Sales Tax Discount Worksheet

Are you a small business owner or a finance professional looking for a useful tool to help you calculate sales tax discounts? Look no further! Introducing the Sales Tax Discount Worksheet - a simple and effective solution designed to make your calculations a breeze. Whether you're a retailer, a wholesaler, or anyone who deals with sales tax, this worksheet can save you time and effort by providing a clear breakdown of the discounted amount. Say goodbye to manual calculations and hello to accuracy and efficiency with our Sales Tax Discount Worksheet.

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

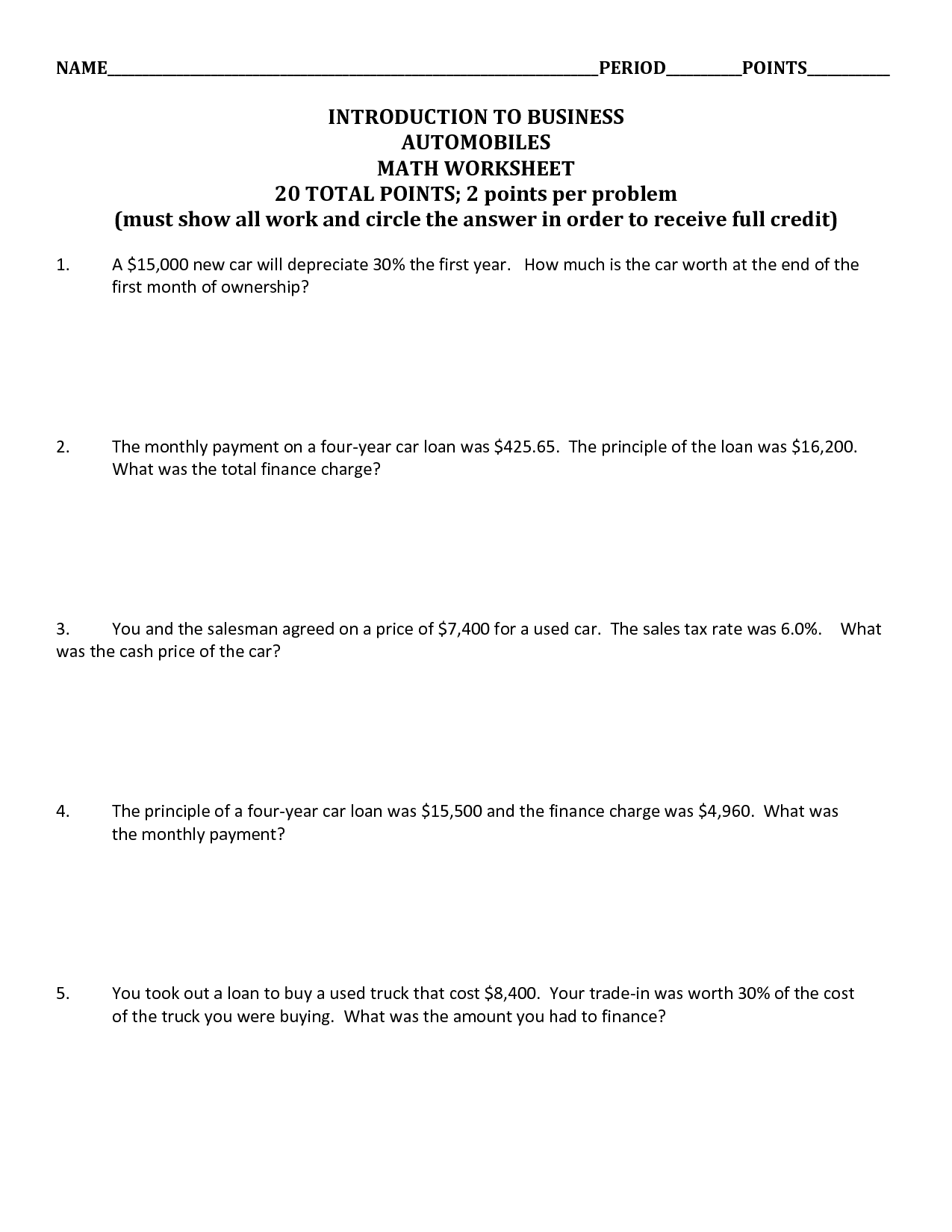

What is a Sales Tax Discount Worksheet?

A Sales Tax Discount Worksheet is a document used to calculate the amount of sales tax to be discounted from a total sale amount. This worksheet helps businesses determine the exact amount of sales tax to be deducted before arriving at the final price that a customer pays. It helps businesses accurately account for discounts and maintains compliance with tax regulations.

When is a Sales Tax Discount Worksheet used?

A Sales Tax Discount Worksheet is typically used when a business wants to calculate the discounted sales tax amount on a product or service. This worksheet helps in determining the reduced tax liability after applying any discounts or promotions to the taxable amount, ensuring accurate tax calculations during transactions.

What information is typically included in a Sales Tax Discount Worksheet?

A Sales Tax Discount Worksheet typically includes the total sales amount, the sales tax rate, the amount of sales tax owed, any discounts applied, the discounted sales tax amount, and the final amount due after the discount is applied. It helps businesses calculate and track the sales tax owed on their sales transactions, taking into account any discounts that may have been offered to customers.

How is the sales tax discount calculated on a worksheet?

To calculate the sales tax discount on a worksheet, you typically multiply the sales amount by the sales tax rate to get the total tax amount. Then, you multiply the total tax amount by the discount rate (expressed as a decimal) to calculate the discount. Subtract the discount amount from the total tax amount to arrive at the discounted sales tax.

What is the purpose of calculating the sales tax discount?

The purpose of calculating the sales tax discount is to determine the reduced amount of sales tax that needs to be paid when a discount is applied to the original price of a product or service. This helps businesses accurately account for and report the correct amount of sales tax owed to the tax authorities, ensuring compliance with tax regulations and potentially reducing the overall cost for customers.

How can a Sales Tax Discount Worksheet help with tracking sales tax payments?

A Sales Tax Discount Worksheet can help track sales tax payments by providing a detailed breakdown of the amount owed, any discounts applied, and the final payment amount. By using this worksheet, you can easily monitor the accuracy of your sales tax payments, track any discounts or adjustments made, and ensure that you are correctly calculating and remitting your sales tax obligations on time. It can serve as a helpful tool for organizing your sales tax information, maintaining compliance with tax laws, and avoiding any potential errors or discrepancies in your payments.

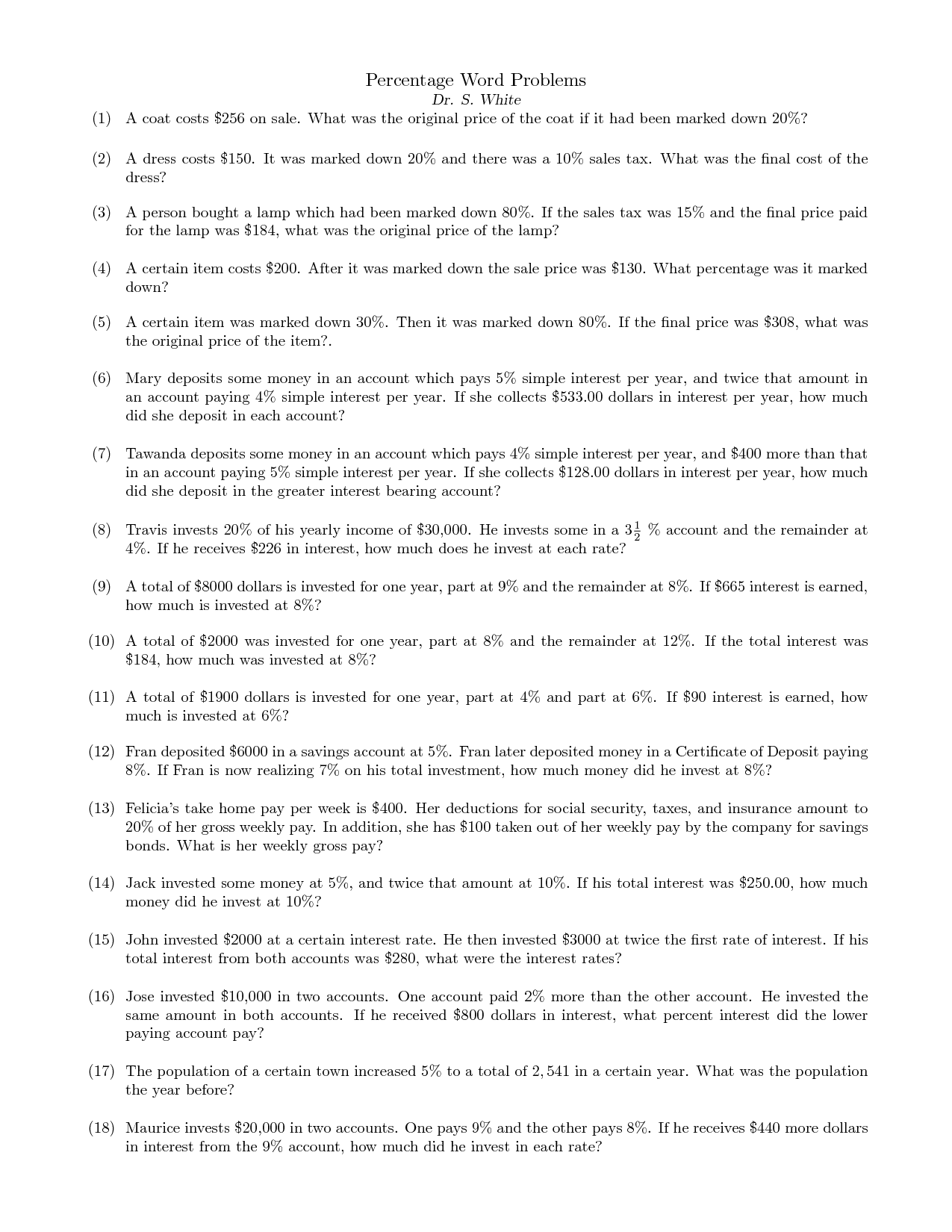

What are some common formulas or equations used in a Sales Tax Discount Worksheet?

In a Sales Tax Discount Worksheet, some common formulas or equations used are the calculation of sales tax amount by multiplying the total amount of purchase by the sales tax rate, calculation of sale price before tax by dividing the total amount by 1 plus the sales tax rate, and calculation of sale price after discount by subtracting the discount amount from the sale price before tax. Additionally, formulas for calculating total amount due after discount, total amount saved, and percentage discount are also commonly utilized in a Sales Tax Discount Worksheet.

How can errors in the Sales Tax Discount Worksheet be identified and corrected?

Errors in the Sales Tax Discount Worksheet can be identified and corrected by thoroughly reviewing the calculations made for each transaction, cross-checking the data entered with the original source documents, and verifying that all discounts and sales tax rates are accurate. If discrepancies are found, they can be corrected by recalculating the numbers, ensuring correct inputs, and making adjustments as necessary to rectify the errors in the worksheet. Regular audits and reconciliations can also help in detecting and resolving any inaccuracies in the sales tax discount worksheet.

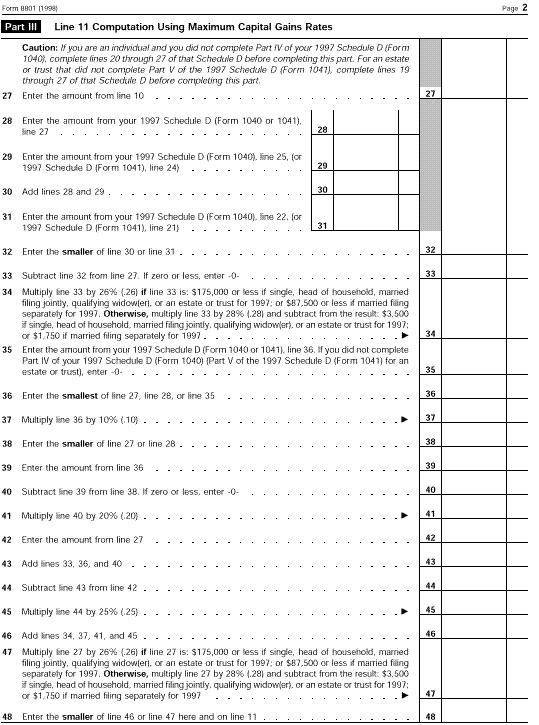

Are there any specific regulations or guidelines for creating a Sales Tax Discount Worksheet?

Yes, there are specific guidelines for creating a Sales Tax Discount Worksheet, especially when dealing with sales tax calculations. It is essential to accurately reflect the applicable tax rates, discounts, exemptions, and any other relevant factors that may impact the final sales tax amount. Additionally, the worksheet should adhere to any regulatory requirements set forth by the local or state tax authorities to ensure compliance and accuracy in reporting sales tax transactions.

How can a Sales Tax Discount Worksheet aid in the reconciliation of sales tax payments with financial records?

A Sales Tax Discount Worksheet can aid in the reconciliation of sales tax payments with financial records by providing a detailed breakdown of the sales tax discounts applied to transactions. By using this worksheet, businesses can ensure that the correct discounts have been accounted for and reconcile them with their financial records. This helps in identifying any discrepancies or errors in sales tax calculations, ensuring accurate reporting and compliance with tax regulations.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments