Small Business Monthly Budget Worksheet

Managing your small business finances can be a daunting task, but with the help of a monthly budget worksheet, you can stay organized and stay on top of your expenses. This straightforward tool allows you to track your income and expenses, helping you gain a clear understanding of your financial situation. Whether you're a small business owner or a freelancer, this monthly budget worksheet will be the perfect entity to keep your finances in check.

Table of Images 👆

- Small Business Budget Worksheet Printable

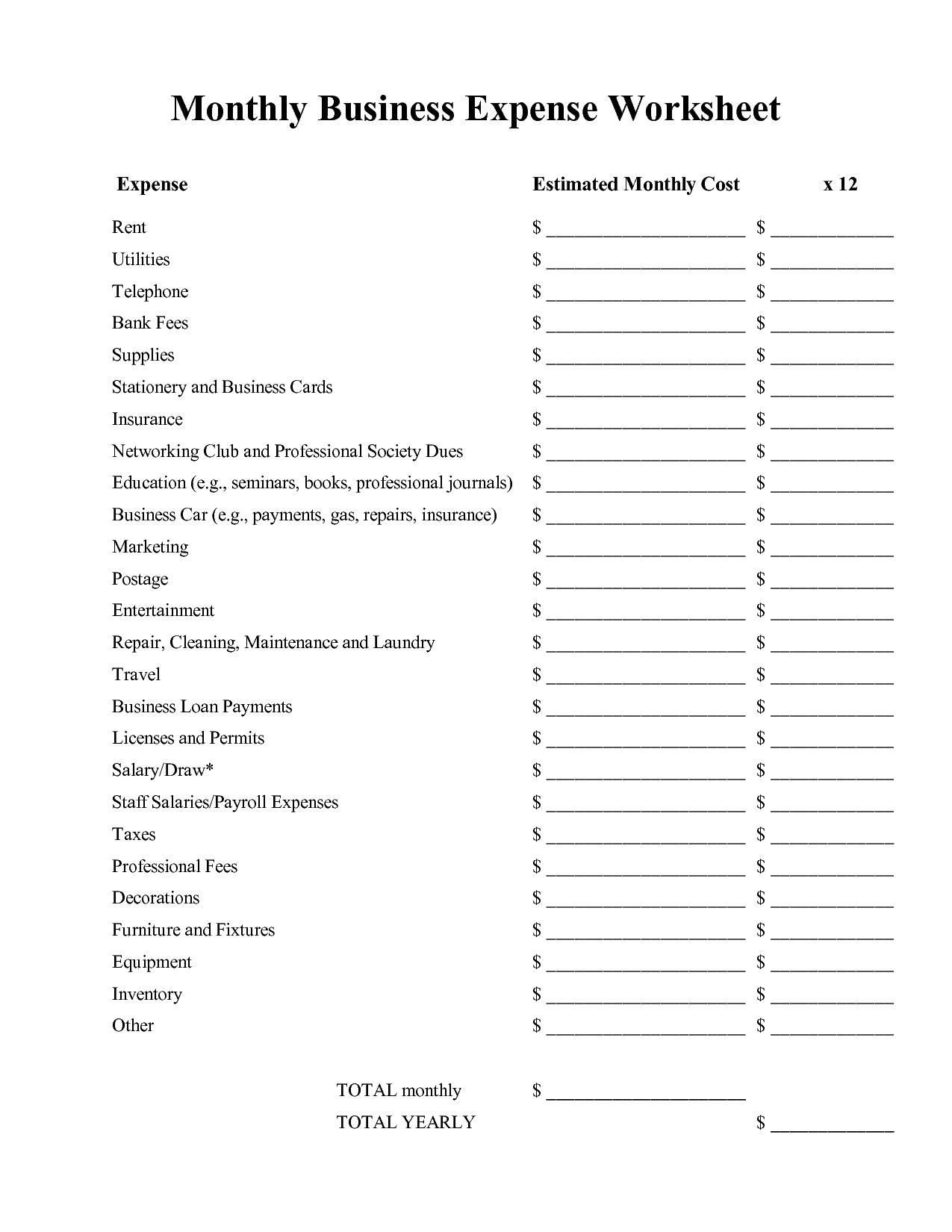

- Monthly Business Expense Worksheet Template

- Free Printable Weekly Monthly Budget Worksheet

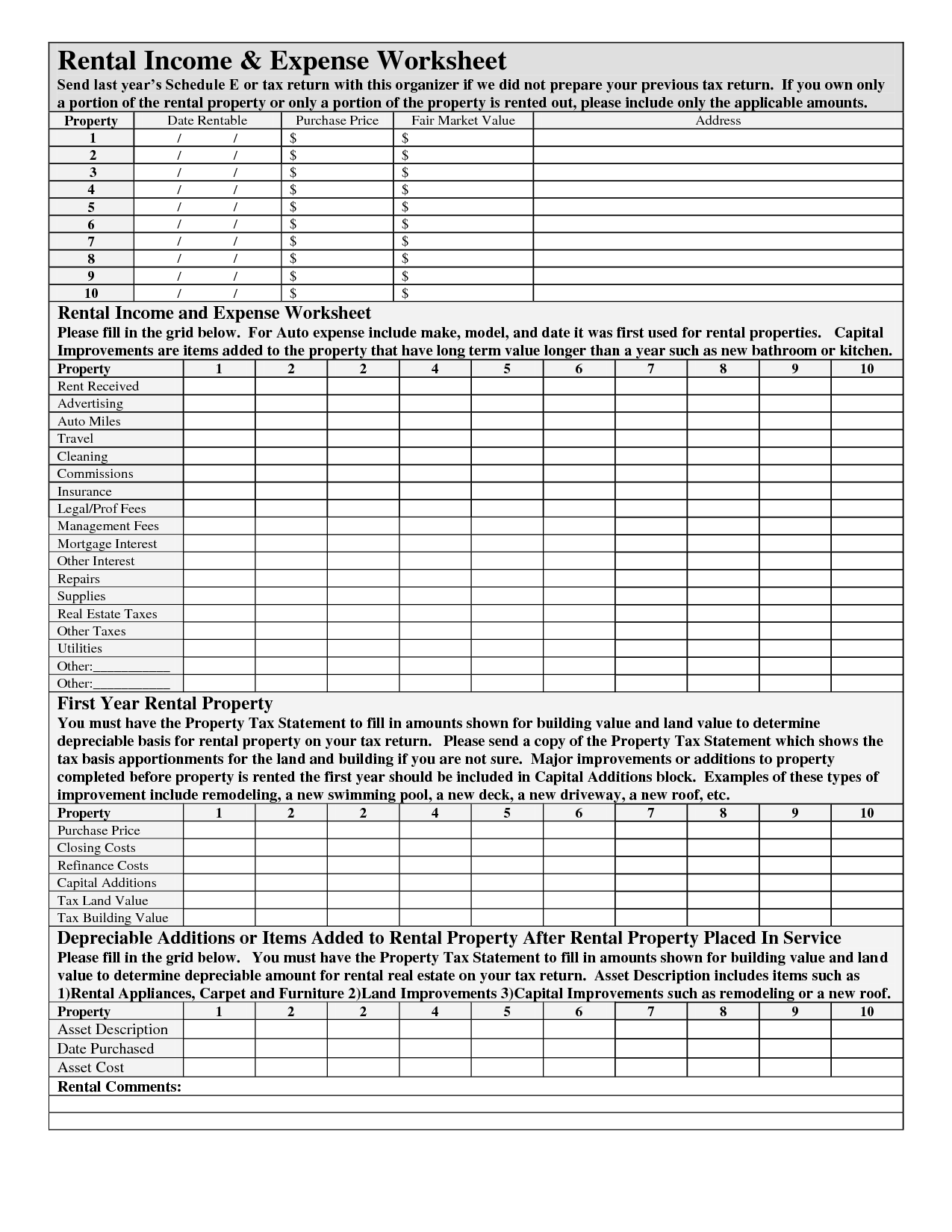

- Rental Property Income Expense Worksheet

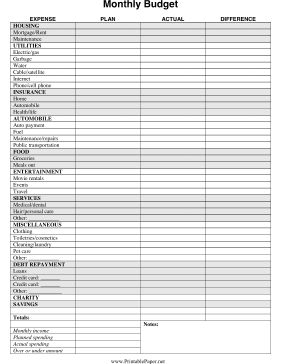

- Printable Monthly Budget Paper

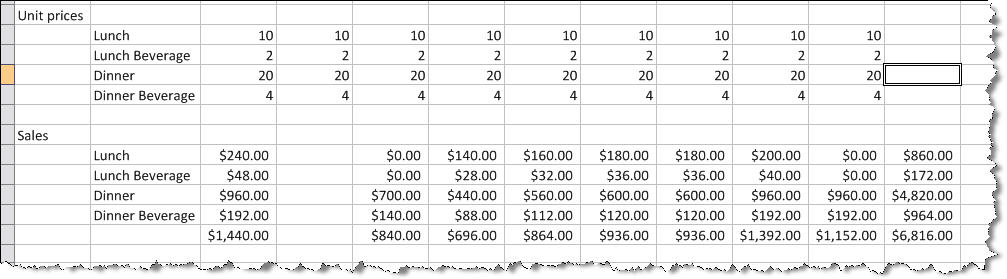

- Restaurant Sales Forecast Template

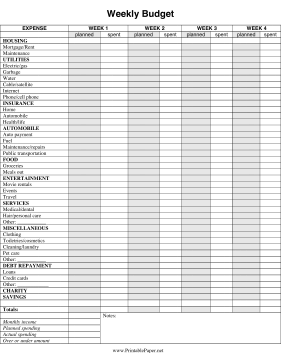

- Free Printable Weekly Budget Template

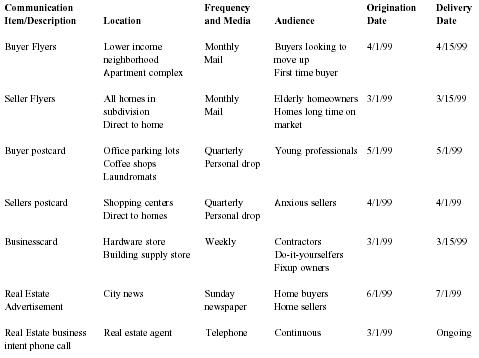

- Real Estate Business Plan Template

- Printable 4 Month Calendar Template

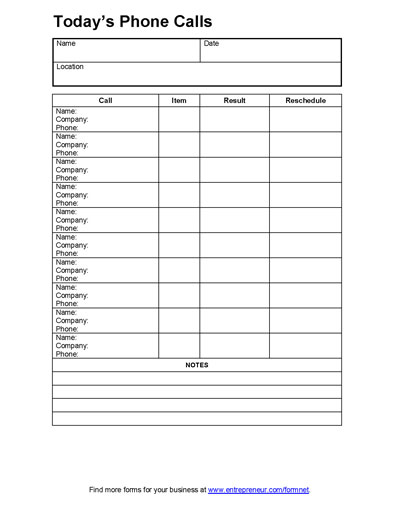

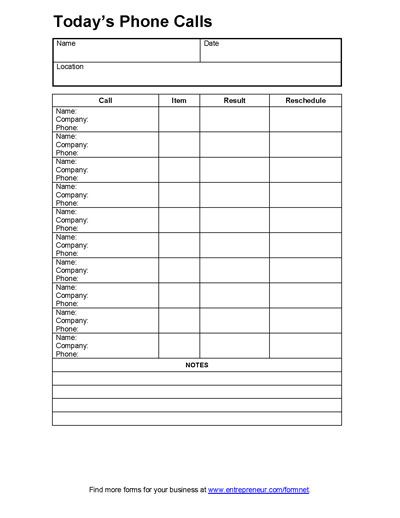

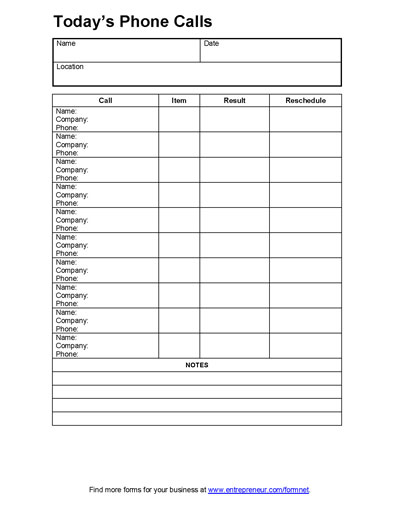

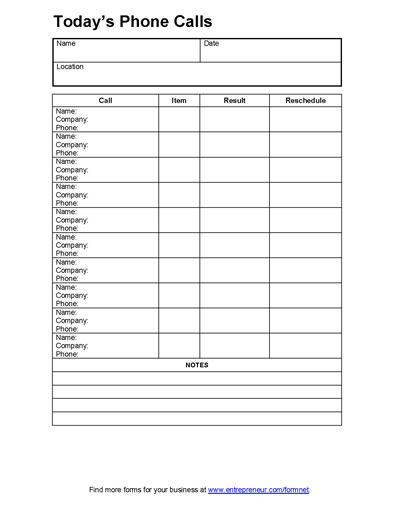

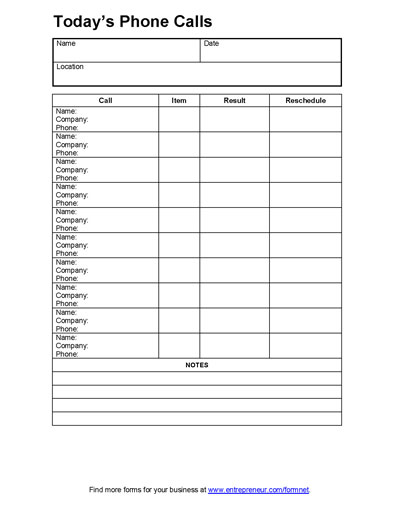

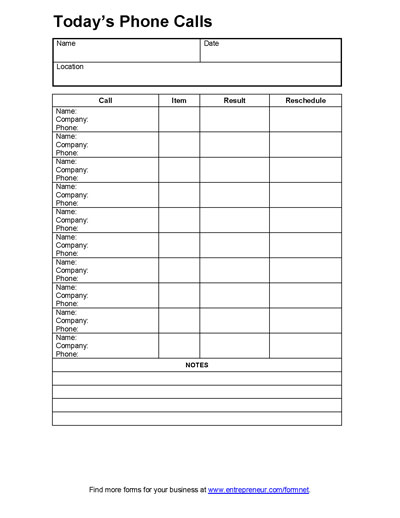

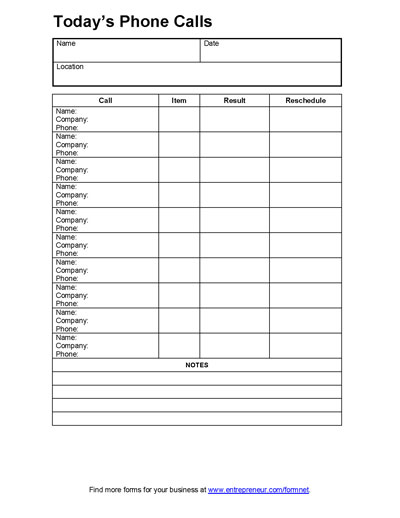

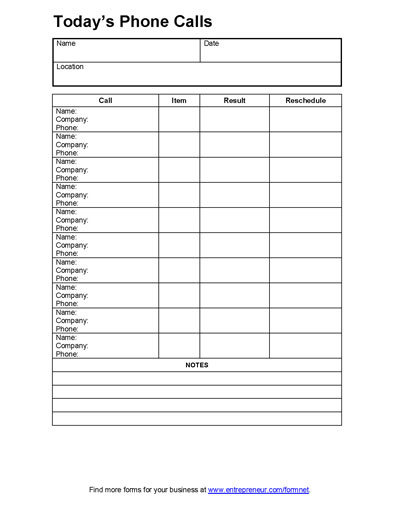

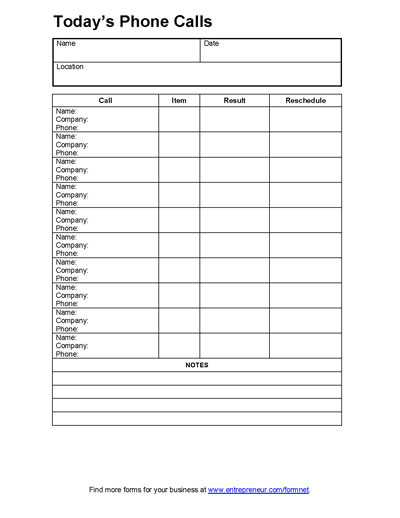

- Phone Call Log Sheet Printable

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is the purpose of a Small Business Monthly Budget Worksheet?

The purpose of a Small Business Monthly Budget Worksheet is to help small business owners track and manage their finances effectively. It allows them to plan for income, expenses, and savings on a monthly basis, enabling them to make informed decisions about their financial strategies, investments, and business operations to ensure financial stability and growth.

What are the key components included in a Small Business Monthly Budget Worksheet?

A Small Business Monthly Budget Worksheet typically includes key components such as revenue projections, expenses (both fixed and variable), profit calculations, cash flow analysis, budget variance analysis, and a breakdown of individual budget categories. It helps small business owners track their financial performance, make informed decisions, and ensure financial stability by comparing actual figures to the budgeted amounts on a monthly basis.

How often should a Small Business Monthly Budget Worksheet be updated?

A Small Business Monthly Budget Worksheet should ideally be updated on a regular basis, such as at the end of every month. This allows the business owner to track expenses, monitor cash flow, and make any necessary adjustments to the budget to ensure financial stability and success.

Why is it important for small businesses to have a budget?

Having a budget is important for small businesses because it helps them manage their finances effectively, plan for future expenses, and ensure they have enough resources to cover costs. A budget allows small businesses to track their income and expenses, identify areas where they can save money or invest more, allocate funds strategically, and make informed financial decisions that can lead to growth and sustainability. Additionally, a budget can also help small businesses anticipate and prepare for any unexpected challenges or opportunities that may arise in the course of their operations.

How can a Small Business Monthly Budget Worksheet help with financial planning?

A Small Business Monthly Budget Worksheet can help with financial planning by providing a clear overview of the company's income and expenses on a monthly basis. By accurately tracking and categorizing all financial transactions, it allows for better decision-making regarding resource allocation, identifying cost-saving opportunities, and ensuring that the business operates within its financial means. This tool helps small businesses project future cash flow, set realistic financial goals, and monitor performance against the budget to make adjustments as needed to stay on track towards achieving long-term financial stability and growth.

What categories should be included in the income section of a Small Business Monthly Budget Worksheet?

The income section of a Small Business Monthly Budget Worksheet should typically include categories such as total sales revenue, income from services, rental income, interest income, investment income, grants or funding, and any other sources of income specific to the business. It is important to include a detailed breakdown of all sources of revenue to accurately track and manage the business's financial performance.

What expenses should be considered when creating a Small Business Monthly Budget Worksheet?

When creating a Small Business Monthly Budget Worksheet, some key expenses to consider include fixed costs such as rent, utilities, insurance, and salaries, variable costs like raw materials, inventory, and marketing, one-time expenses like equipment purchases or renovations, and ongoing expenses such as software subscriptions, professional fees, and miscellaneous costs. It is also important to account for taxes and potential emergency funds in the budget to ensure financial stability and preparedness for unexpected situations.

How can a Small Business Monthly Budget Worksheet help identify areas of cost savings?

A Small Business Monthly Budget Worksheet can help identify areas of cost savings by providing a clear overview of all expenses and income in one place. By tracking month-to-month spending patterns, businesses can identify areas where costs are consistently high or increasing, prompting them to explore ways to reduce these expenses. Additionally, budget worksheets help businesses prioritize spending, allocate resources more efficiently, and set specific cost-saving goals that can be monitored and adjusted regularly to ensure financial stability and growth.

How can a Small Business Monthly Budget Worksheet be used to monitor financial performance?

A Small Business Monthly Budget Worksheet can be used to monitor financial performance by tracking actual expenses and comparing them to the budgeted amounts. By regularly updating the worksheet with actual income and expenses, businesses can quickly identify any discrepancies or areas of overspending. This allows for better financial decision-making, adjustments to spending, and the ability to stay on track with financial goals. Additionally, by analyzing trends over time, businesses can spot patterns and make informed projections for future financial planning.

What are the potential benefits of using a Small Business Monthly Budget Worksheet for small business owners?

A Small Business Monthly Budget Worksheet can provide small business owners with numerous benefits, such as tracking expenses and income to maintain financial discipline, identifying areas of overspending or opportunities for cost savings, setting financial goals and monitoring progress towards them, facilitating better decision-making on resource allocation, helping with tax planning and reporting, and providing a clear overview of the financial health of the business to promote long-term sustainability and growth.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments