Ramsey Debt Snowball Worksheet

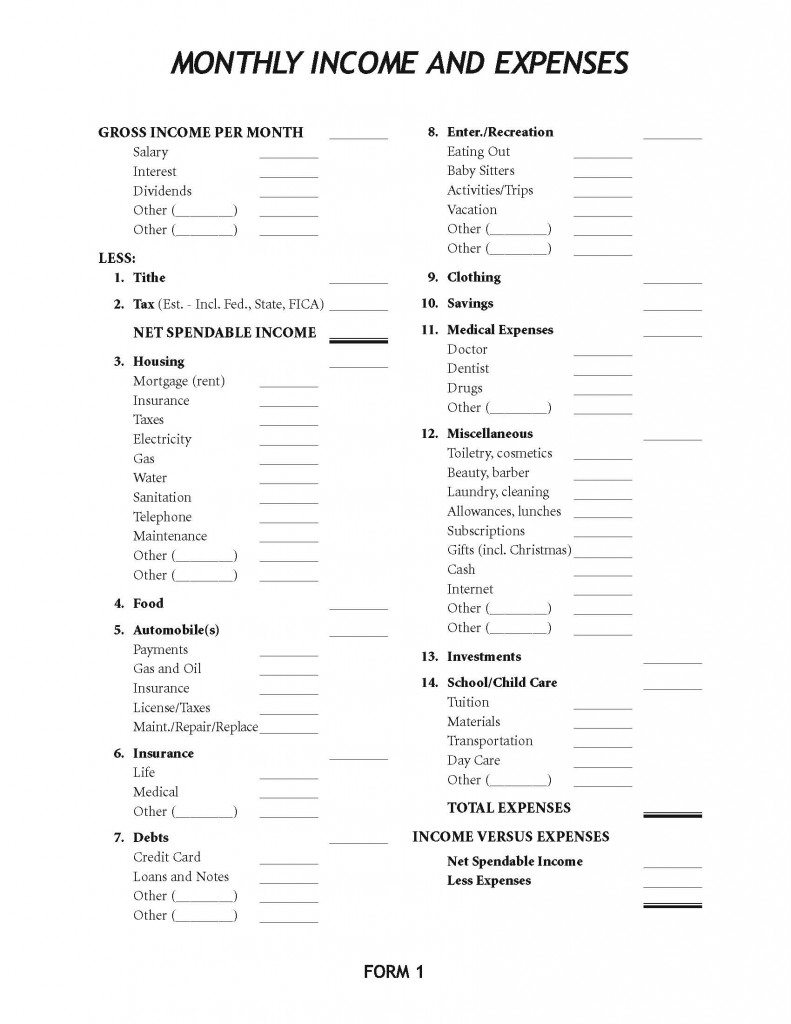

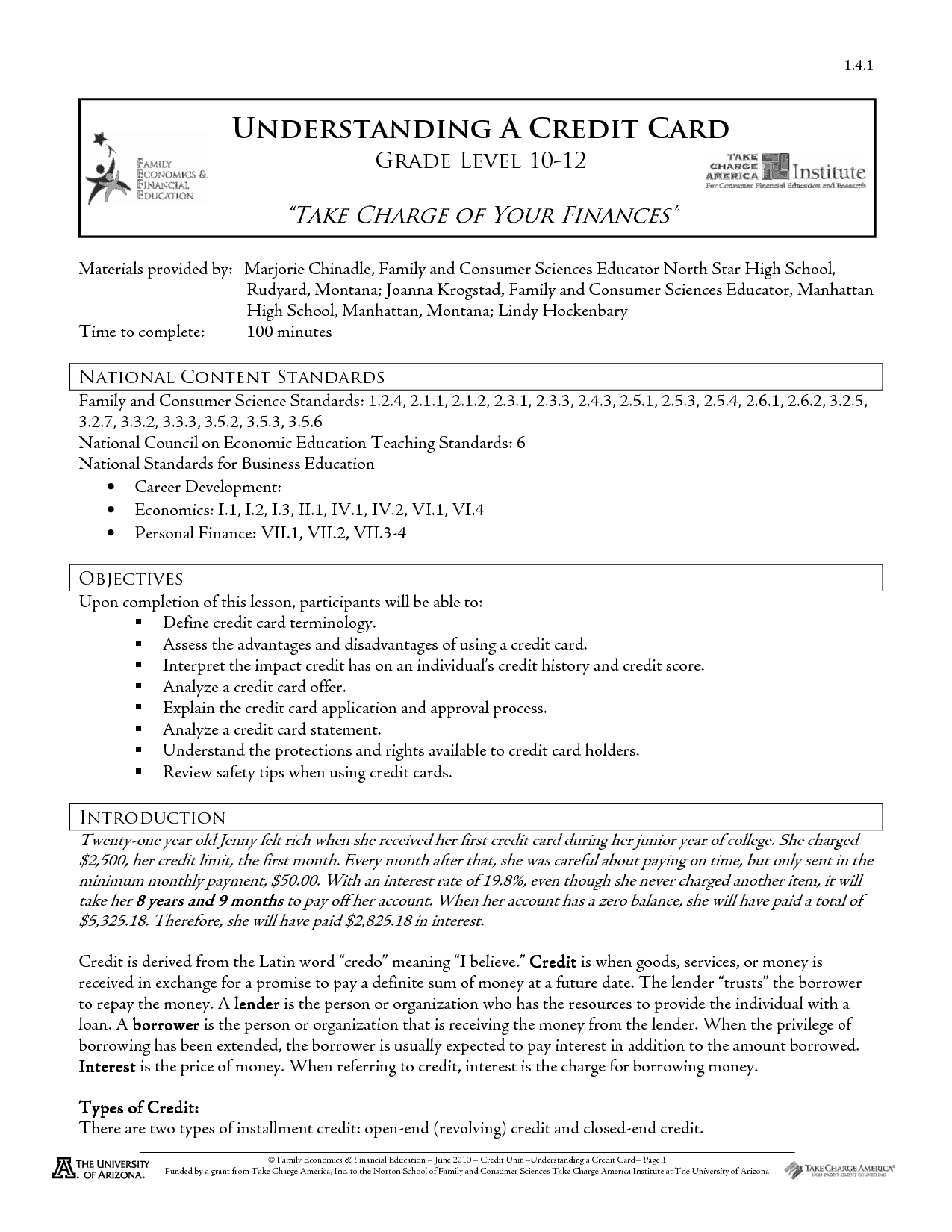

Are you struggling to stay organized with your debts and find it challenging to make progress towards becoming debt-free? Look no further than the Ramsey Debt Snowball Worksheet. This helpful tool is designed to assist individuals who are serious about taking control of their financial future and paying off their debts. Whether you have credit card debt, student loans, or other outstanding balances, this worksheet will help you track your progress and make a plan to tackle your debts one by one.

Table of Images 👆

- Dave Ramsey Debt Snowball Form

- Dave Ramsey Debt Snowball Worksheet

- Snowball Debt Worksheet Template

- Debt Snowball Worksheet Printable

- Dave Ramsey Total Money Makeover Budget

- Dave Ramsey Snowball Budget Forms

- Dave Ramsey Budget Worksheet Printable

- Debt Snowball Worksheet Printable Template

- Family and Consumer Science Worksheets

- Free Printable Dave Ramsey Budget Worksheets

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

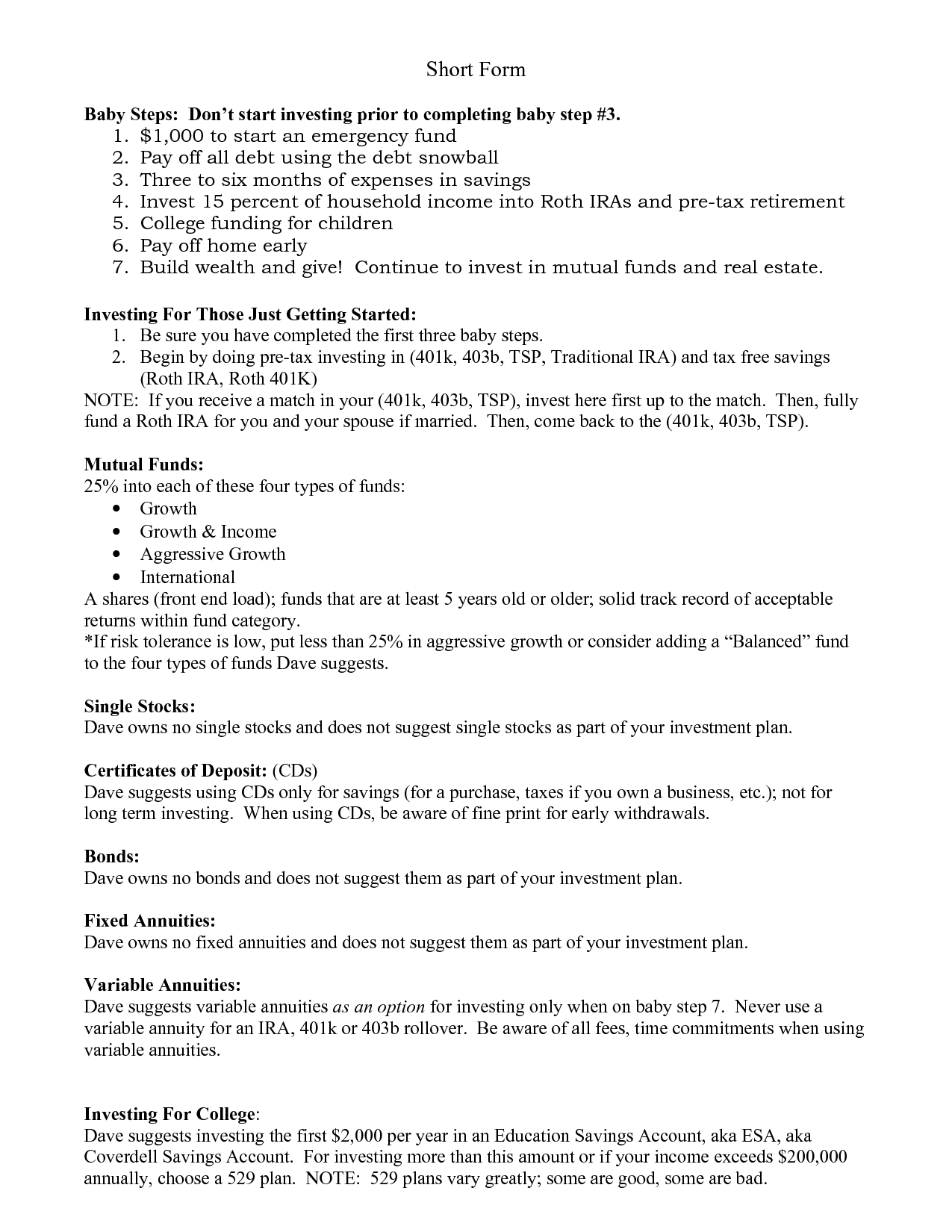

What is the purpose of the Ramsey Debt Snowball Worksheet?

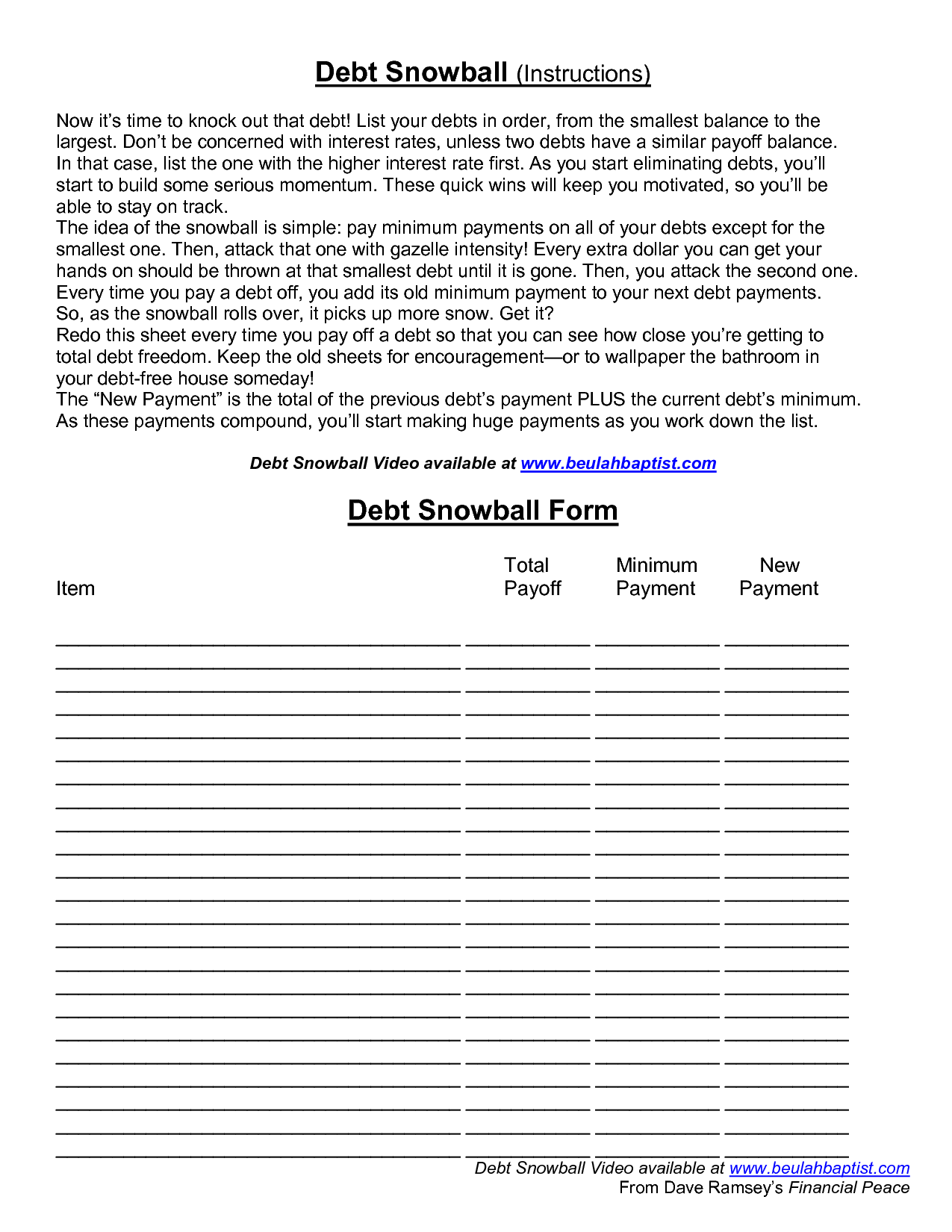

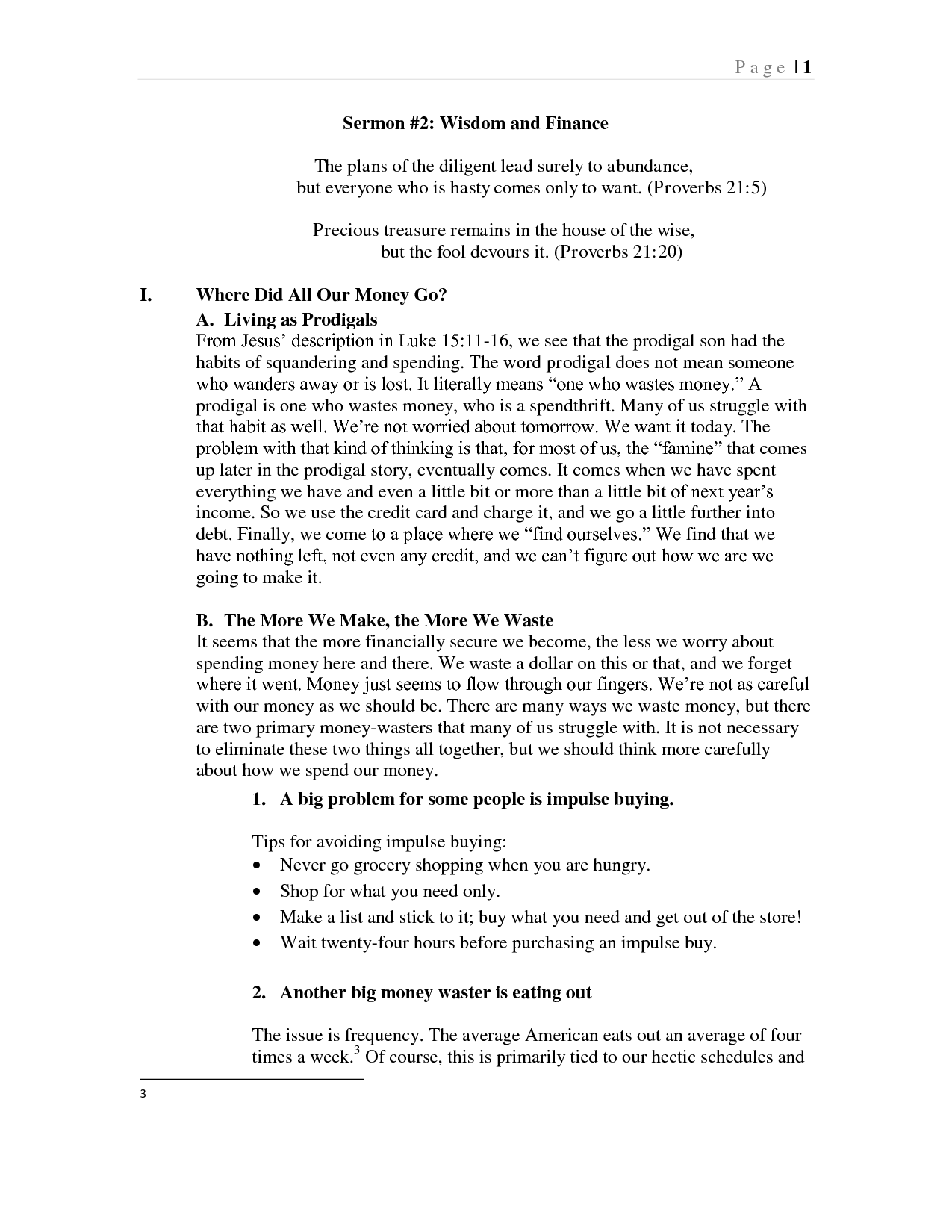

The purpose of the Ramsey Debt Snowball Worksheet is to help individuals prioritize and track their repayment of debts in a strategic manner. By listing debts from smallest to largest and systematically paying off the smallest debt first while making minimum payments on others, individuals can gain momentum and motivation in their debt repayment journey, ultimately leading to a sense of accomplishment and financial freedom as debts are paid off one by one.

How does the Ramsey Debt Snowball Worksheet help with debt repayment?

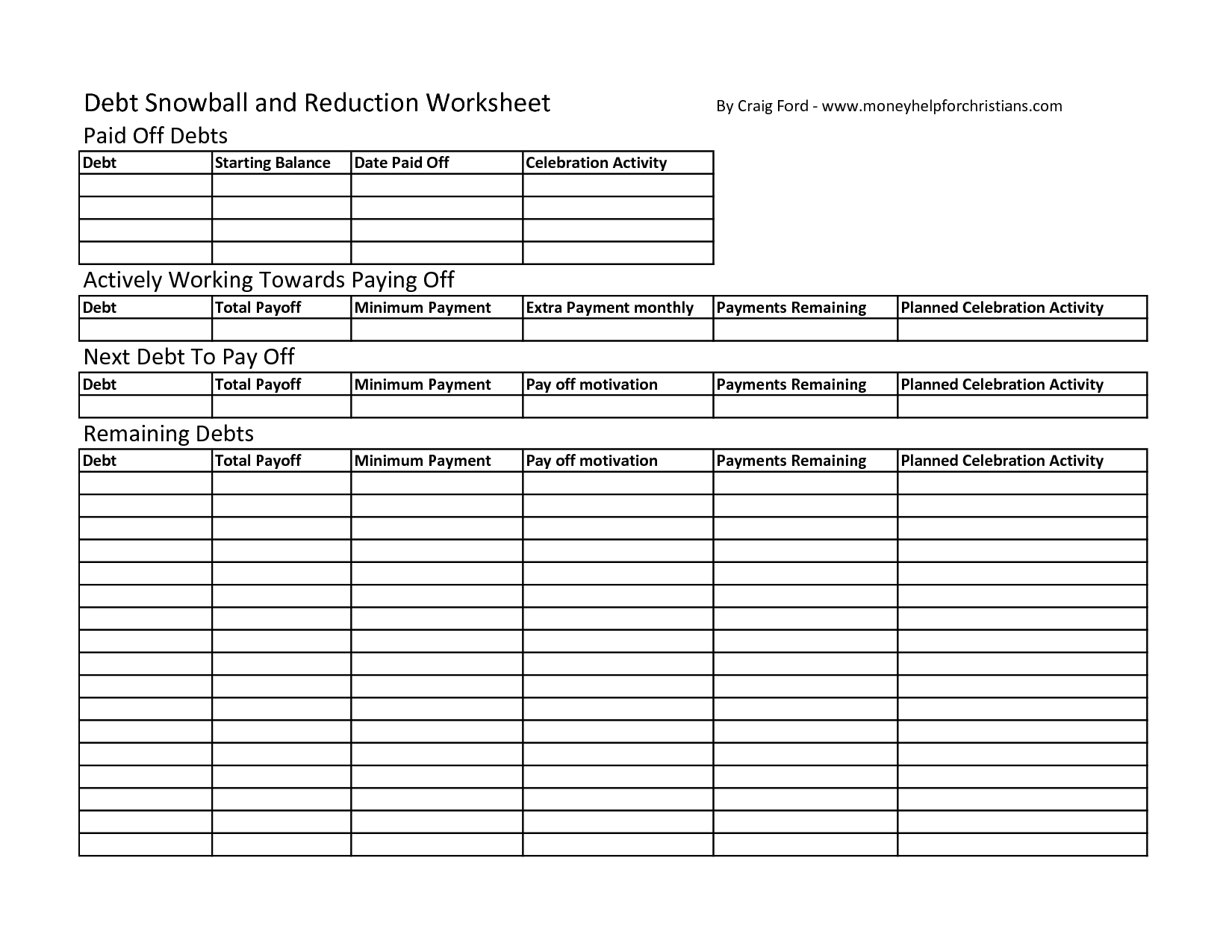

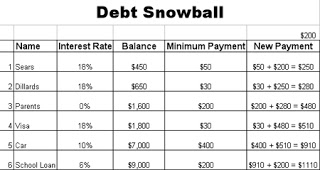

The Ramsey Debt Snowball Worksheet is a tool that helps individuals list their debts from smallest to largest, then allocate extra funds towards paying off the smallest debt first while making minimum payments on the others. Once the smallest debt is paid off, the amount that was being paid towards it is then rolled over to the next smallest debt, creating a snowball effect that increases as each debt is paid off. This method provides a sense of accomplishment and motivation as debts are paid off quicker, helping individuals stay focused and committed to their debt repayment strategy.

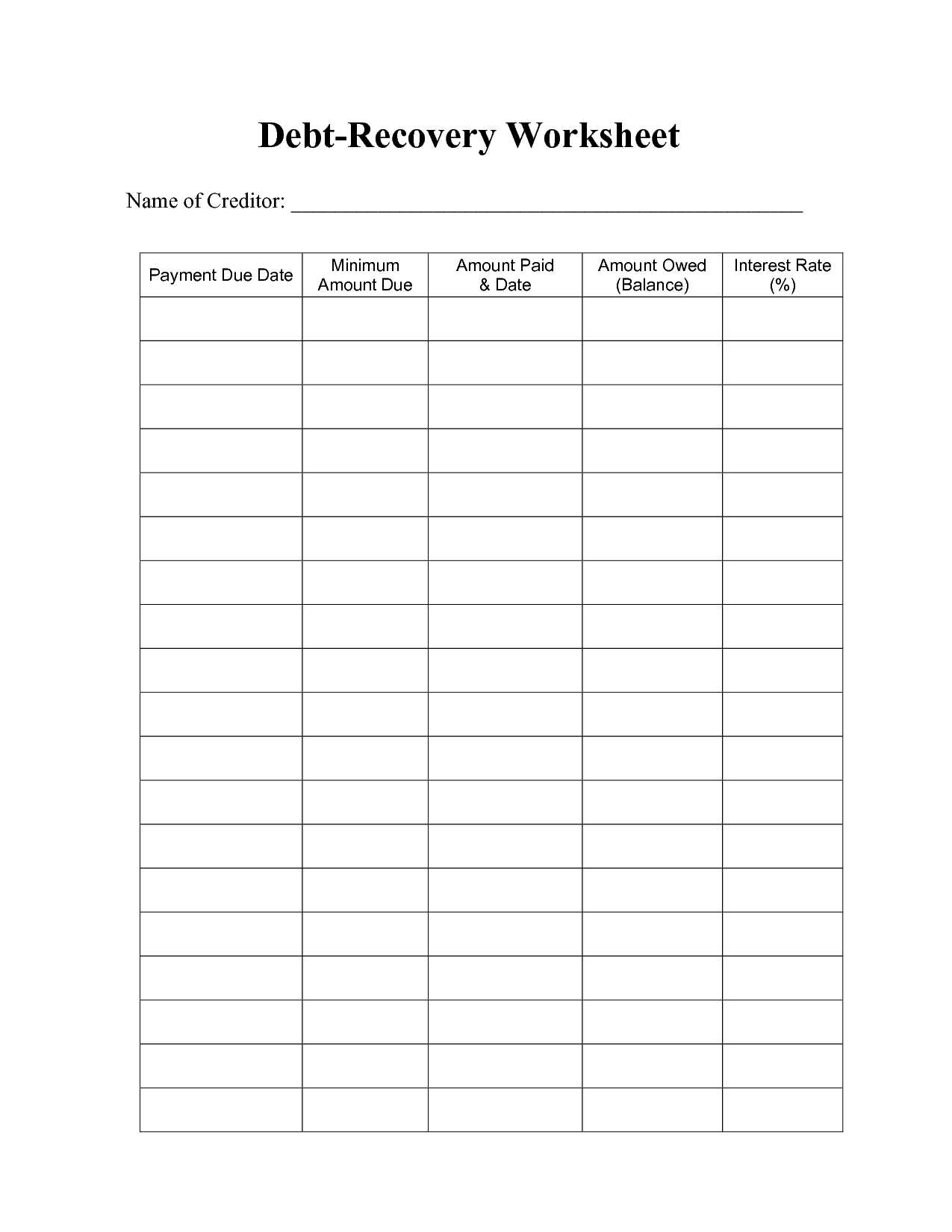

What information is included in the Ramsey Debt Snowball Worksheet?

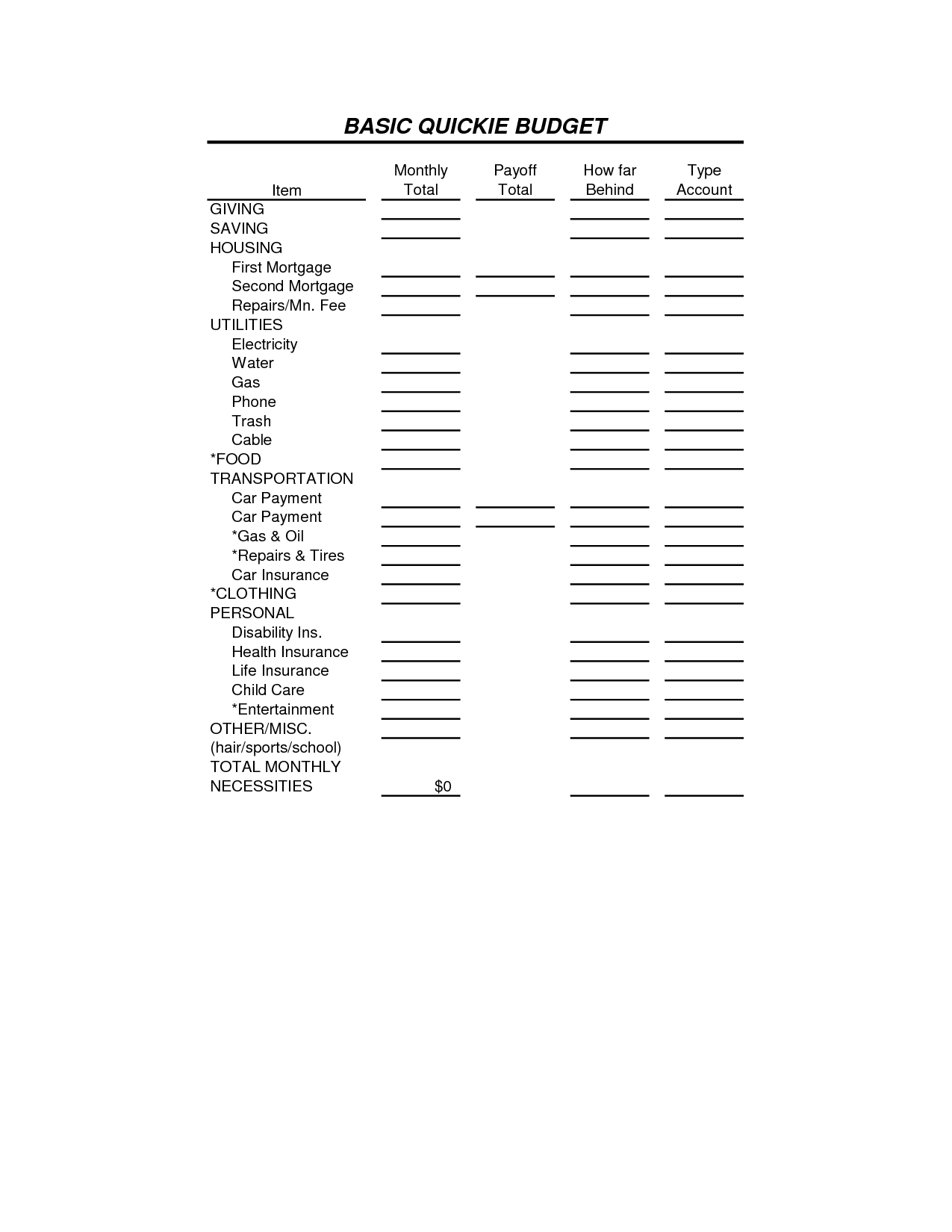

The Ramsey Debt Snowball Worksheet typically includes details such as the name of each debt, the outstanding balance, the minimum monthly payment, the interest rate, and the order in which debts should be paid off. It provides a structured plan for individuals to pay off their debts by focusing on one debt at a time, starting with the smallest balance and progressing to larger balances.

How does the worksheet prioritize which debts to pay off first?

The worksheet prioritizes which debts to pay off first based on factors such as interest rates, outstanding balances, and potential penalty fees. Typically, debts with higher interest rates are targeted first to minimize overall interest costs, followed by debts with lower interest rates. Additionally, debts that carry penalties for late payments or have a substantial impact on credit scores may also be prioritized to avoid additional financial repercussions.

Can the Ramsey Debt Snowball Worksheet be customized for individual situations?

Yes, the Ramsey Debt Snowball Worksheet can be customized for individual situations by adjusting the amounts owed, interest rates, and monthly payments to fit your specific financial circumstances. This customization allows you to tailor the debt repayment plan to better suit your needs and goals, helping you take control of your finances and work towards becoming debt-free.

Does the worksheet take into account interest rates when prioritizing debts?

No, the worksheet does not take into account interest rates when prioritizing debts. It typically focuses on factors such as total amount owed, due dates, and types of debts to help individuals organize and manage their debts effectively. If you want to prioritize debts based on interest rates, you may need to adjust the worksheet or use a different approach that considers interest costs.

How often should the Ramsey Debt Snowball Worksheet be updated?

The Ramsey Debt Snowball Worksheet should be updated whenever there is a change in your financial situation, such as paying off a debt or incurring a new one, or a change in your income that may affect your ability to pay off your debts. It is recommended to review and update your worksheet regularly, such as monthly or every time you make a payment towards your debts, to stay on track with your debt repayment goals.

Does the worksheet track progress towards debt repayment goals?

Yes, the worksheet can track progress towards debt repayment goals by including columns for current debt balances, monthly payments, and remaining balances. This allows you to monitor how much debt has been paid off over time and track if you are on target to meet your repayment goals.

Can the Ramsey Debt Snowball Worksheet be used for different types of debts, such as credit card debts or student loans?

Yes, the Ramsey Debt Snowball Worksheet can be used for different types of debts, including credit card debts and student loans. The worksheet helps individuals to prioritize and track their debts by listing them from smallest to largest balances, regardless of the type of debt. It encourages people to focus on paying off the smallest debt first and then rolling the payments into the next debt, creating a snowball effect that can help to eliminate debts more quickly.

Are there any additional resources or tools that accompany the Ramsey Debt Snowball Worksheet?

Yes, there are additional resources and tools that accompany the Ramsey Debt Snowball Worksheet, such as budgeting spreadsheets, debt calculators, online forums for support and advice, and financial coaching services offered through Dave Ramsey's website and programs. These resources can further help individuals track their progress, stay motivated, and receive guidance on their journey to financial freedom.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments