Tax Itemized Deduction Worksheet

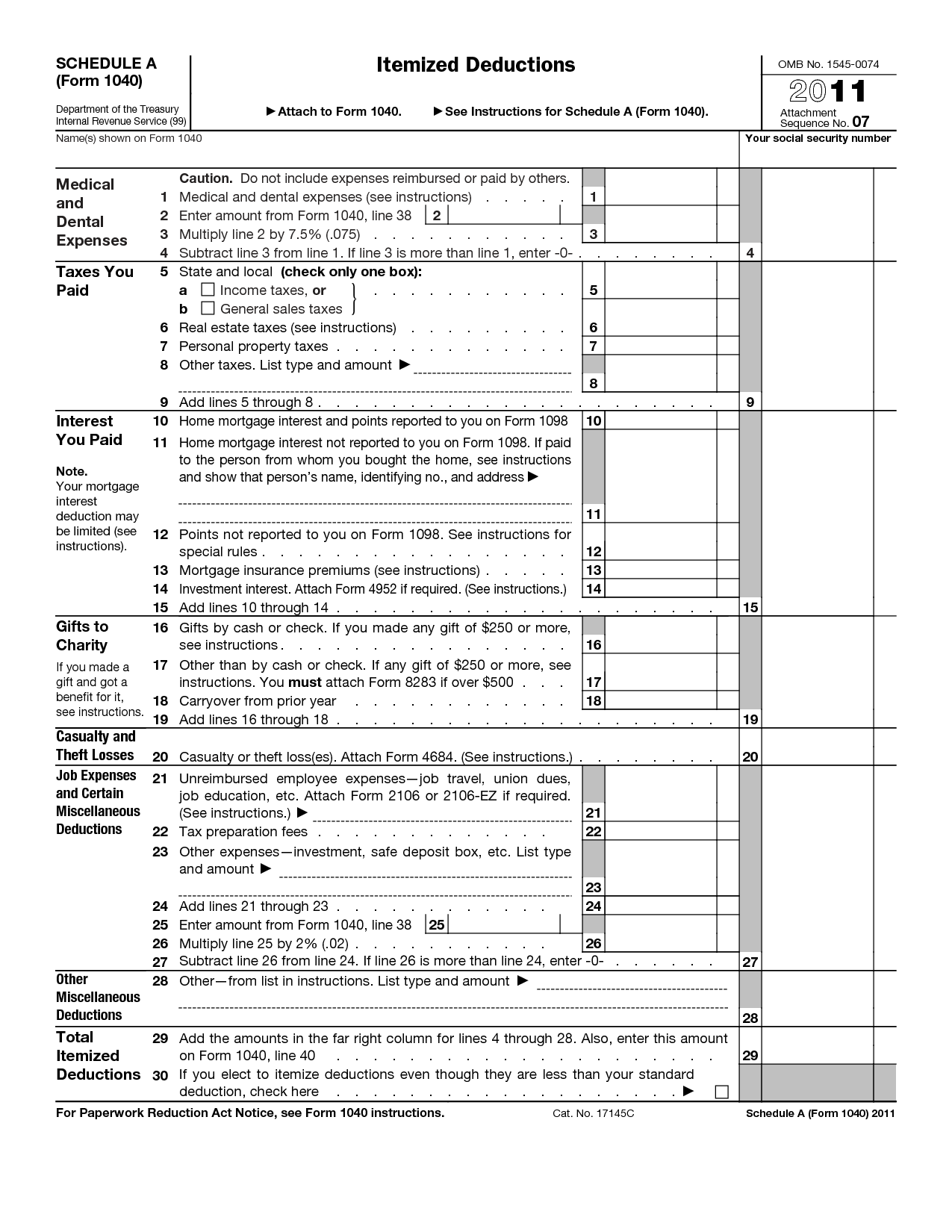

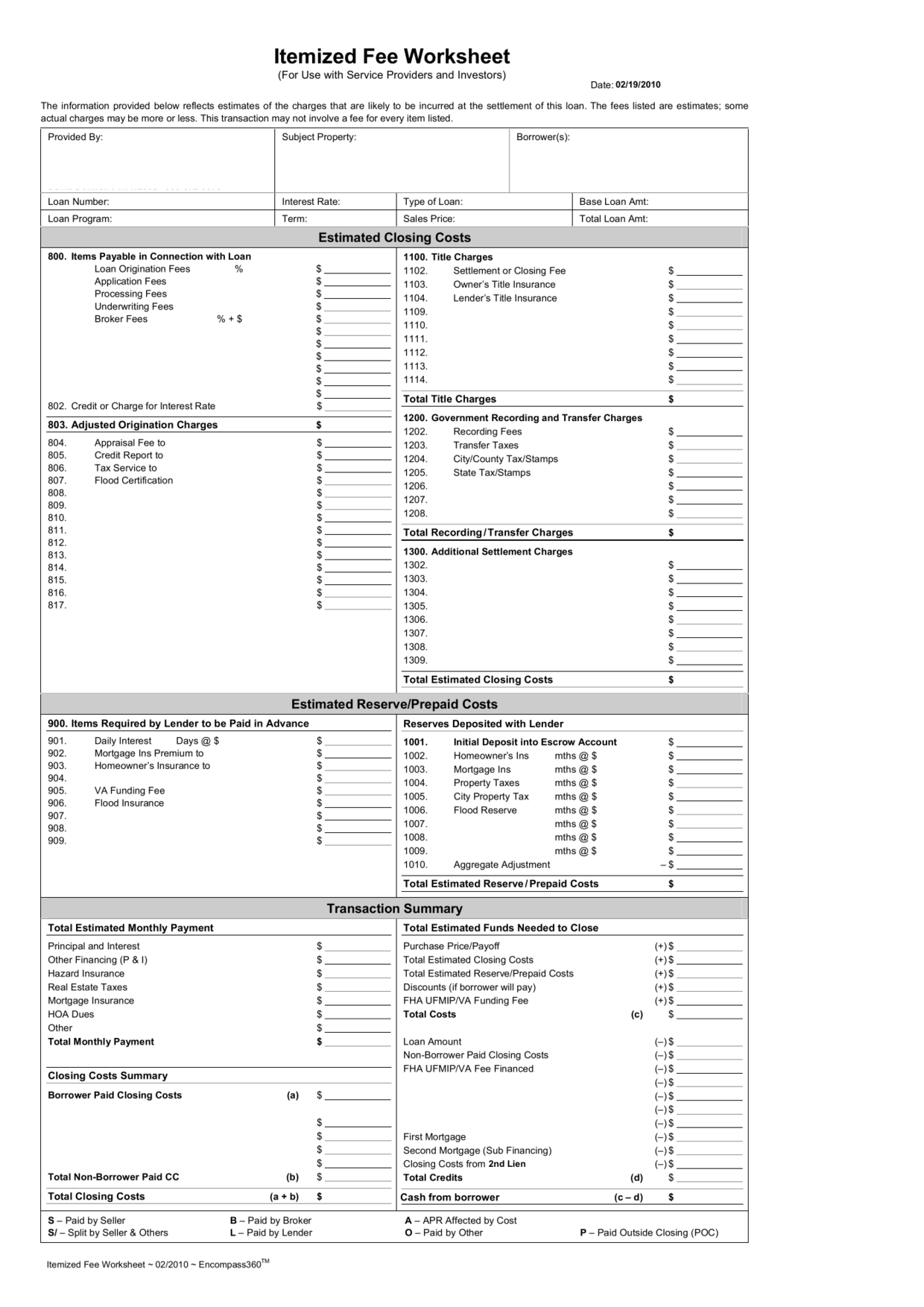

Are you someone who itemizes your deductions when filing your taxes? If so, you may find the Tax Itemized Deduction Worksheet to be a helpful tool when organizing your expenses and maximizing your deductions. This worksheet serves as a comprehensive entity for individuals who want to keep track of their deductible expenses and ensure they claim all eligible tax breaks. By using this worksheet, you can accurately and efficiently gather all the necessary information needed to complete your tax return.

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a Tax Itemized Deduction Worksheet?

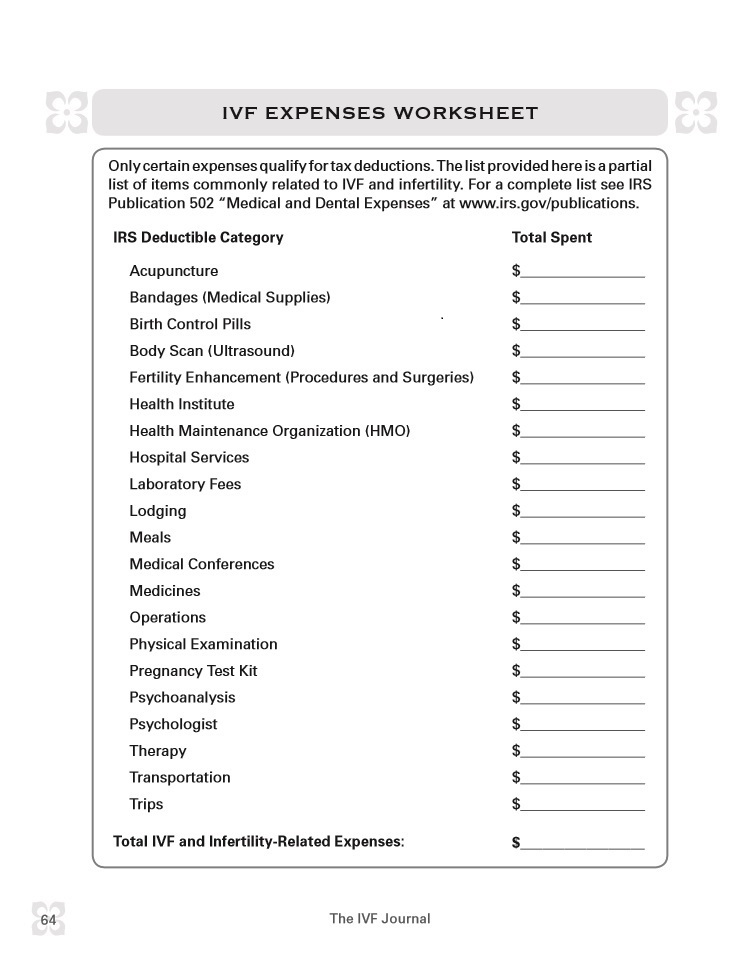

A Tax Itemized Deduction Worksheet is a document used by individuals to calculate their itemized deductions for the year. This worksheet helps taxpayers list and calculate various expenses that qualify as deductible, such as medical expenses, charitable contributions, mortgage interest, and state and local taxes. By using the worksheet, individuals can determine if their total itemized deductions exceed the standard deduction and decide whether it's beneficial to itemize deductions on their tax return.

How does a Tax Itemized Deduction Worksheet work?

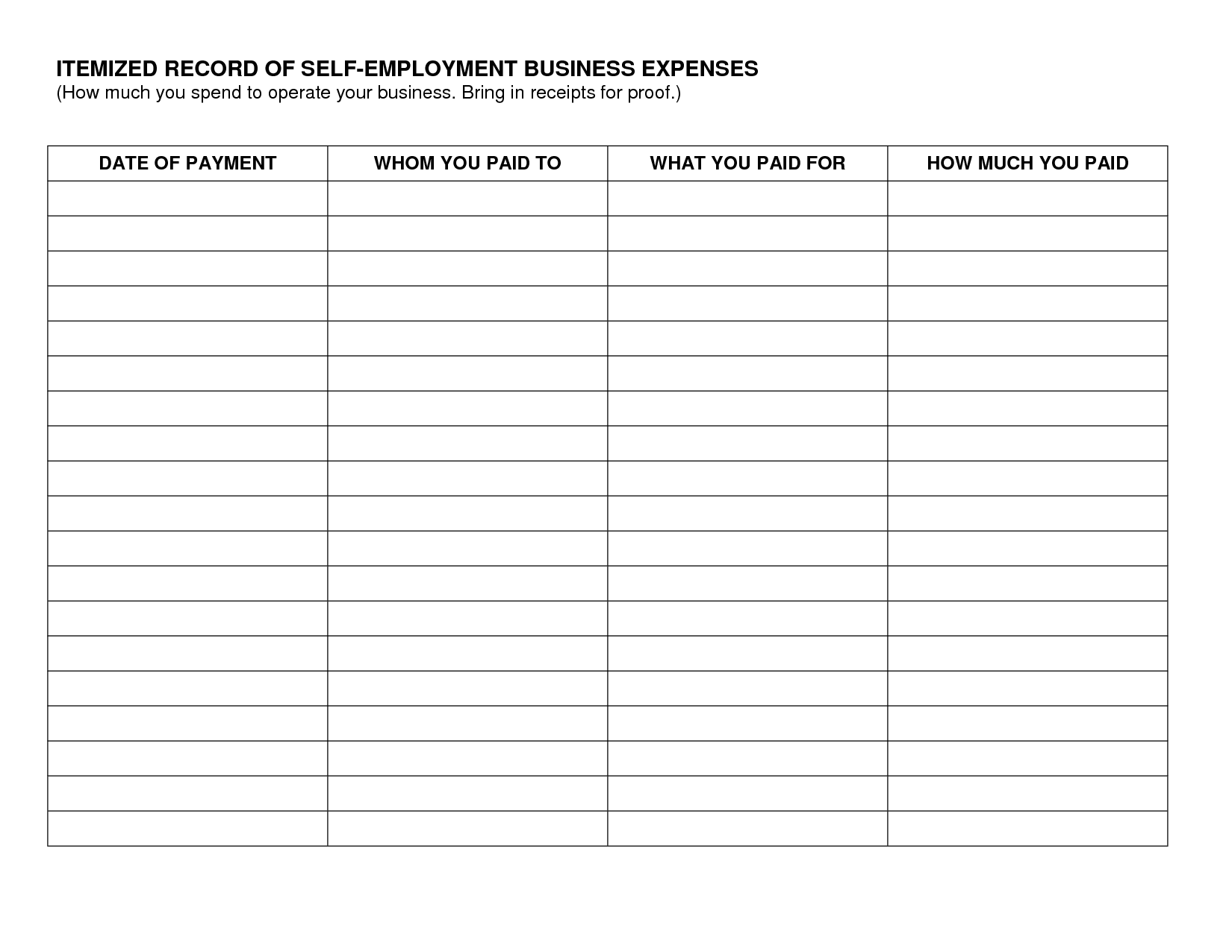

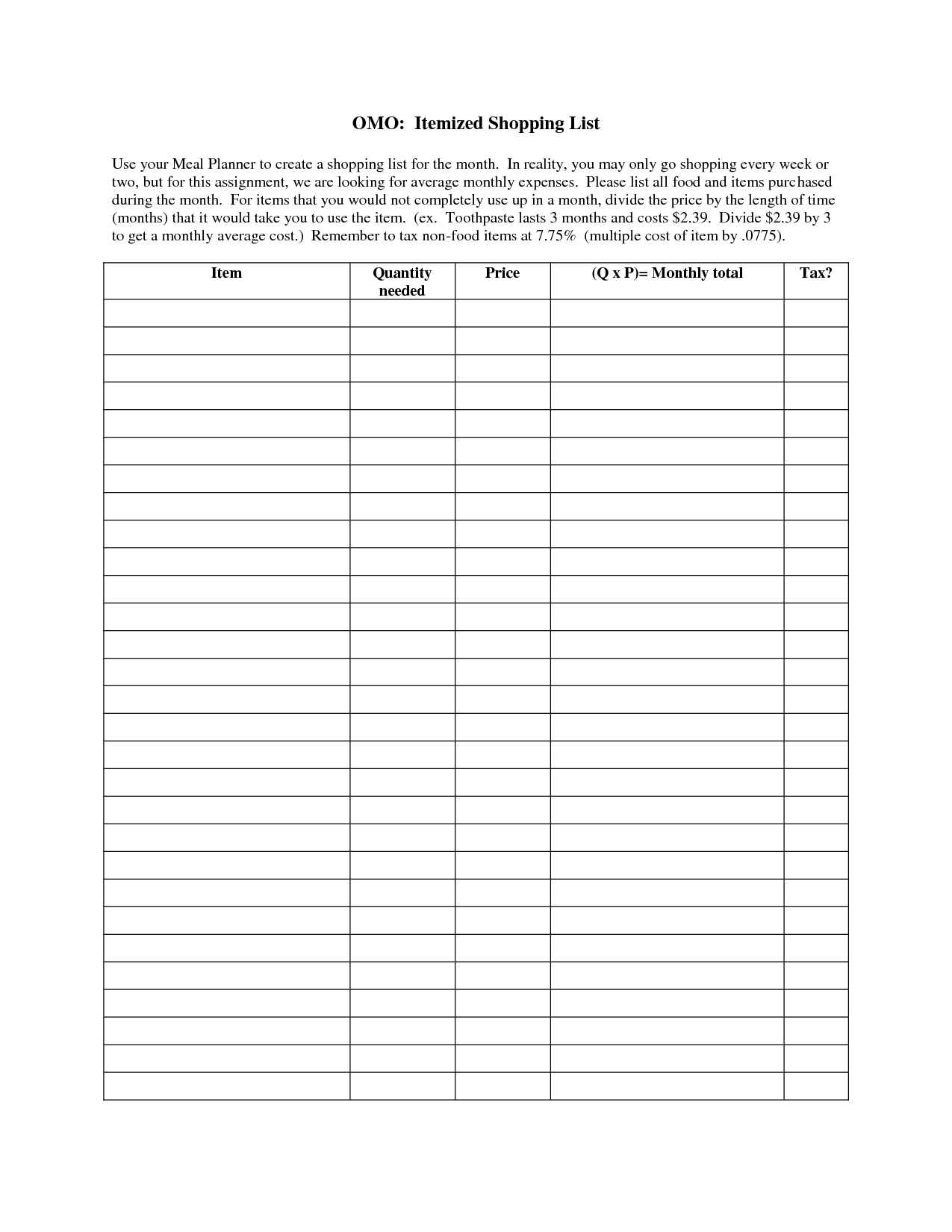

A Tax Itemized Deduction Worksheet helps taxpayers determine the total amount of itemized deductions they can claim on their tax return. It typically includes categories such as medical expenses, state and local taxes, mortgage interest, charitable contributions, and miscellaneous deductions. Taxpayers list their expenses in each category, calculate the total for each category, and then add up all the totals to arrive at their total itemized deductions. This total is compared to the standard deduction amount, and taxpayers can choose to claim the higher of the two on their tax return to reduce their taxable income.

What types of expenses can be included on a Tax Itemized Deduction Worksheet?

Some common types of expenses that can be included on a Tax Itemized Deduction Worksheet include medical expenses, state and local taxes, mortgage interest, charitable contributions, unreimbursed employee expenses, and casualty or theft losses. It's important to keep accurate records and receipts for these expenses to substantiate the deductions claimed on your tax return.

How do you calculate the total amount of deductions on a Tax Itemized Deduction Worksheet?

To calculate the total amount of deductions on a Tax Itemized Deduction Worksheet, you need to add up all the individual deductible expenses listed on the worksheet. This typically includes expenses such as mortgage interest, property taxes, medical expenses, charitable contributions, and other eligible deductions. By summing up the amounts for each category, you will arrive at the total amount of deductions for the tax year.

Are there any limitations or restrictions on the deductions you can claim on a Tax Itemized Deduction Worksheet?

Yes, there are limitations and restrictions on the deductions you can claim on a Tax Itemized Deduction Worksheet. Some deductions may be limited based on your income level, while others may have specific eligibility criteria or requirements. Additionally, certain deductions may be subject to phase-out thresholds or alternative minimum tax considerations. It is important to thoroughly review the IRS guidelines and consult with a tax professional to understand the specific limitations and restrictions that may apply to your situation.

Are there different versions of the Tax Itemized Deduction Worksheet for different tax years?

Yes, there are different versions of the Tax Itemized Deduction Worksheet for different tax years. The Internal Revenue Service (IRS) updates and modifies tax forms and worksheets each year to reflect changes in tax laws and regulations. Taxpayers should use the most recent version of the Tax Itemized Deduction Worksheet that corresponds to the tax year for which they are filing their taxes to ensure accurate calculations and compliance with current tax laws.

Can you claim deductions for both federal and state taxes on a Tax Itemized Deduction Worksheet?

No, you cannot claim deductions for both federal and state taxes on a Tax Itemized Deduction Worksheet. You can only claim one or the other, as state and local income taxes are usually grouped together as one deduction on the worksheet.

Is there a specific order in which deductions should be listed on a Tax Itemized Deduction Worksheet?

While there is no specific order required for listing deductions on a Tax Itemized Deduction Worksheet, it is recommended to follow a systematic approach based on the most common deductions such as medical expenses, state and local taxes, mortgage interest, charitable contributions, and miscellaneous deductions. Organizing deductions in a logical sequence can help ensure accuracy and facilitate the overall tax preparation process.

Are there any special rules or requirements for certain deductions on a Tax Itemized Deduction Worksheet?

Yes, there are specific rules and requirements for certain deductions on a Tax Itemized Deduction Worksheet. For example, medical expenses must exceed a certain percentage of your adjusted gross income to be deductible, while charitable contributions must be made to eligible organizations. It's important to carefully follow the guidelines set by the Internal Revenue Service to ensure that you qualify for these deductions and accurately report them on your tax return.

Can you use a Tax Itemized Deduction Worksheet if you are taking the standard deduction instead?

No, you cannot use a Tax Itemized Deduction Worksheet if you are taking the standard deduction instead. The purpose of the Tax Itemized Deduction Worksheet is to calculate the total amount of itemized deductions you can claim on your tax return, which is only relevant if you choose to itemize deductions instead of taking the standard deduction. If you are taking the standard deduction, you do not need to fill out the Tax Itemized Deduction Worksheet.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments