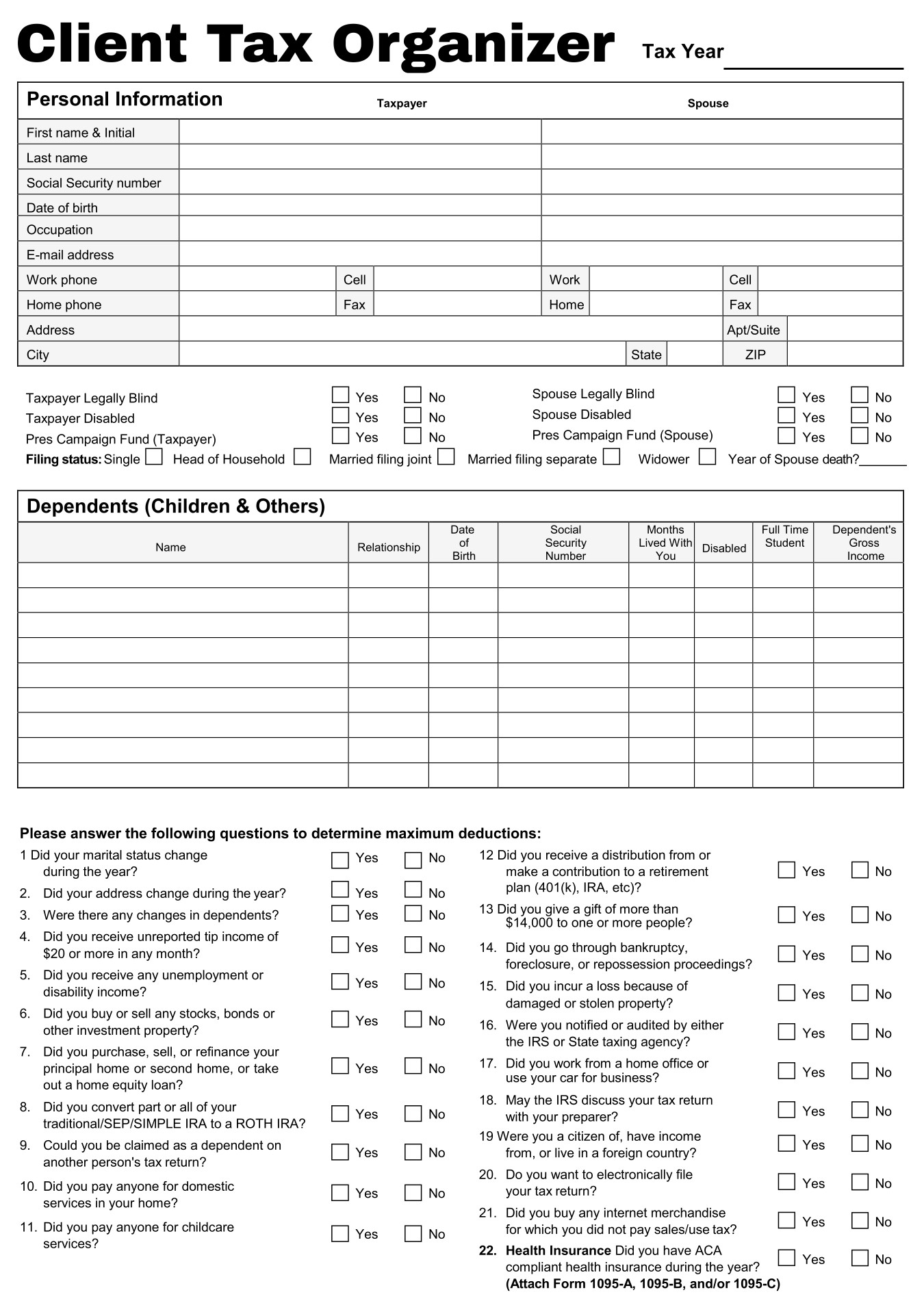

What type of information should be included on a Tax Preparation Organizer Worksheet?

A Tax Preparation Organizer Worksheet should include personal information such as name, address, social security number, and contact information. It should also include details of income sources like W-2s, 1099s, and other income documentation, as well as deductions and credits like expenses, donations, and tax payments. Additionally, information on dependents, retirement accounts, and property ownership should be included.

How can a Tax Preparation Organizer Worksheet assist with organizing income-related documents?

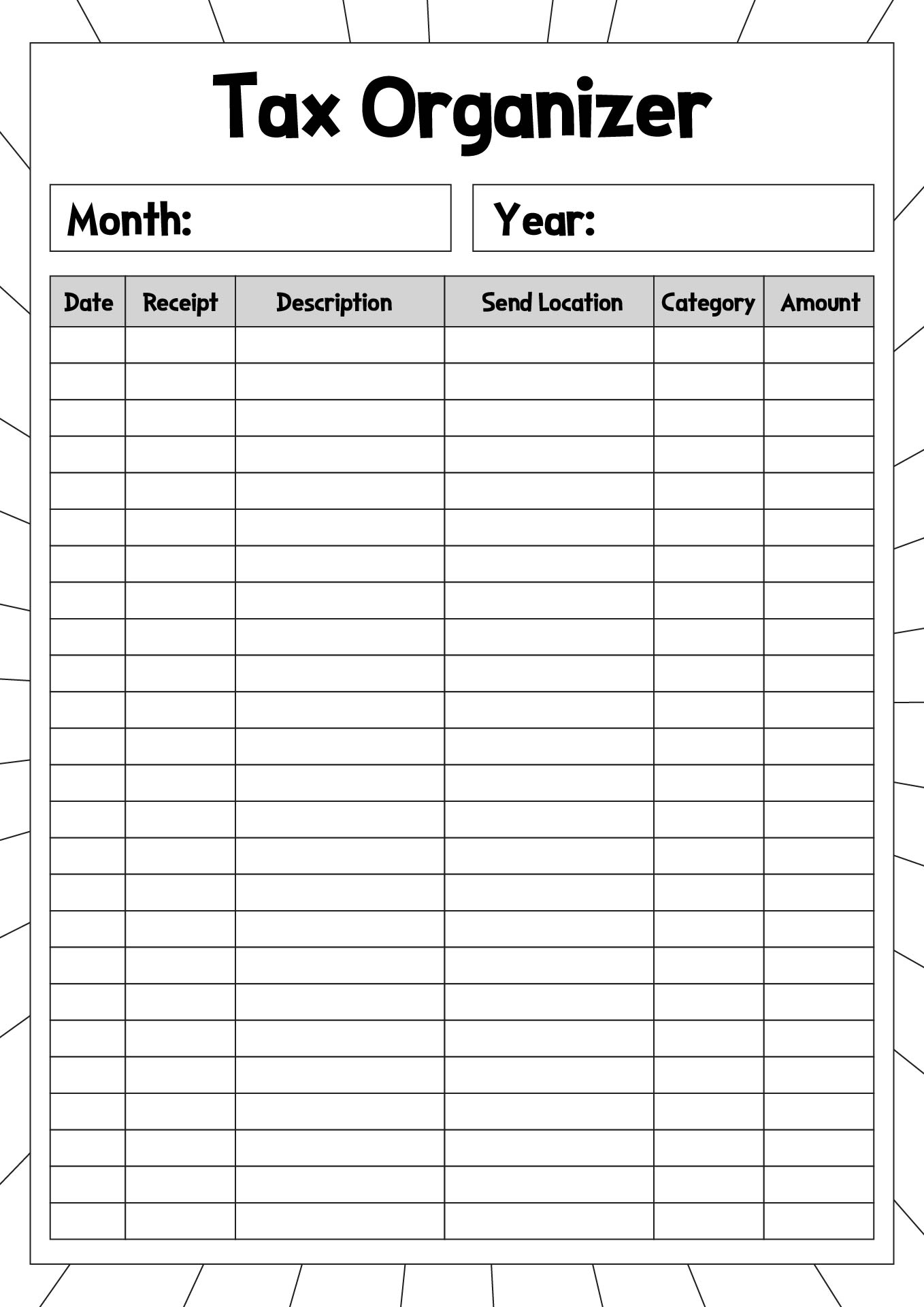

A Tax Preparation Organizer Worksheet can assist with organizing income-related documents by providing a structured framework to gather and categorize important information such as income sources, receipts, and necessary forms. By using the worksheet, individuals can easily track and compile their income-related documents in one central location, ensuring that nothing is missed and making the tax preparation process more efficient and less overwhelming.

What sections should be included on a Tax Preparation Organizer Worksheet for expenses?

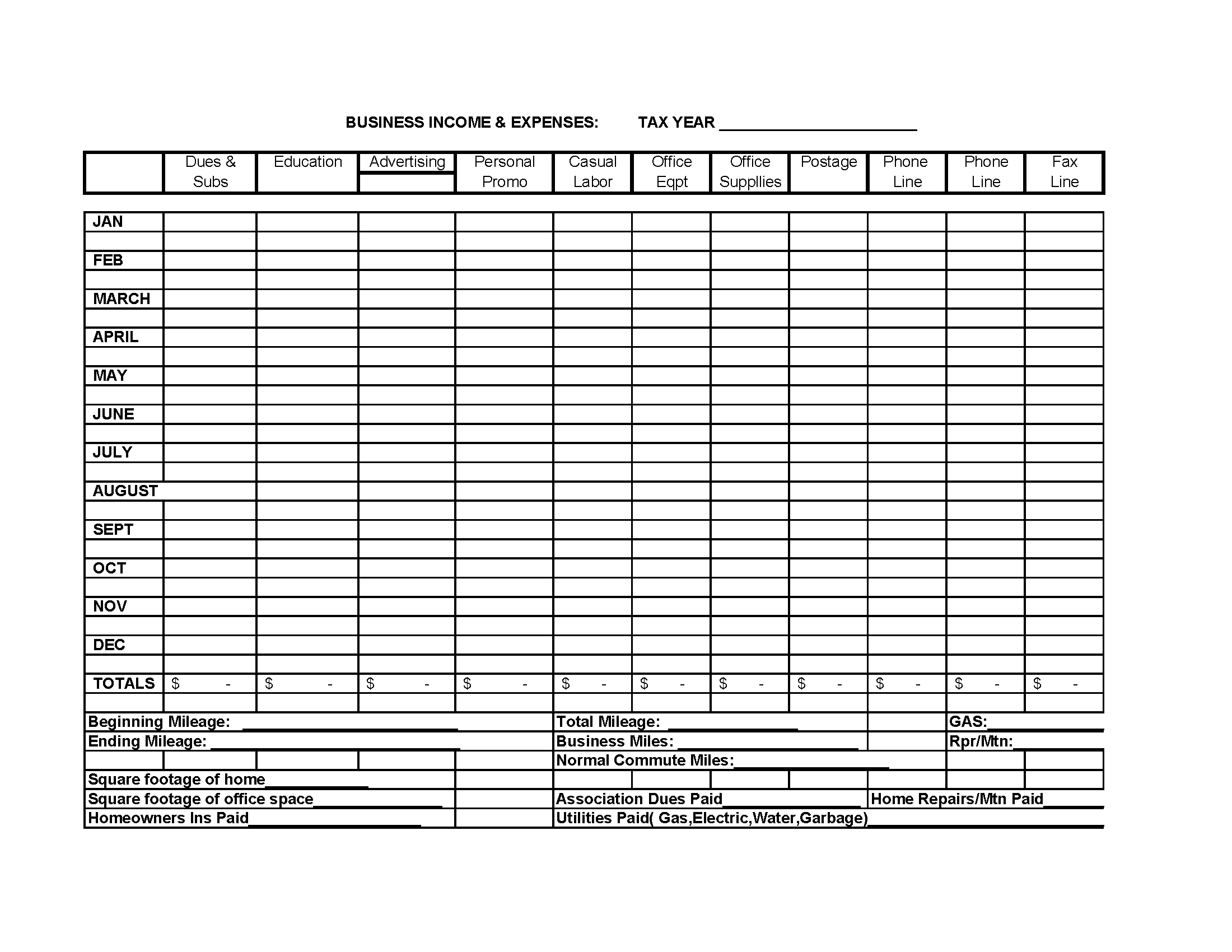

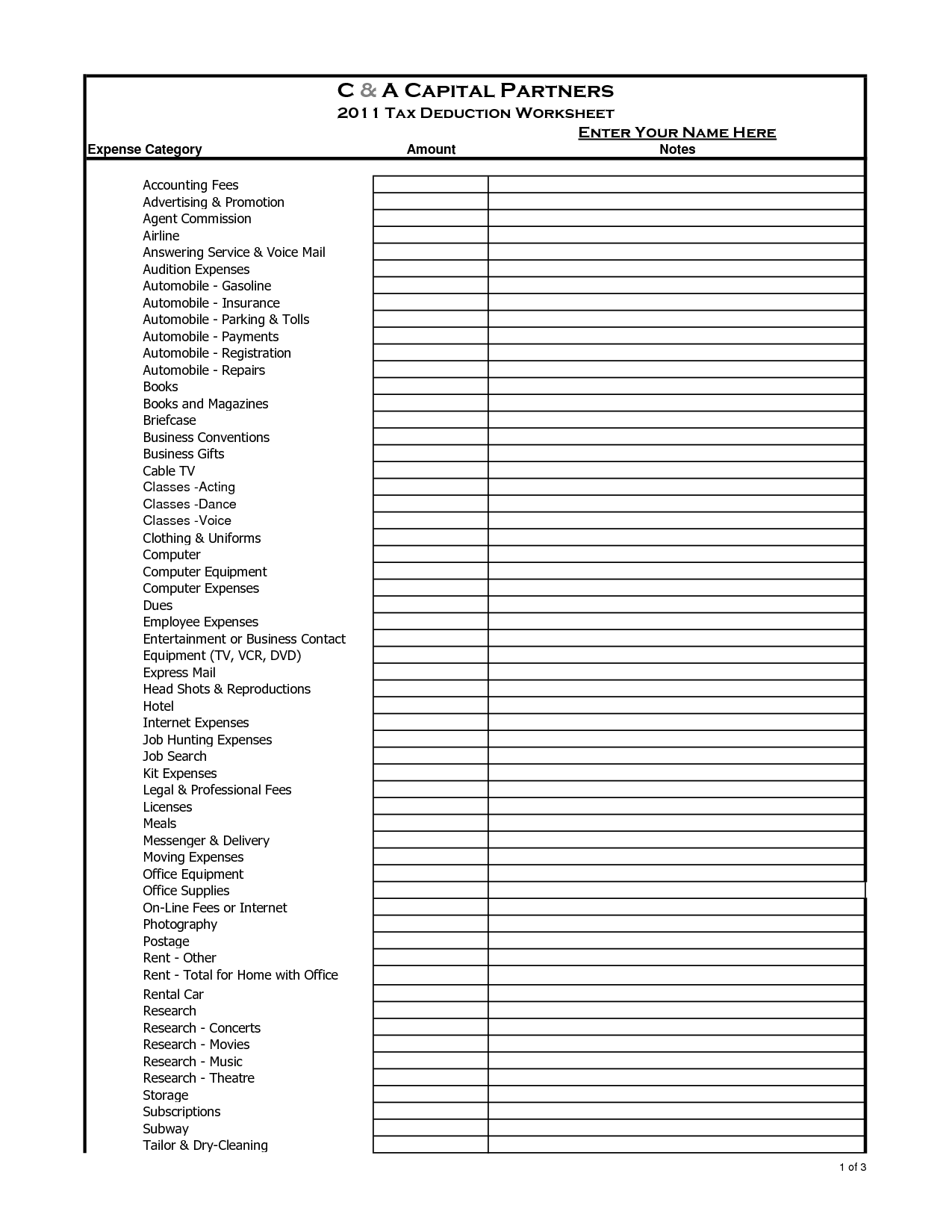

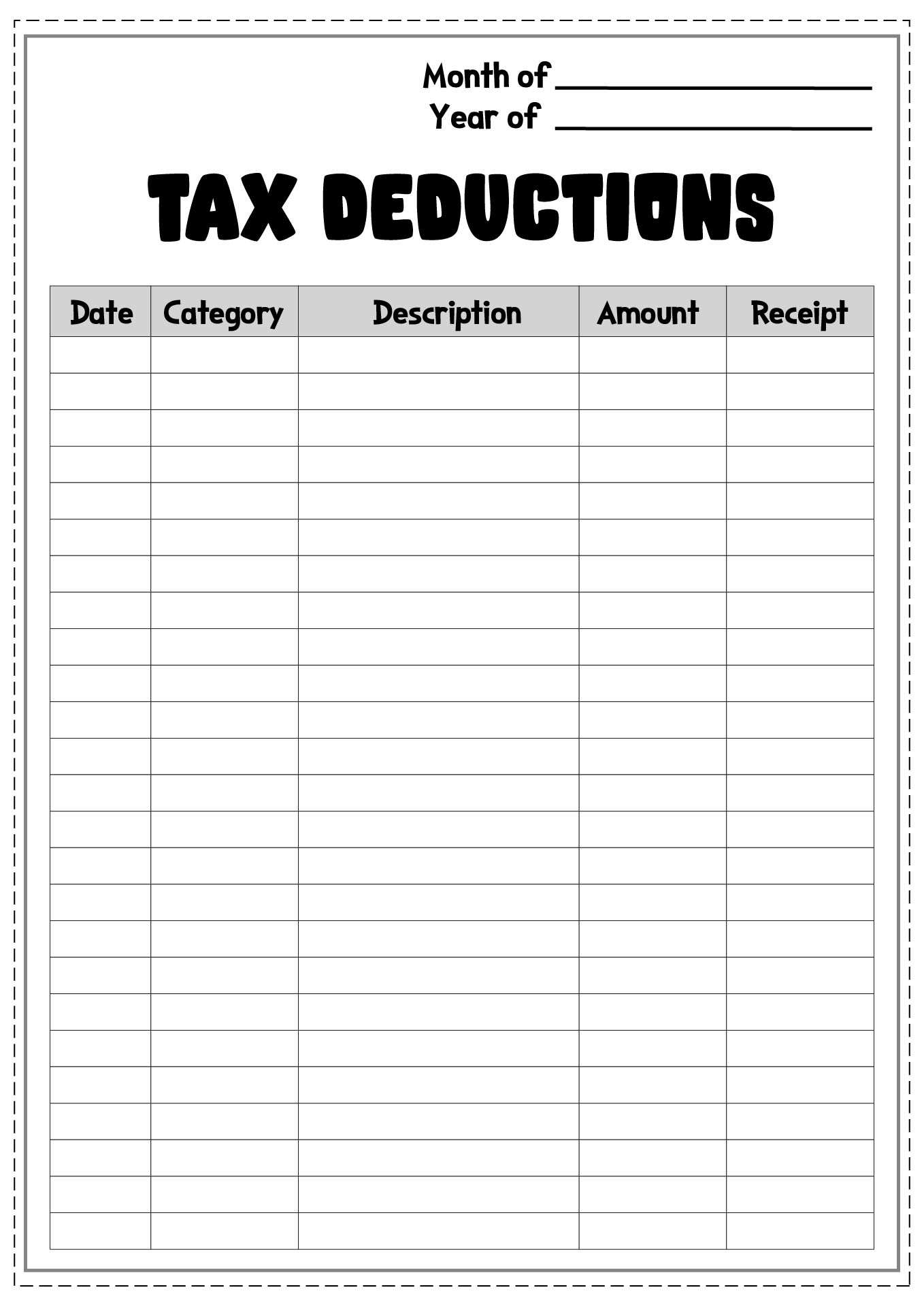

A Tax Preparation Organizer Worksheet for expenses should include sections for different categories of expenses such as medical expenses, charitable contributions, mortgage interest, property taxes, business expenses, education expenses, retirement contributions, and any other relevant expenses that may be tax deductible. It should also have sections for documenting details like the date of the expense, the amount spent, and any supporting documentation or receipts. Additionally, it should have a summary section for total expenses in each category for easy reference during tax preparation.

How can a Tax Preparation Organizer Worksheet help with tracking deductions and credits?

A Tax Preparation Organizer Worksheet can help with tracking deductions and credits by providing a structured format to compile and organize relevant financial information, such as expenses, income sources, and potential tax credits. By systematically detailing and categorizing this information, individuals can easily identify eligible deductions and credits, ensuring they maximize their tax savings. Additionally, the worksheet can serve as a reference tool to ensure all necessary documentation is gathered and reported accurately, ultimately simplifying the tax preparation process and potentially reducing the risk of errors or missed opportunities for tax savings.

What should be included in the section for charitable contributions on a Tax Preparation Organizer Worksheet?

The section for charitable contributions on a Tax Preparation Organizer Worksheet should include details such as the name of the charitable organization, the date and amount of the donation, and whether the donation was made in cash or non-cash items. Additionally, any supporting documentation, such as donation receipts or acknowledgment letters, should be included in this section to substantiate the contributions claimed on the tax return.

How can a Tax Preparation Organizer Worksheet be used to track self-employment income?

A Tax Preparation Organizer Worksheet can be used to track self-employment income by listing all sources of income related to the self-employment, including earnings from clients, online platforms, or any other business activities. The worksheet can help document and organize income received throughout the year, making it easier to accurately report this information on tax forms. Additionally, the worksheet can be used to track any deductible expenses related to self-employment, such as equipment purchases, business travel, or office supplies, ensuring that all relevant data is kept in one place for tax preparation purposes.

What types of information should be included in the "Other Income" section of a Tax Preparation Organizer Worksheet?

In the "Other Income" section of a Tax Preparation Organizer Worksheet, you should include any income that does not fit into common categories like wages or self-employment income. This can include things like: alimony received, rental income, awards and prizes, gambling winnings, royalties, unemployment compensation, and any other miscellaneous sources of income. It's important to report all sources of income accurately to ensure compliance with tax regulations.

How can using a Tax Preparation Organizer Worksheet help streamline the tax preparation process?

A Tax Preparation Organizer Worksheet can help streamline the tax preparation process by providing a structured template where individuals can gather and organize all necessary tax-related documents in one place. This helps ensure that no important information is missed and makes it easier for both taxpayers and tax professionals to review and prepare the required forms efficiently. By having a clear overview of all financial details and documents, individuals can save time and reduce the likelihood of errors during the tax preparation process.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments