Restaurant Budget Worksheet

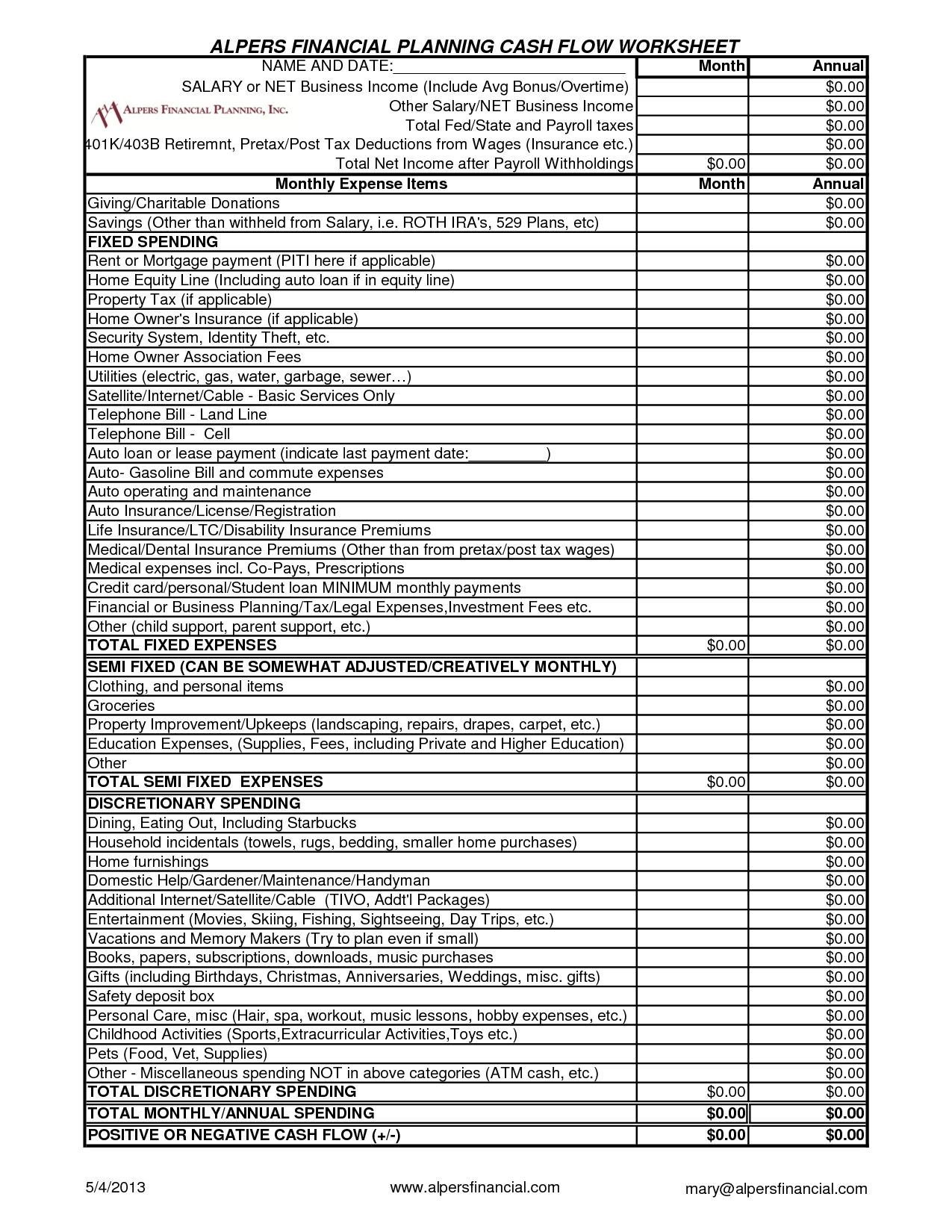

Tracking and managing your restaurant's expenses and revenues is essential to ensure its financial success. That's where a restaurant budget worksheet comes in handy. These worksheets serve as a valuable tool for restaurant owners and managers to keep track of their finances, identify areas of improvement, and make informed business decisions. With a comprehensive restaurant budget worksheet, you can effectively monitor your expenses, track revenues, and manage your cash flow.

Table of Images 👆

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a Restaurant Budget Worksheet?

A Restaurant Budget Worksheet is a financial planning tool used by restaurant owners and managers to track and manage expenses related to running a restaurant. It typically includes categories for fixed costs such as rent, utilities, and insurance, as well as variable costs like food and beverage expenses and labor costs. By using a budget worksheet, restaurant owners can monitor their spending, identify areas for cost control, and ensure that the restaurant stays on track financially.

Why is a Restaurant Budget Worksheet important?

A Restaurant Budget Worksheet is important as it helps restaurant owners effectively manage their finances by tracking expenses, setting financial goals, forecasting revenues, and identifying areas of potential cost savings. It serves as a valuable tool in monitoring the financial health of the business, making informed decisions, and ensuring long-term sustainability and profitability.

What types of expenses should be included in a Restaurant Budget Worksheet?

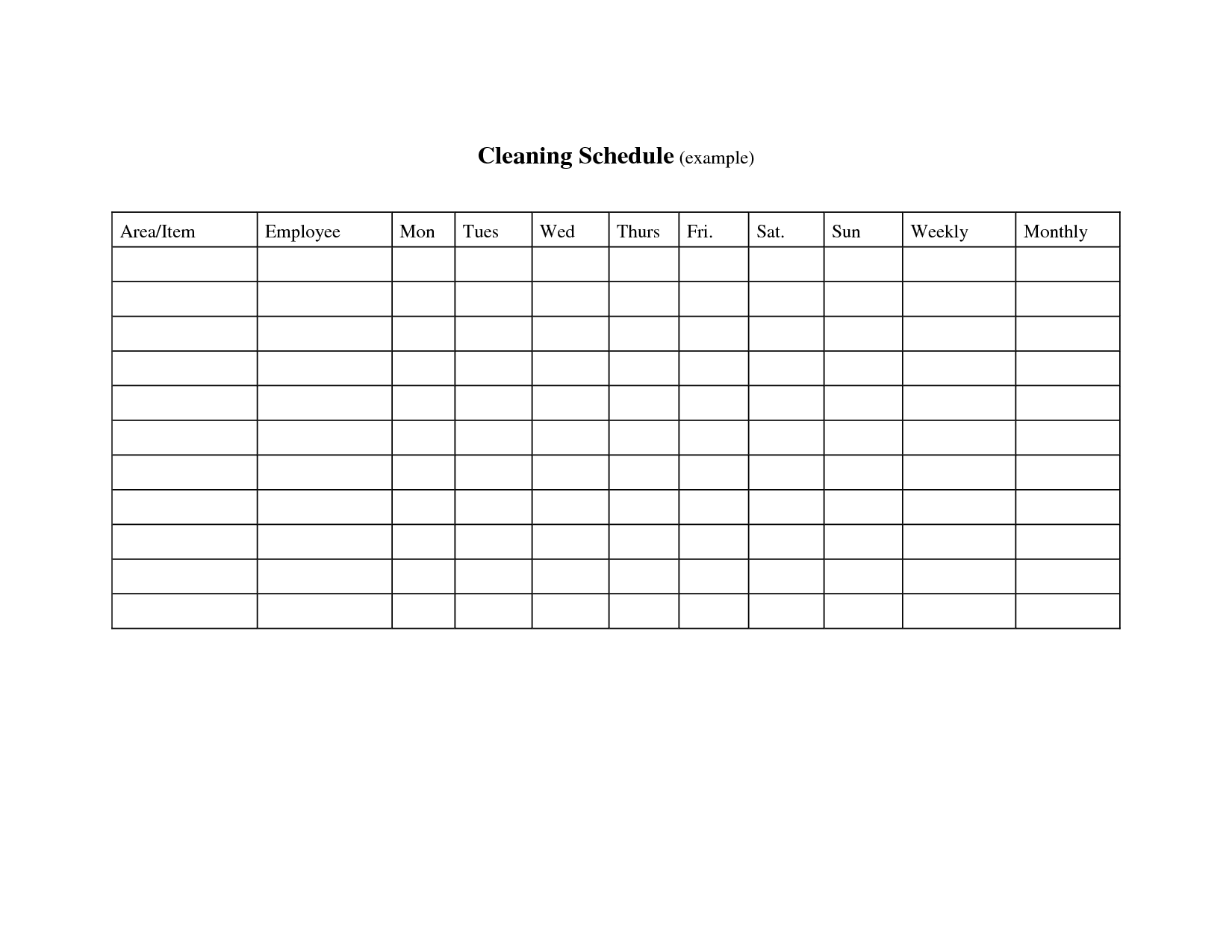

A restaurant budget worksheet should include various types of expenses such as food costs (including ingredients and supplies), labor costs (salaries and wages for employees), rent or lease payments for the space, utilities (electricity, water, gas), equipment maintenance and repair, marketing and advertising expenses, insurance costs, taxes, licensing fees, and other overhead expenses like cleaning supplies, uniforms, and credit card processing fees. Itís important to include all fixed and variable costs in order to accurately track and manage the financials of the restaurant.

How often should a Restaurant Budget Worksheet be updated?

A Restaurant Budget Worksheet should be updated on a regular basis, ideally weekly or at the very least monthly. This will help ensure that the budget remains accurate, reflects any changes in income or expenses, and allows for timely adjustments to be made in order to stay on track financially.

What are the key sections or categories in a Restaurant Budget Worksheet?

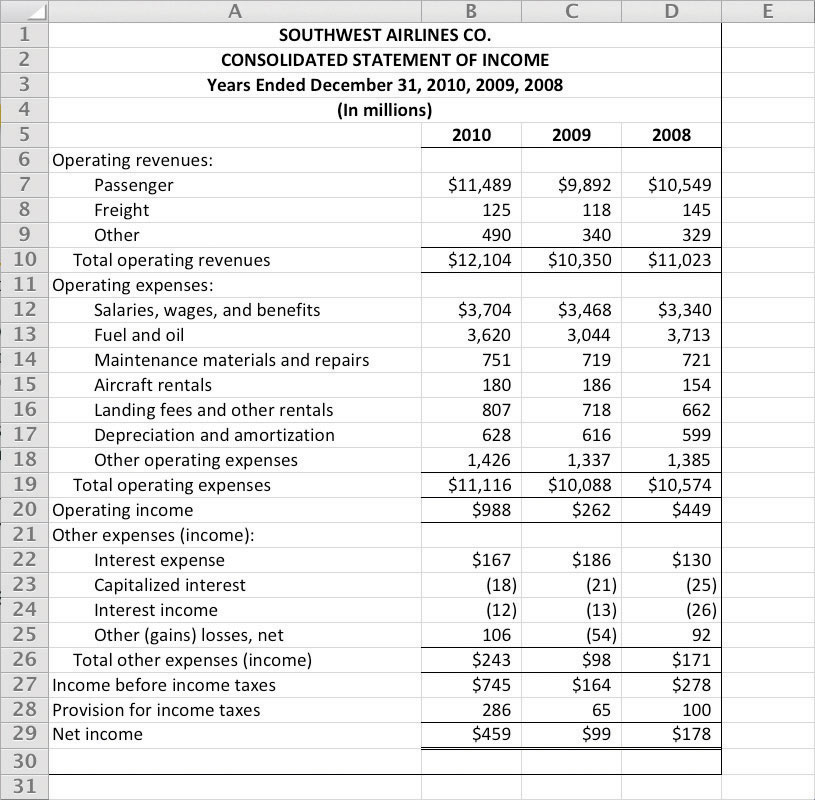

The key sections or categories in a Restaurant Budget Worksheet typically include expenses such as food costs, labor costs, overhead expenses (rent, utilities), marketing and advertising expenses, equipment and maintenance costs, insurance and permits, and other miscellaneous expenses. Additionally, budget worksheets may also include sections for revenue projections, profit margins, and cash flow analysis to provide a comprehensive overview of the restaurant's financial health.

How can a Restaurant Budget Worksheet help in controlling costs?

A Restaurant Budget Worksheet can help in controlling costs by providing a comprehensive overview of all expenses and revenues, allowing for better planning and allocation of resources. By tracking expenses such as ingredients, labor, utilities, and marketing against projected revenues, restaurant owners can identify areas of overspending, make necessary adjustments, and set realistic financial goals. This tool enables effective cost management by highlighting potential savings opportunities, optimizing operational efficiency, and ultimately ensuring the financial health and sustainability of the business.

How does a Restaurant Budget Worksheet contribute to financial planning?

A Restaurant Budget Worksheet is a crucial tool for financial planning as it helps restaurant owners and managers track and manage their expenses, revenues, and overall financial performance. By detailing all income and expenses, such as food costs, labor, utilities, rent, and other overhead costs, the worksheet provides a clear picture of the restaurant's financial health. It allows for setting realistic financial goals, identifying potential cost-saving opportunities, and making informed decisions to improve profitability and ensure the business remains financially sustainable in the long run.

What are some common challenges or pitfalls when creating a Restaurant Budget Worksheet?

Some common challenges or pitfalls when creating a Restaurant Budget Worksheet include underestimating expenses, overlooking seasonal fluctuations, failing to account for unexpected costs, not properly tracking expenses, and neglecting to regularly review and update the budget. It is important to carefully consider all possible expenses, factor in varying revenue streams, maintain accurate financial records, and consistently monitor and adjust the budget to ensure its effectiveness in managing the restaurant's finances.

How can a Restaurant Budget Worksheet be used to track revenue and profit margins?

A Restaurant Budget Worksheet can be used to track revenue and profit margins by inputting all the expected incomes and expenses related to the restaurant's operations, such as food costs, labor expenses, utilities, and other overhead costs. By comparing the actual financial results against the budgeted figures, managers can easily identify areas where revenue is not meeting expectations or where profit margins are not as healthy as projected. This enables them to make informed decisions on cost-cutting measures or revenue-boosting strategies to improve the restaurant's financial performance.

What other financial documents or tools can be used in conjunction with a Restaurant Budget Worksheet?

In conjunction with a Restaurant Budget Worksheet, other financial documents and tools that can be used include profit and loss statements, balance sheets, cash flow statements, inventory tracking sheets, sales forecasts, and cost analysis reports. These tools can provide additional insights into the financial health of the restaurant, help with decision-making, and enable better financial planning and management.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments