Personal Spending Budget Worksheet

Creating and sticking to a personal spending budget is key to managing your finances effectively. You need a tool that not only helps you track your expenses but also provides a clear overview of where your money is going. A personal spending budget worksheet can be the perfect solution for keeping your financial matters in order and achieving your financial goals.

Table of Images 👆

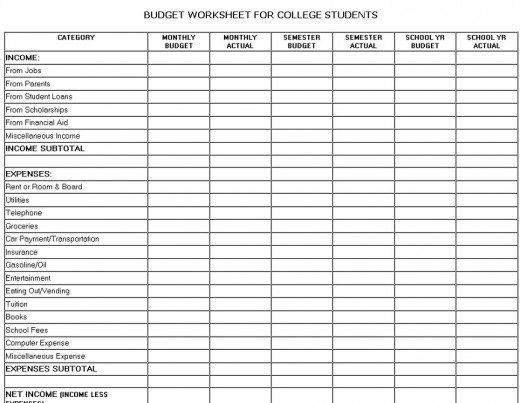

- Money Budget Worksheet

- Daily Budget Worksheet Printable

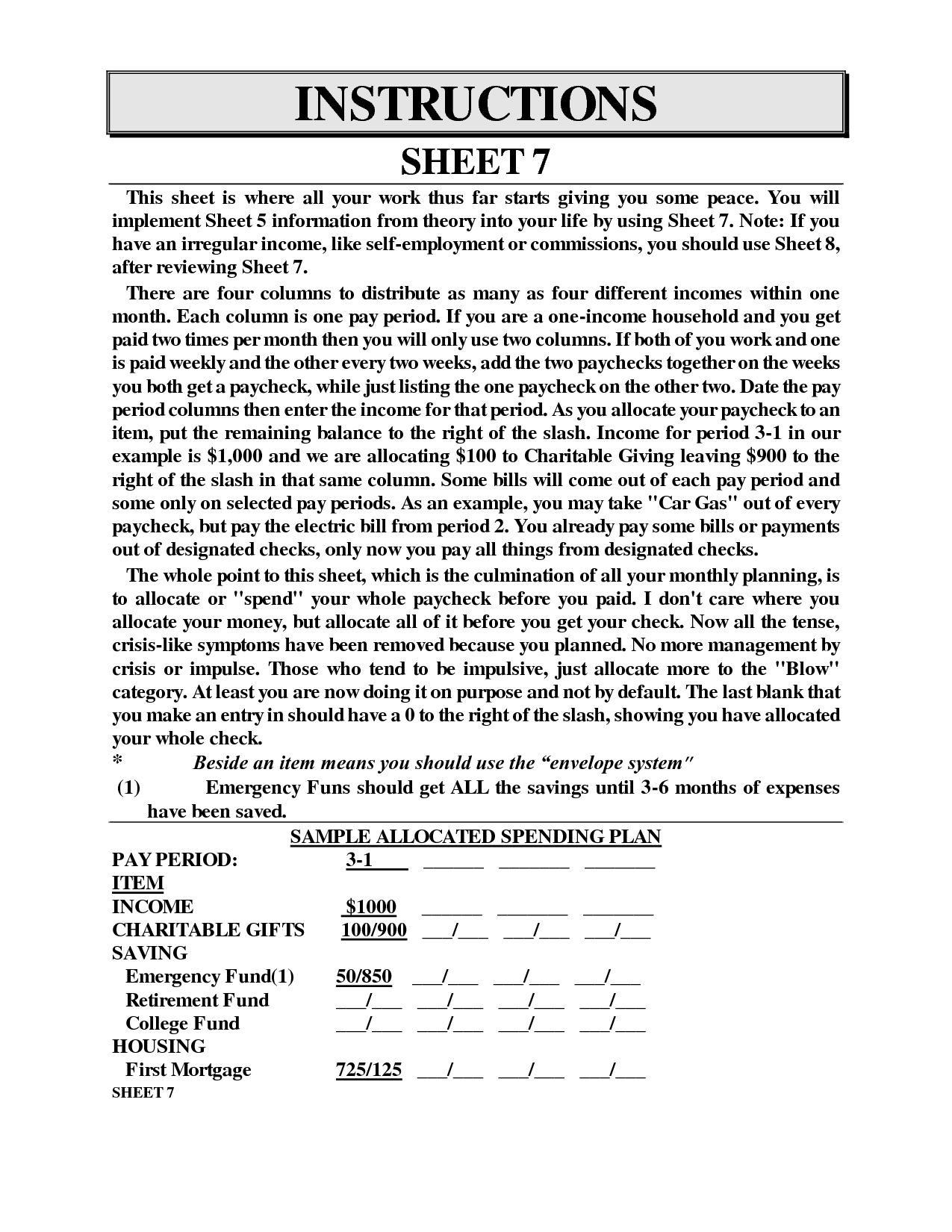

- Dave Ramsey Allocated Spending Plan Budget

- Free Printable Business Budget Worksheets

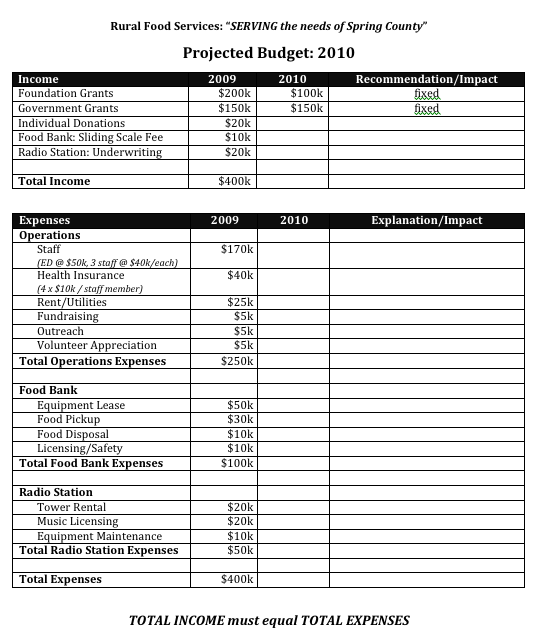

- Non-Profit Budget Worksheet

- Free Printable Weekly Budget Template

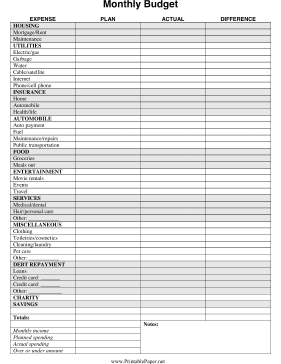

- Printable Monthly Budget Paper

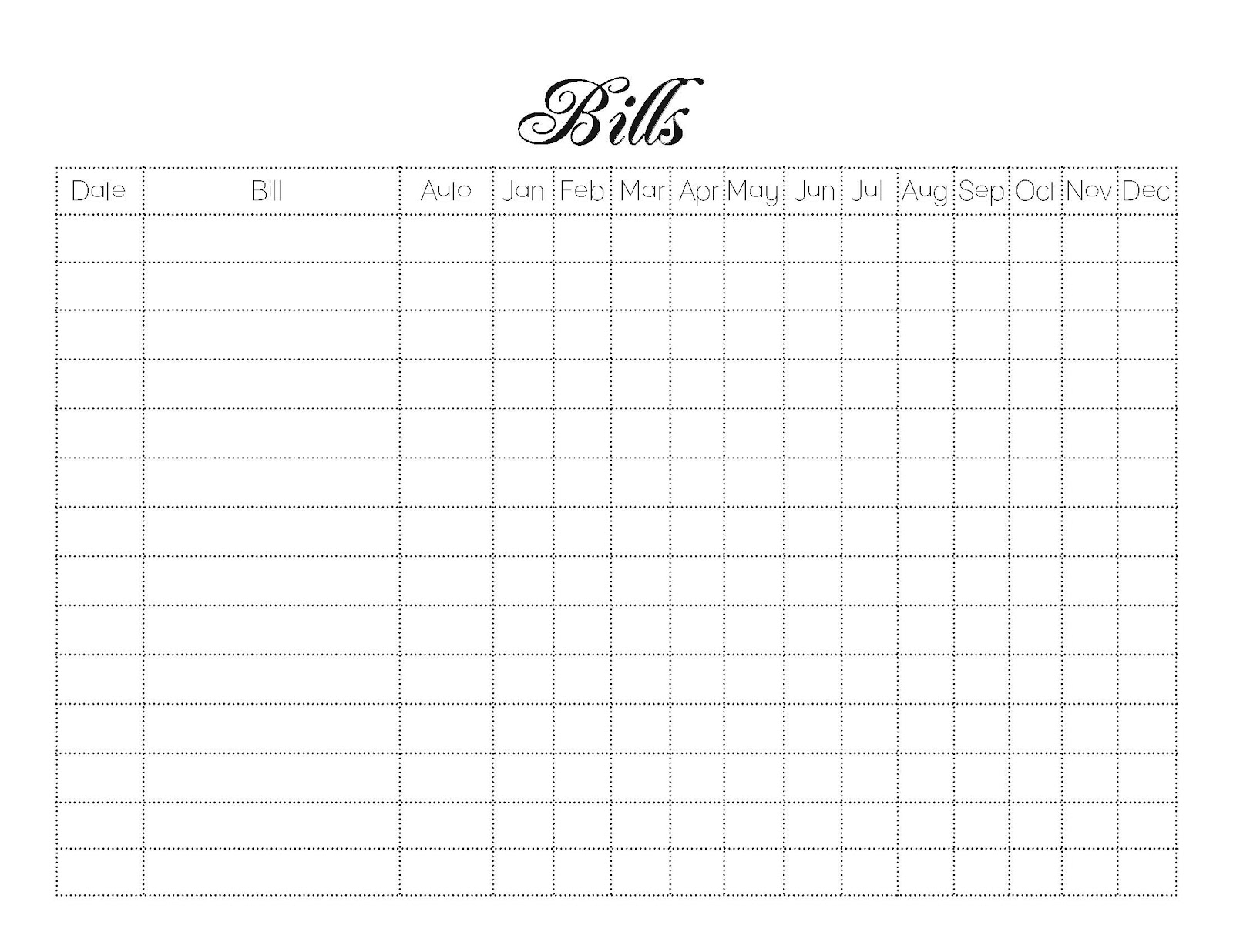

- Free Printable Monthly Bill Templates

- Investment Term Sheet Template

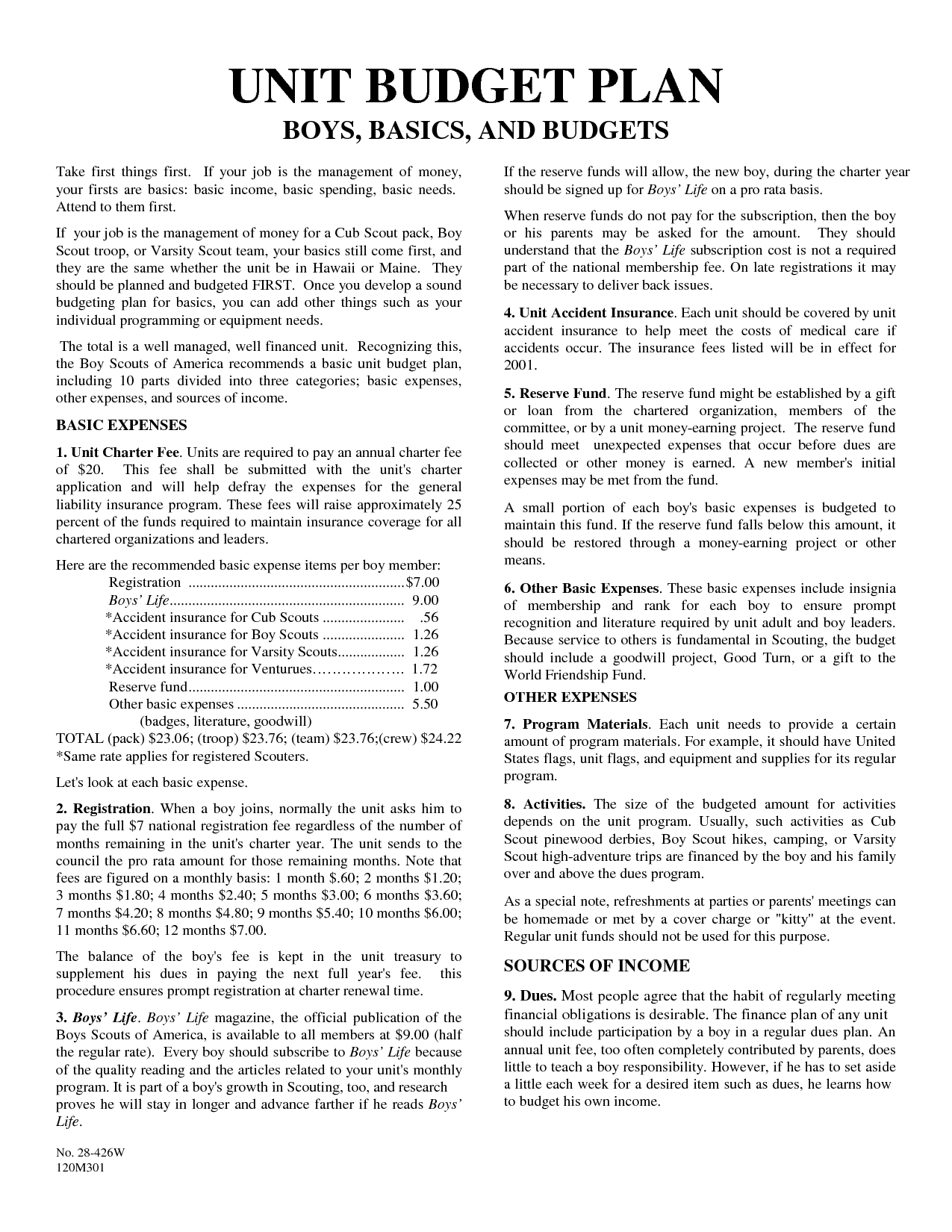

- Sample Nursing Unit Budget

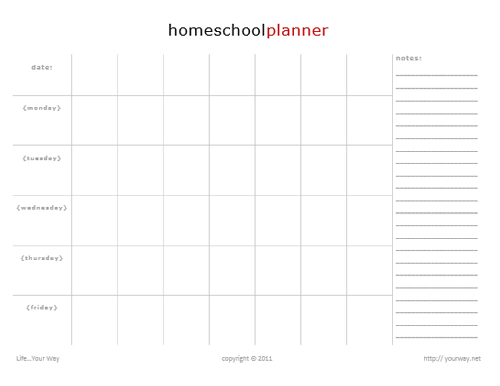

- Free Printable Homeschool Planner Cover

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a Personal Spending Budget Worksheet?

A Personal Spending Budget Worksheet is a tool used to track and manage income and expenses in order to create a financial plan. It typically includes categories such as income, fixed expenses (e.g. rent, bills), variable expenses (e.g. groceries, entertainment), and savings goals. By using a budget worksheet, individuals can gain insight into their spending habits, identify areas where they can cut back, and ultimately achieve their financial goals.

What is the purpose of using a Personal Spending Budget Worksheet?

The purpose of using a Personal Spending Budget Worksheet is to track and manage one's expenses in order to gain a better understanding of where their money is being spent. It helps individuals create a plan for spending, prioritize expenses, and identify areas where they can potentially save money or cut back on spending. By using a budget worksheet, individuals can take control of their finances, work towards financial goals, and make more informed decisions about their spending habits.

How can a Personal Spending Budget Worksheet help in tracking expenses?

A Personal Spending Budget Worksheet can help in tracking expenses by providing a structured format to list and categorize income and expenses. By recording all expenses and income on the worksheet, one can easily see where money is being spent, identify areas where expenses can be reduced, and track progress towards financial goals. The worksheet serves as a visual representation of financial habits and allows for accurate monitoring of spending patterns over time, enabling better decision-making and financial planning.

What categories should be included in a Personal Spending Budget Worksheet?

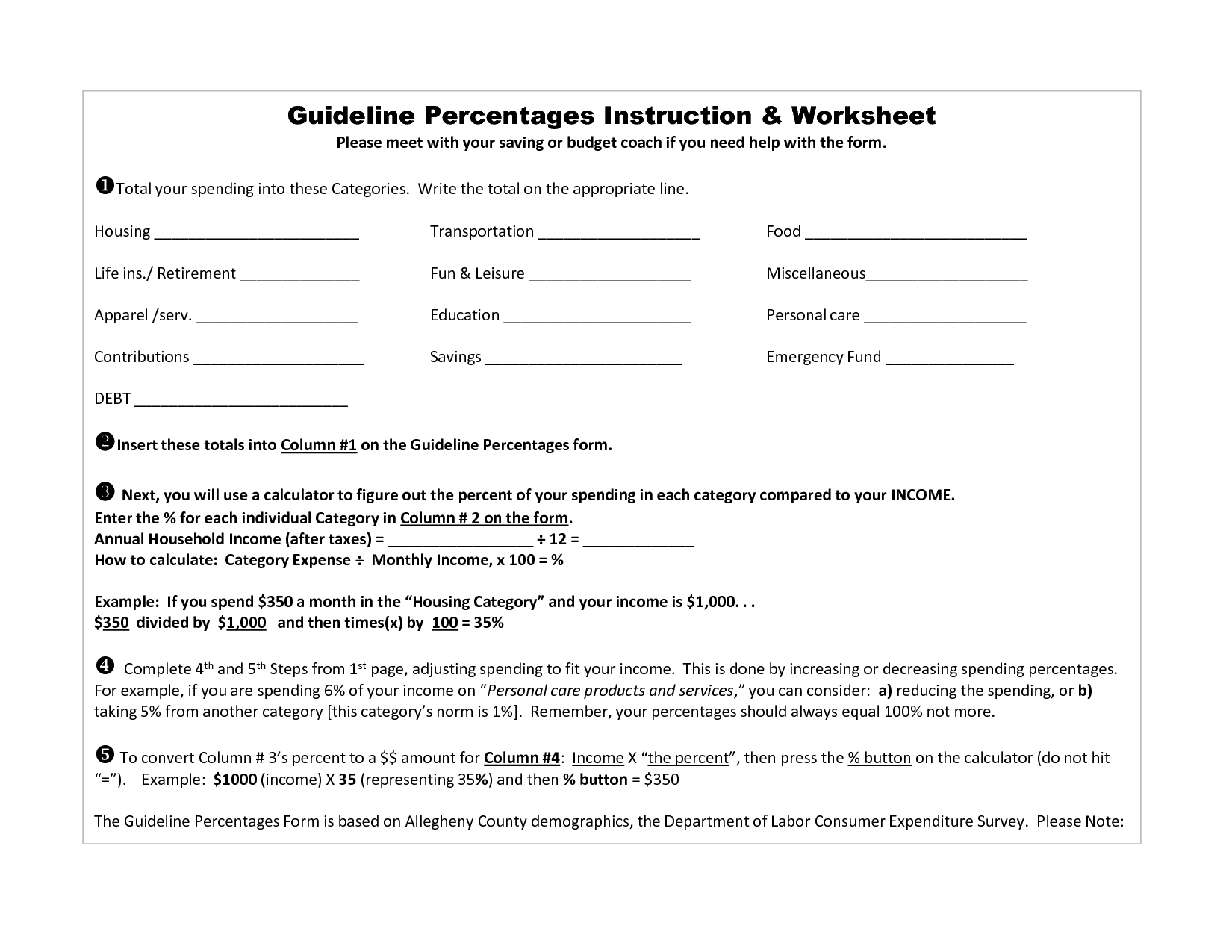

A Personal Spending Budget Worksheet should ideally include categories such as housing expenses (rent/mortgage, utilities), transportation costs (car payments, gas, public transit), food expenses (groceries, dining out), healthcare expenses, insurance payments, debt payments, savings contributions, entertainment and leisure, personal care, and miscellaneous expenses. Creating a budget that encompasses these categories can help individuals monitor their spending, prioritize their financial goals, and make necessary adjustments to improve their financial well-being.

How often should a Personal Spending Budget Worksheet be updated?

A Personal Spending Budget Worksheet should ideally be updated on a monthly basis to accurately track income, expenses, savings, and financial goals. Regularly updating the budget allows for better financial planning and adjustments to be made based on changing circumstances or unexpected expenses. This consistent monitoring can also help in identifying potential areas for improvement and ensure that financial goals are being met effectively.

What information should be recorded in each category of a Personal Spending Budget Worksheet?

In a Personal Spending Budget Worksheet, crucial information to record in each category includes income sources and amounts, fixed expenses such as rent and utilities, variable expenses such as groceries and entertainment, discretionary spending like dining out or shopping, savings contributions, and any debts or loans to be paid off. It is important to track and update these figures regularly to ensure an accurate representation of your financial situation and make informed decisions about managing your finances.

What are the benefits of using a Personal Spending Budget Worksheet?

A Personal Spending Budget Worksheet helps individuals track their income and expenses, allowing them to gain a clear understanding of where their money is going. By using the worksheet, individuals can easily identify areas in which they can cut back on spending, save more money, and reach their financial goals. It also helps in creating a sense of control and awareness over personal finances, leading to better financial decision-making and overall financial health.

How can a Personal Spending Budget Worksheet help in identifying unnecessary expenses?

A Personal Spending Budget Worksheet can help in identifying unnecessary expenses by providing a detailed breakdown of all income and expenses. By tracking all expenses, individuals can see where their money is going and identify areas where they may be overspending or allocating funds towards non-essential items. This allows them to make informed decisions about cutting unnecessary expenses and reallocating funds towards more important financial goals.

What steps can be taken to stick to the budget outlined in a Personal Spending Budget Worksheet?

To stick to the budget outlined in a Personal Spending Budget Worksheet, track your expenses regularly to compare them against your budget, make adjustments as needed, prioritize essential expenses over non-essential ones, avoid impulse purchases, look for ways to cut costs (like cooking at home instead of dining out or using discounts/coupons), set short-term financial goals to stay motivated, and regularly review and adjust your budget to ensure it aligns with your financial goals and priorities.

How can a Personal Spending Budget Worksheet help in achieving long-term financial goals?

A Personal Spending Budget Worksheet can help in achieving long-term financial goals by providing a clear overview of one's income and expenses, enabling them to track and manage their spending effectively. By creating a budget and sticking to it, individuals can identify areas where they can cut costs and save more money towards their long-term financial goals, such as buying a house, saving for retirement, or paying off debt. Regularly reviewing and adjusting the budget based on changing circumstances can ensure that they stay on track towards achieving their financial objectives in the long run.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments