Personal Money Management Worksheets

Managing your personal finances can be a daunting task, but with the right tools, it becomes much more manageable. Personal money management worksheets are a great way to keep track of your income, expenses, and savings. These worksheets are designed to help you stay organized and make informed financial decisions. Whether you are a college student looking to budget your limited funds or a young professional wanting to save up for a big purchase, these worksheets will provide you with the entity and subject you need to take control of your money.

Table of Images 👆

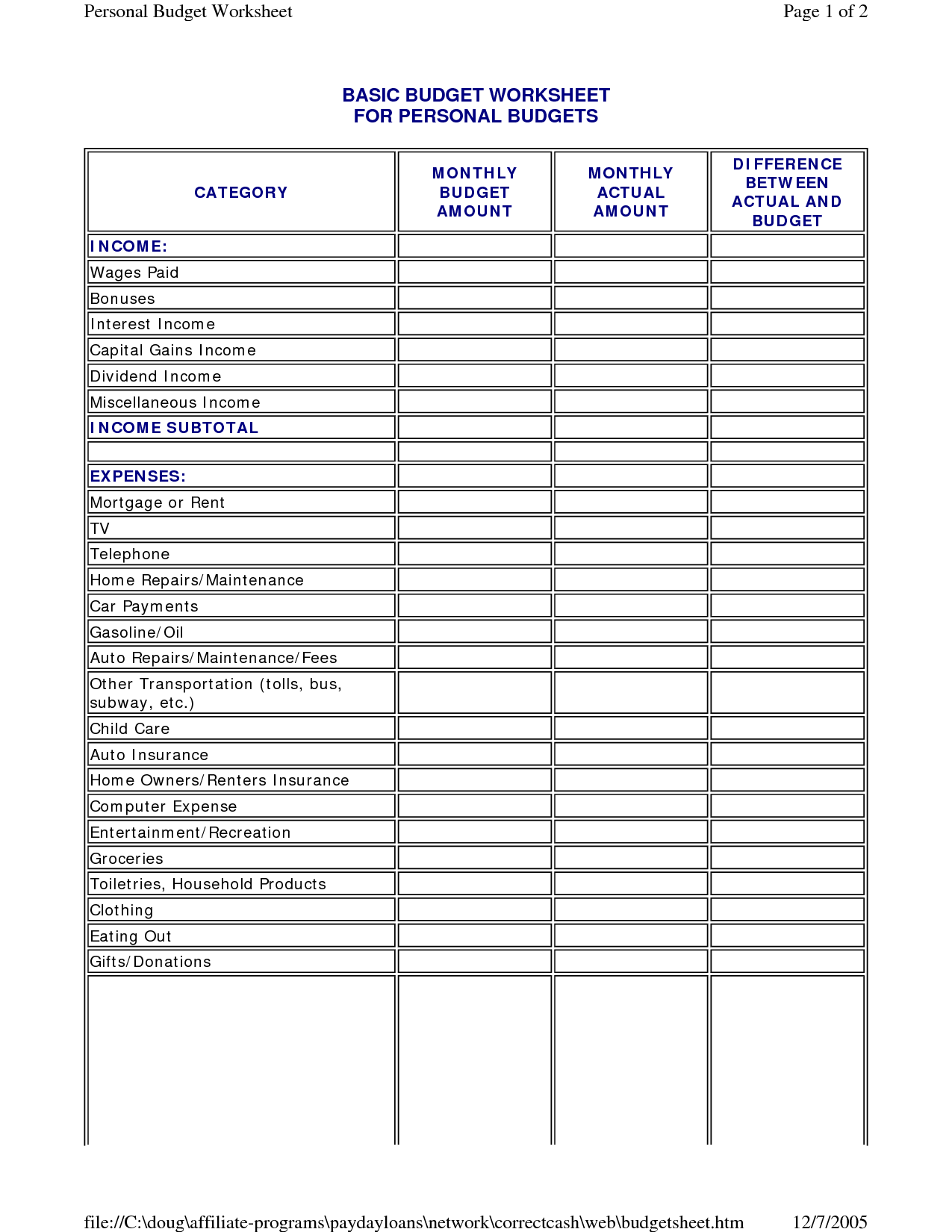

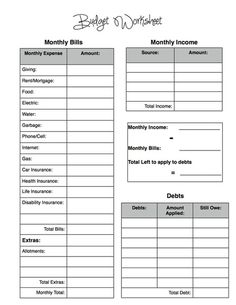

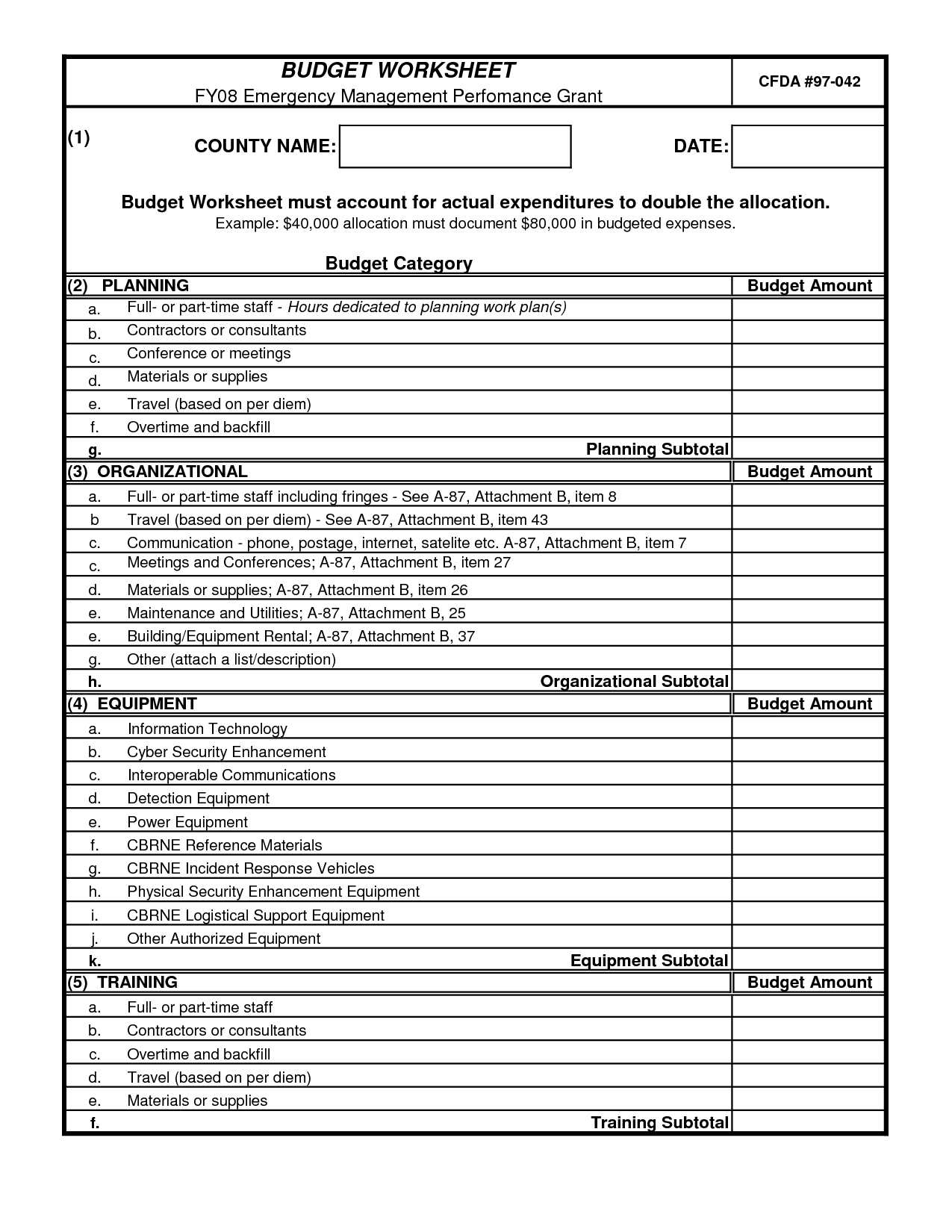

- Basic Budget Worksheet Template

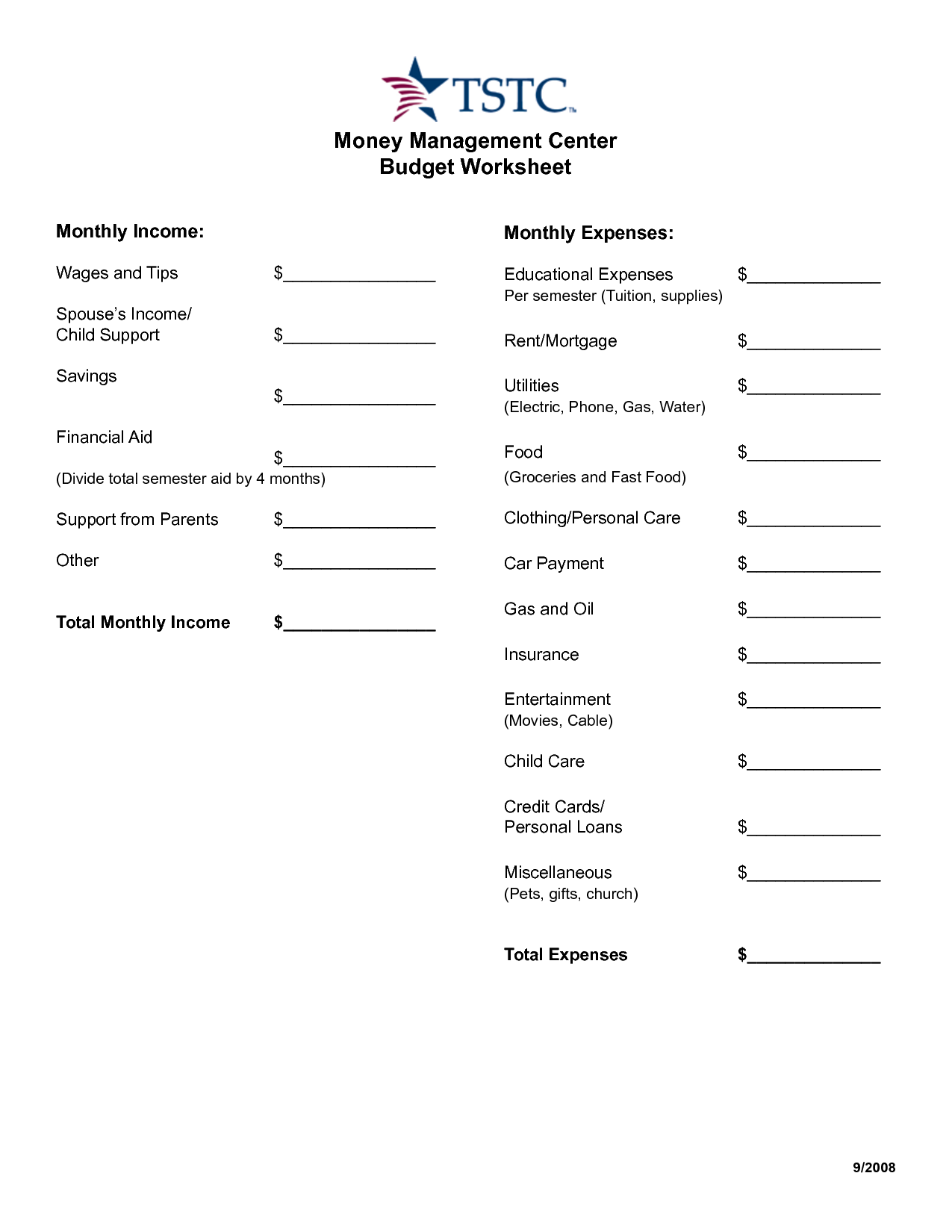

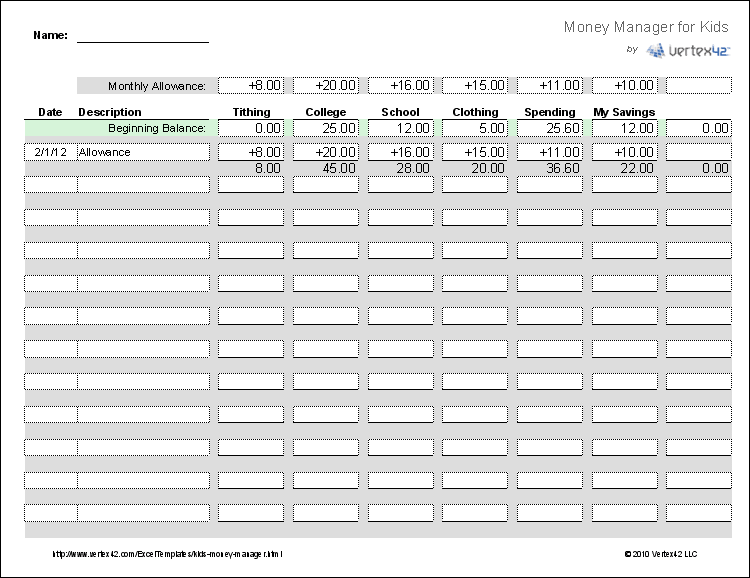

- Money Management Worksheets

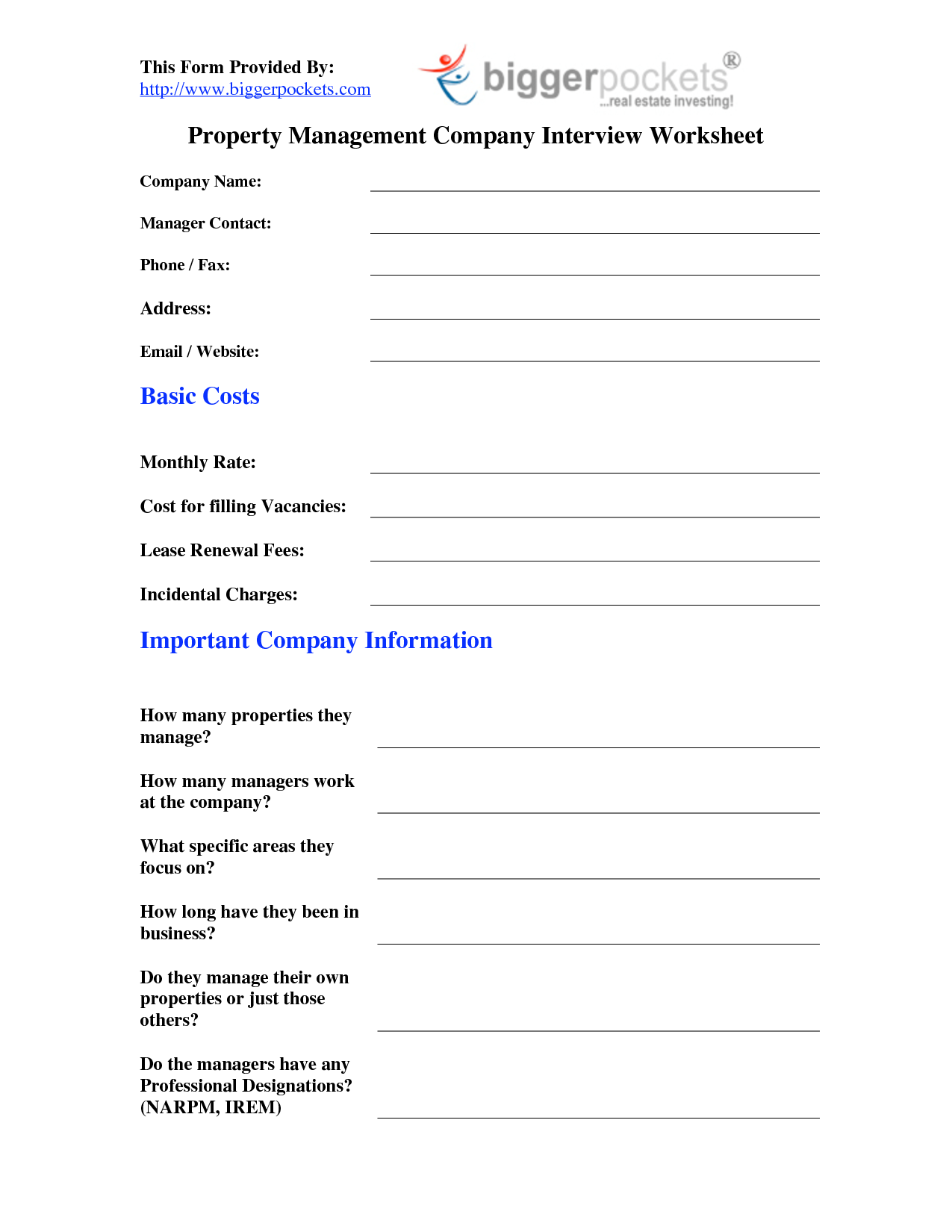

- Basic Money Management Worksheets

- Daily Budget Tracking Worksheet

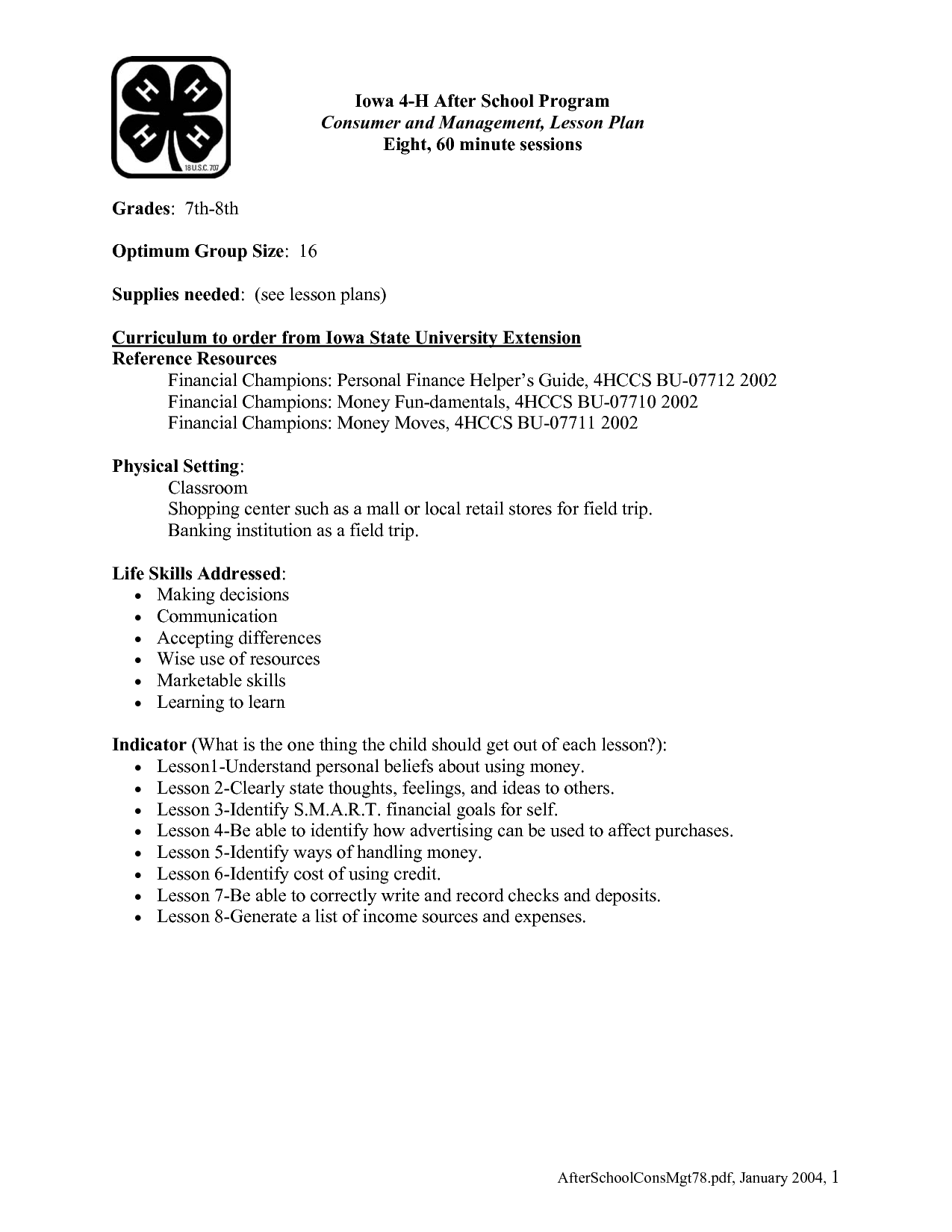

- Money Management Lesson Plans

- Free Printable Dave Ramsey Budget Worksheets

- Free Printable Monthly Budget Worksheet

- Budget Worksheet Template for Young Adults

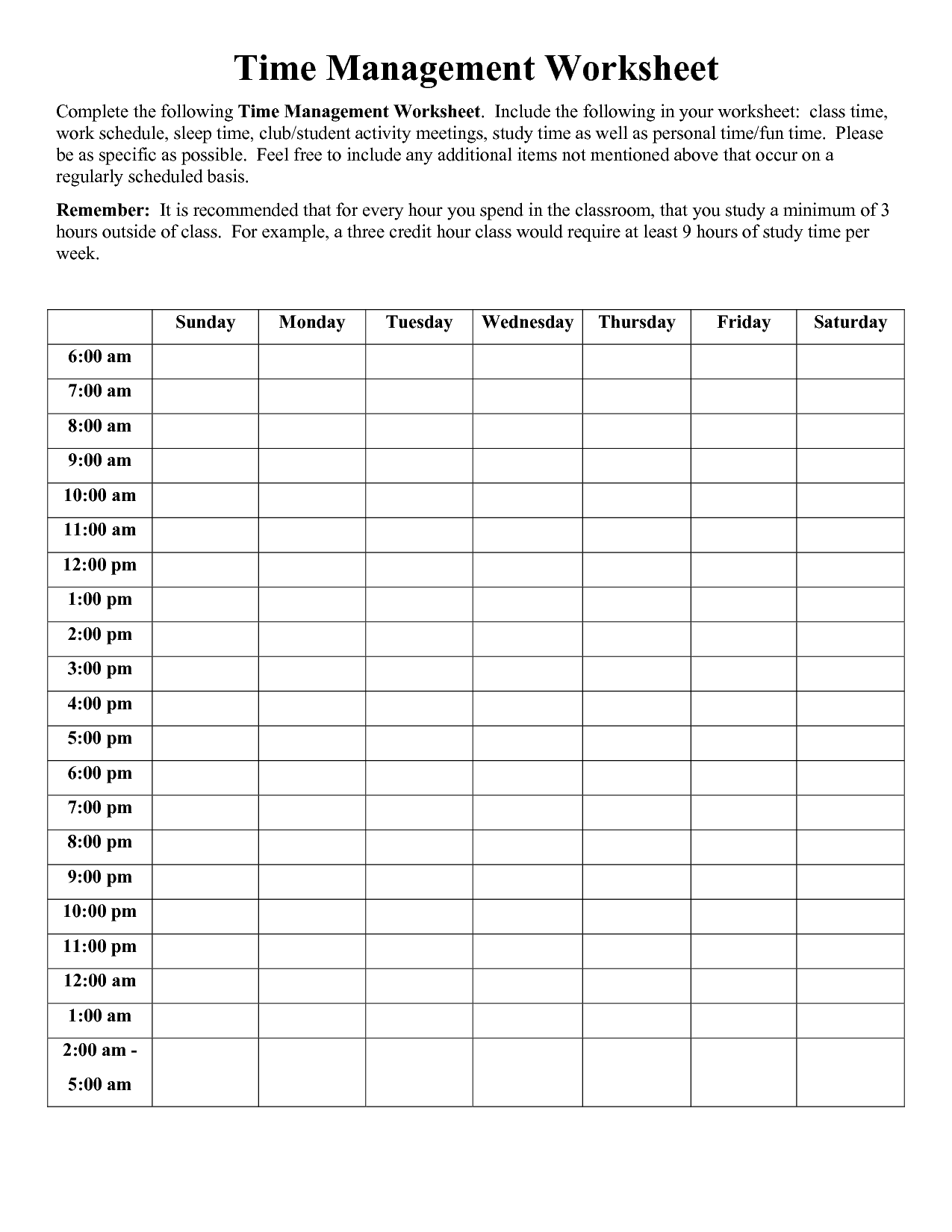

- Time Management Worksheet PDF

- Money Budget Worksheet Sample

- Printable Home Budget Worksheets

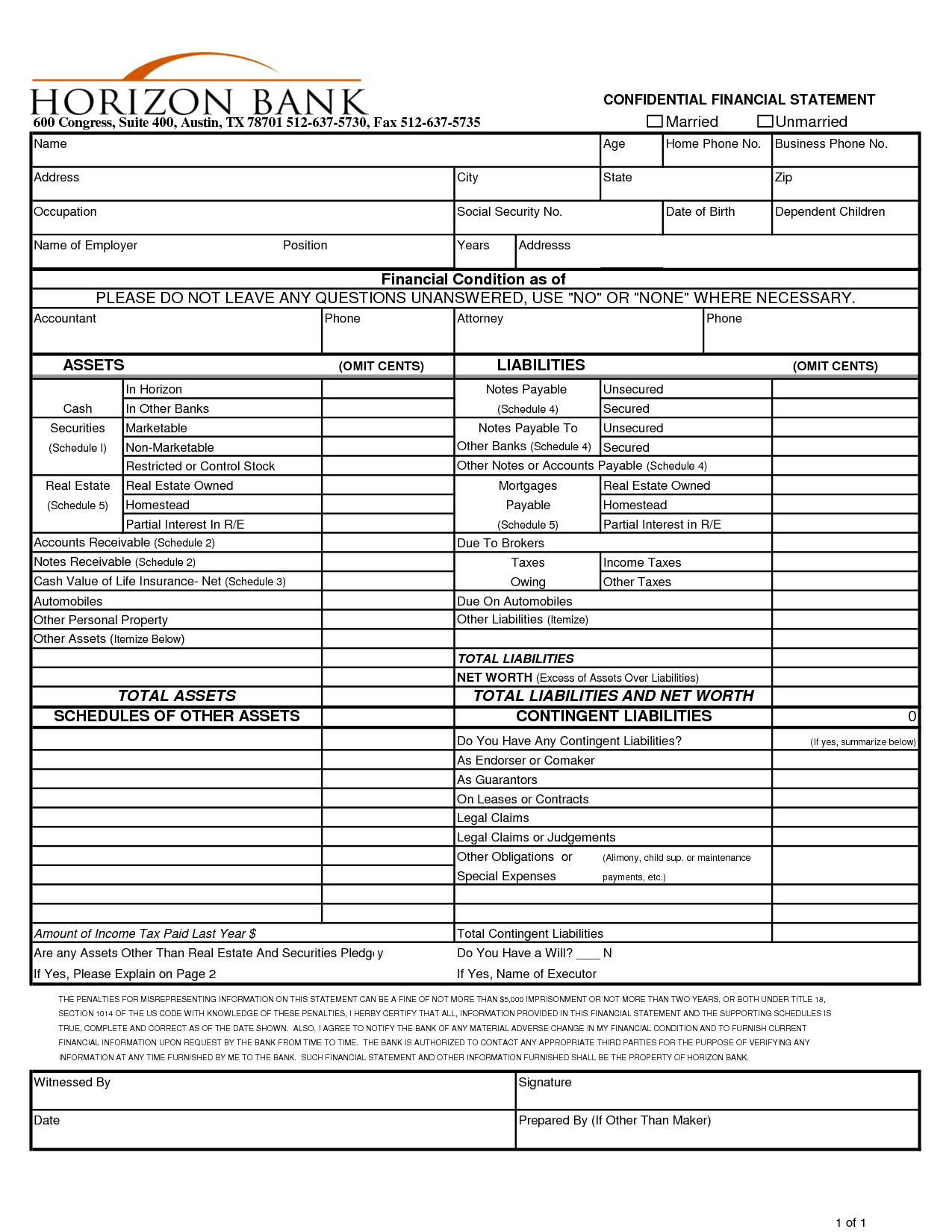

- Personal Financial Statement Form

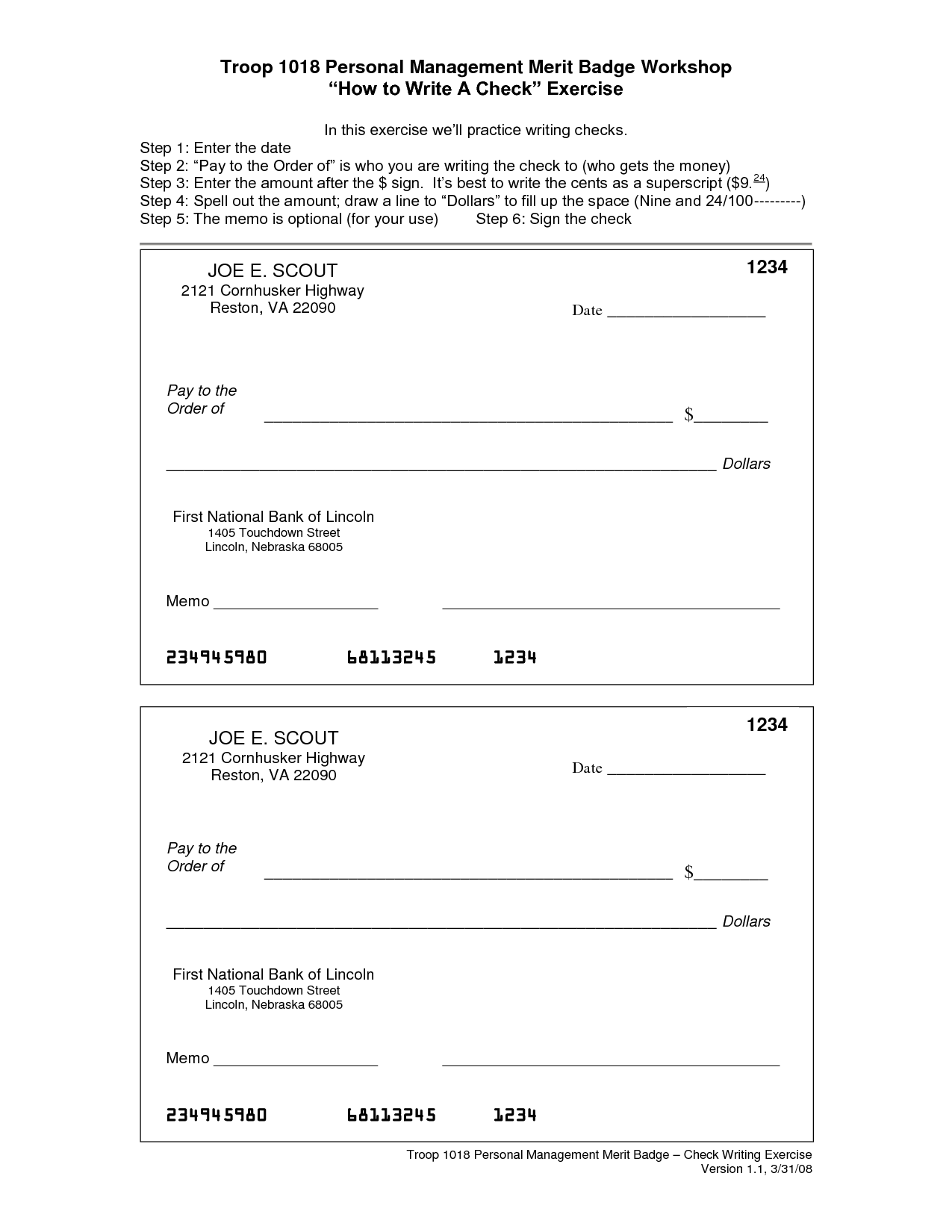

- Personal Management Merit Badge Worksheet

- Money Management Skills Worksheets

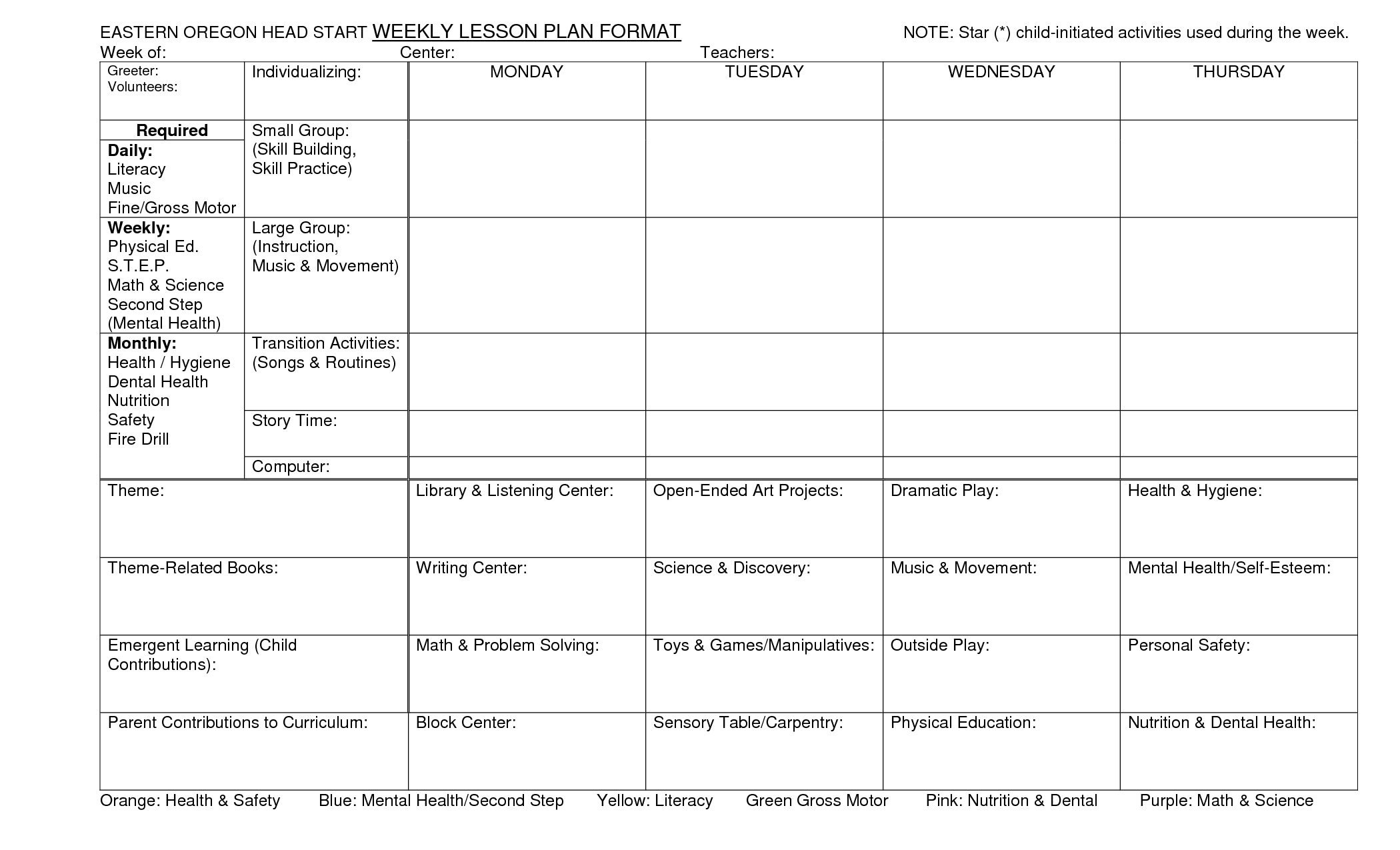

- Head Start Lesson Plan Template

More Other Worksheets

Kindergarten Worksheet My RoomSpanish Verb Worksheets

Cooking Vocabulary Worksheet

DNA Code Worksheet

Meiosis Worksheet Answer Key

Art Handouts and Worksheets

7 Elements of Art Worksheets

All Amendment Worksheet

Symmetry Art Worksheets

Daily Meal Planning Worksheet

What is a Personal Money Management Worksheet?

A Personal Money Management Worksheet is a tool used to help individuals track their income, expenses, and savings. It typically includes categories for various sources of income, such as salary or investments, as well as expenses such as rent, groceries, and transportation. By documenting and categorizing their financial activities, individuals can gain a clearer understanding of their spending habits, identify areas where they can cut back or save more, and ultimately work towards their financial goals.

How can a Personal Money Management Worksheet help individuals track their expenses and income?

A Personal Money Management Worksheet can help individuals track their expenses and income by providing a structured template for recording and categorizing financial transactions. By documenting all sources of income and itemizing expenses, individuals can gain a comprehensive overview of their financial situation. This tracking system enables them to identify spending patterns, pinpoint areas where they can cut costs, set financial goals, and ultimately achieve better control and understanding of their personal finances.

What types of information should be included in a Personal Money Management Worksheet?

A Personal Money Management Worksheet should include details such as income sources, expenses (fixed and variable), debt obligations, savings goals, investment accounts, insurance policies, and other financial assets. It may also incorporate a budget that outlines monthly spending limits for different categories, such as housing, transportation, utilities, groceries, entertainment, and savings. Monitoring and tracking expenses, debt repayments, and savings contributions can help individuals manage their finances effectively and make informed decisions about their financial future.

How often should individuals update their Personal Money Management Worksheet?

Individuals should update their Personal Money Management Worksheet regularly, ideally every month. This allows them to track their expenses and income, monitor their budget, and make adjustments to their financial goals as needed. Regular updates help individuals stay on top of their financial situation and make informed decisions about their money management.

Can a Personal Money Management Worksheet help individuals create a budget?

Yes, a Personal Money Management Worksheet can help individuals create a budget by guiding them through organizing and tracking their income, expenses, savings, and financial goals. By using a worksheet, individuals can visually see where their money is going, identify areas where they can cut back, set financial priorities, and ultimately create a comprehensive budget that aligns with their financial objectives.

What are the benefits of using a Personal Money Management Worksheet?

A Personal Money Management Worksheet can help individuals track their expenses, create a budget, and set financial goals. By organizing and categorizing their income and expenses, individuals can gain a better understanding of their financial habits and identify areas where they can cut costs or save money. This tool can also help individuals stay on track with their budget, maintain financial discipline, and work towards achieving their long-term financial objectives.

Are there any drawbacks or limitations to using a Personal Money Management Worksheet?

Yes, there are some drawbacks and limitations to using a Personal Money Management Worksheet. These may include the potential for human error in inputting data, the possibility of overlooking expenses or income sources, the need for regular updates to ensure accuracy, and the inability to account for unexpected financial emergencies or fluctuations. Additionally, some individuals may find it tedious or time-consuming to maintain and may struggle to stick to using it consistently. It is important to recognize these limitations and consider alternative methods or tools that may better suit your personal financial management needs.

How can individuals use a Personal Money Management Worksheet to identify areas of overspending or underspending?

To identify areas of overspending or underspending using a Personal Money Management Worksheet, individuals can track their income and expenses over a specific period, usually a month. By categorizing expenses such as groceries, housing, utilities, entertainment, transportation, and others, they can compare their actual spending to their budgeted amounts in each category. This comparison will reveal areas where they are overspending, indicated by exceeding budgeted amounts, or underspending, shown by having leftover funds. Analyzing these discrepancies can help individuals adjust their spending habits and create a more balanced budget.

Can a Personal Money Management Worksheet help individuals save money or reach financial goals?

Yes, a Personal Money Management Worksheet can help individuals save money and reach financial goals by providing a structured way to track income, expenses, and savings progress. It can help individuals identify areas where they can cut costs, set realistic budgets, and monitor their financial health over time, ultimately leading to better financial decision-making and greater control over their money.

Are there any tools or software available to assist with creating and maintaining a Personal Money Management Worksheet?

Yes, there are various tools and software available to help create and maintain a Personal Money Management Worksheet. Some popular options include Excel spreadsheets, Google Sheets templates, budgeting apps like Mint, Personal Capital, YNAB, and EveryDollar. These tools can help with tracking expenses, setting budgets, monitoring savings goals, and analyzing financial trends to assist with managing personal finances effectively.

Have something to share?

Who is Worksheeto?

At Worksheeto, we are committed to delivering an extensive and varied portfolio of superior quality worksheets, designed to address the educational demands of students, educators, and parents.

Comments